Additional Comments from Labor Senators

1.1

Labor Senators support Schedules 2, 3 and 4 of the bill, which relate to

the work bonus, the pension loans scheme and other technical amendments.

1.2

Labor Senators do have concerns about the consideration of Schedule 1,

relating to new means test rules for lifetime income streams. Given the recent

publication of both the Productivity Commission report Superannuation:

Assessing Efficiency and Competitiveness and the publication of the Royal

Commission final report into Misconduct in the Banking, Superannuation and

Financial Services Industry, it is important that disclosure frameworks,

trustee obligations, financial advice frameworks and behavioural impacts are

well understood and improved alongside any changes to means testing.

1.3

The concerns in question are outlined below.

Inquiry Process

1.4

The submission by AustralianSuper makes it clear that the Government has

not completed complementary work regarding the framework for Comprehensive

Income Products for Retirement (CIPRs):

In summary, Schedule 1 to this Bill is but one of a series of

measures supporting the Government's developing retirement income framework.

This framework envisages the development of Comprehensive

Income Products for Retirement (CIPRs). The CIPRs framework is still being

developed with the following outstanding items yet to be actioned by the

executive government to complete this framework for implementation by industry:

- The passing of legislation for retirement income covenant

designed to protect member interests in the development of retirement products.

-

The disclosure regime for such products which is presently under

consultation.

- The creation of a framework that enables trustees to offer a CIPR

product, which is inherently complex, without personal advice, and include

measures to protect consumers at the same time.[1]

1.5

In a similar way, the Australian Institute of Superannuation Trustees

indicated that insufficient context and preparatory work has been completed for

the passage of Schedule 1:

Taken out of context, the measure proposed in schedule 1 of

the Bill appears to go a considerable way to satisfying one of the aims of the

Government, being the goal to remove regulatory barriers to the use of

innovative (in this case, lifetime) income streams. However, viewing this in

context is problematic, since we do not have a context to view this in.

...

In any event, as Treasury indicated in their Retirement

Income Disclosure Consultation Paper, there are remaining parts to the proposed

Retirement Income Framework that remain before "consumers are supported to

make informed decisions about the income, risk and flexibility associated with

different retirement income products", including retirement income

projections and changes to the regulatory framework.

...

We are also concerned that, in the absence of basic consumer

protections which, at the very least, must include sufficient consumer

disclosure to enable fund members to have informed consent when selecting these

products, social security incentives commencing on 1 July 2019 are badly timed

and inappropriate.

Whilst we are aware that the industry requires certainty in

relation to the new rules, we believe that these are being implemented in the

wrong order, and the unintended consequences of incentivising Australians to

potentially choose the wrong retirement income product at this early stage are

too great.[2]

1.6

Industry Super Australia also outlined concerns about other unresolved

"moving parts" relevant to implementing the Government's CIPRs-based

framework:

- The introduction of a retirement income covenant to the

Superannuation Industry (Supervision) Act 1993 that will include a requirement

that trustees develop and offer CIPRs to their members.

- The design and implementation of a disclosure framework

that will provide consumers who wish to purchase a retirement income product

with a factsheet for each product containing simplified metrics that will

enable meaningful comparisons to be made prior to purchase.

- Proposed new means testing rules

...

In short, the proposed rules [means testing rules] are

intended to promote the sale of complex retirement income products before

implementing measures that would help to protect consumers from buying products

that may not be in their best interests.

In particular, many of the products that will be sold from

July 2019 are likely to comprise annuities that purchasers may not be able to

exit from should they later conclude (perhaps when a disclosure regime is in

place) that a different product is better.[3]

1.7

Labor Senators agree that the Government has failed to provide the

supporting architecture necessary to properly support the take-up of lifetime

income products and guarantee that pensioners will be protected.

1.8

Finally, submissions make it clear that there are concerns about the

obligations these products will place on superannuation trustees:

Further, as a superannuation trustee, we have concerns about

the operation of the means testing rules and the need for a consumer to

understand that they are entering into a long-term trade-off for means testing

purposes (see Appendix A). AustralianSuper as a fiduciary is concerned as to

application of these rules to new CIPR products which are designed to be offered

by superannuation trustees to their members without personal advice.

Traditionally, these types of products have been sold to customers directly not

through the fiduciary overlay of superannuation. A higher duty is owed by

superannuation trustees as fiduciaries than applies under contract law.[4]

Productivity Commission Report

1.9

A number of submissions outlined findings from the recent Productivity

Commission final report into superannuation. Labor Senators understand that the

Government is considering its response to this report and as yet has not made

public its final position on recommendations.

1.10

A number of findings were made with regard to retirement income

products.

1.11

The most pertinent is Recommendation 10:

The Australian Government should reassess the benefits, costs

and detailed design of the Retirement Income Covenant — including the roles of

information, guidance and financial advice — and only introduce the Covenant if

design imperfections (including equity impacts) can be sufficiently remediated.

In conjunction with this reassessment, the Australian

Government should also:

-

consider cost-effective options, including possibly extending the

Financial Information Service to provide retirees with access to a one-off,

impartial information session to help them navigate complex retirement income

decisions

-

explore the business case for investing in digital technology

that assists people’s financial decision making.[5]

1.12

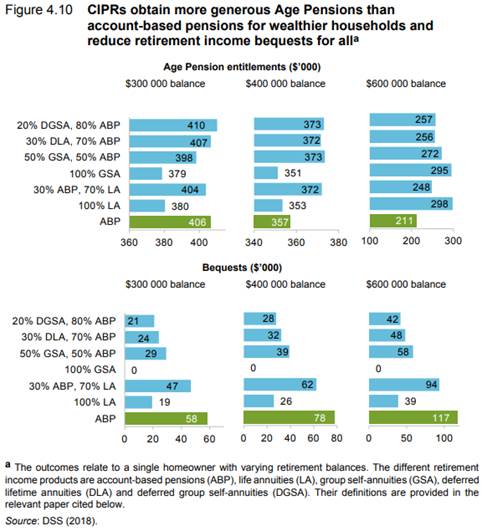

Supporting this recommendation was the finding that lower-income

households might be worse off with an annuity in terms of total benefits and

access to the Age Pension when compared to an account based pension (ABP):

The opposite pattern applies to lower-income households,

where most annuity types reduce total benefits and decrease access to the Age

Pension compared with an ABP. These contrasting outcomes appear inconsistent

with any income distributional function of the Age Pension, and imply that

choosing an annuity may not be favourable for households with lower net

superannuation assets. Given that lower educational qualifications tend to

reduce earnings and ultimately retirement balances, low-balance households will

have fewer sophisticated investors able to make an informed decision about the

desirability of CIPRs — especially given their complex variants (as shown in

figure 4.10). This would become more problematic if the proposed Retirement

Income Covenant nudges people into such products. The same equity concern would

arise for groups with systematically lower life expectancy for whom longevity

insurance is less valuable.[6]

1.13

The second supporting issue that Labor Senators wish to raise is that

there is currently limited competition in the offering of lifetime income

products. As noted by the Productivity Commission:

Putting aside the practical issues of implementing the

Covenant, government-sponsored nudging should demonstrably be for people’s

good. As discussed in the previous section, CIPRs almost certainly suit some

people, especially those who do not value bequests or will benefit from the

more favourable access to the Age Pension.

...

On the practical front, there are also several concerns.

- Requiring funds that are unable to develop pooled products

in-house to still offer a third party product may provide some degree of market

power to the few current incumbent providers.[7]

Royal Commission Report

1.14

The Royal Commission Final Report has expressed concerns about the

ability of the financial services industry to provide independent advice to the

public:

Second is poor advice – which, too often, is the result of

the conflicts of interest that continue to characterise the financial advice

industry. Other professions are not so pervaded by conflicts of interest and do

not have such a high tolerance for the continued existence of conflicts of interest.

Other professions do not have such faith in the notion that conflicts of

interest and conflicts between duty and interest can be effectively managed.

Until something is done to address these conflicts, the financial advice

industry will not be a profession.[8]

1.15

Industry Super Australia has expressed concerns that the current state

of the financial advice regime is inadequate to support retirement income

products:

In short, the current financial advice regime cannot be

relied upon to protect consumers.

Until appropriate regimes for retirement income products,

disclosure and financial advice are in place, legislating concessional means

testing rules for retirement income products amounts to ‘putting the cart

before horse.’

It risks exposing consumers to significant, and unnecessary,

financial harm.[9]

Conclusion

1.16

Labor Senators are supportive of efforts to improve the superannuation

system, particularly as people move to the retirement phase. It is important

that there be a suitable suite of retirement income products available to

people in retirement and that older Australians and pensioners are properly

protected.

1.17

Labor Senators also note that COTA Australia is supportive of the

proposed changes to the pension means testing of pooled lifetime income stream

products.[10]

1.18

Labor Senators recognise that there are potential risks associated with

Schedule 1 of the Bill, as noted above. Labor Senators believe it would be

preferable for disclosure frameworks, trustee obligations, financial advice

frameworks and behavioural impacts to be well understood and improved alongside

any changes to pension means testing.

1.19

That said, Labor Senators do not believe that these risks warrant

delaying passage of this Bill. Accordingly, Labor will carefully monitor the

implementation and impacts of Schedule 1 of the Bill and the regulation of

related financial services products to ensure they operate fairly and that

older Australians and pensioners are protected.

Senator Chris Ketter Senator

Jenny McAllister

Deputy Chair Senator

for New South Wales

Navigation: Previous Page | Contents | Next Page