Data matching

Raising a debt is no small matter. Most Centrelink customers

rely upon income support for their survival. To make them pay money back can

result in significant financial hardship and social problems. That is why

Centrelink, prior to the robo-debt regime, had procedures in place to ensure

that they could be satisfied a debt had occurred before issuing a debt notice.

That is not to say mistakes were not made, but the procedures minimised risk.[1]

What the robo-debt process does is shift the onus onto the

client to prove their innocence, and that is unusual. Data-matching is not new.

The problem with the system as it stands is that, rather than Centrelink making

the inquiries when there is perhaps evidence to suggest a person has underreported

their income, they turn it over to the client to contact them.[2]

2.1

As outlined in chapter 1, data-matching with Australian Taxation Office

(ATO) records and subsequent debt collection to recover income support overpayments

is not a new process for the Department of Human Services (department). What is

different in the Online Compliance Initiative (OCI) program, is how the lump

sum income information data from the ATO is subsequently checked against actual

fortnightly income support payments, to determine if overpayments have been

made. As noted in Chapter 1, this process has largely been outsourced to the

individual income payment support recipients under the new OCI program. This

change in process has had a significant impact on the accuracy of the department's

advice to income payment support recipients regarding purported debts incurred

as a result of income support overpayments.

2.2

This chapter will outline the debt calculation process from the initial

data matching, to seeking clarification from individuals where there is a

discrepancy in income data, up to the point when a formal decision is taken by

the department that there is a purported debt amount owing. This chapter will

also outline the relevant laws and provisions which govern how this should be

undertaken.

Overpayment data matching

2.3

Centrelink income support payments are subject to an income test which

means that a recipient's fortnightly payment may be reduced once their income

reaches a specific threshold. The more income a recipient earns, the greater

the rate that their fortnightly payments are reduced. The rate at which the

payments are reduced depends on the individual's circumstances.[3]

2.4

Centrelink payment recipients must report their income fortnightly and

their fortnightly payments are calculated based on this information.[4]

Where it is found that a recipient has incorrectly reported their fortnightly

income, and the correct amount would have affected their entitlement to a

payment, a Centrelink debt may be raised.

2.5

Such purported debts are usually identified by the department following

some form of data-matching process to check whether a recipient's income

information reported to Centrelink is consistent with records held by other

agencies, such as the ATO.

2.6

The department provides the ATO with the identity information of

Centrelink recipients which the ATO matches against their records. In order for

the ATO to provide income information to the department, the ATO must identify

a high confidence match between the identity information provided and the ATO's

records.[5]

2.7

The data-matching process then involves comparing Pay-As-You-Go (PAYG)

statements provided by employers to the ATO with the information on earned

income declared by Centrelink recipients. The data-matching is used to identify

whether there is a potential discrepancy between the amount of income self-reported

by the recipient to Centrelink, and the amount reported by the recipient's

employer to the ATO.

2.8

Up until recently, if a potential discrepancy was found, a departmental

officer would seek date-specific income data directly from an individual's

employer to verify dates of when the income was earned.

2.9

As noted above, the new Online Compliance Intervention (OCI) system has

altered the way in which the department verifies discrepancies between

self-reported income and the ATO income data. Since November 2016, the

department has significantly changed the protocol for the data-matching

program, by removing the requirement for a departmental officer to undertake this

manual income verification process[6].

Instead, individuals are now required to undertake this process and communicate

the verified data back to the department.

OCI data matching program

2.10

As noted above, the department uses a data-matching process to determine

whether a current or former recipient of Centrelink payments has correctly

declared their income and received the correct payment.

2.11

The Illawarra Legal Centre noted the key change is not in the data

matching process, but in the way that data is later verified:

There is nothing new in this. Data-matching has been around

for years. If Centrelink has suspicions, it could contact the employers

directly. All of this is a cost-saving exercise, transferring the cost of

administration. Centrelink could contact the employer: 'What did this person

earn? Can you provide me fortnightly earnings for this person for this period

of time?' It has moved from that to asking the client, who may no longer be a

Centrelink client, to provide details of their fortnightly earnings from some

time past. People do not keep those records. It is an unwarranted intrusion.[7]

2.12

Previously, where a discrepancy was identified between these two

sources, the department manually checked the information for accuracy and

contacted the recipient and/or their employer to clarify the information. The

department's data matching program protocol of May 2004 explains the process:

Upon contacting Centrelink, the customer is provided with an

opportunity to respond to the information and provide appropriate evidence of

their income from employment. Where Centrelink is satisfied that the

information provided by the customer is complete and accurate, Centrelink will

not approach third parties for further information. If the customer is

unable to provide sufficient evidence, the employer may be contacted to provide

further information [emphasis added].[8]

2.13

The department confirmed that '[i]n the past, if the person was not able

to provide the information themselves, or sometimes even when they did, we used

to go to the employer and get their records.' Ms Golightly, Deputy Secretary of

Integrity and Information, further clarified:

CHAIR: So you used to go to the employers to get the

employment records?

Ms Golightly: In some cases we would go to employers,

but we always went to the individual first.

CHAIR: Yes, and when they had difficulty you went to

the employers?

Ms Golightly: When they had difficulty, we would talk

them through what other information they might have—like bank statements et

cetera—but, yes, we used to go to employers. Now we are trying to eliminate the

need for anybody to do that so that it is easier...[9]

2.14

The OCI system now, in essence, outsources the clarification stage to

the income payment recipient. Where this was previously a function performed by

a staff member of the department trained in such operations, the department now

directs income payment recipients to an online portal to clarify and update

their information:

[T]he recipient is contacted by letter which provides the

recipient the employment information that DHS has received from the ATO and

requests them to clarify this information online...

Upon contacting DHS or accessing the online system, the

recipient is provided with the opportunity to clarify the information and

provide appropriate evidence of their income from employment [emphasis

added].[10]

2.15

A key concern raised throughout this inquiry, has been that the data-matching

process identifies income reporting discrepancies by comparing different

sources of information, that is, a person's annual total income amount provided

by the ATO, with the total fortnightly income amounts a person declares to the

department, which was how the department calculated the income support payment

a person received.[11]

2.16

The period of employment and fortnightly income information is

fundamental to the department being able to accurately assess whether a

recipient has received the correct fortnightly payment. The information

provided to the department for data-matching purposes by the ATO includes a

person's payment summary, investment income information and income tax data.[12]

2.17

It is important to note that employers are not required to provide period

of employment information to the ATO for their staff, rather employers must

only provide an annual figure paid during that financial year.[13]

The ATO advised that of the income information transferred to the department in

2016, 49.1 per cent of records were for a full year employment and 50.9 per

cent of records included part-year employment information. A similar proportion

of records included full or part-year employment information in the preceding

five years.[14]

2.18

The ATO noted that while there has been an increase in the volume of

data-matching requests processed by the ATO, the ATO's processes have not

changed since the introduction of the OCI system.[15]

2.19

However, prior to the OCI system, when data matching identified a

discrepancy, a departmental officer would contact the recipient by letter and

by phone to clarify the discrepancy. The departmental officer would then

undertake a manual assessment to determine if a debt was owed.[16]

2.20

Under manual data-matching arrangements in 2009-2010, approximately

25.5 per cent of identified discrepancies were resolved as the recipient

or employer was able to provide information which confirmed the recipient had

received the correct Centrelink payment.[17]

What's changed?

2.21

Three key changes have occurred under the OCI system. Firstly, the

responsibility for checking and clarifying income information has shifted from the

department to current and former recipients of Centrelink payments. Secondly,

recipients are directed to an online portal to check the information and

provide supporting evidence of their fortnightly income, dating back to 2010

for some people.[18] .

And third, the significant reduction in workload for the department by this

outsourcing, has allowed for a huge increase in the number of income

discrepancy investigations that the department initiates, the start of which is

the initial letter sent to an individual.

2.22

The department's 2017 data matching program protocol, released in April

2017, outlines that where a discrepancy is identified between the information

provided by the ATO and the information on Centrelink's record, the department

issues an initial clarification request to recipients: 'the recipient is

contacted by letter which provides the recipient the employment information

that DHS has received from the ATO and requests them to clarify this

information online'.[19]

2.23

The initial letter directs recipients to an online portal and requests

recipients to confirm the annual income information provided by the ATO or

provide evidence such as bank statements or payslips to demonstrate how much income

was earned per fortnight.[20]

The department then utilises this information to recalculate whether past Centrelink

payments have been paid at the correct rate and whether a purported debt is

owed.[21]

2.24

Notably, the 2017 data matching program protocol does not include

reference to Centrelink contacting a customer's employer where the customer

cannot provide the information. In addition, there is no indication that

Centrelink staff must undertake an assessment that the information provided by

the customer is 'complete and accurate', rather the information provided by the

letter recipient must meet the lower threshold of 'sufficient'.[22]

2.25

While data-matching systems have been in place for a number of years,

the implementation of the OCI system has enabled the department to

significantly increase the number of recipients who are subject to the process,

by virtue of removing the manual verification process undertaken by the

department, and having income payment recipients undertake the verification function.

Since November 2016, the department has issued between 10 000 and 20 000

compliance interventions per week compared to only 20 000 a year

previously.[23]

2.26

The Community and Public Sector Union (CPSU) expressed concern that the

move away from manual processing and towards the OCI system had negatively

impacted on departmental staff:

This new approach, which removes and reduces human oversight

of suspected overpayments and reduces employees' roles in a range of elements

of the system, has been an absolute disaster for many Centrelink use[r]s and

also for the workers charged with implementing a system they know to be deeply

flawed and unfair.[24]

2.27

The CPSU attributed the shift to the OCI system to a lack of resources

within the department as a result of budget cuts across successive governments

and questioned whether the change was counter-productive to budget saving

measures.[25]

The CPSU stated:

If we want to look at where robo-debt has come from, it is a

fairly obvious consequence of a department that no longer has the resources to

provide effective services. The decision to replace the human oversight of debt

recovery with automated data matching was absolutely based on a desire and an

imperative to save money. It has of course proven to be a classic false economy

and has created costly reverse workflows where staff are taken offline to deal

with complex and difficult disputes over incorrectly raised automated debts.[26]

2.28

Furthermore, the consequences of not providing, or being unable to

provide, information which verifies income received during a particular period

are potentially severe. Under the OCI system, if the recipient of a letter

seeking clarification does not provide further information or confirms the

annual income received without providing fortnightly income information, the

ATO income information alone is used to assess whether the recipient received

the correct Centrelink payment and whether a purported debt is owed.[27]

2.29

The committee heard from a number of witnesses and submitters that this

has resulted in debt notices being issued based on inaccurate or incomplete

information. This is because the purported debt is calculated by averaging the

annual income data into an average fortnightly sum, which may then

retrospectively change a person's eligibility for a fortnightly Centrelink

income support payment.[28]

Committee

view

2.30

The committee is concerned about the shift in the onus from the

department to the individual recipient to verify whether or not a purported debt

exists. The committee is particularly concerned that individuals do not have

access to the same resources and coercive powers as the department to access

historical employment income information.

2.31

The committee notes that the department has taken some steps to make

this process less burdensome for recipients, such as by allowing recipients to

provide bank statements as opposed to payslips, which may be particularly

difficult for a recipient to obtain.

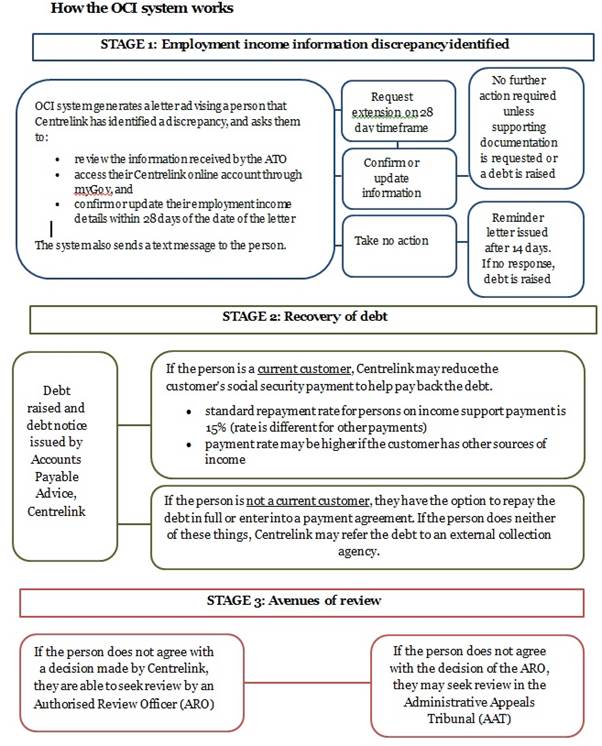

How the OCI system works

2.32

The data-matching process and OCI system utilised by the department have

three fundamental elements:

-

Stage 1: Employment income information discrepancy identified and

income data verified.

-

Stage 2: Recovery of purported debt (by the department or

external debt collection agencies).

-

Stage 3: Avenues of review.

Figure 2.1 below summarises each stage of the process.

2.33

It is important to note that Stages 2 and 3 are not distinct stages, as

alleged debtors are able to seek review of the debt amounts at any time through

the process. Additionally, many alleged debtors first became aware of the purported

income data discrepancy only after receiving an accounts payable letter,

commonly referred to as a debt notice. This issue is discussed in greater

detail in chapter 3. The recovery of the purported debt once a notice has been

received and the avenues of review available will be explored further in

chapters 4 and 5.

Figure 2.1: Stages of OCI system[29]

Consultation

2.34

A number of submitters raised concerns that the department had not

adequately consulted with other government agencies and stakeholders prior to

the commencement of the OCI system.

2.35

The Digital Transformation Agency (DTA) is responsible for leading the

digital transformation of government services and advising government about

digital service delivery and shared platforms.[30]

Despite their role and experiences in digital transformation, the committee

heard that the department did not consult with the DTA prior to the

implementation of the OCI system. During the 2017 additional estimates, the DTA

clarified:

[The Program Management Office of the DTA] were not

previously involved in any of those particular projects that you have

mentioned. The only thing I would add is that, while we were not involved in

the Centrelink project, we did do some work in late January on the request of

DHS to work with them on some short-term user design expertise to add to their

team and to assist with the automated debt calculator project.[31]

2.36

The ATO also noted that it had not been consulted on the design or

implementation of the system.[32]

The department clarified that the ATO's role in providing income information

for data-matching purposes had not changed under the OCI system and that the measure

was the development of an online tool to seek clarification from recipients.[33]

However, following the roll-out of the OCI system the department and the ATO discussed

the OCI system during two teleconferences on 14 December 2016 and 7

February 2017.[34]

2.37

The Australian Council of Social Service (ACOSS) noted they were not consulted

on the design of the OCI system and that had key experts in social security

administration such as themselves, the National Social Security Rights Network

(NSSRN) and Legal Aid groups been consulted prior to implementation, a number

of flaws may have been prevented.[35]

At a later hearing, ACOSS indicated 'there had not been a further meeting with

the Minister in relation to the robo-debt program, including ACOSS and other

stakeholders', despite ACOSS's clear articulation of the desire for engagement

in the stakeholder process.[36]

2.38

The department provided evidence on 16 May 2017 indicating that they had

not as yet had any discussions with stakeholders who raised concerns about the

system, but that they would 'plan to have discussions... before we change the

system structurally'.[37]

2.39

Similarly the CPSU described the increasing level of alarm and distress

as the OCI system was rolled out and noted that neither departmental staff nor

the union were consulted on the design of the system or its potential impact on

staff.[38]

One department staff member told the CPSU that:

The OCI program was rolled out without my team in Compliance

ever having had the chance to look at it or understand the details - had we

been consulted, we could have pointed out many problems (some of which have

been addressed in later updates, months down the track).[39]

2.40

On 19 January 2017, the CPSU requested a briefing with the secretary of

the department, Ms Kathryn Campbell CSC, in order to understand the operation

of the OCI system and its potential impact on staff. At the committee's hearing

on 8 March 2017, the CPSU advised that the request for a briefing had, to

date, not been responded to.[40]

2.41

The concerns raised by submitters regarding a lack of consultation were

echoed in the Ombudsman's report. The report noted that a lack of risk

management and consultation contributed to the number of issues raised after

the system was implemented:

In our view the risks could have been mitigated through

better planning and risk management arrangements at the outset that involved

customers and other external stakeholders in the design and testing phases.[41]

Committee view

2.42

The committee notes concerns from a number of key stakeholders that they

were not adequately consulted by the department concerning the implementation

of the OCI system. The committee considers that it is important that

stakeholders are widely consulted when system changes which alter established

practices and have the potential to affect a large number of vulnerable people

are being considered for implementation.

Debt collection and privacy guidelines

2.43

Debt collection of income support overpayments is not a new

process for the department. Where an individual has a debt to the department

for an overpayment, there are a range of debt recovery actions the department may

take. For current income payment recipients, up to 15 per cent of their

payments can be reduced until the debt is paid. For individuals who are no

longer receiving payments, the department generally first seeks to contact the

individual and negotiate a repayment plan. Where

debts are not paid, the department contacts the ATO and seeks to recoup the

debt from the next tax refund. At the same time, the department can also: add an interest charge to the

debt; refer the debt to an external collection agency; recover the amount from

wages, other income and assets, including money held in a bank account; refer

the matter to solicitors for legal action, and issue a Departure Prohibition

Order to stop debtors from travelling overseas.[42]

2.44

There are a range of laws, guidelines and voluntary codes relating to

data-matching, privacy and debt collection, that are relevant to any data

matching and debt collection undertaken by the department, including the OCI

process. As discussed in greater detail below, many submitters and witnesses

questioned whether the actions of the department and its contracted service

providers are fully compliant with all relevant provisions restricting how

programs such as the OCI can operate.

Privacy Act 1988

2.45

The Privacy Act 1988 (Privacy Act) regulates how personal

information is handled. Schedule 1 to the Privacy Act sets out the Australian

Privacy Principles (APPs). The APPs apply to most Australian Government

agencies and regulate how APP entities must collect, use, disclose and store

personal information.

2.46

The APPs impose a number of obligations on entities, including:

-

protection of a debtor's personal information, including the

collection, use and disclosure of personal information; and

-

maintenance of accurate, complete and up-to-date records.[43]

2.47

The department has a privacy policy which outlines the department's information

handling practices in accordance with APP 1 of Schedule 1 to the Privacy Act. The

department's privacy policy sets out its practices relating to collection, use,

disclosure and storage of personal information, as well as its policy for

handling requests to access or correct personal information.[44]

2.48

The Office of the Australian Information Commissioner (OAIC) identified

a number of APPs which were relevant to the department's processes under the

OCI system and raised concerns that the department's activities were not

meeting their obligations under the APPs.[45]

2.49

Specifically, the OAIC noted APP 10 which relates to the quality of

personal information:

An APP entity must take reasonable steps to ensure the

personal information it collects is accurate, up to date and complete. An

entity must also take reasonable steps to ensure the personal information it

uses or discloses is accurate, up to date, complete and relevant, having regard

to the purpose of the use or disclosure.[46]

2.50

With regard to APP 10, the OAIC raised concerns about the practice of

averaging annual income over the year, the use of automated data-matching which

resulted in duplication of income, recipient's not receiving correspondence

from the department and the department placing the onus on the individual to

establish whether any of the ATO data used was not accurate.[47]

2.51

In addition, APP 13 requires an entity to take reasonable steps to

correct personal information to ensure that it is accurate, up-to-date,

complete, relevant and not misleading. APP 13 also requires that an entity must

state in its privacy policy how an individual may make a request to correct

information.[48]

2.52

The OAIC noted their concern at media reports which indicated that a

number of individuals had experienced difficulties uploading evidence and

correcting their data through the online platform. The OAIC also noted that

while the department was able to draw individual's attention to a preferred

method of correcting their information, they cannot require an individual to

follow a particular procedure, and encouraged the department to ensure their

processes were flexible and facilitative.[49]

2.53

The Australian Information Commissioner, Mr Timothy Pilgrim, advised the

committee that in the 2017-18 financial year, the OAIC will be conducting an

audit of the department's PAYG data-matching program and OCI system. The audit,

which is initiated under section 33C of the Privacy Act, will focus on the

quality and accuracy of personal information handling practices of the program,

with specific references to APPs 109 and 13.[50]

2.54

During the course of the inquiry, a number of witnesses and submitters

raised concerns about the issue of privacy in relation to personal data held by

the department and its public release in response to critical comments in the

media by individuals. Witnesses cited the case of Ms Andie Fox, discussed in

greater detail below, where the department provided personal data to the

Minister, who subsequently released the information in response to an article

Ms Fox wrote criticising the OCI program.[51]

Case study: Ms Andie Fox

2.55

Ms Andie Fox, an income support payment recipient, wrote an article

critical of the OCI program after she began to receive calls from a debt

collector.[52]

The department subsequently released information to the Human Services

Minister, the Hon. Alan Tudge MP, pertaining to Ms Fox's claims history

with Centrelink, as well as details of her interactions with the department. The

Minister then released the information to Fairfax Media and it was published in

a separate article.[53]

2.56

The department stated the release of information was justified in order

to correct the public record about inaccurate claims made by Ms Fox, and

stated:

Unfounded allegations

unnecessarily undermine confidence and takes staff effort away from dealing

with other claims. We will continue to correct the record on such occasions.[54]

2.57

This case has garnered much media and public attention, with many

submitters and witnesses to this inquiry expressing concerns around the breach

of Ms Fox's privacy and concerns for the impact on broader public

discourse. The Australian Privacy Foundation (APF) submitted this release of

information was a clear breach of privacy:

Personal information should never be released to the media

simply because an individual is criticising the Government. All citizens must

be free to criticise the Government and not face an abuse of their privacy. The

media is not a court and there is no 'record' to protect.[55]

2.58

Willing Older Workers submitted that many people in the community were

concerned that they might be subjected to similar actions and stated 'We've

been inundated by calls from people who are stressed because they heard the

news about Human Services Minister Alan Tudge speaking to a reporter about Andie Fox.'[56]

2.59

The Victorian Council of Social Service

agreed with this view, and told the committee of the impact this has had on the

community by making individuals afraid to speak out:

The government has created a climate of fear that has

silenced victims and critics. One woman who received a bogus debt notice would

not let me talk about her experiences today, even when I explained to her that

her name would not be used.[57]

2.60

A submission from legal academics has stated the release of information

'represents a breach of procedural fairness, in failing to recognise the power

of government against the relative lack of power of the citizen. The rule of

law is expressly designed to protect citizens against such an abuse of power.'[58]

2.61

Following the release of Ms Fox's information, the Hon Ms Linda Burney

MP, Shadow Minister for Human Services, referred the matter to the Australian

Federal Police (AFP) for investigation. In May 2017, the AFP released a

statement noting, 'The AFP has conducted an evaluation into this matter and

concluded that there was no breach of Commonwealth legislation.'[59]

2.62

The release of the information is currently under investigation by the

Australian Privacy Commissioner.[60]

Data matching laws and guidelines

2.63

Prior to the OCI program, the department and the ATO conducted their data-matching

activities using Tax File Numbers (TFNs).[61]

The use of TFNs triggers a requirement to comply with the Data-matching

Program (Assistance and Tax) Act 1990 (Data-matching Act), which

regulates the use of TFNs to compare personal information held by the ATO and

an 'assistance agency', such as the department.[62]

Subsection 12(2) of the Data-matching Act gives the OAIC the power to issue

legally binding rules relating to the matching of data under the Data-matching

Act.

2.64

However, the department has chosen not to use TFNs under the OCI

program. This has meant that, unlike previous data-matching processes, the OCI

program is not legally bound by the provisions of the Data-matching Act.[63]

Of particular note, while the Data-matching Act only allows for data-matching

in relation to the previous four financial years, the decision not to use TFNs

has allowed the department to data-match up to six years in the past[64]

2.65

The OAIC has issued non-binding voluntary data guidelines, which outline

best practices in instances where the Data-matching Act does not apply.[65]

The voluntary data-matching guidelines provide greater 'flexibility as to how

data-matching activities may be conducted' and do not restrict the volume of

data matching activity.[66]

However, the voluntary guidelines do require that agencies develop a

data-matching program protocol which is to be provided to the OAIC and is

generally made publicly available:

Protocols must contain the information set out in the

guidelines, this includes a description of the data to be provided and the

methods to be used which will ensure the data is of sufficient quality and

accuracy for use in the data-matching program. This reflects the principles

contained in APP [Australian Privacy Principals] 10, which requires agencies to

take reasonable steps to ensure that the information it uses or discloses,

having regard to the purpose of the use or disclosure, is accurate, up-to-date,

complete and relevant. A copy of the program should be provided to the OAIC and

generally made publicly available [67]

2.66

The department's privacy policy states that '[it] prepare[s] a Program

Protocol for each of our data matching programs, in accordance with guidelines

issued by the [OAIC]'.[68]

Although the protocol was available on the department's website at least by

June 2017,[69]

it appears this protocol was only made publicly available sometime after April

2017, well after the initial start of the OCI program. In its submission,

Victoria Legal Aid outlines a previous unsuccessful attempt to seek a copy of

the protocol from the department.[70]

2.67

The Australian Privacy Foundation has argued the OCI program has

breached a number of Privacy Act provisions:

The voluntary data-matching guidelines have pages and pages

of principles in relation to what you are supposed to do before a data-matching

exercise. I cannot see evidence that Centrelink did any of it—not one bit. They

did not do a report, they did not communicate with the people who were

affected. All these issues that simply were not done are set out in the Privacy

Commissioner's submission. I can only come to the conclusion that they decided that,

because they were voluntary, somehow they did not apply to them, even though [they]

were issued by a government regulator and described as best practice.[71]

2.68

Echoing the evidence provided by other witnesses, the Australian Privacy

Foundation made the recommendation that the non-binding voluntary data

guidelines should be 'mandatory and subject to active compliance and

enforcement action.'[72]

Commonwealth consumer protection

laws

2.69

The Competition and Consumer Act 2010 (CAC Act) provides

protection for consumers in their dealings with creditors. Schedule 2 to the

CAC Act sets out the Australian Consumer Law (ACL), which is enforced by the Australian

Competition and Consumer Commission (ACCC). The Australian Securities and

Investments Commission Act 2001 (ASIC Act) contains similar consumer

protection provisions to the CAC Act and is enforced by the Australian

Securities and Investment Commission (ASIC).

2.70

Commonwealth consumer protection laws impose certain obligations and

prohibitions on creditors, including prohibitions on:

-

the use of physical force, undue harassment and coercion;[73]

-

misleading or deceptive conduct[74];

and

-

unconscionable conduct.[75]

2.71

The ACL applies to Commonwealth government agencies, to the extent that

they can be said to be 'carrying on a business'.[76]

Debt collection guidelines

2.72

The ACCC and the ASIC joint guideline entitled 'Debt collection

guideline: for collectors and creditors' (collection guidelines) sets out the

laws and regulations applicable to debt collection practices in Australia.[77]

The ACCC and ASIC are the agencies responsible for regulating and enforcing

Commonwealth consumer protection laws, including laws relevant to debt

collection.[78]

The collection guidelines assist creditors, collectors and debtors to

understand their rights and obligations.

2.73

The collection guidelines set out best practice recommendations for

creditors when dealing with debtors, including initial contact, hours of

contact, frequency and location of contact, and obligations to protect a

debtor's personal information.[79]

The collection guidelines also recommend maintenance of accurate and up-to-date

records of correspondence with debtors, and provision of information and

documents to debtors where requested.[80]

Further, the collection guidelines state that if a debt liability is disputed,

collection should be suspended.[81]

2.74

The collection guidelines are not legally enforceable, but their

adoption is encouraged by the ACCC and ASIC to ensure that creditors'

collection activities are compliant with Commonwealth consumer protection laws.[82]

The collection guidelines apply to government bodies in so far as they are

engaged in trade and commerce.[83]

2.75

Mr David Tennant, Chief Executive Officer of FamilyCare and former

consultant with Care Inc. Financial Counselling Service and the Consumer Law

Centre of the ACT in Canberra, submitted that the collection guidelines do not

apply to Centrelink's debt collection process, as it is not considered to be a

business practice:

Centrelink is not however required to comply with the

Australian Consumer Law and the debt collection guideline only applies to

government bodies engaged in business activities. In other words Centrelink is

not bound by the rules that apply to every consumer creditor and collection

body in Australia – even the much maligned banks.[84]

2.76

Mr Tennant submitted that Centrelink could opt to be bound by the

collection guidelines by adopting them into its service standards or operating

procedures.[85]

2.77

The Australian Privacy Foundation also submitted that the debt

collection guidelines do not 'apply to the Government or any debt collectors

used by the Government'.[86]

2.78

However, the department told the committee that the private debt

collection agencies which the department engages are required under contract to

comply with the debt collection guidelines:

The external debt collectors are required to meet all of the

guidelines, policies and requirements that are set out by the ACCC. That is

part of their contract.[87]

2.79

The department further commented that it monitors the compliance of its

external collection agencies with the guidelines, noting that:

We also have very good guidelines in the contracts about

reasonable hours of contact and reasonable amounts of contact within a certain

period.[88]

2.80

The two debt collection agencies with operational contracts to undertake

debt collection activities on behalf of the department, Dun and Bradstreet and

Probe Group, provided evidence to the inquiry on their operations and

compliance with relevant laws and guidelines.

2.81

Dun and Bradstreet outlined that their staff are trained as to

obligations under the ACCC and ASIC guidelines, such as limiting communications

with individuals to a maximum of three per week or 10 per month.[89]

Dun and Bradstreet further outlined that as members, they also comply with the

guidelines of the Australian Association of Debt Collectors.[90]

The company acknowledged that although they complied with debt collection

guidelines once a purported debt had been referred to them, whether or not the

actual debt itself was raised in accordance with relevant laws and guidelines

was 'a matter for the department.'[91]

2.82

Probe Group confirmed that relevant debt collection laws and guidelines

were built into the contract it holds with the department.[92]

Furthermore, Probe Group's Chief Operating Officer provided evidence to the

committee that the debt collection sector saw taking a contract with the

department as providing premium status to contract holders because:

...[u]sually the Commonwealth has the highest standards in

terms of compliance and information security, technology and physical security.

In terms of industry standing, it is quite significant.[93]

Committee

view

2.83

The committee acknowledges concerns raised by some submitters that the

department is not bound by debt collection guidelines issued by the ACCC and

ASIC. The committee notes the department's comments that it is a requirement of

its contract with the external debt collection agencies it engages that they

comply with the collection guidelines. The committee also notes that the

department regularly monitors compliance of its external collectors with the

collection guidelines.

2.84

However as will be noted further in the report the committee did receive

evidence of people being contacted in circumstances that appear to be contrary

to the guidelines.

Error rates

2.85

The OCI system's use of data-matching has required current and former

recipients of Centrelink payments to re-report their fortnightly income in

order for Centrelink to re-apply the income test and re-calculate whether they

were paid the correct Centrelink payment. Furthermore, as employers are not

required to provide period of employment or fortnightly income information,

only an annual figure for a financial year, many people who correctly reported

their fortnightly income information in the past were subject to this process.

2.86

Submitters and witnesses informed the committee that where a discrepancy

or purported debt was identified and later resolved, this was often due to the

OCI system making assumptions about their income and incorrect information was

therefore included in Centrelink's calculation. These assumptions include:

-

income averaged over 26 fortnights in equal portions when the

income was earned in a shorter time period;

-

difference in employer's name (for example, where a business name

is provided to Centrelink and the ATO record includes company name) which

resulted in the same income being duplicated; and

-

non-assessable income considered assessable income such as a lump

sum termination payment, paid parental leave and meal, laundry and uniform

allowances. [94]

2.87

While the department's calculations may have been mathematically

correct, the inclusion of these assumptions has resulted in debt calculations

which were not based on accurate information and therefore have become known as

errors.

2.88

In approximately 20 per cent of cases where an individual has received

an initial letter identifying a discrepancy between the ATO and Centrelink

information, the individual has been able to provide clarifying information and

this has resulted in no debt being owed.[95]

2.89

The media and submitters have generally referred to this as an error

rate of 20 per cent, however, the department disputes the characterisation

of these instances as 'errors' or 'inaccurate'.[96]

The department released a statement emphasising that:

Commentary on the department's online compliance system

continues to incorrectly say 20 per cent of letters are being issued in error.

This is misleading and a misrepresentation of the process.

Initial notices request information to explain differences in

earned income between the Australian Taxation Office and Centrelink records.

These result in a debt in 80 per cent of cases. The remaining 20 per cent are

instances where people have explained the difference and don't owe any money

following assessment of this updated information.

This is how the system is designed to work, in line with the

legal requirements of welfare recipients to report all changes in circumstances

and the department's obligation to protect government outlays.[97]

2.90

The secretary of the department also explained that the department does

not believe that initial clarification letters have been sent in error:

When there is a difference between the two sets of

information, we ask the recipient or the former recipient to clarify. On 20 per

cent of occasions, they were able to clarify something in it. It may have been

dates. It may be that the information held by the tax office said that they had

worked an entire year when in fact they had only worked two months. When we had

that clarification, we were able to identify that was the end of the matter,

and nothing further went on. I do not consider that that makes the initial

letter wrong.[98]

2.91

However, the Victorian Council of Social Service raised concerns that

the error rate may actually be greater than 20 per cent of cases, commenting

that:

Given the scale of the program and the issues that are set

out in the Ombudsman's report, I think it is reasonable to assume others have

no debt but have not been able to provide an explanation. From the Ombudsman's

report, DHS cannot say how many more debts might be over calculated and by what

margin.[99]

2.92

ACOSS concurred, pointing out that while it is known that in 20 per cent

of cases an individual can explain the discrepancy and does not owe a debt, the

circumstances of the remaining 80 per cent of cases is not known. ACOSS told

the committee that:

Using the government's own figures, we know at least 20 per

cent of these so-called discrepancy notices, generated automatically, are in

fact incorrect. What we do not know is how many more have been sent in error.

We do not know how many have been sent that have alleged debts that do not in

fact exist. We do not believe we know how many debts have been pursued that

were higher than what was actually owed. We certainly do not know how many

people have entered into agreements to repay debts that they did not owe, or

certainly a level of debt that they did not owe. And we do not know in how many

cases people have entered into debt repayment arrangements that they simply

cannot afford.[100]

2.93

ACOSS attributes this to concerns that the OCI system has created a

climate of fear where recipients of letters feel they cannot challenge the

information provided by the department or risk losing the financial safety net

which the department provides.[101]

There have also been accounts of debt notice recipients simply paying the purported

debt amount without investigating the circumstances of the purported debt due

to other challenges in their life such as unstable employment or a lack of time

to consult the department.[102]

Consequences of averaging

2.94

The committee received evidence that the averaging of annual income

under the OCI program has in some instances led to inaccurate calculations of

debt.

2.95

The department advised that annual income provided by the ATO is

averaged over 26 fortnights when:

-

a recipient reports equal earnings across a period;

-

a recipient accepts the averaging of their earnings equally

across the period;

-

a recipient chooses to accept the dates provided by the ATO and

does not provide a further detailed breakdown; or

-

no other information is provided by the recipient.[103]

2.96

In many circumstances a purported debt has been raised for a current or

former recipient due to averaging annual income over a 26 fortnight period. The

National Social Security Rights Network (NSSRN) noted that averaging 'may

result in factual error if a person's fortnightly income was not stable across

the period of employment recorded by the ATO.'[104]

2.97

Due to the application of the income test, averaging income is

particularly problematic for recipients who have inconsistent working hours or

who have received Centrelink payments 'on-and-off' throughout a year as

averaging their annual income over 26 fortnights will not reflect the 'peaks

and troughs' of the recipient's income throughout the year.

2.98

The Welfare Rights and Advocacy Service provided the following example:

Pretend it is $500 as the cut-off for Newstart for this

fortnight. If I earn $5,000 in this fortnight, I am cut off for Newstart. It

does not matter whether I earn the $500 that is the cut-off or anything above. In

the next two fortnights, I might have no income, so I have got an entitlement

to Newstart for two fortnights. If you average my $5,000 across those three

fortnights, I have got a debt for the two fortnights.[105]

2.99

The ACT Council of Social Services outlined their concerns with the

operation of the OCI system and its inability to accommodate the circumstances

of Centrelink's clients:

One of the concerns we have about the regime is that it does

not recognise the labour market in which people are trying to work and comply

with their Centrelink requirements, which is a market in which people get bits

and pieces of work; work irregular hours and often spend periods of time across

a financial year out of the workforce. This leads to it being way more

complicated and extremely onerous to comply with a Centrelink system that

assumes that people either have or do not have a job across a financial year.[106]

2.100

The University of Adelaide's Student Representative Council explained that

in particular the OCI system does not account for the intermittent nature of

student's work and study commitments throughout a year. For example:

Students might be studying and receive Centrelink benefits

such as youth allowance, and then in the same financial year drop their studies

and work full time, temporarily foregoing their benefits. The automated system

averages ATO data over 26 periods in a year which means if students were to

work full time at parts of the year when they are not receiving benefits, their

income is averaged and false debt notices are issued when students were

rightfully receiving those benefits at the time.

The automated debt collection system is not equipped to

address the often sporadic work and study nature of students, contradicting the

purpose of Centrelink by creating additional stress and anxiety for students

than supporting them through their period of studies.[107]

2.101

ACOSS highlighted that the consequences of averaging annual income over

26 fortnights may result in an incorrect purported debt being raised:

Where someone does not enter that fortnightly income through

the online portal, it will automatically average that income over the 26

fortnights and subsequently result in a debt that may be incorrect or, indeed,

higher than what is actually owed. Previously, Centrelink would investigate

data matches between Centrelink and the ATO to be (a) certain that a debt

existed and (b) sure about the level of that overpayment if it did indeed

exist. Now the responsibility lies with the person targeted, and we believe

that is fundamentally unfair.[108]

Committee

view

2.102

The committee notes concerns expressed by submitters that the averaging

of annual employment income information into fortnightly data has in some

instances resulted in incorrect calculations of debt, especially where a

recipient's income was intermittently earned over a 12 month period.

2.103

The committee considers that it is important that calculation of debts

is based on complete and accurate information, and that the fluctuations in

recipient's income, particularly if they are employed on a casual or part-time

basis, should be closely reviewed before issuing a debt notice.

Individuals' experience

2.104

In order to avoid income averaging, the OCI system requires recipients

to confirm their fortnightly income information in the online portal in order

for Centrelink to re-apply the income test and re-calculate their Centrelink

payment, often dating back over a number of years. This has placed a

significant burden on individuals who have spent hours finding old bank

statements and payslips for each fortnight, in conjunction with difficulties

using the online portal.[109]

2.105

As the provider of social security in Australia, the department holds a

position of power in its recipients' minds, and the power imbalance this

creates cannot be underestimated when considering individuals' reactions to the

OCI system.[110]

2.106

The committee heard that some individuals were not confident enough to

correct the information provided by Centrelink or challenge the purported debt

calculated by Centrelink, as well as instances where people were simply

overwhelmed by the possibility of repaying thousands of dollars.[111]

2.107

Queensland Advocacy Incorporated submitted a case study outlining the

experience of one of their clients. The client first noticed a problem with

their Centrelink payments when $86 was deducted from their Newstart allowance three

fortnights in a row. The client attempted to phone Centrelink 5 or 6 times but

found the phone line was engaged each time. Following this the client visited

their local Centrelink office in person. The Centrelink officer found that the

client had not been sent a letter requesting further information, or notifying

them a purported debt had been raised and referred the client to contact the 'Compliance'

area by phone. [112]

The officer I spoke to explained: 'our software presumes that

income is distributed evenly over 26 fortnights per annum. It operates on the

presumption that people are working permanently part-time or full-time, but it

has no provision for casual work.' The officer explained that I had to contact

my previous employers to get pay slips, and I explained that I had only one.

The software had presumed (because of inadequate free character spaces in the

Field for 'Employer') that I had two sources of income, instead of one only.[113]

2.108

This individual's experience is representative of many personal accounts

the committee heard at public hearings and received via email. The committee

often heard that individuals had not received letters from Centrelink, that

their calls to Centrelink went unanswered, or they spent hours on hold. When

individuals have managed to speak to someone, a Centrelink officer was able to

identify the issue such as averaging or out of scope income being included in

the calculation of assessable income yet individuals were still directed to the

online portal.

2.109

In Brisbane, the committee heard from Michael whose income was averaged

over 26 fortnights, resulting in advice that he owed $3000. Following a review,

Michael's purported debt was reduced to $50. Michael explained the evident

problem with averaging his income:

Michael: When I clicked open the letter I clicked the

link and it gave me the option. I knew it was going to happen before I clicked,

because I had heard about it happening to people. It said $26,000. I checked my

records and it was accurate. I believe it was maybe a couple of dollars

different and that is what triggers the process, as I understand it. But it was

within a dollar or two so I went, 'Well it is within a dollar or two. Sure. Why

not?'

CHAIR: Of what you put on your tax return?

Michael: It was my records of what I had declared to

Centrelink versus the ATO: it was within a couple of dollars and so I had no

problem in saying, 'Correct.' Instantly my phone beeped and the initial

decision had been made instantly, within 10 seconds. So I went back onto the

website and it gave me the report of how it had made the finding. It was

$1,000, $1,000, $1,000 for each fortnight and so it was instantly obvious. I

was only on Centrelink for nine payments, over three months. Each payment said:

'You declared this much income'—but, according to information you have just

gave to the government by clicking yes, the government suggested that I had

asserted that I had made a salary of $1,000 every fortnight for the whole year.

So for me, seeing $1,000, $1,000, $1,000, it was obvious. Just to beat a dead

horse: 10 seconds of staff time would have been enough—10 seconds.[114]

2.110

The committee repeatedly heard from individuals that the OCI system had

caused them feelings of anxiety, fear and humiliation and dealing with the

system had been an incredibly stressful period of their lives. Individuals had

spent hours finding the required pay slips and bank statements, some dating

back to 2010-11, often for Centrelink to find that no debt was owed.

2.111

At its hearing in Sydney, the committee heard from Phoebe who was one of

the first recipients of a clarification letter in October 2016. Phoebe had been

told she owed Centrelink $14 576 due to payments made as far back as 2010

and had spent many months challenging the purported debt, which had taken a

significant emotional toll:

I would estimate that I have spent probably 100 hours, if not

more, gathering payslips from multiple employers; learning my rights about debt

collectors, and what debt collectors can and cannot threaten; and learning my

legal rights surrounding inaccurate welfare debts. I have spent hours on the

phone to Centrelink, with many calls going unanswered and cut off midway. This

process has resulted in emotional and physical stress, and increased sick leave

from work.

I feel that these robo-[debts] are targeting the wrong

people, those who honestly and diligently reported believing all they were

doing was right. I am now a healthcare worker and every day give back to the

community yet to now be labelled as a welfare fraud could impact my future and

my career. My trust in the system is definitely shaken.[115]

2.112

The impact of Phoebe's experience on her trust for Centrelink was echoed

by Ewan in Melbourne:

But the threat to financial security that this process

creates for anyone involved in the welfare system is absolutely terrifying. It

is the greatest threat you can have when you have known what it is like to not

have a home. It does not treat people with the dignity they deserve, and the

concern I have is how many people do not want to even touch the system now. It

is so poorly tainted by the fear that if you get caught up in any of the

welfare system the government could actually come after you in years to come.

It is not just a problem for people now; it is a problem for an entire

generation of people, who might not want to go into the system to get the help

they need when they need it.[116]

2.113

These individuals' accounts represent only a small proportion of people

affected by the OCI system and of those who told the committee their experience.

The personal accounts which the committee heard were instrumental to

understanding how purported debts had been calculated and the consequences of

the OCI system. Individual's interactions with the department and the online

portal are discussed further in Chapter 3.

Committee

view

2.114

The committee notes concerns expressed by several submitters regarding

the difficulty and distress many recipients have experienced attempting to

access payslips and bank statements, in some instances dating back over 5

years, in order to verify their employment income information. The committee

considers that it is important recipients are supported throughout the process

of verifying a purported debt, and that they are given adequate information as

to how their purported debt has been calculated.

Communication process

2.115

As outlined above, the responsibility to verify income information has

placed a significant burden on current and former Centrelink recipients. The

challenges individuals have faced in providing the required information and

understanding how a purported debt was calculated has been compounded by the

difficulties individuals faced communicating with Centrelink.

2.116

The committee heard that individuals had experienced great difficulty in

receiving information from the department about how their purported debts were

calculated. The Welfare Rights Centre of South Australia explained that often

their requests for information to understand their client's purported debt were

met with the response 'We cannot provide you with any information. You have to

resolve this through the online process.'[117]

2.117

Victorian Legal Aid considers that the data-matching process and the way

in which discrepancies and purported debts are identified lacks transparency.[118]

Victorian Legal Aid advised that the lack of information surrounding the

process has had a significant impact on the resources of legal service

providers who are unable to understand how their client's purported debt has been

raised and have resorted to Freedom of Information (FOI) requests in an attempt

to gather information relating to their client's purported debt.[119]

2.118

Individuals have also resorted to FOI requests to understand their purported

debts, however, as Geoff explained to the committee in Melbourne, the thick wad

of papers he received through FOI was total 'gibberish' and the income numbers

did not make sense or appear to correlate.[120]

In another instance an individual was provided with their complete 600 page

file in order to assess how their purported debt was calculated.[121]

2.119

The challenges people encountered communicating with Centrelink will be

explored further in Chapter 3.

Navigation: Previous Page | Contents | Next Page