Navigation: Previous Page | Contents | Next Page

Chapter 13 - The potential of electronic banking

13.1

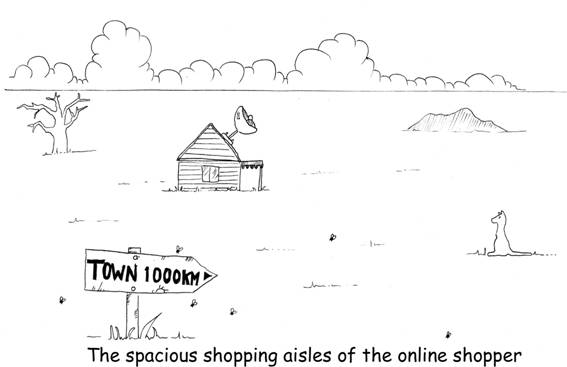

Advances in technology were expected to bring

great benefits to consumers in meeting their banking needs. Indeed, many

consumers have enthusiastically adopted the new ways of conducting banking and

welcomed the ease, convenience and safety it offers them. A recent guide to

e-commerce for Australians living in rural and regional Australia announced:

Rural and

regional Australians in particular stand to reap significant social and

economic benefits from e-commerce as it helps to overcome ‘the tyranny of

distance’ which so often isolates rural and regional communities from larger

domestic and international markets.[1]

Overcoming the ‘tyranny of distance’[2]

13.2

Ironically, although advances in technology have

enabled people to transact basic banking business at any hour of the day and

from the comfort of their own home or office, it has also effectively erected

barriers between the bank and some of its customers. As noted in chapter 3, one

of the major concerns expressed by witnesses was the loss of personal service.

In many ways, this sense of distance between the bank and the customer has been

exacerbated by new technology.

13.3 The challenge for the banks is to meet the

growing consumer demand for new service channels while ensuring that the

growing reliance on electronic banking does not effectively sever important

links between customers and their bank. The following section touches on the

potential for new technology to enhance and strengthen ties by using technology

to extend the reach of financial services providers to those living in remote

districts. It also goes beyond exploring the provision of basic banking

transactions to consider the broader issue of using new technology to provide financial

assistance and advice to people in regional, rural and remote Australia.

Using technology to bridge the divide

13.4

Some Councils are taking on the dual

responsibility not only of making available the necessary equipment but also providing

a friendly reassuring environment in which people can experiment with and

finally use the internet for banking purposes. A simple example of this

practical and sensitive approach came from the Rosalie Shire Council whose

mobile library provides Internet and email services to all areas of the shire. Mr Weber explained:

I come back to our flagship, our mobile library. We have

recently established Internet connections in all of these towns—Acland,

Bowenville, Cooyar, those kinds of places. Again, the populations in those

areas are older. We found in the beginning that people came to use the library

and take the books as they always had done; it has taken them a while to

realise that the computer that is sitting in the corner is something that they

can use to talk to their sons and daughters who are wherever in the world.

Usage has been slow to take off, but we have pushed it over the last 12 to 18

months and acceptance is increasing.

...

Our librarian provides them with training and shows them how to

use it. It is not formalised, and we did not intend to formalise it, from the

beginning, but certainly he does provide training. Acceptance has been

excellent.[3]

13.5

The council is considering ways to ‘piggyback on

that service’ to deliver banking services to its community.[4]

13.6

Along similar lines, the Upper Murray Regional

Library is taking advantage of a service already in place to improve banking

services to regional communities. The library operates two mobile libraries to

service the remote localities in the district. It noted that many of the areas

covered by the mobile library service do not have the telecommunications

infrastructure to provide online access to services. In September 2001, the

Library launched a pilot program using two-way mobile satellite telecommunications

that provide the rural and remote communities with online access to the same

services as delivered in their 12 static branches. It found that the pilot

project indicates that:

...online services can be delivered to communities that do not

have online access via standard telecommunications infrastructure. This offers

the possibility of introducing innovative delivery of other services than

online information and library services.[5]

13.7

It has been pursuing the idea of a Mobile Rural

Transaction Centre that would include banking services among the other services

it would deliver. It concluded:

It is possible for these services to be delivered via a vehicle

similar to (but not as large as) that delivering Library and Information

Services from Upper Murray Regional Library. This is one option for the expansion

of banking facilities through non-traditional channels including the new

technology being piloted by Upper Murray Regional Library. The benefit being

that for one financial outlay a number of communities can have the same

services as provided by static Rural Transaction Centres.[6]

13.8

The idea of the mobile rural transaction centre

is an innovative approach to addressing the problem of enabling people to

conduct basic banking transactions. The ground-breaking work in this area in

South Africa with their mobile ATM scheme provides a practical example of how

technology can be used to provide people in outlying areas with an effective

combination of over-the-counter and self-service banking services (see Chapter

7, para 7.37) The Committee is of the view that such schemes warrant government

support and further consideration should be given to the wider implementation

of such schemes. Moreover, the Committee believes that the banking industry

should be spearheading innovation in this area.

Recommendation 16

The Committee recommends that the review as suggested in

recommendation 10 include consideration of the more innovative ways that RTCs

may be involved in delivering banking services to the remote areas of Australia

including the concept of a mobile RTC.

Electronic banking and customer relationships

13.9

The possibility of disenfranchisement from the

banking and finance world highlights the importance of providing all

Australians with access to new ways of banking. The innovative use of

technology such as mobile rural transaction centres are designed to assist

consumers better manage basic banking services. A number of submissions noted

that physical access to a facility or equipment is not the only matter of

concern when considering the adequacy of banking services. The Gunning Shire

Council submitted that personal contact should not be underestimated and that

electronic options fail to recognise the importance of the social interaction

that is associated with banking transactions.[7]

13.10

For example, the Uniting Church Synod of South

Australia which often intercedes on the part of people who feel they have been

treated unfairly or inappropriately by banks highlighted some of the

difficulties experienced by people without access to over-the-counter services.

It noted:

The removal of face-to-face banking services in rural

areas has meant that advocacy work is relegated to phone communication.

Ministers have found their ability to confront bank staff with a problem and to

resolve it over the phone is more difficult than previously.[8]

13.11

The Shire of Dandaragan maintained that, ‘people

want to be able to communicate with their local bank branch and its officers,

not to go through metropolitan areas.’ It maintained that ‘local decision

making is required as queries/decisions are directed to a centralised location

which cannot necessarily have the local knowledge to deal with a specific

request’.[9]

It highlighted a few simple improvements that would help to compensate for the

lack of personalised customer service. It suggested the need ‘to have direct

phone contact to individual bank branches and not to have to go through major

capital cities’.[10]

13.12

Dr David Morgan highlighted the difficulties that electronic banking can generate

for bank customers. He stated:

And the real problem is not just because the ATMs are sometimes

down, or the branch computers have a hiccup or the lines are busy on telephone

banking. Yes, these are the points of considerable irritation, but more

importantly they highlight the deficit of understanding the technology creates.

Technology might empower people but it also adds to the feeling of

powerlessness. It has dehumanised what has been a very human business. And it

adds up, I’ve little doubt, to a perceived lack of recognition and respect.[11]

13.13

The business sector in particular finds that the

centralisation of banking facilities by some major financial institutions makes

it difficult for them to discuss their banking and business needs with

professional staff or the bank manager. The Gosford City Council noted that

while ‘reliance on technology may assist some businesses with the efficiency of

transactions, the issue of access to professional banking staff also needs to

be considered’. [12]

13.14

The Committee believes that the increasing trend

toward the centralisation of services and the reliance on electronic banking

has not been accompanied by appropriate measures by banks to ensure that they

retain and foster personal relationships with their customers. The Australian

Bankers’ Association Industry Standards for both Automated Telephone Banking

and Internet Banking offer valuable guidance for banks on how to make these

services more accessible to their customers. For example a standard set down in

the industry standard for automated telephone banking requires:

Users who are having difficulty in navigating or comprehending

the automated service shall, during the hours operators are normally available,

be given the option to speak with an operator in order to carry out their

transactions.[13]

13.15

Although such standards are definitely a step in

the right direction they do not adequately address this issue of the quality of

communication between the customer and their bank. Evidence to the Committee

shows that people, especially business people, want to be able to converse with

an officer who has an understanding of their affairs and an appreciation of the

local economy. Measures including dedicated phone lines and designated account

managers are going some way to restoring better personal relationship between

customers in regional, rural and remote Australia and their banks. The Committee believes, however, that the people

fulfilling these roles must have more local community knowledge then currently

appears to be the case.

Recommendation 17

The Committee recommends that banks have trained officers

available in their regional centres to look after the banking needs of

customers in country Australia who do not have face-to-face access to trained

bank staff. These designated officers would have responsibility for customers

from a particular geographic area and have direct knowledge of the local

community and businesses in the district.

The broader issue of access to financial advice and assistance

13.16

The focus on the delivery of the more elementary

aspects of banking should not eclipse the much broader issue of the provision

of advice and assistance across a range of financial services. According to

many witnesses, modern technology has not compensated for the loss of

face-to-face banking. They argued that while communities in rural, regional and

remote Australia may generally

have access to transaction services, many do not have access to comprehensive

financial services.[14]

The Committee has discussed the importance of the personal relationship between

the customer and the bank. The following section broadens the scope of this

examination to include a wider range of financial services.

13.17

The Finance Sector Union of Australia made the

point that there is a clear distinction between transaction banking and

comprehensive financial services and suggested that all initiatives ‘must aim

to provide comprehensive financial services to rural, regional and remote

communities, not just transaction services’.[15]

13.18

A recent survey highlighted the importance of

addressing all aspects of banking and financial services not just basic banking

transactions when considering the adequacy of banking and financial services in

country Australia. It found

that generally, there was a strong demand for further education in banking and

financial matters, with only 14 per cent of respondents considering that they

did not need further education in relation to finance.[16] On presenting the survey, Mr John MacFarlane, CEO of

ANZ, stated:

While this survey indicates Australia has a good foundation of

basic skills it is very clear there are challenges. These include increasing

understanding in the areas of investment, superannuation and retirement

planning and in assisting the most vulnerable sections of the community many of

whom are struggling with financial skills.

By empowering people with the appropriate financial skills,

knowledge and information they are better placed to make informed decisions

about their money and avoid being mislead on financial matters.[17]

13.19

Of particular relevance to this inquiry was the

survey’s finding that people living in country areas are slightly

overrepresented in the lowest financial literacy quintile and under-represented

in the highest financial literacy quintile.[18]

This lower level of financial literacy coupled with more difficult access to

banking and financial services, particularly face-to-face service, makes the

task of ‘empowering people with the appropriate financial skills, knowledge and

information’ more of a challenge.

13.20

The findings of this financial literacy survey

underscored the importance of ensuring that people in regional, rural and

remote Australia have access to

the full range of banking services. Where over-the-counter service is not a

commercially viable option, the innovative use of technology can assist people

with their banking needs and put them in closer contact with their bank. The

Committee believes that the potential of technology to enhance communication

between banks and their customers has not been adequately tapped.

13.21

A number of the problems could be solved partly

by service providers informing themselves of their customers needs, taking

account of their requirements and using technology to engage their customers

not disconnect them. Rather than alienate the customer, the Committee believes

that the clever use of technology and sensible communication initiatives could

be used to bridge the divide.

Use of video conferencing

13.22

The Community Teleservices Australia (Inc) (CTSA) is a national

association representing rural and regional Telecentres, RTCs, Online Access

Centres and any other community-based Teleservice Centres. These centres are

community owned and operate service facilities based mainly in small rural

towns throughout Australia.

Each Centre serves the unique needs of its community. Overall, however, they share

many common objectives and capabilities, including community development,

information provision, technology-based training, distance education, email and

internet access, secretarial, financial and desktop publishing services.[19]

13.23

Teleservice Centres are found throughout rural

and remote Australia in places

that have a population ranging from 200 to 5000 people. CTSA believes that

these Teleservice Centres already provide a structure that may be used ‘to

develop banking services to rural areas with minimal establishment costs,

providing that ongoing issues of funding for personnel and communications

access (cost and speed) can be addressed’.[20]

13.24

A number of other submissions also saw the

potential for new technology to be used to deliver banking and financial

services. The Guyra Shire Council suggested the use of video technology to

assist in providing face-to-face contact with an appropriate person of

authority in the bank who may be located in another town. It submitted:

A separate booth or room could be set up for video

conferencing in each branch. A similar facility may be able to be shared

between the various banks in the same town. Relevant documents could also be

faxed between the locations and if done professionally, every thing that could

be carried out at a face to face meeting could be carried out via interactive

video conferencing.[21]

13.25

The Shire of Victoria Plains suggested that if

services such as online banking, advice access and technological advantages

could be provided through agencies then the services offered could be the same

as those offered by the actual bank branch to a major extent. It acknowledged,

however, that the cost of the installation would be a significant barrier to

any organisation contemplating installing such facilities in regional Australia.[22]

13.26

Mr Brittain, CEO, Nanango Shire Council, who

has experience with the technology, agreed with the view that videoconferencing

could restore the personal interaction between the bank and customers in towns

without a bank branch. He observed, however, that ‘as an operator of an RTC, I

do not want to be wearing the cost of operating a videoconferencing centre in

Blackbutt’.[23]

13.27

Although the use of technology such as

videoconferencing hinges on costs which at the moment are a major obstacle, the

Committee believes that there is scope for improvement and increasing use.

Again it would like to see the ADIs take a leading role in experimenting with

this type of technology as a means to enhance their relationship with their

customers.

Conclusion

13.28

This report has shown that e-commerce has the

potential to break down the geographical barriers and allow people living in

the more remote areas of Australia easy access to a range of banking and financial services. For all

the advantages that modern technology brings to consumers, however, it also

creates difficulties for some people. This is particularly so in the case where

a consumer lives or works in an area that does not provide full banking

services and who, therefore, must rely on new service channels as a substitute.

13.29

Although some submissions argued that new

technologies would not provide sufficient services to meet residents’ needs,[24] the Committee believes that the

banking sector has not done enough to facilitate access to new technology and

most importantly has failed to ensure that their clients have the opportunities

and are encouraged to use new technology. It would like to see the banking

sector work more closely with community organisations especially with funding

for projects such as computers in libraries and the mobile library concept.

13.30

The Committee also urges the banking industry to

consider how best they can use new technology to cultivate a far more positive

environment in which country people could conduct their banking business. It

has already mentioned adopting communication methods that are easier to use and

less intimidating and establishing travelling or mobile banking units to make

personal contact with customers. Better training of staff in agencies and more

constructive use of the Post Offices would also assist ADIs build stronger

links with their customers.

13.31

It clearly sees a role for government in

partnership with the banking industry and community groups to ensure that the opportunities

offered by new technology are fully exploited. The RTC program and Australia

Post present scope for testing a range of projects designed to explore the

potential of new technology.

13.32

The practical difficulties of gaining access to

a reliable and affordable telecommunications service are not the only barriers

to the use of electronic banking. Attitudes towards the technology and the

ability to use it effectively can influence the use of modern technology. The

following chapter looks at matters such as competency and confidence in using

electronic banking and examines them in the context of the needs and

experiences of older Australians.

Part III - Groups in rural, regional and remote Australia facing particular

difficulties in accessing banking and financial services

The report so far has discussed the difficulties experienced

by some sectors of the community with the changing dynamics of banking. It

notes that the withdrawal of over-the-counter services and the growing

expectation that customers will use modern technology as a substitute for

face-to-face banking places some groups in the community at a distinct

disadvantage.

Part III looks at two groups that have particular problems

gaining access to banking and financial services and in adjusting to the rapid

changes taking place in the banking industry—older Australians and Indigenous

Australians. By concentrating on just these two groups, the report hopes to

identify problems likely to be experienced by other groups in the community,

such as the unemployed, those on fixed low incomes, welfare recipients, and the

disabled.

Navigation: Previous Page | Contents | Next Page

Top

|