Chapter 1

Introduction

Referral

1.1

On 12 November 2015, the Senate referred the provisions of the Health

Insurance Amendment (Safety Net) Bill 2015 (Bill) to the Senate Community

Affairs Legislation Committee (committee) for inquiry and report by 23 November

2015.[1]

Objective of the Bill

1.2

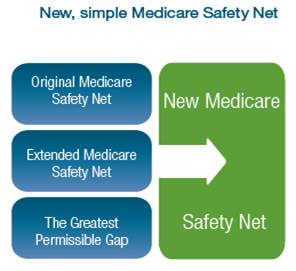

The Bill seeks to amend the Health Insurance Act 1973 to introduce

a new Medicare Safety Net, to replace the Original Medicare Safety Net (OMSN),

Extended Medicare Safety Net (EMSN) and the Greatest Permissible Gap.[2]

1.3

In the second reading speech, the Hon Sussan Ley MP, Minister for Health

(Minister), said that the Bill:

...will ensure that a strong safety net continues to protect

all Australians from high out-of-pocket costs for medical services provided out

of hospital. It will also address many of the known equity and complexity issues

of the current arrangements.[3]

1.4

The Minister identified four issues that the Bill aims to address:

The current safety nets are complicated and confusing...they

work in different ways and have different thresholds. They interact with each

other and can sometimes all be applicable to the same medical service. They are

unnecessarily complex and difficult to understand.

The current arrangements are also inconsistent. There is a

limit on safety net benefits that will be paid for some but not all

out-of-hospital services. Some of these limits are fixed dollar amounts, while

others are based on a percentage of the Medicare fee. This inconsistency in

arrangements can be very confusing for patients and medical practitioners.

While most doctors charge reasonable fees for their services,

some doctors and service providers have used the Extended Medicare Safety Net

to underwrite excessive fees. This has led to increased patient out-of-pocket

costs in some areas...

The current arrangements may also support less safe medical

practice, such as providing complicated surgical services out of hospital

to take advantage of the unlimited rebate available under the Extended Medicare

Safety Net.[4]

1.5

The Minister stated that previous changes to the EMSN had attempted

unsuccessfully to address these issues. The changes increased the program's

complexity and left two particular issues unresolved: 'excessive fee inflation

can still occur to services that are uncapped' and 'some people reach their

threshold almost immediately due to the unlimited amount of out-of-pocket costs

that count towards the threshold', desensitising patients to further fees and allowing

for fee inflation.[5]

1.6

The Minister concluded:

The time is right to replace the complex, inefficient

Medicare safety net arrangements with a new Medicare safety net. The new

Medicare safety net will strengthen the system for patients into the future

while contributing to a more sustainable Medicare system. Its design has been

informed by the findings of two independent reviews; ongoing consultation with

the medical profession since the introduction of the Extended Medicare Safety

Net in 2004; and concerns raised by patients.[6]

Background to the Bill

1.7

At present, Medicare safety net arrangements include the OMSN,

the EMSN and the Greatest Permissible Gap. Of these arrangements, the EMSN

accounts for the majority of expenditure[7]

and has been independently reviewed twice in the past six years, followed by the

Government's announcement of the current measure in the 2014–15 Budget.

Safety net arrangements affected by

the Bill

1.8

The OMSN was introduced in its current form in 1991. It increases the general

rebate for out-of-hospital Medicare services to 100 per cent of the Medicare

Benefits Schedule (MBS) fee once an annual threshold of gap costs has been met.[8]

In 2015, the annual threshold is $440.80.[9]

1.9

The EMSN was introduced in 2004. It provides an additional rebate (80

per cent of out‑of‑pocket costs) for families and singles whose out‑of‑pocket

costs for out‑of‑hospital Medicare services reach an annual

threshold. In 2015, the annual threshold is $2,000 for families and singles,

and $638.40 for Commonwealth concession cardholders and people who are eligible

for Family Tax Benefit Part A (FTB(A)).[10]

1.10

The Greatest Permissible Gap was introduced in 1984. It increases the

rebate for high cost out‑of‑hospital Medicare services, so that the

difference between the rebate and the MBS fee is no more than $79.50.[11]

2009 and 2011 independent reviews

1.11

In 2009 and 2011, the EMSN was independently reviewed by the Centre for

Health Economics Research and Evaluation (CHERE).

Extended Medicare Safety Net,

Review Report 2009 (2009 review)

1.12

The 2009 review analysed the operation of the EMSN, the extent to

which the EMSN had achieved its stated purpose, and any changes to Medicare

billing and peoples' access to services which were directly attributable to the

introduction of the EMSN.[12]

1.13

CHERE reported that despite its objective—to provide financial relief to

families and singles who incur high out‑of‑pocket costs for out‑of‑hospital

medical services, thereby making healthcare more affordable—the EMSN appeared not

to have achieved its objective:

The EMSN appears to have made services more affordable for

some (people using assisted reproductive services, some patients with complex

health conditions such as cancer), but has had little impact for those in more

remote areas or in lower socioeconomic groups. Despite the lower threshold for

low and middle income households, the EMSN appears to be a relatively

ineffective way to direct higher benefits to those households.

A concern is that most EMSN benefits have flowed to services

that are more often used by wealthier sections of the community. The

implication of this is that the EMSN has increased the affordability of

high-cost services for these groups, but has had relatively little impact on

the affordability of medical services for other sections of the Australian

population. In this sense, the EMSN is a poorly targeted policy because it has

not addressed one of the main barriers to access that many patients on low

incomes face.[13]

1.14

CHERE concluded also that the introduction of the EMSN had fundamentally

affected the fees charged for out‑of-hospital Medicare services:

The EMSN...provides benefits that increase with provider fees,

regardless of how high those fees may be. This feature has resulted in

significant increases in provider fees for some services and has meant that

patients do not receive the full benefit of the EMSN.

The impact of the EMSN on fees is most pronounced for

Medicare items that are usually associated with high out-of-pocket costs per

service. We believe that providers know, if they bill these items, their

patients are likely to qualify for EMSN benefits. Under these circumstances,

providers feel fewer competitive constraints on their fees.[14]

1.15

In response to these findings, the Government introduced caps on the

amount of EMSN benefits paid for about 570 MBS items—such as obstetric

services, pregnancy related ultrasounds, assisted reproductive technology (ART)

services, cataract surgery, hair transplantation, a varicose veins procedure

and midwifery services.[15]

Extended Medicare Safety Net,

Review of Capping Arrangements Report 2011 (2011 review)

1.16

The 2011 review evaluated:

-

the operation of capping EMSN benefits;

-

the extent to which EMSN caps had made the program more

sustainable into the future; and

-

changes to fees charged, services provided and patient out‑of‑pocket

costs for the capped items since the introduction of EMSN caps.[16]

1.17

Although it was too early to gauge the full effect of EMSN caps, CHERE reported

that the capping arrangements had clearly reduced program expenditure. CHERE

warned however that there remained the possibility of increased program expenditure:

For capped items, the introduction of EMSN caps has removed

the government's financial exposure to provider fee rises. However, the

government remains exposed to EMSN expenditure growth due to the volume of

services used, the number of people/families who qualify for EMSN benefits, as

well as fee increases for uncapped items.[17]

1.18

The EM refers to the Health Insurance Amendment (Extended Medicare

Safety Net) Act 2014, which increased the EMSN annual

threshold for non‑concessional families and singles from $1,248.70 to $2,000,

from 1 January 2015. The EM stated that, while this change would slow expenditure growth, it would

not resolve fundamental structural problems within the program. For example, some

families and singles reach the annual threshold early in the calendar year, due

to the unlimited amount of out‑of‑pocket costs that can accumulate

to the threshold.[18]

2014–15 Budget

1.19

In the 2014–15 Budget, the Government announced that, from 1 January

2016, the OMSN, the EMSN and the Greatest Permissible Gap would be replaced by

a new Medicare Safety Net.[19]

Source: Australian

Government, Budget Overview, 2014, p. 13.

1.20

The Government estimated that the proposed measure would achieve $266.7

million in savings over five years, by simplifying Medicare safety net

arrangements.[20]

This estimate was reiterated in the EM and in evidence to the committee.[21]

Key features of the Bill

1.21

The Bill would introduce the new Medicare Safety Net from 1 January

2016. The new Medicare Safety Net would be similar to the EMSN in that it would

continue to provide an additional rebate to families and singles whose out‑of‑pocket

costs for out‑of‑hospital Medicare services reach an annual

threshold.[22]

The proposed safety net would have the following features:

-

the rebate would cover up to 80 per cent of out‑of‑pocket

costs, subject to a new cap (150 per cent of the MBS fee less the general

Medicare rebate); and

-

there would also be a limit on the total amount of out‑of‑pocket

costs for an out‑of‑hospital Medicare service that can be included

in the calculation of the annual threshold.[23]

1.22

In addition:

Families will still be able to pool their out‑of‑pocket

costs and there will be a lower threshold for concession card holders and an

intermediate threshold for families eligible for [Family Tax Benefit Part A (FTB(A))]

and singles that are 'confirmed singles' or are 'FTB(A) persons'. A number of

rules are being changed to improve administration of the programme for

families.[24]

Key provisions and features

1.23

The key provisions of the Bill are contained in Part 1 of Schedule 1.[25]

Some of these provisions and their corresponding features are:

-

item 6 removes the Greatest Permissible Gap;

-

item 7 removes the OMSN and EMSN and replaces them with the new

Medicare Safety Net (proposed Division 3 of Part II–Medicare Benefits);

-

proposed Subdivision D of Division 3 provides for the safety net threshold,

including specifying the threshold that would apply to concessional people

($400), an FTB(A) person, a person confirmed as a member of an FTB(A) family or

a confirmed single ($700), and an unconfirmed single or a person confirmed as a

member of a family ($1,000) (proposed section 10DC);

-

proposed Subdivision P of Division 3 provides for the expenses for

a service that can accumulate toward the threshold—that is, the expenses are

either out‑of‑pocket costs or, if these exceed the 'maximum amount

to be included in safety net expenses for the service', then no more than that

cap. A formula is provided for calculation of the cap which includes a 150

per cent cap (proposed section 10P);

-

proposed Subdivision R of Division 3 sets out the methodology for

calculating the benefit amount, so that the rebate is either the 'adjusted

expenses' for a particular service or the 'maximum safety net amount',

the formula for which includes a cap of 150 per cent (proposed section

10R); and

-

proposed Subdivision S deals with indexation matters—that is, the

annual threshold would be indexed on 1 January each year in accordance with the

Consumer Price Index (proposed section 10S).[26]

1.24

A table in the EM sets out the key changes to these program parameters,

together with examples of how the accumulation of out‑of‑pocket

costs and the amount of the rebate would be calculated under the new Medicare

Safety Net.[27]

Examples of the new Medicare Safety Net calculations are provided also in the

Department of Health's submission to the inquiry.[28]

Consideration by committees

1.25

The Senate Standing Committee for the Scrutiny of Bills considered but

had no comment on the Bill.[29]

1.26

The Parliamentary Joint Committee on Human Rights (PJC–HR) has also

considered the Bill. In its Thirtieth Report of the 44th

Parliament, the PJC–HR considered that the changes to Medicare may limit

the right to social security and the right to health (Articles 9 and 12,

respectively, of the International Covenant on Economic Social and Cultural

Rights (ICESCR)).[30]

1.27

The committee accepted that the Bill seeks to achieve a legitimate

objective for the purposes of international human rights law—that is, better

targeting of the safety net arrangements and ensuring that these arrangements

are financially sustainable.[31]

However, on the question of proportionality, the committee referred to the

explanation of the measure's impact, as contained in the EM's Statement of

Compatibility with Human Rights (Statement of Compatibility):

The Commonwealth will continue to provide an additional

rebate for out‑of‑hospital medicare services once the threshold has

been reached...

While the average benefit paid under the new medicare safety

net will reduce, the number of people that will receive a safety net

benefit will increase compared to the number of people who will receive a

benefit under the EMSN in 2015. It is anticipated that benefits under the new

medicare safety net will be more equitably distributed between

socio-economically advantaged and disadvantaged areas. Currently, the EMSN disproportionally

directs benefits to people living in more advantaged areas and encourages fee

inflation. This fee inflation disadvantages people who do not qualify for

safety net benefits.

The new

medicare safety net threshold for people who qualify for a Commonwealth

concession card is lower than under the EMSN. Therefore this Bill protects the

benefits of individuals that are financially disadvantaged.[32]

1.28

The committee reported that the position of financially disadvantaged

people does not appear to have been considered in the Bill. The committee also

reported that the Statement of Compatibility contains no information regarding

how many financially disadvantaged people will be worse off as a result of the

changes and what safeguards exist to ensure that such people are not barred

from accessing appropriate out‑of‑hospital medical services due to

a reduction in benefits.[33]

1.29

In summation, the committee questioned whether the measure proposed in

the Bill is a justifiable limitation on the rights contained in Articles 9 and

12 of the ICESCR. The Minister has been requested to advise whether the

limitation is a reasonable and proportionate measure for the achievement of the

objective, with particular reference to the position of financially

vulnerable people.[34]

At the time of writing, the PJC–HR has not published a response from the

Minister.

Conduct of the inquiry and acknowledgement

1.30

Details of the inquiry, including links to the Bill and associated

documents, were placed on the committee's website.[35]

The committee also wrote to 11 individuals and organisations, inviting

submissions by 19 November 2015. The committee received 29 submissions, which

are listed at Appendix 1. All submissions were published on the committee's

website.

1.31

The committee held a public hearing in Canberra on 16 November 2015. A list

of witnesses who appeared at the hearing is at Appendix 2, and the Hansard

transcript is available through the committee's website. References in this

report to the Hansard are to the proof Hansard, and page numbers

may vary between the proof and the official Hansard transcript.

1.32

The committee thanks those individuals and organisations who made submissions

and who gave evidence at the public hearing.

Navigation: Previous Page | Contents | Next Page