Robert Dolamore and Indra Kuruppu

The ‘headlines’ at a glance

|

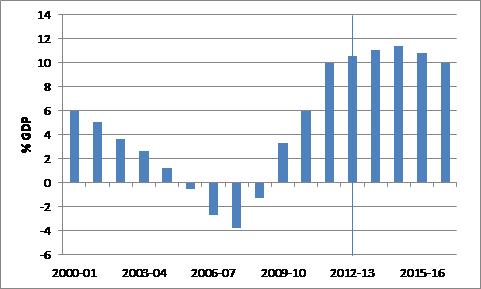

The Budget is forecast to remain in deficit in 2013–14 and not break even until 2015–16. A small surplus forecast for 2016–17

|

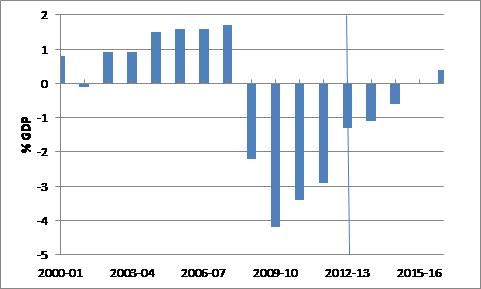

Underlying Cash Balance

|

|

Year

|

$m

|

% GDP

|

|

2011–12

|

–43,360

|

–2.9

|

|

2012–13

|

–19,377

|

–1.3

|

|

2013–14

|

–18,043

|

–1.1

|

|

2014–15

|

–10,888

|

–0.6

|

|

2015–16

|

849

|

0.0

|

|

2016–17

|

6,591

|

0.4

|

|

Underlying Cash Balance % GDP

Source: Australian Government, Budget strategy and outlook: budget paper no. 1: 2013–14, Statement 10, Table 1, p. 10‑7.

|

|

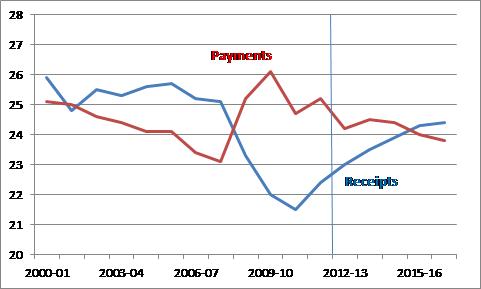

Achieving a surplus depends on closing the gap between payments and receipts

- Payments peaked at 26.1 per cent of GDP in 2009–10 and are forecast to be 24.5 per cent of GDP in 2013–14 and decline to 23.8 per cent in 2016–17.

- Receipts bottomed at 21.5 per cent of GDP in 2010–11 and are forecast to be 23.5 per cent of GDP in 2013–14 and increase to 24.4 per cent of GDP in 2016–17.

- Looking at the out years the revenue side is going to be doing most of the heavy lifting to bring the Budget back into surplus.

|

Reciepts and Payments % GDP

Source: Australian Government, Budget Strategy and outlook: budget paper no. 1: 2013‑14, Statement 10, Table 1, pp. 10‑6 - 10‑7.

|

|

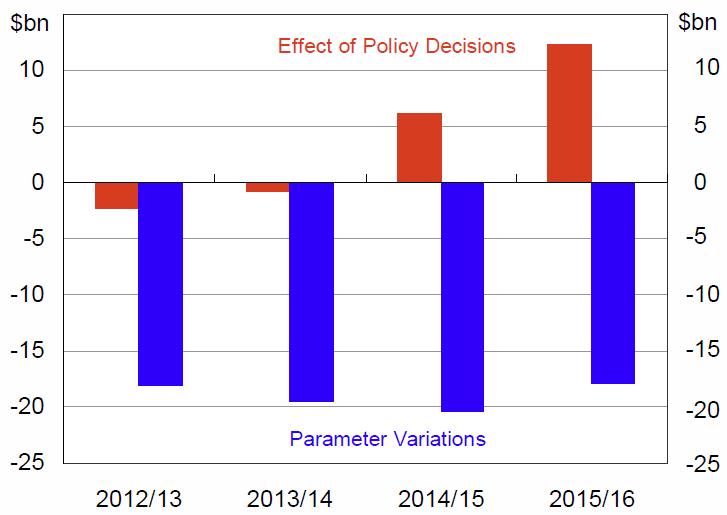

Since MYEFO 2012–13 most of the change in the forecasts of the Underlying Cash Balance has been driven by parameter changes

- Weaker forecast nominal GDP growth has led to large write-downs in forecast tax receipts and increased the size of the Budget deficit.

- Policy measures to reduce the size of the Budget deficit come later in the forward estimates period.

|

Comparing Budget 2013–14 with MYEFO 2012–13

Source: National Australia Bank, 2013–14 Federal Budget, 14 May 2013, p. 2.

|

The ‘headlines’ at a glance (continued)

|

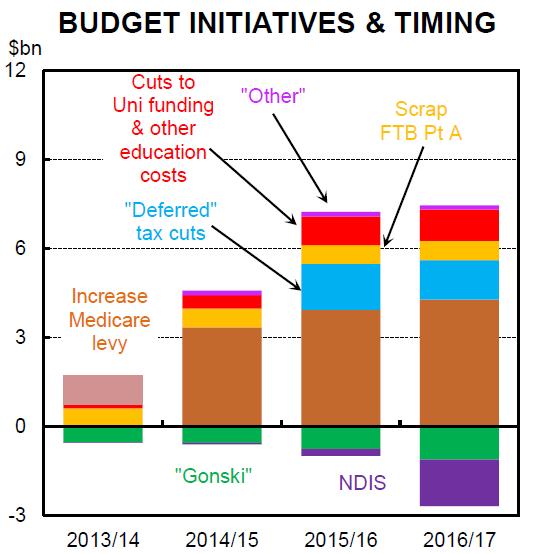

Savings measures in the Budget are designed to cover new spending

- The Budget bottom line will benefit from savings measures kicking-in before some of the big-ticket spending measures get going.

|

Source: Commonwealth Bank of Australia, The Budget we had to have: The 2013–14 Budget, May 2013, p. 24.

|

|

Net debt is forecast to peak in 2014–15

|

Net Debt

|

|

Year

|

$m

|

% GDP

|

|

2011–12

|

147,334

|

10.0

|

|

2012–13

|

161,603

|

10.6

|

|

2013–14

|

178,104

|

11.1

|

|

2014–15

|

191,552

|

11.4

|

|

2015–16

|

191,172

|

10.8

|

|

2016–17

|

185,662

|

10.0

|

|

Net Debt % GDP

Source: Australian Government, Budget Strategy and outlook: budget paper no. 1: 2013‑14, Statement 10, Table 3, p. 10‑9.

|

|

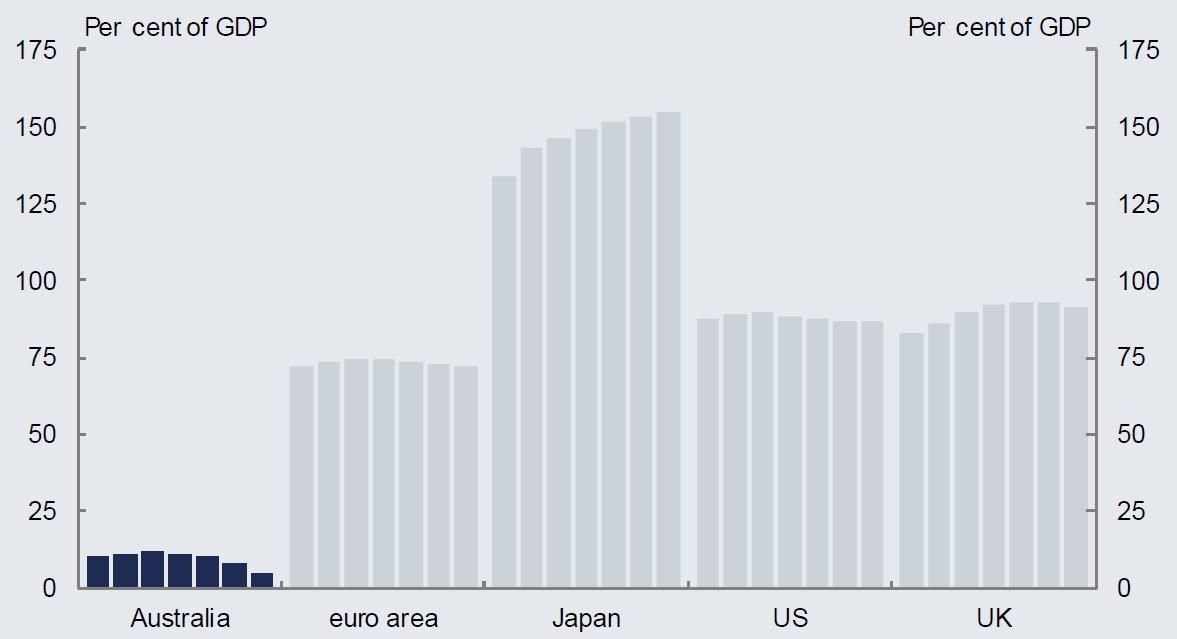

However, Australia’s level of net debt is very low by international standards ….

- The peak in the average net debt position of the G7 economies is expected to be 92.6 per cent of GDP in 2014.

|

Comparison of government net debt 2012–2018

Source: Australian Government, Budget Strategy and outlook: budget paper no. 1: 2013‑14, Statement 7, Box 2, p. 7‑7.

|

Introduction

This overview looks at the international and domestic economic context for the Budget, factors that will affect the success or failure of the Government’s budget strategy, and how various groups have reacted to the Budget.

The 2013‑14 Budget was introduced into Parliament on 14 May 2013. The context for this year’s budget is a domestic economy that is expected to run a little below trend for the next year or so. Resources sector investment which has been the key driver of growth over recent years is expected to peak as a share of GDP during 2013‑14. As this peak passes, Australia will need to make the transition to another set of growth drivers. While there are signs this rebalancing is already underway there is quite a bit of uncertainty about how it will ultimately play out.

The fiscal outlook presented in the 2013‑14 Budget is markedly different to the one presented in last year’s budget or even the 2012‑13 Mid-Year Economic and Fiscal Outlook (MYEFO) in October 2012. The Budget is now not expected to return to surplus until 2016‑17 and even then the surplus is relatively modest. Significant write-downs in expected tax receipts are largely but not totally to blame. Although the Government’s medium‑term fiscal strategy is to return the budget to surplus it has decided to slow the pace of fiscal consolidation in order to support jobs and growth.

Despite the fiscal outlook having deteriorated over the last year, Australia’s overall budgetary position continues to compare favourably with most other advanced economies. The deficits over the next few years are relatively small and net debt is only forecast to peak at 11.4 per cent of GDP in 2014‑15. Importantly, Australia’s strong budgetary position continues to provide scope to respond to any further global shocks.

The Budget context

International economic conditions

Treasury is forecasting global economic growth will strengthen slightly from 3.25 per cent in 2013 to 4 per cent in 2014 and 2015.[1] Over the last six months some acute risks have eased such as a disorderly break‑up of the Euro area, a sharp fiscal contraction in the United States and key emerging economies suffering a ‘hard landing’. Nevertheless, significant downside risks remain and the recovery remains fragile as governments in many advanced economies grapple with trying to repair public balance sheets without damaging demand in the short‑term. Much will depend on governments, particularly in Europe, seeing through the types of structural reforms needed to achieve sustainable economic growth and putting uncertainty to rest.

In its latest World Economic Outlook report, the International Monetary Fund (IMF) argues that the world recovery has moved from a ‘two speed’ to a ‘three speed’ recovery.[2]

- Among advanced economies there appears to be a growing divergence between the performance and prospects of the United States and those of Europe. The IMF is forecasting the United States to grow by 1.9 per cent in 2013 and 3 per cent in 2014. In contrast, the euro area economy is forecast to contract by -0.3 per cent in 2013 before growing by 1.1 per cent in 2014.

- The IMF is forecasting emerging market and developing economies to grow by 5.3 per cent in 2013 and 5.7 per cent in 2014.

Treasury’s forecasts are not significantly different to the IMF’s (see Table 1). If anything, the IMF forecasts are slightly more optimistic for 2014.

Table 1: Comparison of Treasury and IMF international growth forecasts

|

|

2012

|

|

2013

|

|

2014

|

|

United States

|

|

|

|

|

|

|

Treasury

|

2.2

|

|

2.0

|

|

2.5

|

|

IMF

|

2.2

|

|

1.9

|

|

3.0

|

|

Euro area

|

|

|

|

|

|

|

Treasury

|

-0.6

|

|

-0.5

|

|

1.0

|

|

IMF

|

-0.6

|

|

-0.3

|

|

1.1

|

|

China

|

|

|

|

|

|

|

Treasury

|

7.8

|

|

8.0

|

|

7.75

|

|

IMF

|

7.8

|

|

8.0

|

|

8.2

|

|

Japan

|

|

|

|

|

|

|

Treasury

|

2.0

|

|

1.25

|

|

1.0

|

|

IMF

|

2.0

|

|

1.6

|

|

1.4

|

|

India

|

|

|

|

|

|

|

Treasury

|

4.0

|

|

5.75

|

|

6.5

|

|

IMF

|

4.0

|

|

5.7

|

|

6.2

|

|

World

|

|

|

|

|

|

|

Treasury

|

3.2

|

|

3.25

|

|

4.0

|

|

IMF

|

3.2

|

|

3.3

|

|

4.0

|

Sources: Australian Government, Budget strategy and outlook: budget paper no. 1: 2013‑14, May 2013, p. 2‑16, accessed 15 May 2013; International Monetary Fund World economic outlook April 2013: hopes, realities, risks, IMF, Washington, April 2013, p. 2, accessed 15 May 2013.

The United States

The US economy is growing at a moderate pace with activity being weighed down by sizeable fiscal consolidation (around 1.8 per cent of US GDP in 2013). Nonetheless there are promising signs that recovery is taking hold and the pace of growth is forecast to pick-up in 2014. The IMF notes that credit growth has increased, bank lending conditions are easing slowly from tight levels, construction activity has rebounded albeit from low levels; and job creation picked up in the second half of 2012.[3] Underlying private demand is quite strong thanks to low interest rates and pent-up demand for housing and durables.

The Euro area

Economic conditions in Europe remain weak and not just in the crisis economies. The euro area as a whole is in recession and the weakness is no longer just in the periphery. Germany’s growth is strengthening but is still expected to be only 0.6 per cent in 2013, while France’s growth is forecast to be slightly negative.[4] The need for public and private balance sheet repair, banking systems which are still fragile and continued policy uncertainty appear to be weighing on a robust recovery in investment and consumption. Nevertheless, the IMF is forecasting growth to strengthen gradually over 2013 in the euro area, reaching 1 per cent by the fourth quarter.[5]

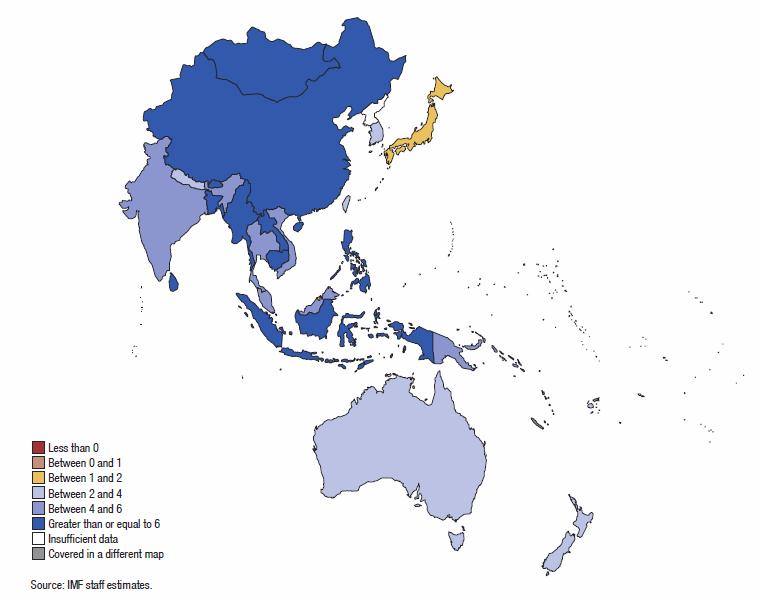

Asia

The IMF is forecasting the Asian economy will grow by 5.7 per cent in 2013 and 6 per cent in 2014 (figure 1).[6] Although growth in the region slowed around the middle of 2012 it is expected to gradually pick up during 2013 thanks to stronger external demand and continued solid domestic demand. The advanced Asian economies are forecast by the IMF to grow by 2.2 per cent in 2013 and 2.6 per cent in 2014, while growth of developing Asian economies is forecast to be 7.1 and 7.3 per cent.[7] Continued strong growth among developing countries in Asia is clearly advantageous for Australia. The Reserve Bank of Australia recently noted that:

Growth in developing economies is also expected to be stronger in 2014 and is forecast to remain considerably higher than in the advanced economies. Australia trades more with developing economies, which are currently experiencing better economic conditions. As a result, growth in Australia’s major trading partners is expected to be around its average pace and continue to exceed that for the world as a whole.[8]

Growth in the Chinese economy slowed slightly in the first quarter of 2013 with the economy expanding by 7.7 per cent from a year ago, compared to 7.9 per cent (year on year growth) in the preceding quarter and 7.8 per cent for 2012.[9] However, forecasts suggest that growth will strengthen over 2013 with stronger net exports and a recovery in private consumption helping to underpin growth. Both Treasury and the IMF are forecasting the Chinese economy will expand by 8 per cent in 2013. While Treasury is forecasting growth in the Chinese economy to slow slightly in 2014 to 7.75 per cent, the IMF is more optimistic, forecasting growth of 8.2 per cent.

Japan is forecast to grow by 1.25 per cent in 2013 by Treasury and 1.6 per cent by the IMF. This follows a sharp contraction in the second half of 2012. In part this improved outlook reflects the new Japanese government’s determination to end years of deflation and little or no growth by substantially easing monetary policy, adopting a new inflation target, funding a sizeable fiscal stimulus package and implementing structural reforms. While the IMF has welcomed these initiatives it notes that in the absence of a medium-term fiscal consolidation plan, the increase in government expenditure comes with a large increase in fiscal risk.

Figure 1: IMF Asian growth forecasts for 2013

Source: International Monetary Fund, World economic outlook: April 2013: hopes, realities, risks, IMF, Washington, p. 54, accessed 16 May 2013.

Both Treasury and the IMF are forecasting India’s economic growth will pick-up in 2013 following a marked slowdown in 2012. This reflects improved external demand and the effects of recently implemented pro-growth measures. Nevertheless, India continues to face structural challenges that are likely to impede supply-side growth and Budget Strategy and Outlook: Budget Paper No. 1 notes that India’s current account deficit makes it vulnerable to capital outflows in response to unfavourable global or domestic circumstances.[10]

Risk assessment

Overall, Treasury considers risks on the international front are more balanced than they were a year ago but remain tilted to the downside.[11] It identifies the euro sovereign debt crisis as the key risk to the global recovery. The IMF also considers the short-term risk picture has improved.[12] The IMF estimates the probability of global growth falling below 2 per cent in 2013 has fallen to about 2 per cent from 17 per cent in October 2012.[13]

Nevertheless, the IMF argues that risks are still high in the medium-term and include:

- very low growth or stagnation in the euro area

- fiscal trouble in the US or Japan

- less excess supply than expected in advanced economies or a sudden burst of inflation

- risks related to unconventional monetary policy and

- lower potential output in key emerging market economies.[14]

There is also a risk that optimism in global financial markets could get too far ahead of developments in real economic activity. Specifically, there is a risk that quantitative easing could fuel asset price bubbles as easy money chases higher returns. The OECD has observed that:

This shift in the balance of risks, together with abundant liquidity, was an important factor behind the marked strengthening of financial markets in recent months. Equity prices in OECD economies have surged, corporate bond spreads have narrowed and, despite a number of negative shocks, sovereign spreads in the Euro area periphery moved down substantially in the last quarter of 2012 and have declined further in 2013. Riskier assets have generally gained the most. However, real activity has yet to reflect fully the improvement in financial market sentiment, especially in the euro area. This highlights the risk of asset prices getting out of line with fundamentals, especially as regards corporate securities.[15]

Having regard for the international outlook and associated risks, the Government cautions in Budget Paper No. 1 that:

The periodic bouts of financial market volatility since the global financial crisis … are a reminder that confidence remains fragile with significant downside risks to the global economic outlook. With many advanced economies under significant constraints, and policy actions by major advanced economy central banks already very accommodative and unconventional, there is very limited space to respond to any further negative shocks to the global economy.[16]

Domestic economic conditions

While Australia’s real economic growth continues to compare favourably with other advanced economies, the outlook for the domestic economy is relatively subdued over the next couple of years. Treasury is forecasting Australia’s economic growth will be slightly below trend in 2013‑14 at 2.75 per cent before picking up to 3 per cent in 2014‑15 and the out years (table 2). Unemployment is forecast to remain relatively low and inflation is forecast to be comfortably in the RBA’s target range.

Table 2: Treasury forecasts of major economic parameters

|

|

2011–12

|

2012–13

|

2013–14

|

2014–15

|

2015–16

|

2016–17

|

|

Real GDP

|

|

|

|

|

|

|

|

Budget 2012–13

|

3.0

|

3.25

|

3.0

|

3.0

|

3.0

|

|

|

MYEFO 2012–13

|

3.4

|

3.0

|

3.0

|

3.0

|

3.0

|

|

|

Budget 2013–14

|

3.4

|

3.0

|

2.75

|

3.0

|

3.0

|

3.0

|

|

|

|

|

|

|

|

|

|

Employment

|

|

|

|

|

|

|

|

Budget 2012–13

|

0.5

|

1.25

|

1.5

|

1.5

|

1.5

|

|

|

MYEFO 2012–13

|

0.7

|

1.0

|

1.25

|

1.5

|

1.5

|

|

|

Budget 2013–14

|

1.2

|

1.25

|

1.25

|

1.5

|

1.5

|

1.5

|

|

|

|

|

|

|

|

|

|

Unemployment rate

|

|

|

|

|

|

|

|

Budget 2012–13

|

5.25

|

5.5

|

5.5

|

5.0

|

5.0

|

|

|

MYEFO 2012–13

|

5.1

|

5.5

|

5.5

|

5.0

|

5.0

|

|

|

Budget 2013–14

|

5.1

|

5.5

|

5.75

|

5.75

|

5.0

|

5.0

|

|

|

|

|

|

|

|

|

|

Consumer Price Index

|

|

|

|

|

|

|

|

Budget 2012–13

|

1.25

|

3.25

|

2.5

|

2.5

|

2.5

|

|

|

MYEFO 2012–13

|

1.2

|

3.0

|

2.25

|

2.5

|

2.5

|

|

|

Budget 2013–14

|

1.2

|

2.5

|

2.25

|

2.25

|

2.5

|

2.5

|

|

|

|

|

|

|

|

|

|

Nominal GDP

|

|

|

|

|

|

|

|

Budget 2012–13

|

5.5

|

5.0

|

5.25

|

5.25

|

5.25

|

|

|

MYEFO 2012–13

|

5.0

|

4.0

|

5.5

|

5.25

|

5.25

|

|

|

Budget 2013–14

|

5.0

|

3.25

|

5.0

|

5.0

|

5.25

|

5.25

|

Sources: Australian Government, Budget strategy and outlook: budget paper no. 1: 2012‑13, May 2012, pp. 1‑8 & 2‑12; Australian Government, Mid-year economic and fiscal outlook, October 2012, pp. 5, 18, accessed 15 May 2013; Australian Government, Budget strategy and outlook: budget paper no. 1: 2013‑14, May 2013, p. 2‑16, accessed 15 May 2013.

Treasury’s growth forecasts for the Australian economy are consistent with those of the RBA. The RBA is forecasting growth of 2–3 per cent for 2013‑14 and 2.5–3.5 per cent for 2014‑15.[17]

The need to transition to a different set of growth drivers

In the short-term, a key challenge facing the Australian economy is the need to transition from one set of growth drivers to another. Resources sector investment has been the main driver of growth in recent years and is expected by Treasury to peak in 2013–14.[18] Even if resources sector investment plateaus rather than falls away precipitously, this investment will no longer be the driver of growth it has been. Achieving Treasury’s growth forecasts will depend on any shortfall being made up by some mix of stronger growth from exports, non-mining business investment and household spending. Considerable uncertainty remains about how smoothly this transition will occur.

Two key factors shaping the outlook for the domestic economy over recent years have been the two or even three speed nature of the Australian economy and recognition that at some point in the near-term resources sector investment will peak. The high Australian dollar has put considerable pressure on non-mining trade exposed sectors of the economy (including manufacturing, tourism and education services). Moreover, since the onset of the global financial crisis the household savings ratio has been at around 10 per cent, which is similar to the rate of saving in the mid-1980s and well above the levels prevailing in the 1990s and early 2000s.[19] More cautious consumer spending has put increased pressure on the retail and wholesale sectors. With some parts of the economy clearly doing it tougher than others, there have been concerns about how Australia’s growth will be sustained once the peak in resources sector investment passes.

Monetary policy has been playing a key role in supporting domestic demand in the face of these challenges. The RBA has lowered the cash rate by 200 basis points since October 2011. The initial cuts in late 2011 were intended to remove a mildly restrictive monetary policy stance as concerns about inflation picking up abated. During 2012 the RBA adopted a more accommodative position intended to support demand in response to concerns about the global economic outlook and softer domestic conditions in the second half of the year. In cutting the cash rate to 2.75 per cent in May this year, the RBA decided to use some of the scope afforded by the favourable outlook for inflation to further support domestic demand.[20]

There are signs this substantial easing of monetary policy is having an expansionary effect on the economy. The RBA has observed:

Over recent meetings, the Board has noted that interest rates have already been reduced substantially, with borrowing rates approaching previous lows, and that the effects of this on the economy are continuing to emerge. Savers have been changing their portfolios towards assets with higher expected returns, asset values have risen and some interest-sensitive areas of spending have increased.[21]

Treasury’s forecasts for the domestic economy suggest the expansionary effects of the interest rate cuts will continue to build momentum in the near-term.

- Treasury is forecasting household consumption to grow solidly over the forecast period and provide a platform for recovery in some non-resources parts of the economy.[22] This is consistent with the RBA’s latest assessment of the domestic economy. In its May Statement on Monetary Policy, the RBA revised up a little its forecasts for household consumption as the prospects for increased household demand appear to be slightly more positive.[23] The RBA pointed to indications that household consumption strengthened in early 2013 after slowing considerably in late 2012. Importantly, the RBA’s liaison work suggests this improvement has been sustained. However, the RBA also noted that moderate employment growth in the near term and slower growth in wages than in recent years is expected to continue to restrain growth in labour income.[24] Overall, the RBA is expecting household spending to grow at around its long-run average over the next couple of years and broadly in line with real income growth. This is consistent with Treasury’s forecasts for growth in household consumption of 2.5 per cent in 2012‑13 and 3 per cent in 2013‑14 and 2014‑15.[25]

- Treasury is forecasting a very strong turn around in residential dwelling investment. It argues that low interest rates, rising dwelling prices, favourable demographics and tight rental market conditions will support a pick-up in homebuyer demand.[26] While residential dwelling demand is forecast to have grown by just 0.5 per cent in 2012‑13, Treasury is expecting above-trend growth of 5 per cent in 2013‑14 and 5.5 per cent in 2014–15. For its part, the RBA has noted that a number of forward-looking indicators point to a further recovery in residential dwelling investment over coming months.[27] Further, its liaison work suggests demand for new housing is improving from low levels, with enquiries from prospective purchasers and visits to display homes increasing.

- Treasury is forecasting quite a mild slow down in the growth of business investment in view of the approaching peak in resources sector investment. It is forecasting business investment to grow by 10.5 per cent in 2012‑13, 4.5 per cent in 2013‑14 and 1 per cent in 2014‑15.[28] Treasury is forecasting resources sector investment will peak at a record 8 per cent of GDP in 2013‑14 and although it will subsequently soften it will remain at historically high levels to at least the middle of the decade.[29] Crucially, Treasury is expecting non-resources sector investment will strengthen, stimulated by low interest rates and a broadening of economic growth. The RBA’s liaison work suggests that although mining companies have scaled back their investment intentions since the middle of 2012, it seems likely that mining investment in 2013‑14 will be around current levels.[30] The RBA notes that this reflects the large stock of resources projects already committed to, which is expected to keep mining investment at an elevated level for some time. The outlook for non-resources sector investment is mixed. Recent Australian Bureau of Statistics data suggests firms’ capital expenditure plans for 2013‑14 are positive. Against this the RBA’s liaison work suggest some firms remain reluctant to invest because of concerns about the strength of demand, general uncertainty about the economic outlook and a focus on containing costs.[31]

As the peak in resources sector investment passes, some of the slack will be taken up by stronger export growth. Treasury is forecasting exports to grow by 7 per cent in 2012‑13, 6.5 per cent in 2013‑14 and 7 per cent in 2014‑15.[32] This strong growth is largely being driven by exports of non-rural bulk commodities as production in the resources sector ramps up considerably following a period of record investment. The RBA notes that this increase in exports is expected to be supported by continued demand from China and other developing countries.

With infrastructure needs in China remaining large – including to accommodate the growing high‑density urban population – steel consumption is likely to continue to grow, albeit a good deal more slowly than in the past decade. However, given the substantial increase in the size of the Chinese economy, the lower growth rate of the economy (compared with the past) can still generate a large increase in the demand for steel.[33]

Against this, Treasury is forecasting imports to grow by 5 per cent in 2012‑13, 6 per cent in 2013‑14 and 3 per cent in 2014‑15.[34] Treasury notes that capital goods imports associated with the expansion of the LNG sector are expected to be a significant driver of the increase in 2013‑14. Growth in resources sector capital goods imports will slow once the peak in resources sector investment passes.

Given this picture of the external sector, Treasury is forecasting net exports will contribute 0.5 of a percentage point towards growth in 2012‑13 and will make no contribution in 2013‑14.[35] After that net exports are forecast to begin to kick in, contributing 1 percentage point towards growth in 2014‑15.

Overall, Treasury’s forecasts suggest Australia will make a relatively smooth transition to a new set of growth drivers in the near term. This appears to largely align with the RBA’s view of the outlook for the domestic economy.

Growth in nominal GDP

One factor that is central to understanding the impact of recent economic developments on the Budget and the expected outlook is somewhat counter-intuitive. While real economic growth–growth after taking account of inflation–has been quite robust, nominal growth–the apparent growth before taking account of inflation–has been weak by historical standards. Weak nominal growth tends to be correlated with lower growth in company profits, lower growth in wages and salaries, and hence lower growth in government revenues. It is one possible explanation for why over the last year or so people’s perceptions of the Australian economy have seemed at odds with the more positive headline indicators. At the end of the day, people’s perceptions are likely to be shaped by their experience of the nominal economy and how it has been changing.

There is a risk that nominal weakness can flow back into the real economy through sentiment and income channels. For example, households may defer spending and focus on balance sheet repair and the business sector may defer spending and labour hiring plans.

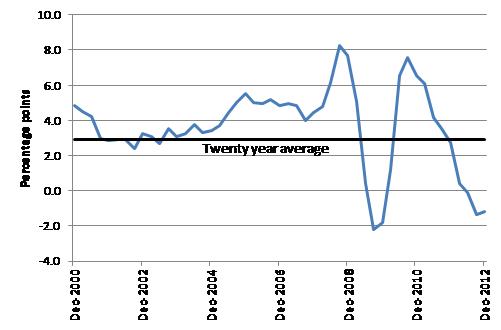

In Budget Paper No. 1 the Government notes that nominal GDP growth has historically exceeded real GDP growth by around 2.5 percentage points, but this relationship has recently reversed (chart 1).[36] Nominal GDP grew by only 2 per cent through the year to the December quarter 2012, well below the rate of real GDP growth of 3.1 per cent. The Government notes that this was the third consecutive quarter where nominal GDP growth was outpaced by real GDP growth, the first time this has happened in at least the past half–century.

The fall in nominal GDP growth reflects the decline in Australia’s terms of trade (roughly the ratio of export prices to import prices). A fall in the terms of trade implies Australia can buy fewer imports from the same amount of exports. Australia’s terms of trade fell by 2.6 per cent in the December quarter 2012, the fifth consecutive fall in the terms of trade. Australia’s terms of trade are now 16.5 per cent below the third quarter peak in 2011.[37] Generally, nominal GDP growth will grow faster than real GDP when the terms of trade are improving strongly, but nominal will grow more slowly than real GDP when the terms of trade fall sharply.

Importantly, profits represent around 40 per cent of nominal GDP.[38] The Government notes in Budget Paper No. 1 that total gross operating surplus (the national accounts measure of profits) has fallen for the last five quarters, the first time this has occurred in the history of the National Accounts.[39] This is attributed to the effects of falling commodity prices and the high Australian dollar on the profitability of resources companies and the effects of the high Australian dollar on the profitability of non-resources sector companies.

Chart 1: Difference between nominal and real GDP growth

Source: Australian Bureau of Statistics (ABS), Australian national accounts: national Income, expenditure and product, Dec 2012, cat. no. 5206.0, ABS, Canberra, 2013, accessed 17 May 2013.

Over the last year Treasury significantly revised its forecast for nominal GDP growth for 2012‑13 from 5 per cent at the time of the 2012‑13 Budget to 3.25 per cent in the current Budget. As discussed in the fiscal outlook section below, this has contributed to a large write-down in revenue forecasts for the current year.

Treasury is forecasting nominal GDP growth of 5 per cent in both 2013‑14 and 2014‑15, which it notes is below the 20 year average of 6.5 per cent.[40] The terms of trade are forecast to fall by 7.5 per cent in 2012‑13, 0.75 per cent in 2013‑14 and 1.75 per cent in 2014‑15.[41] Gross operating surplus (or profits) is forecast to decline by 0.75 in 2012‑13 before recovering to grow by 4.75 per cent in 2013‑14 and 5.5 per cent in 2014‑15.[42] Compensation for employees (mostly wages) is forecast to grow by 5.75 per cent in 2013‑14 and 5 per cent in 2014‑15, reflecting the slightly below-trend outlook for wage and employment growth.[43]

Treasury’s forecast of a recovery in nominal GDP growth is central to achieving its revenue projections and returning the budget to surplus (see the fiscal outlook section below).

Risk assessment

As noted above, Treasury’s forecasts suggest Australia will make a relatively smooth transition from one set of growth drivers to another. The RBA has recently said there are signs the rebalancing is beginning to occur but considerable uncertainty remains about how it will proceed.[44]

On the resources investment side there is uncertainty about the profile of new investment over the next few years. While it seems generally agreed the inevitable peak in investment is approaching, there is uncertainty about how fast investment will fall away after that. Treasury is forecasting resources sector investment will remain at historically high levels at least until the middle of the decade.[45] This does not appear unreasonable given the complexity, scale and multi-year nature of large resources projects. However, if resources investment falls away more sharply it would leave a larger growth ‘pothole’ that would need to be filled from other sources.

Looking at alternative sources of growth there is little doubt that increasing non-rural commodity exports will help underpin strong export growth in coming years. This reflects the enormous expansion in the production capacity of the resources sector that is still unfolding. It also reflects the continued strong demand for these exports from developing countries in Asia.

However, there is less certainty about the outlook for non-resources sector business investment and household spending. On balance business investment in the non-resources sector still looks subdued. Trade exposed industries in this sector are continuing to feel the pressure of the high Australian dollar on their profitability and their investment has been squeezed in recent years by resources sector investment. Growth in business funding has been relatively subdued recently, consistent with the weakness in non-resources sector business investment.[46] That said, the pre-conditions for a recovery in this type of investment would appear to be in place. The RBA has noted that businesses appear to be in a position to fund additional investment, having large holdings of cash and other liquid assets on their balance sheets, and generally good access to external sources of funds.[47]

The outlook for residential dwelling investment is also uncertain. While a recovery in this type of investment appears to be underway there is nevertheless a question as to whether it will rebound by the extent forecast by Treasury in view of the still high household savings rate. The RBA has noted that while the preconditions for an ongoing recovery in residential dwelling investment are in place, there remains uncertainty about the breadth and strength of such a recovery.[48]

On balance the largest risk to the domestic economic outlook would appear to be non-resources sector business investment not picking up fast enough to offset any shortfall in growth as resources sector investment comes off its peak. Naturally, this would be exacerbated if resources sector investment falls away more precipitously than Treasury is currently forecasting.

Related to this, there is a risk that if the pick up in non–resource sector business investment significantly lags the softening in resources sector investment, it will have a negative impact on the labour market. This could then flow through into lower than expected household spending and residential investment. Further, it is important to bear in mind that the construction phase of resources projects tends to be more labour intensive than the production phase. As the resources sector moves more solidly into the production phase of the boom some labour will inevitably be freed up.

Moreover, the indirect effects on employment in other sectors of the economy may also be sizeable. In the 2012‑13 Budget there was a box devoted to the direct spillovers from the resources boom (box 2, p. 2‑18).[49] It would appear reasonable to assume that, while the ramp up in production in the resources sector will also generate positive spillovers for other parts of the economy, they are likely to be smaller than during the construction phase. In part this reflects that fewer inputs are needed from other sectors to support the smaller production-phase workforce and the spillovers from manufacturing mining related equipment and specialised machinery have already been had during the construction phase.

More generally, work by Bob Gregory and Peter Sheehan suggests that as the resources investment boom unwinds over the next few years there will be a large deflationary shock on the Australian economy.[50] Essentially the resources sector will move from being a stimulatory force to a contractionary one, although they acknowledge it is not clear how strong the negative forces will be:

As the resources boom unwinds over the next few years, Australia will experience a large deflationary impact, primarily driven by the fall in the terms of trade and in resource investment. The production and export of resource commodities will rise sharply as projects are completed, but this will generate little employment and limited domestic income to offset the terms of trade decline and the falls in mining investment. Whether the exchange rate remains high or falls sharply over this time period will mainly affect the form rather than the scale of this deflationary shock: a high $A will preserve real income gains through lower import prices for those who consume imports but at the cost of continued pressure on trade exposed industries, while the effects will be reversed if the $A falls sharply.[51]

There is a risk that Treasury’s forecast of Australia’s terms of trade only falling by 0.75 per cent in 2013‑14 and 1.75 per cent in 2014‑15 is on the optimistic side. There is a reasonable downside risk that commodity prices may have further to fall as new production capacity comes on line both in Australia and elsewhere.

On the face of it, this suggests Treasury’s forecasts of nominal GDP growth of 5 per cent in 2013‑14 and 2014‑15 may also be on the high side. In commenting on the Budget forecasts, the Commonwealth Bank of Australia observed:

Revenue forecasters have had a torrid time of late. And we had expected risk-averse forecasters to err on the conservative side as a result. This conservative bias is not apparent. In fact the implied revenue elasticities (i.e. what sort of rise in revenue do you get from a given increase in nominal GDP) are at the high end of the range of the past fifty years. The risks with current Budget projections may once again be that outcomes disappoint.[52]

The Budget strategy

The Government had committed to return the budget to surplus in 2012‑13. As late as the 2012‑13 MYEFO statement in October 2012, the budget was forecast to record a small surplus of $1.1 billion in 2012‑13.[53] However, by December 2012 the Government had moved away from this commitment when it was clear that revenues for the year were going to be considerably below the 2012‑13 Budget forecasts.[54] At the time, the Treasurer said:

At this stage I don’t think it would be responsible to cut harder or further in 2012‑13 to fill a hole in the tax system if that puts jobs or growth at risk. While the real economy does remain resilient, I think it now has reached a point where it would be difficult to responsibly offset dramatic revenue downgrades with substantial, short-term savings. I think that’s the bottom line here – it wouldn’t be responsible to continue to make up for the revenue hole if that endangered jobs and growth.[55]

As the economy was showing signs of having slowed in the second half of 2012 and with concerns this would continue into early 2013, the Government’s decision was generally regarded as the appropriate course.

In the 2013‑14 Budget the Government has reaffirmed its commitment to its medium-term fiscal strategy (see Box 1).

Although the Budget continues to be underpinned by the same fiscal strategy, arguably the earlier sense of urgency to return the budget to surplus as soon as possible appears to have waned. The budget is now forecast not to break even until 2015‑16 and to record a small surplus in 2016‑17 of $6,591 million (0.4 per cent of GDP).[56]

|

Box 1: The Government’s medium-term fiscal strategy

The Government’s fiscal strategy is designed to ensure fiscal sustainability, while providing the flexibility for the budget position to vary in line with economic conditions. According to Budget Paper No. 1, the Government’s fiscal strategy has remained unchanged since 2008‑09 and is to:

- achieve budget surpluses, on average, over the medium-term

- keep taxation as a share of GDP, on average, below the level for 2007‑08 (23.7 per cent) and

- improve the Government’s net financial worth over the medium term.

To ensure a timely return to surplus and recovery in the fiscal position, since the beginning of the global financial crisis (GFC) the Government has further committed to:

- allow the level of tax receipts to recover naturally as the economy improves, while maintaining the Government’s commitment to keep taxation as a share of GDP below the 2007‑08 level on average and

- build growing surpluses by holding real growth in spending to 2 per cent a year, on average, until the budget surplus is at least 1 per cent of GDP, and while the economy is growing at or above trend.

Further, in his budget speech, the Treasurer noted that since mid‑2009 the Government has fully offset all new spending with savings measures and this continues to be the case.

Sources: Australian Government, Budgets strategy and outlook: budget paper no. 1: 2013‑14, May 2013, pp. 1–11 – 1–12, accessed 15 May 2013; W Swan (Treasurer), Budget speech 2013‑14, p. 3, accessed 15 May 2013.

|

In his annual post-budget address to the Australian Business Economists last year, the Secretary to the Treasury observed that:

There are also those who argue that returning the budget to surplus in 2012‑13 is a political gesture and there would be no great harm in delaying this by a year or so.

The problem with this argument is that if it’s not appropriate to restore the structural budget position when we have low unemployment and the economy is expected to grow at around trend, when will it be appropriate?[57]

The Government did achieve significant fiscal consolidation in 2012‑13 of $23,983.0 million (1.6 per cent of GDP), but this Budget is forecasting further consolidation over the next two years of just $1,334.0 million (0.1 per cent of GDP) in 2013‑14 and $7,155.0 million (0.4 per cent of GDP) in 2014‑15. This reduction in the rate of tightening is despite real GDP growth forecast to be close to trend at 2.75 per cent in 2013‑14 and increasing to 3 per cent from 2014‑15 onwards.[58] Further, the unemployment rate is forecast to remain relatively low at 5.75 per cent in 2013‑14 and 2014‑15. And, nominal GDP growth is forecast to be 5 per cent in 2013‑14 and 2014‑15 up from 3.25 per cent in 2012‑13.[59]

According to Budget Paper No.1, the Government has decided to ‘recalibrate’ the pace of fiscal consolidation because it considers making significant cuts to offset revenue write downs in the near term would come at a significant cost to jobs and growth.[60] As discussed above, Australia faces the challenge of needing to make the transition from one set of growth drivers to another and there remains considerable uncertainty about how this will ultimately play out. By slowing the pace of fiscal consolidation the Government is reducing the extent to which the public sector will have a contractionary effect on the economy. Other things being equal, it is likely growth would have been even more subdued over the next couple of years if the Government had decided to return the Budget to surplus more quickly.

Bob Gregory and Peter Sheehan argue that given the size of the deflationary shock Australia is facing, monetary policy can no longer be expected to play the central role in supporting domestic demand and as a consequence fiscal policy will need to be more expansionary.

Australia has a strong fiscal and public debt position, and is recognised as having extensive ‘fiscal space’ to address shocks such as those discussed here. But three factors qualify that assessment. First, government revenue as a share of GDP is currently at a historically low level, as a result of revenue of about 5% of GDP foregone in tax cuts in the first stage of the resources boom and of special factors since the GFC. Secondly, revenue is likely to grow only slowly over the medium term, because of slow growth in the non-resource sector and in tax payments from resources companies. Thirdly, the focus on the political debate remains firmly on deficit elimination and debt reduction, still reflecting earlier stages of the resources boom.[61]

In the short-term the Government is trading-off providing some additional support to the economy by slowing the pace of fiscal consolidation against returning the budget to surplus. Given the economy is running a little below trend and the risks Gregory and Sheehan have identified, it can reasonably be argued that now is not the time to be taking large amounts of money out of the economy. Against this, the budget is not forecast to return to surplus until the end of the forward estimates period and even then the surplus is relatively modest. In the context of the Government’s stated medium-term fiscal strategy, the return to surplus at this stage looks more aspirational than ‘locked in’. The question is whether more should have been done in the 2013‑14 Budget to make the return to surplus towards the end of the forward estimates period more secure.

The fiscal outlook

The budgetary outlook is quite different to what it was a year ago. The 2012‑13 Budget forecast a return to a small surplus in 2012‑13 following what would have been one of the sharpest fiscal consolidations since the 1950s at about 3 per cent of GDP. Instead, only around half of that fiscal consolidation was achieved in 2012‑13. As a consequence, the underlying cash balance in 2012‑13 is estimated to be a deficit of $19,377 million (1.3 per cent of GDP) (table 2). The Budget is forecast to continue to generate relatively small deficits until breaking even in 2015‑16 and returning to a small surplus in 2016‑17.

Whereas the 2012‑13 Budget was forecasting accumulated surpluses of $16,367.0 million over the period 2012‑13 to 2015‑16, the latest forecasts suggest an accumulated deficit of $47,459.0 million. This implies the fiscal outlook has deteriorated over this period by around $63,826.0 million.

Table 3: Treasury forecasts of major economic parameters

|

|

Actual

|

|

Estimates

|

|

Projections

|

|

|

2011–12

|

|

2012–13

|

2013–14

|

2014–15

|

|

2015–16

|

2016–17

|

|

Underlying cash balance ($b)(a)

|

-43.4

|

|

-19.4

|

-18.0

|

-10.9

|

|

0.8

|

6.6

|

|

Per cent of GDP

|

-2.9

|

|

-1.3

|

-1.1

|

-0.6

|

|

0.0

|

0.4

|

|

Fiscal balance ($b)

|

-44.5

|

|

-20.3

|

-13.5

|

-6.3

|

|

6.0

|

10.8

|

|

Per cent of GDP

|

-3.0

|

|

-1.3

|

-0.8

|

-0.4

|

|

0.3

|

0.6

|

(a) Excludes net Future Fund earnings.

Source: Australian Government, Budget strategy and outlook: budget paper no. 1: 2012‑13, May 2012, p. 3‑6; Australian Government.

Most of the forecast adjustment to bring the Budget into balance by 2015‑16 is on the revenue side. Expenditure as a share of GDP is only forecast to fall slightly from 24.2 per cent of GDP in 2012‑13 to 24.0 per cent of GDP in 2015‑16. Over the same period revenue is forecast to increase from 23 per cent of GDP to 24.3 per cent of GDP. The Government observes in Budget Paper No. 1 that:

The Government’s approach is to let the automatic stabilisers on the revenue side of the budget operate in the near term. This means not offsetting substantial near term revenue downgrades by making large spending cuts, which would come at a significant cost to jobs and growth.[62]

Achieving a balanced budget in 2015‑16 would appear to depend on higher nominal GDP growth supporting a recovery in tax receipts. If nominal GDP growth does not bounce back as Treasury is forecasting, the improvement on the revenue side of the Budget may disappoint.

Nevertheless, as the Government argues in Budget Paper No. 1, overall Australia remains in a relatively strong fiscal position compared to other advanced economies.[63] Despite the deterioration in the fiscal outlook since the 2012‑13 Budget, Australia’s net debt to GDP ratio is expected to peak at only 11.4 per cent of GDP in 2014‑15. In comparison, the peak in the average net debt position of the G7 economies is expected to be 92.6 per cent of GDP in 2014.[64] Overall, the budget continues to have a high degree of resilience, affording Australia more space to respond to any further global shocks than many other advanced economies.

Reconciling the changes since the 2012‑13 Budget

Looking across the period 2012‑13 to 2015‑16 most of the deterioration in the fiscal outlook has been due to ‘parameter variations’ (table 4). Parameter changes are changes in receipts and payments due to economic conditions being different to Treasury’s forecasts. For example, since the 2012‑13 Budget, the forecast bottom line for 2012‑13 has deteriorated by $20,913.0 million, of which $18,096.0 is accounted for by parameter variations.

Overwhelmingly these parameter variations consist of significant write-downs in revenue forecasts. Tax receipts have been revised down by $12.9 billion in 2012‑13, $16.6 billion in 2013‑14 and $61.0 billion over the four years to 2015‑16.[65]

It is important to understand the write-down of tax receipts in 2012‑13 does not mean the Government collected less tax in 2012‑13 than it did in the previous year. Tax receipts actually grew by 5.3 per cent in 2012‑13.[66] Further, tax receipts as a share of GDP increased to 21.5 per cent of GDP in 2012‑13 up from 21 per cent in 2011‑12.[67] The revenue write-downs simply mean that the amount of tax collected was significantly less than forecast at the time of the last budget.

As discussed earlier, nominal GDP grew by much less than forecast in 2012‑13. The combined effects of the decline in the terms of trade and the high Australian dollar squeezed the profitability of Australian companies, which flowed through into lower company tax receipts. Indeed, company tax receipts is the single largest contributor to the write-downs in tax receipts, accounting for $5.2 billion in 2012‑13, $7.2 billion in 2013‑14 and $24.3 billion over the four years to 2015‑16.[68]

Other significant tax write-downs include:

- resource rent taxes (minerals resource rent taxes and petroleum resource rent taxes) are expected to be $3.6 billion lower in 2012‑13 and $3.2 billion lower in 2013‑14 and

- capital gains tax receipts are expected to be lower by $1.8 billion in 2012‑13 and$2.9 billion in 2013‑14.[69]

There is a separate brief on the revenue side of the Budget explaining in more detail the tax write-downs that have occurred since the 2012‑13 Budget.

Table 4: Reconciliation of underlying cash balance estimates

|

|

Estimates

|

Projections

|

|

2012–13

|

2013–14

|

2014–15

|

2015–16

|

|

$m

|

$m

|

$m

|

$m

|

|

2012–13 Budget underlying cash balance(a)

|

1,536

|

2,044

|

5,318

|

7,469

|

|

Per cent of GDP

|

0.1

|

0.1

|

0.3

|

0.4

|

|

Changes from 2012–13 Budget to 2012–13 MYEFO

|

|

|

|

|

|

Effect of policy decisions(b)

|

1,411

|

5,121

|

1,917

|

1,897

|

|

Effect of parameter and other variations

|

-1,869

|

-5,000

|

-3,910

|

-2,958

|

|

Total variations

|

-458

|

121

|

-1,993

|

-1,061

|

|

|

|

|

|

|

|

|

2012–13 MYEFO underlying cash balance(a)

|

1,077

|

2,165

|

3,325

|

6,408

|

|

Per cent of GDP

|

0.1

|

0.1

|

0.2

|

0.4

|

|

|

|

|

|

|

|

|

Changes from 2012–13 MYEFO to 2013–14 Budget

|

|

|

|

|

|

Effect of policy decisions(b)(c)

|

|

|

|

|

|

Receipts

|

-56

|

255

|

5,603

|

9,521

|

|

Payments

|

2,302

|

975

|

-584

|

-2,803

|

|

Total policy decisions impact on underlying cash balance

|

-2,358

|

-720

|

6,188

|

12,324

|

|

Effect of parameter and other variations(c)

|

|

|

|

|

|

Receipts(d)

|

-16,358

|

-17,024

|

-14,557

|

-15,306

|

|

Payments

|

1,738

|

2,464

|

5,843

|

2,576

|

|

Total parameter and other variations impact on

|

|

|

|

|

|

underlying cash balance

|

-18,096

|

-19,488

|

-20,400

|

-17,882

|

|

2012–13 Budget underlying cash balance(a)

|

-19,377

|

-18,043

|

-10,888

|

849

|

|

Per cent of GDP

|

-1.3

|

-1.1

|

-0.6

|

0.0

|

(a) 2012–13 MYEFO and 2013-14 Budget figures exclude expected net Future Fund earnings, whereas 2012–13 Budget figures exclude expected gross Future Fund earnings.

(b) Excludes secondary impacts on public debt interest of policy decisions and offsets from the Contingency Reserve for decisions taken.

(c) A positive number for revenue indicates an increase in the fiscal balance, while a positive number for expenses and net capital investment indicates a decrease in the fiscal balance.

(d) Receipts will differ from the cash receipts reconciliation published in Budget Statement 5 as they exclude Future Fund earnings.

Source: Australian Government, Budget strategy and outlook: budget paper no. 1: 2012‑13, May 2012, p. 3‑17.

Revenue measures

Since the 2012‑13 MYEFO a number of policy decisions have been taken, which are expected to increase receipts by $255.0 million in 2013‑14, $5.6 billion in 2014‑15, $9.5 billion in 2015‑16 and $10.1 billion in 2016‑17.[70] These measures include increasing the Medicare levy to help pay for the Government’s DisabilityCare Australia initiative, measures to protect the income tax base, changes to the superannuation system and restricting some tax expenditures.

The main revenue measures are listed in Statement 3 of Budget Paper No. 1 and include the following:

- a series of measures intended to protect the corporate tax base by addressing current abuses, which is expected to increase tax receipts by $4.1 billion over the forward estimates period

- the Australian Tax Office (ATO) is to be provided with additional resources to expand data matching with third party information, which is expected to increase tax receipts by $432.0 million over the forward estimates period

- the ATO is also to be provided with additional resources to address risks to the tax system from exploitation of trust structures. This is expected to increase tax receipts by $217 million over the forward estimates period

- the Clean Energy Future personal income tax cuts that were to commence on 1 July 2015 have been deferred, which is expected to increased tax receipts by $1.5 billion over the forward estimates period and

- access to the R&D tax incentive will be limited to those companies with annual aggregate Australian turnover of less than $20.0 billion from 1 July 2013, which is expected to increase tax receipts by $1.1 billion over the forward estimates period.

Expenditure measures

Since the 2012‑13 MYEFO, total cash payments for 2013‑14 have increased by $3.4 billion, comprising new policy decisions which have increased payments by $975.0 million and parameter and other variations which have increased payments by $2.5 billion.[71]

The main expenditure measures are listed in Statement 3 of Budget Paper No. 1 and include the following:

- additional funding of $9.8 billion over six years from 2014‑15 has been provided to implement a new needs‑based funding model for schools, as part of the Government’s Better Schools: A National Plan for School Improvement package

- additional funding of $14.3 billion over the seven years from 2012‑13 has been provided to fully implement DisabilityCare Australia (the national disability insurance scheme) by 1 July 2019 and

- additional funding of $682.0 million over the five years to 2016‑17 to cover the cost of a number of new and amended listings on the Pharmaceutical Benefits Scheme and the Repatriation Pharmaceutical Benefits Scheme.

The funding commitments for the education and national disability insurance scheme reform extend beyond the forward estimated period. However, the impact of these decisions up until 2016‑17 has been more than offset by a number of savings measures. These savings measures are also listed in Statement 3 of Budget Paper No. 1 and include:

- a range of changes to Family Tax Benefit payments including: not proceeding with the 2012‑13 Budget measure Spreading the Benefits of the Boom; abolishing the Baby Bonus; and continuing the current indexation pauses on upper income thresholds and supplements. These are expected to decrease payments by $349.0 million in 2013‑14 ($4.3 billion over the five years to 2016‑17)

- deferring the commitment to 0.5 per cent of Gross National Income on Official Development Assistance by one year to 2017‑18, decreasing payments by $1.9 billion over the five years to 2016‑17

- offering Student Start‑up Scholarships as income contingent loans rather than as grants to all new full-time higher education students in receipt of Youth Allowance, Austudy or ABSTUDY from 1 January 2014, decreasing payments by $35.0 million in 2013‑14 ($1.2 billion over the five years to 2016‑17) and

- applying an efficiency dividend of 2 per cent in 2014 and 1.25 per cent in 2015 to most grants provided un the Higher Education Support Act 2003, decreasing payments by $85.0 million in 2013‑14 ($903.0 million over the five years to 2016‑17).

New infrastructure funding

The Government announced in the Budget additional investment in infrastructure worth $24 billion. Some of the big ticket items being funded include:

- $3.0 billion for the Melbourne Metro

- $715.0 million for the Brisbane Cross River Rail

- $1.8 billion for Sydney motorway projects (the M4 extension and M5 duplication) and

- $718.0 million towards the Gateway North upgrade in Brisbane.

Reactions from business associations and community groups

Australian Chamber of Commerce and Industry

The Chief Executive of the Australian Chamber of Commerce and Industry, Peter Anderson, has criticised the federal budget as doing little to take cost pressures off the private sector, particularly small businesses, and failing to wind back government spending to avoid future deficits and allow future investment in the economy.[72] Mr Anderson stated that the lack of company tax relief, lack of capital gains tax relief, higher personal income tax through the Medicare levy, lack of cost offset to fund the increase in the superannuation levy, failure to restore incentives to hire new apprentices and the lack of reduction in tax compliance and red tape had failed to support the ‘nation’s economic engine room’ of two million small businesses with seven million employees. Mr Anderson claimed that an increased tax burden will erode Australia’s productive capacity and make Australia less competitive.

Australian Council of Social Services

The Australian Council of Social Service (ACOSS) has welcomed measures in the federal budget to secure disability care, dental and schools reform and strengthening of public service revenue to secure funding for these and other services, but expressed concern at the lack of income relief for the ‘people who are the poorest’.[73] ACOSS CEO, Dr Cassandra Goldie, supported changes to the income test but was disappointed that there was no change in the Newstart rate failing to reduce the rate of poverty in Australia. Dr Goldie supported the increase in the Medicare levy to fund DisabilityCare Australia, measures to close tax loopholes and other inefficient tax arrangements, investment in reducing tax evasion through trusts and better targeting by integrating the baby bonus into the family payments system.

Australian Council of Trade Unions

The President of the Australian Council of Trade Unions, Ged Kearney, has labelled the Budget a success.[74] Ms Kearney welcomed investment in areas that will encourage job creation and indicated the union’s strong support of closing company tax loopholes which allow multinational companies to pay less than their fair share in tax. Ms Kearney stated that the schools improvement plan and disability funding are historic reforms and that those who require welfare the most will be better targeted through the Paid Parental Leave scheme than the baby bonus.

Australian Industry Group

The Chief Executive of the Australian Industry Group, Innes Willox, stated that the Budget confirms industry concerns about a slowing economy, and while it does little immediate harm, the Budget does not provide confidence in the medium-term path back to surplus.[75] Mr Willox expressed concerns that the Budget is based on forecasts that are too optimistic, and fails to introduce measures to boost investment, innovation, competitiveness and productivity. Mr Willox welcomed budget measures that will assist industry in the current economic climate, such as infrastructure investments, flexibility of apprenticeships, Skills Connect, maintaining the immigration intake and bringing forward expenditure in the Clean Technology Investment Fund. However, measures such as increased charges for 457 Visa applications and import processing and more frequent and earlier tax payments for medium size businesses will increase the cost of doing business.

Business Council of Australia

The Chief Executive of the Business Council of Australia, Jennifer Westacott, has criticised the failure of the Budget to provide a credible path back to surplus.[76] Ms Westacott stated that the Budget does not address the lack of confidence in the economy nor the fiscal fundamentals to create an environment that drives investment and supports competitive business. She supported the focus on growth and jobs but criticised the business tax changes. Ms Westacott welcomed the 10- year forecasts for funding the National Disability Insurance Scheme, Gonski reforms and measures around infrastructure and skills training.

National Farmers’ Federation

The National Farmers’ Federation is disappointed that the Budget does not take a long term strategic view and invest in the future of the agriculture sector.[77] Although the Budget has spared the agriculture sector from major cuts, the Government has allocated funds to new initiatives (drought policy assistance package) from funds already committed to agriculture (Caring for our Country project). The Federation welcomed the flow on effects of the Budget’s investment in road and rail, but also stated that cuts in other areas, such as a reduction in assistance to industries affected by the carbon tax, may have a flow on effect to farmers through increased costs being passed on. Changes to the PAYG system will also impose increased regulatory burdens on farmers.

[10]. Budget strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 2‑19.

[12]. International Monetary Fund, World economic outlook April 2013: Hopes, realities, risks, op. cit. p. 12.

[16]. Australian Government, Budget strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 2‑19.

[17]. Reserve Bank of Australia, Statement on monetary policy: May 2013, op. cit., p. 62.

[18]. Budget strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 2‑26.

[19]. Reserve Bank of Australia, Statement on monetary policy: May 2013, op. cit., p. 28.

[22]. Budget strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 2‑5.

[23]. Reserve Bank of Australia, Statement on monetary policy: May 2013, op. cit., p. 63.

[25]. Budget strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 2‑14.

[27]. Reserve Bank of Australia, Statement on monetary policy: May 2013, op. cit., p. 31.

[28]. Budget strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 2‑14.

[30]. Reserve Bank of Australia, Statement on monetary policy: May 2013, op. cit., p. 32.

[32]. Budget strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 2‑14.

[33]. Reserve Bank of Australia, Statement on monetary policy: May 2013, op. cit., p. 63.

[34]. Budget strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 2‑14.

[38]. Budget Strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 2‑44.

[44]. Reserve Bank of Australia, Statement on monetary policy: May 2013, op. cit., p. 65.

[45]. Budget strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 2‑26.

[46]. Reserve Bank of Australia, Statement on monetary policy: May 2013, op. cit., p. 32.

[56]. Budget Strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 10‑7.

[58]. Budget Strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 1‑8.

[61]. P Sheehan and B Gregory, The resources boom and economic policy in the longer run, op. cit., p. 20.

[62]. Budget strategy and outlook: budget paper no. 1: 2013‑14, op. cit., p. 3–6.

[69]. Ibid., pp. 3‑17 - 3‑18

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Feedback is welcome and may be provided to: web.library@aph.gov.au. Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Entry Point for referral.