The general insurance industry in Australia

Overview

2.1

Australia has a large and long-established general insurance industry.

As at

30 September 2016, there were 109 Australian Prudential Regulation Authority

(APRA) registered general insurers licensed to conduct business in Australia.

Of these, 99 were direct insurers and 10 were reinsurers.[1]

2.2

The home and motor insurance market in Australia is dominated by four

main insurers—IAG, Suncorp, QBE and Allianz—issuing cover under multiple

brands.[2]

Collectively, these larger insurers make up approximately 74 per cent of the

market.[3]

Smaller and newer market entrants include Youi, Auto & General, and

Hollard.

Figure 2.1 details the market share of the top 12 general insurers for home

insurance in Australia.

Figure 2.1—Market share of top 12 general insurers for home

insurance[4]

2.3

The number of licenced insurers has fallen in recent years, with a net

decline of 25 over the past decade.[5]

This trend toward greater market concentration was noted by APRA, the

prudential regulator of the financial services sector, in its latest annual

report:

The steady decline in recent years is largely the result of

rationalisation within some insurance groups that had held multiple licences

arising from past mergers and acquisitions. As a result, the industry has

become more concentrated, with the five largest insurers accounting for 54 per

cent of total gross written premium (GWP). A decade earlier, the five largest

insurers wrote only 42 per cent of GWP.[6]

2.4

In the 12 months to 30 September 2016, GWP[7]

for home insurance was $7882 million, with an average premium of $668, and GWP

for motor insurance was $8625 million, with an average premium of $566.[8]

2.5

Over the same period, total industry net profit[9]

after tax was $3.1 billion, up from $2.4 billion the previous year and

representing a return of 11.2 per cent on net assets.[10]

However, as noted by the Insurance Council of Australia (ICA), while net profit

increased by $0.7 billion in the year to 30 September 2016, it is down around

25 per cent from the 13 year average (September 2003–September 2016) of

$4.1 billion.[11]

Regulatory framework

2.6

Australian Government bodies are responsible for some aspects of

regulation of the general insurance industry, such as consumer protection and

licencing; however, the operation of the industry is self-regulated and

operates under a voluntary code.

Government bodies

Australian Securities and

Investments Commission

2.7

The Australian Securities and Investments Commission (ASIC) is the

government body with primary responsibility for regulation of insurers. ASIC has

oversight of consumer protection matters and licencing for the financial

services sector, and by extension, internal and external dispute resolution. ASIC's

regulatory powers pertaining to the general insurance industry are carried out

in accordance with two laws, the Corporations Act 2001 (Corporations

Act), and the Australian Securities and Investments Act 2001 (ASIC Act).

2.8

The Corporations Act[12]

provides for a licencing system for financial services providers, including

insurance companies. General insurance products are considered financial

products under the Corporations Act; and therefore, insurers are required to be

licensed by ASIC in order to provide financial services.

2.9

The Corporations Act and Insurance Contracts Act 1984 (Insurance

Contracts Act) set out the current product disclosure regime for general

insurance products (discussed in detail in chapter 3), under which insurers

must comply with a number of mandatory disclosure requirements.

2.10

The ASIC Act also contains ASIC's consumer protection powers in relation

to financial products and services, including general insurance. Under the ASIC

Act, general insurers are prohibited from partaking in misleading or deceptive

conduct, unconscionable conduct, and from providing false or misleading

representations.

2.11

Of considerable importance to this inquiry is the current exemption of

insurance contracts from the unfair contract terms (UCT) provisions under the

ASIC Act. The UCT provisions apply to all other standard form contracts[13]

in the financial services sector. The exemption of insurance from the UCT

regime is discussed further in chapter 5.

Australian Prudential Regulation

Authority

2.12

Insurers must adhere to capital adequacy laws. Mr Geoff Summerhayes,

Executive Board Member at APRA, told the committee that APRA is 'primarily concerned

with the institutions' viability and ability to meet the promises they make to

beneficiaries'.[14]

APRA supervises general insurers under the Insurance Act 1973 (Insurance

Act).

2.13

APRA's responsibilities under the Insurance Act include:

-

authorising companies to carry on a general insurance business;

and

-

monitoring authorised general insurers to ensure their continuing

compliance with the Insurance Act, in particular, its minimum solvency

requirements.[15]

Australian Competition and Consumer

Commission

2.14

In accordance with the Competition and Consumer Act 2010, the

Australian Competition and Consumer Commission (ACCC) is responsible for the

investigation and enforcement of prohibitions on certain anticompetitive

conduct. However, the ACCC's role in relation to insurance is limited and, as

noted above, ASIC has primary responsibility for regulation of insurers.

Insurance Contracts Act 1984

2.15

Insurers must comply with general contract law and the Insurance

Contracts Act, which regulates the content and operation of insurance

contracts.

2.16

Section 13 of the Insurance Contracts Act places a statutory obligation

on both an insurer and the insured[16]

to comply with a 'duty of upmost good faith'. Specifically:

A contract of insurance is a contract based on the utmost

good faith and there is implied in such a contract a provision requiring each

party to it to act towards the other party, in respect of any matter arising

under or in relation to it, with the utmost good faith.[17]

2.17

In other words, the duty requires both parties to act honestly with each

other throughout the duration of the policy and voluntarily disclose any

information which would be considered material to contract negotiations.

2.18

The purpose of the Insurance Contracts Act is to:

...improve the flow of information from the insurer to the

insured so that the insured can make an informed choice as to the contract of

insurance he enters into and is fully aware of the terms and limitations of the

policy; and to provide a uniform and fair set of rules to govern the

relationship between the insurer and insured.[18]

2.19

Of particular relevance to the inquiry, Part 5 of the Insurance

Contracts Act provides for a number of prescribed classes of insurance

contracts. The operation of prescribed contracts is clarified in the Insurance

Contracts Regulations 1985. These regulations set out the minimum requirements

for a policy to provide 'standard cover'. However, under Section 35(2) of the

Insurance Contracts Act, insurers can provide policies that deviate from

standard cover if the insurer 'clearly informs' the insured of this fact.

2.20

In 2012, the Parliament passed legislation amending the Insurance

Contracts Act to enable regulations to be made requiring insurers to provide a one-page

Key Facts Sheet (KFS) for home building and contents insurance policies. The

Insurance Contracts Regulation 2012 (No. 2) prescribes the content, format and

information that must be included in a KFS. The effectiveness of the KFS with

regard to improving consumer outcomes is discussed in detail in chapter 3.

Insurance Council of Australia

2.21

Established in 1975, Insurance Council of Australia (ICA) represents the

interests of the Australian general insurance industry and is the peak representative

body for general insurance companies licenced under the Insurance Act.

General Insurance Code of Practice

2.22

The General Insurance Code of Practice (the Code) is a voluntary

self-regulatory industry code developed by the ICA. First introduced in 1994,

the Code covers most classes of general insurance, including home, strata and

motor insurance. The current version of the Code came into effect on 1 July

2014 and has been adopted by 49 companies in the industry.

2.23

The Code sets out the standards that general insurers must meet when

providing services to their customers. For example, the Code requires that:

Our sales process and the services of our Employees and our

Authorised Representatives will be conducted in an efficient, honest, fair and

transparent manner.[19]

2.24

The Code is monitored and enforced by the Financial Ombudsman Service

(FOS), an accredited dispute resolution provider under ASIC's requirements.[20]

2.25

On 17 February 2017, the ICA announced that it will be undertaking a

limited industry review of the Code. The review has been prompted in response

to recent developments in the general insurance industry, including this

inquiry. The ICA will carry out the review in consultation with key

stakeholders including ASIC and FOS.[21]

Insurance comparison services

2.26

Issues of clarity, transparency and ease of comparability among general insurance

products have been a consistent focus of this inquiry. Consumers' ability,

particularly in complex transactions like insurance, to understand and make

appropriate choices is often hindered by the lack of sufficient understanding

or information to compare different insurance products.

2.27

An insurance comparison service, often referred to as an aggregator or

price comparison website (PCW), is generally an online platform that acts as an

intermediary between insurers and consumers searching for a range of insurance

products. Consumers are generally required to provide certain personal details

online before being presented with information on a number of insurance

products to compare.[22]

2.28

There are a number of private and independent (government-run)

comparison services operating in Australia and overseas jurisdictions,

including the United Kingdom, Norway, Ireland, and the United States.

Australian examples include the North Queensland home insurance (NQHI)

comparison website, administered by ASIC; privatehealth.gov.au, administered by

the Private Health Insurance Ombudsman; and commercial comparison websites such

as iSelect and Compare the Market. The merits and efficacy of these comparison

services are discussed in greater detail in chapter 4.

Regulator guidance for comparison

websites

ASIC Regulatory Guide 234

2.29

In 2012, ASIC issued its Regulatory Guide 234, Advertising financial

products and services (including credit): Good practice guidance (RG 234).

RG 234 'contains good practice guidance to help promoters of financial services

comply with their legal obligations to ensure they do not make false or

misleading statements or engage in misleading or deceptive conduct'.[23]

It includes guidance relating to the promotion and provision of financial products

through comparison websites, and specifies that promoters should disclose:

- the basis of any ratings or

awards attributed;

- any links to providers of the

products that are being compared, including commissions, referral fees,

payments for inclusion in comparisons and/or payments for 'featured' products;

- a warning if not all

providers are included in the comparison;

- that any advertisements included

on the website are presented as advertisements, to prevent consumers being

misled about the ranking of a product; and

- a warning that products

compared do not compare all features that may be relevant to the consumer.[24]

ACCC guide for comparison website

operators and suppliers

2.30

Following a review of Australia's comparator website industry in 2014,

the ACCC released a guide for comparison website operators and suppliers. As

well as encouraging compliance with the Competition and Consumer Act 2010,

the guidance is intended to assist operators and suppliers when making

decisions about all aspects of comparator services, including in advertising

and marketing. Moreover, in recognising the growing role of online markets to

the Australian economy, the guide aims to promote positive consumer experiences

and fair trading in the online sector.[25]

But this guide is voluntary, and does not prescribe what information comparison

websites must provide or the rules by which they must abide.

Increases in general insurance premiums

2.31

As part of its terms of reference, the committee was asked to examine

the increase in the cost of home, strata and car insurance cover over the past

decade in comparison to wage growth over the same period.

Home and motor insurance premium

trends

2.32

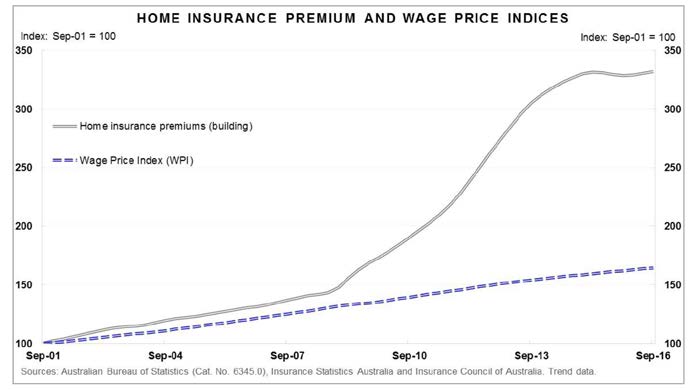

In the 15 years to 2016, home insurance premiums in Australia have

increased at an average annual rate of approximately 8.3 per cent. Over the

same period, Australia's Wage Price Index (WPI) has increased at an average

annual rate of approximately 3.4 per cent.[26]

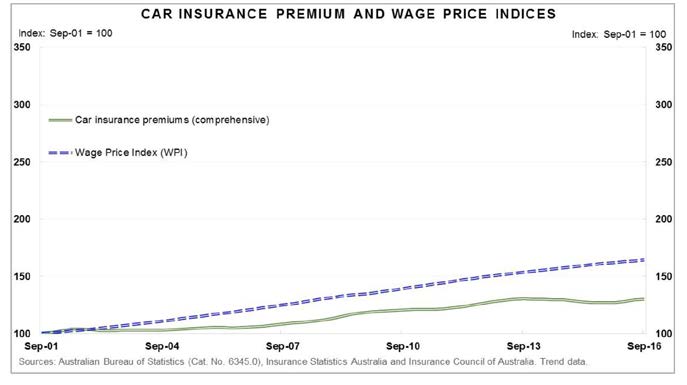

In contrast, growth in motor insurance premiums has been significantly slower,

increasing at an average annual rate of approximately

1.7 per cent.[27]

2.33

Since the beginning of 2014, home insurance premiums have experienced

notably subdued growth and motor insurance premiums have experienced no growth.[28]

2.34

Figures 2.2 and 2.3 illustrate these increases in home building and comprehensive

motor insurance premiums relative to the WPI respectively.

Figure 2.2—Home insurance premiums and wage price indices[29]

Figure 2.3—Car insurance premiums and wage price indices[30]

Strata insurance premium trends

2.35

In 2013, the government commissioned the Australian Government Actuary

to conduct a study into strata insurance pricing in North Queensland. In

undertaking this study, the Australian Government Actuary was asked to compare

strata insurance pricing across Northern Australia and other east coast

centres.[31]

2.36

The Australian Government Actuary's report showed that, between 2006 and

2013, strata premiums for Australia's east coast centres increased at a similar

rate relative to Australia's WPI,[32]

which grew by approximately 28 per cent.[33]

In contrast, strata insurance premiums in North Queensland increased at a

significantly faster rate, more than tripling the rate of increase in other

centres over the same period

(figure 2.4).[34]

Figure 2.4—Strata premiums in North Queensland and east

coast centres[35]

Reasons for insurance premium

increases

2.37

The main driver for increased premiums in home, strata and car insurance

in recent years has been growth in claims costs.[36]

However, there are a wide range of other complex and inter-related factors that

have contributed to increases in these classes of insurance. Some of these

factors have had a direct and significant impact on premium increases, while

others have had smaller, more indirect impacts. Moreover, the risk-based nature

of general insurance means that some factors have affected certain consumers more

than others, such as those living in regions that face greater natural perils.[37]

2.38

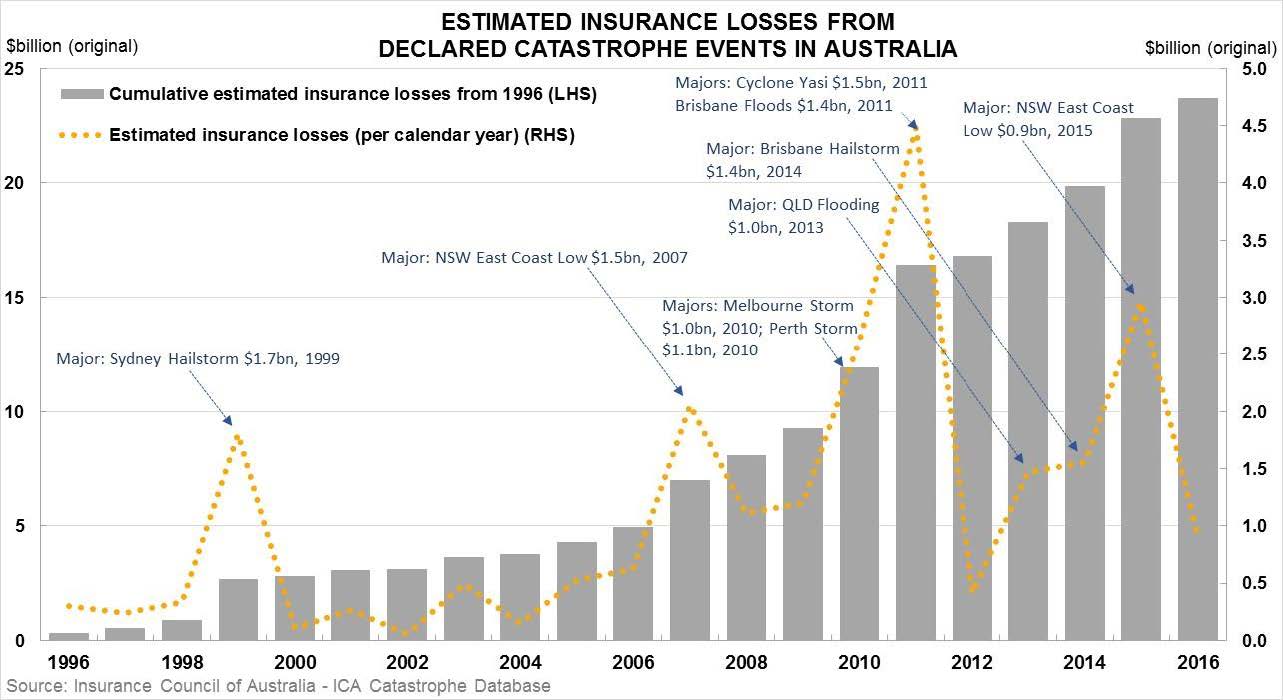

Rising premiums in home insurance, particularly in regions such as North

Queensland, have been driven by sharp increases in claims volumes, higher claim

amounts, and substantial increases in the costs associated with meeting those

claims (e.g. repairing and rebuilding costs). These factors have largely

resulted from a high number of major weather and natural catastrophe events

over the past decade, including cyclones, storms, floods and bushfires.[38]

Insurers have revised their natural peril data following these events to more

appropriately reflect the risk faced in regions where such events are more

frequent, severe and costly.[39]

2.39

The growth in strata insurance premiums has been largely driven by the

same factors affecting home insurance. However, rises in this class of

insurance have also been affected by the location and concentration of strata

properties, with extensive strata development along Australia's east coast,

particularly in cyclone-prone regions, in recent years.[40]

2.40

With regard to strata insurance in North Queensland, the Australian

Government Actuary found that premium increases in that region were a result of

numerous factors, such as historical under-pricing, increases in the cost of

reinsurance and losses caused by a number of natural disasters.[41]

2.41

According to the ICA, insurance losses resulting from declared

catastrophe events over the past two decades total approximately $24 billion.[42]

Moreover, QBE analysis estimates that between 2000 and 2012 alone, the losses

borne by insurers from natural disasters totalled $16.1 billion, an average of

over $1.2 billion per year.[43]

Figure 2.5 illustrates the estimated insurance losses from declared catastrophe

events in Australia over the past two decades.

Figure 2.5—Estimated insurance losses from declared catastrophe

events in Australia (1996–2016)[44]

2.42

Factors that should be considered when examining increasing general

insurance premiums include:

-

the increased cost of reinsurance;

-

the introduction of automatic flood cover;

-

improved flood information data;

-

the increasing cost of construction, rebuilding and repairs;

-

the use of some modern construction methods and materials;

-

the tightening of building regulations, codes and standards;

-

the growth of the housing market;

-

a lack of competition in some areas (e.g. Northern Australia);

-

the increase in motor vehicle technology and complexity;

-

increased use of granular data profiles; and

- standard inflationary pressures and general economic conditions.[45]

Premiums and wage growth

2.43

A number of submitters questioned the validity of comparing increases in

premiums for home, strata and car insurance with wage growth, emphasising that

changes in these measures are driven by different and largely uncorrelated

factors.[46]

2.44

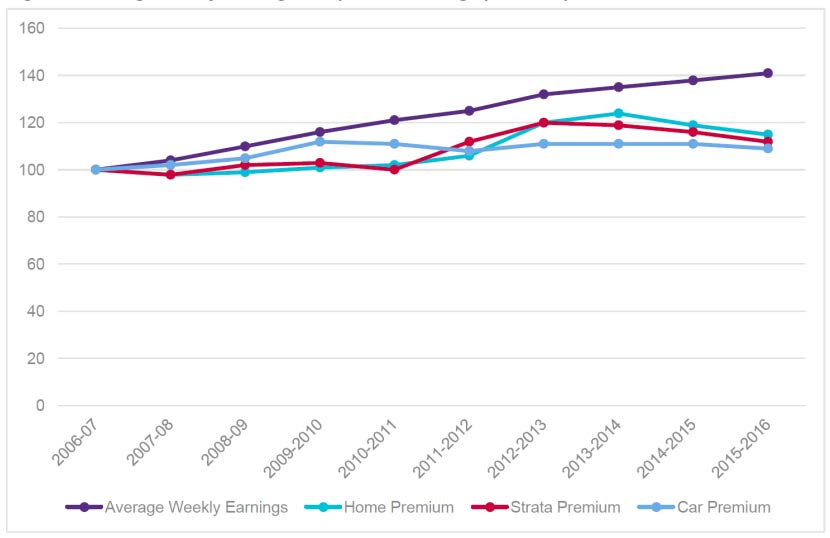

In its submission, IAG argued that 'the cost of a home insurance premium

must be viewed in the economic context that the value of the asset has

increased over the past decade'. IAG further argued that 'a more accurate

indication of the movement of insurance premiums in comparison to earnings over

time takes into account the sum insured of the asset being covered' (figure 2.6).[47]

Figure 2.6—Average weekly earnings compared to average

premium per $1000 sum insured[48]

Committee view

2.45

The committee acknowledges that premium increases and wage growth are

influenced by a variety of internal and external factors. However, the

committee also considers the rate of premium increases relative to wage growth,

particularly for home and strata insurance, has important implications with

regard to the financial pressure placed on Australian consumers and the

proportion of income being spent on insurance.

2.46

The committee recognises that rises in insurance premiums observed in

regions such North Queensland have undoubtedly been influenced by the incidence

of major weather and natural catastrophe events over the past decade. However,

the committee is concerned that consumers are unable to determine if premium

increases have been driven by this increased risk alone, or whether other

factors, such as a lack of competition, have also contributed to the premium

rises.

2.47

That said, the committee also notes that there have been several

government and industry reviews relating to premium increases in home and strata

insurance. These reviews have consistently found that, despite notable

increases, premiums remain commensurate with the level of risk.[49]

Given this, the committee does not propose to examine premium increases or

their justification further in this report; however, it acknowledges the

increased financial pressure that these increases can and has placed on many

consumers. The role of disaster mitigation in reducing insurance premiums is

discussed in chapter 5.

Competition in the general insurance industry

2.48

Competition is the cornerstone of well-functioning markets, driving

efficiency with regard to price, innovation, service and product quality, and

providing better information that allows for more informed consumer choices. To

that end, competitive markets deliver positive consumer outcomes and, by

extension, increase the welfare and prosperity of all Australians.

2.49

Healthy competition is integral to insurance affordability and

accessibility. A lack of competition in insurance markets can result in

negative consumer outcomes, such as premium increases, underinsurance, or

coverage that is inappropriate to consumers' needs. These outcomes can have

potentially devastating effects, not only on consumers' financial stability,

but also on their mental and physical health. North Queensland provides some

evidence of these negative effects. A lack of providers in this market,

particularly for strata insurance, has resulted in barriers to many consumers

acquiring cover.[50]

Stakeholder views on competition

2.50

Industry stakeholders were of the consistent view that Australia's

general insurance industry is highly competitive, contending that the large

number of participants in the market and recent entry of challenger brands are

evidence of this fact. For example, Mr Anthony Justice from IAG argued:

I think it is fair to say there is strong evidence that the

market in Australia is highly competitive; there is a very large number of

participants in the marketplace. We continue to see new entrants into the

Australian market and we have seen several from overseas, particularly in

recent years, who have built good market share positions. We feel the effect of

that competition, we feel the effects of market share coming under pressure and

we feel the effects of margins coming under pressure over time. So we would

argue that there is very healthy competition in the Australian marketplace. [51]

2.51

The Australian Prudential Regulation Authority (APRA) shared this view,

noting that:

The personal lines market continues to display healthy

competition. Incumbents have maintained a competitive position in all classes

of business, while coming under increasing pressure from challenger brands such

as Auto and General, Youi and Hollard, which continue to grow their market

share. Large retail groups are also continuing to have an impact, as they seek

to gain market share, particularly in the domestic motor class of business.[52]

2.52

The National Insurance Brokers Association (NIBA) acknowledged that IAG

and Suncorp have dominant positions in the general insurance market. However,

NIBA also asserted that consumers 'have easy access to a number of alternative

suppliers', with a range of smaller, challenger brands infiltrating the

Australian market.[53]

2.53

The ICA pointed out that the Financial System Inquiry (FSI) made a

similar assessment of the level of competition in the general insurance

industry.[54]

Specifically, the FSI Interim Report observed that:

Although the sector has generally become more concentrated, some

trends are moving in the opposite direction. For example, a number of new

insurers have entered the market, including Youi, Hollard and Progressive.

Banks and retailers have also entered the insurance market, usually white

labelling products provided by the main insurers, but with some underwriting

themselves.[55]

Illusion of competition

2.54

Some inquiry participants queried the industry's assessment of the state

of competition in the insurance market.

2.55

Mr John Rolfe argued that the general insurance market in Australia

gives the 'illusion of competition, rather than genuine competition'. This is

because, from a consumer perspective, there are a 'lots of different players to

choose from. However, most of the major brands are ultimately controlled by

just two companies: Suncorp and Insurance Australia Group'.[56]

2.56

iSelect echoed this opinion, remarking that 'there can be a

misrepresentation to the man on the street about pure competition'.[57]

iSelect explained this view in its submission to the inquiry:

The significant concentration in the Australian market of the

two major players—Suncorp and IAG—with around 70% market share [for motor

insurance] between them, would appear to be substantially reducing competition

in the general insurance market. This lack of true competition is masked from

consumers as the major companies have maintained a plethora of brands retained

after acquiring a number of smaller competitors. These multiple brands give

consumers the false impression that the marketplace is highly competitive.[58]

North Queensland strata insurance

2.57

In her submission the inquiry, Mrs Margaret Shaw highlighted the

apparent lack of competition in the strata insurance market in North Queensland

and suggested that premiums have been affected as a result:

In 2012 North Queensland had only one insurer offering

insurance for strata properties valued a replacement cost of $5M and

above—SUU—owned by CGU—owned by IAG. Premiums went haywire.[59]

2.58

Mrs Shaw elaborated on this issue at a public hearing:

As to competition, in North Queensland, we are still

experiencing difficulty in obtaining sensible quotes, especially for the strata

properties of more than 10 units or those with a replacement value of greater

than $5 million. We quite often get stupid quotes such as $20,000 for a house in

Ingham. They do not earn $20,000 in Ingham. There is also a large difference

between quotes. For the 25 apartments where I live, quotes ranged from $51,000

to over $80,000. Companies which are considered major players, such as CHU,

have not returned to the market, and some such as Zurich and Amp GI have left

the strata market for good.[60]

Industry profitability

2.59

During public hearings, the committee questioned stakeholders about the

level of profitability in the industry and how this should be used to assess the

state of competition in the general insurance market.

2.60

As noted earlier in this chapter, in the year to 30 September 2016,

total industry net profit after tax was $3.1 billion, up from $2.4 billion the

previous year and representing a return of 11.2 per cent on net assets.[61]

However, while net profit increased over the 12 month period, APRA data

indicates that there has been deterioration in the financial performance of the

general insurance industry over recent years.[62]

2.61

Representatives from APRA noted that the agency is not observing

'excessive profits' in the industry at a portfolio level. Mr Geoff Summerhayes,

Executive Board Member at APRA, further advised the committee:

As you would appreciate, we are not the competition

regulator, so our primary lens is the prudential soundness of the institutions.

That said, our mandate does require us to balance competition, contestability

and competitive neutrality, so it is a factor in our decisions. But, as we see

the market, it is a well-functioning, healthy market which does not appear to

be making excessive returns and is subject to a whole range of external

influences that make profitability from one year to another quite variable.[63]

2.62

Industry representatives emphasised the fact that profitability in the

general insurance industry has experienced a downturn in recent years. For

example,

Mr Andrew Broughton from QBE commented:

As I think was stated by both our competitors before,

insurance returns have actually been falling in recent years. We have a number

of independent reports suggesting that returns in this sector, particularly in

Australia, are adequate—certainly no more than that. They have actually

deteriorated over recent years...We operate in a very tough market with broad

macro-economic factors, such as low investment returns impacting our ability to

return higher than what we would consider are adequate returns.[64]

Competition in supply versus demand

2.63

In their submission, Professor Allan Fels and Professor David Cousins

cautioned against making conclusions on the effectiveness of competition in the

general insurance industry solely on the basis of supply factors, such as the

number of providers or degree of market concentration. They reasoned that this

kind of assessment 'fails to consider competition from the perspective of

consumers'; that is, from a demand perspective.[65]

2.64

Further elaborating on this point, Professors Fels and Cousins noted

that:

From a consumer viewpoint, an important dimension of industry

competition is the degree to which that competition is 'effective' in producing

price and other outcomes (e.g. range of products and services, product

innovation) that benefit consumers.[66]

2.65

In giving evidence at a public hearing, Professor Fels argued that

competition in the general insurance market 'is not fully effective', and that

there is a clear weakness on the demand side of competition in the industry.

This weakness is manifested in the low rates of consumer switching between

insurers (consumer inertia), and the wide disparity that may be found between

insurers in their quotations for identical properties and risks.[67]

Professor Fels highlighted information asymmetry between insurers and

consumers, particularly with regard to how insurance is priced, as a primary

barrier to effective competition from a demand perspective.[68]

2.66

The concept of information asymmetry as it relates to insurance is

discussed further in chapter 3.

Committee view

2.67

The committee notes that the government is yet to release its response

to the final report of the Northern Australia Insurance Premiums Taskforce. The

report was provided to the government in November 2015.

Recommendation 1

2.68

The committee recommends that the government release its response to the

final report of the Northern Australia Insurance Premiums Taskforce.

2.69

The committee notes APRA's comments that the 'personal lines market

continues to display healthy competition'. However, the committee also

acknowledges the importance of examining the effectiveness of competition in

the industry from a demand perspective. In this regard, the committee tends to agree

with the view of Professors Fels and Cousins that competition in the general

insurance market is not fully effective, and considers that consumers would

benefit from increased competition.

2.70

With regard to strata insurance in North Queensland, the committee is

highly concerned by evidence pointing to the difficulties experienced by

consumers in obtaining quotes in this region. In light of the evidence

received, the committee considers that a focused review into competition in the

strata insurance market in North Queensland is warranted.

Recommendation 2

2.71

The committee recommends that the government conduct a review into

competition in the strata insurance market in North Queensland to establish a

fact base and explore avenues to improve insurer participation in this region.

Navigation: Previous Page | Contents | Next Page