Investigation and enforcement

3.1

Despite the framework of laws and policies designed to

criminalise foreign bribery, as discussed in Chapter 2, Australia's prosecution

record suggests that foreign bribery offences are not adequately enforced.

However, in this context, it is necessary to recognise that: the lack of

visibility of the work of government departments and agencies in identifying,

investigating and enforcing allegations of foreign bribery is, in part, due to

confidentiality issues. Additionally, since this inquiry commenced in 2015, a

number of significant changes have been made to strengthen Australia's response

to foreign bribery. Indeed, as noted in the December 2017 Phase 4 OECD Report, since

the inception of the Fraud and Anti-Corruption Centre (FAC), Australia is able

to report the successful prosecution of seven offenders across two cases.[1]

3.2

This chapter discusses the different roles of government

departments and agencies in identifying and investigating instances of foreign

bribery. It also examines the evidence relating to the enforcement of foreign

bribery legislation, before exploring some of the criticisms raised by

stakeholders about what is perceived to be a lack of enforcement in this area,

and the relevant government initiatives taken since the establishment of this

inquiry.

Government departments and agencies

3.3

Australia has a multi-agency approach to identifying and

investigating foreign bribery. The Attorney-General's Department (AGD) has principal

policy responsibility for foreign bribery issues and leads Australia's

engagement with the Organisation for Economic Co-operation and Development (OECD)

Working Group on Bribery.[2]

3.4

The Australian Federal Police (AFP) has responsibility for

investigating offences of bribing a foreign public official in Division 70 of

the Criminal Code Act 1995 (Criminal Code); and the Australian

Securities and Investments Commission (ASIC) has responsibility for

investigating fraudulent, misleading and deceptive conduct in relation to corporations,

including some conduct outside Australia.

3.5

The Commonwealth Director of Public Prosecutions (CDPP) has no

investigative powers or functions; however, it provides prosecution services

for all foreign bribery offences.

3.6

Other departments and agencies also assist with foreign bribery

related offences by: identifying practices that may breach Australia's foreign

bribery regime which can lead to an investigation; and providing information to

assist with investigations of alleged foreign bribery.[3]

These include the:

- Australian Taxation Office (ATO);

-

Australia Trade and Investment Commission (Austrade);

-

Australian Transaction Reports and Analysis Centre (AUSTRAC);

-

Department of Foreign Affairs and Trade (DFAT); and

-

Export Finance and Insurance Corporation (Efic).

3.7

When considering the enforcement of foreign bribery legislation

in Australia, it is important to remember that the CDPP does not make a

decision to prosecute a case until after the matter is referred to it for that

purpose.[4]

The CDPP therefore 'depends upon the Australian Federal Police (AFP) [and other

departments and organisations] to investigate alleged foreign bribery offences

and to prepare briefs of evidence to support prosecution action'.[5]

That said, the CDPP is increasingly involved in the early stages of foreign

bribery investigations (see below).

Fraud and Anti-Corruption Centre (FAC)

3.8

In July 2014, the AFP established the FAC to bring together

officers from the Commonwealth agencies identified above, as well as others,[6]

to work collectively 'to prevent, detect and investigate fraud and corruption

against the Commonwealth',[7]

including offences of foreign bribery.

3.9

The FAC is focussed on 'providing a coordinated approach to

prioritising the Commonwealth operational response for matters requiring a

joint agency approach'.[8]

Indeed, where the referring agency has sought AFP investigation and assistance

and the allegation relates to an offence of foreign bribery, the FAC will prioritise,

triage and evaluate it. It does this this in consultation with the AFP Foreign

Bribery Panel of Experts which was established in 2012:[9]

This Panel is made up of senior investigators with experience

in significant foreign bribery investigations. It provides expert advice on

foreign bribery referrals and investigations, and conducts foreign bribery

specific training modules and awareness-raising activities.[10]

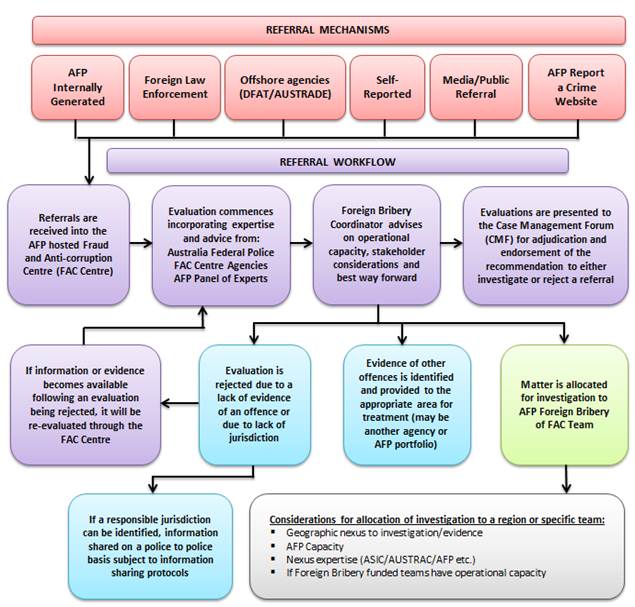

3.10

The below flowchart details the FAC referral process.

Figure 3.1— FAC Referral

Flowchart

Source: OECD Working Group on

Bribery, Implementing the OECD Anti-bribery Convention, Phase 4 report:

Australia, 15 December 2017, p. 67.[11]

Criticisms of Australia's enforcement of foreign bribery legislation

3.11

Overall, submitters to the inquiry, and in particular those made

in the 44th Parliament, were highly critical of Australia's

legislative scheme and enforcement record in combatting foreign bribery.[12]

The Australia Institute and The Jubilee Australia Research Centre commented in

their joint submission:

Australia has a poor record on enforcing foreign bribery and

corruption laws, despite major scandals such those around the AWB in Iraq,

Securency in Asia and BHP in China. It is important that laws and corporate

governance arrangements are enforced to minimise the occurrence of corruption

and improve Australia’s record of prosecution.[13]

3.12

The Governance Institute of Australia argued that Australia's reputation

is 'suffering from the perception of the rigour of its anti-bribery laws and

the appetite of its regulators to enforce those laws'.[14]

3.13

The International Bar Association's Anti-Corruption Committee (IBAACC)

expressed the view that it was:

...essential for the Government to review the current structure

to ensure not only that it works but that it is seen to work. If nothing is

done to address the structure and attitude of investigating and prosecuting

foreign bribery cases, the existing fractured approach will continue and the

public perception that nothing is being done to police corporate criminal

conduct by weak regulators will persist to Australia’s overall detriment.[15]

3.14

Investigative journalist, Mr Nick McKenzie, took a systemic view

of the lack of enforcement in Australia, noting that the small number of cases

actually investigated by the AFP represent just a fraction of the actual

bribery occurring. It is equally concerning, he pointed out, that 'most of the

cases under investigation have not produced a prosecution. Put simply, those

strongly suspected of corruption by police have so far gotten away with it'.[16]

Mr McKenzie stated:

This failure to hold to account corrupt companies and

executives is a systemic, whole of government problem, which manifests itself

in delayed or ineffective investigations, political inaction and, ultimately,

impunity for the corrupt.[17]

3.15

In evidence before the committee in the 45th

Parliament, Mr McKenzie maintained this position, and opined that: 'unless

there are successful charges and prosecutions, we are failing. It's as simple

as that. The regime in this country at the moment is an absolute failure'.[18]

3.16

Similarly, Dr Mark Zirnsak, Justice and International Mission,

Synod of Victoria and Tasmania, Uniting Church in Australia, explained that

'one of the issues around Australia has obviously been a lack of cases that

have been prosecuted on foreign bribery'.[19]

Factors contributing to a lack of enforcement

3.17

Submitters to the inquiry drew to the committee's attention a

number of factors that potentially contribute to the lack of enforcement of

foreign bribery cases involving Australian companies, including the complex

nature of the cases, a deficiency of sufficient expertise, delays, a lack of

cooperation and limited resources.

Complexity

3.18

The sheer complexity involved in investigating and prosecuting

foreign bribery cases can be associated with the lack of enforcement. Mr Robert

Wyld,

Co-Chair of the IBAACC, considered that:

...the real problem with a lack of prosecutions is the sheer

complexity, now, of international finance, international commerce and the way

transactions are conducted in an opaque way—at one level under legal systems,

tax systems and corporate structures that are perfectly legal, but are then

used, in effect, for another purpose. That is part of the problem to address.[20]

3.19

A number of submitters also argued that the legislative complexity

of Australia's foreign bribery offence was unnecessary and contributing to the

lack of prosecutions. Indeed, in discussing Division 70 of the Criminal Code,

the Law Council of Australia highlighted what they believe to be key drafting

deficiencies of the Division. These were identified as follows:

The application of the fault and default fault requirements

of the Criminal Code to Division 70 is likely to involve practical difficulties

with prosecutions through the complexity of those requirements when applied to

the three limbs of conduct that constitute the offence. The legislation would

benefit from more simply expressed fault requirements.

The requirements that a benefit not be legitimately due to

the bribe taker and bribe giver creates unnecessary complexity to the offence.

The UK Bribery Act deliberately removed these requirements from that

legislation.

Corporate culpability is too complex.

Liability for acts of agents involves ambiguity.[21]

3.20

Similarly, the Young Lawyers International Law Committee of the Law

Society of New South Wales drew to attention the fact that the difficulty

involved in identifying a 'foreign public official' lies in the complexity of

ascertaining the degree of government control over corporations, emphasising

that:

In countries such as China, this may be obscured by extensive

commercial monopolisation or by the existence of private entities that have

become government-funded after the Global Financial Crisis.[22]

3.21

Ms Sophie McMurray, a lawyer who specialises in anti-corruption

compliance, agreed, suggesting that:

...there is a need for a more modern, innovative approach to

corporate liability...given the increasing complexity of multinational

corporations and globalisation, placing more Australian companies in countries

where corruption was prevalent.[23]

3.22

Dr Zirnsak, argued that lowering the legal bar to make

prosecutions easier would:

...encourage a great will to engage in prosecution. Once the

law enforcement authorities know that they've got a better chance of getting a

prosecution, hopefully that will increase their willingness to pursue and put

resources into these kinds of cases.[24]

Expertise

3.23

A number of submitters to the inquiry took the view that the AFP,

as the body with primary responsibility for enforcing foreign bribery laws,

lacked the necessary expertise to conduct foreign bribery investigations.

3.24

The Law Council of Australia expressed a view that traditionally

the AFP did not have the expertise to investigate foreign bribery offences,

which invariably occur within a corporate environment:

The AFP has traditionally lacked a good understanding of

corporate governance structures deployed within a commercial enterprise

(operating within and outside Australia) and how corporations delegate

functions to lower levels of management for execution through foreign agents or

other intermediaries.[25]

3.25

Similarly, the IBAACC concluded that:

While the AFP has coordinated its activities in a more

streamlined manner, experience on the ground leads the Committee to question

the AFP’s knowledge and skills, at a personal investigator level, on

international finance, corporate governance and the way international

corporations do business.[26]

3.26

Mr Wyld, Co-Chair of the IBAACC, remarked that:

Historically, the experience of some of the

investigators has, in my experience...been less than knowledgeable of what they

are looking into. Effectively, you are, in a sense, educating the investigator.[27]

3.27

Mr Stephen Sasse, a former executive of Leighton Holdings Limited

(now CIMIC Group), one of Australia's biggest construction companies that has

been implicated in a number of instances of foreign bribery, gave a similarly

critical view of AFP investigators' expertise when it comes to corporations:

I think, in the case of the AFP, they have not the slightest

understanding, in my experience, of how corporations work. I think, to be able

to investigate and identify [foreign bribery]...Based solely on my four-hour

interview with them in 2012 and the nature of the questions—what was asked and

what was not asked—my primary conclusion was that these guys are playing in an

area that they do not really know much about, which is hardly surprising. Your

average AFP officer does not have experience in corporate Australia.[28]

3.28

Mr Sasse was asked if he believed people with good corporate

knowledge is an area which is missing within the AFP, to which he replied:

Yes. Not just a corporate knowledge that is learnt from

sitting in law school learning a corps act, but knowledge that comes from

working and living in those environments.[29]

3.29

Other submitters reflected on the lack of incentives for

investigators to seek to specialise in financial crime and advance their

careers. Mr McKenzie recommended that the AFP 'create a clear and attractive

career path for investigators who specialise in financial crime and

corruption'.[30]

In evidence before the committee, he elaborated on this point, explaining that:

At the moment, the place to make your career in the AFP is

not in financial crime, and that really should change. That's a big cultural

change. It requires an immense amount of training. It requires recruiting the

right sorts of people. In the UK Serious Fraud Office and at the DOJ [United

States Department of Justice] and FBI [United Stated Federal Bureau of

Investigation] in the US, they have lawyers, accountants and forensic

specialists all embedded in these teams and they can make a career at an

agency. There's some of that at the AFP, but I think there could be far more.

At the moment, this area of the AFP is a diversion from a career. It should be

a career in itself; we need specialists in this area.[31]

3.30

Mr McKenzie went on to describe the FBI as a 'great place to be',

where agents want to 'make' and 'take on' foreign bribery cases, and where

agents can advance their careers. In contrast, he noted that:

At the AFP it's still regarded as a bit of a backwater.

Agents don't want to take on these cases. They don't want to join the FAC,

where the foreign corruption team lies...[32]

Delay

3.31

The considerable duration of foreign bribery investigations was

noted by some witnesses as a barrier to enforcement of foreign bribery cases. However,

it is important to note, as Mr Ian McCartney, Acting Deputy Commissioner of the

AFP did, that: 'The issue of long, protracted investigations on foreign bribery

is not just isolated in Australia'. Mr McCartney went on to explain:

If you look at the OECD reporting, the common term of an

investigation, from investigation to prosecution, is between five and 7½ years,

so this is an issue that is identified around the world.[33]

3.32

In 2014 the OECD also observed that the average number of years

between last criminal act and sanction for foreign bribery has been increasing

over time, rising particularly quickly from 4.3 years in 2011 to 7.3 years in

2013. This analysis indicates that almost half of all cases took between 5 and

10 years to bring to a conclusion.[34]

3.33

Mr Wyld also emphasised the length of time over which an

investigation of the commission of a foreign bribery offence may be conducted:

The OECD has certainly recognised now that these sorts of investigations

can take up to seven years—and these are ones that have settled, let alone been

prosecuted...A lot of processes and procedures partly explain why, for example,

it can take 18 months or two years before witness A has one interview and

another interview. It is a significant process, and one that I do not think any

of us should underestimate. I know that from working on cases across the world

over 20 years.[35]

3.34

Some stakeholders also reflected on the delay between the

referral of an instance of alleged foreign bribery and the commencement of an

investigation, in addition to delays in the investigation process itself.

3.35

Mr McKenzie argued that investigators lack the tools to

effectively investigate foreign bribery cases and bring them to a resolution

within a reasonable timeframe.[36]

He asserted that:

Sometimes it takes six to eight months for a case assessment

to be made, and that's before an investigation even starts. By that stage

evidence is drying up; the witnesses are forgetting things.[37]

3.36

Mr Sasse also recounted his experiences as a whistleblower at

Leighton Holdings (now CIMIC Group), and described his interactions with ASIC during

the investigation process. In this respect, the committee heard that Mr Sasse

had one formal interview with ASIC in November 2014, and then some 16 months

later he had a further discussion with ASIC in March 2016 to finalise an affidavit.[38]

3.37

Mr Sasse recounted a similar delay in the context of the AFP's

investigation. He told the committee that he was interviewed by the AFP in May

or June 2012 but had not heard from the AFP since, that is, some four years

later as at the time of hearing.[39]

3.38

Mr Sasse suggested to the committee that 'a good investigation

starts quickly and finishes quickly'.[40]

Emphasising the importance of a speedy investigation, Mr Sasse suggested

that delays see the evidence available to investigators degrade:

In any investigation...you need to get the investigation

underway and completed as soon as you possibly can. The longer it takes, the

more it is delayed—people lose things, they forget things and they create cover

stories. This stuff has to be acted on, more or less, immediately...it seems to

me that the AFP and, to an extent, the regulator [ASIC] just do not act with

the alacrity that one needs for these kinds of issues.[41]

3.39

The AGD also reflected on the challenges posed in obtaining

timely evidence in foreign bribery matters due to the use of legal professional

privilege (LPP) claims by those under investigation and other third parties. In

their cross-agency submission to this inquiry, the AGD indicated the AFP had

encountered this issue in a number of investigations where it had taken a

significant period of time for the AFP and the defence to resolve LPP claims,

adding to the difficulties faced in obtaining timely evidence to support

prosecutions.[42]

Domestic and international

cooperation

Domestic cooperation

3.40

Some stakeholders raised concerns about the manner in which

government departments and agencies have traditionally operated in the foreign

bribery space, with an emphasis on the lack of cooperation. For example, Mr

McKenzie described the AFP, CDPP and ASIC as entities that operate as silos.[43]

3.41

Indeed, this historical lack of domestic cooperation was cited by

Mr Ian McCartney of the AFP as a reason for the low number of

prosecutions. However, Mr McCartney argued that cooperation has since

increased, particularly with the advent of certain interagency projects:

...a number of years ago there was a silo approach between

agencies, but now, with the work through Wickenby and the work through the

Serious Financial Crime Taskforce, in fact it is very much a joined-up

approach. In terms of expertise, we bring agencies such as ASIC to the table

who have significant expertise in relation to corporate crime, and everything

we do in this space is joint. In terms of legislation, obviously that is an

issue for the Attorney-General's Department, but we have provided significant

input and we have seen positive development.[44]

3.42

The interagency work Mr McCartney referred to, former Project

Wickenby and the Serious Financial Crime Taskforce (SFCT), are multi-agency

taskforces of which the AFP was and is a member. Project Wickenby played a role

in the Australian Government's fight against tax evasion, tax avoidance and

crime. It was established in 2006 to protect the integrity of Australia's

financial and regulatory systems by preventing people from promoting or

participating in the abusive use of secrecy jurisdictions.[45]

Project Wickenby finished on 30 June 2015 when the SFCT began operating. [46]

3.43

The SFCT was established to bring together the knowledge,

resources and experiences of federal law enforcement and regulatory agencies to

identify and address serious and complex financial crimes.[47]

The SFCT is one aspect of the

AFP-led FAC. Indeed, a number of submitters observed a marked improvement in

cooperation between agencies since the establishment of the FAC. This is

discussed later in this chapter.

3.44

However, improvements on the level of domestic cooperation aside,

some submitters raised the possibility of a dedicated Serious Fraud Office

(SFO), similar to those established in the UK and NZ, as a way forward for

Australia.

3.45

Reflecting on the differences between Australia's mutli-agency

approach to foreign bribery, and the NZ and UK SFOs, Mr McKenzie told the

committee:

The key thing they [the NZ SFO] have that we don't have is

that dedicated focus—a singular agency dedicated to financial crime, bribery and

corruption. You have that esprit de corps being formed very quickly amongst

these multifaceted investigators and people with expertise who are there to

make cases in this crime type. Having that dedicated mind set and that task

force mentality is extremely valuable. I saw that in the US with the FBI's

foreign bribery teams. Obviously, the Serious Fraud Office in the UK is the

best example of an entire agency with 220-odd staff and millions of dollars in

funding all dedicated to tackling these financial crime grand corruption type

cases. We don't have that in Australia at the moment.[48]

3.46

Considering the benefits of a dedicated SFO body in Australia, Mr

Mark Pulvirentu, Partner at Control Risks, observed that:

...you do need a variety of skill sets in an investigation,

from the capturing of evidence—electronic evidence in particular—from forensic

specialists through to forensic accountants and seasoned investigators. It's

not necessarily one size fits all. You're going to need a cross-section of

expertise in that dedicated centre.[49]

3.47

Having practiced in the foreign bribery area in Australia and

internationally over many years, Mr Wyld in his capacity as the immediate past

Co-Chair of the IBAACC and partner at Johnson, Winter & Slattery, submitted

that:

I think the real issue about regulators, their culture and

how they behave is that there is no one agency responsible for it in this

country. That is a topic that seems to be neglected. You've got skills within

the AFP, ASIC, the tax office and AUSTRAC, but you don't have a stable,

standard, dedicated agency or body of people who look at this and this alone.

You do in a number of other countries, particularly the United Kingdom and New

Zealand. They have their serious fraud officers, who are trained as lawyers,

prosecutors and investigators, and they're dedicated to that task, rather than

coming in and out of cases. What I have seen over many years is change in

personnel because of the demands. Demands are natural in an organisation like

the AFP and ASIC and the ATO. People come and go, priorities come and go, and

the focus comes and goes, depending upon what is happening in the real world

and what the politics of the day demand. But what that means is that you do not

have a body of knowledge and skill that remains.[50]

3.48

Mr Wyld went on to suggest that the continued absence of a

dedicated agency in Australia, such as a SFO, would:

...certainly help contribute to an impression that we don't

treat it seriously and we perhaps treat other things more seriously, and

therefore people will continue to look at Australia in a way that they

traditionally have done.[51]

3.49

In contrast, the Law Council of Australia highlighted the

importance of the AFP's investigative powers and concerns around giving such

powers to another body:

...the AFP have investigative powers under part IB of the

Crimes Act [Crimes Act 1914], which put them in a quite different

position to other investigative agencies. I don't know that it would

necessarily be a desirable thing to arm another agency with those powers simply

for the purposes of them being able to investigate this kind of conduct—if you

can do it through that which you've got, which is the body that is given those

investigative powers. They are investigative powers that can be exercised in a

particular way, because they can be utilised in a particular way, which is for

the purposes of obtaining evidence, not for the purposes of obtaining

information.[52]

International cooperation

3.50

Evidence provided to the committee also suggested that there is

difficulty in obtaining evidence from other countries due to the inefficiency

of international cooperation. Mr McCartney of the AFP suggested that:

...part of the problem is some of the delays. To obtain that

evidence we simply cannot go to that country and ask for that evidence and

bring it back; we have to obtain that evidence under a mutual assistance

request. That process can be lengthy, depending on the country we are dealing

with....[53]

3.51

The AGD explained that:

Mutual legal assistance is a formal government-to-government

process for obtaining assistance in a criminal investigation or prosecution, or

to recover the proceeds of crime. It is different but often complementary to

agency-to-agency assistance which is informal assistance that may be provided

by one agency to its foreign counterpart.[54]

3.52

While Australia has a comprehensive framework for dealing with

incoming and outgoing mutual assistance requests,[55]

the committee heard evidence about the difficulties in securing prosecutions

where there are delays in processing mutual assistance requests. For example,

in discussing the issue of international engagement, Commander Tim Crozier of

the AFP observed that:

We've seen with mutual legal assistance requests that they

are a challenge and they can be time-consuming.[56]

3.53

Mr Shane Kirne of the CDPP agreed that getting evidence from

foreign jurisdictions in foreign bribery cases can be challenging and explained

that:

...in the limited number of matters that we've run, I think the

cases have largely been proved by way of evidence that was Australian-based.[57]

3.54

Other stakeholders also reflected on the complex processes for

admitting evidence provided by another country. For example, Mr Wyld pointed

out that the process of admitting the evidence obtained from a mutual

assistance request is problematic:

The way countries interact with each other, the mutual legal

assistance scheme and the processes for admitting evidence from one country

into Australia under the Foreign Evidence Act is technical, is convoluted and

is rife with the process that all good defence lawyers... will strike out, or

attempt to strike out, whatever they can because it does not comply with quite

strict procedures when you are involving a criminal trial.[58]

Lack of resources

3.55

The Phase 3 OECD Report on implementing the OECD Anti-Bribery

Convention in Australia noted that the AFPs flexible resourcing model raised

concerns about the sufficiency of resourcing and recommended that:

Steps should be taken to ensure that the CDPP has sufficient

resources to prosecute foreign bribery cases.[59]

3.56

The committee also heard evidence from submitters that the lack

of enforcement of foreign bribery offences in Australia may be linked to

insufficient resources.

3.57

Submitters observed that foreign bribery is only one of the AFPs

many priorities, which include counter terrorism and drug law enforcement. Mr

McKenzie argued that the resourcing of the AFP's foreign bribery team was

'manifestly inadequate'.[60]

However, he went on to remark that:

At the moment the AFP—though they may say something different

here—is, unfortunately, extremely resource stretched. Resources aren't going

into this area like they should. That's why we're seeing cases not being made

or not being dealt with in a quick and effective fashion. Sometimes it takes

six to eight months for a case assessment to be made, and that's before an

investigation even starts. By that stage evidence is drying up; the witnesses

are forgetting things. So, again, creating a greater sense of priority inside

the AFP and ensuring the AFP has the money to do what's required is critical.[61]

3.58

KordaMentha also thought the AFP was under-resourced, noting:

...it appears that largely due to the historical lack of focus

on enforcing foreign bribery, these agencies may not be adequately resourced to

enforce foreign bribery legislation.[62]

3.59

In addition to recent specific funding received by the AFP

(discussed in more detail below), the AFP informed the committee that:

The organisation has also received significant funding in

relation to its specialist capabilities, which all parts of the organisation

draw upon to undertake investigations at the high end. That has certainly been

beneficial to the organisation, because it covers myriad specialist

capabilities, a lot of which foreign bribery will use. We've made mention about

how we use some of those higher end techniques that are supported by that

really high-end technical capability. There's no question that investigations

such as these are resource intensive. We've had a number of matters of high

profile, including in the serious taxation space. It's not hard to recognise

the amount of resources that go in, not just to a specific investigations team

but to all those capabilities that the organisation has to assist and move

through to a prosecution phase. We do recognise those issues and are aware of

them, but it's drawn out of our normal business.[63]

3.60

CDPP explained to the committee that funding of foreign bribery

matters comes out of their general budget and that they have no specific tied

or unique funding to handle such matters. Mr Kirne of CDPP told the committee:

We have specific funding sometimes for other types of

matters, such as GST fraud prosecutions. In terms of foreign bribery, which we

are finding already incredibly resource and financially intensive for us, they

are coming out of our general budget, so it does create challenges. If there

was some blockbuster funding or a pool of money, that would obviously be

something that we would be appreciative of. It would make our lives a bit

easier, because we have to draw on the existing funding that we have and the

budget is already quite constrained.[64]

3.61

In contrast, since October 2012, in addition to a core budget, the

UK SFO has been supplemented as necessary by additional funding agreed with the

UK Treasury. This includes 'blockbuster' funding, which enables the UK SFO to

take on very big cases where the annual expenditure is expected to exceed an

agreed percentage of their core budget.[65]

3.62

Mr Kirne explained that in the past, CDPP has encountered

problems when tied funding is allocated as it has a specified timeframe. He

advised:

There is a huge lag, sometimes, between the investigation

phase and ultimately the commencement and, particularly, the conclusion of the

litigation, which can drag on for many years past the time frame that the tied

funding is effectively exhausted. One attraction in my mind for the blockbuster

funding would be an as-needs-at-time fund that one could go to, not just for

foreign bribery matters but for other very complex, expensive litigation.[66]

3.63

ASIC explained that they have their own version of 'blockbuster'

funding in the form of an enforcement special account which is 'effectively a

fighting fund... that goes up and down based on the ASIC major cases'.[67]

However, Mr Chris Savunrdra of ASIC cautioned the committee that:

In order to get access to the enforcement special account we

have to first spend $750,000 of our general funding before we can get in. Given

the competition over those resources, it takes some time through staff

allocation for any given matter to get to $750,000. That $750,000 upfront is a

bit of a barrier to entry. It's not like we can say from the get-go: 'This is a

blockbuster foreign bribery matter,' and reach straight into that pool. We first

have to spend $750,000 of our own money before we do that.[68]

3.64

Mr Savundra went on to recognise that the $750,000 threshold

presents a barrier which ought to be looked at:

...to see whether there could be better criteria by which we

ascertain whether you can reach straight into that blockbuster funding rather

than having to spend $750,000 of your own money out of a very limited resource

pool before you get access to that blockbuster funding.[69]

Recent initiatives to improve enforcement

Targeted funding

3.65

The Hon Prime Minister Malcolm Turnbull announced on 23 April

2016 that the government would dedicate $15 million to strengthening

Australia's foreign bribery enforcement. Prime Minister Turnbull said in a

press release:

We are investing a further $15 million over three years to

strengthen the capacity of the Australian Federal Police and specialist

agencies to trace corrupt money flows, seize tainted proceeds and engage the

best lawyers to prosecute perpetrators.[70]

3.66

Prime Minister Turnbull stated that the funds would be sourced

from confiscated proceeds of crime and used 'to expand and enhance the foreign

bribery investigation teams of the Fraud and Anti-Corruption Centre [FAC]'.

Specifically, 26 new positions within the AFP would be funded, making up

three new investigative teams—which will include the recruitment of investigators,

forensic accountants and proceeds of crime litigators.[71]

3.67

Commander Crozier of the AFP explained that provision of these

specific resources to deal with foreign bribery as an organisation 'is

indicative of the seriousness not only [in] the way the AFP takes it but also

the way the government is looking at these issues'.[72]

The AGD confirmed that this funding allowed the:

AFP-led FAC centre to develop dedicated specialist teams in

Perth, Sydney and Melbourne to identify and investigate instances of foreign

bribery.[73]

3.68

Commander Crozier also commented that, in addition to this

specific funding received by the AFP in relation to the establishment of

foreign bribery teams in Sydney, Melbourne and Perth, significant funding had

been received in relation to the AFPs specialist capabilities, which all parts

of the organisation draw on to undertake investigations. Commander Crozier

explained that this funding had been beneficial:

...because it covers myriad specialist capabilities, a lot of

which foreign bribery will use. We've made mention about how we use some of

those higher end techniques that are supported by that really high-end

technical capability. There's no question that investigations such as these are

resource intensive. We've had a number of matters of high profile, including in

the serious taxation space. It's not hard to recognise the amount of resources

that go in, not just to a specific investigations team but to all those

capabilities that the organisation has to assist and move through to a

prosecution phase. We do recognise those issues and are aware of them, but it's

drawn out of our normal business.[74]

3.69

While acknowledging the gains that have been made in recent

years, some submitters called for the devotion of further resources to the area

of foreign bribery. For example, the Law Council of Australia stated:

The gains that have been made in recent years, I think, are

quite profound—the additional funding, the centre of excellence within the

Australian Federal Police, the devotion of further resources.[75]

3.70

The IBAACC also noted the increase in financial resources, but

recommended that such resources be made available on an ongoing basis.

Specifically, they called for the additional funding to be:

...maintained by all Governments at a commensurate level to

target serious financial crime including foreign bribery and to ensure that the

AFP and agencies working within the area of foreign bribery and their

investigators are suitably experienced in international tax, finance and

business transactions.[76]

3.71

The CDPP also reminded the committee that:

Current experience demonstrates that foreign bribery matters

will be some of the most complex and resource intensive matters prosecuted in

this country. The resource challenges may be magnified by the fact that

defendants may be very well resourced and backed by insurance.[77]

Interagency cooperation

3.72

As previously stated, submitters to the inquiry indicated that

since the establishment of the FAC in July 2014, cooperation on foreign bribery

matters between the relevant Commonwealth departments and agencies, as well as

their state and territory counterparts had improved. For example, Mr Wyld noted

that since the FAC was established:

...there is a much better level of coordination, cooperation

and secondment between officers of the Commonwealth entities that are part of

that centre, including Tax, Customs, Immigration, AUSTRAC, the AFP, ASIC and

APRA.[78]

3.73

Indeed, in its submission to the inquiry, the AGD explained that

since the establishment of the FAC:

...the AFP has strengthened its engagement with state and

territory counterparts in relation to foreign bribery and corruption and fraud

offences. This engagement has resulted in intelligence from a state police

force that led to an allegation of foreign bribery being referred to the AFP

FAC Centre.[79]

3.74

Mr Wyld agreed, remarking that things have substantially changed

over the more recent years. Mr Wyld told the committee:

...I think a lot of credit has to go partly to the government's

initiative in getting the AFP to focus on this sort of work, and, in turn, the

AFP themselves in reorganising their internal affairs to dedicate time and

people to develop that experience—which takes a long time.[80]

3.75

The committee heard evidence from a panel of representatives from

the AFP, ASIC and the CDPP who reflected on improved collaboration, specialised

interagency training and the benefits of early engagement across their agencies

in foreign bribery matters. Further, the panel suggested that through the

implementation of both internal changes, as well as the FAC, Australia had enhanced

its capabilities to handle foreign bribery investigations.[81]

3.76

ASIC brought the committee's attention to action it had taken in

response to recommendations of the Phase 3 OECD Report that ASIC and the AFP

more closely engage and share expertise. ASIC explained:

We have seconded a staff member into the AFP, in the FAC

Centre, to bring knowledge and expertise of ASIC matters to the AFP. We have

been actively involved in training, and I think the advanced foreign bribery

training course was mentioned. ASIC staff attend that training but also

participate in that training. I've presented at that training myself. Certainly

the sharing of expertise has occurred; the sharing of resources has occurred.

The expertise, both on the part of the AFP and ASIC, has been enhanced as a

result.[82]

3.77

In recognition of the very specialised nature of foreign bribery

matters, Mr Kirne of the CDPP advised that in October 2015, it established

a specialist national focus group. Mr Kirne informed the committee that the

CDPP's specialist national focus group is:

...a forum that meets every five to six weeks and is designed

to discuss foreign bribery related matters and to share knowledge and learnings

of issues and also is a means to ensure a consistent national approach. As

noted in the cross-agency submission, due to the complexity and volume of

foreign bribery matters, the CDPP provides early and ongoing legal advice to

investigative agencies during the course of investigations. For example, there

is a case officer appointed for each foreign bribery investigation that the

office has been advised of.[83]

3.78

Ms Jeldee Robertson of the CDPP also commented on the benefits of

increased prebrief engagement with the AFP:

...the ability to assess the briefs more quickly has certainly

increased in the last few years because of that very, very early engagement. I

think that's been a real improvement.[84]

3.79

Mr Kirne added that the CDPP has also:

...moved more towards a team based approach to assessing the

litigation rather than having a single lawyer working on a matter, which of

course makes it susceptible, when the person retires or resigns or takes leave

et cetera, to the matter stopping in its assessment phase. So, we're teaming

lawyers—pairing them to work on these more complex matters. In some

particularly complex matters, at times we've had up to half a dozen lawyers, I

think, working on one matter—not all the time, obviously, and not for huge periods

of time, but at various times in the assessment stage.[85]

3.80

With respect to delays caused by LPP, the Phase 4 OECD report

noted that the AFP had recently created a LPP Practice Group, to ensure that

all AFP investigations at risk of LPP claims are able to manage these

effectively. The report explained that:

...the Group runs an internal training programme for all

investigators who may face LPP issues, ensuring that they can manage these

through comprehensive strategies and well informed negotiations. A member of

the Group also acts an 'LPP coordinator' as required throughout an

investigation.[86]

3.81

In this regard, Mr Kirne of the CDPP offered his views on the

potential for LPP to 'get in the way—or be misused' in foreign bribery cases:

LPP is one of those issues that we know, in most of the

investigations, when you're actually working in this complex space that we're

working with corporations and the like, and financial crime is always a

potential issue that you're going to have to deal with. What we have to do, as

an agency and working with our partners, again, is start to look at strategies

to try and lessen the impact of LPP and work with our own internal agencies in

developing frameworks, including what we have as an LPP practice group, within

our organisation which assist us to build some strategies for a potential

claim. It also ensures that the negotiations that are occurring with a person

who is making a claim are well understood. There are good frameworks around

them, and it ensures that, as much as we can, there's some sort of timely

response into that process rather than the potential for a matter to linger for

an extended period of time in which neither party really benefits.[87]

3.82

Commander Crozier also noted that the AFP will continue to look

for ways to improve Australia's enforcement of foreign bribery laws, and

emphasised that this may see involvement from agencies, other than ASIC and

CDPP. He told the committee that:

...we will continue to expand our relationships, ensuring that

early engagement is happening not just with the CDPP but across agencies for

the contributions or expertise that they might be able to provide, and considering

what other agencies may be able to contribute and assist.[88]

3.83

Mr Kirne also explained that the CDPP now provides relevant training

and partakes in the AFP advanced foreign bribery training program.[89]

3.84

In addition, Commander Crozier advised the committee that the

AFP, in conjunction with their partners across the FAC Centre, is undertaking a

review that is due in 2018 to ensure that it's delivering what was intended.

Commander Crozier indicated that the FAC is:

...not just around having people in the centre doing their

work; it's about changing mindsets around what we might be able to do and how

we deal with issues from a broader range of treatments. To ensure that what was

set up in the philosophy of establishing it back in 2014 is still current,

we're doing that review to get an understanding and making sure the other

agencies contributing to the FAC Centre are getting out of it what they

intended so we can meet those requirements.[90]

ASIC enforcement review

3.85

With reference to their abilities to investigate foreign bribery

related offences, ASIC commented that the powers at their disposal 'were not

designed with foreign bribery in mind'.[91]

Mr Savundra of ASIC went on to explain:

An example of that would be section 286 [of the Corporations

Act 2001], which is about ensuring that financial accounts are true and

fair. It'll be very rarely the case that a foreign bribery is material such

that the misreporting of a bribe in the accounts is unlikely to impact that

financial position being true or fair. Section 286 will, I anticipate, unless

the foreign bribery is material, be limited in its use.[92]

3.86

On 19 October 2016, the Minister for Revenue and Financial

Services, the Hon Kelly O’Dwyer MP, announced a taskforce to review the

enforcement regime of ASIC.[93]

3.87

The Enforcement Review Taskforce is led by a Panel chaired by

Treasury, and includes senior representatives from ASIC, AGD, and CDPP, with

support from an Expert Group drawn from academia and legal experts recognised

for their expertise in corporations, consumer, financial and credit law. The

Expert Group will provide ongoing advice and feedback to the Panel in preparing

its report and recommendations.

3.88

The Enforcement Review Taskforce was due to report to the government

in 2017 and invited submissions from the public on proposed policy responses,

including on Strengthening Penalties for Corporate and Financial Sector

Misconduct.

3.89

Mr Savundra explained that the work of the Enforcement Review

Taskforce will be critical to improving ASIC's enforcement record. He told the

committee that:

The Enforcement Review Taskforce is looking at search

warrants, telephone intercepts—a number of issues which would enhance ASICs

toolkit.[94]

3.90

In terms of penalties, Mr Kirne of CDPP told the committee that

the Enforcement Review Taskforce is:

...looking at penalties for offences across the board, both for

individuals involved in financial crimes and for corporate entities.[95]

3.91

Ms Kate Mills from the Treasury informed the committee that there

is a position paper on penalties from ASIC to the Enforcement Review Taskforce.

In the context of criminal penalties, Ms Mills stated:

The principal provision that ASIC would rely upon in this

regard is section 184 of the Corporations Act [Corporations Act 2001],

which criminalises the behaviour of directors and officers of the company if

they engage in the requisite conduct intentionally or recklessly...What the task

force is currently proposing as a preliminary position is that section 184,

from a criminal perspective, be increased up to 10 years. That will bring it

into line with equivalent state legislation outcomes for fraud or like

offences. It will also potentially eliminate the difficulty that ASIC has at

the moment in having to bring prosecutions with the DPP under both the state

and Commonwealth law. It could bring it all under state law and get the benefit

of the maximum terms, but then it is not able to use a lot of its investigative

and other powers, because it's not investigating a Commonwealth offence. The

proposal put forward by the task force will eliminate that particular

difficulty. Of course, it ultimately has to be accepted by government; but that

is the current position, and we are consulting on that.[96]

3.92

With respect to civil penalties under the Corporations Act

2001,

Ms Mills informed the committee:

Section 1317E of the act gives you a list of all the civil

penalties. For an individual, the maximum fine is $200,000. In the case of a

corporation, the maximum fine is $1 million. The task force recognises—and has

put a position out in relation to this—that those penalties need to be amended.

In the case of individuals, they are looking at a fine of up to $540,000-odd. In

the case of a corporation, that will certainly increase—in some cases to $2

million and in other cases much more significantly than that. In addition, it

adds a couple of other options to the menu, if you like. One is that the

company can be required to disgorge the benefit. It can be a multiple of three

times the benefit, so it can be very substantial. In addition, there may be

ability to impose up to 10 per cent of turnover of the organisation. So, even

though the fine ordinarily might be relatively low, the court, in appropriate

circumstances, may be able to impose a much more significant financial penalty

than would otherwise normally be the case.

Likewise, in relation to penalties on the criminal side, the

proposal is that they be increased and brought up to roughly the same level as

exists currently for market misconduct, which is around $9.45 million, plus the

disgorging option, plus the three times benefit option, plus the 10 per cent

turnover option.[97]

3.93

Indeed, Ms Mills confirmed that the Enforcement Taskforce Review

expected to make recommendations to the government on these issues by the end of

2017.[98]

Proposed amendments to the foreign

bribery offence and related measures

3.94

In evidence before the committee in October 2017, AGD noted that:

The government has consulted on a number of significant

reforms to improve the response to corporate crime and to help ensure foreign

bribery is detected, investigated and prosecuted. These include possible

changes to the foreign bribery offence to address operational barriers...[99]

3.95

As mentioned in Chapter 2, as a result of these consultations in

December 2017, the government introduced the Crimes Legislation

(Combatting Corporate Crime) Bill 2017 (CCC bill) which implements, in part,

the proposals to amend the foreign bribery offence and introduce a deferred

prosecution agreement (DPA) scheme.

3.96

These proposals are discussed in more detail in Chapters 4 and 5.

Phase 4 OECD Report

3.97

In its Phase 4 OECD Report the OECD evaluation team was impressed

by the substantial steps Australia had taken since Phase 3 to enhance its

capacity to investigate foreign bribery cases. In particular, the report noted

the creation of FAC, the enhanced role of the Panel of Experts, the

establishment of three dedicated foreign bribery investigative teams, and

ongoing training provided to all investigators with AFP's FAC. The examiners

stated they are:

...confident that AFP now has the systems in place to

effectively evaluate and investigate foreign bribery referrals and recommends

that the government continue to resource AFP effectively to ensure it can

continue its foreign bribery enforcement efforts.[100]

3.98

With respect to the CDPP, while impressed by recent efforts to

increase expertise and dedication toward combatting foreign bribery, the Phase

4 OECD Report suggested:

...that the current level of resources for foreign bribery

prosecutions, whilst adequate for the CDPP’s current workload, will need to be

carefully monitored, particularly if the level of referrals continues to

increase.[101]

3.99

In this light, the Phase 4 OECD Report recommended, among other

things, that Australia continue to resource the CDPP so it can effectively

prosecute foreign bribery cases at the rate that they are expected to be

generated by AFP.[102]

Committee view

3.100 The

committee notes the criticisms of stakeholders about Australia's legislative

scheme and enforcement record in combatting foreign bribery. Indeed, the

committee considers that a deficiency of sufficient expertise, delays in

investigation and prosecution, and a lack of cooperation and limited resources may

have contributed to the scarce enforcement of foreign bribery involving

Australian companies and individuals.

3.101 The

committee is cognisant that establishing a legitimate system to tackle

instances of foreign bribery is not straightforward and needs to efficiently

and effectively utilise existing resources. The committee endorses an

interagency approach in this area, and acknowledges the work and role of the

Fraud and Anti-Corruption Centre (FAC) in addressing matters of foreign

bribery.

3.102 Noting

that the FAC was only established in 2014 and the average duration of a foreign

bribery case is between five and seven and a half years, the committee

considers that more time is needed to assess the effectiveness of the FAC in

investigating and prosecuting foreign bribery. In this context, the committee

also recognises that it is difficult to assess the impact of the additional

funding of $15 million for foreign bribery enforcement which was provided

in 2016.

3.103 Evidence

presented to the committee established that foreign bribery cases are complex,

lengthy and resource intensive. The committee is therefore of the opinion that

given the serious nature of foreign bribery, the complexity and time necessary

to secure evidence, and the high public interest in ensuring that corporate

criminal conduct does not go unpunished, there should remain no time limit for

foreign bribery offences (see statute of limitation discussion in Chapter 2).

However, the committee considers it essential that the government establish a

permanent funding mechanism to ensure agencies are equipped to thoroughly

investigate all foreign bribery allegations, and to support any necessary

prosecutorial action.

3.104 With

regard to ASIC's enforcement powers, the committee notes that the Enforcement

Taskforce Review was expected to make recommendations to the government by the end

of 2017. While this review is a welcome and important start, the committee

believes that any proposed changes should be considered in the context of ASIC's

ability to enforce penalties for foreign bribery related offences.

Recommendation 2

3.105

The committee recommends that the Australian Federal Police's

(AFP) annual report incorporate specific information about the Fraud and

Anti-Corruption Centre (FAC), including de-identified data regarding the number

of referrals received, the number of matters allocated to the AFP foreign

bribery or FAC team, the number of investigations completed, the resources

devoted to these activities, and the number of investigations which led to criminal/civil

actions and the timeliness of such enforcement actions.

Recommendation 3

3.106

The committee recommends that consideration be given to

developing a contingency mechanism that explicitly provides for additional

one-off funding to appropriate agencies (Australian Federal Police, Australian

Securities and Investment Commission, Commonwealth Director of Public

Prosecutions) for large and complex investigation of foreign bribery offences

to ensure any allegations are thoroughly investigated, and where appropriate,

fully prosecuted.

Recommendation 4

3.107

The committee recommends that in considering the report of the

review of the enforcement regime of Australian Securities and Investment

Commission (ASIC), the government have regard to how any proposed changes will

help improve the enforcement of penalties by ASIC for foreign bribery related

offences.

Navigation: Previous Page | Contents | Next Page