Chapter 5

The current indexation formula

Introduction

5.1

This chapter considers the factors impacting on financial viability of

the aged care sector including increasing costs such as wages, construction

costs, changing consumer expectations and the adequacy of the current

indexation formula and specifically Commonwealth Own Purpose Outlays and the

Conditional Adjustment Payment (CAP) to address those costs.

Indexation formula

5.2

In aged care, the basic subsidy rates are adjusted annually in line with

movements in the Commonwealth Own Purpose Outlays (COPO). COPO indexation

arrangements came into effect in relation to residential aged care funding from

1 July 1996. COPO is weighted 75 per cent for wage costs and 25 per cent for

other costs and is calculated using the following algorithm:

COPO% = (annual CPI %

x 0.25) + (annual *SNA % x 0.75)

*SNA Safety Net Adjustment: SNA% = Safety Net Increase per

week/average weekly.[1]

5.3

As part of the Commonwealth's initial response to the Hogan Review, from

the 2004‑05 financial year, a Conditional Adjustment Payment (CAP) for

residential aged care was provided. CAP aims to provide 'medium term financial

assistance to residential care providers to assist them to become more

efficient, and more able to continue to provide high quality care to residents,

by improving corporate governance and financial management practices'.[2]

5.4

The amount of CAP payable in respect of resident is calculated as a

percentage of the basic subsidy amount payable in respect of a resident. In

2004–05, CAP was 1.75 per cent and then rose annually by 1.75 per cent

increments. CAP was initially introduced for four years and subsequently extended

for a further four years with no further annual increases so that the CAP is currently

set at 8.75 per cent. According to the Australian Government, this increase

will result in $2 billion in total CAP payments to the residential aged sector

over the next four years to 2011–12.[3]

5.5

In the 2008–09 Budget, it was announced that a review of the CAP arrangements would be undertaken to examine the CAP's effectiveness in encouraging efficiency

through improved management practices and the future need for, and level of,

this type of assistance. According to Australian Government, the findings of

the review will be submitted for consideration in the preparation for the

2009–10 Budget.

Adequacy of the current indexation formula

5.6

Concerns were raised by a number of witnesses regarding the current

indexation formula as its adequacy in compensating providers for the provision

of services impacts directly on their financial viability and their ability to

provide high quality services. The Aged Care Alliance submitted to the

committee, providers are constrained by static revenue flows based on subsidies

and periodic adjustments by mechanisms such as COPO. Providers have limited

influence over cost increases and no capacity to adjust the price of their

services.[4]

5.7

Mr Martin Laverty of Catholic Health Australia commented:

We would observe that there is not a mechanism by which the

market is able to inform the setting of prices, the provision of service and

the types of services that are provided, and nor is there an adequate mechanism

to determine what is an adequate Commonwealth subsidy to provide services for

those that do not have the capacity to meet the cost of the care themselves.[5]

5.8

The significance of indexation for providers was highlighted by Mr

Gerard Mansour of Aged and Community Care Victoria:

There is a whole range of cost drivers that impact on the

industry. So it is not surprising, given that we do not control pricing, that

the industry relies very heavily on indexation. It is like a slow death. If

indexation is gradually declining over time at any one point of change, then

the impact is marginal but the compounding impact of not meeting rising costs

is most significant. As I characterised it earlier, I hear very regularly about

how stretched and pushed the industry is and I have described it in a number of

places as being like the taut rubber band.[6]

5.9

It was argued by many providers that the current formula does not

adequately recognise the costs of the delivery of aged care services.[7]

Aged and Community Services Australia (ACSA) stated, for example, that the

indexation formula had resulted in a 'steadily widening gap between the costs

of providing a service and the subsidies provided by the Australian Government'.[8]

5.10

A major concern with the current indexation formula was that it does not

adequately take into account the cost drivers for aged care providers, in

particular wage increases. Some submitters commented that wages account for 70

to 80 per cent of their total costs. It was noted that annual wage increases

are generally between three and four per cent per annum. Aged and

Community Services SA & NT stated that the current indexation arrangement

was 'inadequate' because it 'does not actually reflect the health and aged care

labour market conditions'.[9]

The Australian Physiotherapy Association noted that indexation had not

maintained parity with salary increases in the health sector where competitive

salaries are necessary to ensure that sufficient numbers of appropriately

trained and qualified staff are employed in aged care to maintain quality of

service.[10]

5.11

Other costs such as groceries have increased about five per cent while

utilities have increased about 10 per cent per annum.[11]

Tasmanian providers, for example, indicated that they expected their

electricity costs to increase significantly (25 to 30 per cent) from July

2009 as they move into the retail contestible electricity market. Aged &

Community Services Tasmania noted that 'considering energy costs are in the top

five expenditure items for residential care facilities this has significant

implications for our sector in Tasmania'.[12]

5.12

Witnesses argued that present formula was impacting adversely on

provider viability and service provision. According to ACSA the indexation

system and system of user charging for the costs of accommodation in

particularly high care, has led to increasing numbers of residential aged care

services operating at a loss with all suffering declining returns.[13]

Capecare, for example, provided details of the impact of the current indexation

system's failure to recognise the actual costs of aged care:

The operating result has gone from a surplus of $7.03 per bed

per day in 2005/06 to a budgeted deficit of $11.37 in 2008/09. Wages and

related costs (leave provision, training, workers compensation, and

superannuation) make up 75% of all operating costs. Wages and related costs

have increased by 23% during these 4 years. Operating income had increased by

10% during the same period.[14]

5.13

Villa Maria, a non-for-profit operator of residential and

community-based care, commented:

Continued pressure for wage related increases are

outstripping fee increases, creating a growing area of concern about long-term

financial viability. Essentially, the indexation applied to subsidies is not

maintaining relativity to wages increases.[15]

5.14

The Brotherhood of St Laurence (BSL) also submitted that the inadequacy

of the current indexation is demonstrated by the BSL's current Enterprise

Bargaining Agreement which allowed for an annual salary increase of 4 per cent

for staff and the current annual increase of most supplies in excess of 4 per

cent. The CPI increase for the year to September 2008 was 5 per cent and the

annual COPO increase was around 2.3 per cent. This left a gap of around 1.7 per

cent which for the BSL meant a funding shortfall, in terms of indexation only,

of nearly $98,500 for the 2008‑09 financial year. The BSL stated that

these figures take into account the CAP.[16]

5.15

Submitters argued that the impact of the shortfall in subsidies has led

to service providers seeking savings in operation costs. Anglicare noted that

the rationing of services impacts particularly on older people with limited

means and limited alternative supports.[17]

5.16

Submitters also argued that the current indexation formula for community

based services has not kept pace with costs, particularly travel costs for

home-based services. For example, Bromilow Home Support Services stated that

there has been a reduction in services hours provided to clients and commented

that 'it is impossible for service providers to maintain consistency in the

service levels provided to clients from one year to the next when subsidy

levels continue to fall in real terms'.[18]

Care Connect commented that the annual packaged care subsidy increase, as

determined by the COPO index has fallen behind the annual rate of increase in

unit costs of providing care and operating services. As a result, the amount of

care that can be purchased per package has been severely eroded over the last

ten years.[19]

5.17

NCOSS similarly commented that the existing indexation method is

inappropriate for community care, as it does not reflect the real staffing and

other costs of running services. NCOSS also noted that the indexation for

Community Aged Care Packages and HACC are calculated in a slightly different

way for each program resulting in different levels of compensation for similar

cost increases.[20]

Aged Care Queensland also noted that services such as Day Therapy Centres have

lower levels of COPO indexation applied, with that result that Day Therapy

Centres received 2 per cent indexation and other community care programs

received 2.2 per cent.[21]

5.18

Evidence was also provided to the committee concerning the long-term

impact of the current indexation formula on the sector. According to the House

Group of Companies, the real value of COPO has eroded 23.5 per cent over the

past eight years, which means according to the group, 'a continued

deterioration of our sector's viability in the long run'.[22]

5.19

Mr Peter Wright of Anglicare Aged Care South Australia commented:

I would like to reiterate that we have experienced our costs

rising faster than CAP and COPO combined. In effect, we are going backwards,

because our costs are exceeding the reimbursement or the indexation method that

is employed. You probably have the paper by the Aged Care Industry Council,

which gave a very good summary of the shortcomings of the COPO and the CAP. It

is very poignant to point out, without going through the detail of that paper,

that COPO/CAP increases are actually less than the safety net adjustments and

also the average weekly overtime earnings adjustments. We are well behind some

key benchmarks.[23]

5.20

The Aged and Community Services Association of NSW and ACT held that

whilst the CAP was not introduced for community aged care, COPO does not

adequately recognise increases in wages with the result that purchasing

capacity of a Community Aged Care Package (CACP) has diminished considerably

since 1994:

Between 1995/96 and 2005/06 the value of the package had

increased by 27%, yet the overall increase in the ordinary time earnings of

full time working adults has been 64%, more than double the increase in CACP

subsidy.[24]

5.21

Alzheimer's Australia cites the Aged Care Industry Council submission to

the CAP Review to demonstrate that the indexation of CACPs, EACH and HACC has

been at a level below the increase in labour costs:

...from 1996–7 to 2003–04, the Commonwealth's "COPO"

indexation formula meant that the CACP subsidy increased by 21.6%. During that

same period, ordinarily time earnings for full time adults increased by 47.3%.

Indexation of community care subsidies needs to be based on

the labour component. The Conditional Adjustment Payment should be paid

immediately to community care services. Continuation of CPI indexation simply

means fewer services being provided as increase in wage costs eat into service

provision hours.[25]

5.22

According to NCOSS, the growth of the HACC program has been compromised

by inadequate indexation. Citing the Aged and Community Services Association of

NSW and ACT, NCOSS maintained that the indexation method does not reflect the

true costs:

...estimating that, between 1999–2000 and 2001–02, the HACC

Program in NSW had been underfunded by between $17.6m and $28.5m. Indexation

for the same period to HACC services in NSW was estimated at 6.36% according to

the COPO method; other indices suggest a figure closer to 14% for increases in

costs for this period.[26]

5.23

The Department of Health and Ageing (the department) responded to these

comments and noted that the Government has provided substantial increases in

funding for residential aged care. The expenditure in 2008–09 is estimated to

be $6.7 billion which represents an increase of some 10.8 per cent over

the expenditure of $6.0 billion in 2007–08. In 2008–09, Government funding for

each day a resident spends in residential care will be about 8 per cent more

than it was in 2007–08 for a resident of the same level of frailty. This growth

reflects the increases in funding accompanying the implementation of the new

Aged Care Funding Instrument (ACFI) and funding changes to accommodation

charges and supplements introduced on 20 March 2008.

5.24

The Government made changes to enable increases in accommodation

payments – both government subsidies and user contributions – particularly in

high care. Overall these changes will deliver increased revenue to the

residential care sector of more than $750 million over four years, including

more than $480 million in increased government subsidies. In 2008–09, the

changes will result in an increase from the Commonwealth of more than $267

million in residential care funding. Once fully phased in the changes will

deliver more than $350 million per year in increased revenue, mostly in respect

of high care residents, to support investment in high care facilities.

5.25

The growth in Government funding to the residential aged care sector

reflects indexation and the Conditional Adjustment Payment, population growth,

increases in frailty and changes in policy. Net funding growth has been 8 per

cent per resident. The contribution of various factors to this total growth for

2008–09 is as follows:

-

indexation contributed 28 per cent;

-

CAP contributed 18 per cent;

-

frailty growth contributed 17 per cent; and

-

new policy contributed 37 per cent.[27]

5.26

The department also noted that developed cost and revenue indices for

both high- and low-care providers to look at the comparison of cost to revenue

for both low- and high-care homes. Mr Stuart commented that the revenue has

been increasing faster than cost since 1998–99. The department provided the

following comparison of the growth of revenue indices with the growth in cost

indices. The data is presented on an index basis with revenue and cost for

1998–00 set to 100.

Graph 5.1: Unit cost and revenue growth (constant frailty) –

low care

Graph 5.2: Unit cost and revenue growth (constant frailty) –

high care

Source: Department of Health and Ageing, Supplementary

Submission 114a, p.26-27.

5.27

Mr Andrew Stuart from the Department of Health and Ageing commented on

the difference in the department analysis and that of the sector:

I think I should explain that the main difference between

what the department has been doing in this area and what the industry has been

doing is that the industry has been comparing revenue to prices, in particular

labour prices, on a per-unit basis, and the department has taken account of

productivity improvement in looking at the relationship between revenue and

cost.[28]

5.28

Dr David Cullen, from the department also made these comments:

What we do know and what we have

given in evidence here is that, for the last 10 years—and we have only gone

back 10 years in our data—revenue has grown faster than cost. So, if that is

the case, if revenue has grown faster than cost and if, as we have given you

evidence, the average payment per resident this year is eight per cent greater

than the average payment per resident of the same level of frailty last year,

that would seem to indicate that the problem is not on the revenue side.[29]

And further:

The fundamental difference between the department’s analysis

and the industry’s analysis is that the industry looks at what would be called

the unit costs of inputs and says, ‘How much does a unit of import go up?’ We

look at the unit cost of outputs. We say, ‘How much does it cost to produce a

day of care?’ When you are producing a day of care, or in any industry, each

year you make productivity improvements. It becomes cheaper to produce care one

year on the next because of productivity improvements. We take that into

account; they do not.[30]

Use of COPO and CAP

5.29

According to witnesses the reason for the inadequacy of indexation in

the aged care sector is the use of COPO and its failure to recognise actual

costs in the industry. These problems have been longstanding and the

compounding impact over the last decade has resulted in increasing negative

impacts on the sector. Mr Greg Mundy of Aged and Community Services Australia

stated:

In terms of...the indexation formula, that is one of two main

contributors to that scenario. It has been not a sudden development but a

steady development over a long period of time that the value of the

Commonwealth's subsidies for care has not kept pace with the cost of providing

that care. The main reason for that is that the way the government measures

wage cost increases is based on what we used to call the safety net adjustment,

now the Fair Pay Commission adjustment. Health staff are in relatively short

supply, especially but not only nurses, and they have done better than that

adjustment over a long period of time. So there has been a steadily widening

gap between what it costs us to provide services and what the subsidies will

cover.[31]

5.30

Many submitters voiced the same concern as Mr Mundy about the

recognition of wage increases. Submitters noted that over the past 10 years the

subsidy increase have averaged approximately two per cent per annum which is

far below annual increase in wages and other cost inputs.[32]

In addition, it was noted that the Commonwealth uses the Safety Net Adjustment

rather than actual aged care sector wage increases which have occurred as a

result of enterprise bargaining, to determine COPO.[33]

The result of this, according to Care Connect, in a method of indexation 'insufficient

to maintain pace with real increases in the costs of running businesses and

providing care'.[34]

5.31

The concerns about the recognition of wage movements are longstanding.

In its 2008 report, the Productivity Commission made the following comments on

COPO:

A longstanding concern of the aged care industry has been

that the indexation of basic subsidy rates is not based on movements in

industry-specific costs. Rather, subsidies are indexed using the Commonwealth

Own Purpose Outlays (COPO) index, which is weighted 75 per cent for wage costs

and 25 per cent for non-wage costs. The COPO is premised on the view that

virtually all wage increases are productivity based. Hence, it only makes

provision for safety net increases in wages and for economy-wide movements in

non-wage costs. Thus, if productivity gains within the aged care sector do not

keep pace with other sectors, the subsidy, as indexed, will be increasingly

inadequate.[35]

Comparison of aged care indexation

with other indices

5.32

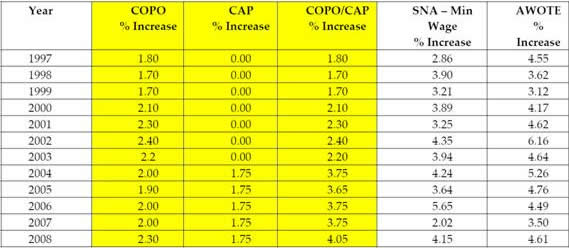

Submitters provided the committee with comparisons of the current

indexation compared with other indices. Aged and Community Care Australia

provided the following comparison of combined COPO/CAP subsidy to SNA – Minimum

Wage and AWOTE.

Table 5.1: Comparison of COPO, CAP, SNA and AWOTE

Source: Aged and Community

Care Australia, Submission 92, p. 16.

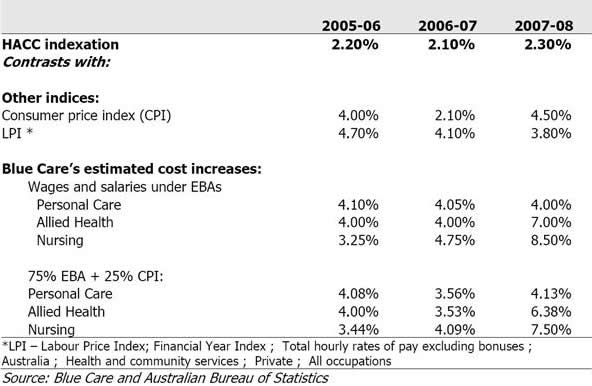

5.33

Blue Care provided the following analysis of HACC indexation.[36]

Table 5.2: Comparison of HACC indexation with other cost

indices and Blue Care's input cost increases

5.34

Witnesses also noted that the Department of Veterans' Affairs is

understood to have abandoned the COPO index for its Veterans' Home Care program.[37]

The BSL commented:

It is clear that the current COPO indexation is inappropriate

for the Aged Care industry. The Veterans' Home Care program does not use the

COPO index and private health insurance premiums have had much higher increases

authorised by successive Ministers for Health, which have actually fuelled wage

growth.[38]

The Conditional Adjustment Payment

5.35

The committee was provided with evidence on the importance of CAP to the

aged care sector. It was noted by Catholic Health Australia that CAP was a

significant factor in maintaining subsidy levels close to the CPI:

Most notably, increases in both High care subsidy rates

(average 3.5% per annum) and Low care rates (average of 3.7% per annum) only

kept pace with CPI growth and, indeed, slightly exceeded it when topped up by

the CAP payment set at 1.75%.[39]

5.36

Witnesses noted that the CAP was intended as a temporary measure but for

many providers CAP was required to maintain their viability. The Aged Care

Alliance noted that 'the effects of external costs, the inadequacy of COPO and

workforce issues have created high dependence on its [CAP's] continuation'.[40]

UnitingCare Australia, which provides residential aged care to approximately

6,900 elderly people representing approximately four per cent of funded

residential aged care beds, noted that without the temporary CAP:

...losses may have already resulted in UnitingCare withdrawing

from the provision of residential aged care services. In the absence of

substantive positive funding reform this will occur.[41]

5.37

Indeed, UnitingCare Australia maintained that had the CAP not existed, its agencies would have lost $36.5 million from the time of the introduction of

the CAP to the end of the 2008–09 financial year. Consequences of removing the CAP for UnitingCare Australia agencies may include:

-

withdrawal from the provision of

residential aged care (closure of existing facilities);

-

deferral/abandonment of new

investment (already happening);

-

refurbishment of run-down

facilities rather than replacement (already happening);

-

relinquishment of provisional

allocations of residential care places and not proceeding with new capital

investment (already happening).[42]

5.38

Concerns were raised in a number of submissions that the CAP is now effectively frozen for the next four years with no annual 1.75 per cent increase.

According to Management Consultant and Technology Services and Baptcare,

without the annual increase adjustment, the aged care industry cannot further

stretch COPO funding increases, which are already less than costs, and have

been eroded 23.5 per cent over the past eight years.[43]

They maintain that this freeze will result in a drop of funding of $750 per

resident per annum. The Aged Care Association Australia – SA commented that 'at

best, CAP has prevented further erosion in the real value of subsidies, but has

gone no way to offsetting the significant erosion which accumulated during the

years before the introduction of CAP'.[44]

5.39

Aged Care Association Australia WA and Aged and Community Services WA

also noted that the reporting requirements for the CAP were considerable whilst

the industry had not been provided with any certainty that the payments will

continue in coming years.[45]

5.40

Alzheimer's Australia maintained that the 'biggest anomaly' of the

indexation system was in relation to community aged care:

Community care has a very high proportion of its costs as

labour costs, but the indexation of CACPS, EACH and HACC ahs been at a level

well become the increase in labour costs. The additional funding that flowed to

residential care as a result of the Conditional Adjustment payment (CAP) did not flow to community care, despite its higher labour costs.[46]

5.41

COTA Over 50s also noted that the CAP has not been applied to the

community care program despite the cost pressures which it maintains are

similar to that in residential care.[47]

The Aged and Community Services Association of NSW and ACT held a similar view,

stating that the CAP should be extended to community care programs from 2009.[48]

Calls for an improved indexation

formula

5.42

Witnesses argued that there was a need for a new indexation formula

which adequately addresses the sector's needs. The BSL for example, commented

that:

A new long term indexation formula needs to be introduced

which accurately captures all the cost drivers such as wage increase, consumer

items, building costs and energy and water prices.[49]

5.43

Mr Stephen Teulan, UnitingCare Australia, commented:

Unless indexation of subsidies improves in terms of the way

that it is calculated or in the meantime if the conditional adjustment payment

does not continue there is going to be a huge hole in the budgets of every

residential aged care provider in Australia.[50]

5.44

The committee received a number of suggestions as to how the indexation

formula could be improved. CHA recommended the introduction of a new benchmark

weighted at 75 per cent for wage growth and 25 per cent for non-wage growth,

using the Labour Price Index (Health and Community Services) for the wage

element and the CPI for general prices.[51]

5.45

Blue Care submitted that future indexation formulae should:

5.46

An industry specific indices, or an 'Aged Care index', was also

supported by other submitters.[53]

According to Baptcare, a long term 'aged care index' which properly recognises

all cost drivers, wage growth, consumer items, building costs and increased

energy and water prices is required.[54]

Similarly, the Aged and Community Services Association of NSW and ACT held that

a specific residential aged and community care index should be developed and

applied annually in order that movements in the average cost of care are

covered each year. According to the association:

This could be administered by an independent body, analogous

to the Fair Pay Commission, to ensure transparency and to avoid conflicts of

interest.[55]

5.47

Submitters also supported the extension of CAP to community care

services.[56]

Conclusion

5.48

Witnesses raised grave concerns about the adequacy of the indexation

formula used by the Commonwealth for both residential and community aged care, particularly

in relation to addressing wage increases. The committee considers, on the

balance of the evidence before it, that the current indexation formula may no

longer be appropriate for the aged care sector. The committee therefore

considers that the formula needs to be reviewed and modified if required. The

suggested review of the benchmark of care costs, as detailed in Chapter 3,

should inform this review.

Recommendation 14

5.49

The committee recommends that the taskforce undertake a review of the

indexation formula used for the aged care sector in order to identify its

adequacy in relation to costs faced by the sector and to identify modifications

to the formula if required.

5.50

The committee further recommends that consideration be given to an

independent mechanism to continually assess the indexation formula.

5.51

The committee also acknowledges that a review of CAP is presently being

undertaken. The committee strongly urges the Commonwealth to consider the

continuation of CAP whilst the recommended all-encompassing review is being

undertaken.

Navigation: Previous Page | Contents | Next Page