Chapter 4 - Economic and social impacts of possible higher fuel prices and reduced oil

Introduction

4.1

The terms of reference ask the committee to consider the economic and

social impacts of a possible long term rise in the price of transport fuels. The

International Energy Agency's reference scenario assumes that the oil price

will ease to 2010, then rise again to reach $US55 per barrel by 2030 (though

prices are expected to be volatile).[1]

Some 'early peak' commentators fear that much higher prices are possible. (see

paragraph 3.117ff) It is difficult to predict with reliability what the effects

might be of higher and increasingly volatile oil prices.

4.2

The economic and social impacts of peak oil will be determined by how

prepared the world is to produce alternative sources of fuels, and the energy

efficiency of productive and consumptive processes. Given the long lead time

required to implement alternatives to oil consumption the smoothness of the

transition will depend upon a range of factors:

- how soon the world reaches peak oil;

- how steep the decline in oil supply is afterwards;

- what the price effect is of a shortfall in supply (which depends

on the elasticity of demand);

- how much support governments give to encouraging the alternatives

to oil; and most importantly,

- whether market signals are sufficiently clear and timely for the

necessary investments in new technologies or other adaptations.

4.3

Submissions and evidence to this inquiry on the possible effects of high

fuel prices were mostly qualitative and anecdotal. There appears to have been

little detailed research on the effects to date or the likely longer term

effects of the range of price increases being predicted.

4.4

A recent report for the US Department of Energy, the Hirsch report,

considered the impact of three different scenarios on the world and American

economies. One assumed that no mitigating action was initiated until peaking,

the second assumed that action is initiated 10 years before peaking and

scenario three assumed that action is initiated 20 years before peaking. The

severity of the impact of peak oil on the world economies was different for

each of the three scenarios.

4.5

The Hirsch report claims that only aggressive supply and demand side

mitigation initiatives will allay the potential for peaking to result in

dramatically higher oil prices, which will cause protracted economic hardship

in the world. ASPO-Australia also claims that the economic and social impacts

will be very serious unless we take the necessary precautions very soon. The potential

seriousness of the problem is also accepted by some political leaders, the W.A.

Minister for Planning and Infrastructure, the Hon. Alannah MacTiernan MLA

commenting that:

It is also certain that the cost of preparing too early is

nowhere near the cost of not being ready on time.[2]

The effects of recent price increases

4.6

Recent sharp rises in the price of oil have served to demonstrate

that there are significant sectors within Australian society which have limited

capacity to cope with sustained high oil prices. While prices have recently

trended back down, the price spike provides some useful insights into what

effects a longer term, sustained price rise might have.

4.7

The committee received submissions suggesting

that those with the means to adapt began doing so. This included drivers moving

away from larger cars to smaller cars and motor scooters becoming more popular.[3] Patronage of public transport increased.[4] It remains to be seen if these adaptations persist if prices

return to more moderate levels for a sustained period.

4.8

The Council of Social Services of New South Wales (NCOSS) expressed

concern that for many low income households transport costs consume a

comparatively large proportion of household expenditure, with car ownership

costing 28 percent of the income of low-income earners compared to the 13 per

cent of average incomes.[5]

When accompanied by increasing interest rates, the consequence for families can

be a substantial cut in discretionary spending and real financial stress. The

committee was told that signs of financial stress are already apparent in the

community, bank repossession of homes having increased in recent years with

rising fuel prices and interest rates.[6]

4.9

Notwithstanding the obvious economic difficulty faced by some members of

the community, the recent oil price rises have had limited adverse

macroeconomic impacts. Economic growth has remained high and current account

balances have been less affected than might have been expected given the

magnitude of the increases. This is due to the remarkable strength of the world

economy with high rates of growth in production and income, coupled with low

inflation. Strong economic growth and increasing oil demand is partly

responsible for rising oil prices.[7]

Macro economic impacts of rising oil prices

4.10

Oil is a critical commodity that underpins much of our way of life.

ABARE noted that with transport consuming three quarters of the petroleum

products used in Australia any prolonged spike in prices and/or disruption of

supplies could have significant economic and social impacts.[8]

4.11

The Hirsch report cautioned that the world wide impact of increasing oil

prices is expected to be a reduction in economic growth.

Oil price increases transfer income from oil importing to oil

exporting countries, and the net impact on world economic growth is negative.[9]

4.12

The way in which this phenomenon occurs was explained by the International

Energy Agency's (IEA) 2006 World Energy Outlook:

[T]he boost to economic growth in oil exporting countries

provided by higher oil prices has, in the past, always been less than the loss

of economic growth in importing countries, such that the net global effect has

always been negative. This is explained both by the cost of structural change

and by the fact that the fall in spending in net importing countries is

typically bigger than the stimulus to spending in the exporting countries in

the first few years following a price increase.[10]

4.13

The Hirsch report outlines some of the expected economic consequences

that result from higher oil prices.[11]

Higher oil prices result in increased costs for the production

of goods and services, as well as inflation, unemployment, reduced demand for

products other than oil, and lower capital investment. Tax revenues decline and

budget deficits increase, driving up interest rates. These effects will be

greater the more abrupt and severe the oil price increase and will be

exacerbated by the impact on consumer and business confidence.[12]

4.14

The IEA notes that the severity of the effects of higher oil prices depends

partly on endogenous economic conditions:

Energy-import intensity provides a useful gauge of the

vulnerability of a country’s economy to an increase in oil and other energy

prices. But, in practice, the overall consequences of higher prices for growth,

the trade balance, inflation, employment and other economic indicators also

depend on economic structures and conditions, and behavioural and policy

responses.[13]

4.15

The IEA cautions that it is difficult to predict adjustments in response

to increased prices and hence the magnitude of the effects:

While the mechanism by which oil prices affect economic

performance is generally well understood, the precise dynamics and magnitude of

these effects – especially the adjustments to the shift in the terms of trade –

are very uncertain.[14]

Impacts on GDP

4.16

The IEA attributes falls in domestic output of net oil importing

countries resulting from higher oil prices to second-round effects rather than

the direct effects of higher oil prices. Nominal wage, price and structural

rigidities in the economy typically lead to a fall in GDP in practice in net

oil importing countries. This is due to reduced non-oil demand and falling

investment. Where businesses are not able to pass on all of the increase in

energy costs to higher prices for their final goods and services, profits fall,

further dragging down investment.[15]

4.17

The IEA examined a number of studies and although the results were not

strictly comparable, it was able to generalise a rule of thumb on the expected

global effects of a price rise in oil:

[W]e estimate that a sustained $10 per barrel increase in

international crude oil prices would cut average real GDP by around 0.3% in the

OECD and by about 0.5% in non-OECD countries as a whole compared with the

baseline. Overall world GDP would thus be reduced by about 0.4%. Oil-exporting

countries would receive a boost to their GDP, offsetting part of the losses in

importing countries. Oil-importing developing Asian countries would incur

bigger GDP losses, averaging about 0.6%. Most of these effects would be felt

within one to two years, with GDP returning broadly to its baseline growth rate

thereafter.[16]

4.18

The potential impacts on Australia's GDP have been examined by some

limited modelling of modest price increases. An ABARE study of the impact of

higher oil prices in the APEC region compared a base case scenario of West

Texas Intermediate oil prices at US$56/bbl in 2005 falling to $US31/bbl in 2015

with a scenario of oil prices that were assumed to be 30 per cent higher. It

found that Australia’s Gross National Product (GNP) would average an estimated

0.8 per cent lower than in the reference case at 2010. If oil prices were

assumed to be 60 per cent higher than in the reference case, GNP was estimated

to average 1.2 per cent lower than in the reference case at 2010.[17]

4.19

The Queensland Treasury’s Office of Economic and Statistical Research

modelled the consequences of a permanent 100 per cent increase in the price of

oil and petroleum, moving from $30 to $60 a barrel over two years. This modelling

projected a decline of 1.2 per cent in aggregate export demand and an increase

in the prices of imported commodities. The study found that the dominant

macroeconomic feature was a decline in the terms of trade. This decline

translated to a decline in real income for Queenslanders with a projected fall

of 2.98 per cent in real GSP [Gross State Product] by the second year of the

simulation. In the long run it found real GSP was projected to recover

somewhat, to a level 1.01 per cent lower than it would otherwise have been.[18]

4.20

The difficulty in producing such forecasts needs to be kept in mind. The

Commonwealth Treasury sounded this warning:

Unfortunately, economists do not have an enviable track record

predicting how powerful, but countervailing, economic influences will be

resolved nor, in particular, the timing of their resolution.[19]

Impacts on Australia’s balance of payments

4.21

The impact on Australia’s balance of payments of a growing oil deficit

was discussed by a number of witnesses. ABARE argued that as Australia is a net

energy exporter, a rise in the cost of oil imports would be expected to be

offset to a large degree by increasing prices and demand for Australia’s energy

exports, to the extent that there is some substitution between energy sources

available.[20]

4.22

Others have disputed this position:

Many economists have spun the line Australia is a net energy

exporter so we are immune. My analysis of our growing oil deficit means we have

to export more and more coal and LNG to buy oil. This line will get harder to

defend with the oil deficit growing faster than our coal and LNG surplus.[21]

and:

Remarkably, economists find it very puzzling that our balance of

payments keeps on not balancing and they scratch their heads and wonder why all

this exporting of minerals to China does not come up in a marvellous balance of

payments. Of course it does not, because, on the other side of the ledger, we

are going down. They are the absolutely key points.[22]

4.23

The Australian Petroleum Production and Exploration Association (APPEA)

pointed out that Australia had historically benefited from being a net exporter

of oil, gas and petroleum products, which had made a significant contribution

to our overall trade balance and economic position. APPEA said that the last

two years had seen a dramatic turnaround as a consequence of both a rise in

international energy prices and a fall in the level of domestic crude oil

production.[23]

In 2004/05, imports exceeded exports of petroleum by more than

$3 billion. For the year 2005, the amount increased to around $4.7 billion.[24]

4.24

Sasol Chevron quoted a CSIRO study which found that by 2010, Australia

will need to import 50-60% of its crude oil requirements which will have a

negative impact on the balance of payments of $7-8 billion per year.[25]

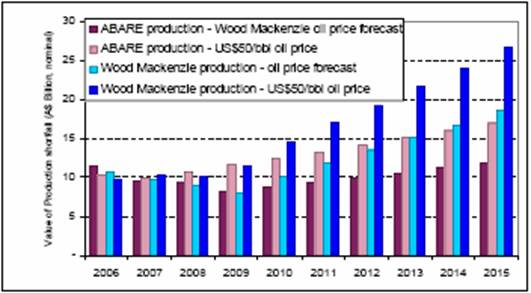

4.25

APPEA estimated that that Australia’s

oil deficit could be in the range A$12-25 billion by 2015 (depending on

assumptions about Australian production and price), and significantly higher in

later years. The following graph from the APPEA submission illustrates

the results of a study conducted on APPEA's behalf by Wood Mackenzie of the

possible balance of trade shortfall that will result from declining Australian

self sufficiency in oil production.

Figure 4.1 – Balance of trade

consequences of declining Australian oil self sufficiency

Source: APPEA, Submission 176, p.8.

Inflation and interest rates and

unemployment

4.26

Submissions raised the prospect of increasing oil prices impacting on

inflation and hence interest rates:

The price and availability of virtually everything that we

import, export, manufacture, construct, transport, eat, wear, buy, sell, rent,

live in or use in our daily lives will be affected by peak oil.[26]

4.27

The IEA sees oil price increases leading to upward pressure on nominal

wage levels, which together with reduced demand, tends to lead to higher

unemployment. It warns that the effects can be magnified by the negative impact

of higher prices on consumer and business confidence.[27]

4.28

The committee also received evidence claiming that the increasing price

of oil has already caused plastics, which are derived from oil and gas, to more

than double in price in just over a year.[28]

Reduction in globalisation

4.29

The Murdoch University Institute for Sustainability and Technology

Policy expects global trade to continue in a post peak oil world, although the

character of global trade is expected to change once it becomes expensive to

conduct because of higher transport costs. Trade in future is likely to become

more localised.[29]

Impacts on industry

4.30

The Hirsch report noted that end use sectors that are able to switch to

other fuels such as natural gas, coal and nuclear will do so but considers that

in the transport sector, there are no alternative sources that are able to

compete economically.[30]

The transport, mining, chemical, electricity generation and agricultural

sectors have higher than average fuel utilisation and tend to experience

significant first round effects. In addition, construction and agriculture in

particular are adversely affected by rising interest rates which tend to

accompany rising fuel prices. Tourism is also adversely affected as high fuel

costs reduce the amount of discretionary holiday travel:[31]

Tourism in Queensland will suffer unless alternative transport

solutions are considered. Should there be a contraction in overseas visitors, a

contraction in interstate air travel and a contraction in discretionary

household expenditure on long-distance holidays generally, then it is difficult

to imagine a future for remote locations such as Airlie Beach, or even the

tourism-based economy of the Gold Coast. Many tourism sites were developed when

transport was cheap and the population could afford to be highly mobile. This

is not likely to be the case in the future.[32]

Impacts on transport

4.31

More than 95 per cent of Australia's transport fuel is derived from oil.[33]

Air transport is the most fuel intensive segment of this industry; hence it is

expected to be the most adversely affected industry. Modelling of a permanent

doubling in the world oil price, commissioned by the Queensland Government,

projected air transport activity to be some 27 per cent lower by 2016-17 than

it would otherwise have been. Commentators expressed concern about a lack of

preparations in the aviation industry for the severe impact of rising oil prices.[34]

Air freight as well as passenger travel was expected to be adversely affected: [35]

So I think the airline industry really needs a bit of a kick up

the derriere to say, ‘Hey, what are we going to be putting in our tanks in 20

years time?’ If JetA-1 is still available, what will the price be? Typically

the cost of a seat is roughly 20 per cent...fuel, which does not sound very high.

But if the cost of fuel doubles it might be the cost of a seat beyond the point

at which mass travel is affordable, apart from business travel and the high end

of the market.[36]

4.32

Because increases in the price of oil are expected to result in

depreciation of the Australian dollar, sea transport activity was projected by

Queensland Government modelling to be some 12 per cent higher than the base case

level, because of its strong linkages with commodity exports.[37]

Impacts on agriculture

4.33

The Queensland Farmers Federation (QFF) relied on ABARE data to

illustrate the impact that rising fuel prices have had and are expected to have

on agriculture. The QFF told the committee that farm costs are projected to

rise 4.2 per cent faster than farm gate prices in 2005/06, with farmers

continuing to be price takers rather than price dictators.[38] The QFF said that farmers have little capacity to pass on

increased fuel charges. Net farm incomes have been falling with fuel being the

fastest growing cost input. Fuel costs in 2006 are double what they were eight

years ago, while farm revenues have risen by just a quarter.[39] Further increases in fuel costs will

severely challenge the viability of many farming enterprises. Inflationary

pressures and interest rate rises will also have a significant impact as farm

indebtedness has been rising steadily over the last five years.[40]

4.34

The QFF told the committee of its concern that State and Federal

Governments have failed to make necessary policy adjustments:

After the oil shock of 1974, Governments around the world

invested in a range of measures which dramatically increased the fuel

efficiency of their economies, ultimately breaking the power of the OPEC cartel

for two decades. However, such concerted Government efforts at State and

Federal levels is sadly lacking at present. [41]

4.35

As well as diesel for farm machinery and transport to and from the farm

gate, oil is used to produce chemicals such as fertilisers and pesticides used

in modern agriculture.[42]

These chemicals and the mechanisation of agriculture provided by cheap oil have

underpinned a sharp rise in world food production. World fertilizer production

has risen from 3 million tons in 1938 to 90 million tons in 2003.[43]

[M]odern industrial agriculture has been

described as a way of using land to convert petroleum into food.[44]

The Green Revolution increased the energy flow to agriculture by

an average of 50 times the energy input of traditional agriculture.[45]

Impacts on communities

4.36

A study by Dodson and Sipe of Griffith University has found that those

Australians affected soonest and most severely by rising petrol costs are

likely to be those most reliant on car transport and who lack access to

suitable alternatives. These people tend to be those in socioeconomically

disadvantaged outer-suburban locations and those on the fringes of urban areas

and in regional and remote communities.[46]

[47]

The Western Sydney Regional Organisation of Councils (WSROC) noted the

increasing dependence on car transport by the outer suburbs:

While Sydney’s annual total vehicle VKT [vehicle kilometres)

increased on average 2.3% each year from 1991 onwards, the patterns were

geographically uneven – with a 23% increase in outer and south-west Sydney

compared with a 10% decline in inner and eastern Sydney.[48]

4.37

Further analysis by Dodson and Sipe has found that household mortgages

are also spatially differentiated, with higher debt burdens in the outer suburbs.[49]

This compounds the impacts of higher fuel prices as these contribute to

inflation and lower real wages and result in higher interest rates and lower

housing affordability.

4.38

Some commentators condemned current urban development policies that

result in oil dependence by generating low density urban sprawl in the outer

suburbs, without adequate public transport.[50]

For example, the City of Wanneroo described the rapidly growing urban

population in the area beyond the current terminus of Perth’s Northern Suburbs

railway:

Due to the absence of the railway in this area, conventional low

density, single residential housing types are tending to predominate, rather

than a more diverse mix of housing (including higher densities) which would

have more chance of being attractive to the market if the railway had been in

place. A more diverse housing mix would be more supportive of public transit

use. [51]

and:

Poor urban and service planning tied to significant under

investment in public transport has led to an over reliance on private motor

vehicles in order to 'bridge the geographic' divide between people and jobs and

services. [52]

4.39

The International Association of Public Transport has called for homes

schools, employment, shopping and recreation to be brought closer together to

relieve the need for car use.[53]

The Western Sydney Regional Organisation of Councils (WSROC) has cautioned that

low density urban development actually contributes to poor public transport

services.

4.40

WSROC has called for the development of high quality integrated services

which would increase public transport patronage. It notes that Sydney's public

transport is split between State Rail, Sydney Transit and a number of loosely

coordinated private operators throughout the western region:[54]

Successive State and Federal governments have failed to

adequately address the public transport needs of Western Sydney’s growing

population.[55]

4.41

WSROC acknowledges recent initiatives by the NSW State Government but

regards the level of funding to be insufficient to address years of

under-investment:

The north-west, south-west rail line, assuming it survives

several changes of government and everything else, is 2017 to 2020. The bus

corridors will probably happen a bit sooner than that. The other planning is

going on but it is a fairly slow and, I would say, very under resourced

process.[56]

4.42

WSROC called for a substantial increase in funding and the maintenance

of high levels of ongoing government commitment. It criticised the Commonwealth

Government's complete withdrawal from funding urban public transport

infrastructure.[57]

The International Association for Public Transport noted that there was an

almost complete lack of any mention of public transport on the agenda of the

Australian Transport Ministers' meetings over the last decade or more.[58]

4.43

The Western Australian Government advised the committee that it had

undertaken a range of measures aimed at improving accessible public transport

and more integrated transport and land use planning to address Perth's high

level of automobile dependence.[59]

Measures include a new Metrorail project for the rapidly growing city of Mandurah

south of Perth, which is to double the size of Perth's urban passenger rail

system and is expected to carry 35,000 people each weekday and remove 25,000

vehicles from the freeways. It also includes measures to improve the existing

public transport infrastructure by making it safer, more accessible and easier

to use. The Western Australian Government has also spent $60 million since

February 2001 to improve cycling infrastructure in the state.[60]

4.44

NCOSS expects that fuel costs will impact upon the financial viability

of non-government human service providers, particularly those that rely heavily

on vehicles to deliver services such as meals on wheels, community health,

community transport and neighbour aid.[61]

4.45

The Australian Medical Association expressed concern about the potential

for continuing rises in fuel costs to exacerbate the social gradient of health

that runs across society with the most disadvantaged in society having the most

health problems.[62]

The risk of supply side disruptions

4.46

The IEA warned that over the next two-and-a-half decades, oil and gas

production would become increasingly concentrated in fewer and fewer countries

and that this would add to the perceived risk of disruption and the risk that

some countries might seek to use their dominant market position to force up

prices. [63] The IEA

considered that unacceptable risks would result if policies continued

unchanged:

The energy future which we are creating is unsustainable. If we

continue as before, the energy supply to meet the needs of the world economy

over the next twenty-five years is too vulnerable to failure arising from

under-investment, environmental catastrophe or sudden supply interruption.[64]

4.47

IEA was concerned that $4 trillion of investment over 2005-2030, which

was needed to meet growing world demand, might not be forthcoming:

The ability and willingness of major oil and gas producers to

step up investment in order to meet rising global demand are particularly

uncertain.[65]

4.48

The issue of transport fuel security was acknowledged in the Australian

Government's 2004 Energy White Paper, although the paper regards the security

of transport fuels as 'not currently under threat.[66]

The paper however acknowledges the dominance of the Middle East as the primary

oil-producing region, the ability of those countries to act as a cartel through

OPEC, and the political instability of some countries in the region, as well as

longer term concerns about the longevity of oil supplies as having 'been major

factors behind concerns about transport fuel security'.[67]

4.49

More recently, Treasury expressed somewhat greater concerns. In the

2006-07 budget papers, Treasury noted that given the low level of spare

capacity for oil production, there remained a risk of further supply side

disruptions. In particular Treasury was concerned about the potential for

instability in key oil producing countries to have a more pronounced impact

than the demand driven rises experienced to date.[68]

Treasury noted that oil demand is unresponsive to price in the short run, and

modest disruptions in world supply could raise oil prices very substantially,

and for some time.[69]

4.50

Treasury considered the risk to be one that would increase in time with

potential disruptions due to conflict involving key energy producers,

unfavourable political shifts or major terrorist attacks:

World oil demand is projected to increase by around 45 per cent

over the next 20 years. Potential vulnerability is magnified by reliance on

supplies from the Middle East, which already accounts for 30 per cent of world

production — of which 11 per cent is from Saudi Arabia. This reliance on Middle

East sources is projected to rise to 46 per cent by 2030.[70]

4.51

ASPO-Australia expressed concern about our dependence on oil coming from

geopolitically unstable parts of the world:[71]

President Bush recently acknowledged "...we have a serious

problem: America is addicted to oil, which is often imported from

unstable parts of the world". ASPO-Australia agrees with the

President about the US and recognises Australia is almost as addicted to oil

and automobiles as the US.[72]

4.52

The 2004 Energy White Paper notes Australia's obligations as a member of

the International Energy Agency (IEA). The Emergency Oil Sharing System of the

IEA Agreement on International Energy requires Australia to maintain emergency

reserves equivalent of at least 90 days of net oil imports, provide a programme

of demand restraint measures, and to participate in oil allocation measures

amongst IEA members in the event of a severe oil supply disruption.[73]

4.53

The White Paper also noted that total national stocks of crude oil and

product have been about 50 days of supply, and with petrol and diesel stocks of

the order of 15 to 18 days. Commercial practice has seen a tendency to reduce

stocks.[74]

In the past, such as during the 1991 Gulf crisis, Australia was less dependent

on oil imports and was able to meet its required contribution to market

contingency of 46,000 barrels per day through surge production and demand

restraint.[75]

4.54

Submissions expressed concern about Australia's energy security.

Increasing levels of import dependence and a remote geographic location may put

Australia at risk, as it does not have an oil security stock holding above

that which is commercially optimal.[76]

4.55

The 2006 White Paper update describes the Commonwealth Government's

establishment of a new Energy Security Working Group under the Ministerial

Council on Energy (MCE) with ongoing responsibility for managing the National

Liquid Fuel Emergency Response Plan.[77]

4.56

A submission by Mr David Bennett pointed out the strategic importance of

oil security in times of war:

Yet oil is fundamental to our ability to defend ourselves. The

strategies employed by the Nazi Government in the Second World War were aligned

to securing oil reserves in order to fight. Rumanian oil fields were the first

to be occupied. The advance on the Caspian was stopped at Stalingrad and the

advance to the Persian Gulf was stopped at El Alamein. The Japanese occupied

the Indonesian fields and a major part of the Allied counter-attack was centred

on destroying oil tankers carrying oil back to Japan; a similar tactic was used

by the Germans in the North Atlantic.[78]

4.57

ASPO noted that defence currently accounts for 48 per cent of the

Commonwealth Government's total energy consumption and argued that rapidly

increasing fuel costs will have a significant impact on defence and security

budgets and capabilities. ASPO quoted an Australian National Audit Office

(ANAO) report that concluded that Defence did not have a fuel procurement price

risk management policy:

The Australian National Audit Office (ANAO) report in 2002

examined the Australian Department of Defence Fuel Management. The report

states that “fuel is a critical component of military capability as it is an

essential consumable for the mobility of the Australian Defence Force (ADF).

The procurement, storage and distribution of fuel by the ADF represent a

complex range of activities in a number of Defence sub-programs and are

conducted at geographically dispersed locations. The ADF uses eight different

types of fuel, four of which are military specification fuels. Military

specification fuels include additives that the ADF considers essential for the

operation of its ships, aircraft and vehicles, in a range of demanding

environments. Factors underlying the military specific requirements include the

wide range of climates where the ADF may be required to operate, the need for

longer-term fuel storage and safety requirements in combat situations. Over 750

different oils and lubricants are used by the ADF. The Defence fuel and

lubricants supply chain is complex and involves a wide range of processes and

control structures. The strategic management of this supply chain is fragmented

and insufficiently coordinated”.

The ANAO also found that Defence does not have a “fuel

procurement price risk management policy” and that more needs to be done to

effectively “identify, analyse and manage these risks”. [79]

Avoiding adverse impacts

4.58

In the World Energy Outlook 2006, the IEA reported on a number of

forecast scenarios it had modelled to examine the potential economic effects of

a range of future investment and policy scenarios. The Alternative Policy

Scenario examined the implementation of policies including efforts to improve

efficiency in energy production and use, increase reliance on non-fossil fuels

and sustain the domestic supply of oil and gas within net energy-importing

countries. This modelling predicted that these policies would yield substantial

savings in energy consumption and imports compared with the base case Reference

Scenario. Implementation of such policies was expected to enhance energy

security and help mitigate damaging environmental effects, with the benefits

achieved at lower total investment cost than in the Reference Scenario:

What this scenario shows is that the world economy can flourish

while using less energy. The perpetual rise in OECD oil imports can be halted

by 2015. Carbon dioxide emissions can be cut by thousands of millions of tonnes

by 2030. The investment cost is higher for consumers; but their extra cost is

more than offset by savings in energy bills and in investment elsewhere. The

challenge for governments is to persuade society that it wants this outcome

sufficiently to give its backing to the necessary action, even where that means

bearing a cost today for the benefit tomorrow.[80]

4.59

The Hirsch report argues that adverse impacts from peak oil could be

avoided using existing technologies if given enough lead time.[81]

ASPO-Australia argues that many adaptations are justifiable even without peak

oil concerns:

Certainly, preparing well in advance for peak oil is a very

prudent strategy. Many of the possibilities are “no regrets” options (those

that are already justified on social, environmental, health or economic

grounds).[82]

4.60

The Hirsch report argued that mitigation strategies would take 10 to 20

years to put in place. This was also echoed by several submissions (see also

discussion in chapter 6 on coal to liquids and gas to liquids):

A lot of it comes back to market failure, that there is just not

enough information for markets to operate efficiently. The point I want to make

about why governments need to get involved is around the speed of change. Markets

take a long time to move.[83]

4.61

In the 2004 Energy White paper the Commonwealth Government described

energy security as involving a balancing of supply reliability versus cost and

noted that increasing energy reliability can be expensive. The Paper went on to

say that this expense flows onto prices and lowers the competitiveness of the

Australian economy. It stated that the Government's energy security policies

aim to pursue enhanced reliability while maintaining competitive energy prices.[84]

4.62

The Energy White paper recognised that the potential for disruptions in

world oil supplies from any major producing region poses challenges for the

world as a whole and that these challenges required a global response. The

paper identified Australia’s best path to provide for the continuity of oil

supplies as multilateral efforts to ensure that world markets remain open and

that effective response mechanisms are in place to mitigate the impact of

short-term supply disruptions.[85]

4.63

The November 2006 G20 meeting held in Melbourne discussed the need for

resource security to be underpinned by effective domestic and international

policy frameworks that support markets.[86]

Committee comment

4.64

The committee notes concerns that markets will not respond in time to

provide a smooth transition to a post peak oil world without government action.

Given the uncertainty about much of the information on world oil supplies and

the geopolitical instability of some key oil bearing regions, it is possible

that there may be a risk that markets will under invest in oil and energy

technologies, resulting in economic and social hardship when supply of

conventional oil falls below demand.

4.65

The information required to make a clear determination on whether peak

oil will occur before the market can provide mitigating action is not

available. The following chapters discuss possible mitigation actions. These

offer options for a prudent approach to managing the possibility of peak oil

and associated issues contributing to oil vulnerability, resulting in substantially

higher oil prices and a constraint on liquid fuel availability.

Navigation: Previous Page | Contents | Next Page