Chapter 2

Background

2.1

This chapter provides background information on the electricity market

in Australia, including a snapshot of electricity consumption.

Electricity

2.2

Electricity is an essential resource for Australian households and

businesses. It provides the energy needed to power lights, heaters, air

conditioners, refrigerators, appliances and many more important machines.

2.3

Electricity is a form of energy produced by the flow of electrons along

a conductor. It is a secondary energy source as it is produced by the

conversion of other energy sources such as the chemical energy in coal, natural

gas and oil. Other primary sources of energy, like the sun and wind, are

increasingly being used to produce electricity.[1]

2.4

Electricity can be produced by either chemical means or mechanical

action. Electricity produced by chemical means relies on a flow of charged

particles from cells in a battery. This type of electricity production is

expensive and can meet only limited, specific requirements.[2]

2.5

Electricity generated by mechanical means requires large, powerful

magnets to spin rapidly inside coils of conducting wire driven by steam, gas or

water turbines. This is how many generators in modern power stations produce

electricity.[3]

2.6

Electrical energy cannot be stored (except in a limited number of

circumstances) and therefore its supply must match demand. If it does not, then

generation and transmission systems may become unstable and dangerous.

Electrical energy can be measured, and being measurable, can be bought and sold

according to the quantities delivered.

2.7

A unit of electrical energy is referred to as a watt (W). Electricity to

consumers is usually measured in kilowatt-hours (kWh) with one kilowatt-hour being

the amount of energy consumed by an appliance in one hour if it operates at a

power of one thousand watts.

2.8

Once electricity has been generated, it is transmitted to where it is

needed at near the speed of light though a sequence of specific events:

- A transformer converts the electricity produced at a generation

plant from low to high voltage to enable its efficient transport within the

high voltage transmission network.

- The energy then passes through a step down transformer to a lower

voltage line for supply into the wider distribution network.

-

The energy then travels along a distribution line to the point of

use. For domestic consumers, the energy undergoes a final reduction which

converts the electricity to a voltage compatible with household appliances.[4]

2.9

Electricity supply can therefore be thought of as having four key

components:

- Generation—power stations create electricity from sources such as

fossil fuels, hydro, wind and solar power.

- Transmission—electricity is transferred by high voltage power

lines from power stations to population centres.

- Distribution—electricity is sent by low voltage power lines from

specified high voltage distribution points to homes and business.

- Retail—electricity is sold to end users.

History of Australian electricity markets

2.10

Prior to the 1990s, electricity in Australia had been a utility provided

by state or territory governments. State government-owned utilities provided

all four components of electricity supply in each state (generation,

transmission, distribution and retail). [5]

Each state had its own separate electrical supply systems with only limited interconnection.

Individual state agencies were responsible for planning, developing,

commissioning and operating these electricity systems.[6]

2.11

Reviews by the Industry Commission and the Independent Committee of

Inquiry into a National Competition Policy for Australia (the Hilmer Inquiry)

in the early 1990s identified the significant benefits that were potentially

available from introducing competitive market arrangements for the trading of

electricity.[7]

2.12

In May 1996, New South Wales (NSW), Victoria, Queensland, South

Australia and the Australian Capital Territory (ACT) entered into an agreement

known as the National Electricity Market Legislation Agreement (NEMLA) under

which each of the participating jurisdictions agreed to enact a National

Electricity Law (NEL), with South Australia as the lead jurisdiction.[8]

2.13

Enactment of the NEL in each of these states ensured that all

significant electricity industry participants (such as generators, distributions

and retailers) were required to participate in a single electricity market—the National

Electricity Market (NEM).[9]

The regulatory arrangements established for the NEM were consistent with the reforms

taking place in national competition policy.

2.14

The NEM commenced operation on 13 December 1998.[10]

Each of the participating jurisdictions developed complementary reforms which

involved the separation of government-owned utilities and introduced

competition between the generators and, on a phased basis, between the

retailers.[11]

The establishment of the NEM also brought the monopoly network elements under

economic and access regulation to ensure open access at fair and reasonable

tariffs. Electricity generated in one state could now be transmitted and sold

to a retail customer in another state.

2.15

In 2004, the Commonwealth, state and territory governments replaced the

NEMLA with the Australian Energy Market Agreement (AEMA). This agreement sets

the ongoing agenda for a transition from standalone electricity systems to

national energy regulation. The AEMA also aims to '...promote the long term

interests of consumers with regard to the price, quality and reliability of

electricity and gas services'.[12]

2.16

Under the AEMA, the Standing Council on Energy and Resources (SCER)[13]

is the national energy policy and governance body for Australia's energy

markets. Membership of SCER comprises the federal, state and territory and New

Zealand energy and resources ministers, chaired by the Commonwealth Minister

for Resources and Energy.[14]

2.17

Western Australia and the Northern Territory were not included in the

development of the NEM, primarily because of their geographical distance from

the east coast. In 2006, a wholesale electricity market was established in the

South West Interconnected System (SWIS) in Western Australia.[15]

The National Electricity Market

2.18

The NEM is a wholesale market though which generators sell electricity in

Queensland, NSW, the ACT, Victoria, South Australia and Tasmania.

2.19

As mentioned above, the market commenced operation in December 1998 and

physically links five regions—Queensland, NSW (including the ACT), Victoria,

South Australia and Tasmania—by an interconnected transmission network

(Figure 2.1).[16]

Figure 2.1 Regions and networks in

the National Electricity Market[17]

2.20

The NEM is the most geographically dispersed electricity network in the

world.[18]

It stretches for more than 4000 kilometres from Port Douglas in the north of

Queensland to Port Lincoln in South Australia and via the Basslink undersea

cable between Victoria and Tasmania. The physical infrastructure encompasses

high powered transmission lines known as interconnectors, which carry

electricity between five regions (roughly created around state borders), and

transmission and distribution networks within each region.

2.21

The NEM has a registered capacity of 49 110 megawatts (MW).[19]

There are 305 registered generators in the NEM who service nine million

customers.[20]

2.22

Some assets that comprise the NEM's infrastructure are owned and

operated by state governments and some are owned and operated under private

business arrangements.[21]

Regulation

2.23

The Council of Australian Governments (COAG) is the peak

intergovernmental forum in Australia. Through it, SCER is responsible for

developing inter-jurisdictional policies related to the electricity and gas

markets. Beneath COAG and SCER, the Australian Energy Market Commission (AEMC),

Australian Energy Market Operator (AEMO) and Australian Energy Regulator (AER) have

responsibility for managing, operating and regulating the NEM (Figure 2.2).

Figure 2.2: Governance structure in

the National Electricity Market[22]

2.24

The NEM is established by the NEL under the National Electricity

(South Australia) Act 1996. The NEL is applied as law in each participating

jurisdiction of the NEM by application statutes.[23]

2.25

The National Electricity Rules (NER) govern the operation of the NEM.[24]

The rules have the force of law, and are made under the NEL.[25]

Australian Energy Market Operator

2.26

The NEM is managed and operated by AEMO. AEMO has had this function

since 1 July 2009 when operational responsibility was transferred from the

National Electricity Market Management Company (NEMMCO) which managed the

market prior to this date.[26]

2.27

The primary responsibility of AEMO is to balance the demand and supply

of electricity by dispatching the generation necessary to meet demand.[27]

In respect to the electricity market, AEMO is responsible for the management of

the NEM, pricing for network services, overseeing reliability and security,

directing generators to increase production during periods of supply shortfall,

and instructing load shedding to rebalance supply and demand to protect power

system operations.[28]

2.28

AEMO also has responsibility for national transmission planning in

eastern and southern Australia, electricity emergency management and

facilitation of full retail competition.[29]

2.29

AEMO operates on a cost recovery basis as a corporate entity limited by

guarantee under the Corporations Law.[30]

Its membership structure is split between government and industry (60 per cent

and 40 per cent, respectively). Government members of AEMO include the

governments of the Commonwealth, Queensland, NSW, Victoria, South Australia,

Tasmania and the ACT. Industry members comprise electricity generators, network

businesses and retailers.[31]

2.30

AEMO performs its functions under the NEL and NER. AEMO's functions are

prescribed in the NEL while procedures and processes for market operations,

power system security, network connection and access, pricing and national

transmission planning are all prescribed in the NER.

Australian Energy Regulator

2.31

The AER is the NEM regulator. It is an independent statutory authority

and a constituent part of the Australian Competition and Consumer Commission

(ACCC). The AER operates under the Competition and Consumer Act 2010.

2.32

The NER set out how the AER must regulate electricity and gas networks.

According to the rules, the AER is required to:

- set the prices charged for using energy networks (electricity

poles and wires and gas pipelines) to transport energy to customers;

- monitor wholesale electricity and gas markets to ensure suppliers

comply with the legislation and rules, and taking enforcement action where

necessary;

- publish information on energy markets; and

- assist the ACCC with energy-related issues arising under the

Competition and Consumer Act, including enforcement, mergers and

authorisations.[32]

2.33

The AER is also responsible for regulation of the retail electricity and

gas markets where jurisdictions have adopted the National Energy Retail Law

(South Australia) Act 2011. The National Energy Retail Law (NERL), together

with the National Energy Retail Rules (NERR), establishes the National Energy

Customer Framework (NECF).[33]

To date, only Tasmania and the ACT have applied the NECF.[34]

2.34

The AER board comprises one member nominated by the Commonwealth government

and two nominated by state and territory governments.[35]

Board members are appointed by the Governor-General for terms of up to five

years, and one of them is appointed as chair of the AER.

2.35

The AER is funded by the Commonwealth government with staff, resources

and facilities provided through the ACCC.

Australian Energy Market Commission

2.36

The AEMC was established in 2005 under the Australian Energy Market

Commission Establishment Act 2004 (South Australia). The AEMC is

responsible for developing the NER under the NEL and conducting independent

reviews of energy markets for SCER.[36]

2.37

Under the current statutory rule making process, the AEMC is required to

assess any proposed change to the NER against the National Electricity

Objective (NEO) and in doing so must 'follow an open and consultative process

to ensure decisions take account of the views of stakeholders'.[37]

Any individual or organisation, other than the AEMC, can propose a rule change.[38]

2.38

Once the AEMC makes a final determination on a proposed rule change, the

NER are amended. Separate government approval is not required for rule changes

to take effect.

2.39

In accordance with the provisions of the AEMC Establishment Act, two of

the three commissioners are appointed to the AEMC on the recommendation of the

participating state and territory jurisdictions; the other is appointed on the

recommendation of the Commonwealth government.

2.40

The AEMC is fully funded by state and territory governments based on an

agreed cost sharing arrangement.[39]

Western Australian and Northern Territory electricity markets

2.41

Western Australia's electricity market is divided into several distinct

systems: the SWIS, the North West Interconnected System (NWIS) and 29 isolated

regional power systems. The SWIS operates as a wholesale electricity market,

whilst the NWIS remains a fully vertically integrated system with one

state-owned corporation providing the transmission, distribution and retailing

of electricity.[40]

2.42

The SWIS includes Perth and extends from Albany in the south, to

Kalgoorlie in the east and to Kalbarri in the north (see Figure 2.3). The NWIS

services the communities of Dampier, Wickham, Pannawonica, Paraburdoo and Tom

Price through the Pilbara Iron Network and Port Hedland, South Hedland,

Karratha, Roebourne and Point Samson through the Horizon Power Network (Figure

2.3).[41]

Figure 2.3: The South West

Interconnected System (SWIS) and North West Interconnected System (NWIS)[42]

2.43

The electricity industry in the Northern Territory is small, reflecting the

territory's small population. There are three relatively small regulated

systems: Darwin-Katherine, Alice Springs and Tennant Creek. Given the scale of

the Northern Territory market, it has not been considered feasible to establish

a wholesale electricity spot market.[43]

Market reforms were undertaken in 2000 to phase in competition of electricity

supply and reduce the state government-owned Power and Water Corporation's

natural monopoly.[44]

South West Interconnected System

2.44

On 21 September 2006, the Wholesale Electricity Market (WEM) for the SWIS

commenced operation following a decision by the WA state government to reform

the state's electricity industry.[45]

The Western Power Corporation, which supplied electricity in the southern

region of Western Australia, was restructured into four separate corporations providing

generation, network infrastructure and retailing.[46]

2.45

The SWIS has a capacity of approximately 4500 MW and 46 registered

generators.[47]

The SWIS services approximately 980 000 customers.[48]

2.46

The WEM is run and operated by the Independent Market Operator (IMO) according

to the Wholesale Electricity Market Rules.[49]

2.47

A second body, System Management, is responsible for the physical

operation of the power system so as to ensure its secure and reliable operation.[50]

2.48

The Economic Regulation Authority (ERA) in Western Australia licences

electricity operators, including generators, distributors and retailers.[51]

The ERA also assesses the terms and conditions (including prices) offered by

owners of monopoly infrastructure to third parties in the electricity

industries. It interprets, applies and enforces the Electricity Networks Access

Code which governs the operation of these networks.[52]

Australia’s electricity generation and use[53]

2.49

The Bureau of Resources and Energy Economics (BREE) estimates that

Australia's overall energy consumption in 2010–11 was around 6000 petajoules.[54]

Over the past two decades Australia's energy consumption has increased at

around two per cent per annum, a slower rate than production, which has been

driven by global demand.

Generation

2.50

In 2010–11, approximately 250 000 gigawatt (GW) hours of electricity was

generated in Australia. Most of this electricity was produced using coal, which

accounted for almost 70 per cent of total electricity generation.[55]

2.51

Gas is Australia's second largest energy source for electricity

generation, accounting for 19 per cent of electricity generation in 2010–11.

2.52

Renewable energy sources accounted for around 10 per cent of electricity

generation in 2010–11. Of this generation, hydro accounted for 67 per cent,

wind 23 per cent, bioenergy 8 per cent and solar 3 per cent.[56]

2.53

In the five years to 2009–10 Australia's electricity generation capacity

has grown steadily from 45 GW to 54 GW. As a result of that and the relatively

constant output, capacity utilisation has fallen steadily from 56 to 49 per

cent.[57]

2.54

The majority of Australia's electricity generation is supplied by steam

plants, using coal or gas, with most of the black coal-fired generation

capacity in NSW and Queensland. The largest gas-fired generation capacity is

also in Queensland.[58]

The distribution of clean energy production facilities in

Australia reflects the climatic characteristics of different regions.

Hydroelectricity capacity in Australia is located mostly in New South Wales,

Tasmania, Queensland and Victoria; while wind farms are most abundant in South

Australia and Victoria. Almost all bagasse-powered energy facilities are

located in Queensland where sugarcane production is located. In contrast, there

is a more even distribution of biogas-powered facilities across Australia, as

these facilities are mostly based on gas generated from landfill and sewerage.[59]

Distribution

2.55

In 2008–09, the energy generated in the NEM was distributed among the

states as follows:

- NSW—38 per cent;

- Queensland—25 per cent;

- Victoria—25 per cent,

- South Australia—7 per cent, and

- Tasmania—5 per cent.[60]

Users

2.56

There were over 10 million electricity consumers in Australia in 2009–10.

The number of consumers has grown slightly over the past ten years, increasing

from 9.5 million consumers in 2005–06.[61]

2.57

Within the NEM, 88 per cent of consumers (by number) are residential,

and around 12 per cent are businesses. However, residential use accounts for

only 27.7 per cent of the electricity consumed, with the other major users

being:

- commercial—23 per cent;

- metals—18 per cent;

- aluminium smelting—11 per cent;

- manufacturing—9 per cent; and

- mining—9 per cent.[62]

Overview of Australian electricity prices

2.58

Australian household electricity prices remained relatively constant in

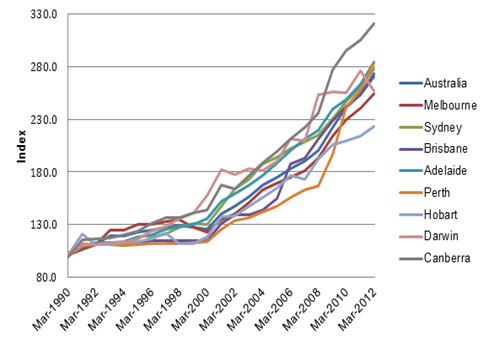

real terms between 1991 and 2007 (see Figure 2.4). From 2008 onwards, household

electricity prices have risen rapidly, with an average national rise of around

40 per cent in real terms over the last three years.[63]

2.59

Price increases have varied between states and territories, however, all

have experienced a significant rise in prices since 2007 (Figure 2.5).

2.60

The Australian Bureau of Statistics (ABS) reported that the proportion

of real household expenditure on energy is at the same level as a decade ago.[64]

Rather, it is the rapid increase that has occurred in recent years that is

causing consumer pain. This spike is due to a period of catch-up following

prolonged under-investment combined with increased reliability standards.

2.61

An update to the Garnaut Climate Change Review in March 2011 found that:

While the consumption of electricity makes up a relatively

small component of a typical household's expenditure, these price rises are

putting pressure on lower income households.[65]

Figure 2.4: Electricity price

indices for Australian households and businesses, 1981–2011[66]

Figure 2.5: Australian capital

cities electricity price indices[67]

2.62

According to BREE, average wholesale electricity prices in the NEM have

moderated since an increase in 2007 due to record average demand and drought

conditions.[68]

However, in contrast to wholesale prices, retail electricity prices have

increased sharply.[69]

Overseas comparison

2.63

BREE has calculated that, using a straight comparison of currency

exchange rates, Australian household electricity prices (cents per kilowatt

hour) in 2011 were higher than the Organisation for Economic Co-operation and

Development (OECD) average.[70]

2.64

BREE pointed out, however, that by using a more meaningful comparison of

purchasing power parity (what can actually be bought with money in different

currencies) shows that Australian household electricity prices are well below

the OECD average.[71]

Figure 2.4: Household electricity

prices in OECD economies, 2010[72]

|

Household electricity prices, (cents per kilowatt

hour)

|

Household electricity prices, (PPI measure)

|

|

|

|

Context of the inquiry

2.65

Electricity is an essential resource for almost all Australian

households and businesses. Rises in the cost of electricity impact significantly

on household budgets, increase the cost of living and increase the costs for

businesses to operate.

2.66

Over recent years the cost of electricity has increased substantially

with the average household electricity bill, excluding the cost of the carbon

price, going up by at least 48 per cent in the past four years.[73]

2.67

A number of government and independent reviews have taken place over the

last two years to identify the reasons for rises in electricity prices and to recommend

policy changes to address these increases (some of these reviews are listed in

the following section). At the end of 2012, the Commonwealth government is due

to release a Final Energy White Paper intended to establish a 'comprehensive

strategic policy framework to guide the further development of Australia's

energy sector'.[74]

2.68

Over the next few years, the AER will also embark on a new round of

determinations for electricity networks in the NEM.[75]

These determinations, which occur on a cycle of approximately every five years,

will allow the AER to scrutinise and regulate the amount of revenue for network

business in future years. These determinations are important to electricity

prices as network charges constitute a significant part of the cost of

electricity.

2.69

In a speech to the Energy Policy Institute of Australia on 7 August

2012, the Prime Minister, the Hon Julia Gillard, argued that the time was right

to 'get a plan in place to prevent unnecessary price rises in [the] future'.[76]

The Prime Minister stated that:

The inefficiencies that exist in the current system cannot be

ignored.

Even decisions made this year will reap benefits over several

years to come—so we must get on with the job now.

I want real decisions this year to guide price determinations

beginning next year.[77]

2.70

The Prime Minister advised that the December 2012 COAG meeting will consider

reforms to the Australian energy market.[78]

Reviews of the electricity market

2.71

In addition to this inquiry, there are a number of other reviews of the

electricity market currently underway or recently completed. These reviews

include:

- The Productivity Commission's investigation into opportunities to

benchmark electricity network businesses to improve efficiency and examine

interconnection investment.[79]

The inquiry commenced in January 2012, with a draft report released on 18

October 2012. The final report is expected to be handed down by April 2013.

- The AEMC's Transmission Frameworks Review is considering how

generation and transmission network investment and operating decisions could be

better aligned to deliver efficient outcomes.[80]

The AEMC's final report is to be delivered to SCER by 31 March 2013.[81]

- The AEMC's Power of Choice review is considering ways of

enabling consumers to have more control of their electricity use and ways to

manage electricity consumption through demand management in the NEM. A draft

report was released on 6 September 2012; final recommendations will be

presented to SCER on 16 November 2012.[82]

-

The AEMC's Review of the Distribution Reliability Outcomes and

Standards is assessing the balance between ensuring sufficient investment in

distribution networks to maintain reliability and pricing outcomes for

consumers.[83]

An issues paper for public consultation was published on 28 June 2012.[84]

A draft report on the merits of moving to a nationally consistent framework for

delivering and reporting on distribution reliability outcomes will be published

in November 2012.[85]

- The Australian Government's Final Energy White Paper which

reviews Australia's future energy needs to 2030 and defines a policy framework

to guide further development of the energy sector.[86]

The draft was released for public comment on 11 December 2011. Following a

period of public consultation the final white paper is to be released in late

2012.[87]

- The SCER Expert Panel Review of the Limited Merits Review Regime assessed

whether the appeals process against decisions made by the AER is providing an

appropriate balance between the competing interests of all stakeholders,

including consumers.[88]

The review commenced on 7 March 2012 and was completed on 30

September 2012.[89]

- On 31 May 2011 Update Paper 8 to the Garnaut Climate Change

Review was released. The update paper addressed developments across a range of

subjects including the electricity sector.[90]

2.72

At its meeting of 25 July 2012, COAG also requested that its Taskforce

on Competition and Regulatory Reform investigate and report to COAG in late

2012:

...any additional action required to deliver a regulatory

framework that promotes a competitive retail electricity market, including

appropriate support for vulnerable customers, and efficient investment.[91]

2.73

COAG has also expressed concern over 'recent substantial electricity

price increases arising from factors including increases in transmission and

distribution charges'.[92]

COAG requested that SCER, as the body with primary responsibility for energy

reform, 'focus current reviews of market regulation in the interconnected

market on achieving efficient future investment which does not result in undue

price pressures on consumers and business'.[93]

SCER will report to COAG at its December 2012 meeting and is expected to

offer a package of energy market reforms for consideration.[94]

Committee comment

2.74

In light of the numerous review processes currently underway or recently

completed, the upcoming round of network determinations by the AER and the

Commonwealth's anticipated policy blueprint for Australia's energy sector, the

committee notes there is presently a window of opportunity for reform to the

electricity market.

2.75

The committee believes that the timing of its inquiry is timely and an

opportunity to take advantage of the extensive work already done examining the

NEM. The committee has crafted its recommendations in a way it hopes is not

inconsistent with this work and expects, therefore, that its recommendations—together

with the inertia generated by the other reviews—will result in real and lasting

change to the electricity market for the benefit of Australian consumers.

Navigation: Previous Page | Contents | Next Page