Challenges facing the dairy industry

2.1

Despite being Australia's third largest agricultural industry, the dairy

industry faces a number of significant challenges which, if left unaddressed,

have the potential to threaten the long term viability of dairy production. The

industry is not homogenous and varies with distinct challenges across different

geographical regions. Challenges also arise due to the inherent and

interconnected relationships between farmers and end consumers. For many

farmers, the challenges they were already facing were exacerbated by the retrospective

price step‑downs of May 2016.

2.2

A perennial question voiced by stakeholders is why hasn't the Australian

dairy industry grown like its counterpart in New Zealand. A comparison of the two

industry structures is briefly undertaken in this chapter.

Overview of Australia's dairy industry

2.3

The dairy industry in Australia is a $13.7 billion farm, manufacturing

and export industry.[1]

With a farm gate value alone of $4.5 billion, the Australian dairy industry is

Australia's third largest agricultural industry behind beef and wheat.

2.4

Australia's dairy industry consists of around 6000 dairy farms which

produce approximately 9.5 billion litres of milk a year. The industry is

estimated to directly employ approximately 39 000 people on farms and in

factories, while more than 100 000 Australians rely on dairy for their

livelihoods, including vets, scientists, mechanics, financial advisers and feed

suppliers. Approximately 98 per cent of dairy farms are family-owned

businesses.[2]

Increased productivity and farm

debt

2.5

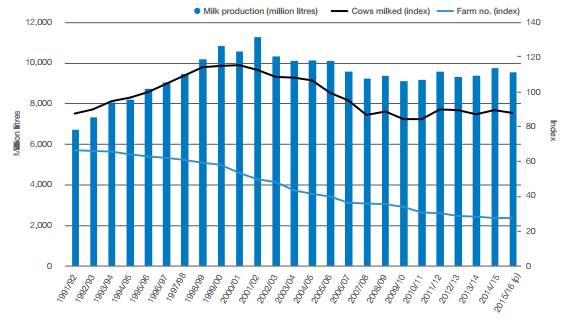

Since deregulation of the industry in 2000, production has remained

relatively stable as herd sizes increased while the number of farms decreased.

The average herd size has increased from 168 head per farm in June 2000 to 273

head per farm in June 2016, while the number of farms halved from almost

13 000 to just over 6000 in the same period (Figure 2.1).[3]

Productivity increases, arising from more efficient practices and the closure

of farms in less productive regions, have resulted in relatively stable

production volumes for the industry overall.

2.6

While Australian dairy farmers' productivity has consistently improved

since deregulation, the price they receive at the farm gate is generally much

less than their international counterparts, particularly northern hemisphere

farmers who are subsidised. That said, their return, on average, has been

higher that New Zealand farmers.

2.7

Murray Goulburn noted that the structural adjustment which increased

productivity was associated with industry deregulation:

The removal of incentives for over-production in 2000

encouraged dairy farms to become more productive (to ensure viability in the

absence of government assistance). In some cases, the land, capital and labour

previously used in dairy farming was reallocated to more productive uses. These

developments have led to fewer, but larger and more productive, dairy farms in

Australia.[4]

Figure

2.1: Australian milk production versus indices of farms and cows milked

Source:

Dairy Australia, Australian Dairy Industry In Focus 2016, p. 13.

2.8

Average farm debt has also increased from $346 000 in 2000 to

$861 500 in 2015 in real terms, reflecting increased farm size and the

exit of smaller farms. Greater levels of borrowing have made many farmers more

vulnerable to exceptional circumstances, such as drought and floods, and variations

in farm gate milk prices.

Increased domestic demand

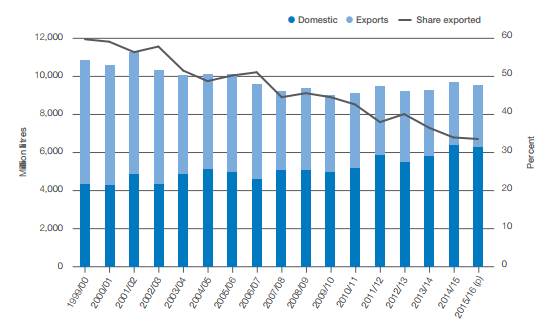

2.9

Domestic demand for dairy products remains strong with population growth

and per capita milk consumption both contributing to increased dairy

consumption. Dairy Australia notes that 'in 2015–16, 25 per cent of Australia's

milk production was used for drinking milk compared to 18 per cent in 2001–02'.[5]

2.10

As a result, the share of dairy production devoted to export markets has

decreased from 56 per cent in June 2000 to 34 per cent in June 2016 (Figure 2.2).

Figure 2.2: Australian milk consumption and exports

(milk equivalents)

Source:

Dairy Australia, Australian Dairy Industry In Focus 2016, p. 19.

2.11

However, international prices for dairy commodities influence farm gate

milk prices as import barriers to the Australian market are low:

Australian dairy manufacturers will generally not sell into

the domestic market at a lower price than can be obtained in export markets,

and competition amongst domestic manufacturers and from imports (noting import

barriers such as tariffs are low) will ensure that domestic consumers do not

pay more than the world price (notwithstanding there will be some divergence in

prices due to quality differences).[6]

2.12

This view was shared by Murray Goulburn which noted that:

The domestic Australian market is also exceptionally competitive

with international dairy groups also able access this market via free trade

agreements.[7]

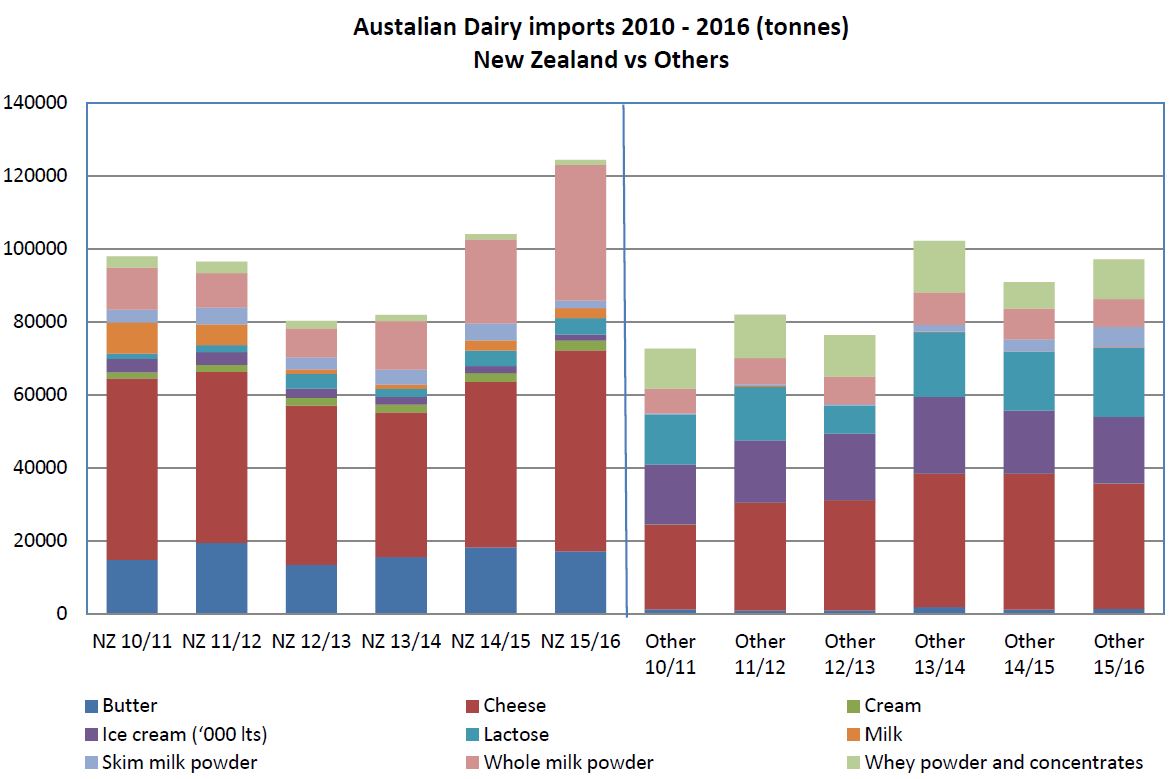

2.13

Australia is a significant importer of dairy products, particularly

cheese, butter and whole milk powder from New Zealand and cheese, ice-cream and

lactose from other countries (Figure 2.3).[8]

The importation of dairy products increases the competitive pressure on the

domestic production of manufactured products and provides an alternative avenue

for retailers and food processors to source dairy products.

Figure 2.3: Australian dairy imports

Data sources: Dairy Australia, Australian Dairy

Industry In Focus: Volumes 2012–2016.

Recent challenges

2.14

It is fair to say that the Australian dairy industry has faced a number

of challenges both domestically and internationally in the last few years.

2.15

Globally, the dairy industry has been impacted by oversupply arising

from increased production in Europe, the United States and New Zealand, and

constrained demand from Russian trade bans and an economic slowdown in China.

As the world's fourth largest exporter, lower international prices have flowed

through to processor margins and farm gate milk prices.

2.16

Domestically, weather events and increased input costs have provided

challenging conditions for many farmers, resulting in tighter margins, lower

on-farm investment and reduced confidence. According to Dairy Australia:

The increased level of market and margin volatility within

the industry in the last five to six years has served to undermine confidence

in the outlook for many farmers who are seeking reliable returns on which to

build a longer term future.[9]

2.17

These challenges have affected some dairy regions disproportionately,

particularly those farmers in the Southern Milk Region where retrospective

price step‑downs by Murray Goulburn and Fonterra in April and May 2016

significantly reduced incomes in the 2015–16 season.

2.18

Despite the recent challenges faced by the industry, some stakeholders

were positive about the future.[10]

For example, Australian Dairy Farmers submitted:

While the dairy industry has been under intense pressure, we

are also an industry that has the know-how and resilience to overcome adversity

and thrive in the long term.[11]

2.19

The Department of Agriculture and Water Resources expressed similar

sentiments:

Despite the current challenging operating environment for the

sector, industry fundamentals are sound and long-term prospects remain good.

This is evidenced by continuing capital investment aimed at improving on-farm

efficiencies, greater value-adding in the processing sector to take advantage

of increasing export opportunities arising from Australia's free trade

agreements.[12]

2.20

There also appear to be opportunities in the domestic market and, if

recent trends continue, it is likely that domestic dairy consumption may

outstrip domestic supply in the next decade or so. This situation may provide

an impetus for processors and retailers to reconsider how best to meet future

demand in an environment of increasing population and greater per capita dairy

consumption.

Regional differences in production matter

2.21

The dairy industry is one of Australia's leading rural industries in

terms of adding value through downstream processing. Much of this processing

occurs close to farming areas thereby generating economic activity in many regional

towns.[13]

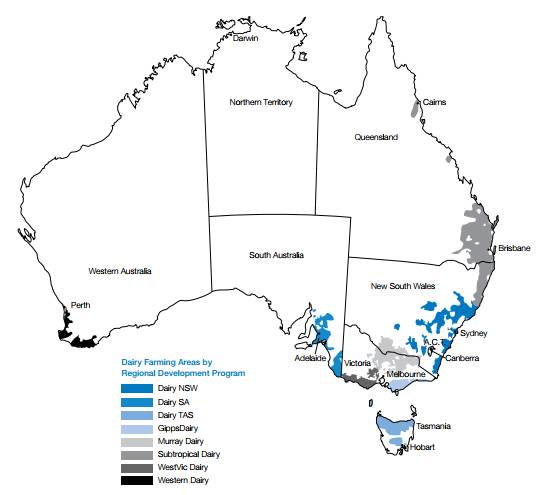

2.22

While there are eight dairy regions in Australia, it is useful to split

these regions into two distinct groups to understand the main differences in

production (Figure 2.4). The Southern Milk Region—comprising Victoria,

Tasmania, South Australia and southern New South Wales—produce the majority of Australia's

milk and production varies by season. The other dairy regions of central and northern

New South Wales, Queensland and Western Australia, predominantly supply fresh

milk to the domestic market and have more stable production profiles to meet

processor requirements.

Figure 2.4: Australia's dairy regions

Source: Dairy Australia, Australian Dairy In Focus

2016, p. 36.

2.23

Although milk is produced in all states, the majority of milk

production is concentrated in the Southern Milk Region. Indeed, Victoria

produces over 60 per cent of all milk by value, has 57 per cent of the dairy

farms and 65 per cent of dairy cattle. Compared to the rest of the country, the

Southern Milk Region is more climatically favourable for dairy farming as it

receives sufficient rainfall for pasture growth which, along with grain,

comprises the critical feed input for dairy farming.[14]

Seasonal differences and variations

in milk production across regions

2.24

Milk output varies with seasonal conditions and is dependent on when

calving takes place. This normally occurs in spring when pasture is most

abundant and is referred to as 'seasonal production'.[15]

The Australian dairy industry is strongly seasonal, which allows it to be

predominantly pasture-based. Approximately 60 to 65 per cent of cattle

feed requirements comes from pasture feed and this results in efficient,

high-quality milk production.[16]

2.25

In the Southern Milk Region where seasonal production is most common,

milk production peaks in October, tapers off until late-Summer, and then

flattens out into the cooler winter months. The production of less perishable

dairy products, such as cheese, milk powders and ice‑cream, in these

areas allows producers and manufacturers to maximise their large production of

raw milk within the seasonal cycle.[17]

2.26

The other production system used is 'year round production', and is

mainly found in Western Australia, Queensland and northern New South Wales.

Year round production is when calving is distributed throughout the year to

achieve a more reliable supply of raw milk. Producing milk to meet the

consistent daily demand throughout the year is challenging, given the normal seasonal

variation in the production cycle. As such, requirements by processors for

farmers to have flat production systems to match fresh milk market profiles adds

to farm cost structures and risks, resulting in higher costs of production.[18]

Relationships with processors are also important

2.27

The Australian dairy processing sector includes farmer‑owned co‑operatives,

public, private and multinational companies. Farmer‑owned co‑operatives

were once dominant in the industry; however, only two remain—Murray Goulburn

and Norco—and process around 40 per cent of milk production.[19]

While Murray Goulburn is the market leader, the next four largest processors

are all foreign‑owned or controlled—Fonterra (New Zealand); Parmalat

(France); Lion Dairy and Drinks (Japan); and Warrnambool Cheese and Butter (Saputo,

Canada). In 2015–16, the five largest processors accounted for 79 per cent of

volume nationally.[20]

2.28

As there has been no growth in milk production over the last decade,

there has been limited investment to increase processing capacity. While some

processors have invested in the development of new product lines, such as

Murray Goulburn's establishment of fresh milk processing capacity in Laverton,

others have closed or sold off production facilities which were not profitable

and/or did not fit with their business objectives.

2.29

Processors make operational and investment decisions about how best to

add value to raw milk which reflect expectations about projected market demand

and existing capacity in other processors. However, these decisions lock

processors into particular product mixes whereby the prices for these products

are subject to market forces. Decisions made by processors on the size of

facilities, scale of operations and asset utilisation rates depend on the

volume and seasonal variability of milk supply. These factors also affect the

cost and competitiveness of dairy processing.[21]

2.30

In addition, market dominance by a small number of large processors has

the potential to reduce options for farmers, particularly as processing

facilities must be located relatively close to farms. Following the retrospective

price step-downs in April and May 2016, for example, many farmers found that

they could not find alternative processors willing to take their milk.

Similarly, a small number of farmers in Western Australia were forced to exit

the dairy industry when none of the three processors in that region were

willing to take them on.

2.31

That said, many processors consider that competition for raw milk is

robust, particularly in the Southern Milk Region. Bega Cheese noted that:

When considering the market environment the Australian dairy

industry operates in, it is notable that it is one of the most competitive in

the world with a wide range of dairy manufacturers competing for both market

share and milk supply.[22]

2.32

Fonterra also noted that the Southern Milk Region is highly competitive,

with processors competing for supply to fill their factories and setting milk

prices at levels similar to that of their competitors.[23]

Interdependencies between

processors and farmers are strong

2.33

The interdependency between processors and farmers are more important in

the dairy industry than most other agricultural industries. Australian Dairy

Farmers noted that:

Collaboration is the key to get use where we need to be. Our

industry relies on all the elements to operate efficiently. Farmers need

processors and vice versa—so the solutions require all stakeholders to come

together to ensure a positive future.[24]

2.34

While there is no doubt that collaboration is important, it does appear

that the interdependencies between processors and farmers, and retailers and

processors, have resulted in power being concentrated in the hands of

processors and retailers. To many stakeholders, addressing the imbalance of

power between retailers, processors and farmers is of central importance to

ensuring the sustainability and viability of the dairy industry in Australia.

For example, WA Farmers commented that:

Due to the very nature of dairy products being fresh and

perishable, farmers are in a perilous situation as the milk they produce must

be collected on a daily basis. As a result, dairy farmers have very limited

market power. Unlike farmers that produce commodities like wheat which can be

stored until more favourable market conditions prevail.[25]

2.35

Similarly, Mr Nigel Hicks submitted that:

...processors and retailers have used market power to impact on

farm gate prices and deliver returns to their shareholders. This is normal

business practice and an obligation of the directors of these companies to do

so. It also highlights that there is money to be made from the dairy industry

but that there is an imbalance in the distribution of the income generated.[26]

2.36

Issues related to power imbalances within the dairy industry and the

effect it has on farm gate milk prices is considered in more detail in chapter

3.

Comparison with the New Zealand dairy industry

2.37

Many parallels have been drawn between the Australian and New Zealand

dairy industries, with some stakeholders questioning why the Australian dairy

industry has effectively stalled over the last decade while output in New

Zealand has almost doubled. Many of these stakeholders have advocated for

Australia to emulate the so-called New Zealand dairy model by creating a

'national champion' dairy product manufacturer.

2.38

The Productivity Commission (PC) examined this issue in detail in the 2014

report, Relative Costs of Doing Business in Australia: Dairy Product

Manufacturing, and concluded:

...it is overly optimistic to attribute New Zealand's dairy

export performance primarily to the formation of Fonterra, let alone to use this

experience to drive policy decisions in Australia. While the formation of

Fonterra may well have assisted—at least in part—New Zealand's recent success

on global dairy market, it is also the case that—relative to Australia—the New

Zealand dairy industry has benefited from a number of significant advantages

over this period including:

-

a free trade agreement with China,

which has provided New Zealand dairy with significantly improved access to the

Chinese market...

-

the absence of drought compared

with Australia, which has experienced severe drought in 2002–03 and 2006–07

-

a lower-valued currency...

-

competition for land, labour and

expertise amongst domestic industries was—more than likely—less intense in New

Zealand than in Australia over recent years. While the resources investment

boom in Australia drew resources away from dairy and toward higher returning

industries, relatively low returns to many non-dairy agricultural industries

(such as sheep and forestry) in New Zealand led to a high rate of land conversion

towards dairying.[27]

2.39

Bega Cheese also provided some useful context on the differences between

the dairy industries in each country:

The Australian dairy industry has evolved differently to the

industry in New Zealand which it is often compared to. While the New Zealand

dairy industry has a very small domestic market and is almost totally exposed

to international markets, the Australian industry is more balanced with a

little less than half of its production destined for international markets and

the remainder being sold in the Australian domestic market. The difference has

seen Australian based companies develop a strong focus on value added retail

and food service products and high value dairy ingredients. The benefit of

these strategies, and a more stable return in the Australian domestic market,

can be seen in generally a stronger price to farmers in Australia when compared

to New Zealand in periods where the global dairy commodity price in relative

terms is low. In times where global commodity prices are high generally the New

Zealand farm gate milk price out performs the Australian price.[28]

2.40

Indeed, Fonterra provided the committee with details of the farm gate

milk price it paid to its farmers in Australia and New Zealand. Table 1

illustrates that the New Zealand farm gate price is much more volatile

depending on global conditions.

Table 1: Fonterra milk price in Australia and New

Zealand since 2010

|

FY10 |

FY11 |

FY12 |

FY13 |

FY14 |

FY15 |

FY16 |

| Australia FMP (A$/kgMS) |

$4.50 |

$5.7 |

$5.45 |

$4.97 |

$6.95 |

$6.00 |

$5.13 |

| New Zealand FMP (NZ$/kgMS) |

$6.10 |

$7.60 |

$6.08 |

$5.84 |

$8.40 |

$4.40 |

$3.90 |

Source: Fonterra Co-operative, Submission 38,

p. 7.

2.41

There is no doubt the New Zealand dairy industry has expanded rapidly

while its Australian counterpart has remained relatively stable by comparison.

This has been assisted by the emergence of a dominant processor, Fonterra,

which has been able to optimise the investment in, and operating of, processing

facilities for a rapidly expanding industry. It has done this in a way that the

fragmented and privatised structure of the industry in Australia has not been

able to follow. Whereas productive land in New Zealand has been drawn into

dairy industry, many Australian dairy farms have been converted for other applications,

reflecting opportunities to use this land for more productive purposes. As a

result, it is not appropriate to make simple comparisons between the dairy

industries of Australia and New Zealand when there are more complex and often

subtle forces that explain the different trajectories between these

jurisdictions.

Navigation: Previous Page | Contents | Next Page