Background

Operation of the Superannuation Guarantee

2.1

The Superannuation Guarantee (SG) was introduced on 1 July 1992 with the

enactment of the Superannuation Guarantee (Administration) Act 1992 and

the Superannuation Guarantee Charge Act 1992.[1]

2.2

In conjunction with voluntary superannuation contributions and a means

tested, government funded age pension, the SG system forms an integral part of

Australia's retirement income policy. As noted by the Inspector-General of

Taxation, the SG system 'relies upon the effective interaction and information

flows between employers, employees and superannuation funds who all have a role

to play.'[2]

2.3

Generally, if an employee is over 18 years of age and earning over $450

per month, their employer is obligated make SG contributions on their behalf.

The amount of SG that an employer is required to pay is a percentage of the

employee's ordinary time earnings (OTE). OTE is, in the main, salary and wages

paid less bonuses, overtime and termination payments related to unused annual

leave. The current SG percentage commenced in July 2014 and is 9.5 per cent of

OTE. It should be noted that the SG contribution rate is the minimum amount

that must be contributed by employers, and that some awards and enterprise

agreements require a higher rate be paid.[3]

2.4

Employers are generally required to make SG contributions to the

complying superannuation fund of the employee's choice four times per annum.

However, some superannuation funds, industrial awards, or contracts require

that SG is paid more regularly (e.g. monthly). The quarterly payment due dates

are set out in Table 2.1.

Table 2.1—quarterly timeframes for superannuation

payments[4]

| Quarter |

Period |

Payment due date |

| 1 |

1 July–30 September |

28 October |

| 2 |

1 October–31 December |

28 January |

| 3 |

1 January–31 March |

28 April |

| 4 |

1 April–30 June |

28 July |

2.5

If an employer does not pay the correct SG contribution to an employee's

nominated fund by the quarterly payment due date, they may be liable for the SG

charge (SGC), payable to the Australian Taxation Office (ATO).[5]

2.6

The SGC is made up of three components:

-

the shortfall amount (i.e. the amount of SG not contributed);

-

nominal interest (currently set at 10 per cent from the beginning

of the period); and

-

an administration fee (currently $20 per employee, per quarter).[6]

2.7

An employer subject to the SGC must lodge a SGC statement with the ATO,

calculate the amount payable, and pay the charge by the due date for the

relevant quarter. The ATO then forwards the shortfall and nominal interest

component to the employee's superannuation fund.[7]

2.8

As the ATO noted in its submission:

The system was designed for employers to pay adequate and

timely SG contributions direct to an employee's super fund. The SGC introduced

a strong deterrent for employers not paying as they would incur significant

penalties and administration fees.[8]

2.9

The administrative arrangements for the operation of the SG system are

set out in the Superannuation Guarantee (Administration) Act 1992 (SGA

Act). The Commissioner of Taxation is responsible for the day-to-day

administration of the SGA Act, and the ATO has a range of responsibilities

under it. These responsibilities include:

-

educating employers and employees about their responsibilities

for SG;

-

monitoring employer compliance with SG obligations;

-

the receipt and redistribution of the SGC; and

-

investigating employers for possible breaches of the SG

legislation.[9]

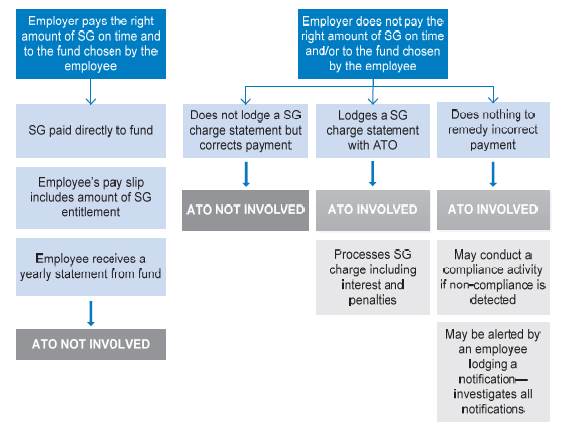

2.10

In its 2015 performance audit report, the ANAO characterised the ATO's

role in administering the SG system as follows:[10]

Figure 2.1—ATO's role in administering the SG scheme

2.11

The operation of the SG system also directly involves other

stakeholders, such as superannuation funds. The Superannuation Industry

(Supervision) Act 1993 categorises superannuation funds into large funds,

which are regulated by the Australian Prudential Regulation Authority; and

self-managed superannuation funds (SMSFs), which are regulated by the ATO.[11]

2.12

Industry funds hold almost 40 per cent of all member accounts and under

certain circumstances can intervene to pursue and collect superannuation

contributions in arrears, which may include employing debt collection services.[12]

Further discussion on the ability of third parties to detect and recover unpaid

SG can be found in chapter 6 of this report.

2.13

For example, Industry Fund Services (IFS) provides a range of services

to not-for-profit superannuation funds, with unpaid superannuation services

covering arrears collection, enforcement and participation in insolvency

proceedings. IFS acts on behalf of nine not-for-profit superannuation funds

with members across a range of industries.[13]

2.14

The committee did not receive any evidence from retail superannuation

funds, and as such is unable to comment on what actions they take in regard to

following up unpaid SG for their members.

2.15

An employee who has cause to believe that their SG contribution has not

been paid, or has been paid incorrectly, can lodge an enquiry (known as an employee

notification or EN) with the ATO. The ATO aims to investigate all employee

notifications and, where it considers it appropriate, audit employers to verify

that the correct payments have been made. [14]

The ATO aims to commence 99 per cent of ENs within 28 days of receipt, and

where an EN proceeds to audit, it aims to complete 50 per cent of

compliance cases within 4 months, and 90 per cent within 12 months.[15]

2.16

According to the ATO's submission:

All ENs are investigated to establish the accuracy of the report

through an initial review or audit action against the reported employer. Some

28 per cent of reports do not need to proceed to an audit case due to finding

that the:

-

employer is already being

contacted

-

employee withdraws report

-

employee is covered by assessments

already raised

-

employer is insolvent/bankrupt and

the ATO is unable to pursue the debt

-

employment was more than 5 years

ago and the employer is no longer required to keep records.[16]

Previous reviews into the operation of the SG system

2.17

Over many years there have been numerous reports examining the operation

and administration of the SG system and various measures have been recommended

to improve rates of SG compliance.

2.18

As far back as April 2001, the Senate Select Committee on

Superannuation and Financial Services (the select committee) tabled its report

into the enforcement of the Superannuation Guarantee Charge. Many of the

concerns and suggestions the select committee noted in its report were similar

to those raised during the course of the current inquiry. For example, the

ATO's apparent lack of activity in pursuing defaulting employers and addressing

individual complaints, the complexity of the SG system, and low levels of

education among employers and employees with regard to superannuation rights

and responsibilities were mentioned. In addition, the report noted support for

more frequent SG payments and observed calls for more effective protection for

employees who lose their SG contributions through employer non‑compliance

or insolvency.[17]

2.19

In March 2010, the Inspector-General of Taxation (IGT) published a

review report titled 'Review into the ATO's administration of the

Superannuation Guarantee Charge'.[18]

The report found that while the SG system worked well for the majority of

individuals, those employees most at risk within the system were amongst the

most vulnerable in society. The IGT made seven recommendations aimed at better

supporting the underlying SG policy intent and improving compliance with the

relevant obligations. The IGT submission to the inquiry noted that the government

and the ATO had implemented a number of these recommendations, resulting in a

degree of alleviation of the difficulties faced. However, the IGT noted that,

as evidenced by the ongoing complaints regarding unpaid SG entitlements and the

frustrations encountered by employees in recovering unpaid amounts, challenges

still exist in the administration of the SG system.[19]

2.20

More recently, in 2015 the Australian National Audit Office (ANAO)

published a performance audit of the ATO and its work in promoting compliance

with SG obligations.[20]

As outlined by the ANAO at its appearance at a public hearing:

The audit concluded that the ATO's administration of the

super guarantee scheme had been generally effective, particularly having regard

to the scale of the scheme and the substantial flow of legislative revenue

generated. The audit noted that the ATO carries out a wide range of activities

to promote compliance and to help employers and employees understand their

super guarantee rights and obligations... The audit identified scope for the ATO

to better target its compliance activities and more effectively promote

employer compliance with super guarantee obligations. In particular, the ATO

should gain a greater understanding of the level of noncompliance with super

guarantee obligations across industry sectors and types of employers.[21]

2.21

The audit contained four recommendations directed at the ATO, centring

around: better analysing non-compliance and further engaging with superannuation

stakeholders; emphasising the enforcement role of the ATO in education

material; better coordinating compliance activities within the agency; and

evaluating the effectiveness of compliance activities. The ATO agreed with all

four recommendations.[22]

2.22

The IGT also informed the committee that in 2016 it completed a review

into the ATO's employer obligations compliance activities, which included an

examination of opportunities to reduce employers' regulatory burden in

complying with SG obligations whilst improving voluntary compliance.[23]

The terms of reference focused on easing the compliance burden for employers

and evaluating the ATO's conduct of compliance activities. The full terms of

reference can be found at Appendix 3.[24]

2.23

The IGT noted in its submission that the review report is currently with

the Minister and not yet publicly released.[25]

Multi-agency working group on SG non-compliance

2.24

On 25 January 2017, the Minister for Revenue and Financial Services, the

Hon Kelly O'Dwyer MP, announced that in December 2016 a multi-agency working

group had been established to investigate and develop practical recommendations

to deal with SG non-compliance.[26]

2.25

The working group is comprised of senior representatives from the

following government bodies:

-

the Australian Taxation Office;

-

the Department of the Treasury;

-

the Department of Employment;

-

the Australian Prudential Regulatory Authority; and

-

the Australian Securities and Investments Commission.[27]

2.26

The multi-agency working group has the following terms of reference:

- Analyse

the information and data available in order to establish [a] 'fact base' and to

identify characteristics and detect drivers of superannuation guarantee

non-compliance. Also have reference to:

- the extent of non-compliance

amongst insolvent employers

- the extent to which salary

sacrifice is used to meet superannuation guarantee obligations.

- Develop

and consider administrative options to improve compliance and foster

participation in the superannuation guarantee by employers. Have reference to:

- information about

superannuation guarantee payments coming to the ATO

- the use of deterrents, such as

prosecutions and audits

- review service offerings to

support employers (including understanding the employee/contractor

distinction), such as online forms and tools for employers

- the role of superannuation funds

to assist employer compliance.

- Develop

and consider policy options to address superannuation guarantee non-compliance,

including potential legislative change. Have reference to:

- potential to improve

compliance through collection of more timely and accurate data

- the frequency of employers paying

superannuation guarantee

- the appropriateness of

penalties and interest rates for non-compliance.[28]

2.27

The ATO informed the committee that as the focus of the working group

was on clarifying internal views and establishing a 'fact base', as at February

2017 no consultation with external stakeholders in the superannuation industry

had been undertaken. The ATO noted however, that it was possible that some

targeted consultation may be undertaken by individual agencies in the process

of finalising recommendations.[29]

2.28

The working group was due to report to the Minister by the end of March

2017. An interim report was provided to the Minister on 31 January. At the time

of the committee's report being drafted, the interim report had not been

released publicly, nor had the final report.

2.29

The committee heard from members of the working group during a public

hearing in Canberra. The evidence received during this session will be examined

in chapter 4.

Committee view

2.30

The committee is aware that there has been, and continues to be, work

conducted on aspects of SG non-compliance and the SG system in general, and

notes the findings of the previous reports around the topic. In particular, the

committee awaits with interest the findings of the multi-agency working group

on SG non‑compliance, noting that the working group terms of reference

encompass matters similar to those covered in the committee's inquiry.

Additionally, the committee looks forward to the release of the 2016 IGT review

report into the ATO's employer obligations compliance activities.

Recommendation 1

2.31

In the interests of better informing the debate on the current state of

the SG system, the committee recommends the Minister for Revenue and Financial

Services publicly release the interim and final reports of the multi-agency

working group on SG non-compliance, as well as the 2016 review by the

Inspector-General of Taxation as soon as is practicable.

Navigation: Previous Page | Contents | Next Page