Chapter 2

The Australian responses to climate change

Introduction

2.1

Chapter two provides an overview of the development of Australia's

responses to climate change. It charts Australia's domestic actions and gives

an account of the involvement in international mechanisms to tackle climate

change. This chapter also traces the deeply flawed policy development process

that has dogged the development of the carbon tax.

Australia's emissions in context

2.2

According to the Department of Climate Change and Energy Efficiency,

Australia represents about 1.5 per cent of anthropogenic global greenhouse gas

emissions.[1]

Graphic 2.1 puts Australia in an international comparison.

Graphic 2.1: International greenhouse gas emissions[2]

![Graphic 2.1: International greenhouse gas emissions[2]](/~/media/wopapub/senate/committee/scrutinynewtaxes_ctte/completed_inquiries/2010_13/carbontax/interim_report/c02_1_jpg.ashx)

2.3

Australia emitted 565 million tonnes of carbon dioxide emissions in

2009, the last year with available figures.[3]

The graphic below highlights the sources of Australia's emissions. It indicates

that electricity generation, direct fuel combustion, agriculture and transport

are the main sources of emissions.

Graphic 2.2: Australia's carbon pollution profile[4]

![http://www.cleanenergyfuture.gov.au/wp-Graphic 2.2: Australia's carbon pollution profile[4]](/~/media/wopapub/senate/committee/scrutinynewtaxes_ctte/completed_inquiries/2010_13/carbontax/interim_report/c02_2_jpg.ashx)

2.4

Even taking into account the Renewable Energy Target and the Carbon Farming

Initiative, Australia's carbon emissions trajectory is projected to rise to

679 million tonnes in 2020, in the absence of further action to reduce carbon

dioxide emissions.[5]

Australia and international agreements on climate change policy

2.5

The international negotiation process to reduce global greenhouse gas

emissions is organised around the sessions of the Conference of the Parties to

the United Nations Framework on the Convention on Climate Change (UNFCCC). The

Conference of the Parties meets every year to review progress and take

decisions on the Convention’s implementation. Additional negotiation sessions

are scheduled between each Conference of the Parties to develop the draft text

that will go forward to the Conference for decision. Some of the UNFCCC

milestones are outlined below.[6]

Graphic 2.3: International meetings to tackle climate change[7]

![Graphic 2.3: International meetings to tackle climate change[7]](/~/media/wopapub/senate/committee/scrutinynewtaxes_ctte/completed_inquiries/2010_13/carbontax/interim_report/c02_3_jpg.ashx)

Kyoto Protocol

2.6

The Kyoto Protocol, an international agreement setting legally binding

greenhouse gas emissions reduction targets for developed countries, was adopted

on

11 December 1997. It entered into operation on 16 February 2005. While

developing countries can sign up to the Protocol, they are not subject to the

legally binding targets.[8]

2.7

In 1998 the Australian Government, under then Prime Minister, the Hon. John

Howard, established the Australian Greenhouse Office, which at the time was the

world's first government agency dedicated to cutting greenhouse gas emissions.

2.8

Australia signed the Kyoto Protocol on 24 April 1998 but did not ratify

it until 12 December 2007. Under the Protocol, Australia committed to cutting

its average greenhouse gas emissions to 108 per cent of 1990 emissions, over

the 2008-12 commitment period.[9]

Australia is on track to meet its Kyoto target.[10]

2.9

On 4 May 2009, the government committed to a new medium term target of

emissions reduction of up to 25 per cent relative to 2000 emission levels,

subject to action being taken by the rest of the world.[11]

United Nations Climate Conference –

Copenhagen, Denmark

2.10

In December 2009, representatives from governments and other

organisations met in Copenhagen to map out further measures to reduce global

greenhouse gas emissions. There was much expectation that Copenhagen would

prove to be the first step on the way to establishing a comprehensive, legally

binding agreement to limit carbon dioxide emission in both developed and

developing countries. As the (then) Prime Minister said in the lead up to the

Conference:

Let me tell you, the direction in which we are pushing hard,

which the Danes are pushing hard and which I believe the Americans are pushing

hard, is for an operational framework agreement, capable of giving real

guidance to technical negotiators to translate into a legally binding global

treaty. [12]

2.11

The Copenhagen Conference was widely recognised as a failure. Participants

were unable to reach agreement on a global framework to price carbon, with

important players pursuing sectional interests that impeded the progress of negotiations:

... at all-day talks between 115 world leaders, it was left

to Barack Obama and Wen Jiabao, the Chinese premier, to broker a political

agreement. The so-called Copenhagen accord "recognises" the

scientific case for keeping temperature rises to no more than 2C but does not

contain commitments to emissions reductions to achieve that goal.[13]

2.12

Kevin Rudd at the time agreed that the results of Copenhagen did not

meet expectations:

Did it [Copenhagen] achieve everything that we wanted to

achieve? Absolutely not.[14]

2.13

As the World Bank reported six months after Copenhagen:

...the Copenhagen climate conference’s inconclusive outcome has

deepened the sense of uncertainty over the future of the global emission

reductions effort and the likelihood that international policymakers will be

able to reach a legally binding agreement next December in Cancún.[15]

2.14

The driving force behind the collapse of a meaningful international

agreement are complex, but they can be distilled down to:

Lastly, and perhaps most important, China and India seem

unlikely to agree to internationally binding commitments to emissions-cutting

actions any time soon. Both countries appear to believe that they are unlikely

to receive substantial benefits -- large financial assistance, for instance --

that would, for them, justify adopting such measures, and developed countries

do not seem willing to change that calculus. At the same time, the United

States would be unwise to push for a deal that requires legally binding

commitments while its own domestic efforts remain embroiled in political

uncertainty.[16]

2.15

China had clear goals for what it wanted to accomplish at Copenhagen:

As both the largest greenhouse gas emitter and the country

expected to account for the largest percentage of increased emissions between

now and 2050, China inevitably played a critical role at Copenhagen. Beijing

apparently had three major goals: 1. to maintain the structure of the Kyoto

Protocol and the principles of the Bali Roadmap, which placed major

responsibility for emissions reductions and contributions to developing

countries on the shoulders of the Annex I countries; 2. to avoid all legally

binding international commitments in favor of preserving China's own freedom of

action in the future; and 3. to avoid becoming the target of criticism should

Copenhagen "fail".[17]

2.16

Following the conclusion of Copenhagen:

Australia submitted information on its 2020 emissions

reduction target range to the secretariat on 27 January 2010: 5 per cent

unconditional, with up to 15 per cent and 25 per cent both conditional on the

extent of action by others, as announced by the Prime Minister on 4 May 2009.[18]

United Nations Climate Conference -

Cancun, Mexico

2.17

At the Cancun Conference between 29 November and 10 December 2010, a

range of developed and developing countries made 'pledges' to reduce their

national greenhouse gas emissions. However, a legally binding agreement to

reduce carbon dioxide emissions remained out of reach.

2.18

Country's pledges were made in different ways. Australia's pledge was

made in the form of an absolute reduction, expressed as a percentage below an

emissions level in an earlier year. The table below puts Australia's absolute

reduction in context with other countries.

Table 2.1: Absolute greenhouse gas emission reduction made

at Cancun[19]

![Table 2.1: Absolute greenhouse gas emission reduction made at Cancun[19]](/~/media/wopapub/senate/committee/scrutinynewtaxes_ctte/completed_inquiries/2010_13/carbontax/interim_report/c02_4_jpg.ashx)

2.19

Some countries expressed their pledge as a reduction in emission

intensity. That is, greenhouse gases produced per unit of economic output. The

graphic below, puts Australia's pledge and that of other countries into the scale

of emissions intensity reductions.

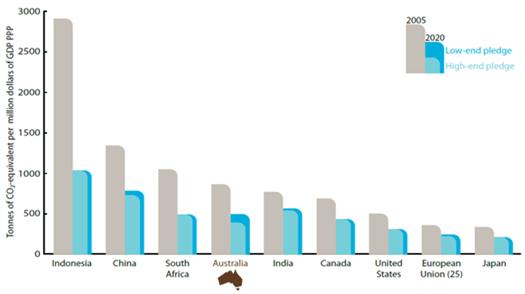

Graphic 2.4:

Emissions intensity of key economies in 2005 and 2020

(low and high end pledge)[20]

2.20

In addition to the methods of expressing reductions in greenhouse gas

emissions as outlined above, a further approach is to express a target as being

below a business as usual standard. Graphic 2.5 shows Australia in the context

of the business as usual method of examining reductions in greenhouse gas

emissions.

Graphic 2.5:

Percentage change in emissions under Cancun pledges, relative to

business as

usual at 2020[21]

2.21

On 19 September 2011, the United States Energy Information

Administration released a table showing emission reduction goals announced by

selected countries. Table 2.2 is a summary of that table:

Table 2.2: Emissions mitigation goals announced by

selected countries (million metric tons carbon dioxide)[22]

|

Country/region |

Reduction goal |

Carbon dioxide

emissions goal

for 2020a |

Business as

usual emissions without action |

2008

emissions |

Emissions

reduction

needed to achieve goal |

|

Countries

with goals for total emissions reductions |

|

United

States |

To

17 percent below 2005 level by 2020 |

4,977 |

5,777 |

5,838 |

800 |

|

OECD

Europeb |

To

20 percent below 1990 level by 2020 |

3,301 |

4,147 |

4,345 |

846 |

| |

To

30 percent below 1990 level by 2020 |

2,889 |

4,147 |

4,345 |

1,249 |

|

Japan |

To

25 percent below 1990 level by 2020 |

785 |

1,142 |

1,215 |

357 |

|

Brazil |

By

36 to 39 percent relative to projected level in 2020 |

353-371 |

579 |

423 |

208-226 |

|

Russia |

To

between 15 and 25 percent below 1990 level by 2020 |

1,776-2,013 |

1,607 |

1,663 |

-- |

|

Countries

with goals for carbon dioxide intensity reductions |

|

China |

To

between 40 and 45 percent below 2005 level by 2020 |

10,149-11,071c |

10,128 |

6,801 |

-- |

|

India |

To

between 20 and 25 percent below 2005 level by 2020 |

2,512-2,679c |

2,056 |

1,462 |

-- |

a It is

assumed that country goals are applied proportionally to energy-related carbon

dioxide emissions and other greenhouse gases.

b Because IEO2011 does not model the European Union as a

region, emissions and projections for OECD Europe are used as a proxy. The

reduction goal is based on 20 percent of the 1990 level for OECD Europe.

Although some countries in OECD Europe are not members of the European Union,

the European Union also includes some countries that are not included in the

OECD Europe region. On balance, OECD Europe's 1990 emissions were 2 percent higher

than the European Union's emissions. In 2005 and 2008, OECD Europe's emissions

were about 2 percent and 3 percent lower than the European Union's emissions,

respectively. The difference could be more pronounced in future years,

depending on emissions from the various countries. Conference of Parties-16

omitted Turkey from the European Union's commitments; IEO2011 includes

Turkey as part of OECD Europe.

c Carbon dioxide intensity is defined as emissions per unit of

output (as measured by GDP expressed in purchasing power parity). The carbon

dioxide emissions goal is calculated by multiplying the 2020 carbon intensity

goal by IEO2011 GDP projections for 2020.

Source: Reduction goals: United Nations Framework Convention on Climate Change,

National Reports, Appendix I—Quantified Economy-wide Emissions Targets for

2020, website http://unfccc.int/home/items/5265.php. Reduction goal targets:

Estimated based on announced targets, and EIA, estimates. 2008 emissions: EIA,

International Energy Statistics database (as of March 2011), website

www.eia.gov/ies. Goal year projected Reference case carbon dioxide emissions:

EIA, World Energy Projection System Plus (2011).

2.22

Under the Copenhagen Accord, various developed and developing countries

made pledges regarding their actions to reduce emissions. The Copenhagen Accord

itself represents the difficulties faced by disparate countries engaging in

collective action to solve a common problem: climate change.

2.23

Under the pledge framework, many countries have provided qualitative pledges

in terms of a percent reduction either in terms of emissions or emissions

intensity from a specific year or a 2020 business as usual projection.

2.24

The difficulty with the pledge framework is that the 'Accord is binding

politically, but not legally'.[23]

In addition. '[m]any pledges are conditional, and these conditions go to some

of the most contentious issues in the international negotiations...'.[24]

2.25

With the underlying difficulties of the Copenhagen Accord set to one

side, it is sensible to ask what impact the Accord will have on emissions. As

mentioned earlier, different countries have used different approaches for their

'Pledges'. A study led by Australian economist Warwick McKibbin converted the

different 'Pledges' to a common value and this has enabled a clearer comparison

of the respective efforts by different countries. In essence it is now possible

to compare oranges with oranges rather than apples with oranges. Graphic 2.6

shows a cross-section of emitters and their respective action.

Graphic 2.6.: 2020 policy scenario with reductions to

selected based years[25]

![Graphic 2.6.: 2020 policy scenario with reductions to selected based years[25]](/~/media/wopapub/senate/committee/scrutinynewtaxes_ctte/completed_inquiries/2010_13/carbontax/interim_report/c02_7_png.ashx)

2.26

The striking feature of graphic 2.6 is that the US, Japan, Europe and

Australia all reduce emissions in 2000, 2005 and the Businesses As Usual case

in 2020. The emissions of China and India are substantially higher. China's

emissions are a staggering 496 per cent above its 1990 levels when compared to

the 2020 Business As Usual case while Australia's are 30 per cent above the

same benchmark. While climate change policies will be biting hard in some

countries, other nations will not be making the same contribution to reduce

emissions.

2.27

Treasury has reported the government's expectations of global emissions

for some time. An important point to note relates to Treasury modelling about

carbon dioxide emissions in China. Current carbon dioxide emissions in China are

reported at 10.3 billion tonnes.[26]

In 2008 Treasury modelling expected Chinese carbon dioxide emissions in 2020 to

reach 16.1 billion tonnes.[27]

The most recent Treasury modelling conducted in the context of the carbon tax in

2011 now expects Chinese carbon dioxide emissions in 2020 to reach 17.9 billion

tonnes.[28]

This is a staggering 1.8 billion tonne increase in expected carbon dioxide emissions

per year from China by 2020.

2.28

Tables 2.3 to 2.6 provide the source for the afore mentioned material on

China's emissions and the revised forecast by the Treasury:

Table 2.3: Treasury modelling 2008 – China and others

forecast emissions 2011[29]

![Table 2.3: Treasury modelling 2008 – China and others forecast emissions 2011[29]](/~/media/wopapub/senate/committee/scrutinynewtaxes_ctte/completed_inquiries/2010_13/carbontax/interim_report/c02_8_png.ashx)

Table 2.4: Treasury modelling 2008 China and others 2020[30]

![Table 2.4: Treasury modelling 2008 China and others 2020[30]](/~/media/wopapub/senate/committee/scrutinynewtaxes_ctte/completed_inquiries/2010_13/carbontax/interim_report/c02_9_png.ashx)

Table 2.5: China's emissions at present[31]

![Table 2.5: China's emissions at present[31]](/~/media/wopapub/senate/committee/scrutinynewtaxes_ctte/completed_inquiries/2010_13/carbontax/interim_report/c02_10_png.ashx)

Table 2.6: Treasury's expectation of China's emissions in

2020[32]

![Table 2.6: Treasury's expectation of China's emissions in 2020[32]](/~/media/wopapub/senate/committee/scrutinynewtaxes_ctte/completed_inquiries/2010_13/carbontax/interim_report/c02_11_png.ashx)

2.29

An increase of 1.8 billion tonnes of carbon dioxide emissions in China

for 2020 alone is more than three times the amount of carbon dioxide emissions Australia

generates in a whole year. Australia emitted 565 million tonnes of carbon

pollution in 2009, the last year with available figures.[33]

2.30

Taking the matter of India further, it has an emission intensity based

scheme, while Australia has a scheme that is expressed as a target of

emissions. While different countries are pursuing different approaches

comparing them can lead to confusion:

CHAIR: What assumptions has Treasury made in this

modelling about the level of abatement in India up to 2020?

Ms Quinn: To 2020, we have also taken their pledges on

board. There are two elements here: the pledges they have on the table but also

what might happen within their jurisdictions as a result of the opportunity to

sell offsets. It is the case at the moment, for instance, that international

companies are creating offsets through the international market and providing

those abatements to other countries. There is a difference between the amount

of emissions reductions happening within a country and the amount that a

country gets to own, in a sense, in relation to any international action.

CHAIR: But if I look at chart 3.1 [of the initial

treasury modelling released on 10 July 2011] and at the footnote, it says that

India's mitigation to 2020 will be zero.

Ms Quinn: Footnote to chart 3.1—

CHAIR: So India does not appear on the chart because

its emissions mitigation is zero compared to the baseline.

Ms Quinn: That is the international action

assumptions. The government has got a reduction in emissions intensity and

therefore the translation of their pledge is that they will reduce emissions

but reduce emissions relative to the baseline.

CHAIR: But its emissions mitigation is zero compared

to the baseline.

Ms Quinn: That is right.

CHAIR: So, when the Treasurer talks about how India is

doing all these things to reduce emissions, they are not actually reducing

emissions; they are continuing to—

Ms Quinn: They are reducing their emissions intensity

compared to today. They are reducing the intensity of their economy, which is

what their pledge is framed around.

CHAIR: I am just quoting your document—

Ms Quinn: And I am explaining it. They have got an

emissions intensity target rather than an absolute emissions reduction. So, if

their economy were to double—they make the point that they have got a very low

income per capita, so they have got an intensity based target.

CHAIR: I totally understand the argument. The point is

that the government, in the way they are presenting some of the information,

are comparing apples with pears and, when you question them about the pears,

they try to compare them with the apples again. This is just another example of

that.

Ms Quinn: I can just explain the analysis. The

characterisation you put forward was not accurate, so I was correcting that.

CHAIR: But emissions reduction and reductions in

emissions intensity are not the same thing. You would agree with that?

Ms Quinn: That is correct.[34]

2.31

The issue of India's attempts at mitigation were further explored in the

context of the Joint Parliamentary inquiry into the Clean Energy Future

Legislation.

Senator CORMANN: Does Treasury assume that India has

already taken strong national action on climate change, as is asserted by the

Department of Climate Change and Energy Efficiency in its fact sheets, which

were launched by the Prime Minister?

Ms Quinn: For all the countries, we have modelled the

pledges that they have put on the table through international negotiations.

Senator CORMANN: But in the footnote to chart 3.1, it

says that India does not appear on the left-hand side chart because its

emissions mitigation is zero compared to the baseline—that is, you do not

expect any further mitigation. How is that consistent?

Ms Quinn: There are two different things here. This is

looking at the share of mitigation in terms of the targets put on the table for

the Cancun and Copenhagen pledge process. It does not capture the actual

reduction in emissions within their borders. What is happening in this analysis

is that India's agreement on the table is an emissions intensity target, but

they are also contributing to reductions in global emissions through the Clean

Development Mechanism. So this chart looks at their pledges, which is what they

might be accountable for in any international arrangements. It does not capture

the actual reductions in emissions within the Indian economy, which is what is

important for the global mitigation effort.[35]

2.32

As indicated by this evasive Treasury response, the Department does not appear

to endorse the view that strong action is being taken by India to achieve

emissions reductions and tackle climate change. This should not be surprising

given that the Indian Environment Minister, Jairam Ramesh, said in 2009 that:

India will not accept any emission-reduction target – period.

This is a non-negotiable stand.[36]

2.33

An analysis of emissions reduction targets compared to the business as

usual scenario was conducted by an American organisation, the Institute for 21st

Century Energy. It noted similar results:

Table 2.7: Estimated gross

greenhouse gas emissions in 2020, historical emissions, and projected business

as usual emissions in 2020 (excluding land use and forestry) (million metric

tons CO2 eq.)[37]

|

Country/ Region |

2020 Emissions with

minimum reduction |

2020 Emissions with

maximum reduction |

1990

Baseline |

2005 Baseline |

2020 BAU (business as usual)

Baseline |

|

Australia |

470 |

371 |

416 |

525 |

727 |

|

Canada |

607 |

607 |

592 |

731 |

937 |

|

European Union* |

4,451 |

3,895 |

5,564 |

5,108 |

5,210 |

|

Japan |

952 |

952 |

1,270 |

1,358 |

1,170 |

|

New Zealand |

56 |

49 |

62 |

77 |

87 |

|

Russian Federation |

2,821 |

2,489 |

3,319 |

2,118 |

2,410 |

|

USA |

5,878 |

5,878 |

6,084 |

7,082 |

7,492 |

|

Brazil |

2,180 |

2,100 |

1,200 |

1,860 |

2,480 |

|

China |

12,450 |

11,590 |

3,910 |

7,530 |

12,880 |

|

India |

4,290 |

4,080 |

1,580 |

2,390 |

3,650 |

|

Indonesia |

860 |

680 |

620 |

860 |

1,320 |

|

Republic of Korea |

570 |

640 |

290 |

594 |

813

|

2.34

The US Energy Information Administration table (Table 2.7) shows that

three of the largest emitters of carbon dioxide – Russia, China and India – have

2020 targets that are greater than their projected emissions if they took no

policy action to reduce their emissions. That is, the targets that Russia,

China and India have set do not require them to take any action to reduce

emissions in their economy.

2.35

For instance, for Russia, its minimum emission reduction in 2020 is

2,821 million metric tonnes, while its business as usual baseline is 2,410

million metric tonnes. In the case of China, its minimum reduction target is

12,450 but is 2020 business as usual emission is 12,880 million metric tonnes. In

respect of India, its minimum emission reduction target for 2020 of 4,290

million metric tonnes while is business as usual 2020 emissions are 3,650

million metric tonnes.

2.36

Indeed, if these numbers were a true target, not a ceiling, Russia,

China and India, would need to subsidise the emission of carbon dioxide to meet

them. Together, Russia, China and India represent 35 per cent of the world’s

carbon dioxide emissions.[38]

2.37

One of two things can be concluded from these figures. Either Russia,

China and India do not intend to take action to reduce their emissions or any

action they will take will not result in an overall reduction in world carbon

dioxide levels.

2.38

It is worth exploring what China will do in the future given its

economic size and its emissions potential:

The facts on China are simple and irrefutable. It has a

coal-fired system equal to more than 13 times our entire electricity

generation. Between now and 2020, it is going to add between 400GW and 500GW to

its existing 670GW of coal-fired power generation.

That's its projections. And that's net. So if they close,

say, 200GW of really dirty old stations, they will be building 600GW to 700GW

of new ones, all pumping out carbon dioxide, if hopefully not also grit.

Total power generation in Australia is about 50GW.

Yes, China might be aiming for 150GW of wind and 20GW of

solar by 2020. But that's installed capacity. When the wind don't . . . and the

sun don't . . . Real capacity of the two combined will be closer to 50GW by

2020, as against an extra 400GW at least of additional coal-fired generation.

Despite those clean coal-fired stations that exist only in

the deeper and increasingly darker recesses of Garnaut's mind, by 2020 China

will be emitting something like 25 times the entire emissions of Australia

today. Rendering utterly ineffective the 5 per cent cut we will purport to

achieve at such huge and permanent cost.[39]

2.39

More importantly for any consideration of the government's carbon tax, these

analyses call into question Treasury's decision to assume, for the purposes of

its modelling, that countries will meet their carbon reduction pledges. The

assumptions made by the Treasury in its modelling, including international

action on carbon reduction pledges, are examined in greater detail in Chapter 10.

2.40

Furthermore, in the United States, seven states including Arizona,

California, Montana, New Mexico, Oregon, Washington and Utah were implementing

a regional emissions trading scheme, but it now seems that only California

remains officially committed to implementing one next year.

2.41

New Jersey and New Hampshire had regional greenhouse gas initiatives in

place and are now in the process of abandoning those schemes.

2.42

The Chicago Climate Exchange wound down in late 2010.[40]

2.43

A robust and effective international scheme is essential to the

operation of the government's scheme. Around $650 billion worth of permits will

be needed to be purchased from overseas to enable Australia to meet its

emission reduction targets.

2.44

Specifically:

The $650 billion that captures both the Government's insanity

and Treasury's disgrace is the rough amount that Australian emitters will pay

for foreign CO2 permits, between 2020 and 2050, indicated by the Treasury

modelling.

The critical question is WHY does Treasury factor in these

foreign permits? Why won't we just cut our emissions in line with the local

permits issued by the Government?

Because the foreign permits are critical to squaring the

insane circle. Without them, the emission cut targets would be literally

impossible.

To cut by "just" 5 per cent by 2020 - just, it's

important to note, nine years away - we have to actually cut by something like

25 per cent from our present emission levels as against the 2000 reference

point.

To get all those cuts domestically would be to run a chainsaw

through the Australian economy. We would have to close power stations and

literally turn off the lights.

So Treasury's model felicitously comes up with the conclusion

that we will cut our emissions by only 58 million tonnes by 2020. We'll buy

permits from foreigners covering the bigger portion of 94 million tonnes.[41]

No harmonised global climate change mitigation action scheme

2.45

The earlier section of the report highlighted some of the limited

efforts being taken by Australia's international counterparts to tackle climate

change. This next section of the report explores the issue in more details and

highlights the lack of coordinated global action to tackle climate despite

claims being made to the contrary about coordinated global action.

2.46

The assumptions that underpin the government position and the carbon tax

are as follows:

CHAIR: ...Your assumptions have been criticised, as

they appear to assume that many countries that do not currently impose a carbon

price and that are not showing any signs of implementing one are assumed to

change their minds by 2016. Can you give us some detail on your assumptions as

to what action you believe the US, Canada, Japan, China, South Korea, Brazil,

South Africa and India will take by 2016?

Ms Quinn: The analysis we have undertaken relating to

international action on climate change indicates that countries that have made

pledges at either Cancun or Copenhagen conventions through the UNFCCC process

implement policies to achieve those pledges. For example, the United States has

pledged to reduce its emissions by 17 per cent of its 1990 levels by 2020, and

that is the assumption that we have modelled in the 550 parts per million

scenario. Where countries have identified a range in their pledges, we have taken

the low-end pledges over the period to 2020. They are the international action

assumptions that are embodied in the modelling.

For the more ambitious international action, we have assumed

that countries have to achieve the highest of their pledges between now and

2016 and then countries have to take greater action than is currently on the

table, because there is a mismatch between the pledges that are currently on

the table and the stated agreement or aim of parties to the UNFCCC of achieving

a two degrees or less warming of the world. There is a bit of an inconsistency

at the moment between those two pledges.[42]

2.47

While the Treasury suggested that general catch-all assumptions are

appropriate for its modelling, a look at the actual level of past and current

commitment by countries to tackling climate change is instructive and puts the

Treasury view in a very different context:

CHAIR: Canada recently had an election where the

Harper government was re-elected on a specific pledge of no carbon tax. What

are your Canada assumptions?

Ms Quinn: It is also the case that British Columbia

has a carbon tax in place, which is a significant proportion of the Canadian

economy, and it is set at higher than the Australian rate.

CHAIR: Are you extrapolating the British Columbia

circumstance across the whole of the Canadian economy?

Ms Quinn: No, I am simply saying that you made the

observation that, at a federal level, there was a change in policy frameworks

but, at a provincial level, that has not been the case, so you have to—

CHAIR: You have not adjusted your assumptions around

Canada as a result of—

Ms Quinn: The Canadian government has still maintained

its commitment to achieve its pledge of similar reductions to the United

States, and so we take governments at their word when they make international

pledges and pledges to their electorates that those reductions will be

achieved.

CHAIR: Has the US met Kyoto targets in the past?

Ms Quinn: As you know, the United States was not a

signatory to the Kyoto protocol, and there has been significant abatement

activity in the United States through various mechanisms.

CHAIR: Have they met the theoretical Kyoto targets?

Ms Quinn: They have not met the Kyoto targets.

CHAIR: Has Canada met the Kyoto targets?

Ms Quinn: No, Canada has not met the Kyoto targets

either.[43]

2.48

The evidence provided to the committee appears contradictory and

unstable, especially when it is considered that it has formed the basis of a

policy that is intended to reshape the Australian economy.

2.49

In the context of the differing approaches being undertaken overseas, a

variety of approaches can be deployed to tackle climate change. Australia has

chosen the carbon tax route but the United States has taken the direct action

path: This naturally raises the question about the efficacy of the carbon tax

itself:

CHAIR: Lenore Taylor wrote in a recent article—and I

think this is similar to what you just said:

The government says it is not assuming countries such as the

US actually have an emissions trading scheme, but rather that they would try to

reach their emission reduction targets at a cost no higher than the

international price.

Do you agree with that?

Ms Quinn: Yes.

CHAIR: That is what Treasury is assuming? That is a

fair reflection of your assumption?

Ms Quinn: What we are assuming is that there are

mechanisms in countries to achieve emissions that result in an implicit or

explicit carbon price based on those economies. It does not mean it

specifically has to be an emissions trading scheme within all countries. It is

the case that we are assuming that there is a continuation of the international

offset market which exists now in order for Australia to be able to purchase

permits from overseas. So we are assuming that there is an arrangement, either

through an international framework or through bilateral trades, such that

Australian liable entities are able to purchase offsets overseas. That is not

the same as saying that all countries have to sign up to an international

binding agreement, and it would be inaccurate to make that statement.

CHAIR: Are you saying, then, that countries like the

US can achieve abatement at a world price without a carbon tax?

Ms Quinn: The United States has an abundance of

abatement opportunities. It is a relatively low-cost abatement country. It is

our expectation that, at a prevailing world price we modelled, it would be able

to sell abatement overseas. Therefore, we do believe it is possible for the

United States to achieve abatement within its own borders at below the

international prices that we modelled.

CHAIR: So abatement in the US would be comparatively

cheaper than abatement in Australia?

Ms Quinn: On average, that is what our modelling

finds, yes.

CHAIR: So on average abatement in the US would be

cheaper than in Australia, yet we think that Australia has to go ahead of the

US in its effort.[44]

2.50

The modelling places great weight on coordinated global action and makes

great assumptions about a range of countries:

Senator CORMANN: ... In the medium global action

scenario Treasury assumes that OPEC countries enter coordinated global action

on carbon pricing from 2021—that is, that they are effectively going to have

ETSs in place. Look at the second paragraph below table 3.1 of the main

modelling document. How plausible is it really that countries like Iran, Qatar,

Saudi Arabia, Venezuela, Syria and Yemen will have operational and

internationally linked ETSs within 10 years?

Ms Quinn: The assumption does not rely on the

characterisation that you have just put on the table. The assumption—once

again, it is the same for the United States and all other countries—is that

they have got some mechanism for putting an implicit or explicit price on

carbon. Some of the countries you have just mentioned are already part of the

Clean Development Mechanism. They are already contributing to emissions

reductions at a global level through that mechanism, which is an international

trading arrangement where countries can purchase abatement from overseas or

sell abatement to overseas. So given that some of those countries in the OPEC

region are already within that scheme it seems plausible that that scheme could

expand over time, given appropriate regulatory frameworks, to bring all

countries into a global pricing mechanism.

Senator CORMANN: Except that your modelling in table

3.7 shows that even for the medium global action scenario the GDP per person

cost for OPEC countries will be around eight per cent in 2050, which is more

than 20 times the estimated cost for the US or the EU. Given that, how can you

be so confident that countries like Qatar and Saudi Arabia—or, for that matter,

China and India, where the GDP per person costs in 2050 are projected to be over

10 times as large as in the US and Europe—will choose to join globally

coordinated action on carbon pricing by 2021?

Ms Quinn: It is a global issue that needs a global

solution and so the expectation is that, over time, countries will play a role,

depending on their view of timing et cetera. So it is the case that some

countries are going to face higher economic costs relative to what they

otherwise would experience. [45].

2.51

The Treasury assumptions do not appear to be supported when questioned.

2.52

The effectiveness of other countries undertaking effective climate

change action is central and integral to the efficacy of the Treasury modelling

of the carbon tax. As outlined in this chapter, various assumptions about the

conduct of other countries are heroic. To further illustrate this point,

consider the action to be taken by the economic bloc known as the Organisation

of Petroleum Exporting Countries (OPEC). While this organisation is well known

for its cartel arrangements with respect to petroleum, it is an important bloc

in the context of Treasury's climate change modelling:

Senator CORMANN: We were talking about the action

taken by countries like Iran, Syria and Venezuela in your assumptions then.

Looking at table 3.8, it says that by 2050 Treasury is expecting that the OPEC

bloc will be purchasing 1.5 billion tonnes of abatement per year from other

countries, which is far more than the US, Europe and Japan combined. Does it

seem plausible to Treasury that this is what countries like Iran, Syria and

Venezuela will be doing—collectively spending around US$150 billion a year, in

real 2010 US dollars, to buy carbon credits from other nations?

Ms Quinn: The modelling we have undertaken is to

achieve an environmental target. You are talking about a 550 parts per million

scenario. To 2020 we have modelled the pledges that countries have put on the

table through the international negotiations. After that we have looked at a

scheme where countries make the same emission reductions as each other relative

to their 'business as usual' path. So the analysis is that OPEC would reduce

its emissions relative to its business as usual path by the same amount as

Australia. That is the allocation framework. It is a combination of the carbon

price and what countries find efficient to do within their borders, and then

the allocation that results in how much they purchase from overseas. It is

entirely plausible, at the carbon prices that we are looking at, given the

comparative advantage of the OPEC nations in producing oil and gas, that they

may well find it profitable to continue to produce oil and gas while achieving

their allocated abatement by sourcing abatement from other countries.[46]

2.53

In addition to there being legitimate questions about the future

efficacy of actions by China, India, Russia and OPEC, there are also legitimate

questions being asked about the rest of the world:

Senator CORMANN: I want to go a bit further down that

same table, 3.8, and question the plausibility of Treasury assumptions. That

table also says that, under the medium global action scenario, by 2020 the

'rest of the world' bloc will be purchasing more than 800 million tonnes of CO2 abatement per annum from other countries—more

than the total abatement being purchased that year by the US, Europe, Japan and

Canada combined. How can it be considered plausible? By a process of

elimination, the rest of the world includes countries like PNG, Somalia,

Malawi, Pakistan, Mongolia and others. Do you really see those countries

purchasing more than Europe, the US, Japan and Canada combined on an

international market by 2020?

Ms Quinn: I would be happy to take that question on

notice and provide you the breakdown of countries that are in the rest of the

world, but it is certainly more than just the very poor nations. There are

countries in there such as Brazil and other members of the G20. I would

certainly be happy to take that question on notice.[47]

2.54

At the time of finalising this report, Treasury had still not provided a

reply to the question taken on notice.

2.55

Another important bloc of countries covers the south and east Asia

region. In this part of the world, Treasury has once again made some heroic

assumptions about what can be done:

Senator CORMANN: In the same vein, let us go to table

3.9, where the Treasury modelling envisages that the bloc of 'other south and

east Asia' will reduce its emissions by around twice as much by 2020 in

percentage terms from 2001 levels as either the US or the EU. That bloc

consists of Brunei, Cambodia, Laos, Malaysia, the Maldives, the Philippines,

Korea, Singapore, Thailand, East Timor and Vietnam. How plausible does that

seem, and can you tell us where this bloc's emissions stand currently, at the

halfway mark between 2001 and 2020?

Ms Quinn: Most of the emission reductions in that bloc

occur through land use change and forestry analysis, and that information was

provided by the Berkeley laboratory of analysis in the United States, using

their global land use change and forestry analysis. So it is the case that a

very reputable international organisation used by many other international

organisations has provided that information. They have looked at the detailed

availability of abatement in those countries from the land use change and

forestry sector, and that is what we have incorporated into the analysis. Most

people looking at international abatement opportunities recognise the potential

for fairly low-cost abatement through land use change and forestry mechanisms.

The other elements of your question I am happy to take on notice.[48]

2.56

At the time of finalising this report, Treasury had not provided a reply

to the question taken on notice.

Pessimism over future prospects for a binding international agreement

2.57

At the heart of international negotiations on climate change responses,

there is a fundamental gap between the views of developed and developing

countries. Developed countries believe that any Kyoto successor agreement must

extend legally binding reductions, from the business as usual case, for

developing countries. Whereas developing countries want the Kyoto arrangements

to continue, whereby legally binding reductions in emissions are imposed on

developed, but not developing, countries. The evidence presented above on the

increasing importance of carbon emissions in China and India demonstrate that no

tangible reductions in global emissions can be achieved without those major

emitters being part of a global binding framework.

2.58

It is not surprising then that a World Bank survey of participants in

carbon trading markets are sceptical about any new legally binding agreement

soon. Indeed, according to this survey, released in June 2011, less than 50 per

cent of participants are confident that there will be a legally binding

agreement in place before 2020 (see Graphic 2.7 below)–

Graphic 2.7: Levels of confidence concerning success of

Kyoto[49]

![Graphic 2.7: Levels of confidence concerning success of Kyoto[49]](/~/media/wopapub/senate/committee/scrutinynewtaxes_ctte/completed_inquiries/2010_13/carbontax/interim_report/c02_12_png.ashx)

2.59

These views would appear to be inconsistent with the assumptions made in

Treasury’s modelling which assumes that large cuts in carbon emissions are made

in both developed and developing countries by 2020.

The evolution of Australia's recent climate change policy

The Carbon Pollution Reduction Scheme

2.60

On 30 September 2008, Professor Ross Garnaut presented the Garnaut

Climate Change Review: Final Report, which was commissioned by the then

federal Australian Labor Party (ALP) opposition and ALP state and territory

governments in 2007. The review was undertaken to investigate the likely

economic and environmental impact of climate change and possible strategies to

cut greenhouse gas emissions.[50]

2.61

The Department of the Treasury modelling report, Australia's Low Pollution

Future: The Economics of Climate Change Mitigation, was released on 30

October 2008. It explored the possible impacts of policies to cut domestic

greenhouse gas emissions on the Australian economy.[51]

2.62

On 12 February 2009, the Treasurer, the Hon. Wayne Swan MP, asked the

House of Representatives Standing Committee on Economics to inquire into 'the

choice of an emissions trading scheme as the central policy to reduce

Australia's carbon pollution'. The inquiry was cancelled a week later by the

Treasurer.[52]

2.63

On 10 March 2009, the Australian Government released the exposure draft

of the Carbon Pollution Reduction Scheme Bill 2009 and associated legislation.

The exposure draft of the Bill was referred to the Senate Standing Committee on

Economics on 11 March 2009 for inquiry. The committee report was presented on

16 April 2009.

2.64

Shortly after the release of the exposure draft of the Bill, the then Prime

Minister, the Hon. Kevin Rudd MP, announced some additional changes to the

proposed Carbon Pollution Reduction Scheme (CPRS). The changes included a one

year delay in the implementation of the CPRS, a one year fixed price period and

a revised 25 per cent emissions reduction target by 2020 'if the world agrees

to an ambitious global deal to stabilise levels of CO2 equivalent at 450 parts

per million or lower'.[53]

2.65

Legislation to implement the CPRS from 2011 was rejected in the

Australian Senate twice, on 13 August and 2 December 2009.[54]

The legislation was re-introduced into Parliament with amendments on

2 February 2010. On 27 April 2010, Mr Rudd announced that

implementation of the CPRS would be deferred.[55]

2.66

On 17 July 2010, the Prime Minister, the Hon. Julia Gillard MP, called

an election for the Commonwealth Parliament. On 16 August 2010, during the election

campaign, the Prime Minister made the following commitment:

There will be no carbon tax under the government I lead.[56]

2.67

The Prime Minister made further comments ruling out a carbon tax:

There will be no carbon tax under the Government I lead.[57]

I rule out a carbon tax.[58]

2.68

The Deputy Prime Minister and Treasurer made comments ruling out a

carbon tax:

We have made our position very clear. We have ruled it out.[59]

JOURNALIST: Can you tell us exactly when Labor will apply a

price to carbon?

WAYNE SWAN: Well, certainly what we rejected is this

hysterical allegation somehow that we are moving towards a carbon tax...we

certainly reject that.[60]

The carbon tax

2.69

Following the 2010 Commonwealth Election, the returned Labor Government to

put a price on carbon, a tax, even though the ruled one out before the

election.

2.70

On 27 September 2010, the Prime Minister, the

Hon. Julia Gillard MP, the Deputy Prime Minister and Treasurer, the Hon. Wayne

Swan MP and the Minister for Climate Change and Energy Efficiency, the Hon.

Greg Combet AM MP, announced the establishment of the Multi-Party Climate

Change Committee (MPCCC). The MPCCC's terms of reference are at Appendix 3. The

Opposition declined an offer of membership to the MPCCC.

2.71

Table 2.8 lists the membership of the MPCCC:

Table 2.8: Membership of the Multi-party Climate Change

Committee[61]

|

The

Hon. Julia Gillard MP |

Prime

Minister |

Chair |

|

The

Hon. Wayne Swan MP |

Deputy

Prime Minister |

|

|

The

Hon. Greg Combet AM MP |

Minister

for Climate Change and

Energy Efficiency |

Co-Deputy

Chair |

|

Senator

Bob Brown |

Leader,

Australian Greens

(Tasmania) |

|

|

Senator

Christine Milne |

Deputy

Leader, Australian Greens

(Tasmania) |

Co-Deputy

Chair |

|

Mr

Tony Windsor MP |

Independent

(Member for New England) |

|

|

Mr

Rob Oakeshott MP |

Independent

(Member for Lyne) |

|

2.72

The Committee was advised by a panel of four independent experts -

Professor Ross Garnaut, Professor Will Steffen, Mr Rod Sims and Ms Patricia

Faulkner.[62]

2.73

On 27 September 2010, the government also announced that it would

establish two roundtables to advise it on climate change reform. The two

roundtables are the Business Roundtable and the Environment and

Non-Governmental Organisation Roundtable.[63]

2.74

On 28 April 2011, the Department of Climate Change and Energy Efficiency

called for submissions to assist the work of the MPCCC. Submissions closed on

10 May 2011.[64]

Carbon tax

2.75

Prior to the 2010 election, the Prime Minister, the Hon Julia Gillard

MP, declared that “there will be no carbon tax under a Government I lead’. On

24 February 2011, the Prime Minister, reversed this promise and announced what

her government's intentions were in relation to tackling climate change:

... the Government’s plan (is) to cut pollution, tackle

climate change and deliver the economic reform Australia needs to move to a

clean energy future.

This is an essential economic reform, and it is the right

thing to do.

The two-stage plan for a carbon price mechanism will start

with a fixed price period [a carbon tax] for three to five years before

transitioning to an emissions trading scheme.

The Government will propose that the carbon price commences

on 1 July 2012, subject to the ability to negotiate agreement with a

majority in both houses of Parliament and pass legislation this year.[65]

The architecture of the carbon tax

2.76

On the 24 February 2011, the MPCCC released the 'Carbon Price Mechanism'

document. It set out:

... a proposed carbon price mechanism that has been discussed

by members of the Multi-Party Climate Change Committee (MPCCC). The proposal

has been agreed by the Government and Greens members of the Committee.

Mr Windsor and Mr Oakeshott have agreed that the proposal be released to enable

consideration by the community and to demonstrate the progress that has been

made.[66]

2.77

The details surrounding the cost, impact, scope and operation of the

carbon tax were not disclosed at the time of the government's announcement that

it would seek to introduce a carbon tax despite emphatic promises before the

election not to.

2.78

The 'Carbon Price Mechanism' document outlined some of the known

features of the government's proposed carbon tax and emissions trading scheme.

Given the absence of detail surrounding the operation of the proposed scheme,

the known features were crucial for stakeholders in terms of their engagement

with the policy development process and critical for the Senate in its role as

a house of review.

2.79

The little information that was available clearly showed that the government

intended to shift consumer behaviour at a domestic and commercial level by

substantially increasing the cost of electricity.

2.80

According to the 'Carbon Pricing Mechanism' document, the known features

of the government's carbon tax were to be:

Start date

The mechanism could commence as early as 1 July 2012, subject

to the ability to negotiate agreement with a majority in both houses of

Parliament and pass legislation this year.

Length of fixed price period

The fixed price phase could be of between three and five

years, with the price increasing annually at a pre-determined rate. The initial

fixed price could begin to drive economic transformation and investment in low

emission technologies, and ensure greenhouse gas emission reductions.

Transition arrangements

At the end of the fixed price period, the clear intent would

be that the scheme convert to a flexible price cap-and-trade emissions trading

scheme. In relation to the transition to a flexible price, it would be

important to design the arrangements so as to promote business certainty and a

smooth transition from the fixed to flexible price.

...

Coverage

A carbon price mechanism could cover all six greenhouse gases

counted under the Kyoto Protocol and have broad coverage of other emissions

sources encompassing:

- the

stationary energy sector

- transport

sector

- industrial

processes sector

- fugitive

emissions (other than from decommissioned coal mines)

- emissions

from non-legacy waste.

Emissions from sources covered under the proposed Carbon

Farming Initiative, such as agricultural emissions sources, would be excluded

from coverage under the carbon pricing mechanism.

...

International linking

During the fixed price phase, liable parties may not be

entitled to use international emissions units for compliance.

In the flexible price phase, international emissions units

(offsets) meeting appropriate criteria concerning their quality could be able

to be used for compliance. In advance of a move to emissions trading, a

decision could be made on any restrictions on the quantity and any other

criteria for the use of international emission units.

Assistance and other matters still to be determined

Ways to promote the environmental effectiveness of the

scheme, to support technological innovation, and ways to manage the impacts of

the scheme on households, communities and business are to be developed

...

Further consideration could

also be given to reviewing existing Commonwealth, State and Territory policies

so that they are complementary to the mechanism. Such complementary measures

may support research, development and commercialisation of clean technologies. [67]

2.81

On 10 July 2011, the Prime Minister finally announced the key features,

costs, scope, impact and operational features of the carbon tax. The key

features of the carbon tax are set out in the next section of Chapter 2.

The carbon tax legislation

2.82

On 28 July 2011, the Treasurer and Deputy Prime Minister, the Hon. Wayne

Swan MP, and the Minister for Climate Change and Energy Efficiency, the Hon.

Greg Combet AM MP, jointly released the Clean Energy Legislation for public

comment. Stakeholders were asked to put their views to government by 22 August

2011.[68]

2.83

The submissions made to the Department of Climate Change and Energy

Efficiency are not available on the agency's website. However, the Prime

Minister, the Hon, Julia Gillard MP, has stated that 300 submissions were

received.[69]

2.84

On 13 September 2011, the Clean Energy Legislation Package was

introduced into Parliament. The Joint Select Committee on Australia's Clean

Energy Future Legislation was established under a resolution of appointment

passed by the House of Representatives on 14 September 2011 and the Senate on

15 September 2011 to inquire into and report on the provisions of 19 Bills.[70]

1. Clean Energy Bill 2011

2. Clean Energy

(Consequential Amendments) Bill 2011

3. Clean Energy (Income Tax

Rates Amendments) Bill 2011

4. Clean Energy

(Household Assistance Amendments) Bill 2011

5. Clean Energy (Tax Laws

Amendments) Bill 2011

6. Clean Energy (Fuel Tax

Legislation Amendment) Bill 2011

7. Clean Energy (Customs

Tariff Amendment) Bill 2011

8. Clean Energy (Excise

Tariff Legislation Amendment) Bill 2011

9. Ozone Protection and

Synthetic Greenhouse Gas (Manufacture Levy) Amendment Bill 2011

10. Ozone Protection and Synthetic

Greenhouse Gas (Import Levy) Amendment Bill 2011

11. Clean Energy (Unit Shortfall

Charge—General) Bill 2011

12. Clean Energy (Unit Issue

Charge—Auctions) Bill 2011

13. Clean Energy (Unit Issue Charge—Fixed

Charge) Bill 2011

14. Clean Energy (International Unit

Surrender Charge) Bill 2011

15. Clean Energy (Charges—Customs)

Bill 2011

16. Clean Energy (Charges—Excise) Bill

2011

17. Clean Energy Regulator Bill 2011

18. Climate Change Authority Bill 2011

19. Steel Transformation Plan Bill

2011

2.85

The Joint Select Committee on Australia's Clean Energy Future

Legislation called for submissions by 22 September 2011, that is, seven days

after the media release requesting submissions was issued.

2.86

The Joint Select Committee on Australia's Clean Energy Future

Legislation will report on or before 7 October 2011.

2.87

The Clean Energy Bills so far released in either draft or final form

have not included legislation covering the Australian Renewable Energy Agency

or the Clean Energy Finance Corporation announced as part of the government’s

carbon tax package on 10 July 2011.[71]

Fallout from the carbon tax policy development process

2.88

The Senate Select Committee on the Scrutiny of New Taxes started on

30 September 2010. The committee conducted five public hearings on the carbon

tax between March and June 2011. For a large part of the time of the

committee's operation, insufficient detail was available for stakeholders to

make comment on the proposed carbon tax.[72]

The detail was released on 10 July 2011.

2.89

The absence of detail has had an impact on the capacity of witnesses to

provide evidence to the inquiry. For example, even the Treasury were unsure of

the carbon tax rate:

CHAIR: Does Treasury know what the initial carbon tax

price will be?

Dr Parkinson: That is a matter that the government and

the Independents and the Greens, and the parliament more generally, will have

to decide.[73]

2.90

According to the National Farmers Federation the absence of detail is an

issue:

We have pretty scant detail out there at the moment about

that system.[74]

2.91

The Association of Mining and Exploration Companies has also expressed

frustration with the lack of information:

AMEC is not represented on that [Multi-Party Climate Change]

Committee and is therefore not aware of any policy details or costing models

and is therefore opposed to the introduction of a tax on carbon...[75]

2.92

The Chamber of Commerce and Industry of Western Australia also expressed

the view that the lack of detail regarding the government's position was not

helpful:

The questions you are asking us are difficult to answer

because it comes back to detail. We cannot at the moment assess or model the

impact that the proposed carbon price will have on our members because we do

not know what the environment, the parameters will be that will be faced. ...

We still do not have that detail, so it is very difficult, almost impossible,

for our members to plan and to ponder what implications it will have for them

and what they can do to adjust their business operations when there are all

those questions in the air.[76]

2.93

The Magnetite Network made the point that:

Indeed, at the moment we are not sure of any of the detail of

the proposed carbon tax. We have been told that it is $20 per tonne, but who it

applies to, what level of industry assistance there will be and what that will

mean for the price of electricity we do not know. What it will mean for the

purchase of gas for some of us who may have a combination of gas or solely gas

we just do not know.[77]

A need for Australians to have their say

2.94

Following the government's announcement of the details of its carbon

plans, the committee resolved to conduct a further eight public hearing into

the carbon tax. These hearings and the hearings that occurred prior to the

announcement of the carbon tax form the basis of the evidence that underpins

this report.

2.95

The carbon tax is one element of the government's overall Clean Energy

Plan announced on 10 July 2011. The program covers a broad range of measures

aside from the introduction of a carbon tax. This report is focussed on the

carbon tax and its associated compensation mechanisms.

2.96

Australians should be given the opportunity to have their say about the

government's proposed carbon tax, given:

-

The government has no mandate to introduce a carbon tax – in fact

it has a mandate not to;

-

The prolonged lack of transparency and the resulting limits on

consultation, with no consultation for example through the Council of

Australian Governments even though the carbon tax has significant implications

for states and territories, especially those that own electricity generation

assets;

-

No release of sufficient details of the economic modelling to

allow third-party scrutiny of the parameters and assumptions used in the

modelling to assess the economic consequences of the carbon tax.

Committee comment

2.97

Pressing ahead with a carbon tax in Australia outside of an

appropriately comprehensive and binding global framework to price emissions is

not effective action on climate change but rather is just an irresponsible act

of economic self harm.

2.98

The committee is of the view that in the absence of an appropriately

comprehensive global agreement to price emissions, the carbon tax will push up

the cost of everything, reduce Australia's international trade competitiveness,

cost jobs, put small business under more pressure, hurt regional Australia and

all without doing anything to help reduce global greenhouse gas emissions.

2.99

Making overseas businesses more competitive than Australian businesses

and helping overseas emitters take market share away from even the most

environmentally efficient equivalent business in Australia will do nothing to

reduce global greenhouse gas emissions – it will just shift emissions overseas.

2.100

The failure of Copenhagen had serious implications for Australia's

policy response to climate change.

2.101

Given there is now no foreseeable prospect of an appropriately

comprehensive global agreement to price carbon dioxide emissions, Australia

should change its policy approach to reducing global greenhouse gas emissions:

away from a carbon tax and an emissions trading scheme towards direct action

initiatives.

2.102

Australians were entitled to believe that the Gillard Government had

reached the same conclusion in the lead up to the last election.

2.103

Why else did the Prime Minister and the Treasurer promise before the

last election that there would be no carbon tax under a Gillard Government after

the election?

2.104

After three years of debate in the last Parliament and after the failure

of Copenhagen it seemed that even the Gillard Labor Government had recognised

that pursuing a carbon tax in the absence of an appropriately comprehensive

global agreement to price emissions was not in the national interest.

Navigation: Previous Page | Contents | Next Page