Chapter 5

The rise and cost of the green bureaucracy

Introduction

5.1

This chapter of the report outlines the rise of a new green bureaucracy

to oversee the administration of the carbon tax and other aspects of the

government's Clean Energy Future legislative program.

5.2

This chapter:

- shines a light on the costs to the Commonwealth Budget of the

green regulators and agencies;

-

highlights the truncated process of consultation regarding the

regulators and agencies; and

-

puts into sharp focus the growth in the green bureaucracy.

5.3

In the event that the relevant legislation to give effect to the

regulators is passed by the parliament, the committee recommends careful

scrutiny of the regulators and the potential impact that a specific regulator,

the Clean Energy Finance Corporation (CEFC), could have on the Commonwealth

Budget.

The regulatory structure

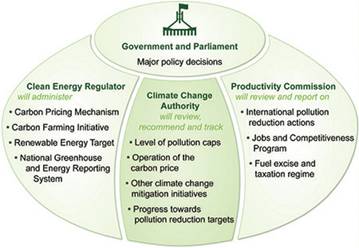

5.4

The governance structure for the scheme is set out in the graphic below.

The Australian Government and the Minister for Climate Change and Energy

Efficiency are responsible for setting the overall policy direction for climate

change.

5.5

The Climate Change Authority (CCA) will recommend pollution caps and

oversee the operation of the flexible carbon permit trading market. It will be

staffed by around 45 employees, including commissioners.[1]

The Clean Energy Regulator (CER) will administer the scheme that enables the

trading of permits. It will be resourced by 330 staff.[2]

These agencies are in the process of being established with staff and other

resources being marshalled to establish these entities.

5.6

The Productivity Commission will conduct ad hoc reviews into climate

change matters at the direction of the government and will review the

compensation provided under the scheme but not the direct spending on, for

example, the CEFC. As a result, significant Commonwealth expenditure will not be

subject to periodic, independent scrutiny. The Productivity Commission is

already established and the CEFC is yet to be established - there is, as yet,

no bill to create that agency.

Graphic 5.1: Governance arrangements for the carbon tax[3]

Issues

5.7

The Energy Supply Association of Australia raised concerns about the

scope of the Clean Energy Regulator’s information-gathering and monitoring

powers, including that they should be contained to circumstances where the CER has

a reasonable belief that breach or non-compliance has occurred.[4]

These concerns express similar views to those raised in the press at the time

the bills were exposed in draft by the Shadow Environment Minister, the Hon.

Greg Hunt MP.[5]

5.8

The Explanatory Memorandum for the Clean Energy Bill 2011 states:

The Regulator has broad powers to gather information to let

it monitor compliance with the mechanism, investigate possible contraventions

and, where necessary, take enforcement action. These powers reflect the nature

of the mechanism, under which liable entities must actively comply with its

requirements, as well as avoid contravening the law.[6]

5.9

While the Joint Committee '...is satisfied that the scope of the Clean

Energy Regulator’s powers is appropriate given its role in promoting compliance

with the mechanism and in ensuring its ongoing integrity and security',[7]

this committee wants such regulatory powers subject to scrutiny in the future

to ensure their proper administration.

Other agencies

5.10

In addition to the establishment of the regulators referred to above,

other agencies will also be getting involved in the implementation of the

government's Clean Energy Plan - the CEFC and the Australian Renewable Energy

Agency (ARENA).

Clean Energy Finance Corporation

5.11

The role of the CEFC will be to invest in the commercialisation and

deployment of renewable energy, energy efficiency and low-emissions technology.

It has allocated funding under the Clean Energy Plan of $10 billion over five

years from 2013-14.[8]

This is amongst the largest single cost item of the Clean Energy Future Plan.

5.12

The CEFC was subject to inquiry during the course of the committee's

public hearings. The corporation is a part of the regulatory architecture for

the overall carbon tax scheme but despite this its exact status remains unclear

with it possibly being part of the Treasury Portfolio or the Finance and

Deregulation Portfolio.[9]

It is not yet established.[10]

5.13

The reason for the inability of the government to determine which

Minister will have responsibility for the CEFC opens the way for speculation

about whether disagreements between Ministers or departmental secretaries are driving

the delay.

5.14

The rationale given by the Gillard Government for a public sector

organisation competing with private businesses in the provisions of loans is that:

- Recipients of commercial loans provided by the CEFC are expected

to be charged an interest rate comparable to that offered by lenders in the

private sector.

- The objective of the CEFC is to remove market barriers that would

otherwise hinder the financing of large-scale clean energy and renewable

projects. That is, the CEFC will operate in the ‘market gap’, encouraging

projects that wouldn’t otherwise proceed by providing an alternative source of

debt or equity to underpin a project’s financial viability.[11]

5.15

While the CEFC will be providing a variety of loans, some of which are

to be non-commercial, this inevitably gives rise to concerns about the fiscal

impact of such organisations on the Commonwealth Budget:

- The fiscal impact of $944 million across the forward estimates

reflects the net impact of revenue and expenses excluding public debt interest

costs. Departmental expense is equal to $60 million over the forward estimates.

- Over half is explained by the expense associated with

concessional loans and the remainder is largely explained by the allowance that

is made for defaults.

- The funding provided to the CEFC will impact on gross debt. To

the extent that the CEFC acquires offsetting debt-like assets, such as loans,

there will be a lesser impact on net debt.

- Treasury expects that taxpayers will, over time, receive interest

and dividends. That is, taxpayers will get a positive return on the investment.[12]

5.16

Many of the government's claims about the rationale for the CEFC and

about its fiscal impact seem to be mutually contradictory.

5.17

The inevitable concern with a government-owned financing corporation

providing funds to industry is the age-old issue of picking winners. During

the 1980s various state governments were engaged in this practice, with the

electorates across Western Australia, South Australia and Victoria left to pick

up the pieces.

5.18

To the extent that picking winners is unsuccessful, there will be an

impact on the Commonwealth Budget. The extent of that impact is a 'thorny

issue'. At present:

There are some issues that we [the Department of Finance and

Deregulation] are working through which go to transparency and accountability

which are really around how to classify the entity and how to classify the

transactions – essentially how to account for what is does. We are working

through that with the ABS [Australian Bureau of Statistics], with ANAO

[Australian National Audit Office], with Treasury and within Finance to

understand the entity and understand the kinds of activities it will undertake.[13]

5.19

The Department of Finance and Deregulation explained the matter further:

Whilst the Clean Energy Finance Corporation is in the general

government sector, the key issue is the activities that it undertakes are the

essential thing in determining whether those activities hit the budget bottom

line or not. If you look at the Clean Energy Future program, you will note that

we allocated the costs from the Clean Energy Finance Corporation to the budget

bottom line. The corporation is being set up to provide loans to commercial

operations. In the vast majority of cases we anticipate that will be so, so the

impact on the budget bottom line does not occur. We have, however, said that in

some proportion of those activities of the corporation there may be an impact

on the bottom line of the budget, and we have taken that into account in the

numbers that were incorporated in the release that was put out on the Clean

Energy Future package.[14]

5.20

The test for the impact on the Commonwealth Budget is as follows:

If an entity in the general government sector is undertaking

investments to achieve a return, then they do not impact on the budget bottom

line, according to the accounting standards.

To the extent to which the Clean Energy Finance Corporation

is undertaking investments, and that is the government's policy, then the

majority of its activities will not impact on the budget bottom line. However,

as announced in the policy, there are effectively two streams of its

investments: one is for renewable energy and the other is for clean energy. On

the renewable energy side, which is an emerging set of technologies, we have

made an allowance of 15 per cent of those investments being deemed ultimately

as grants, which would impact on the budget bottom line.

Effectively, 50 per cent of the activities of the entity will

be in renewable energy investments, of which 15 per cent are assumed as grants

because it is an emerging technology, and there may be some investments that do

not achieve a particular return.[15]

5.21

In these circumstances the total cost of the CEFC program is $10 billion

over five years, with $2 billion being spent annually. Of that, $1 billion per

year is for activities related to renewable energy and it is this part of the

expenditure that is likely to be non-commercial and hit the Commonwealth

Budget. The value of that impact is, according to the Department of Finance

and Deregulation, 15 per cent of that $1 billion. That is a $150 million per

year hit to the Budget under the CEFC.

Australian Renewable Energy Agency

5.22

ARENA will be a statutory authority, set up to provide funds for

research, development and commercialisation of renewable energy technologies.

It will incorporate a number of existing programs, such as the Australian

Centre for Renewable Energy, the Australian Solar Institute and the Australian

Biofuels Research Institute. It is projected to be revenue neutral, as it will

utilise $3.2 billion of funding already allocated to those programs over nine

years. Future funding for ARENA will also come from dividends paid by the CEFC.[16]

5.23

ARENA is located within the portfolio of the Department of Resources,

Energy and Tourism.

5.24

In the context of ARENA, on 13 October 2011, the Senate referred the provisions

of the Australian Renewable Energy Agency (Consequential Amendments and

Transitional Provisions) Bill 2011 and the Australian Renewable Energy Agency

Bill 2011 to the Senate Environment and Communications Committee for inquiry

and report. Submissions were to be received by 20 October 2011. The reporting

date is 7 November 2011.

5.25

Given the important role of ARENA, that is, its oversight of $3.2

billion, it is surprising that such a tight reporting timeline was applied to

the process of scrutinising the Bills.

5.26

The ARENA Bills were not part of the government's Clean Energy Future

Legislative Program that was introduced into the Parliament on 13 September

2011.[17]

Other regulators

5.27

In addition to the climate change regulators and other agencies outlined

above, several other regulators will also be involved in the new regime and

these are outlined below.

Australian Competition and Consumer

Commission

5.28

The government announced on 13 July 2011 that the Australian Competition

and Consumer Commission (ACCC) would be policing claims by businesses that

could mislead consumers into believing that price rises had occurred due to the

carbon tax when this was not the case.

5.29

The funding for the ACCC to undertake this activity is:

...$12.8 million over four years to the ACCC and those funds

will go towards the establishment of a dedicated team which will involve more

than 20 staff and their activities will be directed towards enforcement and

towards education of businesses and consumers.[18]

5.30

This measure was not included as a cost in the government's Clean Energy

Plan announced on 10 July 2011.

Finance sector and criminal justice

regulators

5.31

Under the government's Clean Energy Future Legislative Package, the

Australian Securities and Investments Commission (ASIC) will also have a role

in the emissions trading scheme. As emissions units will be permits and will

be defined as financial products, ASIC will have responsibility for the regulation

of related carbon permit trading markets.[19]

At this time, there are no publicly available costings for ASIC which will

undertake this important role.

5.32

The Clean Energy Regulator will also have powers to work with the

Australian Transaction Reports and Analysis Centre, the Australian Federal

Police and the Commonwealth Director of Public Prosecutions regarding fraud and

criminal activity that could be involved with the permits. As highlighted in

chapter 3, there is considerable risk around of fraud around permits and this

highlights the need for well resourced regulators to act to ensure the

integrity of the permits.

5.33

The Clean Energy Regulator will also have powers to work with the

Australian Transaction Reports and Analysis Centre, the Australian Federal

Police and the Commonwealth Director of Public Prosecutions regarding fraud and

criminal activity that could be involved with the permits[20].

The cost of the regulators

5.34

The table below provides an overview of the costs of the green

regulators and agencies:

Table 5.1: The cost of green regulators and agencies

|

|

Clean Energy Regulator ($m) [21]

|

Climate Change Authority

($m)

[22]

|

Productivity

Commission

Reviews

($m)

[23]

|

Clean Energy Finance Corporation

($m)[24]

|

Australian Renewable Energy Agency

($m)

|

Australian Competition and Consumer Commission

($m)[25]

|

Australian Securities and Investment Commission

($m)

|

|

2011-12

|

-68

|

0

|

-4

|

-60

|

Yet to be disclosed.

|

-12.8

|

Yet to be disclosed.

|

|

2012-13

|

-68

|

-6

|

-4

|

Yet to be disclosed.

|

Yet to be disclosed.

|

|

2013-14

|

-61

|

-9

|

-5

|

Yet to be disclosed.

|

Yet to be disclosed.

|

|

2014-15

|

-59

|

-9

|

-5

|

Yet to be disclosed.

|

Yet to be disclosed.

|

|

Totals

|

-256

|

-25

|

-18

|

-60

|

Yet to be disclosed.

|

-12.8

|

Yet to be disclosed.

|

A deficient consultation process

5.35

The Clean Energy Plan legislative package comprises 19 bills

constituting more than 1 100 pages of new legislation. Yet even these 19 bills

are already known not to constitute the entire legislative package proposed by

the government. The ARENA Bills were introduced into the parliament separately

and the CEFC Bill has not yet been introduced.

5.36

Many stakeholders have expressed concern and dismay at the timelines

provided to participate in the Joint Committee on Australia's Clean Energy

Future and make a meaningful contribution:

AMEC also expresses its complete dissatisfaction in the

manner in which this step-change legislation has been introduced. The timelines

throughout the legislative consultation process have been extremely short,

which has not allowed AMEC and its members any reasonable time to properly

consider the finer detail of the legislation.[26]

BFVG is also disappointed in the amount of time granted (six

days including a weekend) by Government to provide submissions in regards to

the proposed suite of legislation (approximately 1100 pages) under the banner

of Carbon Tax. BFVG would have thought that such an important suite of

legislation deserved a longer time to enable both industries affected and the

general community to provide in-depth submissions and encourage worthwhile

debate.[27]

5.37

As mentioned earlier, the Clean Energy Future legislative plan is not the

entire suite of legislation that will give effect to the government's plan. ARENA

and the CEFC were not part of the suite of 19 Bills introduced into the

Parliament on

13 September 2011. The concern about the process also extended to groups

supportive of the government's reform program. Below is an excerpt from a media

release from the group Climate Action Newtown – 100% Renewable Campaign:

The 100% Renewable Energy campaign has today welcomed the

introduction of the carbon price bills in parliament, but questioned the

reasons for the delay on the Clean Energy Finance Corporation and Australian

Renewable Energy Agency bills.

“The bills that deliver more renewable energy for Australia

are the real clean energy bills. If the government is hoping to win community

support for the carbon tax these are the bills that need to be front and centre

in parliament,” said Lindsay Soutar, 100% Renewable Campaign Co-ordinator.

The parliamentary timetable announced by the government

yesterday did not include the renewable energy bills to institute the Clean

Energy Finance Corporation and Australian Renewable Energy Agency. It is

unclear when these bills will be introduced into the parliament.

“While we welcome the introduction of the carbon price bills,

we think the government’s decision to delay the bills for the two new renewable

energy agencies is the wrong one.

...

"Renewable energy is something we know the Australian

people support – it’s the most popular part of the package - so why delay it?”[28]

Rise of the green machine

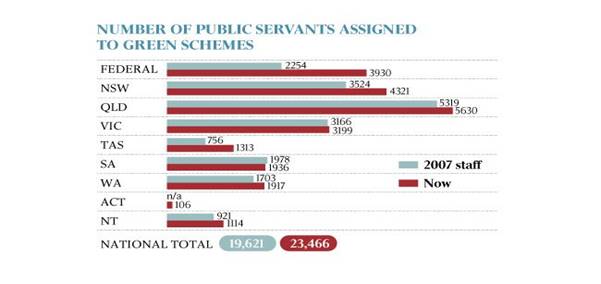

5.38

Since coming to office in 2007, the Rudd and Gillard Government's have

overseen a rapid and sharp rise in the number of officials engaged in policy

advising and regulating matters pertaining to the environment.

5.39

The table below provides a national snapshot of the rise of the 'green

machine'. As the table below highlights, the number of green bureaucrats has

risen from 19 621 in 2007 to 23 466 in 2011. That is around 1 000 new staff per

year since 2007.

Graphic 5.2: Number of public servants assigned to green

schemes, across Australia[29]

5.40

The federal green workforce has risen by more than 75 per cent since

2007.[30]

It has risen from 2 254 in 2007 to 3 930 in 2011. This growth in the green

workforce equates to a workforce of around 4 000 permanent staff. To this 4 000

staff, there is a need to add another 345 for the CER and the CCA. Further

growth can be expected once ARENA and the CEFC are more developed.

5.41

According to the Chief Executive of the Australian Industry Group,

Ms Heather Ridout, '[t]he growing green bureaucracy is a concern for our

members'.[31]

Committee comment

5.42

The committee notes the ever-expanding green bureaucracy and the

potential fiscal risk posed by an agency such as the CEFC. In addition, the

regulators will acquire powers to undertake their tasks and while they will

most likely attempt to act judicially, the committee recommends that the Senate

review the conduct of the green regulators – the Climate Change Authority and

the Clean Energy Regulator.

Recommendation 6

If the Clean Energy Future legislative package is passed by

the Parliament, the committee recommends that the Senate review the conduct of the

relevant regulators.

Recommendation 7

If the Clean Energy Future legislative package is passed by

the Parliament, the committee recommends that the Senate review the cost to the

Budget of the Clean Energy Finance Corporation and the Australian Renewable

Energy Agency given that between them they will be responsible for $13 billion

of expenditure.

Navigation: Previous Page | Contents | Next Page