Chapter 6

Models of regulation

6.1

The previous Chapter determined that a single national regulator

should be established for Not-For-Profit Organisations in Australia. This

chapter determines the functions of such a regulator, based on the functions of

established regulatory bodies for non-for-profit organisations in England and Wales

and New Zealand.

The Regulator for Charity in England and Wales

6.2

A large number of submitters to this Inquiry commended the Charity

Commission in England and Wales (also colloquially referred to as the UK

Charity Commission) to the committee as an example of a regulator which is

working well in a number of areas and could be modified for adoption in Australia:

The Charity Commission in the UK is the best practice model. It

has as its focus the sustainability of the whole sector. It is the face of the

nonprofit sector and focuses on more than disclosure regimes.[1]

CSA points to the UK Charity Commission as one possible model

for such a specialist regulator.[2]

Australian regulation does not differentiate between social

enterprises and charities, failing to address the differences in their

operations. FIA recommends the consideration of a model of regulation that

recognises the difference between charities and social enterprises similar to

the UK model.[3]

Mission Australia recommends the establishment of a national

body that would regulate the charity sector, with a structure similar to the

regulatory bodies established in the UK and New Zealand.[4]

6.3

The Charity Commission for England and Wales was established by

law as both a regulator and a registrar for Charities. The aim of the

Commission is 'to provide the best possible regulation of these charities in

order to increase charities’ efficiency and effectiveness and public confidence

and trust in them'.[5]

The Commission notes that it fulfils the role by:

-

securing compliance with charity law, and dealing with abuse and

poor practice;

-

enabling charities to work better within an effective legal,

accounting and governance framework, keeping pace with developments in society,

the economy and the law; and

-

promoting sound governance and accountability.[6]

6.4

To achieve these aims, the Commission works in four ways. These

include:

-

Using information and advice to influence behaviour – the

Commission is responsible for gathering information on charities individually

and collectively, and making this information public.

-

Equipping charities to work better – this is done through

providing guidance and advice, visiting charities, requiring the modernisation

of the constitutions of existing charities and by registration processes (which

may include recognising new charitable purposes).

-

Promoting legal compliance through publications and casework.

-

Intervention and enforcement – the Commission evaluates

complaints of mismanagement or misconduct or investigates other evidence of

possible causes for concern. The Commission has powers to intervene in

charities to protect charity assets, which can be used if formal investigation

establishes serious mismanagement or abuse.[7]

6.5

In undertaking its work, the Commission follow seven principles,

which include: accountability; independence; proportionality; fairness;

consistency; diversity and equality; and transparency.

Register of Charities

6.6

In its role as Registrar of Charities, the Commission is

responsible for maintaining a Register of Charities. The Register records

details of organisations that:

-

have been recognised as charitable in law;

-

hold most of their assets in England and/or Wales;

-

have all or the majority of their trustees normally resident in England

and/or Wales, or

-

are companies incorporated in England or Wales.[8]

6.7

The Register is maintained online and is a searchable register

that provides a range of key facts and figures about the work and finances of

each charity. It records details about who is responsible for running the

charity and records whether they have complied with their reporting and

accounting responsibilities. Larger entities with an income in excess of £500,000

must also include a financial profile. Information for the Register is

collected from Annual Returns provided by Charities.

[9]

[9]

6.8

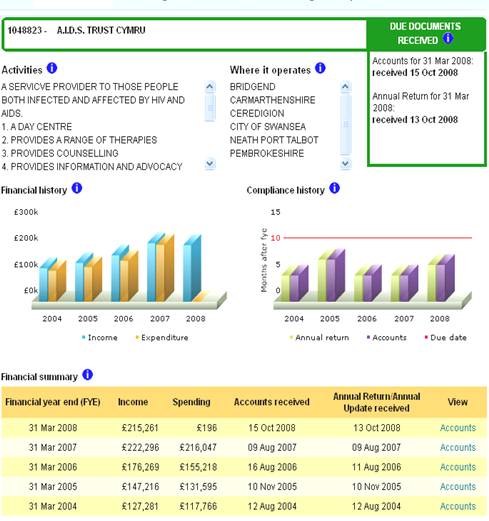

The above was retrieved from the Register. The search term 'AIDS'

was used which revealed that the Regulator monitors 13 AIDS-related charities

in England and Wales. The register of the first entry on the list, A.I.D.S.

Trust Cymru, is pictured. Each entry shows the registered number of the

charity, its activities, where it operates, a financial history, a compliance

history and a financial summary, with additional links to view the accounts of

the organisation.

6.9

The Register also serves a purpose for those wishing to find out

more about a charity in England or Wales, potentially to donate or offer

volunteer services. For example, a person living in Bridgend who wished to

donate to a local HIV charity could use the Register to locate A.I.D.S. Trust

Cymru. It is likely that this function could be expanded to include all

Not-For-Profit Organisations should a similar register operate in Australia.

New Zealand Charities Commission

6.10

The New Zealand Charities Commission was established by the Charities

Act 2005 and commenced operation on 1 July 2005. The Commission is an

Autonomous Crown Entity, which is a body that has been established by, or

under, an Act and is independent of Government, but which must have regard to

government policy when directed by the responsible Minister.[10]

6.11

In announcing its intention to establish a charities commission,

the New Zealand Government indicated that:

One of the key drivers for the Commission's establishment is the

desire to uphold public trust and confidence in the charitable sector by

increasing its accountability to donors, the public and the Government.[11]

6.12

The Charities Act 2005, which was passed by the New

Zealand Parliament in April 2005, specifies the functions of the Commission,

which include:

-

promoting public trust and confidence in the charitable sector;

-

encouraging and promoting the effective use of charitable

resources;

-

educating and assisting charities in relation to matters of good

governance and management though, for example, providing information to

charities about their rights, duties and obligations under the Act, issuing

guidelines or recommendations, and issuing model rules;

-

establishing and maintaining a registration and monitoring system

for charitable organisations;

-

monitoring and promoting compliance with the Act;

-

stimulating and promoting research about the charitable sector;

and

-

reporting and making recommendations to Government about

charitable sector matters.[12]

Registration and Monitoring

6.13

One of the Commission's primary functions is the registration and

monitoring of charities. The Charities Register commenced registrations on 1 February 2007 and charities had until 1 July 2008 to register.

6.14

Registering with the Charities Commission is voluntary and has no

bearing on the legal status of a charitable organisation. For example,

registration with the Charities Commission does not replace incorporation under

the Incorporated Societies Act 1908. Incorporated societies must,

however, still register with the Charities Commission if they want to gain or

maintain tax exempt status.

6.15

A charity that chooses not to register with the Commission may

still call itself a charity and solicit funds from the public, however unregistered

charities do not qualify for tax exempt status. Such organisations are also not

entitled to refer to themselves as a 'registered charitable entity'.[13]

Monitoring

6.16

All charities registered with the Charities Commission are

required to file an annual return, along with a copy of their financial

accounts (audited or unaudited). The Annual Return Form collects information

about the:

-

sector and region in which the charity operates;

-

activities undertaken by the charity and who benefits from those

activities; and

-

people involved in the charity, including number of employees and

volunteers.

6.17

The return also requires financial information relating to income

and expenditure, assets and liabilities, and equity, broken down into a number

of categories, including: membership fees; donations; grants; salaries and

wages; and investments. In addition to the annual return, registered

organisations are required to notify the Commission of changes to a charity's

name, address for service, balance date, rules, purposes or officers, within

specified timeframes.

6.18

Financial penalties may be applied to charities that do not file

Annual Returns in a timely fashion, and to organisations that fail to notify

the Commission of changes to the organisation.

Costs

6.19

Registration is provided free of charge, however organisations

are required to pay a fee for filing their annual return. In July 2008 the fee

was $50 if the return was filed electronically online and $75 if the annual

return was filed in paper form. Organisations would also face compliance costs

in ensuring that annual returns were correctly completed and filed on time.

An Australian Model

6.20

In addition to the endorsements for existing registers, the

Committee heard numerous suggestions for the functions of an Australian

register:

Its primary role shall be that of an enforcement authority with

supportive advisory role.[14]

Such a body would:

− set the format for the way that information is

reported;

− monitor organisational compliance, and

− act when organisations fail to comply with the regime

(ie by failing to supply information, or by supplying inadequate information).[15]

[W]e believe such a body should take on more of an advisory role

providing assistance and a level of accreditation of such organisations. These

could involve:

-

setting parameters and guidelines for best practice;

-

approving exemptions from reporting requirements as referred

to above;

-

assisting in the establishment of training programs; and

-

promoting the principals of good corporate governance.[16]

An Australian body should have a role to support charities to

understand and comply with their obligations in the first instance, as well as

enforcing standards and investigating breaches and complaints where they occur.[17]

6.21

In considering the possible functions of a national regulator in Australia,

the committee examined the functions of the existing regulator for indigenous

corporations operating in Australia.

Office of the Registrar of

Indigenous Corporations – An Australian Case Study

6.22

The Registrar of Indigenous Corporations is an independent

statutory office holder who is responsible for the administration of the Corporations

(Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act).

The Registrar has 'powers to intervene that are similar to those exercised by

the Australian Securities and Investments Commission (ASIC)'.[18]

The role of ORIC is to support the Registrar.

6.23

ORIC is an agency of the Department of Families and Housing,

Community Services and Indigenous Affairs. It is responsible for regulating

approximately 2,600 Indigenous corporations, including charities and

Not-For-Profit Organisations.

6.24

The key functions of the Registrar and ORIC are to:

-

administer the CATSI Act and maintain the register of Aboriginal

and Torres Strait Islander Corporations

-

regulate corporations which are registered under the CATSI Act

-

monitor the legislative compliance of corporations and assisting

corporations to maintain compliance

-

appoint special administrators when required

-

provide training for directors, members and key staff in good

corporate governance

-

advise individuals and groups on the registration process

-

register new corporations

-

assist corporations to transition from the ACA Act to the CATSI

Act

-

provide advice and information to corporations

-

assist with the resolution of disputes within and between

corporations.[19]

6.25

Like the Charity Commission in England and Wales, ORIC has a

enforcement function:

Under the CATSI Act the Registrar has the power to investigate

alleged corporate offences, to identify cases that are appropriate for referral

as a prosecution, and to refer these matters to the appropriate prosecution

agency. These investigation and referral powers enable the Registrar to respond

when alleged corporate offences come to light, further increasing the transparency

and security of Indigenous corporations for funding bodies and the broader

business sector.[20]

6.26

ORIC's system of regulation has not been comprehensively

evaluated to date. However, in its recent publication Overcoming Indigenous

Disadvantage: Key Indicators 2007, the Productivity Commission designated

ORIC's training program, and ORICs training partnership with the Victorian

state government and Swinburne University, as 'Things that work' in the field

of increasing governance capacity and skills.[21]

Committee View

6.27

The committee notes the aims, objectives and functions of the

national regulators in the UK and New Zealand. The committee is also aware that

neither system of regulation can be copied and implemented without change into Australia.

The two fundamental differences between an Australian regulator and the

overseas model are that:

-

Australia's Commission should regulate both charities and other

Not-For-Profit Organisations; and

-

All Not-For-Profit Organisations should be subject to the

regulator, regardless of size (appropriate disclosure regimes for organisations

based on size are discussed in Chapter 10).

6.28

However, the committee believes there is sufficient comparability

between the Australian and UK environment to propose certain functions of the Australian

national regulator. The committee has also had regard to the role of ORIC,

which is already operating successfully in Australia, in recommending the

following functions:

-

Develop and maintain a Register of all Not-For-Profit

Organisations in Australia. Once registered, the Commission should issue each

organisation with a unique identifying number or allow organisations with an ABN

to use that number as their Not-For-Profit identifier. This could be enabled

using existing ASIC website resources.

-

Undertake either an annual descriptive analysis of the

organisations that it regulates or provide the required information annually to

the ABS for collation and analysis. (Chapter 2 provides additional

justification for this function.)

-

Secure compliance with the relevant legislation.

-

Develop best practice standards for the operation of

Not-For-Profit Organisations.

-

Educate / Advise Not-For-Profit Organisations on best practice

standards.

-

Investigate complaints relating to the operations of the

organisations.

-

Educate the public about the role of Not-For-Profit

Organisations.

6.29

Under a single, national regulator, ORIC would cease to operate

as an entity. The new regulator would assume the responsibility of regulating

indigenous Not-For-Profit Organisations, allowing these organisations the same

access to the benefits that other Not-For-Profit Organisations are expected to

gain from the introduction of the national regulator (as identified in Chapters

7, 9 and 10).

6.30

The committee notes that requiring all Not-For-Profit

Organisations to register will have the added advantage of allowing for the

first time a comprehensive descriptive analysis of the Sector.

6.31

The committee also believes that the introduction of a single

national regulator will have extensive benefits for those operating

Not-For-Profit Organisations. It is anticipated that an Australian National

regulator would have an educative function, providing training courses, advice,

basic IT spreadsheet systems and help for those establishing Not-For-Profit Organisations

with a 'starter kit'. The regulator would also offer free help and advice for

organisations wishing to amalgamate with similar organisations.

6.32

The regulator would also assist organisations with sharing part

time staff, and providing details of pro bono lawyers and accountants if

required. This function would be especially helpful for Not-For-Profit

Organisations operating in rural and regional areas.

6.33

A national regulator would also give the general public a role in

monitoring the Sector. Any person could check that an organisation that fundraises

or doorknocks is a genuine, well regulated Not-For-Profit Organisation simply

by looking up that organisation on the Register. If an organisation does not

appear on the Register's website, indicating that it is not registered as

required, it could be reported to the regulator for further investigation and

possible prosecution.

6.34

To offset the cost of operations, larger Not-For-Profit

Organisations should pay a fee, as with the New Zealand Regulator. The committee

believes that micro Not-For-Profit Organisations should be exempt from this

fee. The payment of an annual fee may also serve as a reminder to organisations

with minimal reporting requirements under the regulator to ensure that their

details are current.

Recommendation 4

6.35

The committee recommends that the Australian National Regulator

for Not-For-Profit Organisations should have similar functions to regulators

overseas, and particularly in the UK, including a Register for Not-For-Profit

Organisations with a compulsory sign-up requirement. The committee recommends

consultation with the Sector to formulate the duties of the National Regulator.

6.36

As a minimum, the Regulator should:

-

Develop and maintain a Register of all Not-For-Profit

Organisations in Australia. Once registered, the Commission

should issue each organisation with a unique identifying number or allow

organisations with an ABN to use that number as their

Not-For-Profit identifier. This could be enabled using existing ASIC website

resources.

-

Develop and maintain an accessible, searchable public

interface.

-

Undertake either an annual descriptive analysis of the

organisations that it regulates or provide the required information annually to

the ABS for collation and analysis. (Chapter 2 provides additional

justification for this function.)

-

Secure compliance with the relevant legislation.

-

Develop best practice standards for the operation of

Not-For-Profit Organisations.

-

Educate / Advise Not-For-Profit Organisations on best

practice standards.

-

Investigate complaints relating to the operations of the

organisations.

-

Educate the public about the role of Not-For-Profit

Organisations.

6.37

The voluntary codes of conduct developed by ACFID and FIA

respectively should be considered by the Regulator when implementing its own

code of conduct.

Recommendation 5

6.38

The committee recommends that the Commonwealth Government develops

the legislation that will be required in order to establish a national

regulator for Australia.

Recommendation 6

6.39

The committee recommends that, once a Register is established and

populated, this information should be provided to the ABS, who should prepare

and publish a comprehensive study to provide government with a clearer

picture of the size and composition of the Third Sector.

Navigation: Previous Page | Contents | Next Page