Dissenting Report from Labor Senators

1.1

Labor Senators pushed for the establishment of this inquiry. Given the

total cost of these personal income tax cuts over the medium term is $143.95

billion dollars, it is only right and proper that this bill receives the

scrutiny and analysis that it deserves.

1.2

This inquiry has also demonstrated how out of touch this Government is; a

Government prepared to risk the budget bottom line to hand out tax cuts to big

business and top income earners, while doing very little for low and middle

income households.

The Government’s Policy objective

is ideological, not rational

1.3

Treasury officials confirmed that the design of this package was

designed to meet largely ideological ends:

As far as the government's personal tax plan goes, it was

designed, in the government's words, to deliver lower taxes, protect against

bracket creep and lead to a simpler system.[1]

1.4

Treasury officials also confirmed that policy issues around workforce

participation and consumer spending were not part of the driving reasons to

design these tax cuts:

Senator KETTER: No sorts of objectives in terms of workforce

participation, consumer spending or any of those sorts of things?

Ms Mrakovcic: Well, I think that the government's objectives

as per its Personal Income Tax Plan are set out in what the government has said

about its package. That's not to say it doesn't have those impacts or it

wouldn't impact in those ways, but—

Senator KETTER: It doesn't set out to do those?

Ms Mrakovcic: The government has set out, certainly, the

objectives it set itself in terms of the personal tax plan. But I think that

those were certainly issues that the government would have been aware of, and

they are captured in some of the language around reward for effort and

incentives to take on extra hours to work et cetera. So I think that, if you go

into the detail around where it explains those issues, it does traverse some of

that ground. And certainly the budget documents also make reference to the

forecast taking into account the impacts of the personal tax plan on

consumption.[2]

1.5

This evidence demonstrates that this tax plan is ideologically driven.

Genuine policy concerns such as workforce participation (generally or in key

cohorts), lack of wage growth and increasing disposable income of targeted

households as a way of boosting consumer spending were not in the forefront of

decision making of this Government. Instead, the Government chose to impose its

lower taxing, flatter taxing ideology to personal income taxes. Once again, a clear

sign that this Government has run out of ideas and is resorting to ideology.

1.6

In contrast, Labor has always taken a careful, considered and nuanced

approach to policy development and isn't afraid of detailed analysis.

The Government refuses to disclose year-on-year

costings of this policy beyond the forward estimates, and it is clear that each

step has very different costs.

1.7

During the course of this inquiry, Treasury officials maintained the

Government position, which was to not release year-on-year costings beyond the

forward estimates for different elements of this tax plan. Labor Senators

believe this is both in the public interest and prudent given most of the tax

cuts commence beyond the forward estimates period.

1.8

In response to repeated requests for this information, Labor Senators

asked the Parliamentary Budget Office (PBO) to provide these figures and Labor

Senators thank the PBO for these figures in relatively tight timeframes.

1.9

Labor Senators want to make the following points about the PBO’s figures

on each stage of the plan:

- Step 1 – carries a relatively modest cost of $15.9 billion over the

medium term and is targeted at low to middle income earners;

-

Step 2 – which contains a number of different tax changes contains the

majority of the costs of this package over the medium term (given Step 3

elements commence in 2024-25); and

-

Step 3 – is both very expensive at the end of the medium term at $10.35

billion per year, compared to the full package final annual cost of $24.6

billion per year and the cost of Step 3 grows at about 12% per year, twice the

rate of projected nominal GDP growth.

These tax cuts put at risk the

budget position if key budget forecasts are not met.

1.10

In order to justify these personal income tax cuts, the Government

continues to rely on its budget projections which predict a wafer-thin return

to surplus which does not even reach 1.0% of GDP by the end of the forward

estimates period.

1.11

This inquiry heard a consistent message that the surplus predictions

rely on budget forecasts around wages growth, productivity growth, population

growth and terms of trade which do not match recent historical trends. In

addition, even the Treasury Secretary has admitted that geopolitical risks are

greater now than a year ago:

Senator KETTER: Mr Fraser, in your opening statement you

talked about the global risks, in particular China—the debt situation there,

the geopolitical issues. You've also touched on the royal commission and that

there could well be some unanticipated tightening in financial conditions as a

result of reactions to that. Taking the range of international and domestic

conditions together, in your judgement, are there more risks now than there

were a year or two ago in relation to the economic outlook?

Mr Fraser: Unequivocally, yes, with the geopolitical risks.

That's very sad. When you look over the past year—you know, I, as an amateur,

would say the Middle East situation is more complex and more worrying. The

issues in Saudi Arabia and Yemen, the issues with Israel and Iran—this is all very

worrying. Korea is probably pretty much the same, or even a tad better. But the

issues with the South China Sea are probably worse. The markets—there are

people who have hedge funds that try to make money out of geopolitical risk,

and that is suggesting that they're regarding it as more of a risk.[3]

1.12

The Grattan Institute did not think that it was prudent to legislate for

tax cuts well into the future, beyond the forward estimates:

Secondly, is it prudent to legislate that far in the future?

As our submission makes clear, we don't think so.[4]

1.13

The Grattan Institute went on to say that legislating tax cuts like this

would leave the Commonwealth less able to deal with any potential future downturn

and reduces the Commonwealth's ability to protect jobs in those circumstances:

Mr Daley: It means the government effectively has fewer

options if there is a downturn. It has less fiscal firepower, as many would put

it, less opportunity in the downturn to deliver a short-term tax cut or welfare

payment or whatever is appropriate—a short-term boost to infrastructure or

other forms of fiscal stimulus—that would be aimed, in that circumstance, at

promoting employment to ensure that you don't get the short run unemployment

that then becomes long-term unemployment, which tends to be the really big

problem of economic downturns. That's what you're trying to avoid—that is, a

big jump in unemployment in a downturn. Traditionally, what Australia has done,

and what we did do in 2008, was a big budgetary shift that was largely

successful in avoiding a substantial jump in unemployment.

Senator KETTER: That firepower is used to save jobs, for

example, isn't it?

Mr Daley: It's used to save jobs in the short run so as to

prevent unemployment going up in the short run. One of the things we know about

unemployment is it tends to be sticky: people who lose their jobs in the short

run, in the middle of a recession, often find it very difficult to get jobs in

the longer run, and so you get a permanent drop, or at least a long-term drop,

in the potential economic output and, therefore, the resources available to the

community.[5]

1.14

Dr Stephen Anthony also cited a number of issues with the cost of these

tax cuts given the assumptions that underpin the Government's fiscal position.

His overall position is summarised immediately below, with additional detail on

key economic drivers following:

It would be that I have examined the budget outlook over the

next decade, and my view is that we will be hard-pressed to afford tax cuts at

the same time as growing the economy at the rate that is anticipated in this

budget. There is no room for any sort of economic slowdown or interruption in

the budget as presented last May.[6]

If you look at the budget outlook and the medium-term

projection, the coathanger of that projection is the assumption of productivity

growth of 1.6 per cent. That is double the current rate or the average of the

period since the GFC.[7]

...which leaves the population growth rate to be 1.5 or 1.6 per

cent, depending on the year we're talking about.

The issue with that growth rate is that it's all well and

good, but if we build our population at that rate through time without having

the sort of strategic plan in place to make the most of that population growth

and to develop human capital, then we are no doubt going to generate unbalanced

growth in some regions of the country. Presumably, that's what we're seeing in

Sydney and Melbourne right now.[8]

The idea that we're going to move back to the sort of 30-year

average of wage costs—wage prices—within 18 months seems extremely optimistic,

I would have thought. It suggests a level of capacity utilisation in this economy

and a return to the 'normal' of the pre-GFC period that we're just not

observing. And it's not being observed here or in most of the world right now.

So I would've thought that a budget strategy that's predicated on high wages

growth is extremely—well, at least, not cautious; let's put it that way.[9]

So there is a small reduction in the terms of trade over the

outlook and into the medium term, but it still leaves the terms of trade

extremely high in historical terms. That may be correct but, once again, in a

global environment that could experience significant shocks, those terms of

trade could get dented very quickly, and obviously that would have significant

impacts on the budget bottom line.[10]

1.15

Associate Professor Ben Phillips also stated that lower wages growth of

about 2.5% per year rather than the projected 3.5% per year could impact

revenue as much as $39 billion dollar per annum:

When you look at, say, 2.5 per cent wage growth compared to

3.5—obviously, that's a difference of one per cent per year. When you put that

out to, say, 10 years into the future, it's roughly an 11 or 12 per cent

reduction in wages overall. Already you've got 10 to 12 per cent less tax

revenue from that. Then you've also got bracket creep. On top of that, you're

also missing out on bracket creep, so you're looking at a considerable

reduction in terms of the overall tax take. That's where we get the estimate of

around $39 billion per annum.[11]

1.16

Labor Senators are also deeply concerned that the cumulative impact and

loss of revenue flowing from Government's corporate tax cuts and personal

income tax cuts over medium term will put the budget in a very precarious

position, as summarised by Dr Anthony:

My view is that, by the middle of the next decade, the combination

of the individual tax cuts and the company tax cuts would, even on the

government's budget parameters, essentially remove all of the possible surplus

that the economy could have generated if the economy softens or grows at an

even slightly slower rate than that forecast in the budget. For example I

modelled a half a percentage point of GDP lower each year from 2018-19. If that

slowing occurs, the budget will be in deficit by around one per cent of GDP by

the middle of the next decade. So I don't think the combination of these tax

cuts can be affordable.[12]

1.17

Labor Senators believe that the budget needs to be in a sustainable

position over the long term, which enables future Governments to use fiscal

stimulus where needed to protect jobs. The actions of the last Labor Government

during the Global Financial Crisis prevented widespread unemployment and it is

important that future Governments be afforded such capacity.

1.18

Labor Senators are also concerned if these personal income tax cuts are

passed by the Parliament, such reductions in revenue could be used by a future

Coalition Government during an economic slowdown to justify cuts to essential

services such as health, education and infrastructure.

1.19

This inquiry has demonstrated that there are many downside risks to the

budget position over both the forward estimates and particularly the medium

term. Labor Senators also know that net debt for this coming year is double

what it was when the Coalition came to office; and gross debt, which crashed

through half a trillion dollars on their watch for the first time in history,

will remain well above half a trillion dollars every year for the next decade.

The Government is abandoning all hope of repairing its abysmal record on debt

and deficit by attempting to legislate for this full package of personal income

tax cuts given the well-known downside risks to Australia's fiscal and economic

position.

The behavioural impacts championed

by this Government were refuted by a broad range of stakeholders

1.20

Part of the expected benefits of this package championed by the

Government is that a flatter tax system will incentivise people to take on

additional work:

It is important that the personal income tax system does not

act as a disincentive for those taking on additional work or seeking

advancement.[13]

1.21

The Grattan Institute argued that for many high income earners, marginal

income tax rates are not much of a disincentive to work additional hours:

Many of the submissions, such as those from EY, the Business

Council of Australia and the Centre for Independent Studies, assert that a high

marginal tax rate for top income earners has a big economic cost because it

discourages people from staying in Australia, depriving Australia of their

talent. This is myth four: Australia's high top marginal tax rates do not

materially affect decisions to work more or to live in Australia. There is an

ocean of literature on this, and it all comes to the same conclusion

internationally.[14]

1.22

In fact, Grattan cited that many millionaires are moving to Australia

despite so-called high marginal taxation rates:

Let's look at a nice piece of evidence very recently. The

AfrAsia Bank Global Wealth Migration Review, released recently, looked at the

migration of millionaires around the world. It found that, in the last year,

10,000 millionaires moved to Australia and almost none left. That is the

highest net migration of millionaires to any country last year in absolute

terms, let alone correcting for population. This is in a year where, as lots of

submissions point out, Australia's top marginal tax rate was relatively high

and cut in at a relatively low income. Singapore, with its very famous 15 per

cent tax rate, only attracted a thousand millionaires.[15]

1.23

When The Australia Institute was asked a similar question, they cited

that there are only particular cohorts which face the high issue of marginal

taxation rates, often women who are paying for childcare:

Senator McALLISTER: The Treasurer has spoken, in introducing

this package, about the need to incentivise people to work. Which parts of the

workforce would benefit most from additional financial incentives to work, if

we are interested in increasing productivity and labour productivity in

particular?

Mr Richardson: All the evidence is that it's the second

income earner in the household, especially women returning to work. That's

where the big problem is, and the poverty traps that are facing them are not

just the tax scales, of course, but possibly loss of other benefits—social

security benefits, family tax benefit, childcare expenses and transport

expenses. That was going to be my interjection before. This is the really

serious part of the incentive structure in our tax system. It's one of the

things that's been offered as the explanation of why participation among Australian

women, especially in that demographic, is much lower in Australia than other

comparable OECD countries.

Mr Grudnoff: If the government were seriously interested in

incentivising and increasing participation then it would be far better off

taking the billions of dollars that it's planning to give to high-income

earners and sticking it into something like childcare. You would get far more

bang for your buck and have far more impact on participation by doing that.[16]

1.24

The National Foundation for Australian Women and Professor Stewart also

refuted the idea that there were substantial benefits to reducing top marginal

taxation rates:

I'd like to make one more comment on that rate removal in

general terms, and that is that the efficiency case for that has not been made

out. There really is no empirical evidence to show that, systemically, at that

upper middle of the income distribution between $40,000 and $200,000, there are

negative work effects, for example, or investment effects at that level of

income. To the extent that we might see disincentive effects, they're probably

arising either at the very top or at the bottom of the distribution, and I'll

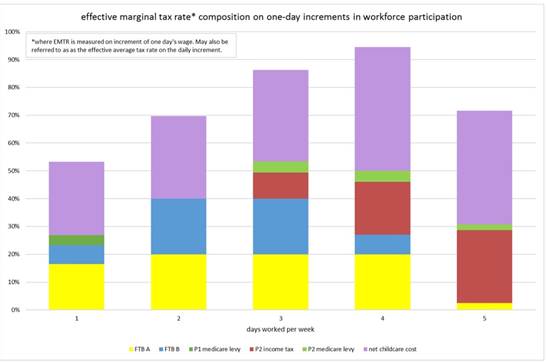

say something about effective marginal tax rates.

...

The final general remark I would make is that the highest

effective marginal tax rates that we see in our distribution are not at the top

of the income distribution. The top marginal rate plus Medicare is 47, as you

know. The highest effective marginal rates are at the bottom and in the middle,

and they are faced primarily by second earners who are losing family benefits

and paying net childcare costs—net of means-tested childcare benefit. The best

way to illustrate that rate, which is, I would say, a significant deterrent to

work participation, is to do it by day. I have an illustration in a sort of bar

chart on page 4 my submission, but I'm not sure if it's before the committee.[17]

The Bill fails to address the high

effective marginal taxation rates (EMTRs) faced by working women with caring

responsibilities.

1.25

Professor Miranda Stewart’s submission states that:

The tax cut does not address the key inefficiency in our

tax-transfer system, which deters work and reduces the ability of households to

save and consume. Australia’s existing PIT rate structure combines with our

tightly means tested and targeted cash transfer system to produce the highest

effective marginal tax rates (EMTRs) for individuals towards the lower-middle

and bottom of the income distribution. This is the result of the combined

withdrawal of family payments or Newstart, the net cost of childcare and the

personal income tax rates. In particular, this negatively affects women with

caring responsibilities, deterring them from increasing work participation

hours. Figure 3 illustrates the effect of combined tax and transfer rules on

earnings by day of the second earner (almost always the woman) in a moderate

wage household with two young children.

Figure 3: EMTR on second earner, salary $50,000, primary

earner $50,000, two children aged 2, 3 (2016).

Source: Stewart (2017), Figure 1.8b

The changes proposed under the PITP Bill do little to address

these high EMTRs. The interim Low and Middle Income Tax Offset will provide

targeted assistance to low income earners but will push up the EMTR faced by

women in the lower middle of the distribution.[18]

1.26

Professor Stewart also stated that lifting the workforce participation

of women, often the second income earner, would have a comparatively bigger

impact on household consumption in the economy:

Senator McALLISTER: My last question goes to the economic

impact of this. We've discussed quite a lot the fairness of organising the tax

system in a way that applies very high effective marginal tax rates to second

income earners in those lower tax brackets, but in terms of the economy the

Grattan Institute has previously said that removing disincentives for women to

enter the paid workforce would increase the size of the Australian economy by

about $25 billion per year. There are substantial economic gains to be made if we

can increase women's workforce participation, aren't there?

Prof. Stewart: Yes, I would support that, even just on the

basis of the ability to push households which are currently, as a matter of

standard practice, 1½-earner households or one-earner households with children

in them to be more what you might call two-earner or two-job households. Those

households have more ability to consume in the economy, to save for a house and

buy houses, to save more generally, to build retirement savings—superannuation

savings—for both people in the household, as this committee has identified

before, and to also pay taxes. Dual-earner households, economically, give quite

a lot of bang for the buck.[19]

1.27

Overall, Labor Senators are sceptical of the Government's claims, particularly

in Step 3 that a flatter taxation system would enable significant additional

hours to be worked. Such concerns are heightened when Step 3 is assessed

against its final annual cost of $10.35 billion dollars per year.

Distributional analysis of this

bill

1.28

Labor Senators believe it is prudent that this legislation receive

scrutiny in terms of the progressivity of the proposed taxation system as well

as distributional effects by gender and geography. The Grattan Institute

confirmed that the full package would decrease the tax burden on high income

earners while increasing the tax burden on middle income earners:

...senators can argue openly about whether reducing the extra

burden on high-income earners but increasing the tax paid by middle-income earners

is fair.[20]

1.29

Professor Miranda Stewart stated that this tax package was:

...both inefficient and a retrograde step and that that

undermines 100 years of progressive income tax rate structure in Australia.[21]

1.30

The Australia Institute found that the later stages overwhelmingly

benefit high income earners:

The problem is that the benefits from the latter stages of

the tax will overwhelmingly flow to high-income earners. These latter stages

are also worth considerably more in dollar value than stage 1. Increasing the

top threshold to $200,000 and removing the 37 per cent tax bracket will mainly

benefit the top 20 per cent of tax payers. By 2024, 80 per cent of the benefit

of that top end tax cut will go to the top 20 per cent and the remaining 20 per

cent will go to the next 20 per cent of taxpayers. This means that the bottom

60 per cent of taxpayers will get no benefit at all. Because of this, we are

recommending to the Senate that it split or amend the bill to remove those

parts that flatten income tax by increasing the top threshold and removing the

37 per cent tax bracket.[22]

1.31

The Grattan Institute also found that that '$15 billion of the annual

$25 billion cost of the plan will result from collecting less tax from the top

20 per cent of income earners'.[23]

1.32

On gender, it is clear that each stage progressively tends to favour

men, who typically receive a higher income.

1.33

The contrast is very high in Step 3, where almost 75% of Step 3 flows to

men ($30.35 billion versus $11.25 billion).[24]

1.34

On gender analysis, Treasury officials confirmed that they had not

carried out such analysis:

Senator KETTER: Also, I just want to confirm, again, that

there was no gender analysis done in relation to the impact of the particular

measure.

Ms Mrakovcic: That's correct.

Senator KETTER: Did the government instruct Treasury not to

carry out a gender analysis?

Ms Mrakovcic: I think it's fair to say that we didn't do

gender analysis because, as the secretary again pointed out last week, we

actually see the tax system as gender-neutral.[25]

1.35

The National Foundation for Australian Women responded to comments in

Senate Estimates confirming the lack of gender analysis this way:

Senator McALLISTER: Right. I asked the Treasury secretary why

gender analysis was not undertaken on this initiative and his response was,

'Because the tax cuts are gender neutral.' Is he correct?

Ms Coleman: He had a smile on his face when he said that?

That's just a nonsense. The intention was gender-blind, I would say, rather

than gender-neutral. The statistics that are there clearly indicate that these

tax cuts are a long, long way from being gender neutral. It's just a nonsense.[26]

1.36

The other distributional impact which is important to Labor Senators is

geography.

1.37

Professor Li stated during the hearing that people living in capital

cities, particularly Sydney and Melbourne would stand to gain the most given

the spatial distribution of high income people. By contrast, that means that

proportionally, the rest of the country stands to gain much less from the tax

package.

1.38

Recent analysis by the Australia Institute confirms such findings:

The biggest winners from the tax cut are wealthy electorates

in Sydney and Melbourne. As shown in Table 1, the top 10 electorates all come

from these cities. The average household in any of the top 10 electorates would

get at least 50% more than the average Australian household.[27]

1.39

Other analysis which is in the public domain are calculations which

paint Labor's bigger, better, fairer tax package as higher taxing, as published

by The Australian on 30 May 2018, titled 'Labor's $2000 tax sting for average

workers'.

1.40

Treasury officials on 30 May 2018 confirmed that they were not aware of

this analysis,[28]

which indicates it is likely that such analysis originated within the

Treasurer's office, not Treasury. Such analysis included a forklift driver

earning $145,000 per year. The ACTU characterised the use of such figures this

way:

Senator KETTER: It was just interesting that, in the context

of our conversation earlier about the Treasurer saying, or the government

saying, that this package is designed to provide relief for middle Australia,

we saw in the Treasury modelling an example of a forklift driver or excavator

operator at BHP coal being on $145,000 used in the context of comparing the

alternative tax policies.

...

Mr Roberts: I've given the median wage figure of $53,000 for

all workers. It increases to about $65,500 for all full-time workers. But that

is the median—

...

Mr Roberts: I'd say if there's a forklift driver earning

$140,000 they would be well and truly the exception.[29]

1.41

Such analysis underscores how the Treasurer has politicised Treasury and

undermined their policy work. Labor Senators are deeply concerned that the

Treasurer continues to operate in the way that he does, and Labor will stop this

activity in Government.

Labor Senator’s position on this

bill

1.42

Labor Senators will continue to take a careful, considered and nuanced

approach to policy.

1.43

This Government is ideologically driven and bereft of ideas. By

continuing to insist that the bill be taken as a whole and refusing to both

conduct and release even basic fiscal and distributional impacts, the

Government insults the intelligence of the Australian people.

1.44

Labor Senators have a strong suite of policies that will be implemented

in Government to put the budget in a sustainable position, including reforms to

negative gearing, capital gains tax, trusts and dividend imputation.

1.45

While the Government continues to take its ideological approach of

lower, less progressive taxation, Labor in Government will seek to get the best

return for the taxpayer as possible, taking economic circumstances into

account.

1.46

The Treasurer has politicised Treasury, which a Labor Government will be

left to fix.

1.47

Labor Senators support low and middle income tax relief.

1.48

Labor Senators want to ensure that a future Government can properly fund

public services such as health, education and infrastructure while recognising

that low and middle income households are under pressure. Labor Senators will

not support unsustainable levels of tax cuts that put essential public services

at risk.

1.49

Labor Senators also have a plan for bigger, better, fairer income tax

cuts that can be responsibly accommodated through Labor's suite of savings.

Recommendation 1

1.50

That the Government deliver tax cuts in a fiscally responsible way that

does not jeopardise the ability for future governments to respond to changes in

economic circumstances.

Recommendation 2

1.51

That the Government ensures that any tax cuts do not risk the ability of

future governments to fund important government services.

Recommendation 3

1.52

That the Government prioritise legislating tax cuts which:

- Are fair and equitable; and

-

Support low and middle income earners so as to deliver a bigger

short term boost to consumption and economic growth.

Senator Chris Ketter Senator

Jenny McAllister

Deputy Chair Senator

for New South Wales

Navigation: Previous Page | Contents | Next Page