Government Minority Report

Introduction

Terms of Reference

On 03 February 2010 the Senate referred the following matter

to the Senate Economics Committee for inquiry and report.

The purpose of the inquiry was to investigate and report on

the current circumstances of issues surrounding access of small businesses to

finance, including:

(a) the costs, terms and

conditions of finance and changes to lending policies and practices affecting

small businesses;

(b) the importance of reasonable access to funding to support small business

expansion and the sector's contribution to employment growth and economic

recovery;

(c) the state of competition in small business lending and the impact of the

Government's banking guarantees;

(d) opportunities and obstacles to other forms of financing, for example,

equity to support small business 'start ups', liquidity, growth and expansion;

(e) policies, practices and strategies to enhance access to small business

finance that exist in other countries; and

(f) any other related matters.

Members of this minority report note that the Government

recognises the important contribution small businesses make to national

prosperity and supporting jobs. During the onset of the global financial

crisis, most small businesses managed to maintain services and production while

retaining staff. Evidence suggested that hours of employees were reduced, but

there were relatively few retrenchments.

Nevertheless government members had many reports of

difficulties for small business in obtaining finance, even for rollovers of

existing loans for firms that had a good credit track record.

We note that the government supported small business in a

number of ways during the global financial crisis. This took a number of

different forms, including reducing financial pressures, providing up to date

information and taking measures to improve the availability of finance through

financial intermediaries.

The Government's support for small business

1 Availability of finance

The Government senators recognise that the Treasurer's announcement

in October 2009 of an extension to the Government's investment in Australian

residential mortgage-backed securities (RMBS), further supports banking

competition.

The Government directed the Australian Office of Financial

Management (AOFM) to provide a further $8 billion of support to new issuances

of high-quality RMBS.

In making this announcement, the Treasurer specified the

additional objective of supporting small businesses year. This was highlighted

in Treasury's submission to this inquiry:

"The extension to the RMBS program includes an

additional objective of supporting lending to small businesses. Consequently,

lenders who seek support under the RMBS program are encouraged to outline how

active they are in lending to small business and to allocate part of the

proceeds raised under the program to lending to small business. This is one of

the factors that the AOFM assesses when deciding whether to support an RMBS deal.

To date, AOFM’s investment of just under $1 billion of the

additional $8 billion has allowed lenders to raise around $4.6 billion in

funds. Based on information provided by these lenders to the AOFM, it is

expected that over $400 million of these funds will be lent to small

businesses."[1]

CEO of smaller lender RESIMAC, Mr Warren McLeland, recently

advised the Government that its support for the RMBS market has "been

vital to permitting a continual flow of finance to the small business

community."[2]

Mr McLeland said that "without such support, there

would be literally thousands of Australian small business owners who would have

been deprived access to finance." He stated that this included a range of

small businesses like those in plumbing, paving, dry cleaning and restaurants.[3]

The company rate will be reduced to 29 per cent in 2013-14

and then cut it further to 28 per cent from the 2014-15 income year.

2 Small Business Tax Break

The Committee heard that the Government provided direct

assistance to small businesses through a special small business tax break.

Small businesses were able to claim an additional 50 per cent tax

deduction for eligible assets costing $1,000 or more, purchased between 13 December 2008 and the end of 2009, and installed before the end of 2010. The 50

per cent tax break was available to small businesses with an annual turnover of

less than $2 million.

This is supported by the Treasury's evidence given in their

submission to the inquiry: "The Commonwealth Coordinator General’s report

on the progress of the Economic Stimulus Plan to 31 December 2009 stated that

‘$2.4 billion in deductions have been claimed to date under the Small Business

and General Business Tax Break.’"[4]

The tax break provided small businesses with an ability to

invest in new capital items, such as computer hardware and business vehicles,

and to undertake capital improvements to existing machinery and equipment.

3 Tax adjustment to provide cash flow relief

during 2009-10

Maintaining cash flow is vital to the viability of small

businesses. To help boost cash flow, the Government reduced quarterly

pay-as-you-go (PAYG) instalments for small businesses during 2009-10.

This $720 million in cash flow relief for 2009-10 came on

top of the boost provided by the Government's discounted December 2008 quarter

PAYG instalment, giving a further benefit for small businesses in difficult

economic times.

4 Economic Stimulus Plan

Although an economy wide measure, small businesses benefited

significantly from the Government's $42 billion Nation Building – Economic

Stimulus Plan introduced to support jobs, build infrastructure and invest in

long-term economic growth. Around 70 per cent of the stimulus plan is

investment in nation-building infrastructure. Tradesmen, other independent

contractors and small business suppliers benefited from this investment in

local infrastructure.

5 Assistance from the Tax Office

As part of the May Budget, the

Government provided $100 million over four years to the Australian Tax Office

to assist small businesses and other taxpayers experiencing financial distress

to remain viable and in the tax system. To assist small businesses that are

having difficulty meeting their tax obligations, the Tax Office’s Small Business Assistance Program works with individual

small businesses to help them meet their obligations

In addition, small businesses with

short-term cash flow problems were permitted to have the due date of their

quarterly or annual tax activity statement payments (e.g. PAYG and GST

instalments) extended for up to two months.

6 Small business advice and support

The Government invested $42 million to enhance small

business advisory services. The service was provided through the existing

Business Enterprise Centres on matters such as developing business plans,

preparing applications for finance and cash flow.

The Small Business Support Line,

launched by the Government on 3 September 2009, provides initial advice to

small business owners and puts them in touch with specialist advisers on

matters such as obtaining finance, cash flow management, retail leasing,

diagnostic services, promotion and marketing advice, and personal

stress/hardship counselling. Support Line advisers link into the nationwide

network of Business Enterprise Centres and other small business advisory

services around Australia.

The existing Small Business Credit

Complaints clearing house has been integrated as part of the service. Issues

are referred to the Australian Bankers Association for a response.

Reserve Bank of Australia

We note the Reserve Bank of Australia’s submission to the

Committee:

“Lending to small businesses has been little changed over

2009, after growing steadily over prior years. The slowdown reflects both

reduced demand from small businesses and a general tightening in banks’ lending

standards. Small businesses in most industries have been able to access funding

throughout the financial crisis,

albeit on less favourable terms than previously.

Since late 2008, the interest rates on small business lending

have been below their averages over the past decade, as the large net reduction

in the cash rate has more than offset the increases in banks’ lending spreads.

Fees have risen, but for most businesses they are only a small part of the

overall cost of a loan.

Competition in the small business lending market has eased

from the strong levels just prior to the onset of the financial crisis, but should recover as the economy

continues to strengthen.”[5]

According to the RBA, "Small business borrowers have

faced lower loan-to-valuation ratios, stricter collateral requirements and

higher interest coverage ratios."[6]

This is consistent with Australia and the world experiencing

the worst global financial crisis in 50 years.

International Regulation

In asking questions of the National Australia Bank (NAB),

Senator Pratt raised the issue of the significance of international Basel II

Capital adequacy rules. She expressed her concern that these rules encourage

banks to favour residential mortgage lending over business lending. She sought

information as to how significant those rules are in the situation that small

businesses currently face.[7]

Mr Joseph Healy, Group Executive, Business Banking, NAB,

responded: “As I mentioned, Basel II makes it more attractive for banks to lend

for household mortgages than to business. If you look at the amount of lending

into the household sector over the last twelve months, as opposed to the

business sector, that will give you an answer to that question. I do not

believe it is necessarily a question of one or the other...”[8]

Reduced Competition

Senator Pratt expressed her concern in relation to the major

banks understanding the nature of farming businesses with the National

Farmers' Federation:

“Clearly the more the banking sector understands the nature

of farming businesses, the better it can be at lending. It does appear here

that we are risk of losing a specialist service, resulting in further

consolidation to the four big banks from the loss of expertise, and emphasis on

it at the ANZ.”[9]

In his opening statement, Mr Peter Anderson, Chief

Executive, Australian Chamber of Commerce and Industry, in his opening

statement before the committee commented: “It is also worth noting that just a

couple of weeks ago, on 8 April, the Australian Bankers Association, in

responding to a report by the Australia Institute, said in a public statement

that close to 60% of banking fees are not paid by households but by businesses

– in other words, we have seen, and our submission points to, the fattening of

margins by retail banks at the expense of small business lending. It is not

just margins in terms of repricing credit; it is margins in terms of a range of

other fees and costs imposed on customers.”[10]

This view was partly shared by Mr Steven Munchenberg, Chief

Executive Officer, Australian Bankers Association:

“...However, we are aware that there has been a number of

concerns expressed for some time now about both access to finance from the

banks but also the price that small businesses are paying for that finance. In

the large part we think these concerns are based in changes that banks have

reasonably and prudently made in their approach to lending through the course

of the global financial crisis,.....Nonetheless, the banks have stood by their

small business customers and, indeed, have picked up a lot of customers from

lenders who are no longer operating because of changes in credit markets.”[11]

Senator Hurley,

in raising the issue of competition between banks to Mr Jim Murphy, Executive

Director, Markets Group, Treasury. “..in terms of competition between

banks, is it the smaller banks or the smaller institutions that loan more

readily to small business or take the risks?”[12]

Mr Murphy in response stated:

“There are two aspects of that. One, the large majority of

funding for small business will come from the major banks. The second point is

that, yes, the fringe players – or non-banks or finance companies – have

traditionally lent to the riskier end of small business or the riskier end of

business. So to some extent both factors have worked against small business in

a downturn; whereas both factors will come back into play to assist small

business because all financial institutions are there to make a profit. So, as

the economy picks up, they will probably start lending more to small business –

this is the majors – and as well as that, drop the price of it, one would

hope. Also as the economy picks up, the smaller players will come more into

operation and become more available for lending to small business.”[13]

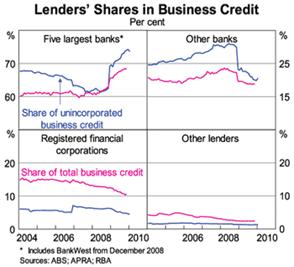

"As the economy strengthens, competition for business

lending is likely to pick up; there are already some signs of this in the

Reserve Bank’s liaison with medium and large sized businesses." (See graph

below) [14]

Mr Graham Johnson, General Manager, Industry Technical

Services, Supervisory Support Division of the Australian Prudential

Regulation Authority responded to whether or not small business is being

treated differently:

“I think there are two dimensions to that. One is the demand

for credit, particularly after the GFC. Having gone through a period of

economic stress like we had, from the evidence available to us, businesses as a

whole had less demand for credit. The large end of town, for example, was

raising equity and deleveraging, and the smaller end had a fall-off in their

approaches to the banks and other lenders for loans.

On the supply side, after something like the global financial

crisis, the increase in arrears rates and non-performing loans, the authorised

deposit-taking institutions and other lenders actually tightened up their

lending terms, as would be expected after something like the global financial crisis.

The ADIs did things like reducing the maximum loan they would give to

particular classes of borrower, they lowered maximum loan to valuation ratios,

had higher interest coverage ratios—those sorts of things—to tighten up their

terms, with more stringent covenants, and hence there was a drop-off in the

available supply. From that point of view, there were two elements—a demand

impact and a supply impact. I do not really know which one dominated.”[15]

In response to further questioning regarding the ease of

obtaining credit prior to the GFC, Mr Johnson responded:

“I think that is a fair characterisation. Prior to the GFC

the spreads on lending were probably the lowest they had been for the

statistics that had been collected. There had been 15 years of economic good

times, and non-performing loans were at historical lows. I think there was a

movement towards lending perhaps without the risk based pricing that should

have really been there just prior to the GFC hitting, and then there was the

correction after that. Our view is that probably we will not go back to the low

spreads that we saw just prior to the global financial crisis.”[16]

In response to a question from Senator Pratt concerning the

permanent tightening on lending based on authentic risk assessment, Mr Johnson

commented that:

“...lending conditions go through a cycle. They tighten when

things get like they have been. As things improve and the outlook gets better,

the loan to valuation ratios, maximum loan terms and those sorts of things will

probably move back to closer to what they were.”[17]

Recommendation from Majority Report

6.3 The Committee recommends that the Trade Practices Act be

amended to reinstate specific anti-price discrimination provision and inhibit

firms achieving market power through takeovers or abusing market power and that

‘market power’ be expressly defined to that it is less than market dominance

and does not require a firm to have unfettered power to set prices. A specific

market share, such as, for example, on third (set based on international

practice) could be presumed to confer market power unless there is strong

evidence to the contrary.

Discussion

This recommendation combines a number of issues that are

dealt with separately under the TPA; firstly whether a firm has market power

which it misuses, secondly whether a firm misuses this market power to price

discriminate in an anti-competitive way, and thirdly what role the TPA should

play in limiting takeovers which will result in market power.

While related, these concepts may be better addressed as

discrete but interconnected topics.

Abuse of market power

- Section 46 in its current form captures those circumstances which

the Committee’s draft recommendation appears to be targeted towards.

- Through amendments made to the TPA in 2007, section 46 currently

states that a firm can have a substantial degree of market power even where it

does not substantially control the market, and does not have absolute freedom

from constraint by the conduct of competitors, and that more than one

corporation may have a substantial degree of power in a market.

- It is unclear whether the Committee is recommending the

introduction of a trigger point, such as a predetermined market share, to

act as a threshold for investigation, or whether the Committee seeks to go

further than a trigger by recommending that a market share be determinative of

breaches of various provisions of the TPA.

- The ACCC already considers market share when determining whether

a corporation has a substantial degree of power in a market. It is not clear on

what basis the inclusion of a requirement to do so would alter the assessment

of possible breaches of section 46.

- There is a risk that the introduction of explicit consideration

of market share may reduce consideration given to other equally or more

important factors, and that it may reduce the consideration given to those

firms whose market share is below the threshold, despite the possibility that

even low market share firms may have market power.

- Market share as an indicator of market power will vary in each

market, for example it is possible a firm may have market power while having a

share of the market in the range of 15 per cent, and similarly, a firm may have

no market power despite having a share of the market greater than 50 per cent.

- It is also important to note that in addition to market share not

necessarily indicating market power, the existence of market power is not an

abuse by itself. The firm must take advantage of that power for a prohibited anti-competitive

purpose for a breach to occur.

Price discrimination

- In 1993, the Hilmer Committee recommended that section 49

(prohibiting price discrimination) of the TPA be repealed. This recommendation

was accepted and section 49 was repealed in 1995.

- The concern was that section 49 generally discouraged competitive

prices and so worked against economically efficient outcomes.

- The Hilmer Committee concluded that price discrimination

generally enhances economic efficiency, except in cases which might be dealt

with by section 45 (anti--competitive agreements) or section 46 (misuse of

market power).

- The Hilmer Committee's recommendation echoed the concerns of

previous inquiries, including the Swanson Review in 1976 and the Blunt Review

in 1979.

- The Blunt Committee’s terms of reference required it to explore

avenues for improvement of the market position of small businesses.

Notwithstanding this, it recommending a repeal of section 49.

- The Dawson Review (2003) supported the findings of the Hilmer

Committee and concluded that no changes should be made to the TPA in relation

to price discrimination.

- It noted that the US law governing price discrimination has been

widely criticised for being too complex, deterring price competition and

promoting price uniformity. While originally directed at large retailers, in

practice it has been applied mainly against small businesses who grant

discounts in order to compete against large sellers or those engaging in

vigorous competition.

- The Federal Trade Commission now only takes action against price

discrimination under the broader competition law.

Mergers

- The existing test already prevents the achievement of market

power through merger and acquisition takeovers as proposed in the draft

recommendation.

-

Section 50 of the TPA prohibits mergers or acquisitions that

would have the effect, or likely effect, of substantially lessening competition

(SLC) in an Australian market. The ACCC assesses each merger on its merits

according to the specific nature of the transaction, the industry and the

particular competitive impact likely to result in each case.

- The ACCC and other competition agencies consider market share as

just one part of their competition analysis in assessing the likely competition

effects of a proposed merger, while also taking into account numerous other

considerations such as the closeness of competition between the merger parties,

competition from imports, substitutes, the threat of competitive entry, the

presence of maverick firms, dynamic characteristics of the market,

countervailing power of customers, and vertical integration of the merged firm.

Focussing on market share to the exclusion of these other important factors may

obscure the true competition effects of a merger.

-

Australia’s SLC test for mergers is consistent with merger laws

in many other OECD countries including the US, Canada, UK and New Zealand.

Minority Senators' Recommendations

Recommendation 1

The government should continue to explore initiatives to support

small business by innovative measures that will assist their general financial

viability and facilitate their access to finance.

Recommendation 2

The government should continue to monitor banks’ behaviour towards

small businesses through its regulatory bodies. The government should also set

up its programs targeted to small business to allow for timely feedback on

financing and related issues, and ensure that the Minister for Small Business

has immediate access to this information.

Recommendation 3

The Government should consider an ongoing assessment of Basel II

capital adequacy rules, to ensure that capital requirements are commensurate

with real risk.

Senator Annette Hurley

Deputy Chair

Senator Louise Pratt

Senator Doug Cameron

Navigation: Previous Page | Contents | Next Page