Chapter 3 - Measures of affordability

3.1

House prices have increased markedly in recent years, by much more than

consumer prices or incomes.

Chart 3.1

Source: Secretariat, based on

splicing ABS house price data from ABS Cat no. 6416.0 to earlier

estimates from Abelson and Chung (2004); the CPI series was constructed by splicing data from ABS Cat no.

6401.0 to that in the ABS 2008 Australia Yearbook.

3.2

By 2007 the average house price in the capital cities had risen to over seven

times average earnings.

Chart 3.2

Source: as for chart 3.1, and ABS Cat no.

6302.0.

3.3

By this commonly-cited measure, housing affordability has deteriorated

quite sharply over the past decade.[1]

3.4

Another commonly-cited measure is the 'affordability index' compiled by the

Commonwealth Bank and the Housing Industry Association, which also takes into

account the level of interest rates. This index, shown on the left-hand side of

the following chart, is now at its lowest in the 23 years for which it has been

compiled.

Chart 3.3

Source: Richards

(2008).

3.5

The CBA/HIA index is calculated as the monthly loan repayment on a

typical 25‑year mortgage loan large enough to pay 80 per cent of the cost

of a house with the median price paid by first home-buyers, relative to

household income.

3.6

Professor Yates (2007) stresses the 'deposit gap', which is shown in the

right-hand panel in the chart above. This is the amount by which the average

house price exceeds the amount which a household on the average income can

borrow. This gap is now at record highs, which she suggests means that many

Generation X families will only be able to buy a home if they are assisted by

their parents. The longer this generation defers the purchase of a home, the

fewer working years they have to repay their mortgage. There will also be

pressures on those who do not buy and continue to rely on the private rental

market:

What is going to happen as a result of these people not getting

into homeownership in their under-40s as they go through to being over-60s? And

because the public or social housing system is stable, it is not growing, as

the population grows, what are the implications of that as the population

ages?’ What you find is you get more people in housing affordability stress and

these are the people who are in the low-income households because they have

gone past their earning age. They will be back on the pension levels of income,

they will still be in the private rental market and there will be higher levels

of problems amongst them. So that is something, looking forward 40 years, that

is going to be a bigger problem unless we do something about it now.[2]

These longer-term inter-generational issues are discussed in

chapter 11.

3.7

A related approach is the UDIA/Matsuik measure, whereby a housing market

is classified as 'unaffordable' when a household spending 30 per cent of the

average income in that region on repayments (and with a 10 per cent deposit)

could purchase less than 15 per cent of the houses in the region. On this

measure there were no 'unaffordable' regions in Australia in 2001 but over a

quarter of regions were 'unaffordable' in 2006.[3]

3.8

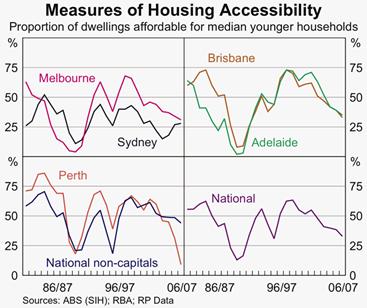

The Reserve Bank recently developed a similar measure, concluding:

on a nationwide average basis around 33 per cent of transacted

dwellings would have been accessible to the median young household in 2006/07,

compared with a longer‑run average of around 45 per cent.[4]

Chart 3.4

Source: Richards

(2008).

Mortgage stress incidence

3.9

Closely related to 'affordability' is the concept of 'mortgage stress'.

Indeed, one definition of 'affordable housing' is that it is housing which

would not put the buyer into mortgage stress.

3.10

The concept of 'mortgage stress' refers to current rather than aspiring

homebuyers. As home prices have increased, the size of the average mortgage has

risen, taking household debt to a record proportion of income.

3.11

As a result, even when mortgage interest rates reached their recent low

point of around 6 per cent in 2002, the proportion of household income going on

home loan repayments was still relatively high. Reflecting the larger

mortgages, home loan interest payments are now a higher proportion of income than

when housing interest rates peaked at 17 per cent in 1989. In addition to this,

an increasing number of households are paying interest on an investment

property. Some 'consumer' debt, such as credit cards, may also be being used to

fund housing.[5]

Chart 3.5

Source: RBA Financial

Stability Review, March 2008.

3.12

Financial institutions have traditionally applied a rule of thumb of not

allowing households to take out home loans requiring more than 30 per cent of gross

income to service.[6]

A government inquiry which looked into housing in the early 1990s concluded

that people on low incomes could not afford to pay more than 30 per cent of

their income on housing.[7]

This proportion has since become a benchmark.

3.13

In 2005 median debt-servicing ratios were below this benchmark for

almost all income groups. Lower income households have higher debt-servicing

ratios (Chart 3.6). These did not increase between 2002 and 2005, but

subsequent interest rate rises will have since pushed them up somewhat.

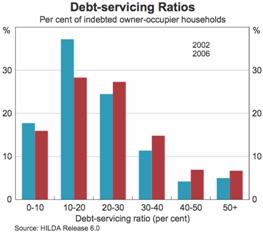

Chart 3.6

Source: Reserve Bank of Australia, Financial

Stability Review, March 2007, p. 26.

3.14

The averages in Chart 3.6 hide the number of households who are above

the average. The distributions in both 2002 (left hand column) and 2006 are

shown in Chart 3.7.

Chart 3.7

Source: Reserve Bank of Australia, Financial

Stability Review, March 2008, p. 54.

3.15

In 2005–06, around 23 per cent of households were spending over 30 per

cent of their income on housing (either mortgage repayments or rent), up from

19 per cent in 1995–96. Table 3.1 shows some of the groups in the community

with above‑average proportions devoting more than 30 per cent of

household income to housing. (Around a third of households own their homes

outright, having paid off any mortgage, and this brings down the overall

average housing cost.)

Table 3.1: Proportion

of households spending over 30 per cent

of disposable income on housing, 2005–06

|

All households

|

23 |

|

Households headed by person under 30

|

35 |

|

Households headed by person aged between 30 and 45

|

32 |

|

Households who bought first home in past three years

|

62 |

|

Households renting

|

32 |

|

Households headed by unemployed person

|

55 |

|

Households whose income is below half the median

income

|

31 |

|

Sole parent households

|

34 |

Source: various tables in Tanton, Nepal and Harding (2008).

3.16

However, a weakness of regarding all households spending over 30 per

cent of income on housing as suffering stress is that households with high incomes

can spend over that proportion on housing and still have plenty of money to

spend on other things. For this reason a '30/40' rule is now the preferred

measure of 'housing stress'; restricting it to households in the lowest 40 per

cent of the income distribution paying over 30 per cent of income on housing.[8]

This benchmark is also used overseas, sometimes called the 'Ontario measure',

as a guide to eligibility for government assistance.[9]

3.17

On this definition, it is estimated that there are now over one million

low and middle income families and singles in housing stress.[10]

This represents about 10 per cent of the population.[11]

3.18

It is, of course, easy to generate larger numbers of households in

'housing stress' by setting the bar lower, and often these larger numbers will

generate a newspaper headline. For example, Fujitsu Consulting (2008) define

any household with a mortgage who has reduced spending on luxuries and

reprioritised spending in response to interest rate increases as being in

'mortgage stress'. Unsurprisingly, this gives a large number of households in

mortgage stress: around 750 000 now, with an additional 150 000 with any

additional 25 basis point increase in housing loan interest rates. Adding in

renters would imply about 1½ million households in housing stress.

3.19

A more reassuring perspective comes from some work tracking households

over time. The HILDA survey data show that households do not necessarily become

mired in stress:

Most households move out of stress: less than half of those

initially in housing stress remained stressed a year later and less than a

third were in that state two years later.[12]

3.20

In the same way that distinctions are drawn between 'absolute' and

'relative' measures of poverty[13],

it was observed by the Reserve Bank deputy governor Ric Battellino that devoting

30 per cent of income to housing may not be as onerous now as it used to be:

real incomes of Australian households have risen quite strongly.

This has allowed households to devote a larger proportion of their income to housing

repayments while still maintaining their living standards more generally. For

example, the household that in 1996 was devoting 30 per cent of its disposable

income to housing loan repayments would today be able to devote 47 per cent of

its disposable income to servicing debt while still maintaining the same

standard of living in terms of being able to buy other goods and services.

This, broadly speaking, is the outcome that has occurred over the last decade

or so. So it is not surprising to us that commentators who use a fixed

benchmark for housing stress, such as housing loan repayments exceeding 30 per

cent of income, are finding that more and more households are exceeding the

benchmark.[14]

3.21

Mr Battellino's analysis refers to average incomes and it may be

that incomes and wealth at the lower end have not kept up with the average.[15]

But statistical evidence is mixed on this point.

3.22

This analysis could help explain the apparent paradox that while there

are large numbers of households facing stress under the 30/40 definition, very

few end up defaulting or having their homes repossessed (Chart 3.8).

Chart 3.8

Source: Reserve Bank of Australia, Financial

Stability Review, March 2008, p. 51.

3.23

There are also relatively few households in arrears:

Housing loan arrears are probably the most tangible indicator of

the extent to which households are getting into difficulty on their housing

loans...the chart shows that, while arrears rates rose somewhat between 2002 and

2006, they remain relatively low by historical standards and, in fact, they

fell through much of 2007. Currently, we estimate that there are about 15 000

households in Australia whose housing loans are 90 days or more in arrears.

This is quite a low number for a country the size of Australia.[16]

Chart 3.9

Source: Chart accompanying

presentation by Mr R Battellino, 24 April 2008.

3.24

Mr Battellino has also drawn attention to the distribution of the

increase in household debt, noting 'the rise to date has been overwhelmingly

driven by those households that had the greatest capacity to service it – the

middle‑aged, high‑income group'.[17]

3.25

Another factor that has helped indebted households stave off falling

into arrears is that in 2005 about half of them, including low income

households, had been ahead on their repayments (Chart 3.10). Around a quarter

of them are over a year ahead. As interest rates have risen, some of this

buffer may have been eroded.

Chart 3.10

Source: Reserve Bank of Australia, Financial

Stability Review, March 2007, p. 27.

3.26

On the other hand, the low level of defaults and arrears may just be an indication

of how hard Australians try to hang onto their homes even at the expense of

scrimping in other 'essential' areas. A recent study of families that were in

'housing stress' in terms of the 30/40 measure found that many were taking

tough decisions to keep meeting housing costs (Table 3.2).

Table 3.2: Measures

taken by stressed households: per cent of respondents

|

|

Renters in lowest two income quartiles paying 30-40%

of income in rent |

Renters in lowest two income quartiles paying over 40%

of income in rent |

Home purchasers in lowest income quartile |

|

Sometimes going without meals

|

21 |

30 |

10 |

|

Sometimes unable to heat or cool home

|

44 |

57 |

24 |

|

Children have missed school excursions or sports

|

40 |

42 |

23 |

|

Children go without adequate health or dental care

|

35 |

39 |

18 |

|

Sold or pawned personal possessions

|

32 |

34 |

8 |

Source: abridged version of

table in Burke (2007, p. 3).

3.27

As one senator summarised the evidence:

a lot of the submissions and oral evidence we have received are

from community support agencies who are saying that what they are finding is an

exponential increase in the number of people who are accessing their services.

For many of them, paying their mortgage is the first thing they do, so then

they cannot put food on the table...Financial counselling services are reporting

a significant increase in the number of people accessing their services.[18]

3.28

As the Department of Families, Housing, Community Services and

Indigenous Affairs (FaHCSIA) pointed out:

there would also be a number of households where the householder

would actually know that they are in arrears and would choose to sell the house

before there is a formal foreclosure process, so they would not necessarily

appear in those statistics.[19]

3.29

As Professor Disney observed, there are also people suffering an

indirect form of housing stress:

They are the people who have only escaped paying above 30 per

cent of their income on mortgage or rents by living in very unsatisfactory

housing or a very long way away from the job they already have or the work

opportunities that they might need.[20]

Effects on home ownership rates

3.30

Another approach to assessing the 'affordability' of home ownership is

to examine home ownership rates. The overall rate dropped only marginally, from

66 to 65 per cent, between the 2001 and 2006 censuses.[21]

However, within this the proportion of households who own their home outright

(ie do not have a mortgage) dropped from 40 per cent to 33 per cent.[22]

3.31

The age of first home buyers is also increasing. Home ownership rates

for those aged under 35, and to a lesser extent other cohorts, have dropped. This

probably reflects a mix of changing preferences and affordability issues:

There might be various social factors as to why that is

happening—people are studying longer, they are getting married later and doing

all sorts of things later. So part of it is a social thing, but I suspect part

of it is also due to the fact that they are having trouble getting the deposit

to get into the housing market.[23]

3.32

Drops in home ownership rates within various age cohorts is consistent

with overall stability in the home ownership ratio as the aging of the

population moves more people into the older cohorts with high ownership ratios.[24]

3.33

There are concerns expressed that around a tenth of people reaching

retirement age have not paid off their mortgages, something very unusual for

previous generations.[25]

(This was discussed further in Chapter 2; see especially Chart 2.1.)

Regional aspects

3.34

Average house prices (and incomes) vary across the country, and

therefore so does affordability. Sydney has the most expensive housing in Australia

while Tasmania, South Australia and most rural areas have significantly cheaper

housing. The pattern of 'affordability' and 'mortgage stress' can be somewhat different,

though, as some areas with cheaper houses also have lower average incomes. For

example, the average house price in Hobart is 44 per cent below that in Sydney,

but the average household income is 26 per cent lower in Hobart than in Sydney.

3.35

As an example of the dispersion, some house price/income measures from Demographia

are given below (see also Chart 8.1).

Table 3.3: Selected median

house price / median household income ratios

|

More affordable

|

|

|

Less affordable

|

|

|

Ballarat-Bendigo

|

5.0

|

|

Sydney

|

8.6

|

|

Canberra

|

5.5

|

|

Gold Coast

|

8.6

|

|

Wagga Wagga

|

5.5

|

|

Perth

|

7.6

|

|

Launceston

|

5.7

|

|

Melbourne

|

7.3

|

Source: Demographia (2008).

3.36

There have also been significant differences in the growth in house

prices in different areas within cities. Using data at postcode level, Richards

(2008) shows:

In four of the five major capitals, average annual growth in

house prices within five kilometres of city centres has been about 2 percentage

points higher than for houses close to the edge of the cities.

International comparison

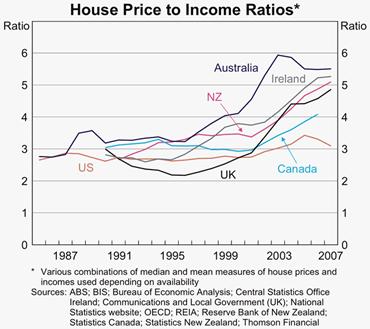

3.37

Over the past decade house prices have risen faster than incomes in a

number of comparable economies. However the increase has been more marked in Australia

than elsewhere and houses are now less affordable than in most comparable

economies.

Chart 3.11

Source: Richards (2008).

Table 3.4: Selected

cities: median house price / median household income ratios

|

More affordable

|

|

|

Less affordable

|

|

|

Dallas

|

2.5

|

|

Los Angeles

|

11.5

|

|

Ottawa

|

3.0

|

|

Sydney

|

8.6

|

|

Manchester

|

5.2

|

|

London

|

7.7

|

|

Canberra

|

5.5

|

|

New York

|

7.0

|

Source: Demographia (2008).

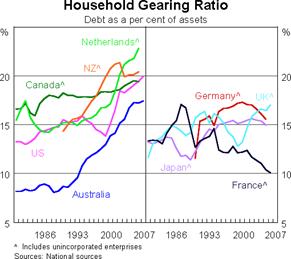

3.38

Whether as a cause or a consequence of this, Australian households have

gone from having relatively low debt-to-income ratios to being relatively

highly geared. Debelle (2004) discusses the general global trend towards

greater household debt.

Chart 3.12

Chart 3.13

Source for Charts 3.12 and 3.13: Debelle (2008).

3.39

Housing may be less affordable in Australia than in otherwise comparable

countries due to Australia's population being unusually concentrated in the two

largest cities, with no 'middle-sized' cities (with populations between 500,000

and 1 million). This is discussed in more detail in chapter 11. Another

factor affecting international comparisons is that the Australian housing stock

primarily consists of detached dwellings.[26]

Distributional implications

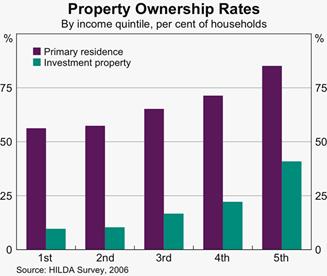

3.40

It can be argued that higher house prices do not benefit the population

as a whole. But they clearly have distributional consequences. Richards (2008) comments:

Renters will be worse off when housing prices rise whereas those

who own rental property will be better off. Owner-occupiers may be largely

unaffected, since they can be thought of as being ‘hedged’ against increases in

the cost of housing. There are also generational differences. Younger people

who have not yet bought homes will be hurt by higher housing prices. Older

owner-occupiers may benefit from an increase in prices if they are intending to

extract part of the increased value of their homes... Both home ownership and

ownership of rental property tend to rise with incomes, so it is lower income

households that tend to suffer from rising housing prices and higher income

households that tend to gain.

Chart 3.14

Source: Richards

(2008).

Interpretation

3.41

While there is general agreement on the above picture of the average

Australian home now costing a larger proportion of income, there are widely

diverging interpretations of the causes, and hence the implications for policy.

3.42

One interpretation is that average house prices are higher just

because households, having become wealthier, now demand better houses. On this

view, the change in the affordability of a house of a constant quality

is overstated by the house price/income measures. There is something in this

argument. The average house sold today has more bedrooms, ensuite bathrooms have

become standard and fittings are of better quality. One estimate is that quality

improvements from alterations and additions could have boosted house prices by

around one per cent per annum over 1970–2003.[27]

On the other hand, there are some aspects in which land quality has

deteriorated. Gardens and yards have become smaller. And new homes in the

cities tend to be progressively further away from work, beaches and cultural

and recreational facilities.

3.43

It seems clear that the large rise in home prices mostly reflects an

increase in land prices, or the price of a good location. One indication is

that the cost of building houses has not risen much faster than the CPI[28],

whereas the cost of buying houses has risen a lot faster. Sale prices of vacant

land show sharp rises.

Table 3.5: Housing

cost increases, 1986–2006, annual average percentage change

|

Established house prices

|

7.5 |

|

Project homes

|

4.7 |

|

Materials used in house

building

|

3.3 |

|

Consumer price index

|

3.6 |

Source: Parliamentary Library

(2006).

3.44

Interpretations of the cause of high land prices differ. Asking whether

the current price reflects supply or demand is like asking which blade of a

pair of scissors is doing the cutting. But in looking at the increase in

prices over time, it is notable that most independent commentators view

increased demand as the prime influence. The reasons for increased

demand are discussed in Chapter 4. Others place more emphasis on restraints on supply,

and these are discussed in Chapter 5. Some commentators regard the impact of taxes

and charges as specifically important and they are discussed in Chapter 7.

3.45

The Productivity Commission's view was that:

the dominant source of the widespread escalation in

prices has been a general surge in demand' ... 'increased demand for better

quality and better located dwellings, rather than for more dwellings, has been

the primary driver of prices in the recent upswing... because recent price

increases have been due mainly to the surge in demand in established areas,

improvements to land release policies or planning approval processes could not

have greatly alleviated them.[29]

3.46

The Reserve Bank 'do not believe supply deficiencies at a macro level

are the main reason for the reduction in affordability for first home buyers'.[30]

It regards the common pattern of house price increases in countries which have

liberalised their financial systems, shown in Chart 3.11 above, as buttressing

this argument:

the widespread nature of the increases in

house prices makes it hard to attribute them to factors that have localised

effects, such as land usage policies and taxes. These sorts of factors are more

likely to have affected prices at the edges of urban development. I think the

big increase in the price of established houses, which has happened right

across Australia and

through most of the developed world, is mainly reflecting factors that relate

to demand and capacity to pay. The big factor here is increased household

access to finance. These forces, as I say, have been global in nature. They

have not been specific to Australia.[31]

3.47

In contrast, Demographia (2008) make it clear they regard supply as the most

important consideration. Writing in the introduction to their report, Don Brash

says:

Affordability of housing is overwhelmingly a function of just

one thing, the extent to which governments place artificial restrictions on the

supply of residential land.

3.48

Demographia support this argument by pointing out that in the US houses

are more affordable in cities such as Pittsburgh and Houston than in cities

such as New York and Los Angeles. Demographia argues that the former cities do

not place artificial restraints on the availability of land.

3.49

This argument has not gone unchallenged. Macquarie Bank's Rory Robertson

provides an alternative interpretation of Demographia's data:

homes in coastal locations with good job

opportunities and pleasant winters tend to be more expensive than homes in

inland centres where job prospects and winters are less ideal ... Much of the

affordable housing in the Western world is found in America's infamous 'Rust

Belt'.[32]

3.50

As noted above, in Australia's capital cities inner city house prices

have risen faster than those on the periphery, suggesting demand factors have

been more important than land supply policies. Price increases seem to have

rippled outwards from the city centres rather than inward from the urban

fringes.

3.51

This implies that measures to increase land supply on the urban fringe

or reduce prices of such land by reducing state and local government charges

(discussed in chapters 5 and 7 respectively) will have only a small impact on

measures of average affordability. Only a small proportion of homes are located

near the urban fringe. Most experts argue with the Reserve Bank that

In most circumstances, an increase in supply in outer areas is

likely to have only a relatively small effect on prices for houses in preferred

locations, including those close to the city.[33]

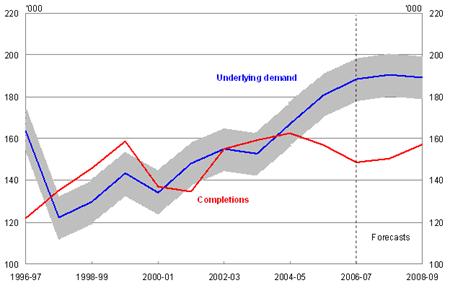

Estimates of the demand-supply imbalance

3.52

There seems to be a consensus that the 'underlying' demand for dwellings

is growing by around 180 000 dwellings a year, around 30 000 more than is the

stock of dwellings. Chart 3.15 shows this gap opened up a few years ago and is

forecast to continue.[34]

3.53

It is important to be clear about what this comparison measures. Underlying

demand for new housing is an estimate of the number of new dwellings that would

be needed based on past growth in population, migration (both long term

arrivals and short term visitors), living standards and the demolition of

existing housing. 'Underlying' (or 'notional' or 'potential') demand differs

from 'effective' demand, which is based not only on the desire for new housing

but also the ability and willingness of potential buyers to pay for it.[35]

As Dr Ronald Silverberg, Managing Director of the Housing Industry Association,

told the committee:

There is a gap in the order of 30,000 dwelling units between the

new housing supply and notional demand. The notional demand is built up on the

basis of demographic estimates. It is a useful reference point.[36]

Chart 3.15

Dwellings:

Completions v Demand

Source: Making Housing Affordable Again, Department of Families,

Housing, Community Services and Indigenous Affairs, March 2008.

3.54

One would expect that housing supply and effective demand for housing

would equilibrate through an adjustment in the market price. For reasons

discussed in Chapter 5, the supply of dwellings has not increased enough to

keep up with the recent increase in underlying demand. Prices have risen to

bring the increase in effective demand down below that in underlying demand. This

analysis would suggest that as soon as interest rates start to fall (unless

there is a recession), effective demand will increase and if supply does not

respond, house prices will rise further and the prospect of home purchase

recede further for some potential buyers. This will only be avoided if policy

changes act to remove impediments to increasing supply or reduce artificial

stimulants to demand. Such responses are the subject of latter chapters in this

report.

3.55

This inability of the supply of housing to keep pace with demand is also

evident from rental housing vacancy rates. FaHCSIA's March 2008 report 'Making

Housing Affordable Again' shows that in all capital cities, there has been a

pronounced fall in the available supply of rental housing since 2002.[37]

The Reserve Bank's May 2008 Statement on Monetary Policy noted that

vacancy rates are at historical lows at just over one per cent: a rate of

around three per cent 'is generally considered to indicate a reasonable

balanced rental market'.[38]

3.56

In the longer term, the underlying demand for housing may decelerate.

One projection has the demand for new houses dropping to under 110 000 in the

2020s, reflecting falling fertility, increasing baby boomer deaths and social

factors.[39]

Conclusion

3.57

There is consistent evidence that housing in Australia has become less

affordable in recent years and the number of households experiencing mortgage

stress has increased. There is also evidence that the number of households

defaulting on mortgages and homes being repossessed is not as high as these

figures might predict. Many families make tough decisions and go without to

meet mortgage payments; most families in housing stress take steps to move out

of housing stress within one to two years. Taken together, these factors stress

that it is important for policy makers to consider the support services offered

to families in housing stress and the range of options on offer to either help

them through a rough period, or help them move to more affordable housing

options. These issues are considered in more detail in chapters 9 and 10.

Navigation: Previous Page | Contents | Next Page