The issues

2.1 This chapter addresses the issues faced by consumers and small

businesses when resolving disputes with financial service providers through the

justice system, in particular the court system and through the Australian

Financial Complaints Authority (AFCA).

2.2

This chapter begins by examining the Code of Banking Practice

(Banking Code), and discusses ways in which financial service providers have

allegedly misused the justice system and the call by many submitters for banks

to act as model litigants in an effort to address such practices. This chapter

also discusses the accessibility of the court system, the legal assistance and

financial counselling sectors, and the way in which financial disputes are

resolved through AFCA. The chapter concludes by examining the issue of a

compensation scheme of last resort (CSLR).

The Code of Banking Practice

2.3

The Banking Code is integral to the resolution of disputes

between banks and their customers through 'both internal dispute resolution

(IDR) and external dispute resolution (EDR) processes'.[1]

2.4

The current, 2013 voluntary code Banking Code is described as 'the

banking industry's customer charter on best banking practice standards'.[2]

Provisions of the code address the resolution of disputes with customers.[3]

2.5

The current Banking Code was finalised in 2013 and sets out the purpose

of the code—namely, to set the standards of good banking practice for banking

services 'to follow when dealing with persons who are, or who may become, our

individual and small business customers and their guarantors'.[4]

Breaches of the code are investigated by the Code Compliance Monitoring

Committee.[5]

2.6

The current code applies to:

- new

banking services we provide to you on or after that date;

- new

Guarantees we take from you on or after that date; and

- things

we do on or after that date in respect of some pre-existing banking services

and Guarantees.[6]

2.7

In July 2016, and as part of an industry initiative 'announced in April

2016 to raise banking standards', an independent review of the Banking Code was

conducted by Mr Phil Khoury.[7]

2.8

As a result of the review, in December 2017 the Australian Banking

Association (ABA) submitted a new Banking Code to the Australian Securities and

Investments Commission (ASIC) for review.[8]

2.9

On 31 July 2018, ASIC approved the new Banking Code and noted the

following about its development:

ASIC’s approval of the Code follows extensive engagement with

the ABA, following a comprehensive independent review and extensive stakeholder

consultation. The ABA made additional significant changes to the Code in order

to satisfy ASIC that it met our criteria for approval.[9]

2.10

The new, enforceable Banking Code 'sets out the standards of practice

and service in the Australian banking industry for individual and small

business customers, and their guarantors'.[10]

The new Banking Code also addresses resolution of complaints through internal

and external dispute resolution processes.[11]

2.11

The new Banking Code will commence operation on 1 July 2019

and signatory banks will have until this date to implement the code.[12]

As compliance with the code is a condition of membership of the ABA, 'banks

with personal or small business customers in Australia will be required to sign

up to the new [code] if they wish to be members of the ABA'.[13]

2.12

The ABA has identified that the new code includes initiatives such as proactive

contact with customers deemed at risk of financial difficulty, improved protections

for guarantors in order 'to ensure they understand their obligations', and '[a]

new independent body who will investigate breaches and apply sanctions as

needed'.[14]

2.13

Despite these claimed improvements, some submitters identified

shortcomings with the new Banking Code. For example, Financial Counselling

Australia (FCA) submitted that, during the review of the current Banking Code,

consumer advocates requested that ASIC Regulatory Guide 209 (RG209)—'which

contains detailed guidance on how the responsible lending provisions'—be

included in the new Banking Code.[15]

FCA noted that the request for the inclusion of RG209 in the code was 'never

recommended or implemented'. [16]

2.14

In its submission, the Consumer Action Law Centre (CALC) noted that the

current code 'imposes very few requirements on signatories in relation to the

sale of debts to debt buyers'.[17]

CALC also noted that the ABA rejected Khoury's recommendation that 'banks be

required to monitor compliance by their debt assignees' with legislation, the code

and the ASIC Debt Collection Guideline.[18]

2.15

The new Banking Code will be subject to formal review every three years.[19]

Alleged misuse of the legal system

2.16

The committee received evidence that financial service providers will

sometimes seek to use their vastly superior resources to resolve legal disputes

with customers in a way that is neither fair nor proportionate.

2.17

For example, the Office of the Australian Small Business and Family

Enterprise Ombudsman (ASBFEO) referred to its 2016 Inquiry into small

business loans, which 'found that banks do not seek to resolve disputes in

a fair or proportional manner'.[20]

ASBFEO explained that its inquiry also found that in disputes over loan

facilities, banks:

...will aggressively seek to cover their risk moving rapidly to

place a loan into default and engage insolvency practitioners to sell assets to

recover funds. Banks procure these services to enable their own decision-making

with regard to the loan security. Disputes over these services often end up

with no access to justice as the banks say it is nothing to do with them as the

third party is a representative of the business.[21]

2.18

Ms Dana Beiglari of Legal Aid NSW informed the committee that, based on

Legal Aid's casework experience, lenders may misuse the legal system when

dealing with elderly guarantors:

[T]here can be a tendency for lenders to act quickly to use

their legal rights, often in court, but to act slowly when entering into

practical hardship arrangements that fit the needs of the individual consumer

in the dispute.[22]

2.19

CALC informed the committee that, based on its casework experience, the

debt recovery process—the most common reason it identified for the use of the

legal system to resolve financial disputes—tends to target the most vulnerable

people involved in financial disputes:

People who are struggling with problem debt who do not engage

[with IDR, hardship or EDR processes] are most at risk of having homes

repossessed by banks through the legal system, or having debts sold to external

debt collectors which sometimes use the legal system as part of debt recovery.[23]

2.20

CALC expressed concern with a number of other practices undertaken by

financial service providers that involve the use of the legal system, and court

processes in particular, to the detriment of consumers. These practices include

the use of legal action 'to pressure consumers into unaffordable repayment

plans or repaying debts that might not be legally owed'.[24]

2.21

Other submitters also discussed what they consider the misuse of the

legal system by financial service providers in resolving disputes. For example,

the Consumer Credit Legal Service WA (Inc) (CCLSWA) raised concerns that some

financial service providers are not acting in accordance with the requirements

of the National Consumer Credit Protection Act 2009 (NCCP Act)[25]

and the National Credit Code (NCC), which provide that consumers are entitled

to certain documents.[26]

2.22

Mrs Anita Shannon informed the committee about their experience with the

misuse of the NCC:

[I]t would appear in reality a consumer under a loan

agreement and mortgage with trustee Credit Provider under a non-bank /

securitisation scheme has limited (if any) legal rights with regard to the

relationship with the trustee Credit Provider, even when the loan agreement and

mortgage fell under the previous Consumer Credit Codes (UCCC), now the National

Credit Code (NCC) and is therefore disadvantaged further than a borrower who

went to a Bank.

The trustee Credit Provider contracts with others to

originate loans and mortgages on its behalf and refuses to take any form of

responsibility for those entities misconduct in the origination of the loan despite

the non‑contracting out provisions of the Consumer Credit Codes (now

S.191 of the NCC).[27]

2.23

The enforcement of the NCC has recently been strengthened by the Treasury

Laws Amendment (Strengthening Corporate and Financial Sector Penalties) Act

2018, which received Royal Assent on 12 March 2019. That Act implemented

certain recommendations of ASIC's Enforcement Review Taskforce,[28]

by amending the Corporations Act 2001 (Corporations Act), the Australian

Securities and Investments Commission Act 2001, the NCCP Act and the Insurance

Contracts Act 1984 in order to introduce a stronger penalty framework for

corporate and financial sector misconduct.

2.24

On a related issue of concern, AFCA acknowledged that the failure to

provide documentation relevant to AFCA, or the provision of misleading

information about the existence of such documents, is 'completely unacceptable'.[29]

Dr June Smith, the Lead Ombudsman at AFCA, expressed the organisation's support

for legislative amendments to the Corporations Act that would

address this issue:[30]

[W]e are fully supportive of the [Royal Commission's

proposed] amendment to section 912A in relation to cooperation with AFCA and a

firm having to use reasonable means to provide documentation and to cooperate

with the service—and we would use that not only in relation to documents in the

dispute but also in relation to the provision of documentation associated with

the professional indemnity insurance policy that may be in place, the current

levels of that and whether or not there have been notifications of claims.[31]

Model litigant obligations

2.25

The committee received evidence that one way in which to address the

alleged misuse of the legal system by financial service providers is to impose

an obligation on these providers to act as model litigants.[32]

2.26

The content and application of model litigant obligations vary between

the Commonwealth, states and territories.[33]

At the Commonwealth level, the model litigant obligation is part of the Legal

Services Directions 2017, issued by the Attorney-General pursuant to

the responsibility vested in this officer for the maintenance of proper

standards by the Commonwealth in litigation.[34]

CALC considered that the obligation to act as a model litigant that applies to

government agencies is integral to the rule of law.[35]

2.27

The ABA advised the committee that it 'has not developed an industry

position across all of its member banks on behaving as model litigants'.[36]

The ABA further explained that, in its view, there is:

...merit in each bank considering what that means for their

bank in their approach to litigation and dispute resolution, and making a

determination [about behaving like a model litigant] individually.[37]

2.28

However, the committee received evidence that this approach does not

serve the interests of consumers and small businesses. Indeed, CALC took the

committee to a key observation of the Royal Commission into Misconduct in the

Banking, Superannuation and Financial Services Industry (Royal Commission)—that

there exists an 'asymmetry of power and information between financial

institutions and their customers'—to illustrate this point.[38]

CALC considered this asymmetry of power to be similar to the 'imbalance of

power when someone is in dispute with a government'.[39]

2.29

Similarly, Mr Josh Mennen of Maurice Blackburn Lawyers (Maurice

Blackburn) considered the model litigant obligation on government agencies a

'reasonable standard' which 'ought to be applied to financial services

providers dealing with consumers'.[40]

In its submission, Maurice Blackburn argued that a requirement for financial

service providers to act as model litigants would:

...place an onus on them deal with claims or disputes promptly,

pay legitimate claims or compensation without litigation, act consistently in

the handling of claims and litigation, and keeping the need for litigation to a

minimum.[41]

2.30

Although conceding that there may be an 'enforcement issue' with respect

to government agencies complying with the obligations, Mr Mennen considered

that 'the rules themselves look sound'.[42]

2.31

In their submission to the inquiry, the Australia and New Zealand

Banking Limited informed the committee that it will publish principles that

are:

...aimed at giving retail and small business customers an

understanding of the steps we will take to ensure that we respond to their

complaint against us in a respectful and fair way. The principles extend to

setting out standards of conduct we will adopt if a matter ultimately involves

litigation.[43]

2.32

Notably, Mr David Locke, the Chief Ombudsman and Chief Executive Officer

of AFCA, stated that AFCA is 'open' to making adjustments to its rules, remit and

processes 'to ensure that we meet community expectations', including by acting

in accordance with model litigant rules.[44]

Mr Locke opined that AFCA and financial firms should both conduct themselves in

accordance with model litigant responsibilities.[45]

Accessibility of the court system

2.33

There was general consensus amongst submitters and witnesses to this

inquiry that the court system is seldom the best forum in which consumers and

small business owners can resolve disputes with financial service providers.[46]

For example, CALC submitted:

The court system is rarely the most suitable forum to resolve

financial services disputes fairly, particularly for consumers experiencing

vulnerability and disadvantage. The process is slow, legalistic, complex and

expensive. Courts expose consumers to serious costs risks, and present significant

barriers to accessing justice. The resources required to run a case via the

court process, as opposed to EDR, are significant and the process is daunting

and entirely inaccessible for participants without access to legal advice and

representation.[47]

2.34

CALC suggested that, in contrast to the court system, 'EDR is better

equipped to support unrepresented consumers as processes are less formal'.[48]

2.35

In CALC's experience, most disputes between financial service providers

and consumers are dealt with in the first instance 'via providers' [IDR] or

hardship teams'.[49]

In the event that a dispute is not resolved to the satisfaction of the

consumer, the consumer may abandon their complaint, or look to an EDR process,

such as AFCA.[50]

2.36

In its submission, Legal Aid NSW identified circumstances in which court

action is a necessary and preferable approach to resolving legal disputes.[51]

However, in its experience, 'the court system can be an impractical,

inefficient and costly means of resolving financial disputes'.[52]

Bankruptcy

2.37

Another issue that goes to the accessibility of the court system is the

ability of a bankrupt party to pursue a cause of action against a financial

service provider, an issue discussed in detail by Maurice Blackburn.

2.38

Maurice Blackburn identified the 'perverse outcome' that, in situations

involving financial service providers, an irresponsible lender causing

bankruptcy 'may have an interest in the cause or action against itself'.[53]

2.39

Maurice Blackburn submitted that it was 'essential to rectify this

perverse outcome':

Section 116(2)(g) of the Bankruptcy Act (1966)

excludes from property divisible among creditors ‘any right of the bankrupt to

recover damages or compensation for personal injury or wrong done to the

bankrupt’ and any damages or compensation recovered in respect of such injury

or wrong. However that does not appear to assist in the case of irresponsible

lending as the question of what is a ‘wrong’ has been judicially considered,

and cases indicate this will extend to claims arising from the person compared

to claims arising from property interests.

One way to remedy this is to legislate an exception in

section 116(2) Bankruptcy Act (1966) such that actions against

[financial service providers], including those taken under the National

Consumer Credit Protections Act (2009) and National Credit Code, are not

divisible among creditors but remain the property of the consumer. That is,

causes of action against any creditor should be quarantined under bankruptcy

law.[54]

Home repossession

2.40

Some witnesses also discussed the issue of home repossession, and possible

changes to this process that could reduce the hardship faced by customers subject

to home repossession.

2.41

The committee heard that it was preferable to address the issues

pertaining to home repossession before engaging with the court system, owing to

the difficulties faced by consumers who are engaged in court proceedings.

2.42

For example, Ms Rebekah Doran of the Law Council of Australia (Law

Council) informed the committee about the challenges faced by consumers with

respect to proceedings regarding home repossession in New South Wales:

There have been a lot of challenges with that process once

the person is at the stage of a judgement being entered against them and the

home repossession process being underway. That is because of the centralisation

of that through the Supreme Court. Particularly for people in regional and remote

areas, engaging with the court in the Sydney Supreme Court is incredibly

difficult.[55]

2.43

Ms Mary Walker of the Law Council referred the committee to the example

of farm debt repossession, where 'there are a lot of possession matters' that

are brought into the EDR scheme 'very early on':

I think we need to be mindful not only that we need to be

accessing capacity to resolve disputes early but that they may very well need

to be accessed outside of the court stream and dealt with internally through

the ombudsman schemes or otherwise. However, one of the other problems is: if

you have too many barriers to entry for someone who actually needs to be in the

Supreme Court then what you're doing is creating more burden. It's a real

balance about how these things are dealt with.[56]

2.44

In Ms Walker's experience of alternative dispute resolution schemes that

are set up to target particular issues are 'often very effective'.[57]

2.45

Mr Gerard Brody of CALC also considered that 'lenders should use

repossession only as a very last resort', and prior to pursuing this end, 'should

take all steps—as they are obligated to do under their own codes of practice—to

offer assistance to people in financial difficulty'.[58]

2.46

Mr Brody opined that a system need to be created 'where people are

pushed into a fair dispute resolution process to resolve [the dispute] before

it escalates to repossession'.[59]

Mr Brody suggested how and at what point dispute resolution could be offered:

I think that any time any credit provider is using a court

process to recover debt—it doesn't really matter what sort of debt it is—they

should be required to inform the customer of their right to go to the ombudsman

service. But, more than that, I think the court should be creating a process to

facilitate that being transferred to that system. At the moment, of course,

credit providers are required to inform people, but people tend not to read

everything. So I think it needs a more interventionist approach, which would

mean the court could actually assist. That would benefit the courts as well.

They have enough cases as it is. They would probably prefer that matters not

proceed through the courts. They could take an interventionist role to make

sure that before a case goes too far down the court pathway it is stayed and

referred to somewhere like AFCA to be resolved, if it's possible to resolve it,

before it advances to any sort of court process.[60]

The legal assistance and financial counselling sectors

2.47

The committee heard from the Law Council that the legal assistance and

financial counselling sectors provide assistance to people engaged in disputes

with financial service providers in a range of circumstances:

Financial counsellors, community legal centres and legal aid

services, and often pro bono services provided by law firms, work incredibly

collaboratively to try to cover the field of legal assistance to the extent

that we can. Often that requires us to match the level of service with the need

of the consumer. For example, it might be that, if the matter is simply that a

person is in temporary hardship and they need a temporary arrangement, a

financial counsellor would be best placed to do that. I guess there's a range

in the level of assistance someone might need. For example, perhaps advice is

sufficient. In the cases that I deal with as a legal aid solicitor, we're

dealing with vulnerable clients who will require ongoing representation much of

the time. To turn to the small business question, there is certainly a distinct

lack of assistance available for small business. There's no question about

that. To some extent advice is able to be provided by financial counsellors,

particularly where they're sole traders. Legal aid does that on occasion. But

ongoing representation is not available.[61]

2.48

As noted by Legal Aid NSW, some disputes are best resolved through the

court system, and for that reason, 'readily available legal assistance services

are critical'.[62]

However, the committee heard that many consumers are unable to access this

legal assistance, creating 'real gaps in access to justice'.[63]

CALC advised the committee that this is particularly true for the those

consumers who cannot afford to pay for their own lawyers, but are too wealthy

to qualify for legal assistance—that is, the 'missing middle' of consumers who

have disputes with financial service providers.[64]

2.49

The strain on the legal assistance sector was highlighted in evidence to

the committee from Ms Walker of the Law Council. Ms Walker discussed one of the

significant findings of the Law Council's 2018 Justice Project, namely that 'only

a small number—less than three per cent—of means-tested legal aid grants for

legal representation and dispute resolution in 2016-17 were for civil law

matters'.[65]

The Law Council informed the committee that:

This places a notable burden on the broader legal assistance

sector, particularly on chronically under-resourced community legal centres,

which are left to address the void of legal assistance services for civil law

matters.[66]

2.50

Many submitters to this inquiry referred to the evidence presented by the

National Association of Community Legal Centres (NACLC) and FCA in their joint submission

to the Royal Commission.[67]

In that submission, NACLC and FCA outlined the levels of demand for legal and

financial counselling services with respect to the resolution of financial

disputes. In respect of the demand for legal services, that the NACLC and FCA

estimated that in 2018:

...at least 6.4% of the population (aged 15 or over), around

1.2 million people, will have experienced a credit or debt legal issue in a 12

month period. (These figures would be higher if they included insurance

matters.) A conservative estimate would suggest at least 20% of the group that

experienced a credit or debt legal issue - 240,000 people a year - would be

financially disadvantaged and therefore need access to free legal information

and/or advice.[68]

2.51

In respect of the demand for financial counselling services, it was

noted that:

Community based financial counsellors assist approximately

120,000 clients a year, and the National Debt Helpline receives 170,000 calls a

year, and struggles to keep pace with this demand. Waiting times for financial

counselling are frequently up to four weeks, and many services have full

waiting lists.[69]

2.52

NACLC and FCA therefore called for 'funding of $157 million per annum to

create a properly funded network of community financial counselling and

community legal services'.[70]

This would equate to '$1 million for the National Debt Helpline, $130 million

for 1,000 financial counsellors, and $26 million for an additional 200

community financial service lawyers located across Australia'.[71]

2.53

Many submitters to this inquiry also wrote in support of NACLC and FCA's

call for specific funding for the legal assistance and financial counselling

sectors,[72]

and some submitters made their own recommendations with respect to funding for

CLCs and financial counsellors. For example, CALC recommended:

...there be a substantial injection into the resourcing of

financial counselling and community legal services to assist with disputes in

the finance sector, and for this to be paid for through an industry levy.[73]

2.54

A large number of submitters also recommended increased, secure and

predictable funding to the broader legal assistance sector, as well as to

financial counselling services.[74]

For example, Women's Legal Service Victoria recommended that the Australian

government also 'resource Legal Aid Commissions to broaden availability of

funding for priority clients to pursue small property matters, including joint

debt disputes'.[75]

Small business

2.55

The committee heard evidence that there are gaps in the provision of

legal assistance for small business.

2.56

For example, Legal Aid NSW informed the committee that Legal Aid

Commissions focus primarily on consumers, rather than farm disputes or small

business disputes.[76]

However, at times Legal Aid has had to address business issues that are tied up

with consumer issues, such as when an older person is a guarantor for a

business loan:

The current state of play is that we have different scopes of

assistance that we can provide that have different guidelines attached to them.

So you could get advice for free from a Legal Aid service in respect of that

matter, and you might be able to get small scopes of assistance like contacting

the bank to try to advocate an outcome. But, if you were to be represented in

court or if you were to be represented in AFCA, you would need a larger scope

of assistance from Legal Aid.[77]

2.57

The Law Council identified that there exists a 'significant gap' in

legal assistance for small business, as they have 'a very different set of

legal problems and a very specific need for legal assistance'.[78]

The Law Council considered that small businesses 'would certainly benefit from

specialised legal services'.[79]

Resolving disputes through AFCA

2.58

Generally, submitters and witnesses welcomed the establishment of AFCA,

and cautioned that as the statutory authority had only been in operation for a

short time, its efficiency and effectiveness cannot yet be accurately

evaluated.[80]

2.59

However, other submitters also highlighted shortcomings with AFCA, and suggested

some improvements to its operations. This section will address the suggested

improvements most commonly raised by submitters and witnesses.

The accessibility and

appropriateness of AFCA

2.60

AFCA addresses the statutory requirement of accessibility[81]

in two ways: first by increasing awareness of its existence; and secondly by

making its service easy to use.

2.61

In its submission, AFCA outlined the work it undertakes with respect to

accessibility,[82]

such as working with the following key stakeholders as part of its outreach

program:

...financial counsellors, community legal centres and financial

rights centres,...vulnerable and disadvantaged groups including culturally and

linguistically diverse communities, those experiencing family violence, elder

abuse or socio-economic disadvantage and Aboriginal and Torres Strait Islander

communities.[83]

2.62

In its submission, AFCA also stated that it ensures there is ease of

access to its service for complainants: its 'processes aim for a minimum of

formality, with regular phone contact with complainants and financial firms and

appropriate flexibility to consider individual circumstances that arise'.[84]

2.63

Legal Aid NSW spoke favourably of AFCA, which it considers 'the most

appropriate, fair and efficient way for Australian consumers to resolve their

dispute' in 'the vast majority of cases':

AFCA is a free and independent forum which is accessible.

Disputes are resolved on the papers—that is, via telephone, email or

letter—which is of great benefit to regionally based clients. AFCA can make a

decision based on what's fair in all the circumstances, and the strict rules of

evidence do not apply to this forum. AFCA also reports to the regulator about

systemic issues that are emerging, and it has a consumer liaison group which

can also report systemic issues. AFCA can conduct systemic issues

investigations where appropriate. For these reasons, we consider AFCA to be the

most appropriate and accessible forum for resolving disputes.[85]

2.64

Although supporting the establishment of AFCA, CCLSWA suggested that

AFCA is 'operating within limitations not optimum to consumer outcomes' and

advocated for the expansion of AFCA’s role and resources.[86]

2.65

In his evidence to the committee, Mr Locke conceded that:

...a lot more needs to be done to make sure that we are a more

accessible service, particularly to communities who have traditionally not used

AFCA, because of language needs, health needs, cultural backgrounds or other

vulnerabilities.[87]

Membership of AFCA

2.66

Many submitters to the inquiry advocated for the expansion of AFCA's

membership, the existing membership resulting in the reduction of access to

justice for customers of firms that are not members of AFCA.[88]

2.67

Mr Brody expanded on this issue in his evidence to the committee:

...debt management firms, debt agreement administrators and

buy-now pay-later firms are not required to provide their customers access to

dispute resolution through AFCA. Our caseworkers see the harm caused by these

financial service providers and a lack of avenues to resolve disputes when they

arise.[89]

2.68

CALC recommended that debt management firms, registered Debt Agreement

Administrators, ‘buy now pay later’ providers, FinTechs and emerging players, and

small business lenders should all be required to become members of AFCA.[90]

2.69

CCLSWA also submitted that 'small business lenders should be required to

be a member of AFCA before being able to provide credit to small business

borrowers',[91]

a recommendation also made by the FCA.[92]

CCLSWA considered that such a change 'would provide small businesses and

guarantors for small business loans an [alternative] avenue for redress that is

not currently available to consumers'.[93]

2.70

In its submission to the committee, ASBFEO proffered that '[a]ll

providers of financial services and third parties engaged by providers should

be required to have an external dispute resolution service', namely, AFCA.[94]

2.71

In respect of third party membership of AFCA, Maurice Blackburn referred

specifically to the professional indemnity insurers of financial service

providers, recommending that they, too become members:

[P]rofessional indemnity insurers [for financial service

providers] should be members of AFCA so as to be subject to its determinations.

That would be consistent the common law doctrine of 'direct recourse' and the

statutory regimes which enable a claimant to look beyond the insured wrongdoer

and seek recovery directly from the relevant professional indemnity insurer...[95]

2.72

Mr Locke acknowledged the existence of 'clear regulatory gaps' in AFCA's

membership which 'need to be addressed', reasoning that:

...by requiring all of these firms and providers to be members

of AFCA, and also having a proper licensing and regulatory regime in respect of

some of these unlicensed parts of the sector, much greater protections could be

provided to consumers and small businesses.[96]

2.73

Further, in response to a question on notice about the recommendation made

by Maurice Blackburn, AFCA noted that professional indemnity insurers are

required by section 912A of the Corporations Act 'to be members of AFCA if they

hold a financial services licence which enables them to offer products and

services to retail clients'.[97]

AFCA noted that for those professional indemnity insurers that do not hold a

licence, this is 'usually because it is limited to wholesale clients'.[98]

AFCA informed the committee that any changes to membership 'would require a

change to the operation of the Corporations Act as well as to the AFCA Rules',

but considered that 'it would be appropriate for this to reviewed'.[99]

Eligibility criteria and

compensation thresholds

2.74

Many submitters suggested that AFCA's eligibility criteria and its

powers to award compensation could be expanded to ensure access to justice for

a greater number of consumers. For example, Legal Aid Queensland observed that

'the current AFCA jurisdictional caps may exclude many farmers'.[100]

2.75

Other submitters objected to an increase in these thresholds. For

example, the Customer Owned Banking Association (COBA) expressed concern with expanded

eligibility criteria and compensation thresholds, warning that 'it is important

for any deliberation on changing these to be undertaken with a careful

assessment of the potential impact on stakeholders'.[101]

COBA argued that:

...increasing AFCA’s eligibility criteria and compensation

thresholds may inadvertently lead to higher professional indemnity insurance

premiums (and/or excesses) or higher contingent funding requirements for

financial firms, including COBA member ADIs.

The financial impact associated with such operational cost

increases would add to the regulatory compliance burden that weighs more

heavily on smaller players in the market than major banks due to a high fixed

costs component. This handicaps the capacity of challenger banking institutions

to grow and expand into new markets and hence reduces competitive pressure on

major banks. High regulatory costs ultimately hurt consumers because resources

are diverted away from investment in product innovation, better service and

better pricing.

Any increase in AFCA’s eligibility criteria and compensation

thresholds may also operate to expand AFCA’s remit and inadvertently move away

from the original intent of EDR as a mechanism for those without the financial

means to pursue a claim through the court process.[102]

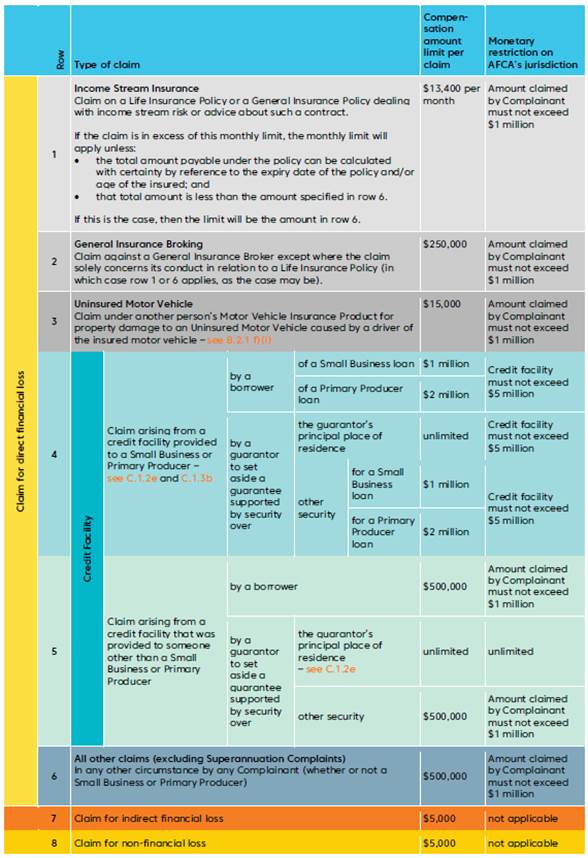

2.76

Table 2.1 sets out AFCA's eligibility criteria and compensation

thresholds.

Table 2.1 Monetary limits—eligibility

criteria and compensation

Source:

AFCA, Operational Guidelines to the Rules, p. 189.

Compensation

2.77

Although '[t]he compensation cap has increased by more than threefold in

the last decade',[103]

the majority of submitters who addressed this issue advocated for an increase

in AFCA's compensation caps.

2.78

For example, CALC considered that an increase in the compensation caps:

...will incentivise all [financial service providers] to act

appropriately in the first place, and resolve customers complaints in a timely

manner, which should reduce the number of AFCA complaints over time.[104]

2.79

In respect of AFCA's existing sub-limits on compensation, which it

submitted are 'too low', CALC referred to the findings of the Royal Commission:

The Banking Royal Commission revealed the stress, anxiety,

and hardship caused by irresponsible loans. Despite these impacts, AFCA can

only award $5000 compensation.

Increasing these limits will incentivise all [financial

service providers] to act appropriately in the first place, and resolve

customers complaints in a timely manner, which should reduce the number of AFCA

complaints over time.[105]

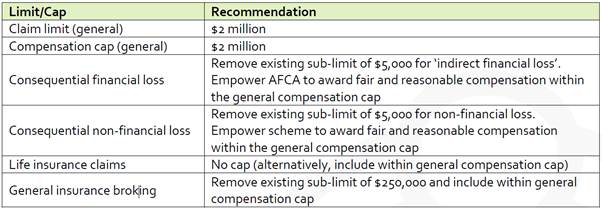

2.80

Both CALC and the Financial Rights Legal Centre (FRLC) proposed the

following recommendations in respect of AFCA's compensation scheme:

Table 2.2 Proposed caps

for AFCA compensation

Source:

CALC, Submission 29, p. 13; FRLC, Submission 42, p. 2.

2.81

In its submission, Legal Aid NSW also supported an increase in compensation

caps, including sub‑limits; a position that was 'informed in particular

by our casework with victims of disasters who are making home insurance claims'.[106]

2.82

In response to questions on notice, AFCA conceded that its 'compensation

caps for non-financial loss and indirect loss are probably too low and need to

be reconsidered', and that ' there are inconsistencies across the product lines'.[107]

In terms of changes to the compensation caps, AFCA recommended 'the removal of

the monthly Income Protection limit', but noted that precise caps are 'a matter

for Government to determine'.[108]

Eligibility criteria

2.83

As seen in the table above, CALC and the FRLC also recommended increasing

the threshold for eligibility criteria.

2.84

Further, FCA recommended enabling AFCA to consider disputes where the

financial service provider has obtained a default judgment in court; removing

the two‑year limitation period on an IDR dispute; and removing AFCA Rule

C.2.2.(d), which excludes complaints that are 'lacking in substance'.[109]

2.85

Other submitters also recommended changes to AFCA's eligibility

criteria. For example, Dr Smith of AFCA outlined the practical limitations of

the existing eligibility criteria thresholds:

There have been many conversations around the compensation

caps, for example, in relation to life insurance matters. We can see that the

cap related to monthly income protection insurance, for example, is $13,400 per

month for that stream of products. We have had only two that have been outside

that limit in their time at AFCA...

At the moment we have one complaint we are looking at where

the amount is about $1.25 million. The complainant has income protection cover

and that started on 3 October 2015. The amount of benefit he is entitled to

receive each month would mean that currently his dispute stands at $882,954.

However, that accumulates every month, so, if we extrapolate it out, based on

those amounts his claim will be worth $2.25 million by August 2023, when he

turns 65. So, indeed, the $13,400 cap is quite limiting and even the $1 million

cap does preclude some people who may even be on the average monthly earnings

from raising and then pursuing their claim before AFCA.[110]

2.86

The committee also heard about other financial disputes that may exceed

the $500 000 cap:

If we also look at financial advice disputes that we see and

assess, there are many related to self-managed superannuation fund advice, for

example, and investment in property. There are also many who are moving towards

retirement who may have investments that are well over that $500,000. In

remediation programs that we've conducted with financial firms, those caps are

usually waived, and, whilst we haven't seen many matters that have been outside

of our terms of reference in relation to the caps, we do feel that might be

because consumers are self-selecting. They know what the cap is and, therefore,

they don't come to AFCA.[111]

2.87

In his evidence to the committee, Mr Locke noted that eligibility

criteria compensation thresholds were put in place before the Royal Commission,

that is, before 'the nature and extent of some of the issues that we've been

exposed to through that inquiry' were understood.[112]

Mr Locke suggested that 'there could be fresh consideration of those levels now'.[113]

A compensation scheme of last resort

2.88

As discussed in chapter 1, the review of the financial system external

dispute resolution and complaints framework (Ramsay Review) recommended the

establishment of a CSLR.[114]

2.89

The Royal Commission recommended the implementation of these

recommendations:

The three principal recommendations to establish a

compensation scheme of last resort made by the panel appointed by government to

review external dispute and complaints arrangements made in its supplementary

final report should be carried into effect.[115]

2.90

The Australian government accepted the recommendation to establish a

CSLR, noting that it would establish a 'forward-looking' scheme within AFCA.[116]

The government explained that it would also:

...require AFCA to consider disputes dating back to 1 January

2008 — the period looked at by the Royal Commission, if the dispute falls

within AFCA’s thresholds as they stand today.[117]

2.91

The committee heard that this scheme was too limited. For example,

Maurice Blackburn submitted that '[t]he CSLR should also cover those consumers

who made complaints to one of AFCA’s predecessors', but that were undetermined

due to the insolvency of the financial services provider, such as those

complaints lodged with the former Credit and Investments Ombudsman.[118]

2.92

In considering the establishment of a retrospective compensation scheme,

Mr Locke considered that 'there are challenges if you are reopening

matters that perhaps have gone to court or perhaps have been dealt with through

the ombudsman scheme'.[119]

However, Mr Locke noted that, fundamentally, the starting point should be 'what

is fair for consumers...If things were got wrong then I think they should be set

right'.[120]

***

2.93

The following chapter sets out the committee's view in respect of

changes that can be made to the justice system to ensure that, in future,

consumers and small businesses engaged in disputes with financial service

providers are able to exercise their legal rights.

Navigation: Previous Page | Contents | Next Page