Government senators' dissenting report

Context for the National Commission of Audit

1.1 The Coalition government was elected with a clear mandate to bring the budget under control and to end the reckless spending that characterised the preceding Labor government.

1.2 The mismanagement of the economy by the Gillard/Rudd Labor governments has given us the biggest deficit in modern Australian history. Their inability to make tough economic decisions has meant that their legacy is one of a structural budget deficit driven by unsustainable spending.

1.3 The government has inherited these decisions, which Labor and the Greens never acknowledged as problems in government and keep denying in opposition.

1.4 Whereas the former government decided to keep spending borrowed money, the Coalition government will not play games with Australia's future prosperity. Addressing the budget deficit is a matter of urgency. It is essential that we act decisively and quickly to fix Labor's economic negligence.

1.5 It is only right that the government seek good advice on putting the budget back on a sustainable footing, including considering the recommendations made by the Commission of Audit (the commission).

The growing burden of Australia's budget deficit

1.6 Recent Treasury projections expect deficits totalling $123 billion over the next four years, with a $47 billion deficit in 2013-14.[1] On current levels of expenditure, this is projected to rise to $667 billion in 2023-24.[2] These growth trends have also been confirmed by the Parliamentary Budget Office (PBO), which found that from 2002-03 to 2012-13 government spending grew by 45.2 per cent, or 3.8 per cent annually, outpacing GDP growth over the same years of 34.3 per cent or 3.0 per cent annually.[3]

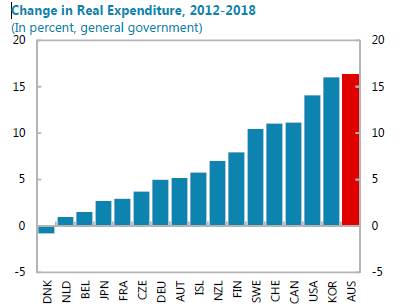

1.7 Moreover, a recent International Monetary Fund (IMF) paper found this situation will only worsen if left unchecked. It noted that Australia has the highest projected change in real expenditure of the 17 nations surveyed and the third highest growth in net debt.[4]

1.8 For the six years from 2012 to 2018 Australia is forecast to have the largest percentage increase in spending of the 17 IMF advanced economies profiled. Our spending is growing faster than countries like Korea, Canada, Germany, France and Japan. The forecasts on which the IMF study is based are based on the spending projections that Labor had locked in while still in government.

1.9 Over the same period, Australia is forecast to have the third largest increase in net debt (in percent of GDP) of the advanced economies profiled. IMF data shows that over half the comparable countries planned a reduction in net debt over the period 2012-2018. Countries that are reducing net debt include France, New Zealand, Germany and Korea.

1.10 These projections are concerning for Australia, because even the Labor Party intended Australia to be in a debt repayment phase over this period.

1.11 Former Labor Minister for Financial Services Chris Bowen went as far as claiming on Radio National that 'the Government has returned the Budget to surplus three years ahead of schedule and ahead of any other major advanced economy'.[5]

1.12 After promising on hundreds of occasions that Australia would be running a surplus from 2012 onwards, Labor was found to be incapable of taking the decisions needed to make such surpluses achievable. Labor delivered an increase of 8,360 in public servants (or 5.82%) from June 2007 to June 2013 after Opposition Leader Kevin Rudd in 2007 promised to take a “meat axe” to the public service. For every saving measure Labor adopted or additional tax they imposed, they surpassed these decisions with additional spending.

1.13 Under Labor’s spending settings, Australian Government finances are projected to stay in deficit in each and every year into the foreseeable future. The former Government established a façade of several fiscal rules, then systemically set about breaching those rules. Most of those fiscal rules were outlined in Labor’s first budget in 2008-09 and published with fanfare in every set of Labor budget papers.

1.14 One of those rules was to achieve budget surpluses on average over the medium term. The reality is that Labor left Australia with six successive deficits. These were the six record largest deficits in Australia’s history.

1.15 Labor also committed to improve the Government’s net financial worth over the medium term. In fact the MYEFO forecasts shows that government Net Financial Worth is projected to rise from -$290 billion to -$361 billion over the forward estimates. Debt is on track to hit $667 billion in a decade.

1.16 A further fiscal rule was to keep taxation as a share of GDP on average below the level of 2007-08 (that is 23.6 per cent). The 2013 Pre-Election Fiscal Outlook (PEFO) made it clear that tax receipts under Labor would be expected to surpass that level based on the existing tax system and based on the fiscal drag that could be expected from a government that is unable to balance its books to allow tax cuts. Page 61 of PEFO states that “Tax receipts would reach around 25 ½ per cent of GDP in 2023-24”.

1.17 A further fiscal rule was published in Labor’s July 2010 Economic Statement. This ‘rule’ was to hold real growth in spending to 2 per cent a year, support a return to surpluses. But the fact is that real average spending growth over the five years to 2012-13 was 3.5% per annum, according to Treasury’s figures in MYEFO. This is almost twice the 2% target. MYEFO also projects average real growth in spending over the medium term, after the forward estimates, to be 3.7%.

1.18 In opposition, the Coalition pointed out Labor decisions in 2013 to ramp up spending meant that important stresses on the budget were hidden in the fifth year, for which there were no published projections.

1.19 Treasurer Joe Hockey revealed in the March 2014 sittings of parliament that the latest Treasury advice shows that without any policy change, spending growth will be 6 per cent over the final out-years of the next budget (2016-17 and 2017-18).

1.20 This is 3 times larger than Labor’s feigned spending limit. This is a direct result of Labor’s poor budgetary decisions.

1.21 The spending growth between 2016 to 2018 will include some increases even higher than 6%. In Defence it will be 13%. In overseas aid 66%. In disability it will be 125%, as the NDIS builds up.

1.22 Labor pushed their spending decisions beyond the immediate estimates period, knowing that the true cost of their reckless decisions would not be revealed until after the 2013 federal election.

1.23 In order for Labor to have met their bogus 2 per cent rule, Labor would have needed to cut tens of billions per year from projected spending over the forward estimates.

1.24 In this report, the IMF expressed surprise that our spending was ‘higher than anticipated' and stated clearly that bringing the budget back to surplus will be difficult on current spending plans.[6]

1.25 They noted particularly the increasing burden of government expenditure on health, age-related pensions and aged care, disability services and education.[7]

1.26 The IMF however noted that notwithstanding the challenges, its analysts 'supported the broad aim of improving the budget position over the medium term, which would help rebuild fiscal buffers and increase the policy scope to deal with adverse shocks, but cautioned that it should be done in a way that does not disrupt growth prospects in the near term.'[8]

1.27 This caution about growth prospects is an important reason for concentrating on expenditure control, rather than taking the economic damaging path of increasing taxes.

1.28 Australia’s fiscal problem is at its heart a spending problem and the Commission of Audit will be an important first-step in understanding the problem and identifying potential remedies.

1.29 Repairing the Australian budget is important to all Australians as it will help us strengthen the economy and create growth and jobs. Unless we take action, rising spending and debt will add pressure on interest rates. It will add pressure on taxpaying businesses and individual taxpayers who already do the heavy lifting and will be made to bear an even heavier burden. It will take away Australia’s capacity to absorb external economic shocks.

The important work of the commission

1.30 The commission is undertaking a timely and necessary review of the entirety of the Commonwealth's expenditure to address the serious budget problem inherited by this government which is denied by the committee majority.

1.31 The commission's recommendations will be one input that informs the development of the 2014-15 Budget. With the benefit of the commission's findings the government will be best placed to make decisions to place the economy on the right footings.

1.32 It should be remembered that the commission's recommendations are not a done deal. Rather, when they are delivered, they will be carefully considered by government. Those that the government chooses to adopt in the short term will still need to be announced as part of the budget process. Many would require legislation which would involve parliamentary scrutiny and further public consultation.

1.33 As can be expected, Labor and the Greens believe the answer is simply raising taxes, which will hit ordinary Australians in the hip pocket.

1.34 Although the Coalition government has committed to a review of the tax system, the results of which we will take to the Australian people at the next election, we believe that it is completely right to consider making government expenditure smaller, better targeted and more efficient.

Timing

1.35 The committee has repeatedly dwelt on when the commission's report will be released to the public. The government is carefully considering the commission's report, and looking at how its recommendations will inform the 2014-15 Budget. It is not unusual for governments to take their time to consider reports, especially when their recommendations are so important.

1.36 The government has consistently said it will release the report before the 2014-15 Budget. The Treasurer, the Hon Joe Hockey MP, has publically stated the report of the National Commission of Audit will be released on Thursday 1 May 2014.

Increasing health expenditure

1.37 This second interim report focuses on how the Australian health system is financed. It is clear recent growth trends in health expenditure are unsustainable and that the government should find ways of driving efficiency and reducing our health costs.

1.38 Australia's health budget has been growing rapidly over the last decade. In 2001-02 the total combined government expenditure at both federal and state levels on health was $82.9 billion. In 2011-12 it was $140.2 billion – an appreciable rise in real terms.[9]

1.39 The bulk of this funding comes from the Commonwealth. In 2011-12, the government spent $59.5 billion on health. A decade earlier, in 2001-02, government funding was just $27.8 billion.[10]

1.40 This is placing an increasingly heavy burden on the Commonwealth budget. The PBO has found that health spending represented 16 per cent of total spending in 2012-13 at $61.3 billion. Between 2002-03 and 2012-13, Commonwealth spending on health grew by around 59 per cent or 4.8 per cent annually, well above our GDP growth rate of 3 per cent over the same period.[11]

1.41 The growth trend of the last decade is expected to continue. The last Intergenerational Report projected that over the next 40 years health expenditure will rise from 4.0 per cent of GDP in 2009-10 to 7.1 per cent of GDP in 2049-50.[12]

Drivers of health expenditure

1.42 Mr John Daley, in a report by the Grattan Institute, found that health is responsible for most of the spending increases above GDP for both Commonwealth and state governments. He noted that the drivers for this increase are not solely the aging population, as is usually argued, but the 'provision of more and better health services per person'.[13]

1.43 Although Australia's health outcomes are reasonably good, there are more worrying signs that Australia's health system is facing increasing pressure. In 2009, the final report of the National Health and Hospitals Reform Commission stated:

While the Australian health system has many strengths, it is a system under growing pressure, particularly as the health needs of our population change. We face significant challenges, including large increases in demand for and expenditure on health care, unacceptable inequities in health outcomes and access to services, growing concerns about safety and quality, workforce shortages, and inefficiency.[14]

Ensuring sustainability of the health system

1.44 There is a clear need to rein in the growth in health spending to ensure the sustainability of the health system into the future.

1.45 The government believes that it is time for a conversation about what the best possible future health system for Australia should look like. Importantly, this should also include the issue of how this system should be funded.

1.46 This means broaching tough questions that the opposition would prefer to ignore, most importantly whether people should make a contribution to their health costs where they can afford to do so.

1.47 The suggested co-payment for GP visits is an example of the scare campaign generated by Labor and the Greens. We do not know if this suggestion will be recommended by the commission but it would not mean the end of Medicare. This is simply the suggestion that a user benefiting from a service should contribute to the cost. This is not a new idea and it is fair.

1.48 It would ensure appropriate value is placed on the service and that the user only consumes as much as is needed. Australia needs a fair system and it could accommodate co-contributions through the use of a safety net or exemptions.

The increasing bill from income support payments

1.49 Australia also has an increasing welfare bill. Social security and welfare payments have increased over the last decade from $73 billion in 2002-3 to $131.7 billion in 2012-13.[15]

Government review

1.50 The most recent annual review of income support payments by the Department of Human Services shows significant growth in income support payments with the result that more than five million, or one in five, Australians now receive income support payments.[16]

1.51 The PBO found that social security and welfare was the largest component of government spending totalling $132 billion in 2012-13, or 34 per cent of the total.[17] Social security and welfare spending represented more than a third of total spending in 2012-13 and contributed approximately a third of the overall growth in spending.[18]

1.52 The PBO also found that social security and welfare, along with health were the largest contributors to the growth in spending over 2002-03 to 2012-13. 'Together, spending on these items accounted for over one half of the growth in total spending over the period'. The PBO noted:

Social security and welfare spending contributed one third of spending growth and contained four of the major program contributors to overall spending growth over the period: the Age Pension, the Disability Support Pension (DSP), Family Tax Benefit, and Aged Care.[19]

1.53 In January 2014, the Minister for Social Services, Mr Kevin Andrews MP, announced a review of the welfare system to be headed by the former chief executive of Mission Australia, Mr Patrick McClure.[20]

1.54 The scope of the review is limited to working age payments such as Newstart Allowance (NSA) and the Disability Support Pension. Payments such as Age Pension and the various forms of family assistance will not be examined.[21]

Employment

1.55 The government is working on its plans to guarantee the long-term sustainability of our economy by creating a strong employment market.

1.56 This includes responding to the challenges of an economy in transition, by ensuring we create the conditions for sustainable and rewarding jobs to be created by private enterprise, as well as an employment relations system that is fair for both employers and employees.

1.57 The government has set out to create two million jobs in the next decade, with one million new jobs in the next five years. This target is ambitious, but possible - should the opposition overcome its unwillingness to assist.

1.58 We need the red tape that constrains private enterprise to be removed to encourage the creation of new jobs in new areas. We need the shackles of the carbon and mining taxes to be lifted, so that the resources, manufacturing and industrial sectors can be revitalised.

1.59 Most importantly, we need to build confidence in Australia's economy by the government living within its means, working to drive efficiency and reduce the deficit.

Labour market conditions

1.60 Currently, Australia has the worst unemployment statistics for a decade. This is due to a number of factors, including the high dollar and terms of trade. However, it is also a legacy of the job-destroying Gillard/Rudd Labor government.

1.61 The Treasury has clearly stated to the government that the employment market consistently reflects a six-month lag behind wider economic factors, including government policy.[22] The current government has inherited the employment conditions we are seeing now from the previous government's economic policy.

1.62 Through its mismanagement of the economy, the last government created uncertainty for the private sector and provided no security for the business community. The Labor-Green carbon tax is an $8 billion a year tax on electricity. Labor’s arbitrary decision to change FBT rules for cars caused damage in the automotive industry, just as their knee-jerk announcement to halt live animal exports damaged Australia’s livestock export industries. The Coalition government is committed to improving this situation.

Wages growth

1.63 The opposition claims that wages growth is slow and productivity is above trend. However, this committee has received evidence that suggests this is not the case.

1.64 Dr Peter Burn, Director, Public Policy, Australian Industry Group, told the committee that wages growth was around the historical trend, but that a 'killer statistic' was our rising unit labour costs:

The nominal wages growth has been well within historical bounds in the last decade. The disturbing thing however is that, in a comparative sense, our unit labour costs have risen very fast. So we have looked at a comparison of 19 OECD economies and our labour costs per hour are among the fastest in that 19 and our labour productivity is among the slowest. The combination of those things means that our unit labour costs have risen the fastest of that sample of 19 countries over the last decade.[23]

1.65 It is clear that we need greater productivity across the board, including through the workplace relations system. The government has committed to a review of the industrial relations system to be undertaken by the Productivity Commission.

1.66 The Minister for Employment, Senator the Hon. Eric Abetz has stated that this will not consider the penalty rates system, which is a matter for the Fair Work Commission.[24] It is irresponsible scaremongering that the opposition has suggested otherwise.

Job losses in the public sector

1.67 The committee majority seems to have conveniently forgotten that Labor had a plan to reduce public service jobs and we are seeing the effect of those cuts now. The committee majority is also glossing over the fact that Labor not only kept but increased the efficiency dividend for the public service.

1.68 The previous government had previously increased the efficiency dividend a number of times, including over the forward estimates period (as shown in the table below). In 2012-13 the efficiency dividend reached a historic high of 4.0%.

|

2006-07

|

2007-08

|

2008-09

|

2009-10

|

2010-11

|

2011-12

|

2012-13

|

2013-14

|

2014-15

|

2015-16

|

2016-17

|

|

Annual ED

|

1.25

|

1.25

|

1.25

|

1.25

|

1.25

|

1.50

|

1.50

|

1.25

|

2.25

|

2.25

|

2.25

|

|

One-off ED

|

-

|

*

|

2.00

|

-

|

-

|

-

|

2.50

|

-

|

-

|

-

|

-

|

* The then Government announced a 2 per cent one-off ED during 2007-08. A pro-rata adjustment of the one-off ED was applied for part of the 2007-08 year, with the full year impact of 2 per cent applied in 2008-09.

1.69 In their final days in office Labor cut agency budgets, but were not transparent about the number of jobs that would be lost. Department of Finance advice provided to the Coalition government after the election revealed that Labor’s policy settings and measures are expected to result in around 14,500 total job cuts across the public service, as set out in the table below.

Number of staffing reductions from legacy Labor decisions

|

2013-14

|

2014-15

|

2015-16

|

2016-17

|

Total

|

|

2013-14 Budget estimates forecast decrease (terminating programs)

|

1,262

|

7,192

|

-925

|

1,290

|

8,819

|

|

Additional efficiency dividend (increase to 2.25% over three years saving $1.8 billion over the forward estimates)

|

-

|

1,372

|

1,628

|

1,808

|

4,808

|

|

More efficient management structures (Redundancies for executive level staff from EL1s to SES)

|

170

|

338

|

338

|

-

|

846

|

|

Total staff reductions

|

1,432

|

8,902

|

1,041

|

3,098

|

14,473

|

1.70 The secret job cuts of the Labor Government forced a large number of departments and agencies to offer voluntary redundancies. But Labor only made a financial provision for only around 800 of these payouts and this has forced some agencies into operating losses. Further, the Labor job cuts were untargeted decisions, making no distinction between higher or lower priority areas of government activity.

1.71 By contrast to Labor’s clandestine cuts, the Coalition took a transparent commitment to the 2013 election to reduce the headcount in the public service through natural attrition.

1.72 In MYEFO the government modified its approach to take account of Labor’s secret cuts of 14,500 positions in the Australian Public Service. The Coalition Government’s approach to streamlining the public service is now subject to advice from the Commission of Audit on the proper shape and scope of government. The government has responsibly asked the Commission to ensure any staff changes were based on deliberate choices about priority areas, the proper functions of government and the opportunities to reform the way we can deliver services.[25]

1.73 Labor’s APS job cuts are timed to have their biggest impact in the 2014-15 financial year. This has required many agencies to undertake preparatory redundancy rounds and recruitment freezes during the 2013-14 year, to ensure their headcounts are brought down to the necessary entry level for July 2014. It is disingenuous of Labor Senators to now insinuate that recent cuts to public agencies all flow from Coalition decisions, or to disown their contribution to bringing about reductions in Australian Public Sector resourcing.

Conclusion

1.74 While Labor and the Greens remain in denial, this will not change the fact that serious budget issues must be addressed. Labor and the Greens have left a huge debt to repay and action must be taken now, so that future generations do not have to reap the consequences of Labor’s irresponsibility.

1.75 Rather than review government spending, Labor and the Greens would have us keep borrowing and raising taxes. This is the easy choice with little immediate electoral pain - but it would leave an unconscionable and burdensome bill for future generations.

1.76 The Coalition believes the first step in addressing the budget emergency is to take a close look at government expenditure, rather than raising taxes for Australian families and businesses.

1.77 The government is taking its time to properly consider the commission's reports and its response. This is not unusual. There are difficult decisions to be made. The government has committed to releasing the reports and this will occur at the appropriate time.

Senator David Bushby Senator Dean Smith

Senator for Tasmania Senator for Western Australia

Senator Sean Edwards

Senator for South Australia

Navigation: Previous Page | Contents | Next Page