Chapter 7

The effect of wind power on retail electricity

prices

7.1

The first term of reference for this inquiry directs the committee to

examine the effect of wind power on household power prices and the merits of

consumer subsidies for wind farm operators. Put another way, it asks the

committee to consider the impact of wind power generation on consumers'

electricity bills, and whether the Renewable Energy Target's (RET) assistance

to wind power in Australia is justified on public policy grounds.

7.2

Significantly, there is no publicly available Australian evidence on the

direct impact of wind power on retail electricity prices. There is limited information

on the impact of wind on the wholesale price, and information on the impact of

renewables on the retail price.

7.3

This chapter argues that isolating and analysing the impact of wind of

retail electricity prices is an area worthy of research. It is important for

the policy-makers, the energy sector and the public to know how different

renewable energy sources affect household power prices, and how the cross

subsidy through the RET from thermal power sources impacts on what households

pay.

Structure of the chapter

7.4

This chapter has four parts:

- The first looks at some preliminary issues that set the scene for later

discussion on the impact of subsidies on the wind industry, and of wind power

on household prices. The key questions are:

-

what proportion of total electricity generation comes from wind

power and how does this contribution compare with generation from renewable and

non-renewable sources;

-

what has been the trend in wind power generation—relative to

generation from other energy sources—over time; and

-

what is the marginal long-run cost of wind energy and how does

this compare with the costs incurred by other energy sources?

-

The second part looks at how the RET supports wind power and the impact

of the RET on wholesale and retail prices.

-

The third part of the chapter considers the impact of renewables, and

wind energy in particular, on retail prices.

-

The fourth part of this chapter considers the merit of consumer

subsidies for wind farm operators. What is the public policy case for assisting

wind companies through the RET? What is the case for reducing this assistance

after the cost of capital is recovered?

-

The final part of the chapter notes the long-term power purchase

agreements between power generators and retailers.

Wind power in the renewables market

7.5

To begin, it is useful to place the contribution of wind power in the

context of the renewable energy sector. Public policy in Australia has treated

renewables—wind, solar and hydro energy—as a block rather than tailoring

policies to particular industries. In 2013, wind power accounted for a little

over one-quarter of the energy generated by renewables in Australia.[1]

Figure 7.1—Electricity generation by renewable

energy source

7.6

The Clean Energy Australia Report found that for the 2013 calendar year,

renewables accounted for 14.76 per cent of all electricity generation in

Australia. The contribution of wind energy to total Australian energy

generation for the calendar year of 2013 was under four per cent.[2]

7.7

The Australian Energy Market Operator (AEMO) noted:

In the 2014-15 year to 1 April, wind generated 4.7% of

grid-connected NEM generation supply. As seen by the figure below, wind energy

has been growing rapidly, and is most concentrated in the South Australian

region of the NEM.[3]

Figure 7.2: Wind output as a percentage of regional output

Source: AER “State of the

Energy Market’ derived from AEMO data.

7.8

A spot check of the National Electricity Market (NEM) using

RenewEconomy.com.au found that at 3.10 pm on 27 May 2015, wind power in the

five eastern states was generating 1107 MW or 4.6 per cent of total power into

the NEM. This was 32 per cent of the power generated by renewables—wind, hydro,

large and small solar.[4]

7.9

However, as many submitters and witnesses to this inquiry have noted,

the input of wind into the NEM is highly variable. On 2 June 2015 at 4.25pm,

wind accounted for only 80 MWh in Tasmania, Victoria, South Australia and New

South Wales. (Queensland did not record any wind power generation and South

Australia recorded only 4 MWh). This represented only 0.3 per cent of total

electricity generation (26 266 MWhs) in the NEM at the time.[5]

7.10

One submitter to the inquiry quantified the contribution of wind power

to the grid for the whole of the 2014 calendar year. Mr Peter Bobroff

personally analysed the five minute data from AEMO for every day of 2014. He

found that:

-

coal fired generators dispatched between 'about 12 and 20

Gigawatts with an average of 16.6 GW';

-

gas fired generators dispatched between 'about 2 to 4 GW with an

average of 2.9 GW';

-

hydro generators dispatches 'about 1 to 3 GW with an average of

2.9 GW'; and

-

wind generators dispatched less than 3 GW with an average of 0.96

GW.

7.11

Mr Bobroff concluded:

...coal dominates the grid. It provides the base load power,

never less than 12GW. Gas and hydro provide the peak loads with their reliable

quick responses. Sometimes only a little peaking is required, but their rapid

responsive reserve is always needed for overall grid reliability. Wind, with

all it’s [sic] special privileges, has over 40% probability of producing almost

nothing.[6]

7.12

The committee asked AEMO to comment on the accuracy and reliability of

Mr Bobroff's analysis. It responded:

AEMO has reviewed this submission and a related blog. We have

not attempted to verify Mr Bobroff’s analysis, however the figures and

quantities appear reasonable and broadly consistent with our own reports.[7]

7.13

The Australian Energy Regulator commented in a 2014 report:

...almost 1200 megawatts (MW) of wind capacity have been added

in the past two years. Nationally, wind generators accounted for 6.3 per cent

of capacity and contributed 4.4 per cent of output in 2013–14. AEMO projected

wind generation will drive much of the growth in electricity generation over

the next 20 years.[8]

7.14

Figure 7.3 below, from the same report, shows that since 2005, wind

power is the only energy source to have annually increased the amount of power

that it puts into the NEM. Further, the report noted that as of June 2014, wind

power accounted for nearly 60 per cent of all major proposed generation

investment in Australia.[9]

Coal accounted for only 10.5 per cent.

Figure 7.3—Annual change in electricity generation

by energy source

Source: Australian Energy

Regulator, State of the Energy Market, 2014, p. 27.

The

Renewable Energy Target cross subsidy

7.15

In 2001, the Howard Government introduced the Mandatory Renewable Energy

Target. The goal of the MRET or RET as it is now known, was—and remains—to

promote additional electricity generation from renewable sources with the aim

of reducing greenhouse gas emissions in the electricity sector.[10]

7.16

The RET works by establishing a 'market' for renewable energy in the form

of renewable energy certificates. One certificate is issued for one MW of power

produced. The Clean Energy Regulator (CER) awards these certificates to

accredited generators of renewable electricity when these generators feed

renewable energy into the grid. Electricity retailers ('RET liable entities')

are then required to purchase a certain amount of certificates from the

generators and surrender them to the CER. The number of certificates that

retailers are required to buy is set annually by the CER based on projections

to meet the 2020 target. This is shown in Figure 7.4.

7.17

The certificate 'market' thereby creates an artificial demand for

renewable energy in preference to thermal energy sources. Under the RET,

renewable energy companies can invest and produce energy in the knowledge that

electricity retailers must purchase their product. Certainly, wind power

companies have created many millions of large scale generation certificates (LGC)

since the RET was introduced as Figures 7.5 and 7.6 show.[11]

LGC's obtain the lion's share of the certificate market.

7.18

Effectively, therefore, the RET is a cross subsidy to the renewables

sector. As the 2014 report into the Review of the RET stated:

The RET has been successful in promoting additional

generation from renewable sources, with renewable energy generation almost

doubling from 2001 to 2013. This reflects the considerable cross subsidy that

the RET delivers to owners of renewable energy power stations and small-scale

systems, estimated to be about $9.4 billion over the same period.[12]

7.19

The cost of investment in renewable energy is higher than investment in

thermal energy sources (coal and gas). This reflects the substantial cost of

building renewable energy infrastructure such as wind and solar farms. Energy

retailers pass the cost of the RET onto consumers through their retail prices.

7.20

Wind energy has been the main form of energy invested in due to the RET.

As AGL stated: 'most large scale projects under the RET to date have been wind

farms, and virtually all wind farm development in Australia has occurred as a

direct result of this scheme'.[13]

RECs make up more than half the revenue that a wind farm earns. The other

component is the wholesale price for electricity.[14]

Figure 7.4—Profile of annual targets under the RET[15]

Figure 7.5—LGCs created by fuel source, 2001–2013 [16]

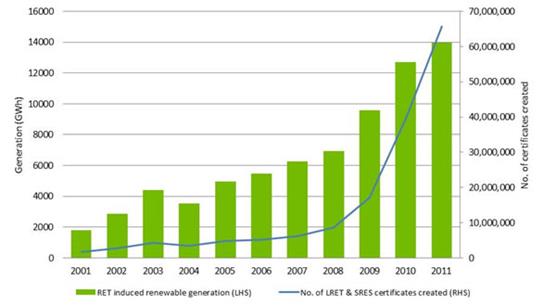

Figure 7.6—RET induced renewable generation and the

number of LRET Large-scale Renewable Energy Target (LRET) and Small-scale Renewable

Energy Scheme (SRES) certificates created[17]

REC prices

in the LGC market

7.21

The spot price for LGCs (minimum parcel of 5000 certificates) in the six

months from October 2014 to May 2015 is presented in Figure 7.7. Spot prices

for certificates have increased sharply since February 2015 to $50 in March

2015 and again in May 2015.

7.22

If the marginal cost for a wind farm company to produce 1 MWh of energy

is around $80, the RET at current prices offers a significant subsidy ($50 of

the $80). In other words, at current REC prices, wind companies have only to

raise $30 per MWh from the electricity itself.

7.23

The high REC price in the LGC market essentially reflects renewed

confidence in the RET. One of the main brokers, Green Energy Market, has noted

that the rising LGC REC price is an indicator of growing confidence that a

political deal would be done on the RET.[18]

7.24

Green Energy Market has noted that at the time the Warburton Review was

announced in early 2014, the spot price was around $32. It then fell to an

equal record low of $21 in June 2014. Green Energy Market attributed the sharp

rise in the spot price from June 2014 to the announcement by the Palmer United

Party that it would not support changes to the RET.[19]

Figure 7.7—Weekly LGC spot price, October 2014 to

May 2015

Source: Green Energy Markets http://greenmarkets.com.au/resources/lgc-market-prices

7.25

The steep rise in the price of the LGC will impact on the consumer as

retailers pass on the price.

The impact of the RET on wholesale and retail

electricity prices

7.26

In terms of the impact of the RET on wholesale and retail electricity

prices, there is a higher retail price from the requirement for retailers to

purchase RECs. Reflected in the cost of certificates is the higher

infrastructure cost of establishing energy from renewable sources.

The

wholesale market

7.27

In Australia, future energy generation is offered to the market by

generators to AEMO in five minute intervals. The bids of generators are then

accepted starting with the lowest cost generator and finishing with the highest

cost. This is called the 'merit order effect'. This effect essentially reflects

that the low marginal cost generation of renewables can underbid coal and

gas-fired generators. The extent to which renewables outbid thermal sources will

determine who bears the financial cost of the RET. The committee asked Frontier

Economics who pays for the large-scale renewable energy subsidy. It responded:

'It is the retail electricity customers via a levy on their electricity bills'.[20]

7.28

As part of the 2014 review of the RET, ACIL Allen found that in most

cases, scenarios modelled with a higher RET resulted in lower annual

residential bills by 2030. This is largely explained by the downward pressure

that large generators such as windfarms would exert on the wholesale price of

electricity. In terms of the wholesale price over the next decade, the report

stated:

NEM regions commence with prices around $44/MWh in calendar

year 2014 and fall to mostly below $33/MWh in 2015 due to it being the first

full year without carbon pricing. Prices rise slightly through 2016 and 2017,

influenced by additional demand in Queensland and reduced output from gas-fired

generation. Through 2017 to 2020 significant amounts of new wind capacity enter

the market driven by the LRET and this tends to hold prices at an average of

around $30/MWh until around 2025. Some incumbent capacity is mothballed late in

the decade due to low profitability as observed within our simulation model.

Capacity withdrawal is required to accommodate the additional wind entry and to

increase wholesale prices to a sustainable level for incumbent plant operators.

Prices begin to slowly rise from 2025 onwards as demand growth has largely

absorbed the additional renewable capacity and mothballed plant is reintroduced

to service.[21]

7.29

AEMO noted in its submission that it does not publish any data or

research on the extent to which renewables (and wind in particular) 'push out'

other generation. It did note that 'it can be reasonably assumed that all

renewable output in the NEM substitutes for non-renewable output'.[22]

7.30

AEMO also noted that some commentators have analysed AEMO's data on individual

days and postulated wholesale prices would have been higher had renewable

energy not been operating. However:

Such analyses should be treated with caution, as they do not consider

the complex long-term feedback loops that exist in the real market. For

example, when wholesale prices are suppressed for a period of time,

non-subsidised plant is likely to withdraw. This in turn has the effect of

bringing wholesale prices back up to a new equilibrium over time.[23]

7.31

The extent to which renewables lower the wholesale price will affect the

revenue that generators receive and the overall impact of the RET. As the

Climate Change Authority commented in its 2014 review of the RET:

Existing generators are affected in two ways. Increased

generation displaces fossil-fuelled plant output. Also, lower wholesale prices

mean they make less money for the electricity they sell. The impact on

households and other retail customers depends on the relative size of the

wholesale and retail price effects. For a particular level of renewable

capacity, the larger the wholesale price effect, the smaller the overall cost

impact on consumers...[24]

7.32

The downward pressure that wind energy places on wholesale prices may

only be temporary if its effect is to force wholesale generators out of

business. As the Australian Energy Market Commission (AEMC) noted in its 2014

Residential Price Trends report:

In the short term, subsidised wind generation under the LRET

has the effect of increasing supply and putting downward pressure on wholesale

energy purchase costs. However, this may only be temporary, as depressed

wholesale prices will likely force unprofitable generators to exit the market

and the consequent reduction in supply will eventually put upward pressure on

wholesale prices. Without lower wholesale prices, the costs of the LRET will

become more apparent to consumers through their retail bills.[25]

7.33

The AEMC report also noted that in jurisdictions where the share of wind

as a proportion of total energy generation is higher, the impact of the RET is

likely to be less given greater reductions in the wholesale price. As it

explained:

...LRET costs are spread equally between retailers in

Australia, and therefore consumers, based on their total consumption. As

investment in renewable generation has primarily been concentrated in the

southern states, any reduction in wholesale energy costs in one jurisdiction is

unlikely to be proportionate to the share of the scheme’s costs recovered in

that jurisdiction.

Consumers in jurisdictions with a high proportion of wind

generation subsidised under the LRET, such as South Australia and Victoria, may

experience a decrease in wholesale energy costs that offset the costs of the

policy in the short term. Conversely, consumers in jurisdictions without

significant wind investment from the LRET will not experience lower wholesale

energy costs to the same degree, and are therefore likely to face a higher

proportion of the costs of meeting the LRET.[26]

7.34

AEMC concluded in its 2014 Residential Price Trends report that

environmental policies account for eight per cent of a consumer's retail

electricity bill. It noted that while the repeal of the carbon tax led to a

fall in residential electricity prices in 2014–15 in most states and

territories, the cost of the RET is 'expected to increase in the years ahead'.

The following table, drawn from the report, shows the anticipated price

increases in each jurisdiction.

Table 7.1—Impact of the RET by jurisdiction

|

|

2013–14

|

2014–15

|

2015–16

|

2016–17

|

|

New

South Wales

|

0.60

|

0.65

|

0.77

|

0.97

|

|

Victoria

|

0.59

|

0.64

|

0.77

|

0.96

|

|

South

Australia

|

0.63

|

0.68

|

0.82

|

1.03

|

|

Tasmania

|

0.81

|

0.79

|

0.88

|

1.03

|

|

Queensland

|

0.58

|

0.63

|

0.75

|

0.94

|

Source: AEMC, Residential

Price Trends, 2014

7.35

The 2014 ACIL Allen report provided modelling of the breakdown of retail

price components for average residential electricity bills. It found that:

Network costs remain by far the largest cost component,

accounting for 50-55%, followed by wholesale energy costs at 20-25%. The RET

currently comprises around 3.7% of total costs, with this projected to rise to

around 6.6% by 2020. After 2020, RET costs decline as a proportion of total

retail prices...[27]

The impact

of the RET on retail prices

7.36

In August 2014, the expert panel commissioned to review the RET reported

to the government. The Review commented on the impact of renewables on the

wholesale price and the impact of the RET on retail prices. Significantly, it

noted that the wholesale price is also affected by the impact of the RET in

generating greater electricity supply and the lower demand for electricity in

Australia:

Analyses suggest that, overall, the RET is exerting some

downward pressure on wholesale electricity prices. This is not surprising given

that the RET is increasing the supply of electricity when electricity demand

has been falling. Artificially low wholesale electricity prices can distort

investment decisions in the electricity market and are unlikely to be sustained

in the long term. Over time, all other things being equal, wholesale

electricity prices could be expected to rise to better reflect the cost of

generating electricity.

The direct costs of the RET currently increase retail

electricity bills for households by around four per cent, but modelling

suggests that the net impact of the RET over time is relatively small. The

impact on retail electricity prices for emissions-intensive trade-exposed

businesses and other businesses is significantly greater. The RET does not

generate an increase in wealth in the economy, but leads to a transfer of

wealth among participants in the electricity market.[28]

7.37

The ACIL Allen report, on which the final report to Government was

based, noted that the RET causes wealth transfers from existing generators to

both renewable proponents and consumers. However, it added that:

7.38

This pattern of price changes does not hold under low demand conditions.

This is due to the inability of new renewable generation to further suppress

wholesale prices below levels which are unsustainable for incumbent generators

to keep operating. Under these conditions, removal of the direct compliance

costs is not offset by wholesale price movements and consumers are better off

under a Repeal scenario. This is particularly interesting in the current NEM

environment in which demand for electricity has fallen every year since 2008–2009

and the largest uncertainty is with respect to future demand growth/decline.[29]Ergon

Energy noted in its submission that:

...across the 2010-2015 regulatory control period green schemes

such as the Carbon Tax, Large Scale Renewable Energy Target (LRET), Small Scale

Renewable Energy Scheme (SRES), Gas Electricity Certificates (GECs) and the

Solar Feed in Tariff (FiT) will cost regional Queensland customers around $1580

million. This equates to an average liability per customer of $2,229 over the

five year period. Prior to the removal of the carbon tax this average liability

was expected to be $2,654 per customer, noting actual impacts vary according to

consumption. For the average residential customer these costs represent

approximately 8.5% of their retail bill. Environmental allowances such as the

LRET, SRES and GECs account for 37 per cent of the impact and the costs of the

Solar FiT and associated network costs account for around 26 per cent.

Specifically the estimated cost of the FiT and associated costs is $413

million, with the costs of the SRES estimated to be $280 million. This equates

to an average cost of $990.49 per customer over the five years, with the

average cost being $311.87 in 2013-14 alone.[30]

7.39

The committee notes that there is some conjecture as to whether

electricity retailers pass on the lower wholesale costs from renewable energy

to the consumer. Wind Prospect Pty Ltd noted in its submission that:

South Australia’s Essential Services Commission has directed

energy companies to pass on the savings from lower wholesale prices and cut

retail prices by 8.1 percent effectively lowering the average power bill by

$160 a year. This coincides with the growth of wind energy in South Australia

where wind energy currently contributes 35% of the state’s electricity

requirements. [31]

The effect

of lowering the RET

7.40

In June 2015, during the course of this committee's inquiry, the Australian

Parliament passed the Renewable Energy (Electricity) Amendment Bill 2015. The

bill reduces the RET from 41 000 GWh to 33 000 GWh by 2020.[32]

7.41

The effect of lowering the RET would be to curb the excess supply of

electricity in the market. There will be fewer RECs created than would

otherwise have been the case and the downward pressure on the wholesale price

will not be as pronounced.

7.42

In 2014, Schneider Electric was commissioned by five large energy users

to examine the electricity price impact of key price drivers in the electricity

market—such as the carbon price, the RET scheme, decreasing electricity demand,

and increasing gas prices. The study found that reducing the LRET target would

result in a minimal reduction in electricity prices in 2016 followed by much

larger increases later.[33]

7.43

Figure 7.8 shows the sensitivity of wind power generation to changes in

the RET. As the Schneider Electric report noted:

Increasing the LRET target (LRET Increased) results in a

significant increase of wind generation capacity (~40%). In contrast,

decreasing the LRET target (LRET Decreased) reduces the amount of installed

wind generation capacity by ~40% compared to the Reference scenario [the status

quo], whilst removing the scheme reduces the amount of installed wind

generation capacity by 53% compared to the Reference scenario.[34]

7.44

The South Australian Government noted in its submission the ACIL Allen

analysis showing that the effect of removing the RET would be to increase power

prices in the longer-term:

The subsequent modelling showed the removal of the RET would

initially lead to lower retail electricity prices, but in the longer term, as a

result of additional low marginal cost renewable energy generation, retail

prices would be on average 3.1% higher for residential, commercial and

industrial customers.[35]

Figure 7.8—Sensitivity of wind power generation to changes in the RET

Source:

Jasper Noort, Simon Venderzalm, Brian Morris and Lisa Zembrodt, Schneider

Electric, Australia's large-scale renewable energy target: Three Consumer

Benefits, 2014, pp 6–7.

The impact of wind energy on retail prices

7.45

The terms of reference for this inquiry direct the committee to consider

the impact of wind energy on household electricity prices. The committee notes

the lacuna of research in Australia that isolates the impact of wind on

household electricity prices. The information before the committee is a

judgment of this impact based on research into the impact of renewable energy

on retail prices.

7.46

Various submitters have drawn the committee's attention to a June 2013

report by the consultancy Sinclair Knight Merz titled Estimating the impact

of Renewable Energy Generation on Retail Prices. This report assessed the

impact of the RET on electricity retail prices by calculating 'the changes to

wholesale prices caused by the injection of new supply into the market, minus

the cost of running the scheme and paying for the certificates that are created

under the scheme'. The report found that:

...customers in Australia are on average likely to have a price

reduction over the period to 2020 as a result of the LRET, albeit that there

may be a modest increase in prices from sometime after 2020...

The price reduction is due to the wholesale price effect of

the LRET, which - at approximately $12/MWh over the period 2011-2025 (in real

mid-2012 dollars) - more than outweighs the impact of increased liabilities for

certificates as the target grows.[36]

7.47

The report added:

In addition, to the extent that competition amongst retailers

is limited, and to the extent that the LRET creates greater contestability

through the creation of economically sustainable new entrant retailers, there

will be further downward pressure on the retail margins. Under such conditions,

the RET scheme may, by providing an opportunity for the creation of integrated

new entrants, increase retail contestability and, hence, retail prices. SKM has

not sought to quantify this effect in this report, but recognises that this may

be a further benefit of the RET.[37]

7.48

Another study found that the price impact of renewables differs

depending on the type of consumer (residential consumers and small businesses).

Dr Iain MacGill, Ms Johanna Cludius and Mr Sam Forrest from the Centre for

Energy and Environmental Markets at the University of Sydney found that:

...some energy-intensive industries are benefiting from lower

wholesale electricity prices whilst being largely exempted from contributing to

the costs of the scheme. By contrast, many households are paying significant RET

pass through costs whilst not necessarily benefiting from lower wholesale

prices. A more equitable distribution of RET costs and benefits could be

achieved by reviewing the scope and extent of industry exemptions and ensuring

that methodologies to estimate wholesale price components in regulated

electricity tariffs reflect more closely actual market conditions.[38]

7.49

As of June 2015, the Independent Pricing and Regulatory Tribunal (IPART)

of NSW estimates that in New South Wales, around 21 per cent of retail electricity

customers pay regulated retail prices—that is, they pay prices not set by the

competitive market. For those customers paying regulated prices, IPART makes a

decision as to the appropriate price band. It noted:

In June 2014 we made a decision on the average changes each

Standard Retailer could make in these regulated retail prices for the next two

years, after an extensive public consultation and review process. We assessed

the Standard Retailers’ proposals against our own estimate of the change in the

efficient costs of supplying gas over the two-year period – including wholesale

gas costs, network prices and retail costs. We decided regulated retail prices

could increase by an average of 11.2% across NSW in 2014-15, and by a further

average of 4.2% in 2015-16. We also undertook to update our decision on the

average price changes in 2015-16 in June 2015 to take account of the latest

information on gas network prices and forecast inflation.[39]

7.50

Australian retail electricity provider Ergon Energy noted in its

submission the cost of 'green schemes' for electricity consumers. It stated:

...policies that seek to stimulate renewable energy increase

costs to consumers under current pricing arrangements. Ergon Energy analysis

shows that across the 2010-2015 regulatory control period green schemes such as

the Carbon Tax, Large Scale Renewable Energy Target (LRET), Small Scale

Renewable Energy Scheme (SRES), Gas Electricity Certificates (GECs) and the

Solar Feed in Tariff (FiT) will cost regional Queensland customers around $1580

million. This equates to an average liability per customer of $2,229 over the

five year period. Prior to the removal of the carbon tax this average liability

was expected to be $2,654 per customer, noting actual impacts vary according to

consumption. For the average residential customer these costs represent

approximately 8.5% of their retail bill. Environmental allowances such as the

LRET, SRES and GECs account for 37 per cent of the impact and the costs of the

Solar FiT and associated network costs account for around 26 per cent.

Specifically the estimated cost of the FiT and associated costs is $413

million, with the costs of the SRES estimated to be $280 million. This equates

to an average cost of $990.49 per customer over the five years, with the

average cost being $311.87 in 2013-14 alone.[40]

The merit of the RET cross-subsidy

7.51

The terms of reference for this inquiry direct the committee to consider

the merit of consumer subsidies for the wind industry. Several submitters to

this inquiry have questioned the underlying principle for these subsidies. Even

if one accepts the need to promote renewables, in a free market, should the

renewables sector be supported through the generous RET scheme, with the cost

ultimately borne by the consumer? More specifically, is it fair that highly

profitable wind companies effectively receive subsidies (through the creation

of a market for certificates) that effectively cover up to 60 per cent of the

cost of producing a MWh of wind energy?

7.52

The economic case against current RET arrangements and the benefit that it

provides the wind industry is built on the following five criticisms:

-

that the RET distorts the market by diverting investment from

elsewhere in the economy and by increasing energy supply above existing demand;

-

that wind should be—and on some assessments will soon

be—self-sufficient and capable of competing in the energy market without

subsidies;

-

that the RET promotes an unbalanced mix in the development of

renewables, disproportionately promoting the development of wind above other

renewable energy sources;

-

that the RET is not the most cost-effective option for reducing

emissions; and

-

that large-scale wind turbines will not be as effective a

mechanism to reduce emissions in the future.

Market

distortions

7.53

By any reckoning, the wind industry receives a substantial and generous

cross subsidy from the RET. On a conservative estimate, each RET-eligible

company receives in excess of $500 000 a year for each turbine. On the basis of

there being 2 077 wind turbines in Australia, the RET provides $1.09

billion per annum to the wind industry. On this basis, and assuming the RET

operates for another 15 years, the RET cross-subsidy for existing turbines from

now until 2030 will be in the vicinity of $9.3 billion. Given that the wind

industry plans significant future investment, the subsidy is likely to be

considerably more than $9.3 billion.

7.54

The 2014 Review of the RET estimated that the future cost of the RET

across all renewables:

...would require a further $22 billion cross-subsidy to the

renewables sector in net present value (NPV) terms over the remainder of the

scheme (in addition to the $9.4 billion cross-subsidy provided from 2001 to

2013) and encourage more than $15 billion (in NPV terms) of additional investment

in renewable generation capacity to 2020. This investment comes at the expense

of investment elsewhere in the economy and the additional generation capacity

is not required to meet the demand for electricity.[41]

7.55

Several submitters and witnesses to this inquiry have argued that these

subsidies should stop on the basis that they distort the market. Regulation

Economics, for example, argued that subsidised renewable energy has been

'sucking capital into worthless investments'.[42]

It added:

The costs to Australia in continuing to force electricity

customers to incorporate uncommercial renewable energy within their aggregate

supply are considerable. By 2020 they will amount to over $3.5 billion a year

in electricity bills plus expenditures via the budget which are also paid for

by consumers. The program, should it run its course, will impose an aggregate

cost on the economy of between $30 and $53 billion. Not only does this inflict

a direct cost on electricity consumers but it also undermines Australia’s comparative

advantage as a low cost electricity supply source, with adverse implications

for industry development.[43]

7.56

Dr Alan Moran of Regulation Economics noted that a renewables subsidy

could be borne by taxpayers without there being any increase in the underlying

market price. He explained that the subsidy:

...would need to be set at the difference between the long run

marginal cost of commercially available power and the long run marginal cost of

the cheapest form of renewable energy that is eligible for the subsidy. And for

it to have no effect on prices it would need to be in the form of a direct

subsidy from taxpayers rather than, as is largely the case at present, the

subsidy coming about by regulatory requirements that retailers include specific

proportions of designated renewable energy.[44]

Wind should

be self-sufficient

7.57

Several submitters to this inquiry emphasised that the wind industry

would not be economically viable in Australia without the certificate market.

The noted Australian geologist, Professor Ian Plimer, argued:

No wind farm could operate without generous taxpayer

subsidies and increased electricity charges to consumers and employers. These

subsidies are given irrespective of whether the wind farm produces any

consumable energy or not and are paid even when a wind farm is shut down due to

strong winds. Wind farmers have been more successful in harvesting massive

subsidies from taxpayers than harvesting the wind.[45]

7.58

Parkesbourne/Mummel Landscape Guardians argued in its submission that

wind power is an inefficient form of energy production and uncompetitive in the

open market. It queried:

Why does wind energy need this indirect subsidy? It is not

because of high research and development costs, or high construction costs, or

high labour costs. It is because wind farms are a very inefficient producer of

their own product. Because they cannot produce reliable power, given the

intermittency and variability of the wind, they cannot compete in the open

market.

For the same reason, their inefficiency and unreliability,

they are an ineffective way to reduce greenhouse gas emissions. Because they

need constant back-up (coal-fired plants in ‘spinning reserve’ or open cycle

gas turbines), the net reduction of greenhouse gas emissions becomes negligible

in comparison with other, more reliable sources of power. If we wish to reduce

greenhouse gas emissions, the only serious options are closed cycle gas

turbines, hydro, and nuclear.

...

If wind farms cannot serve any useful function, then they

should not be subsidized.[46]

7.59

Mr Mike Baner argued in his submission that current subsidies through

the RET should be redirected:

The dollar value placed towards subsidies would be better

utilised in research and development activities to improve generating

technologies and power storage facilities which would lead to a more efficient

use of existing resources resulting in a reduction of Australia's carbon

emissions.[47]

7.60

Other submissions highlighted the international experience to urge that

Australia should discontinue subsidies through the RET. Ms Jenny Holcombe noted

the Spanish experience where, following the removal of subsidies to the wind

industry in 2012, projects proceeded based on their economic viability. As she

explained:

In January 2012, the Spanish Government abolished subsidies to

windfarms. In Spain’s least windy State, Extremadura, a hundred wind projects

that had applied for approval abruptly decided not to proceed.

In contrast, last Wednesday, 18th March, the first windfarm

to operate without subsidies began operating in the State of Galicia, Spain’s

windiest region. And 83 per cent of windfarms in the pipeline for Galicia at

the time the subsidies ceased will also be built. All without subsidies. They

will be backed up by four reversible hydro-electrical plants to store the energy

produced when not needed.

For years, wind farms in Spain had been paid twice for the

electricity they produced: the market price and an equivalent amount as

subsidy. With subsidies withdrawn, the former wastage is revealed: non-viable

projects do not proceed; viable projects proceed without need of subsidies.[48]

7.61

Ms Marie Burton expressed her concern with the international evidence of

the long-term dependence of wind power on subsidies:

Consumer subsidies are backing a non helpful business with

the wind industry because overseas they are turning away from wind due to the

enormous costs involved. Emily Gosden (12 No.2014) stated wind farm developers

receive 115,000 pounds for every person employed and is now expected to be 1.8

billion pounds annually. John Constable said "large numbers of soft

subsidized jobs indicates low productivity, high cost energy" is supported

by the UK Energy Research Centre (govt. funded).[49]

7.62

Interestingly, there are some strong advocates for renewables who argue

that the wind industry may not need the assistance of the RET. For example,

environmental consultant Dr Kim Forde told the committee:

The phenomenal drop in the cost of solar generation in the

last five years is evidence that with investment and a profile, and sales to a

willing public will ensure the viability of these industries. Wind generation

costs have also dropped significantly over the last 15 years. The need for any 'subsidy'

is almost past, as the price parity of solar and wind has been achieved, or

exceeded, traditional costs.[50]

The RET and

the renewables mix

7.63

Another theme of this inquiry has been that the RET has promoted wind

power above other forms of renewable energy. Clearly, wind has been the major

benefactor of the RET. It has been the cheapest of the renewable energy sources

in Australia and has therefore benefitted disproportionately from the RET. It

also has the lowest current capital costs. Questions must be asked, however,

about whether government assistance should be promoting a better mix of

renewable energy sources:

-

should policy-makers reconsider the policy mix to see how it is

currently advantaging the development of wind power over other renewables?

-

should the RET be redesigned to cap the subsidies from any given

renewable source, thereby promoting a more diverse renewables mix?

7.64

In this context, CWP Renewables recognised that a higher RET would

disproportionately benefit consumers without rooftop solar panels:

The reduction in household electricity costs, although

acknowledged to be modest, will result in greater benefit to those households

without rooftop solar panels as they pay a larger relative residential bill

than those that have invested in rooftop solar.[51]

7.65

Frontier Economics noted that eligibility for the RET could be broadened

to include low emissions energy sources and have a similar cost impact on

consumers as the present scheme. It explained the impact of a broadened RET

scheme as follows:

We consider that a [Low Emissions Target] LET, which broadens

the criteria for eligible creation of LGCs, is a "no-regrets" option:

if future gas prices are much higher than what was assumed in our modelling of

a LET then there would still be the option to invest in new wind, solar and

other renewables. At worst a LET would have a similar resource cost/impact on

consumers as the existing RET scheme, but no higher. However, if gas does

continue to provide a cheaper abatement option than wind or solar then the LET

would entail lower resource/consumer costs than the RET while still delivering

emissions abatement, as our modelling found.[52]

7.66

The August 2014 ACIL Allen report found that:

Wind entry over the period 2016-2020 is significant and

displaces primarily black coal generation. Once the wind build necessary to

meet the LRET target is completed however, the future fuel mix is relatively

static throughout the remainder of the modelling horizon, with most growth met

by increased output from existing coal-fired stations.[53]

Wind and

emissions reductions

7.67

The main policy objectives of the RET are to reduce greenhouse gas

emissions in the electricity sector through encouraging the additional

generation of electricity from renewable sources. The 2014 review of the RET

noted ACIL Allen's modelling of the cost of abatement under the (2014) RET. It

found that:

The cost of abatement of the current RET policy is estimated

to be $35 to $68 per tonne over the period 2014 to 2030, with the SRES being

higher than the LRET at $95 to $175 per tonne in comparison with $32 to $62 per

tonne to 2030.[54]

7.68

ACIL Allen used two models to calculate the cost of abatement from the

RET:

Both used the present value of the change in resource costs

(the numerator), while one method applied a discount factor to the change in

emissions (the denominator). In addition to the choice of methodology, the cost

of abatement estimate depends on modelling assumptions, particularly capital

costs.[55]

7.69

The committee has received evidence from Dr Joseph Wheatley, the

Managing Director of the Irish consultancy Biospherica Risk Ltd. Dr

Wheatley's research shows that as the proportion of wind generation increases,

the CO2 abatement effectiveness of wind energy decreases. As he

states in his submission:

The best empirical estimate is that wind power avoided 6.2MtCO2-e,

a reduction in total emissions of 3.5%. Wind power contributed 4.5% of system

demand and therefore the emissions displacement effectiveness of wind power was

3.5%/4.5% or 78% in 2014. Several factors acted to limit the effectiveness of

wind power in reducing emissions in 2014. A significant fraction of South

Australia’s wind output displaced low-emissions gas generation. Wind power

tended to displace black coal plant in New South Wales rather than higher

emissions brown coal plant in Victoria. Part-load inefficiency costs and system

losses also degraded effectiveness. Wind power becomes less effective in

displacing emissions from thermal plant as installed capacity increases. The

evidence in this study suggests that effectiveness in the NEM would fall to 70%

if the proportion of energy provided by wind is doubled from 2014 levels.[56]

7.70

Other submitters and witnesses have highlighted the findings of Dr Wheatley's

research. With reference to Dr Wheatley's work, Mr Peter Lang argued that by

ignoring the factors listed below, analyses have over-estimated the carbon

emissions avoided from wind power and, therefore, overestimate carbon abatement

effectiveness.

- Wind energy displaces the highest marginal cost generator at the time.

This tends to be gas and black coal, rather than brown coal. So wind tends to

displace generators whose emissions intensity is less than the grid average

emissions intensity.

- Ramping—power stations consume more fuel and emit more CO2

per MWh when they are operating at below optimum power and when ramping power

up and down to balance the fluctuating power supplied by wind. For comparison a

car has higher fuel consumption when continually accelerating and decelerating

rather than running at constant speed.

- Cycling—that is, shutting down, starting up, or on standby not

generating electricity but consuming fuel waiting to be dispatched to supply

power when the wind power drops. This is equivalent to the effect of idling at

the traffic lights on your car’s average fuel consumption for the trip.

- Transmission losses tend to be higher for wind generation than for

fossil fuel generators.

- Auxiliaries refers to the power stations own use of electricity for

fans, pumps, conveyor belts, etc. The AEMO figures for the proportion of power

used by auxiliaries assumes a linear relationship between electricity generated

and the power stations own use (auxiliaries). However some of the own use is

proportional to electricity as generated but some is not. The linear assumption

understates the emissions at low power (high wind power).[57]

7.71

Mr Lang argued that using the results of Dr Wheatley's analysis and

projecting the CO2 abatement effectiveness to 2020, 'the estimates

of CO2 abatement cost quoted in the Warburton Review may need to be

increased by around 67%'.[58]

7.72

Mr Lang recommended that the CO2 abatement cost estimates in

the RET Review should be re-estimated taking CO2 abatement

effectiveness into account. He also argued the need for:

-

Australia to collect the data needed to estimate CO2

emissions accurately at the frequency needed to estimate the emissions avoided

by wind energy; and

-

the CER and other agencies to provide guidelines on how to

estimate emissions avoided by wind energy and require that economic analyses of

abatement cost take the CO2 abatement effectiveness into account in

their analyses.[59]

Does the

geographic dispersion of wind farms in Australia pose a threat to the security

and reliability of the National Electricity Market?

7.73

The committee is aware of claims that the geographically large and

highly dispersed nature of Australia's wind farm fleet poses 'significant

security and reliability concerns to the eastern Australian grid'.[60]

The committee asked AEMO for its comment on this view. AEMO responded:

South East Australia does have occasional very widespread

high and low wind patterns, including calms that can affect every large NEM

windfarm simultaneously.

Whilst this creates challenges for the NEM, AEMO would not

say that it poses “significant security and reliability concerns”. AEMO is

responsible for overseeing reliability (adequacy of generation to meet demand)

and system security (the grid’s ability to withstand credible disturbances) and

carefully analyses the technical challenges of integrating the current and

future levels of renewable energy. When issues arise or are anticipated, AEMO

has mechanisms through which they can be addressed.[61]

7.74

AEMO did note that it only counts a small percentage of wind generation

capacity as reliable to meet peak demand in reliability forecasts:

This means that installation of wind generation capacity only

slightly offsets the need for other generation to meet the reliability

standard. This should not be interpreted to mean that reliability is

necessarily threatened by it. The market is designed to reward generation as

required to meet demand, with the high market price cap intentionally selected

to provide sufficient income to reward non-intermittent plant that may operate

only very occasionally.[62]

The Clean Energy Finance Corporation

7.75

The Clean Energy Finance Corporation (CEFC) is a statutory authority

established under the Clean Energy Finance Corporation Act 2012. The

primary function of the CEFC is to invest, directly and indirectly, in clean

energy technologies, which are further defined as energy-efficient technologies,

low-emission technologies and renewable energy technologies.

7.76

The CEFC utilises a commercial approach to investment (investing for a

positive financial return) to overcome market barriers and encourage investment

in renewable energy, energy efficiency and low emission technologies. The CEFC

focuses its investment in projects and technologies at the later stage of

development which have a positive expected rate of return and therefore have

the capacity to service and repay capital.

7.77

The CEFC was intended by the former Australian Government to supplement

existing initiatives such as the Renewable Energy Target, to counteract

barriers to private investment in the clean energy sector, including the then

global financial conditions, the cost of renewable energy and the complex

nature of Australia's electricity markets.

7.78

In setting a new policy direction, the Australian Government put forward

a package of bills in 2013 collectively known as the carbon tax repeal package.

One of the bills sought to abolish the CEFC and transfer its assets and

liabilities to the Commonwealth. This reflected the Australian Government's

policy change to support clean energy projects through direct action such as

the Emissions Reduction Fund and providing strong investment incentives to

business through the renewable energy target. This aspect of the amendment

package did not pass the Senate and was not enacted.

7.79

While still maintaining its policy position that the CEFC should be

abolished, the Australian Government has recently directed the CEFC to change

its mandate to restrict investment to new and emerging clean energy

technologies, on the basis that projects that are economically viable should be

funded through the usual investment mechanisms. This will preclude CEFC

investment in existing clean energy projects such as wind farms.

Long-term Power Purchase Agreements

7.80

The material presented above does not reference the rates set between

power generators and retailers under long term power purchase agreements

(PPAs). PPAs are an avenue through which power generators can mitigate risk

associated with selling their product. As the Parliamentary Library has noted:

Because the RET legislation does not guarantee connection to

the grid, renewable energy developers must negotiate long-term power purchase

agreements (PPAs) with electricity retailers. The availability of these PPAs is

hampered by policy uncertainty as energy retailers are wary of committing to

long-term contracts.[63]

7.81

The committee has viewed one document, tabled in the Senate on 3 September

2014, which gives a strong indication about the effect of wind on retail

prices:

Paying ca. [(approximately)] $32/MWh above market price

AGK booked ca. [approximately] $280m[illion] of wind

development profits in FY [(Financial Year)]07–12 from wind farms it had

developed and sold with 25yr offtake contracts, priced at ca. $112/MWh. As a

result, we estimate that AGK is committed to buying ca 1.3TWh/yr through its

various wind PPAs at ca. $32/MWh above the FY15 wholesale market (ex-carbon).

At a headline level, it will pay $40m/yr more for electricity than it would

have had to without the wind strategy, resulting in 4–5% NPAT [(Net Profit

After Tax)] reduction in FY15E.[64]

7.82

The committee made requests for the production of such agreements from

operators. However, those requests have not been forthcoming. Accordingly, the committee

cannot make any meaningful finding about the true impact of large-scale wind

turbines on household power prices.

7.83

The representations made, and set out above, focus on wholesale power

prices which have been declining for a number of reasons. However, they do not

address the impact of the cost of the large-scale generation certificates

issued to wind power generators of which cost comprises the subsidy paid and

which is recovered by retail power bills.

7.84

In the absence of PPAs as requested, the committee recommends that PPAs

be made available for the purpose of determining the impact of wind power

supplied under the LRET on retail power prices. The Productivity Commission should

have free access to PPAs and the NEM data comprising pricing in all relevant

electricity markets, including the dispatch, wholesale, retail and derivative

markets. Further, the Productivity Commission should investigate and determine

the cost impacts arising from:

-

improved and/or expanded net worth and grid infrastructure

capacity payments required to maintain sufficient reserve capacity to

accommodate fluctuations in wind power output, including generators holding

spinning reserve, capital costs for reserve capacity held by generators using

peaking power plants, such as open-cycle gas turbines; and

-

any other matter relevant to, and associated with, increasing

installed wind power capacity as required to satisfy the LRET.

Recommendation 13

7.85

The committee recommends that the Australian National Audit Office

(ANAO) conduct a performance audit of the Clean Energy Regulator's (CER) compliance

with its role under the legislation. In particular, the committee recommends

that the ANAO examine:

-

the information held by the CER on wind effectiveness in

offsetting carbon dioxide emissions at both 30 June 2014 (end of financial

year) and 3 May 2015;

-

the risk management and fraud mitigation practices and processes that

are in place and whether they have been appropriate;

-

whether all public monies collected in respect of the Renewable

Energy (Electricity) Act 2000 are appropriate;

-

whether there are financial or other incentives, including but

not limited to, the collection of public monies under the Renewable Energy

(Electricity) Act 2000 that are distorting the CER's role in achieving the objectives

of the Act; and

-

whether the expenditure of public monies by the CER has been

appropriately focused on achieving the Renewable Energy (Electricity) Act

2000 objectives.

Committee view

7.86

The committee agrees that Government investment in clean energy is best

directed at supporting emerging technologies that would otherwise struggle to

find early-stage investment. It is only through such investments that existing

energy technologies, such as wind farms and solar power, passed the research

and development phases to become financially viable energy sources.

7.87

This chapter notes the lack of research isolating the effect of wind

power on retail electricity prices. This information is important. It would

address many of the issues and concerns raised in this chapter. Accordingly,

the committee recommends that the Australian Government direct the Productivity

Commission to investigate the impact of wind energy on retail prices.

Recommendation 14

7.88

The committee recommends that the Australian Government direct the

Productivity Commission to conduct research into the impact of wind power electricity

generation on retail electricity prices.

Renewables and the Emissions Reduction Fund

7.89

One of the key objectives of the Renewable Energy Target is to reduce

carbon emissions in the electricity sector. The other objectives, listed under

section 3 of the Renewable Energy (Electricity) Act 2000 are to encourage

the additional generation of electricity from renewable sources and to ensure

that renewable energy sources are ecologically sustainable.

7.90

The Renewable Energy Target, however, is a blunt means of reducing

carbon emissions. The installation of renewable energy is but one way of

reducing carbon emissions among many. Investments in energy efficiency,

destroying methane or waste gas in industrial activities, more transport

efficient vehicles, vegetation management and agricultural practices to retain

more carbon in soils are other ways of achieving the same goal. By restricting

the ways of meeting the end goal of reducing emissions, the Renewable Energy

Target has the potential to increase the cost of meeting any particular

emission reduction target.

7.91

Indeed, the risk of the Renewable Energy Target being a costly way of

reducing emissions in the Australian context is higher given the structure of

our electricity market. Australian electricity production is dominated by coal

fired power stations, our gas resources tend to be more expensive to exploit

than those in other countries such as the United States and we have limited

sources of hydropower. These intrinsic characteristics of Australia’s resource

endowments makes the cost of moving the electricity sector from existing

sources to low carbon emission sources a costly exercise. As the former

Chairman of the Productivity Commission, Gary Banks, said:

Crucially — and this point seems not to be widely understood

— it will not be efficient from a global perspective (let alone a domestic one)

for a carbon-intensive economy, such as ours, to abate as much as countries

that are less reliant on cheap, high-emission, energy sources ... it’s

commonsense that achieving any given level of abatement is likely to be costlier

in a country with a comparative advantage in fossil fuels.[65]

7.92

The limitations of the Renewable Energy Target are not a surprise. Its

original design envisaged that it would be a temporary measure until more

generic carbon reduction policies had been adopted. In 2009, COAG made a

decision to replace various state and territory renewable energy programs with

an expanded Renewable Energy Target. In making the decision COAG announced

that:

It is expected that renewable energy targets will no longer

be required after 2030 as the CPRS [Carbon Pollution Reduction Scheme] will

drive the deployment of renewable energy.[66]

7.93

Australian governments have adopted more generic and widespread ways of

reducing carbon emissions so the ongoing rationale for the Renewable Energy

Target is not clear to the Committee. The former Gillard Labor government

established a carbon tax in 2012. While this has been removed by the Abbott

Coalition government, the Coalition government has adopted an Emissions

Reduction Fund that provides subsidies for carbon emission projects on a

“reverse auction” basis. Climate change policies are likely to remain a matter

of political controversy, however, both major political parties are committed

to policies that seek to reduce emissions from a range of projects rather than

focus on individual sectors. In that context, maintaining a policy that

narrowly seeks to reduce emissions through only investment in renewable energy

is anomalous.

7.94

The Committee considers that these issues can be addressed through

targeted modifications to the Government’s existing carbon emissions policies—the

Renewable Energy Target and Emissions Reduction Fund subject to annual audits

of compliance.

7.95

The Renewable Energy Target should be amended so that all new

investments in renewable energy between 2015 and 2020 will be eligible to

create renewable energy certificates for a period of no more than five years.

Existing investments in renewable energy should be grandfathered so that they

continue to receive renewable energy certificates under the Act.

7.96

In conjunction with this change, eligibility criteria for the Emissions

Reduction Fund should be amended to allow renewable energy projects to receive

funding. In practical terms, this would mean that the Government would develop

a methodology that would detail how many carbon credits[67]

would be created for investment in different types of renewable energy. Under

this model, renewable energy investors could "bid" in Emission

Reduction Fund auctions for a subsidy for a given level of carbon reduction

according to the approved methodologies. A renewable energy investment would

only receive government funding if it could compete against other forms of

carbon emission reduction and demonstrate that it was the lowest cost way of

reducing carbon emissions.

7.97

Consistent with evidence provided to this Committee, any methodology

under the Emissions Reduction Fund should consider the net lifecycle reductions

in carbon emissions from renewable technologies. That is, the estimated

reductions in carbon emissions from a specific renewable energy investment

should consider the carbon emissions generated in its construction (for

example, steel, concrete, etc), the displacement of more carbon intensive forms

of electricity generation and the need for any power generation backup to

renewables.

7.98

The Committee sought information on the carbon payback period for the

carbon costs associated with the manufacturing process of wind turbines. Mr

Terry James Johannesen, Project Development Manager, RATCH-Australia

Corporation Ltd. stated:

[W]e are guided by the information we have received from wind

turbine suppliers. We asked them how long it takes to pay back the

manufacturing costs, the transport costs, the installation costs and all the

fuel that is burnt incorporated in that. A number of those companies that

provide the turbines to us have undertaken studies in that regard. Generally,

they look at it being around about a 12- to 18-month period for all of that

carbon intensive manufacturing cost to be paid back.[68]

7.99

On the question of intermittency of power generated by wind turbines, Dr

Moran told the Committee:

[T]here are some backup costs caused by the inherent

unreliability of wind and indeed of solar, and these increase exponentially

with the increased share of renewables.[69]

7.100

Another cost that would also need to be considered is the carbon cost in

additional transmission infrastructure required by renewables to bring the

power to where it is used due to the need to locate the generating capacity in

sites with suitable wind characteristics and available land which are often

farther away from the major cities than traditional forms of electricity

generation.

7.101

These are important questions. While definitive answers are beyond the

scope of this Committee, resolving such issues is essential for promoting sound

energy policy in Australia and would appropriately be considered in the

development of an Emissions Reduction Fund methodology.

7.102

A methodology for renewable energy technologies will require some

consultation and there should be a transition period between moving new

renewable projects from the narrow Renewable Energy Target to a broader policy

such as the Emissions Reduction Fund. The appropriate period of time is a

matter of judgement, but the Committee views that a period of around five years

should be sufficient to develop the methodology and provide time for renewable

energy operators to adjust. This would mean that the Renewable Energy Target

would cease to be open to new entrants by the end of 2020. One rationale for

employing such a timeframe is that it matches the existing structure and

timeline of the Renewable Energy Target, which has been designed to increase

until 2020 and then be maintained at the level of 33 000 GWh. (Originally the

target was 41 000 GWh).

Committee view

7.103

In the view of the Committee the changes outlined above would, if

implemented as a package, provide a more efficient, consistent and sustainable

policy framework for reducing Australia’s carbon emissions going forward, which

would provide substantial benefits to businesses and individuals across

Australia. In particular, it provides a means of addressing the clear anomaly

resulting from current policy settings which partition the renewables sector

apart from other ways of reducing carbon emissions and thus unnecessarily

inflate the costs of achieving carbon reduction outcomes.

7.104

It is the view of the Committee that if the Government rejects the

approach outlined above, the Government should instead seek to limit

eligibility for receipt of Renewable Energy Certificates to five years after

the commissioning of turbines in the electricity sectors. This would help

constrain the additional costs of the Renewable Energy Target to a defined

period.

Recommendation 15

7.105

The Renewable Energy Target should be amended so that all new

investments in renewable energy between 2015 and 2020 will be eligible to

create renewable energy certificates for a period of no more than five years.

Existing investments in renewable energy should be grandfathered so that they

continue to receive renewable energy certificates under the Act subject to

annual audits of compliance.

7.106

The Government should develop a methodology for renewable energy

projects so that they can qualify for Australian Carbon Credit Units. The

Government should develop this methodology over a five year period in consultation

with the renewable energy industry and the methodology should consider the net,

lifecycle carbon emission impacts of renewable energy.

7.107

If the Government does not adopt the above changes, the Government

should instead limit eligibility for receipt of Renewable Energy Certificates

to five years after the commissioning of turbines.

Senator John Madigan

Chair

Navigation: Previous Page | Contents | Next Page