Overview of the steel industry in Australia

2.1

This chapter gives a broad overview of the steel industry in Australia,

including Australia's primary steel producers and the role of steel

manufacturers and distributors. It also outlines the economic contribution of

the steel industry to the Australian economy and local economies. The chapter

ends with a discussion of the competitiveness of Australian steel and its

contribution to innovation and technology.

2.2

The chapter does not cover in detail international conditions and how

these have impacted the Australian industry – this issue is instead discussed

in chapter 6.

Structure of the steel industry in Australia

2.3

Steel is used in almost all infrastructure and construction.[1]

Significant amounts of steel have been produced in Australia since 1915.[2]Today, the Australian steel industry is an international

leader in coatings, and is recognised globally for its leadership in safety and

product development.[3]

Steel remains an important part of the domestic economy, and the steel industry

employs 90,000–100,000 people around the nation.[4]

2.4

The steel supply chain covers all aspects of steel production, from raw

material inputs, to crude steel and steel products, to manufacturing and end-use

demand for steel products.[5]

The main industries purchasing iron and steel manufacturing products are

manufacturing (48.7 per cent), construction (42.6 per cent) and

mining (5.3 per cent).[6]

2.5

Today, the Australian steel industry consists of various companies

involved in different stages of the steel production and supply chain. The two major

integrated steel producers[7],

BlueScope Steel and Arrium Steel (now Liberty OneSteel), which were both

formerly part of BHP Limited, produce crude steel domestically as 'upstream'

manufacturers, although they produce different products to each other.

2.6

The industry also includes smaller scale operators, manufacturers and

distributors, a network of more than 160 steel distribution and warehouse

premises, 'downstream' supply chains of structural steel fabricators, iron and

steel product importers and recyclers.[8]

BlueScope Steel

2.7

BlueScope Steel is Australia's only producer of flat steel.[9]

Formerly BHP Steel, BlueScope de-merged from BHP Billiton in 2002 to form a

stand-alone public company. The steelworks that it now operates in Port Kembla,

in the Illawarra region of New South Wales, first opened in 1928.[10]

2.8

BlueScope outlined in its submission that its annual steel production

capacity in Australia is 2.6 million tonnes. It manufactures in all mainland

states of Australia and exports approximately 800,000 tonnes a year to various

markets, including the United States, Thailand, Vietnam, the United Arab

Emirates, Malaysia and Singapore. The key focus of the company is:

...higher value, branded products for the building &

construction industry. Products manufactured by Bluescope in Australia include

steel coil and plate, galvanised steels, and a range of coated and painted

steel products... Steel coil and plate products are sold to a range of

manufacturers who convert them into products such as structural steel sections,

girders and beams, fabricated structures, machinery, defence and transport

equipment.[11]

2.9

Following the committee's site visit to the steelworks at Port Kembla, BlueScope's

Chief Executive, Mr Mark Vasella, explained that another key focus of

BlueScope is innovation and research:

Innovation is a key strategy of ours and the basis of our

success in our coated and steel products, which you witnessed today. We are a

small producer of commodity steel by global standards but we are, unusually, a

large manufacturer in terms of value-added painted and coated steel products.

We run an innovation and product development facility here at Port Kembla, with

70 people employed and some 30 PhD qualified scientists. We continue to invest

in our products, such as Colorbond—most recently with the next generation of

Colorbond in partnership with Nippon Steel, our joint venture partner from

Japan. We also invest in the steel innovation hub at the University of

Wollongong.[12]

2.10

BlueScope also supplies products through its Lysaght division which,

according to the division's website, was a pioneering producer of Australian

corrugated iron sheeting used in roofs, sheds and other buildings.[13]

Today, Lysaght rollforms and creates products that include fencing, roof and

wall cladding, rainwater products, steel house framing, structural products

such as flooring systems, walkways and meshes, and home improvement products.[14]

2.11

Between 2011 and 2014, BlueScope reported consecutive net losses after

tax. Mr Vasella stated that 'the current trading environment for BlueScope has

been probably the toughest in living memory'.[15]

2.12

BlueScope outlined in its submission that because of these circumstances,

it had:

...undertaken significant structural transformation, including

halving its commodity steel production in Australia by shutting one of two

blast furnaces, and nominally exiting the export market (although exports

continue due to weaknesses in key domestic markets)... The company has recently

taken action to reduce costs at our Australian steelmaking operations by

approximately $200 million, in order to achieve cashflow breakeven on hot

rolled coil production given current global steel prices and spreads.[16]

2.13

The burden of cost-cutting at BlueScope has fallen heavily on its

workers. In November 2015, BlueScope workers agreed to a new Enterprise

Agreement that triggered 500 job losses, a three‑year pay freeze and the

loss of various employee conditions.[17]

Witnesses from the Australian Workers' Union suggested that because of the

measures employees agreed to so that BlueScope could achieve cashflow

breakeven, some employees experienced financial losses as great as $30,000 a

year.[18]

2.14

The NSW Government announced an assistance package for BlueScope in

October 2015 that involved the deferral of $60 million in payroll tax over

three years.[19]

A federal government assistance package was in turn announced in December 2015,

consisting of $670,000 to assist retrenched workers make the transition to new

jobs, and appoint a local employment facilitator.[20]

2.15

BlueScope reported that it had returned to profitability and payment of

a dividend in the 2015 financial year.[21]

In February 2016, BlueScope announced a $50 million increase in its half‑year

earnings expectations to $230 million, which it attributed to 'earlier [than

expected] delivery of cost reductions, growth in Australia domestic dispatches

and better margins'.[22]

Arrium Mining and Materials

2.16

Arrium, previously known as Onesteel, spun off from BHP in 2000. It was

Australia's only manufacturer of steel long products, and is Australia's

leading steel distributor and reinforcing steel supplier.[23]

The Arrium-owned steelworks in Whyalla, South Australia have operated since

1941.[24]

2.17

Arrium outlined in its submission that its annual steel production

capacity in Australia was 2.6 million tonnes. It produced around 44 per cent of

the total amount of crude steel made in Australia each year, and its share of

the domestic steel production market was approximately 75 per cent.[25]

2.18

Arrium was placed into voluntary administration on 7 April 2016. On 13 July 2017,

Arrium's creditors formally approved the purchase of Arrium's steel division by

international industrial and metals company Liberty House under the banner of the

London-based company GFG Alliance.[26]

Further details of the sale are outlined in Chapter 3.

Steel manufacturers and

distributors

2.19

The Australian steel industry, including both upstream and downstream

supply chains, comprised 12,253 registered businesses as of June 2014. Besides

the major upstream companies, the industry overwhelmingly consists of a large

number of smaller iron smelters, and downstream steel manufacturers and

fabricators, including a network of over 160 steel distribution and warehouse

premises.[27]

The Australian Industry Group reported in its submission that most of these

registered businesses were small: as of June 2014, 93.2 per cent were small

businesses with fewer than 20 employees, and only 6.4 per cent were medium

sized with 21 to 199 employees.[28]

2.20

The Department of Industry, Innovation and Science (Department of

Industry) made a similar observation in its submission, noting that downstream

industries consisted of smaller businesses:

Of the employing businesses, the majority of the firms in the

Iron Smelting and Steel Manufacturing, Iron and Steel Casting, and Steel Pipe

and Tube Manufacturing industries are small businesses employing 1–19

employees. It is only in the upstream industries i.e. the Iron Smelting and Steel

Manufacturing and the Iron and Steel Casting industries where there are any

large firms employing 200 employees or more.[29]

2.21

BlueScope and Arrium also compete in the downstream market, as they both

sell raw steel products to downstream Australian manufacturers and compete

against these manufacturers with their own value-added downstream products.

2.22

Several submitters noted that Arrium and BlueScope's domestic market

shares can be problematic, because they hold a significant degree of market

power and can refuse to supply to or impose particular terms on smaller

industry competitors.[30]

As one submitter observed:

[B]ecause BlueScope and Arrium are so integrated, the smaller

industry participants will generally be required to compete with BlueScope or

Arrium related entities in downstream, value-added markets...

Here-in lies the problem – there are no internal sources of

competition for Arrium or BlueScope. They produce different products from one

another. If an entity cannot purchase steel products from these entities, it

must seek a source from elsewhere, or close-up shop.[31]

Economic contribution of the steel industry to Australia

2.23

The steel industry is an important contributor to the Australian

economy, both in terms of its earnings and as a provider of employment. In its

submission, the Australian Steel Institute referred to ABS data showing that in

2011, the entire steel industry supply chain employed over 100,000 people in

Australia, with an annual turnover in excess of $35 billion.[32]

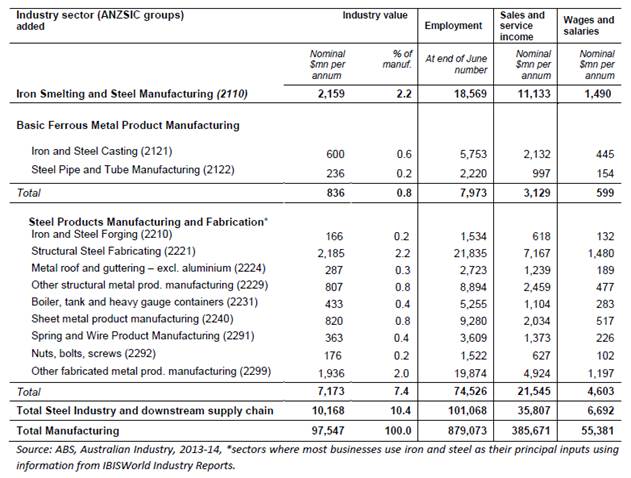

According to 2013–14 ABS data referred to by the Australian Industry Group, the

upstream steel industry (iron smelting and steel manufacturing) directly employed

about 18,500 people, paid annual wages of $1.5 billion and had an annual

sales and service income of about $11.1 billion.[33]

2.24

A summary of the 2013–14 ABS data provided by the Australian Industry

Group in its submission is shown in Figure 2.1.

Figure 2.1 Australian Steel Industry and Downstream Supply

Chain (2013–14)[34]

2.25

The Illawarra Business Chamber noted that the multiplier effect of the

steel industry in Australia is significant, with 3–5 indirect jobs for every

direct job generated by the industry.[35]

2.26

In its submission, BlueScope stated that it employs approximately 7,500

workers in its Australian operations, thousands more as contractors and

suppliers, and a further 8,500 employees overseas.[36]

Arrium stated in its submission that it employs almost 7,000 people directly, generates

around 14,000 jobs through its activities, and spends nearly $4 billion in

goods, services and taxes annually.[37]

2.27

The Bureau of Steel Manufacturers of Australia in its submission noted

that 'it has been estimated that every dollar of steel production generates an

additional gross output of $2.30 across the wider economy'.[38]

Economic contribution of the steel

industry to local communities

2.28

The Bureau of Steel Manufacturers of Australia also highlighted that 'many

steelmaking facilities are... located in regional centres, and form the basis for

the area's economy'.[39]

The presence of local steel plants leads to flow-on jobs in the education,

health, banking and hospitality sectors, which service steel employees. Two examples

of this are the Illawarra region and Whyalla. Both regional economies are

heavily dependent on BlueScope and Arrium continuing to operate within their

regions.

The Illawarra region

2.29

BlueScope Illawarra on its website reported that it directly employs

around 3,000 people in the Illawarra and indirectly supports about 10,000 jobs

in the region, including contractors, suppliers and other service providers who

depend upon the Port Kembla Steelworks.[40]

2.30

Submitters highlighted that the economic impact of Bluescope's

operations in the Illawarra region is significant. The Illawarra Business

Chamber submitted:

Analysis conducted by Wollongong City Council estimated the

impact of this aspect of BlueScope's business at $1.916 billion per annum

(without taking into effect the multiplier effects). This impact would increase

to approximately $2.572 billion per annum, after taking into account all

direct, indirect and consumption effects.[41]

2.31

Councillor Gordon Bradbery, the Lord Mayor of Wollongong, provided

evidence at the Wollongong hearing that the loss of 500 jobs in the BlueScope

steelworks was anticipated to lead to an economic impact on the local economy

of around $402 million. He also argued that even though the region had

experienced a number of economic downturns because of decreases in the size of

BlueScope's workforce since the 1980s:

Manufacturing remains the most

important sector in the output of the region. It contributes about $7.9 billion

annually in revenue to the region's gross regional product. The manufacturing

sector is the second largest industry in terms of employment, after health and

social services, employing about 8,570-odd people, equating to about 12 per

cent of Wollongong's workforce.[42]

2.32

A representative from the Australian Workers' Union who gave evidence suggested

the closure of the BlueScope steelworks would have a 'devastating effect' on

the region, given the number of jobs and businesses dependent on the steelworks:

We have hundreds and hundreds of people who directly or

indirectly rely on the works. Apart from about a thousand contractors on site,

there are also a number of other contractors, fabricators, who buy product

directly for their work or who do work for the company. [W]hether it be a cafe

shop, the little company that supplies the doormats or the people that take

away the oil and recycle it...[43]

Whyalla

2.33

A range of submitters and witnesses at the Whyalla hearing emphasised

that Whyalla's economy is heavily dependent on the local steel industry.[44]

2.34

In its submission, Arrium outlined the contribution of the steelworks to

Whyalla's economy in more detail:

[The Whyalla steelworks] employs 25 per cent of the town's

workforce and makes up 35 per cent of its economy. The presence of the

Steelworks also provides indirect benefits: other sectors, such as education,

health, hospitality and tourism rely on the population base the Steelworks

provides. This base also ensures access to a level of services from governments

(including schools and healthcare) that generally do not exist in nearby,

lower-population towns.[45]

2.35

The importance of Arrium to the Whyalla economy, and the impact of

Arrium's financial crisis on the city, is further discussed in chapter 3.

Trends in Australian steel production and utilisation

2.36

Integrated steel manufacturing in Australia began in the late nineteenth

century with the discovery of iron ore resources in South Australia. Over the

years, integrated steelworks have closed around the country, with only Arrium

and BlueScope remaining.[46]

2.37

The Bureau of Steel Manufacturers of Australia in its submission

outlined the current largest market sectors for steel:

The two biggest market sectors for steel used in Australia

are steel reinforcement and associated steels used in concrete buildings and

structures, and structural steel and associated steels used in steel framed

buildings and structures.[47]

2.38

Australian steel production mainly uses the Blast Oxygen Furnace (BOF) method.[48]

The weighted capacity utilisation of the BOF in Australia (74 per cent) is

relatively low compared to the weighted world average (81 per cent). Of those

plants that use the Electric Arc Furnace (EAF) method, the capacity utilisation

is very high (97 per cent).[49]

Capacity utilisation 'is calculated as the ratio of actual output to the

reported total (maximum) available productive capacity at each plant'.[50]

These ratios are outlined further in Figure 2.2.

Figure 2.2: Available capacity and capacity utilisation for

crude steel production, by method in 2015[51]

|

|

Blast Oxygen Furnace (BOF) |

Electric Arc Furnace (EAF) |

Notes |

| Available

Capacity (‘000 tonnes) |

Capacity

Utilisation (%) |

Available

Capacity (‘000 tonnes) |

Capacity

Utilisation (%) |

Available capacity includes inactive

or mothballed lines. |

| Australia |

6,556 |

74 |

1,558 |

97 |

| World (n=677) |

970,816 |

81 |

354,595 |

89 |

Source: MCI Steel

Consultants and Department calculations; capacity utilisation is output divided

by total available plant capacity.

Trends in exporting and importing

2.39

Australian steel output has varied across different decades, from 7.6

million tonnes in 1980, to a peak of 8.9 million tonnes in 1998, to 7.3 million

tonnes in 2010.[52]

In recent years, steel production in Australia has fallen significantly, to a low

of 4.6 million tonnes in 2014,[53]

with a slight increase in production in 2015 to 4.9 million tonnes.[54]

Recent output has been affected by global conditions. The Department of

Industry submitted that:

Australian steel exports have been negatively affected by the

Global Financial Crisis and, until recently, the high exchange rate, with the

export index falling almost two thirds since 2005–06. Imports of steel into

Australia have been less affected, which may be due to some combination of

price effects, the import of varieties not produced in Australia and the

continuing investments in the mining and gas sectors.[55]

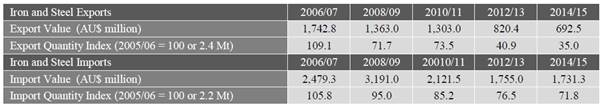

2.40

Figures provided by the Department of Industry show that in 2014–15,

Australia exported steel to the value of $692.5 million, and imported $1.7 billion

worth of steel. While the export value of Australia's steel had declined since

2006/07, thanks to the effects of the Global Financial Crisis and, until

recently, a high exchange rate, the import value of steel had also declined,

though to a lesser extent (see Figure 2.3).

Figure 2.3: Indices of Australian steel exports and imports

– 2006‑07 to 2015‑16[56]

Source: Economic and

Analytical Services, Department of Industry, Innovation and Science – Resources

and Energy Statistics

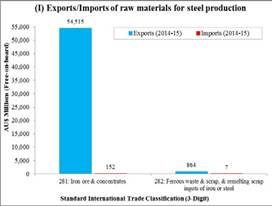

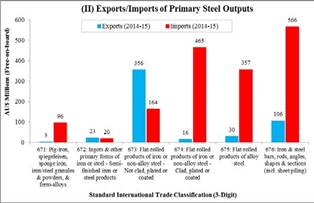

2.41

Further figures in the Department of Industry submission sourced from the

ABS suggest that the raw materials used to create steel are primarily sourced

locally. The figures also show that Australia is a net exporter of flat-rolled

products of iron or non-alloy steel that are not clad, plated or coated. These

products accounted for the largest share of total sales revenue from major

iron/steel products in 2014–15. However, Australia predominantly imports rather

than exports first transformation steel products that are clad, plated/coated

or steel alloys, as well as iron and sheet bars and rods (see Figure 2.4(I) and

(II)).[57]

Figure 2.4(I) and (II): Australian imports and exports of

steel in 2014–15: (I) raw materials and (II) primary steel outputs[58]

Source: ABS (2016)

International Trade in Goods and Services, Australia. Catalogue No. 5368.0

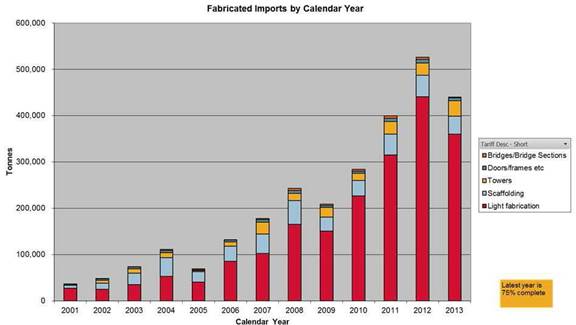

Figure 2.5: Fabricated imports by calendar year[59]

Source: OneSteel, in Australian Steel Association

2.42

The Australian Steel Industry provided figures showing a dramatic

increase in the number of fabricated imports between 2001 and 2013 (Figure

2.5). As outlined in chapter 6, the global oversupply of steel has led to a significant

increase in imports and this has impacted the Australian steel industry.

Employment

2.43

Arrium commented in their submission that annual industry revenue in the

last five years had fallen by an annualised rate of 7.5 per cent.[60]

2.44

Employment in the steel industry in Australia has been declining steadily

since 2006. Between 2006 and 2011, both full-time and part-time employment in

steel production was above 40,000, but since 2012 has remained below 40,000.

The decline in employment between 2012 and 2015 was around 26 per cent,

compared with 12 per cent in manufacturing for the decade. Figure 2.6

outlines changes in employment in the steel industry between 2006 and 2015.

Figure 2.6: Changes in employment for the steel industry,

manufacturing and all industries between 2006 and 2015 (total employment)[61]

| Employment, levels and share |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

| Steel Production

(′000) |

45.5 |

42.3 |

48.8 |

40.9 |

43.1 |

45.4 |

36.2 |

35.7 |

39.7 |

33.8 |

| Manufacturing (′000) |

1,009.5 |

1,027.7 |

1,044.8 |

998.2 |

978.7 |

947.3 |

947.8 |

920.1 |

921.7 |

888.6 |

| All industries

(′000) |

10,088 |

10,408 |

10,695 |

10,775 |

10,991 |

11,178 |

11,315 |

11,425 |

11,536 |

11,770 |

| Steel as a percentage of

manufacturing (%) |

4.5 |

4.1 |

4.7 |

4.1 |

4.4 |

4.8 |

3.8 |

3.9 |

4.3 |

3.8 |

Source: Economic and Analytical

Services, Department of Industry, Innovation and Science; ABS, Labour Force,

Australia, Detailed, Quarterly, Nov 2015, cat.no. 6291.0.55.003

2.45

Despite a global glut in steel supply, and recent falling commodity

prices in the mining sector, demand for domestic steel products remains

considerable. This demand comes primarily from construction services (25.9 per

cent of use as a share of total supply), structural metal product manufacturing

(17.3 per cent), heavy and civil engineering construction (8.2 per cent) and

residential building construction (6.1 per cent).[62]

2.46

The Australian Workers' Union in their submission cited figures

indicating that even though:

...total steel consumption has been fairly stable over the past

seven years, local steel makers have lost a significant share of the total

Australian steel market to imports, falling from a peak of over 62 [per cent]

in 2009/10 to below 56 [per cent] in 2014/15.[63]

Competitiveness of Australian steel production and utilisation

2.47

Factors that make steel competitive include how innovative or

cutting-edge the product is, its value for money and the quality of the finished

product. Factors that influence how cost competitive steel is compared with

steel produced in different contexts include costs involved in production

technology, the regulatory environment, location and demand.[64]

2.48

The Australian Industry Group argued that local steel manufacturers have

several key advantages over international competitors. These include:

-

access to high quality reserves of iron ore and coking coal;

-

the ability to respond quickly to local demand requirements;

-

relatively short lead times;

-

less likelihood of reworks because of misinformation and

mistakes;

-

reduced whole-of-life costs, including maintenance and technical

support;

-

a skilled labour force trained in the latest steel fabrication

techniques and welding processes;

-

strong brand recognition of several product lines; and

-

products that comply with established Australian standards.[65]

Innovation and emerging steel

technologies in Australia

2.49

Several submitters highlighted that one of the

strengths of the Australian steel industry is its track record of producing new

and cutting-edge steel products. These may contribute to the long-term

competitiveness of Australian steel products. The Australian Industry

Group submitted:

The Australian steel industry has a long-standing reputation

for producing high quality products and services backed by a commitment to

investing in technology, innovation and skills development. Modern steel

products are highly sophisticated with new lightweight steel allowing lighter

and more flexible applications that are utilised in the design of cars and

transport equipment, cutting edge medical equipment, defence applications, and

building and construction applications.[66]

2.50

Around 75 per cent of modern steels have been developed in the past 20 years.

This indicates the importance of technology and innovation in the steel

industry, and also the potential for specialisation and niche production.[67]

2.51

Mr Kenneth Watson, the Executive Director of the National Association of

Steel-Framed Housing, gave evidence outlining Australia's position in terms of

steel innovation:

Australia is seen around the world as a leader in the design

and construction of steel-framed buildings using cold-formed steel. The

technological basis for this has been led by BlueScope, with support from many

universities and industry associations around Australia. Due to this leading

technology, Australian companies are exporting products and technology

overseas, particularly to the South-East Asian and African regions. These

technologies include the use of high-strength steels and the development and

application of sophisticated CAD/CAM systems to manufacture steel frames.

[However], recently the overseas countries have been catching up with their

technology and, in some cases, surpassing Australia's leading position.[68]

2.52

The Department of Industry noted in its submission that businesses

classified by the Australian Bureau of Statistics under the Primary Metal

and Metal Product Manufacturing subdivision have a higher level of research

and development (R&D) activity than other industries. For example, between

2008–09 and 2013–14, R&D expenditure as a share of value added for the

primary metal and metal product manufacturing industry ranged from

5.9 to 7.4 per cent; this compared to expenditure between

4.0 to 4.8 per cent for the manufacturing industry and

1.4 to 1.5 per cent expenditure for all industries over the

same period. This was likely because of 'the increasingly technology intensive

production of transformed steel products, as well as the continued improvements

in production technology'.[69]

2.53

Collaboration between iron and steel manufacturing and downstream steel

product manufacturers in Australia has led to the creation of specialised high

strength steel products. These include military products and products for

high-rise construction, storage bins, cement rotating mixers, compactors,

tanker vessels, refinery and petrochemical equipment.[70]

2.54

Other innovations in the Australian steel industry include new

technologies adopted to improve energy efficiency and reduce emissions, and

improvements in plant-heat recovery and air-leakage reduction that have

resulted from technological changes in the sintering stage of the steel

production process. The Australian Industry Group submitted that 'Australia's

leading steel detailing businesses are also at the forefront of international

developments in data interfacing'.[71]

2.55

Liberty OneSteel's recently announced 'green steel' project provides an

example on continuing innovation in the industry. Mr Sanjeev Gupta, Chairman

and CEO of GFG Alliance (owner of the Liberty OneSteel steelworks), announced

in September 2017 that ZEN Energy (also controlled by Mr Gupta) would deliver

renewable energy to power the Whyalla steelworks. The multi-pronged project

will include a mix of solar panels in and around the Whyalla steelworks, and

battery storage and pumped hydro storage in the surrounding region. Mr Gupta

explained:

These first steps in SA will improve reliability and greatly

reduce costs of electricity in our own steelworks at Whyalla, and provide

competitive sources of power for other industrial and commercial users.

This will be followed by early steps to lower Liberty

OneSteel's electricity costs in NSW and Victoria, and to provide power at lower

cost to other industrial enterprises in these states and Queensland.[72]

2.56

BlueScope noted that its operations include innovation and product

development facilities at Port Kembla that employ approximately 70 people,

including around 30 PhD qualified scientists, and at Minchinbury that employ a

further 12 people. It highlighted a new steel coating technology as an

example of an innovative product it had recently developed, which significantly

improved the product's performance and resistance to corrosion, and reduced its

environmental footprint.[73]

2.57

Arrium's Chief Executive of Strategy highlighted:

...the importance of a domestic industry in terms of research

and development, particularly in relationship to new and innovative processes

and technologies...Arrium partners with multiple universities and research

institutions across the country. These partnerships provide us with access to

some of the brightest minds in Australia, and in turn we provide access to

hands-on development.[74]

2.58

Several submitters commented on the work of the Australian Research

Council Research Hub for Australian Steel Manufacturing at the University of

Wollongong, established in 2014.[75]

The Hub's partner is BlueScope Steel, and supporting partners include Arrium,

Bisalloy Steels, the Australian Steel Institute and Lysaght. The University of

Wollongong outlined in its submission the potential benefits of the Steel

Research Hub for the Australian steel industry:

[T]he Australian Research

Council Research Hub for Australian Steel Manufacturing (the hub) is a research

hub bringing together the best and brightest scientists and engineers from

Australia's steel manufacturers and research institutions to drive industry

innovation in product development and improve global competitiveness. The hub

conducts research and development programs that address manufacturing

techniques and best-practice pathways for bringing new ideas to market...

UOW researchers, in a long-standing collaboration with hub

partner BlueScope Steel Ltd, are drawing on expertise in microbiology, surface

engineering, and molecular dynamics to make paints and coatings for steel

sheeting that prevent bacterial growth. Product innovations include a project

to develop a self-cleaning, anti-microbial organic coating for painted sheet

steel to prevent the build-up of mould, algae and other bacteria on roofs,

particularly in humid environments.[76]

Cost-competitiveness

2.59

The Department of Industry in its submission presented figures from 2015

showing how costs in Australian steel plants compare to the rest of the world. On

average, Australian plants using the Blast Oxygen Furnace (BOF) method have a

material cost that is about 10 per cent lower than other plants using the BOF

method in the world in terms of raw materials. However, they also have

significantly higher average labour and overhead costs (54 per cent) and

capital charges (40 per cent). Overall, the cost per tonne output for Australia

on average is about 14 per cent higher than elsewhere in the world.[77]

Input costs are outlined further in Figure 2.7.

Figure

2.7: Contribution of input costs to total product costs – total plant (Blast

Oxygen Furnace), 2015[78]

|

|

Raw

Materials |

Energy

& Reductants |

Labour

& Overheads |

Capital

Charges |

Total

Cost |

| Australian input cost

relative to weighted world average input cost |

-10% |

+6% |

+54% |

+40% |

+14% |

| Component share of

Australian total cost |

31% |

25% |

28% |

15% |

100% |

| Weighted world average component

share of total cost |

40% |

27% |

21% |

12% |

100% |

Source: MCI Steel

Consultants and Department calculations

2.60

It might be noted that since this data was collected in 2015, energy

costs have increased substantially. Underscoring the challenge for Australian

steel producers in this regard, Bluescope recently reported that its Australian

electricity costs have increased from $59 million in 2015–16, to a

projected $113 million in 2017–18, a 93 per cent increase. Bluescope

further reported that its Australian gas costs have increased an estimated

33 per cent over the same period, from $24 million to

$32 million. Overall, Bluescope's forecast $145 million energy bill

in 2017–18 represents a 75 per cent increase over a two-year period.[79]

Given the large increases in energy costs since the collection of the data

presented in Figure 2.7, it is almost certain the proportionate input cost

attributable to energy will have also increased significantly.

2.61

The Electric Arc Method (EAM) on average is more expensive than the

Blast Oxygen Furnace method, in which crude steel is recovered from recycled

steel. On average, Australian plants using the EAM method have a material cost

that is about 4 per cent lower than other plants using the EAM method in

terms of raw material. Like plants using the BOF method, however, they also

have significantly higher labour and overhead costs than other countries (18

per cent – see Figure 2.8).[80]

Figure 2.8: Contribution of input costs to total product

costs – total plant (Electric Arc Method)[81]

|

|

Raw

Materials |

Energy

& Reductants |

Labour

& Overheads |

Capital

Charges |

Total Cost per tonne |

| Australian input costs

relative to weighted world average cost |

-4% |

-7% |

+18% |

-34% |

-4% |

| Weighted input cost share

of Australian total cost |

66% |

13% |

16% |

5% |

100% |

| Weighted world average

input cost share of total cost |

65% |

14% |

13% |

8% |

100% |

Source: MCI Steel

Consultants and Department calculations

Factors influencing the recent cost

competitiveness of Australian steel

2.62

The Chief Executive of the Australian Steel Institute gave evidence in

the Canberra hearing outlining some of the factors highlighted by submitters

leading to a current crisis in the Australian steel industry:

The crisis is a global crisis and it is manifest and very

strong in Australia... When you go right through the value chain, all of our

members—fabricators, galvanisers, all of them—are saying that they are

underutilised and suffering profitability strain... What we are sitting in at the

moment is almost a perfect storm for our manufacturers, where the dollar has

stayed stubbornly high, the margins, because of the glut of steel, have shrunk

quite aggressively and the market share is under threat because of the volume

that is available globally. This is a very unique time and it is a perfect

storm... The process is broken.[82]

2.63

BlueScope Steel, in a previous submission to the Productivity

Commission's inquiry into Productivity and the Australian Workplace Relations

System, also commented on recent changes to the global market and how this had

impacted its activities:

At the time of the de-merger [from BHP in 2002], world steel

production stood at around 905 million tonnes. BlueScope manufactured about

5.2 million tonnes of steel per year in Australia. The company's Port

Kembla Steelworks was a low-cost producer, operating in the lowest quartile of

the world steel production cost curve. The average Australian dollar (AUD) – US

dollar (USD) exchange rate was AUD $0.54 cents.

Since then... BlueScope's Australian steel manufacturing

capacity has halved to approximately 2.6 million tonnes per annum, after the

company closed one of two blast furnaces in 2011 as a result of financial

losses, particularly in export markets. The majority of the company's

Australian production is now sold in the domestic market, with approximately

480,000 tonnes (down from 2.6 million) of exports in FY2014 or about 20 per

cent of Australian production and despatches. Import competition has risen

steeply in the domestic market. There has been a significant rationalisation of

businesses in the Australian steel industry.[83]

2.64

The committee also heard from the Bureau of Steel Manufacturers of

Australia that dumping, or the offloading of surplus or subsidised products by

selling them into foreign markets at reduced prices, may create issues for the

cost‑competitiveness of Australian-produced steel.[84]

2.65

Besides global conditions, the Department of Industry in its submission stated

that government policy reforms over the past few decades have also impacted the

domestic steel industry. These include a phased reduction in tariffs on

imported steel, and the implementation of a flexible exchange rate system, both

of which have increased steel manufacturers' exposure to direct competition

from foreign markets. Free Trade Agreements with China, Japan, Korea and

Trans-Pacific Partnership countries, which aimed to increase Australian access

to key markets and reduce import costs for Australian businesses, have further

opened up the market.[85]

2.66

The Chief Executive Officer of the Welding Technology Institute of

Australia gave evidence that, in his opinion, the impact of global conditions

on the Australian steel industry may mean that 'within five years we may not

have a steel industry or a fabricator in Australia'.[86]

These conditions appear to have contributed to Arrium's collapse, as outlined

in chapter 3, and remain a major contributing factor to the uncertainty

surrounding the future of the Australian steel industry.

2.67

International conditions, including the global glut in steel, dumping,

subsidies and other trade measures from foreign governments and their impact on

Australian steel are outlined further in chapter 6.

Energy costs and security

2.68

When this inquiry commenced, energy affordability was not a key focus of

submitters and witnesses. Previously, Australian steel manufacturers had a relative

competitive advantage because of low energy costs compared to the current

environment. However, recent increased energy prices have affected the

viability of energy-intensive manufacturers like steel.[87]

2.69

BlueScope's chief executive noted that escalating energy costs have

contributed to its decline in underlying earnings in 2017. He predicted that

BlueScope's electricity costs will have almost doubled over the two years to

June 2018, and gas costs will have increased by a third during the same period.[88]

This changed situation led the new owner of the Whyalla steelworks, Mr Sanjeev

Gupta, to declare in October 2017 that Australia has the highest energy costs

in the world:

Over the last year, energy prices have doubled and continue

to remain high and, apart from the price increase, the volatility of prices is

intense...It makes Australia the highest-cost energy environment in the world.[89]

2.70

Mr Gupta declared that Australia's high energy costs had led GFG

Alliance to consider ways in which to make the Whyalla steelworks

self-sufficient, and assist in providing solutions nationwide.[90]

This could prevent a situation such as the state-wide power outage that

occurred in South Australia from recurring and impacting the operations of the

Whyalla steelworks.[91]

Committee view

2.71

The committee notes the important role to be played by governments in

defending Australia's steel manufacturing value chain, from steel makers to

steel fabricators, recognising that it is a strategic national asset. The steel

industry supply chain accounts for tens of thousands of jobs nation-wide, with every

dollar of steel production generating an additional gross output of $2.30

across the Australian economy. Further, Australia is a global leader in

innovation and cutting-edge products in particular steel sectors. The committee

considers that securing the future of the steel industry is essential for the

broader Australian economy.

2.72

Steel manufacturers are heavy consumers of energy and extremely

susceptible to price volatility. The evidence provided to this inquiry largely

concerned conditions during the 44th Parliament and did not focus on

energy. However, because of recent price increases in electricity, the

committee is of the view that energy security and affordability is now the

biggest policy issue concern for energy-intensive manufacturers, including steel.

Given the centrality of this issue to the future of the steel industry, the

committee recommends that a bipartisan solution be formulated that will reduce

energy prices and secure supply for steel manufacturers.

Recommendation 1

2.73

The committee recommends that the Australian Government develop a

bipartisan solution to high energy costs that will reduce energy prices and

secure supply for steel manufacturers.

2.74

The most obvious casualty of the recent decline in the revenue and size

of the Australian steel industry is the collapse of Arrium, as discussed in the

following chapter. The committee is concerned that without remedial measures and

a tenable bipartisan plan to reduce energy costs, the future of the Australian

steel industry remains in doubt.

Navigation: Previous Page | Contents | Next Page