Introduction

Referral

1.1

On 13 June 2016, the Senate referred the following matter to the Senate

Foreign Affairs, Defence and Trade References Committee for inquiry and report

by 14 February 2018:

Australia's trade and investment relationships with the

countries of Africa, with particular reference to:

- existing trade and

investment relationships;

- emerging and possible

future trends;

- barriers and

impediments to trade and investment;

- opportunities to

expand trade and investment;

- the role of

government in identifying opportunities and assisting Australian companies to

access existing and new markets;

- the role of

Australian based companies in sustainable development outcomes, and lessons

that can be applied to other developing nations;

- the role of

Australian based companies in promoting the achievement of Sustainable

Development Goals; and

- any related matters.[1]

1.2

On 27 November 2017 the Senate agreed to extend the reporting date to

27 April 2018.[2] On 26 March 2018 the Senate agreed a further extension to 21 June 2018.[3]

Conduct of the inquiry

1.3

Details of the inquiry were placed on the committee's website at: https://www.aph.gov.au/senate_fadt.

The committee also contacted a number of relevant individuals and organisations

to notify them of the inquiry and invite submissions by 18 August 2017. The

committee continued to receive submissions after the closing date. Submissions

received are listed at Appendix 1.

1.4

The committee held two public hearings for the inquiry: the first in

Perth on 2 May 2018 and the second in Canberra on

11 May 2018. A list of witnesses who gave evidence is available at

Appendix 3. Hansard transcripts of evidence may be accessed through the

committee website.

Acknowledgement

1.5

The committee thanks the organisations and individuals who participated

in the public hearings as well as those who made written submissions. The

committee would like to extend its particular thanks to the Heads of Mission of

the Africa Group for their joint submission and attendance at the committee's hearing

in Canberra on 11 May 2018.

Members of the committee with

the Heads of Mission of the Africa Group

Previous inquiries

1.6

In June 2011, the Joint Standing Committee on Foreign Affairs, Defence

and Trade tabled the report on its inquiry into Australia's relationship with

the countries of Africa which covered: government to government links;

Australia's aid program; education links; research links; trade and investment;

defence and security; and Africans in Australia.[4] The committee made 17 recommendations covering these areas, most of which were

agreed in the government response dated 22 March 2012. Those that were not

agreed included recommendation 10 (to establish a Centre for African Studies),

recommendation 12 (to expand e-visas across Africa), and recommendation 13 (to

undertake for Australia to become compliant with Extractive Industries

Transparency Initiative guidelines). Some matters were again raised during the current

inquiry and, where relevant, will be referred to in the report.

Structure of the report

1.7

This report is structured as follows:

- Chapter 1: introductory information about the inquiry and an

overview of Australia's existing trade and investment relationships with the

countries of Africa;

- Chapter 2: Australian mining in Africa;

-

Chapter 3: barriers to Australian trade and investment with the

countries of Africa; and barriers to African trade and investment in Australia;

- Chapter 4: broadening commercial interests beyond the extractive

industry as well as the promotion of commercial opportunities;

- Chapter 5: the government's role in increasing trade and investment

with Africa;

- Chapter 6: Australia's aid relationship with Africa, including

activities contributing to the achievement of sustainable development goals;

and

- Chapter 7: conclusion and recommendations.

Overview of Australia's existing trade and investment relationships with

the countries of Africa

1.8

The continent of Africa, second only to Asia in both landmass and

population, is diverse geographically, culturally, linguistically, and

economically. Comprising 54 sovereign states, nine territories, and two

de-facto independent states, Africa is home to over 1.2 billion people. This

number is increasing sharply, however, with African nations boasting some of

the youngest and most rapidly growing populations in the world.[5]

1.9

Submissions emphasised the importance of recognising that Africa cannot

be described or analysed as a single market but is comprised of discrete

economies with separate opportunities. For example, Grame Barty and Associates

stated:

When we talk about a trade and investment strategy we should

refer to significant, individual countries – such as Morocco, Ethiopia, South

Africa, Kenya, Nigeria, Ghana, or at least regions – North Africa, East Africa,

West Africa...Southern Africa. Each is different and it is important that we

unbundle it into its relevant parts. A conversation around genuine trade and

investment opportunities cannot occur until this transition by African

advocates is made. [6]

1.10

In its submission to the inquiry, the Department of Foreign Affairs and

Trade (DFAT) provided information on trade between Australia and individual

African economies. This data indicates that the goods trade with South Africa

is, by a wide margin, Australia's most valuable trade relationship with an

African country. In 2016, Australia's trade with South Africa was valued at over

$2 billion.[7]

1.11

Australia also maintains trade relationships with several other African

countries that, in 2016, were valued at over $100 million. These include

Algeria, Egypt, Gabon, Ghana, Mauritius, Mozambique, Nigeria, and Republic of

the Congo.[8]

1.12

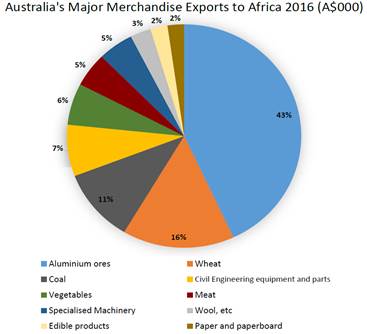

As shown in Figure 1 below, Australia's major merchandise exports to

Africa, in 2016, were largely concentrated in the primary industries, with

aluminium ores, wheat, coal, vegetables, meat and wool all featuring in the top

10 exports. Civil engineering equipment and parts, and specialised machinery,

together formed 12 per cent of merchandise exports to Africa.[9]

Figure

1: Australia's major merchandise exports to Africa 2016 (A$000)

Source: DFAT, Submission 30, p. 15.

1.13

The top five export destinations for Australian goods to Africa in 2016

were:

- South Africa: aluminium ores; coal; machinery and parts.

- Egypt: vegetables; wheat; wool.

- Mozambique: aluminium ores; wheat.

- Nigeria: wheat; edible products.

- Ghana: civil engineering equipment and parts; machinery

and parts.[10]

1.14

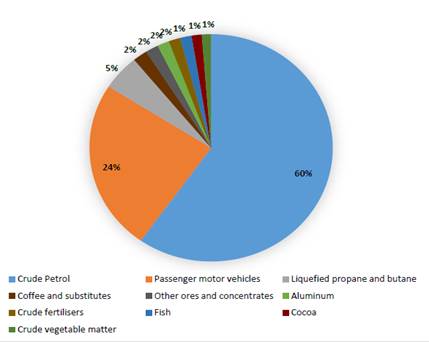

As shown in Figure 2, Australia's major merchandise imports from Africa,

in 2016, were concentrated in crude petrol and passenger motor vehicles which

accounted for 84 per cent of imports.

Figure 2: Australia's major

merchandise imports from Africa 2016 (A$000)

Source: DFAT, Submission 30, p. 16.

1.15

The top five goods import sources from Africa in 2016 were:

- South Africa: passenger motor vehicles, ores and

concentrates.

- Gabon: crude petroleum.

- Algeria: crude petroleum.

- Republic of the Congo: crude petroleum.

- Equatorial Guinea: Liquefied propane & butane.[11]

Australia's trade with Africa,

state-by-state

1.16

DFAT's report, Australia's trade by state and territory 2016–17,

published in February 2018, noted that, on a state-by-state basis, Western

Australia has the greatest export trade relationship with Africa, with exports

valued at $1,389 million, and imports valued at $184 million in 2016-17. This

is followed by Victoria where the relationship is almost inverted, with $376 million

in exports and $1,369 million in imports over the same period. The trade

relationship between Queensland and economies in Africa is still relatively

small, with exports and imports valued at $417 million and $685 million

respectively. This period did, however, see significant growth in the bilateral

trade relationship between Queensland and Algeria predominantly as the result

of petroleum imports. Between 2014-15 and 2016-17, the value of imports from

Algeria to Queensland grew from $0 to $479 million, making Algeria Queensland's

17th largest source of imports. While Tasmania, as a small market,

does not command the same scale of trade as other states, South Africa is an

important trading partner with total trade of $39 million in 2016-17. This

makes South Africa Tasmania's 16th largest trading partner.[12]

1.17

Table 1 below shows the merchandise trade (imports and exports) with

Africa by jurisdiction for the 2014-15, 2015-16 and 2016-17 financial years.

Table 1: Merchandise trade to and from Africa by state and

territory

|

Jurisdiction

|

2014-15

|

2015-16

|

2016-17

|

|

Merchandise exports ($A million)

|

|

NSW

|

300

|

298

|

290

|

|

VIC

|

413

|

401

|

376

|

|

QLD

|

338

|

366

|

417

|

|

SA

|

439

|

315

|

276

|

|

WA

|

1,522

|

1,198

|

1,389

|

|

TAS

|

21

|

15

|

19

|

|

NT

|

2

|

1

|

0

|

|

ACT

|

0

|

0

|

0

|

|

Jurisdiction

|

2014-15

|

2015-16

|

2016-17

|

|

Merchandise imports ($A million)

|

|

NSW

|

650

|

523

|

531

|

|

VIC

|

1,516

|

979

|

1,369

|

|

QLD

|

608

|

382

|

685

|

|

SA

|

34

|

160

|

75

|

|

WA

|

458

|

231

|

184

|

|

TAS

|

29

|

12

|

35

|

|

NT

|

7

|

6

|

5

|

|

ACT

|

4

|

66

|

3

|

Source: Adapted from tables 13, 21, 29, 37, 45, 53, 61, 69 in

DFAT, Australia's Trade by State and Territory 2016-17, February 2018.[13]

1.18

DFAT's report also published data about the percentage share of

jurisdictional exports and imports from selected geographic regions as shown in

Table 2 below.

Table 2: Merchandise trade to and from selected geographic

regions by state and territory

|

Jurisdiction

|

Africa

|

Americas

|

Asia

|

Europe

|

Oceania & Antarctica

|

|

Merchandise exports (% share)

|

|

NSW

|

0.7

|

7.4

|

75.1

|

7.1

|

7.1

|

|

VIC

|

1.5

|

13.8

|

65.0

|

7.9

|

10.4

|

|

QLD

|

0.6

|

6.2

|

81.5

|

8.7

|

2.9

|

|

SA

|

2.4

|

14.1

|

67.3

|

11.6

|

4.5

|

|

WA

|

1.2

|

1.3

|

90.5

|

6.7

|

0.4

|

|

TAS

|

0.7

|

6.3

|

87.1

|

1.6

|

4.3

|

|

NT

|

0.0

|

3.7

|

93.3

|

1.9

|

0.1

|

|

ACT

|

0.0

|

0.0

|

3.0

|

97.0

|

0.0

|

|

Jurisdiction

|

Africa

|

Americas

|

Asia

|

Europe

|

Oceania & Antarctica

|

|

Merchandise imports (% share)

|

|

NSW

|

0.5

|

14.6

|

58.1

|

23.8

|

2.6

|

|

VIC

|

1.9

|

14.2

|

56.8

|

22.9

|

4.0

|

|

QLD

|

1.7

|

16.9

|

62.2

|

15.6

|

3.2

|

|

SA

|

0.9

|

15.8

|

62.5

|

18.3

|

2.3

|

|

WA

|

0.5

|

9.8

|

65.1

|

11.9

|

12.2

|

|

TAS

|

3.9

|

30.1

|

44.1

|

18.7

|

3.2

|

|

NT

|

0.3

|

11.5

|

67.9

|

18.4

|

0.2

|

|

ACT

|

0.0

|

29.8

|

10.3

|

51.1

|

7.8

|

Source: Adapted from tables 13, 21, 29, 37, 45, 53, 61, 69 in

DFAT, Australia's Trade by State and Territory 2016-17, February 2018.[14]

1.19

South Australia's trade relationship with Africa is relatively minor,

with African countries comprising just 2.4 per cent of merchandise exports, and

0.9 per cent of merchandise imports in 2016-17. In New South Wales, African

countries are 0.7 per cent of merchandise exports and 0.5 per cent of

merchandise imports.[15]

Navigation: Previous Page | Contents | Next Page