Balancing the picture on poverty

- Executive Summary

- Overview

- Poverty

- Challenges

1. Executive Summary

- The

best way to assist hardship is to have a job.

- This

Government has overseen a strong growing economy, job growth and implemented a

number of effective initiatives to combat hardship.

- The

Government Senators dispute the myth that ‘Australia is losing the fight for a fair go’.

- Australia has high and

rising living standards with the benefits having been shared widely across the

community.

- Some Australians do continue to face serious

disadvantage.

- This is a result of a number of factors, not

just income.

- Simplistic approaches such as broad increases in

income support do not identify types of hardship, nor do they address the

cause.

- National Poverty summits, jobs strategies or

statutory authorities to oversee a National Poverty Strategy are not

solutions.

- Solutions cannot be achieved by Government

alone.

- Ongoing individual, family, and community

commitment and maximizing individual empowerment are integral to improved

outcomes.

- The key is economic and social participation for

all Australians, both in working age and retirement.

- There is a need to support and encourage

participation, self-reliance and mutual responsibility while assisting those

in hardship to improve their situation.

- In situations where assistance is required early

evidence-based targeted intervention works best.

CORRECTION

On page 448 the figures at the bottom of the table

have been reversed and should read:

ALP Coalition

$1.5 billion: $2.4 billion

2. Overview

The

Government Senators recognise there are challenges to assist those who are

suffering from hardship. It is not something that can or should be solved by

more meetings, reference groups, taskforces or creating more bureaucracy but

rather having the government continue to make decisions that work to the

benefit of those very people. It would be even better if that was to be

achieved in a bipartisan fashion.

The

Government Senators view the Labor Report and its recommendations, not as a

serious attempt to enhance existing successful strategies but rather a shallow,

naïve and purely political attempt to condemn the government of the day. That

is a sad outcome for those for whom this inquiry was initiated.

We

would have preferred to deal with many of the issues in more detail however the

Labor Party Chair denied us a reasonable extension of time after we received a

most unexpected 420 page Draft Report. We requested four weeks to adequately

consider all that was contained in the Draft but were given a week otherwise

the Labor Party was going to table without comment from the Government

Senators.

For

the Labor Party to suggest that Australia has a ‘rapid growth of inequality’ and ‘is

losing the fight for a fair go’ and ‘there is an increasing loss of

opportunity’ defies all logic and fact. It is an example of where politics

is put ahead of principle.

The

Government Senators were hopeful that such an inquiry would have resulted in a

report that seriously sought to strengthen the gains that have been made and

that, in the best interests of those affected by poverty, there would be a

genuine attempt to reach a bipartisan outcome.

The

problems of those affected by poverty are not easily defined, categorised or resolved. Their problems are not solved by simply throwing more money at them, expanding

non-effective approaches or setting up more Government committees.

Issues of poor educational attainment, physical and

mental health problems, family breakdown, drugs, alcohol, gambling, smoking,

illiteracy, disabilities, and indigenous heritage have all been identified, in

one form or another, as important drivers of poor outcomes.

It

is a statement of fact that Australia has one of the best and most generous income support

systems in the world. There are many systems in the developed world whereby an

individual has only a matter of weeks on income support (to which they must

have already contributed) before that support is cut off. No such scheme has

even been part of the Australian ethos.

Australians

are extraordinarily generous in providing income support for those who need it

but equally their 'fair go' attitude to life dictates there be a

requirement for participation and a system that does not encourage passivity

and dependence. The term 'mutual responsibility' is something to which

Australians can relate.

The

Government has shown a commitment to welfare reform including reform to

assistance to those of working age. It is that commitment which, it was hoped,

could have been enhanced with the outcomes of this Report if the Opposition has

been prepared to sideline their political hatchery.

The

Government senators therefore consider it important to provide a backdrop of

what has been achieved since 1996 prior to considering what programs can

usefully be enhanced to give some of the more marginalised people a greater

opportunity.

While

the current system works well for most people, at no stage are we, or the

Government, saying that everything that can be done has been done. Far from

it. Dealing with the issue of poverty is much more than glib comments such as "By

1990 no child will live in poverty ".

The

provision of over 1.3 million new jobs, well distributed between full and part

time employment and between men and women, has resulted in a massive 30% fall

in the unemployment rate since 1996 – from 8.2% to 5.7%.

There

have been more real full-time jobs created in the last six months than there

was in the last 6 years of the previous Labor government. The benefits of this

have had a broad geographic impact; almost half (46%) of local government areas

now have unemployment rates lower than 5%, compared with just 16% when the

Howard Government came to office. Also, there is now only one labour market

region that has an unemployment rate over 10% as against 15 regions in 1996.

The

best national jobs strategy is the implementation of government policies which

ensure strong economic growth, including low inflation, low interest rates,

budget surpluses, a flexible workplace relations system and a tax system which

does not penalise entrepreneurial activity.

The

Government has paid back $66 billion of the Labor Government’s $96 billion

debt, freeing up $5 billion a year in interest alone for new and expanded

Government services.

Good

economic management is not accidental and good economic management is not

something that should be taken for granted. The gains that have been made in

employment opportunities, real wage increases, low interest rates and low

inflation (that benefit rich and poor alike) are all at risk if glib, fanciful

and unrealistic targets and programs are instituted.

It

must also be recognised that assisting people facing disadvantage is not just a

Commonwealth Government responsibility. It is a responsibility that must be

shared by all levels of government, by communities, by churches and other

altruistic bodies, by business, by families and by individuals. The

Commonwealth Government has however sought to support each of these important

components of our society. It acts in partnership with state and territory

governments on important issues such as disability and housing through

Commonwealth-State agreements.

It

also must be remembered that the Commonwealth collects the Goods and Services

Tax and pays the net value, in full, to the State and Territory governments.

The GST provides to the States and Territories $575 million more than they

would have received under the previous revenue sharing arrangements. By 2006

that figure will be $1.4 billion more and will continue to grow.

The

Government Senators believe that it is appropriate for government to take

responsibility for policies and to be accountable. Therefore, we cannot agree

that it would be either wise or necessary to adopt a recommendation (No. 95) of

the Labor Party to establish a statutory authority. This would only remove the

sense of responsibility of others, and the functions that such a body could

perform are already being undertaken.

The

worrying thing about such broad recommendations is that no government in the

world has ever accepted a figure on a poverty line as setting poverty targets

have no real benefit, they are a poor measure and are misleading and measuring

poverty through 'income' has found to be inaccurate. The United Kingdom

has spent over 12 months trying to come up with a definition of childhood

poverty and still hasn’t succeeded. There is ample evidence that the sort of

income poverty measures incorporated into these targets poorly measure the real

outcomes for people and that income based measures are based upon simplistic

assumptions that higher taxes and benefits will solve peoples' problems.

Ireland is often quoted as having set 'poverty targets' and

yet there is now extensive discussion in community organisations that these

'income poverty targets' have failed to deliver any real tangible benefit. Ironically, between 1994 and 2001, while low incomes rose strongly, Ireland's

relative income poverty levels increased from 15% to 22%, as median incomes

increased even more strongly.

Below

is a list of key indicators that demonstrate the gains that have been made and

ones on which the Government senators had hoped Labor would want to build.

Table 1: Key Indicators

3. Poverty

Concepts

of poverty have many dimensions. While some people conceive of it in terms of

income, others emphasise levels of consumption, while still others view it in

terms of outcomes – what actually happens.

Broader

concepts of poverty such as capabilities consider the question in terms that

encompass individual attributes, needs and resources – as well as the ability

of people to use these.

Research

has very clearly shown that when these concepts are measured, to the extent

they can be, there is at best little congruence between the approaches. For

example, a large group of the people who are seen to be in consumption poverty

are not the same as those who have been identified as being in income poverty.

Similarly, income poverty poorly identifies those people with the most adverse

outcomes. Not only does it describe as being in poverty many who show little

if any disadvantage, it defines many as not being in poverty despite the fact

they show much more adverse social outcomes than many of those identified as

being in poverty.

The

issue of income inequality in Australia also needs to be clarified. The Household, Income

and Labour Dynamics in Australia (HILDA) survey indicates that claims about the

inequality of income and wealth distribution can be misleading. Results of the

research show that wealthy households are generally middle-aged working

households who have been saving for many years, including building up

superannuation and other assets. The median wealth of a household headed by

someone in their 50s is around 10 times that of a household with someone in

their 20s.This is a reflection of lifecycle patterns in savings and

consumption.

Australia also has a high degree of income mobility; meaning

that people's income and their wealth change with time. The HILDA survey

found that by 2002, 60% of people on the lowest income scale had moved up out

of this income bracket.

Simple

measures not only give simple and misleading results, they encourage simple

'solutions'. That is not what the Howard Government is about. The Howard

Government wants long term, sustainable solutions that will benefit as many as

conceivably possible.

Getting

more people in jobs reduces the risk of poverty and welfare dependence amongst

families with children. Early intervention policies, including investment in

early childhood programs and support to youth facing critical lifecycle

transitions, and family support services, such as the Commonwealth Financial

Counselling Program and the Family Relationships Services Program, also reduce

the risk of poverty.

Research

conducted by the Department of Family and Community Services shows that young

people who grow up in households that rely on income support are significantly

more likely than other young people to receive income support themselves in

their late teens. Between the ages of 16 and 20 years, young people from income

support families were around three times more likely to be receiving income

support as young people from middle income families.

Overcoming

disadvantage, hardship and poverty is not as simple as giving people a few more

dollars in income support, yet this is what income poverty measures and the

Labor Party suggest solves the problem.

A

result of this is that adopting poverty benchmarks and targets, instead of

providing any guidance in how to reduce real problems and address causes,

simply encourages governments to pursue policies that reduce the target. Many

of the measures are also perverse.

Commonly-used

relative poverty measures can suggest that poverty is falling at times when

living standards of the poor are declining. They also suggest that higher

taxes on middle and higher income earners reduce poverty – regardless of what

happens to the incomes of the poor.

The

Government senators cannot accept a National Poverty Summit (Recommendation 94)

will achieve anything more than has been achieved with this committee.

The

Government Senators believe there is a need to avoid creating anymore talkfests

or occasions for grandstanding. The views and preferred approaches of different

interest groups in this field are already well known – including through the

inquiry. What is needed is a better understanding– especially of issues such as

multiple disadvantage, early intervention and welfare reform.

The

Government has been identified as doing many of these.

These

include:

- welfare reform consultations

- the funding of the HILDA report

and other Social Policy Research, and

- the funding and introduction of Australians

Working Together.

People

who call for a summit ignore the tremendous effort made by community and other

groups already, in their regular and important submissions to and consultations

with government.

4. Challenges

Persons with severe

hurdles to employment

International and Australian research

suggests that the most successful approaches to help people improve their

prospects of employment include those with incentives that ensure rewards from

working and participation requirements tailored to individual circumstances and

capacity. This is the basis for welfare reform and the Australians Working

Together package, including Personal Advisers and the Personal Support

Programme.

Table 2: Initiatives aimed at

encouraging participation by people of working-age

|

Initiative

|

Description

|

|

Personal Support Program

|

Provides support for people with major

non-vocational barriers to participation (implemented July 2002)

|

|

Transition

to Work program

|

Provides vocational assistance to

parents, mature age workers and indigenous job seekers who have been out of

the workforce (implemented July 2002)

|

|

Training Accounts

|

Funds training for indigenous and mature

age job seekers (implemented July 2002)

|

|

Training Credits

|

Funds training for job seekers who have

participated in Work for the Dole or Community Work (implemented

July 2002)

|

|

Passport to employment

|

Provides job search support services for

Work for the Dole or Community Work participants (implemented July 2002)

|

|

Centrelink Personal Advisers

|

Provides participation support for target

groups including parents, older workers and ‘at-risk’ claimants of Newstart

Allowance (implemented September 2002)

|

|

Better assessment of people with

disabilities

|

Provides better assessment services for

the purposes of assessing Support Pension and exemptions from the Newstart

Allowance activity test for reasons of temporary incapacity (implemented

September 2002)

|

|

Support for parents

|

- Provides additional child care places (implemented September 2002)

- Introduction of compulsory interviews where youngest child is aged

over 6 and participation requirements where youngest child is aged over 13

years (implemented September 2003)

|

|

Support for older workers

|

- Introduction of voluntary interviews for payments without

participation requirements, ie Mature Age, Partner and Widow Allowees

(implemented September 2002)

- Closing off of Mature Age and Partner Allowances to new customers

(September 2003)

- Introduction of compulsory annual interviews for Widow Allowance

recipients (September 2003)

- Introduction of a flexible activity test for NSA recipients aged over

50 (September 2003)

|

|

Working Credit

|

Provides incentives to part time work by

allowing people to keep more of their income support payment when they

receive wages (implemented September 2003)

|

|

Support for Indigenous People

|

- Introduction of Indigenous Employment Centres to provide Community

Development Employment Project participants with the skills and experience

they need to make the transition into the paid workforce

- Centrelink to progressively establish 12 new Remote Area Service

Centres located to service remote communities

- Research to assist remote communities to identify practical ways for

their members to contribute to their families and communities in return for

income support through Community Participation Agreements

|

|

Language, Literacy and Numeracy

Supplement

|

Assists with costs of attending training

courses (implemented September 2003)

|

|

Disability places

|

Extra $160 million for disability

employment services (implemented progressively from July 2003)

|

By

December 2003 more than 145 000 eligible clients accessed the services of some

750 Centrelink Personal Advisers, and more than 100 000 participation plans

have been put in place.

Almost

a third of income support recipients experience a common mental disorder (e.g.,

anxiety, depression, substance-use disorder) in any 12 month period, compared

to 18 per cent of the general Australian population. This figure is even

greater among some client segments, with almost half of all lone mothers on

welfare experiencing mental health problems. Further, these conditions are

associated with significant barriers to economic and social participation.

However,

most of those experiencing mental health problems do not seek help.

There

are a range of programs to help those with severe problems including:

- Disability Support Pension (DSP);

- Reconnect;

- Supported Accommodation Assistance

Program;

- Disability Employment Assistance; and

- Personal Support Program.

However,

recent research shows a worryingly high prevalence of less severe, but still

disabling, mental health problems among income support recipients, especially

lone mothers.

The

Government Senators note the Government is developing targeted interventions

for these, based on recommendations from the Centre for Mental Health

Research.

Training

does have an important role in improving hardship, but it is not a universal

panacea. Simply to call for more training ignores the wide range of different

approaches needed.

The

Government has adopted many strategies including work for the dole, access to

childcare, improving incentives and through personal advisors to ensure that

balance is right and meets individual’s needs. Work for the Dole has provided 40 000 man

years of valuable work experience, 15 000 community projects and 0.25 million

Australians contributing benefits to their communities and adding to their work

experience.

The Government, in 2003, has also almost doubled the number

of apprenticeships created compared with 1996.

International evidence from programs to

improve employability through education, training and subsidised work tends to

be mixed. Programs which are more employment–focused do improve employment

outcomes. Program outcomes vary, often depending on the individual’s

circumstances, including their level of disadvantage, skills, education and

training, and access to suitable labour markets.

There is evidence that community work

programs may deter some clients from continuing on unemployment payments,

instead inducing them to leave that payment rather than undertake the program.

Evidence also suggests some participants in the community work programs may

become ‘attached’ to the program and consequently reduce their likelihood of

gaining employment while on the program.

Recommendations:

The

Government Senators recommend that initiatives that assist the transition

from welfare to work continue to be developed and implemented. These

initiatives should include those that:

- address the hurdles confronted by the

unemployed

- improve job readiness

- address onsite and job-centred training

In

particular, the hurdles of language, literacy and numeracy should be

identified as priorities.

- Government initiatives should continue to be

evaluated and funding directed to those initiatives delivering outcomes for

those facing hurdles to employment.

Interaction between

minimum wage and labour demand

Under

this Government average weekly ordinary time earnings for a full-time adult

male are currently $993.30.

- this is a real increase of over

$145 per week since 1996

- a total growth of 17.1%

- and an annualised compound growth rate

of 2.1%.

For

women the rate of growth is even faster

- 18.8% over the period February 1996 to

November 2004

- an annualised growth rate of 2.2%.

These

growth rates are substantially above those recorded in earlier periods.

The

$145 per week increase in real earnings between February 1996 and November 2003

(a period of 7¾ years) compares with just a $45 per week gain in the 12½ years

from November 1983 to February 1996.

The

annual growth rate for males of 2.1% over the later period compares with just

0.5% for the period under Labor.

For

women the rates are 2.2% and 0.7% respectively.

Since

1998 ABS have produced living cost indexes which consider the impact of prices

on different groups in the community. These show that the impact has been

relatively uniform, and in particular that the experience of income support

recipients has been similar to that of the rest of the community.

Since

March 1998 the maximum single rate of age pension has increased by $36.40 a

fortnight more than it would have done under the previous tax system. The

effect of theses measures has been to increase the real rate of pension by more

than 7% above the CPI increase between March 2000 and September 2003. The

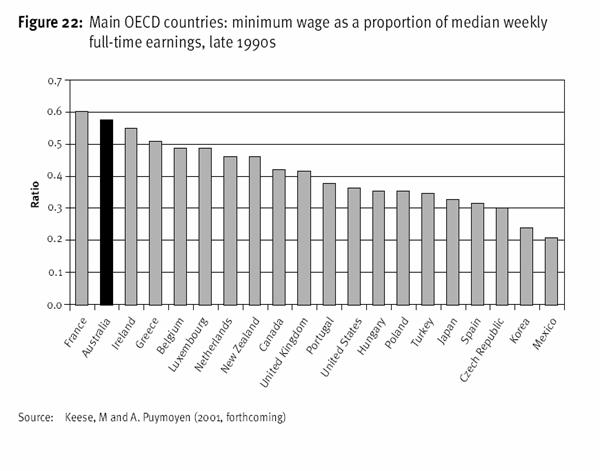

Australian minimum wage is amongst the highest in the world, both relative to

other earnings and in real terms. It has also grown substantially over recent

years.

A

high minimum wage minimises the risk of having a large body of working poor, it

ensures there are reasonable financial incentives to take a job and it gives

employers an incentive to maintain workers’ productivity by investing in them.

However,

it definitely makes entry or re-entry into the labour market more difficult for

some groups – especially the young unskilled. Employers will not take on

someone whose expected productivity is not high enough to justify the cost of

employing them. As no pay is clearly a bigger contributor to disadvantage in Australia

than low pay, unwarranted increases in minimum wages are likely to increase

rather than reduce the level of disadvantage in the community.

Low-wage

families with children have their wages supplemented by family payments. While

the current Federal Minimum Wage is around $431 per week, the net total income

of a minimum wage couple household that is renting, with a single income earner

and two children, is around $680 per week. - $130 to $250 a week above the

commonly used poverty lines for such a household.

Similarly,

for a single person, a full time minimum wage should put them some $70 to $150

a week above the usual poverty lines. Even where a person is employed

part-time, the interaction between income support and earnings is such that

they usually should be well above these poverty lines. Some minor exceptions

may arise to this for some youth in particular living circumstances working

short hours or at junior rates.

Despite

this some survey-based estimates talk of the ‘working poor’. Analysis of these

cases in the survey strongly suggests this reflects poor recording of income in

such surveys. These cases usually record implausibly low hourly rates of pay

(well below the minimum wage) or levels of family payments and income support

well below the rates for which such a household would be eligible. It should be

noted that much of the rhetoric around the working poor reflects the situation

in the United States of America. Attempts to draw parallels between low waged

employment in that country and in Australia are very misleading. For example, in the US the

minimum wage is $US5.15 an hour and excludes entitlements to leave. For a 40

hour week this gives a gross income of $US206 (less 10% tax), compared to their

official poverty line of $US178.

At

current exchange rates the Australian minimum wage is about $US340. In

contrast to Australia, where very few people (around 2%) are employed on

the minimum wage, large numbers of jobs are paid at this rate in the US.

For

most job seekers, unemployment is a transitory phase. However there are people

who, once they become unemployed, find it difficult to obtain suitable

employment. The social safety net performs a vital function as it provides

unemployed people with income and a variety of other support to help them meet

basic living expenses. It also provides a range of incentives and obligations

to help them actively participate in the community and so limit the amount of

time they need to be on income support. An appropriate balance of obligations,

assistance and incentives is essential for encouraging participation. This

needs to be supported by a fair but firm compliance regime with penalties for

non-compliance.

Table 3: Minimum Wages Internationally

Recommendations:

The

Government Senators recommend that we do not return to unnecessary

government intervention in the form of outdated labour market programmes,

which were proven to be unsuccessful in the 1970's and would be a

retrograde step to implement now.

The

Government continue to introduce further reforms, which increase labour

market flexibility while maintaining a safety net.

Asset rich and income

poor

The

Government Senators recognise that Australians may be in possession of large

assets without having a large income stream.

Income support payments are means tested to make sure

that they go to those in most need. People with substantial assets, apart from

the home in which they live, are generally expected to use these assets to

support themselves rather than rely on other taxpayers for support.

However,

the system has special provisions to help where this is not reasonably

feasible. There are hardship provisions that can allow assets to be

disregarded. Where this does not apply, the Pension Loans Scheme allows people

to effectively borrow against their assets for their lifetimes.

Further,

the Government also provides extra concessions for retiring rural people, such

as the foregone wages provisions, the aggregation rules, and concessions that

allow retiring farmers to hold their farm

in a trust so they can hand over the farm to the next generation without having

their pension affected.

Under

the assets test a pensioner’s home is exempt from the assets test. However,

where the home is on more than 2 hectares (5 acres), the value of the land

in excess of the 2 hectares (called curtilage) is included as an

assessable asset for the purpose of the assets test. Where the value of the

principal residence is in excess of allowable curtilage it is likely to affect

a person’s income support payment.

The Government Senators recognise some farmers, in

particular, may be under hardship. Special

hardship provisions exist that assist Australians who have assets that they are

unable to sell, are in the processes of selling, or which it would be

unreasonable for them to sell.

The

Government also assists rural young people through access to additional

benefits such as Rent Assistance and Fares Allowance.

Recommendations:

The Government evaluate the potential benefits and pitfalls of

easing the curtilage rules to assist mature-age Australians.

The Government Senators support the recent superannuation changes

including the introduction of market-based income stream products and the

Government’s co-contribution measures to assist those Australians on low-income

to save.

Participation

More

Australians are working than ever before - the proportion of the adult

population in paid work is at record highs (61% in January 2004). Both men and

women have increased their participation since 1996, although the increase has

been much stronger for women than men – a continuation of trends going back to

the 1960s. The growth in opportunity has also meant that those who work are

working longer hours.

However,

the decline in men’s labour force participation, and especially older men’s

participation, which was a feature of the decades leading up to the mid 1990s,

appears to have stopped and even reversed in the last ten years. While some of

this may be the fruits of strong economic growth, there is reason to hope that

the measures the government has taken to encourage older men to stay working

have begun to take effect – the employment rate of men aged 55-64 has risen

from 55% to 61% since 1996.

As

the Treasurer’s recently released Demographic Taskforce Paper

highlighted, the challenges of increased social spending as a result of an

ageing population need to be addressed. A 2% increase in participation of the

nation’s population in the workforce would result in a 9% increase in the

nation’s GDP. Labor's opposition to creating an environment whereby people

over the age of 55 can work longer if they choose (either part or full-time)

ignores the desire of those concerned and overlooks the possible poverty

impacts in later life. That, we believe, was what we were aiming to overcome.

Many

recommendations of the Majority Report involve simply greater expenditure on

new programs or existing ones. The Report as a whole is not a responsible

response in light of the Treasurer’s Demographic Taskforce paper.

Part

time hours are popular with working Australian women – 45% of them work less

than 30 hours per work. This is one of the highest proportions in the world.

The

evidence strongly suggests that most of those working part time do so because

they prefer to – it allows them to balance work, family responsibilities and

leisure. More people of all working age now have greater choice, and the Labor

Party (it would be hoped) would stop wanting to remove or belittle that choice.

Youth

(15-19 years) unemployment has fallen from a high of 29% in 1993 to 17%. This

is still too high, but it must be remembered that the unemployed are only about

9% of the 15-19 population – many of the rest are studying full time.

Issues

surrounding children who have to leave their homes because of parental violence

are complex and variable.

Under Youth Allowance, young people who

leave the parental home due to parental violence or abuse are treated as

independent as it is unreasonable for them to live at home. Specialist

assistance is offered by Centrelink Social Workers.

There

are also several special programs to help youth:

Reconnect

This

provides early intervention support for young people, aged between 12 and 18

years, who are homeless or at risk of homelessness, and their families. There

are 98 Reconnect services operating across Australia. In 2002-03 they helped 11,392 young people and their families.

Job Placement, Employment and Training Program (JPET)

JPET

offers ongoing support and referral services to young people overcoming a range

of problems, including housing, substance abuse, family difficulties, sexual or

other abuse, lack of self-esteem, reliance on income support, and other

barriers to employment, education or training. The program helps over 14,000

eligible young people each year.

Youth Activities Services (YAS)

The

Youth Activities Services Program supports young people (aged 11–16 years) and

their families to build self-reliance, strengthen family relationships and

encourage community involvement. The program provides after school activities

that are both creative and challenging and also have an aspect of positive peer

support. There are 91 YAS services currently operating.

Transition

to Work (TTW), which commenced on 1 July

2002, is a key component of assistance

for people returning to the workforce. The

primary objectives of TTW are to provide preparatory assistance that builds

self esteem, addresses confidence issues and improve individuals’ prospects of

obtaining paid employment through assessment, skills training, support and

advice on how to get into the jobs market. For some it will be the first step

in their return to paid employment.

Recommendations:

The

Government Senators recommend

a

continuing increased focus on participation (return from welfare to work,

increased mature age participation) and self-reliance to maximise economic

growth and minimise personal hardship.

a

review of the structural and cultural barriers to mature-age employment.

Breaching

The

Howard Government was extremely concerned about the Labor Government’s

breaching policy in which people had all benefits removed if they failed to

meet any of their activity requirements.

There was a need for a change that was fairer so the Howard

Government has done extensive work in this area in the quest to minimize

potential adverse impacts of breaching on vulnerable job seekers.

As a direct result of administrative improvements and policy

changes, breach numbers reduced by 30% in 2001-02, and 50% in 2002-03 and this

trend continues. Job seekers are now also given 14 days notice before a breach

penalty commences, compared to a ‘no

notice policy’ under Labor. This gives job

seekers more warning before they start to receive reduced payments and is one

of the recommendations from the Ombudsman's Review.

Recommendations:

That the Government continue to

implement initiatives that decrease the number of clients breaching while upholding

the principles mutual obligation and joint responsibility.

State and

Territory issues

The

States have a poor record on child protection issues, as a long succession of

scandals have indicated. There is little doubt that the justice and (Commonwealth-funded)

welfare systems are having to bear the burden of decades of inadequate

resourcing and poor management in this area. The neglect by the states of early

childhood intervention is one motive for the Australian government now

diverting funds to this.

A number of Australian Government initiatives recognise the costs

incurred by people with disabilities. Assistance includes:

- concessions linked to

the Pensioner Concession Card

- cash payments (e.g.

Mobility Allowance, Pharmaceutical Allowance)

- tax relief (e.g. the Medical Expenses

Offset);

The Government currently funds approximately 430

non-government organisations to provide employment assistance services to

people with disabilities nationally. The Government also funds Commonwealth

Rehabilitation Service Australia (CRS) to provide vocational rehabilitation

services nationally.

In 2002-03 a total of 64,639 people with

disabilities were assisted by disability

employment services at a cost of $303.7

million, and a further 35,892 were assisted by CRS Australia at a cost of $113

million. The Government also funds a range of employer incentive programs that

seek to encourage and assist employers to employ people with disabilities that

include wage subsidies, a workplace modifications scheme, the Supported Wages

System and a Disability Recruitment Coordinator function.

The

State and Territory Governments have responsibility for the planning, policy

setting and management of accommodation support for people with disabilities.

However, we understand the Australian government is very concerned for the

accommodation needs of people with disabilities. The Australian Government

provides substantial funds to states and territories towards meeting their

responsibilities, and the latest version of the Agreement includes strong

reporting requirements so that all parties – and people with disabilities and

their families – can satisfy themselves that state governments are doing the

right thing by people with disabilities. Bilateral agreements with each state

and territory include strategies to improve systems for balancing long-term

accommodation demand with other early intervention.

Poor

urban planning, public housing policy and transport infrastructure have created

pockets of disadvantage in the major capital cities and in some regional areas.

Once created, these ‘poor neighbourhoods’ are a difficult problem to remedy, as

they set up vicious circles of low aspirations, low education and low

employment.

Housing is primarily a State Government

responsibility to which the Commonwealth makes a contribution. Many of the

issues associated with the cost and availability of housing are local and

better addressed at that level. For the 2003 Commonwealth State Housing

Agreement (CSHA), the Australian Government is providing around $4.75 billion

over five years. About $3.72 billon of this will be provided as base funding

which is primarily used for public housing. This will allow five years of

fiscal certainty for States and Territories to provide housing assistance.

The CSHA assists around 400,000

households. The 2003 CSHA features indexation for the first time. Currently

around $1.9billion is provided per annum for Rent Assistance supporting around

940,000 families / individuals.

The development of the Government’s programs

for housing assistance, the CSHA, the Rent Assistance Program for the private

rental market, and support for home ownership through the First Home Owners

Grant scheme, have ensured that the broader issues of welfare and support

services, employment, the housing industry, taxation, and other national

objectives are being taken into account.

The most important element of the

government’s present strategy for homelessness is to develop people’s capacity,

especially through Personal Advisers and the welfare reform agenda. The

Australian Government response to homelessness is being coordinated under the

National Homelessness Strategy, which recognises that homeless people have many

different needs and therefore need a range of responses. The Strategy is underpinned

by Supported Accommodation Assistance Program and includes a number of targeted

initiatives, such as the Family Homelessness Prevention Pilots.

States

and Territories have promoted gambling as a source of revenue. Their revenue

from gambling has grown enormously since 1992. Given the issues of transparency

and reporting standards for gambling revenues and related programmes in the

states, it is difficult to ascertain precise information on State and Territory

expenditure on gambling support services.

Estimates of the amount

spent on problem gambling services as a proportion of total gambling revenue

range from .04% in WA to .49% in SA – neither of which is a substantial part of

the revenues raised through gambling activities. Spending levels on problem

gambling services do not reflect the growth in revenue from gambling or in the

numbers of people experiencing gambling problems.

Table 4: State Gambling Revenue

State

and Territory revenue from gambling has increased markedly over

the period 1992-93 to 2001-02.

- Victorian

revenue growth increased by a massive 200% from $581.3 million to $1.7 billion.

- In NSW,

revenue growth was 91% from $918.2 million to $1.7 billion.

- Queensland revenue growth was 162% from

$290.7 million to $763.4 million.

- South

Australia had a

similar revenue growth rate of 194% from $133.3 million to $392.4 million.

- WA revenue

growth was 63% from $173.5 million to $283.6 million.

- Tasmanian

revenue growth was 110% from $42.2 million to $88.6.

- ACT revenue

growth was 77% from $38.7 million to $68.5 million.

- NT revenue

growth was an enormous 270% from $13.3 million to $49.2 million.

The

Australian Government has led the way in addressing these problems. It has

already

- committed $8.4 million for research and

to raising public awareness of problem gambling

- established the Ministerial Council on

Gambling

Recommendations:

While

the Government Senators are not in the habit of making recommendations outside

their jurisdiction, they believe there are two issues that really require the

urgent attention of the States and Territories.

Housing

- That State Governments should

assist home buyers by reviewing their ever increasing stamp duty taxes on

houses as those increases virtually wipe out the benefit of the first home

buyer incentive.

Problem Gambling

- That State and Territory Governments

reduce their reliance on Gambling as a source of revenue and increase

investment in problem gambling programs.

Credit

card and social disadvantage

Across

the Australian community, the incidence of ongoing credit card debt is

surprisingly low. However, it is a problem for a minority of people - not all

of them low income. A recent study of ABS data found that having credit card

debt is only weakly associated with measures of serious financial hardship.

Where such debt and hardship are found together, the household is often found

to be suffering serious cash flow problems that indicate poor financial

management of limited resources. In contrast, many elderly households are found

to have low incomes but are yet living quite comfortably.

This

suggests that financial education has an important role to play in reducing the

incidence of real poverty, and conversely that raising the cash incomes of the

poor may not be sufficient to lift them all out of hardship.

The

Government Senators support the development of the Government’s National

Consumer and Financial Literacy Taskforce and look forward to its

recommendations in August 2004.

Recommendations:

That the Government continue to

recognise the need for financial counselling as an effective initiative in

assisting Australians in moving from welfare to work, and to prevent them

accumulating unsustainable debt

Indigenous Australians

The

Australian Government has shown a commitment to working more closely with

Indigenous communities in establishing mutual obligation strategies and

developing sustainable partnerships. Policy development and program delivery

are engaging more directly with local Indigenous communities in the

identification of priorities, consideration of local needs, capacity,

participation and disadvantage. A significant example of participation is the

implementation of the Indigenous Community Coordination Pilots (ICCP), which

have been established in each State and Territory. ICCP is a Council of

Australian Governments (COAG) initiative and is based on the development of

partnerships between the local Indigenous communities, the Australian

Government and State/ Territory Governments. The extent of poor outcomes for

Indigenous Australians has been identified in the report to the Steering

Committee for the Review of Government Service Provision, titled “

Overcoming Indigenous Disadvantage: Key Indicators 2003”. This report

confirms that Indigenous Australians continue to experience marked and

widespread disadvantage. Indigenous Australian disadvantage is compounded by

the extensive diversity within the Indigenous community related to culture,

language, literacy, environment and regional isolation.

Recommendations:

The

Government continue to assist Indigenous Australians through initiatives which:

- identify hurdles to employment and

participation

- assist with the removal or overcoming of

those hurdles

- assist with the transition from welfare

to work

Senator Sue Knowles

(Deputy Chairman)

Liberal

Party, Western Australia

Senator Gary Humphries

Liberal

Party, Australian Capital Territory

Navigation: Previous Page | Contents | Next Page