6 July 2017

PDF version [707KB]

Gregory

O'Brien

Statistics and Mapping Section

Executive summary

- This paper, a companion to the Monthly Statistical Bulletin

published by the Parliamentary Library, provides tables and charts for a broad

range of social, demographic and economic indicators across all Australian

states and territories, and compares these with Australian averages.

- Each table presents data for the past five calendar years to 2016,

while each chart plots data for the calendar year 2016.

- The State Statistical Bulletin is published twice per year

covering data for both the previous financial year and calendar year.

Contents

Executive summary

Introduction

Chapter 1: Labour Market

1.1 Employment

1.2 Unemployment

1.3 Labour force

Chapter 2: Wages and Prices

2.1 Average weekly ordinary time

earnings

2.2 Real average weekly ordinary time

earnings

2.3 Male total average weekly

earnings

2.4 Female total average weekly

earnings

2.5 Wage price index

2.6 Consumer price index

Chapter 3: State Accounts

3.1 Real gross state product

3.2 Real gross state product per

capita

3.3 Labour productivity

Chapter 4: Business Conditions

4.1 Value of retail sales

4.2 Passenger vehicle sales

4.3 Dwelling approvals

4.4 Business investment

Chapter 5: Housing

5.1 Lending for owner occupied

housing

5.2 Home loan size

Chapter 6: Public Sector Finances

6.1 State government net debt

6.2 State government fiscal balance

6.3 State government taxation revenue

Chapter 7: Exports

7.1 International merchandise exports

Chapter 8: Social Statistics

8.1 Population

8.2 Apparent school retention rates

8.3 General practice bulk billing

Introduction

The purpose of this paper is to present a

range of economic and other statistical indicators for the states and

territories of Australia. To facilitate comparisons, indicators are presented

in relative terms such as growth rates, percentages, or proportions of gross

state product, so comparisons can be made using equivalent measures.

This publication is a companion to the Monthly

Statistical Bulletin which contains Australia-wide data only, but on a

more frequent basis.

A glossary of social, demographic and economic terms used in

the tables is provided at the end of this publication.

Data

Sources

Data sources are listed at the bottom of the page for each

indicator. All data is from an original ABS series unless otherwise indicated

as a trend or seasonally adjusted series.

Historical

Data

Long-term data series for every table in this paper and for

the Parliamentary Library’s companion publication, the Monthly

Statistical Bulletin, are available electronically and can be found on

the Parliamentary Library’s Monthly Statistical Bulletin and State Statistical

Bulletin pages.

Note: These links can only be accessed by Senators, Members

and parliamentary staff.

Chapter 1: Labour Market

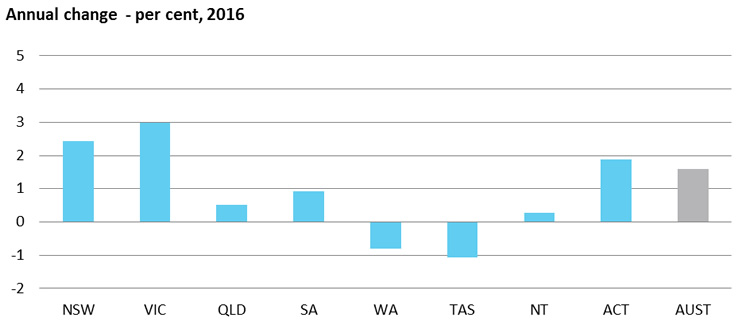

1.1 Employment

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Number

employed (a) – '000 |

|

|

|

|

|

| New

South Wales |

3 543.5 |

3 595.0 |

3 617.6 |

3 713.6 |

3 803.8 |

| Victoria |

2 832.0 |

2 854.6 |

2 876.1 |

2 955.6 |

3 043.5 |

| Queensland |

2 284.6 |

2 300.4 |

2 322.3 |

2 342.8 |

2 354.6 |

| South

Australia |

807.5 |

805.1 |

801.3 |

804.3 |

811.6 |

| Western

Australia |

1 309.3 |

1 325.0 |

1 336.7 |

1 351.6 |

1 340.8 |

| Tasmania |

234.4 |

231.5 |

237.5 |

240.2 |

237.7 |

| Northern

Territory |

125.6 |

128.8 |

130.9 |

133.7 |

134.1 |

| Australian

Capital Territory |

210.5 |

210.3 |

209.8 |

209.8 |

213.7 |

| Australia |

11 347.4 |

11 450.8 |

11 532.1 |

11 751.7 |

11 939.8 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

0.9 |

1.5 |

0.6 |

2.7 |

2.4 |

| Victoria |

0.7 |

0.8 |

0.8 |

2.8 |

3.0 |

| Queensland |

0.6 |

0.7 |

0.9 |

0.9 |

0.5 |

| South

Australia |

-0.1 |

-0.3 |

-0.5 |

0.4 |

0.9 |

| Western

Australia |

5.3 |

1.2 |

0.9 |

1.1 |

-0.8 |

| Tasmania |

-1.8 |

-1.2 |

2.6 |

1.1 |

-1.1 |

| Northern

Territory |

3.5 |

2.6 |

1.6 |

2.2 |

0.3 |

| Australian

Capital Territory |

1.7 |

-0.1 |

-0.2 |

0.0 |

1.9 |

| Australia |

1.2 |

0.9 |

0.7 |

1.9 |

1.6 |

| (a)

Total full-time and part-time employed; Annual average of monthly data. |

| Source:

ABS, Labour Force, Cat. no. 6291.0.55.001, May 2017 |

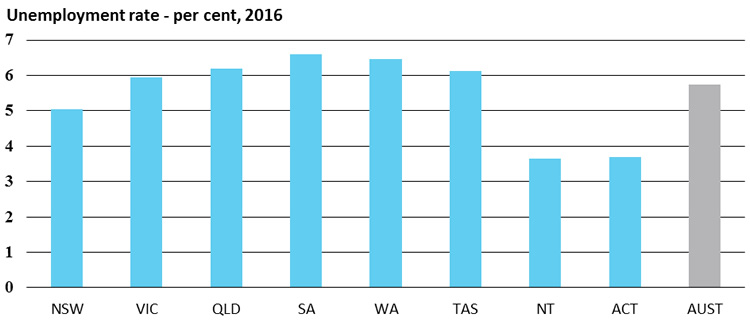

1.2 Unemployment

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Number

unemployed (a) – '000 |

|

|

|

|

| New

South Wales |

188.5 |

212.5 |

220.3 |

227.2 |

205.9 |

| Victoria |

164.6 |

178.1 |

203.0 |

191.7 |

187.9 |

| Queensland |

139.7 |

142.3 |

158.9 |

157.2 |

154.2 |

| South

Australia |

46.8 |

54.2 |

57.5 |

64.1 |

59.3 |

| Western

Australia |

54.3 |

63.9 |

72.8 |

84.7 |

86.9 |

| Tasmania |

17.5 |

19.3 |

18.6 |

17.0 |

16.6 |

| Northern

Territory |

5.5 |

6.9 |

5.5 |

6.0 |

5.4 |

| Australian

Capital Territory |

8.3 |

9.1 |

9.2 |

10.3 |

8.5 |

| Australia |

625.1 |

686.5 |

745.7 |

758.3 |

724.8 |

| Unemployment

rate (b) – per cent |

|

|

|

|

| New

South Wales |

5.1 |

5.7 |

6.1 |

5.3 |

5.1 |

| Victoria |

5.6 |

6.2 |

6.5 |

6.0 |

5.9 |

| Queensland |

6.0 |

6.0 |

6.7 |

6.0 |

6.2 |

| South

Australia |

5.8 |

6.7 |

6.8 |

7.1 |

6.6 |

| Western

Australia |

4.3 |

4.7 |

5.5 |

6.1 |

6.5 |

| Tasmania |

7.1 |

7.7 |

6.7 |

6.6 |

6.1 |

| Northern

Territory |

4.3 |

4.2 |

3.8 |

4.3 |

3.6 |

| Australian

Capital Territory |

4.4 |

3.7 |

4.7 |

4.8 |

3.7 |

| Australia |

5.4 |

5.8 |

6.2 |

5.8 |

5.7 |

| (a)

Annual average of monthly data. |

|

|

|

|

| (b)

Number unemployed as a proportion of the labour force, trend terms, as at

December |

|

| Source: ABS, Labour Force, Cat. no. 6202.0 |

|

|

|

|

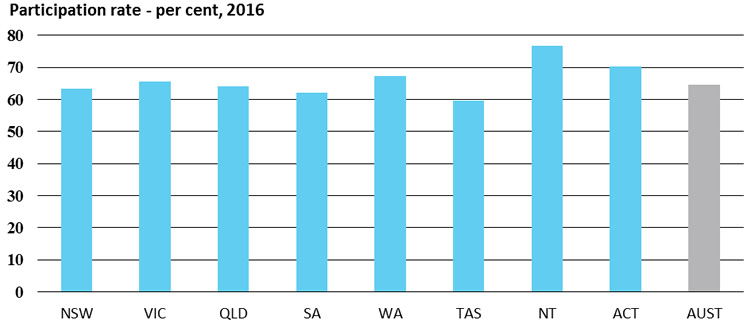

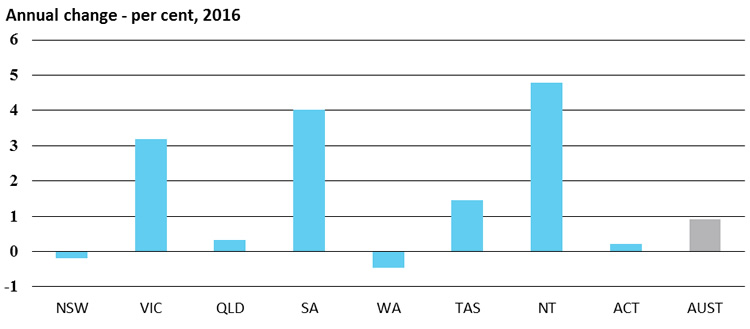

1.3 Labour

force

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Labour

force (a) – '000 |

|

|

|

|

|

| New

South Wales |

3 732.0 |

3 807.5 |

3 837.8 |

3 940.9 |

4 009.7 |

| Victoria |

2 996.5 |

3 032.7 |

3 079.1 |

3 147.4 |

3 231.5 |

| Queensland |

2 424.3 |

2 442.8 |

2 481.2 |

2 500.1 |

2 508.8 |

| South

Australia |

854.3 |

859.3 |

858.8 |

868.4 |

870.9 |

| Western

Australia |

1 363.6 |

1 389.0 |

1 409.5 |

1 436.3 |

1 427.7 |

| Tasmania |

251.9 |

250.8 |

256.1 |

257.2 |

254.3 |

| Northern

Territory |

131.1 |

135.8 |

136.3 |

139.8 |

139.5 |

| Australian

Capital Territory |

218.8 |

219.5 |

219.0 |

220.1 |

222.2 |

| Australia |

11 972.5 |

12 137.2 |

12 277.8 |

12 510.0 |

12 664.6 |

| Participation

rate (b) – per cent |

|

|

|

|

| New

South Wales |

63.4 |

63.0 |

63.0 |

64.3 |

63.3 |

| Victoria |

64.8 |

64.5 |

64.9 |

64.7 |

65.7 |

| Queensland |

66.2 |

65.7 |

65.3 |

65.8 |

64.1 |

| South

Australia |

63.0 |

62.0 |

61.6 |

62.0 |

62.1 |

| Western

Australia |

69.4 |

68.1 |

68.7 |

68.4 |

67.4 |

| Tasmania |

60.4 |

59.7 |

61.3 |

60.5 |

59.8 |

| Northern

Territory |

74.1 |

75.4 |

73.5 |

74.1 |

76.8 |

| Australian

Capital Territory |

72.7 |

71.2 |

70.3 |

70.5 |

70.3 |

| Australia |

65.1 |

64.6 |

64.6 |

65.1 |

64.6 |

| (a)

Annual average of monthly data. |

|

|

|

|

| (b)

Labour force as a proportion of the civilian population aged 15 years and

over, trend series, as at December |

| Source:

ABS, Labour Force, cat. no. 6202.0 |

|

|

|

|

|

|

|

|

|

|

|

|

Chapter 2: Wages and Prices

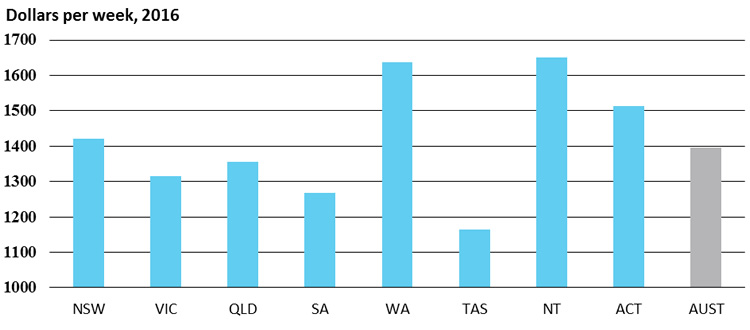

2.1 Average weekly ordinary time earnings (AWOTE)

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| AWOTE

(a) (b) – $ per week |

|

|

|

|

|

| New

South Wales |

1 377.1 |

1 414.5 |

1 475.7 |

1 519.7 |

1 538.4 |

| Victoria |

1 314.3 |

1 363.8 |

1 388.4 |

1 410.7 |

1 477.3 |

| Queensland |

1 346.3 |

1 422.8 |

1 447.9 |

1 443.8 |

1 471.2 |

| South

Australia |

1 253.1 |

1 300.6 |

1 352.8 |

1 362.1 |

1 430.5 |

| Western

Australia |

1 553.7 |

1 632.4 |

1 657.2 |

1 700.0 |

1 700.9 |

| Tasmania |

1 211.8 |

1 267.3 |

1 256.8 |

1 303.9 |

1 339.9 |

| Northern

Territory |

1 413.0 |

1 449.1 |

1 435.6 |

1 533.3 |

1 604.1 |

| Australian

Capital Territory |

1 619.6 |

1 687.0 |

1 682.8 |

1 711.3 |

1 736.2 |

| Australia |

1 372.6 |

1 429.0 |

1 465.6 |

1 491.8 |

1 524.7 |

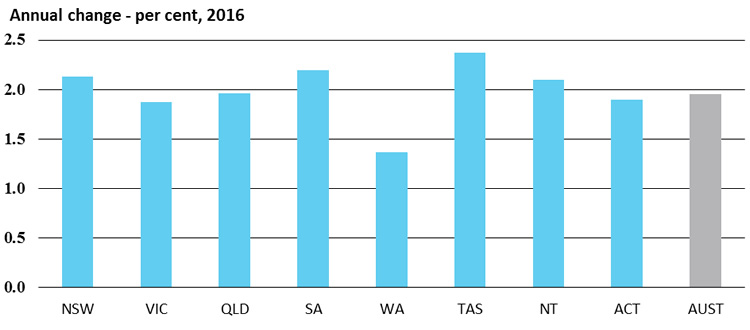

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

4.1 |

2.7 |

4.3 |

3.0 |

1.2 |

| Victoria |

3.2 |

3.8 |

1.8 |

1.6 |

4.7 |

| Queensland |

4.6 |

5.7 |

1.8 |

-0.3 |

1.9 |

| South

Australia |

4.2 |

3.8 |

4.0 |

0.7 |

5.0 |

| Western

Australia |

3.6 |

5.1 |

1.5 |

2.6 |

0.1 |

| Tasmania |

4.2 |

4.6 |

-0.8 |

3.7 |

2.8 |

| Northern

Territory |

5.9 |

2.6 |

-0.9 |

6.8 |

4.6 |

| Australian

Capital Territory |

6.4 |

4.2 |

-0.2 |

1.7 |

1.5 |

| Australia |

4.2 |

4.1 |

2.6 |

1.8 |

2.2 |

| (a)

Annual average of bi-annual data. |

|

|

|

|

| (b)

Average weekly ordinary time earnings for full-time adult employees. |

|

|

| Source:

ABS, Average Weekly Earnings, Cat. no.6302.0 |

| Care

should be taken when comparing average weekly earnings of states over time

due to compositional changes |

2.2 Real

average weekly ordinary time earnings

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Real

AWOTE (a) (b) – $ per week |

|

|

|

|

| New

South Wales |

1 494.0 |

1 496.9 |

1 525.3 |

1 541.5 |

1 538.4 |

| Victoria |

1 429.5 |

1 447.8 |

1 439.8 |

1 443.2 |

1 489.2 |

| Queensland |

1 464.2 |

1 513.8 |

1 499.4 |

1 472.6 |

1 477.6 |

| South

Australia |

1 362.9 |

1 385.0 |

1 405.9 |

1 399.7 |

1 456.0 |

| Western

Australia |

1 689.5 |

1 730.1 |

1 709.3 |

1 730.7 |

1 722.9 |

| Tasmania |

1 324.8 |

1 360.5 |

1 321.2 |

1 356.0 |

1 375.6 |

| Northern

Territory |

1 534.2 |

1 514.6 |

1 458.8 |

1 550.9 |

1 625.2 |

| Australian

Capital Territory |

1 764.6 |

1 800.5 |

1 760.5 |

1 778.9 |

1 782.9 |

| Australia |

1 492.2 |

1 516.3 |

1 517.4 |

1 521.6 |

1 535.5 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

2.1 |

0.2 |

1.9 |

1.1 |

-0.2 |

| Victoria |

1.5 |

1.3 |

-0.6 |

0.2 |

3.2 |

| Queensland |

3.0 |

3.4 |

-1.0 |

-1.8 |

0.3 |

| South

Australia |

2.4 |

1.6 |

1.5 |

-0.4 |

4.0 |

| Western

Australia |

1.8 |

2.4 |

-1.2 |

1.3 |

-0.5 |

| Tasmania |

3.0 |

2.7 |

-2.9 |

2.6 |

1.4 |

| Northern

Territory |

3.9 |

-1.3 |

-3.7 |

6.3 |

4.8 |

| Australian

Capital Territory |

4.9 |

2.0 |

-2.2 |

1.0 |

0.2 |

| Australia |

2.4 |

1.6 |

0.1 |

0.3 |

0.9 |

| (a)

Annual average. |

|

|

|

|

|

| (b)

Average weekly ordinary time earnings for full-time adult employees expressed

in average 2016 dollars; converted to real terms using the Consumer Price

Index. |

| Sources:

ABS, Average Weekly Earnings, cat. no. 6302.0; ABS, Consumer Price

Index, cat. no. 6401.0 |

| Care

should be taken when comparing average weekly earnings of states over time

due to compositional changes |

2.3 Male total average weekly earnings

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| MTAWE

(a) (b) – $ per week |

|

|

|

|

|

| New

South Wales |

1 285.0 |

1 313.6 |

1 348.0 |

1 388.8 |

1 421.9 |

| Victoria |

1 222.1 |

1 281.3 |

1 277.1 |

1 278.1 |

1 314.2 |

| Queensland |

1 299.6 |

1 354.8 |

1 352.9 |

1 323.7 |

1 354.8 |

| South

Australia |

1 177.8 |

1 227.7 |

1 280.4 |

1 241.0 |

1 267.9 |

| Western

Australia |

1 585.0 |

1 641.4 |

1 662.0 |

1 657.8 |

1 636.5 |

| Tasmania |

1 081.4 |

1 115.3 |

1 132.1 |

1 163.2 |

1 163.3 |

| Northern

Territory |

1 439.1 |

1 450.7 |

1 436.4 |

1 508.5 |

1 650.2 |

| Australian

Capital Territory |

1 561.6 |

1 545.9 |

1 511.5 |

1 530.4 |

1 513.4 |

| Australia |

1 304.7 |

1 352.3 |

1 368.1 |

1 372.2 |

1 396.5 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

6.2 |

2.2 |

2.6 |

3.0 |

2.4 |

| Victoria |

2.4 |

4.8 |

-0.3 |

0.1 |

2.8 |

| Queensland |

3.5 |

4.3 |

-0.1 |

-2.2 |

2.3 |

| South

Australia |

5.1 |

4.2 |

4.3 |

-3.1 |

2.2 |

| Western

Australia |

4.6 |

3.6 |

1.3 |

-0.3 |

-1.3 |

| Tasmania |

5.4 |

3.1 |

1.5 |

2.8 |

0.0 |

| Northern

Territory |

6.4 |

0.8 |

-1.0 |

5.0 |

9.4 |

| Australian

Capital Territory |

9.1 |

-1.0 |

-2.2 |

1.3 |

-1.1 |

| Australia |

4.7 |

3.6 |

1.2 |

0.3 |

1.8 |

| (a)

Annual average of bi-annual data. |

|

|

|

|

| (b)

Total average weekly earnings for all male employees. Not adjusted for CPI. |

| Source:

ABS, Average Weekly Earnings, Cat. no. 6302.0 |

2.4 Female total average weekly earnings

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| FTAWE

(a) (b) – $ per week |

|

|

|

|

|

| New

South Wales |

852.2 |

899.8 |

905.0 |

940.1 |

970.7 |

| Victoria |

801.5 |

823.8 |

843.0 |

867.3 |

892.3 |

| Queensland |

812.1 |

814.5 |

854.9 |

897.5 |

894.0 |

| South

Australia |

757.4 |

793.2 |

856.6 |

836.5 |

844.7 |

| Western

Australia |

840.8 |

903.4 |

943.6 |

959.7 |

963.6 |

| Tasmania |

754.9 |

765.2 |

771.4 |

778.1 |

786.2 |

| Northern

Territory |

986.0 |

1 008.5 |

1 006.6 |

1 048.5 |

1 097.9 |

| Australian

Capital Territory |

1 188.4 |

1 171.1 |

1 160.5 |

1 206.1 |

1 217.5 |

| Australia |

831.0 |

861.3 |

884.6 |

911.3 |

929.1 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

3.0 |

5.6 |

0.6 |

3.9 |

3.3 |

| Victoria |

3.0 |

2.8 |

2.3 |

2.9 |

2.9 |

| Queensland |

2.2 |

0.3 |

5.0 |

5.0 |

-0.4 |

| South

Australia |

4.9 |

4.7 |

8.0 |

-2.3 |

1.0 |

| Western

Australia |

6.1 |

7.4 |

4.5 |

1.7 |

0.4 |

| Tasmania |

5.4 |

1.4 |

0.8 |

0.9 |

1.0 |

| Northern

Territory |

4.7 |

2.3 |

-0.2 |

4.2 |

4.7 |

| Australian

Capital Territory |

6.9 |

-1.5 |

-0.9 |

3.9 |

0.9 |

| Australia |

3.6 |

3.6 |

2.7 |

3.0 |

2.0 |

| (a)

Annual average of bi-annual data. |

|

|

|

|

| (b)

Total average weekly earnings for all female employees. Not adjusted for CPI |

| Source: ABS, Average Weekly Earnings, Cat. no. 6302.0 |

2.5 Wage price index

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Wage

price index (a) (b) |

|

|

|

|

|

| New

South Wales |

114.0 |

116.8 |

119.6 |

122.1 |

124.7 |

| Victoria |

113.9 |

116.7 |

120.0 |

122.9 |

125.2 |

| Queensland |

114.4 |

117.3 |

120.3 |

122.6 |

125.0 |

| South

Australia |

113.2 |

117.2 |

120.2 |

123.0 |

125.7 |

| Western

Australia |

116.0 |

119.5 |

122.3 |

124.5 |

126.2 |

| Tasmania |

114.2 |

116.7 |

119.6 |

122.2 |

125.1 |

| Northern

Territory |

115.1 |

117.8 |

121.1 |

124.0 |

126.6 |

| Australian

Capital Territory |

114.8 |

117.5 |

119.5 |

121.4 |

123.7 |

| Australia |

114.3 |

117.2 |

120.2 |

122.7 |

125.1 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

3.2 |

2.5 |

2.4 |

2.1 |

2.1 |

| Victoria |

3.5 |

2.5 |

2.8 |

2.4 |

1.9 |

| Queensland |

3.1 |

2.5 |

2.6 |

1.9 |

2.0 |

| South

Australia |

3.1 |

3.5 |

2.6 |

2.3 |

2.2 |

| Western

Australia |

4.3 |

3.0 |

2.3 |

1.8 |

1.4 |

| Tasmania |

3.3 |

2.2 |

2.5 |

2.2 |

2.4 |

| Northern

Territory |

3.2 |

2.3 |

2.8 |

2.4 |

2.1 |

| Australian

Capital Territory |

4.3 |

2.4 |

1.7 |

1.6 |

1.9 |

| Australia |

3.4 |

2.5 |

2.6 |

2.1 |

2.0 |

| (a)

Index value at December |

|

|

|

|

|

| (b)

Total hourly rate of pay index excluding bonuses, all sectors. Base: 2008–09

= 100.0. |

| Source:

ABS, Wage Price Index, Cat. no. 6345.0 |

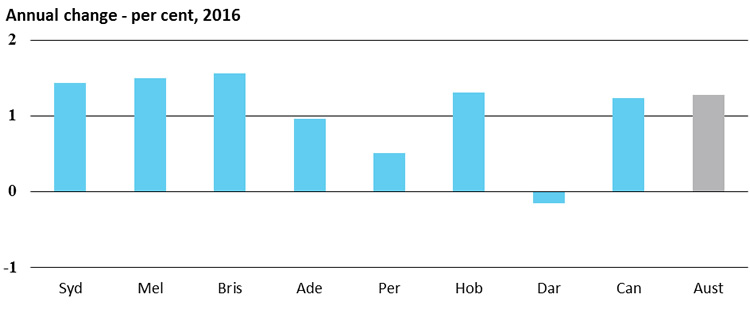

2.6

Consumer price index

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Consumer

price index (a) |

|

|

|

|

|

| Sydney |

101.2 |

103.8 |

106.3 |

108.3 |

109.8 |

| Melbourne |

101.0 |

103.5 |

105.9 |

107.4 |

109.0 |

| Brisbane |

101.0 |

103.2 |

106.1 |

107.7 |

109.4 |

| Adelaide |

101.0 |

103.1 |

105.7 |

106.9 |

107.9 |

| Perth |

101.0 |

103.6 |

106.5 |

107.9 |

108.4 |

| Hobart |

100.5 |

102.3 |

104.5 |

105.6 |

107.0 |

| Darwin |

101.2 |

105.1 |

108.1 |

108.6 |

108.4 |

| Canberra |

100.8 |

102.9 |

105.0 |

105.7 |

107.0 |

Weighted

average eight

capital cities |

101.0 |

103.5 |

106.1 |

107.7 |

109.1 |

| Annual

change – per cent (b) |

|

|

|

|

| Sydney |

2.0 |

2.5 |

2.4 |

1.9 |

1.4 |

| Melbourne |

1.6 |

2.5 |

2.4 |

1.4 |

1.5 |

| Brisbane |

1.5 |

2.2 |

2.7 |

1.5 |

1.6 |

| Adelaide |

1.7 |

2.1 |

2.5 |

1.1 |

1.0 |

| Perth |

1.8 |

2.6 |

2.8 |

1.3 |

0.5 |

| Hobart |

1.2 |

1.8 |

2.1 |

1.1 |

1.3 |

| Darwin |

2.0 |

3.9 |

2.9 |

0.5 |

-0.2 |

| Canberra |

1.5 |

2.1 |

2.0 |

0.6 |

1.2 |

Weighted

average eight

capital cities |

1.8 |

2.4 |

2.5 |

1.5 |

1.3 |

| (a)

Annual average of quarterly data; base year for CPI is 2011-12 |

| (b)

Change in the annual averages of table above. |

| Source:

ABS, Consumer Price Index, Cat. no. 6401.0 |

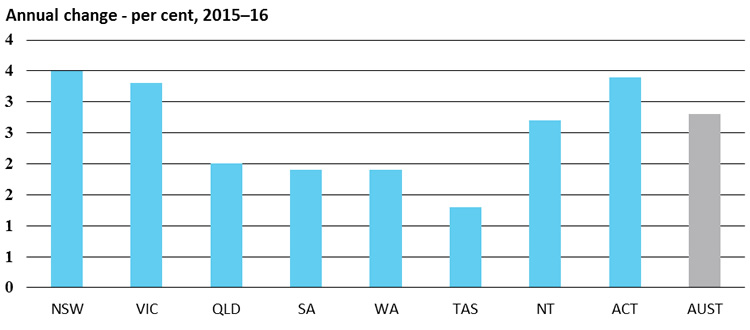

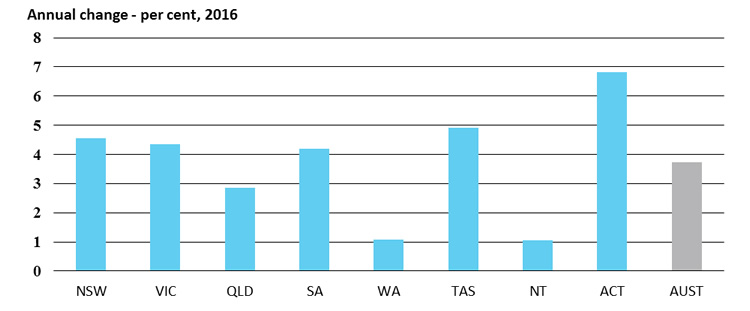

Chapter 3: State Accounts

3.1 Real gross state product

| |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

| Gross

state product, chain volume measures – $ million |

|

|

|

| New

South Wales |

479 485 |

488 691 |

500 306 |

513 529 |

531 323 |

| Victoria |

346 133 |

349 871 |

352 512 |

361 669 |

373 624 |

| Queensland |

288 233 |

295 096 |

304 874 |

308 448 |

314 569 |

| South

Australia |

94 897 |

96 483 |

97 336 |

99 237 |

101 096 |

| Western

Australia |

216 029 |

228 425 |

241 579 |

250 377 |

255 214 |

| Tasmania |

25 112 |

24 925 |

25 370 |

25 695 |

26 039 |

| Northern

Territory |

19 001 |

21 999 |

22 591 |

23 032 |

23 648 |

| Australian

Capital Territory |

33 398 |

34 278 |

34 567 |

35 029 |

36 225 |

| Australia |

1 500 084 |

1 538 634 |

1 578 784 |

1 617 016 |

1 661 739 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

1.8 |

1.9 |

2.4 |

2.6 |

3.5 |

| Victoria |

1.8 |

1.1 |

0.8 |

2.6 |

3.3 |

| Queensland |

6.0 |

2.4 |

3.3 |

1.2 |

2.0 |

| South

Australia |

0.7 |

1.7 |

0.9 |

2.0 |

1.9 |

| Western

Australia |

9.1 |

5.7 |

5.8 |

3.6 |

1.9 |

| Tasmania |

0.1 |

-0.7 |

1.8 |

1.3 |

1.3 |

| Northern

Territory |

2.3 |

15.8 |

2.7 |

2.0 |

2.7 |

| Australian

Capital Territory |

1.6 |

2.6 |

0.8 |

1.3 |

3.4 |

| Australia |

3.6 |

2.6 |

2.6 |

2.4 |

2.8 |

| Source:

ABS, Australian National Accounts: State Accounts, Cat. no. 5220.0 |

|

|

| Note:

Gross state product is only published on a financial year basis. |

|

|

|

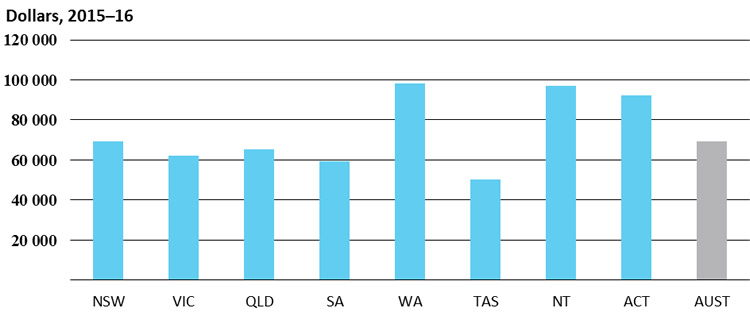

3.2 Real

gross state product per capita

| |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

| Gross

state product per capita, chain volume measures (a) – $ |

|

|

|

| New

South Wales |

66 030 |

66 427 |

67 069 |

67 886 |

69 266 |

| Victoria |

62 001 |

61 591 |

60 938 |

61 440 |

62 308 |

| Queensland |

63 788 |

64 028 |

65 073 |

64 949 |

65 416 |

| South

Australia |

57 620 |

58 045 |

58 053 |

58 664 |

59 371 |

| Western

Australia |

90 329 |

92 125 |

95 246 |

97 312 |

98 012 |

| Tasmania |

49 053 |

48 636 |

49 362 |

49 864 |

50 327 |

| Northern

Territory |

81 654 |

91 932 |

93 027 |

94 709 |

96 906 |

| Australian

Capital Territory |

89 995 |

90 700 |

90 179 |

90 341 |

92 173 |

| Australia |

66 620 |

67 138 |

67 810 |

68 486 |

69 421 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

0.7 |

0.6 |

1.0 |

1.2 |

2.0 |

| Victoria |

0.2 |

-0.7 |

-1.1 |

0.8 |

1.4 |

| Queensland |

4.1 |

0.4 |

1.6 |

-0.2 |

0.7 |

| South

Australia |

-0.2 |

0.7 |

0.0 |

1.1 |

1.2 |

| Western

Australia |

5.8 |

2.0 |

3.4 |

2.2 |

0.7 |

| Tasmania |

-0.2 |

-0.9 |

1.5 |

1.0 |

0.9 |

| Northern

Territory |

1.3 |

12.6 |

1.2 |

1.8 |

2.3 |

| Australian

Capital Territory |

-0.1 |

0.8 |

-0.6 |

0.2 |

2.0 |

| Australia |

2.0 |

0.8 |

1.0 |

1.0 |

1.4 |

| Source:

ABS, Australian National Accounts: State Accounts, Cat. no. 5220.0 |

|

| Note:

Gross state product is only available for financial years |

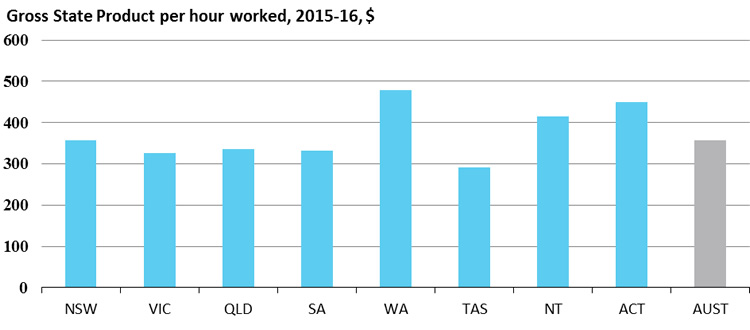

3.3 Labour productivity

| |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

| Gross

State Product per hour worked, $ |

|

|

|

|

| New

South Wales |

350.5 |

354.3 |

353.3 |

364.8 |

357.2 |

| Victoria |

324.1 |

329.4 |

320.1 |

329.8 |

326.2 |

| Queensland |

316.4 |

328.7 |

325.7 |

335.0 |

335.2 |

| South

Australia |

311.6 |

320.4 |

317.4 |

323.9 |

332.0 |

| Western

Australia |

423.8 |

435.5 |

451.8 |

465.7 |

477.5 |

| Tasmania |

289.9 |

298.3 |

295.9 |

294.2 |

291.8 |

| Northern

Territory |

364.4 |

413.0 |

401.5 |

415.0 |

414.0 |

| Australian

Capital Territory |

422.4 |

435.5 |

437.9 |

445.3 |

449.5 |

| Australia |

343.8 |

350.7 |

349.1 |

359.8 |

357.0 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

2.6% |

1.1% |

-0.3% |

3.3% |

-2.1% |

| Victoria |

3.8% |

1.6% |

-2.8% |

3.0% |

-1.1% |

| Queensland |

4.8% |

3.9% |

-0.9% |

2.8% |

0.1% |

| South

Australia |

2.5% |

2.8% |

-0.9% |

2.0% |

2.5% |

| Western

Australia |

4.8% |

2.8% |

3.7% |

3.1% |

2.5% |

| Tasmania |

3.0% |

2.9% |

-0.8% |

-0.5% |

-0.8% |

| Northern

Territory |

1.7% |

13.4% |

-2.8% |

3.4% |

-0.3% |

| Australian

Capital Territory |

2.5% |

3.1% |

0.6% |

1.7% |

0.9% |

| Australia |

4.4% |

2.0% |

-0.5% |

3.1% |

-0.8% |

| (a)

Gross state product (chain volume measures) per hour worked, all sectors

(i.e. market and non-market sectors) |

| Source:

ABS, Australian national accounts: state accounts, Cat. no. 5220.0 |

ABS,

Labour force, detailed, Cat. no. 6291.0.55.001

Note:

Gross state product is only published on a financial year basis |

Chapter 4: Business Conditions

4.1 Value of retail sales

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Value

– $ million |

|

|

|

|

|

| New

South Wales |

78 656 |

81 772 |

88 813 |

93 698 |

97 953 |

| Victoria |

64 221 |

65 574 |

69 613 |

73 320 |

76 508 |

| Queensland |

53 544 |

55 900 |

57 682 |

59 585 |

61 284 |

| South

Australia |

17 415 |

17 559 |

18 187 |

19 017 |

19 813 |

| Western

Australia |

31 223 |

32 205 |

32 797 |

33 687 |

34 052 |

| Tasmania |

5 111 |

5 187 |

5 550 |

5 760 |

6 042 |

| Northern

Territory |

2 877 |

2 953 |

3 080 |

3 092 |

3 124 |

| Australian

Capital Territory |

4 766 |

4 950 |

5 002 |

5 233 |

5 589 |

| Australia |

257 813 |

266 100 |

280 724 |

293 391 |

304 365 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

2.7 |

4.0 |

8.6 |

5.5 |

4.5 |

| Victoria |

1.3 |

2.1 |

6.2 |

5.3 |

4.3 |

| Queensland |

5.0 |

4.4 |

3.2 |

3.3 |

2.9 |

| South

Australia |

0.7 |

0.8 |

3.6 |

4.6 |

4.2 |

| Western

Australia |

9.6 |

3.1 |

1.8 |

2.7 |

1.1 |

| Tasmania |

-1.2 |

1.5 |

7.0 |

3.8 |

4.9 |

| Northern

Territory |

4.2 |

2.7 |

4.3 |

0.4 |

1.0 |

| Australian

Capital Territory |

4.1 |

3.9 |

1.0 |

4.6 |

6.8 |

| Australia |

3.4 |

3.2 |

5.5 |

4.5 |

3.7 |

| Source:

ABS, Retail Trade Australia, Cat. no. 8501.0 |

4.2 Passenger vehicle sales

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Number

(a) |

|

|

|

|

|

| New

South Wales |

185 080 |

181 248 |

176 060 |

176 714 |

171 326 |

| Victoria |

163 856 |

163 282 |

152 200 |

146 173 |

139 667 |

| Queensland |

107 664 |

105 113 |

98 380 |

98 821 |

89 282 |

| South

Australia |

36 296 |

35 843 |

34 173 |

31 078 |

29 406 |

| Western

Australia |

60 206 |

57 080 |

49 800 |

42 602 |

36 998 |

| Tasmania |

8 625 |

9 325 |

7 601 |

7 662 |

6 958 |

| Northern

Territory |

4 320 |

4 226 |

3 917 |

3 585 |

3 430 |

| Australian

Capital Territory |

10 808 |

10 337 |

9 471 |

9 048 |

9 190 |

| Australia |

576 855 |

566 454 |

531 602 |

515 683 |

486 257 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

1.4 |

-2.1 |

-2.9 |

0.4 |

-3.0 |

| Victoria |

3.7 |

-0.4 |

-6.8 |

-4.0 |

-4.5 |

| Queensland |

2.4 |

-2.4 |

-6.4 |

0.4 |

-9.7 |

| South

Australia |

0.4 |

-1.2 |

-4.7 |

-9.1 |

-5.4 |

| Western

Australia |

10.6 |

-5.2 |

-12.8 |

-14.5 |

-13.2 |

| Tasmania |

-0.7 |

8.1 |

-18.5 |

0.8 |

-9.2 |

| Northern

Territory |

3.0 |

-2.2 |

-7.3 |

-8.5 |

-4.3 |

| Australian

Capital Territory |

5.0 |

-4.4 |

-8.4 |

-4.5 |

1.6 |

| Australia |

3.1 |

-1.8 |

-6.2 |

-3.0 |

-5.7 |

| (a)

Includes vehicles designed primarily for the carriage of people, such as

cars, station wagons and people movers. Also includes four wheel drive

passenger vehicles not classified as sports utility vehicles. |

| Source:

ABS, Sales of New Motor Vehicles, Cat. no. 9314.0 |

4.3 Dwelling approvals

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Number

(a) |

|

|

|

|

|

| New

South Wales |

38 828 |

49 175 |

55 584 |

71 493 |

74 093 |

| Victoria |

52 121 |

49 833 |

60 895 |

68 669 |

68 284 |

| Queensland |

28 938 |

35 932 |

40 173 |

50 626 |

47 577 |

| South

Australia |

8 375 |

10 652 |

11 778 |

11 365 |

12 093 |

| Western

Australia |

21 690 |

28 690 |

33 088 |

28 660 |

21 865 |

| Tasmania |

2 010 |

1 898 |

2 551 |

2 781 |

2 148 |

| Northern

Territory |

1 920 |

2 294 |

2 000 |

1 666 |

1 278 |

| Australian

Capital Territory |

3 794 |

4 801 |

3 938 |

4 222 |

6 183 |

| Australia |

157 676 |

183 275 |

210 007 |

239 482 |

233 521 |

| Annual

change – per cent |

|

|

|

|

|

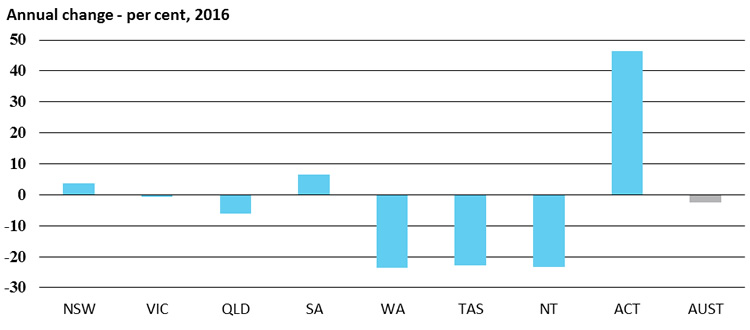

| New

South Wales |

12.8 |

26.6 |

13.0 |

28.6 |

3.6 |

| Victoria |

-0.3 |

-4.4 |

22.2 |

12.8 |

-0.6 |

| Queensland |

4.6 |

24.2 |

11.8 |

26.0 |

-6.0 |

| South

Australia |

-16.7 |

27.2 |

10.6 |

-3.5 |

6.4 |

| Western

Australia |

8.9 |

32.3 |

15.3 |

-13.4 |

-23.7 |

| Tasmania |

-21.4 |

-5.6 |

34.4 |

9.0 |

-22.8 |

| Northern

Territory |

45.2 |

19.5 |

-12.8 |

-16.7 |

-23.3 |

| Australian

Capital Territory |

-31.1 |

26.5 |

-18.0 |

7.2 |

46.4 |

| Australia |

2.6 |

16.2 |

14.6 |

14.0 |

-2.5 |

| (a)

Houses and other dwellings (e.g. flats) intended for long-term residential

use; includes both private and public sector dwellings. |

| Source:

ABS, Building Approvals, Cat. no. 8731.0 |

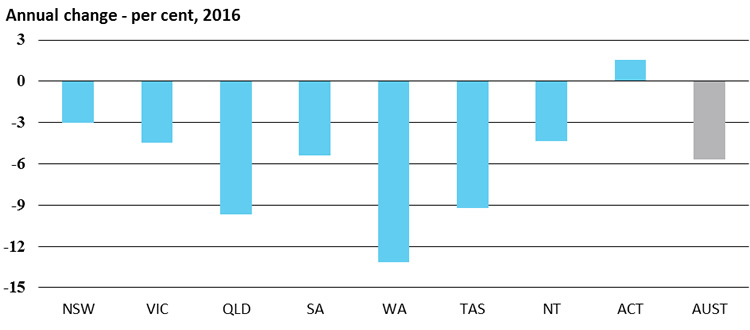

4.4 Business investment

| |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

| Chain

volume measures (a) – $ million |

|

|

|

|

| New

South Wales |

55 332 |

58 714 |

54 131 |

55 495 |

56 363 |

| Victoria |

41 310 |

37 145 |

40 471 |

43 382 |

44 038 |

| Queensland |

66 784 |

70 323 |

69 199 |

54 227 |

41 555 |

| South

Australia |

12 624 |

12 551 |

12 389 |

12 864 |

11 668 |

| Western

Australia |

74 292 |

78 635 |

70 758 |

62 737 |

52 140 |

| Tasmania |

3 038 |

2 494 |

2 423 |

2 594 |

2 474 |

| Northern

Territory |

5 181 |

10 374 |

11 447 |

12 207 |

8 007 |

| Australian

Capital Territory |

2 703 |

2 762 |

2 266 |

2 339 |

2 369 |

| Australia |

261 411 |

272 897 |

263 013 |

245 845 |

218 615 |

| Annual

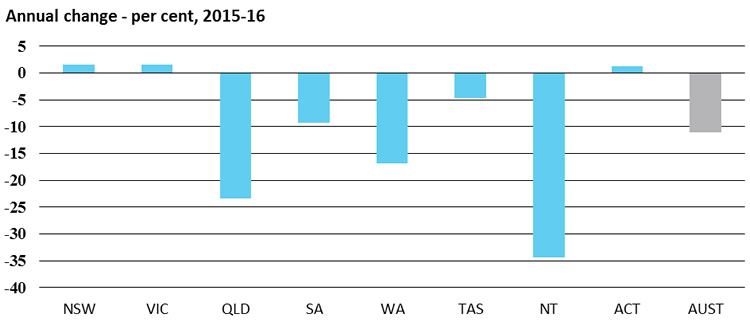

change – per cent |

|

|

|

|

|

| New

South Wales |

5.5 |

6.1 |

-7.8 |

2.5 |

1.6 |

| Victoria |

0.7 |

-10.1 |

9.0 |

7.2 |

1.5 |

| Queensland |

41.1 |

5.3 |

-1.6 |

-21.6 |

-23.4 |

| South

Australia |

11.4 |

-0.6 |

-1.3 |

3.8 |

-9.3 |

| Western

Australia |

43.7 |

5.8 |

-10.0 |

-11.3 |

-16.9 |

| Tasmania |

12.0 |

-17.9 |

-2.8 |

7.1 |

-4.6 |

| Northern

Territory |

85.6 |

100.2 |

10.3 |

6.6 |

-34.4 |

| Australian

Capital Territory |

12.1 |

2.2 |

-18.0 |

3.2 |

1.3 |

| Australia |

23.1 |

4.4 |

-3.6 |

-6.5 |

-11.1 |

| (a)

Private business gross fixed capital formation for other buildings and

structures, machinery and equipment, livestock and intangible fixed assets. |

| Source:

Australian National Accounts: State Accounts, Cat. no. 5220.0 |

| Note:

National account data is only available for financial years |

Chapter 5: Housing

5.1 Lending for owner occupied housing

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Value

(a) – $ million |

|

|

|

|

|

| New

South Wales |

51 919 |

57 956 |

64 369 |

83 386 |

86 782 |

| Victoria |

44 277 |

47 574 |

51 059 |

61 482 |

66 549 |

| Queensland |

29 340 |

32 210 |

35 797 |

38 510 |

41 137 |

| South

Australia |

8 829 |

10 239 |

11 046 |

11 979 |

13 014 |

| Western

Australia |

22 991 |

27 400 |

28 829 |

27 424 |

24 806 |

| Tasmania |

1 927 |

2 128 |

2 392 |

2 463 |

2 738 |

| Northern

Territory |

1 373 |

1 455 |

1 658 |

1 389 |

1 184 |

| Australian

Capital Territory |

2 890 |

3 404 |

3 643 |

4 227 |

4 532 |

| Australia |

163 545 |

182 365 |

198 794 |

230 861 |

240 742 |

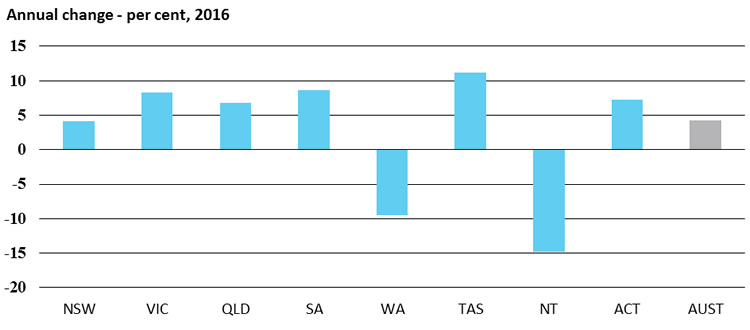

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

-2.9 |

11.6 |

11.1 |

29.5 |

4.1 |

| Victoria |

1.4 |

7.4 |

7.3 |

20.4 |

8.2 |

| Queensland |

8.7 |

9.8 |

11.1 |

7.6 |

6.8 |

| South

Australia |

-2.0 |

16.0 |

7.9 |

8.4 |

8.6 |

| Western

Australia |

19.1 |

19.2 |

5.2 |

-4.9 |

-9.5 |

| Tasmania |

-5.7 |

10.4 |

12.4 |

3.0 |

11.2 |

| Northern

Territory |

22.4 |

6.0 |

14.0 |

-16.2 |

-14.8 |

| Australian

Capital Territory |

2.4 |

17.8 |

7.0 |

16.0 |

7.2 |

| Australia |

3.2 |

11.5 |

9.0 |

16.1 |

4.3 |

| (a)

Lending commitments by all types of lenders for the construction and purchase

of new or established owner occupied dwellings. |

| Source:

ABS, Housing Finance, Cat. no. 5609.0 |

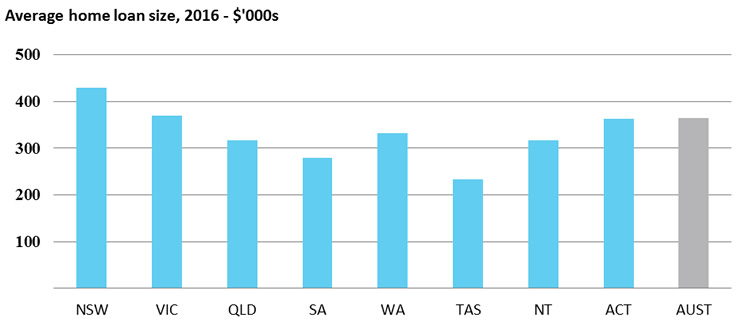

5.2 Home loan size

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Average

size of new owner-occupied home loan (a) – $'000 |

|

|

|

| New

South Wales |

329.7 |

338.7 |

363.3 |

414.1 |

428.3 |

| Victoria |

298.4 |

301.7 |

327.4 |

359.2 |

369.5 |

| Queensland |

283.4 |

280.3 |

294.0 |

307.9 |

316.5 |

| South

Australia |

244.4 |

246.7 |

258.0 |

271.8 |

279.0 |

| Western

Australia |

286.0 |

302.4 |

329.8 |

336.1 |

332.6 |

| Tasmania |

217.4 |

212.4 |

217.1 |

219.4 |

232.6 |

| Northern

Territory |

320.4 |

328.1 |

342.2 |

325.2 |

316.4 |

| Australian

Capital Territory |

334.6 |

325.7 |

325.3 |

347.5 |

362.3 |

| Australia |

298.6 |

303.6 |

324.7 |

354.9 |

363.7 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

-2.4 |

2.7 |

7.3 |

14.0 |

3.4 |

| Victoria |

-2.0 |

1.1 |

8.5 |

9.7 |

2.9 |

| Queensland |

-1.3 |

-1.1 |

4.9 |

4.7 |

2.8 |

| South

Australia |

-2.1 |

0.9 |

4.6 |

5.4 |

2.6 |

| Western

Australia |

1.9 |

5.7 |

9.1 |

1.9 |

-1.1 |

| Tasmania |

0.3 |

-2.3 |

2.2 |

1.0 |

6.0 |

| Northern

Territory |

5.3 |

2.4 |

4.3 |

-5.0 |

-2.7 |

| Australian

Capital Territory |

0.7 |

-2.6 |

-0.1 |

6.8 |

4.3 |

| Australia |

-1.5 |

1.7 |

7.0 |

9.3 |

2.5 |

| (a)

Includes refinancing, but excludes alterations and additions and refinancing.

Comprises construction of new dwellings and purchase of new and established

dwellings |

| Source:

ABS, Housing Finance, Cat. no. 5609.0 |

Chapter 6: Public Sector Finances

6.1 State government net debt

| |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

| General

government sector net debt (a) – $ million |

|

|

|

| New

South Wales |

13 238 |

10 898 |

5 899 |

5 453 |

195 |

| Victoria |

15 287 |

19 927 |

21 262 |

22 327 |

22 306 |

| Queensland |

-5 865 |

2 513 |

5 184 |

5 752 |

634 |

| South

Australia |

3 401 |

4 459 |

6 296 |

3 108 |

3 486 |

| Western

Australia |

2 050 |

4 742 |

6 973 |

9 306 |

13 717 |

| Tasmania |

- 409 |

- 220 |

- 208 |

- 537 |

- 746 |

| Northern

Territory |

1 633 |

1 829 |

1 811 |

1 133 |

768 |

| Australian

Capital Territory |

-2 733 |

-2 504 |

-2 714 |

-2 427 |

-1 789 |

| Total |

26 603 |

41 643 |

44 503 |

44 115 |

38 572 |

| General

government sector net debt – percentage of gross state product |

|

|

| New

South Wales |

2.8 |

2.3 |

1.2 |

1.1 |

0.0 |

| Victoria |

4.7 |

5.9 |

6.1 |

6.2 |

6.0 |

| Queensland |

-2.0 |

0.9 |

1.7 |

1.9 |

0.2 |

| South

Australia |

3.7 |

4.7 |

6.5 |

3.1 |

3.5 |

| Western

Australia |

0.8 |

1.9 |

2.6 |

3.7 |

5.7 |

| Tasmania |

-1.7 |

-0.9 |

-0.8 |

-2.1 |

-2.9 |

| Northern

Territory |

9.0 |

8.8 |

8.2 |

4.9 |

3.3 |

| Australian

Capital Territory |

-8.4 |

-7.3 |

-7.9 |

-6.9 |

-4.9 |

| Total

(b) |

1.8 |

2.7 |

2.8 |

2.7 |

2.3 |

| (a)

Selected liabilities minus selected assets of the general government sector.

A positive sign therefore indicates that selected liabilities exceed selected

assets; a negative sign indicates that selected assets exceed selected

liabilities. |

| (b)

Total or aggregate net debt for all jurisdictions is expressed as a

percentage of gross state product at current prices. |

| Sources:

ABS, Government Finance Statistics, Cat. no. 5512.0, Australian

National Accounts: State Accounts, Cat, no. 5220.0 |

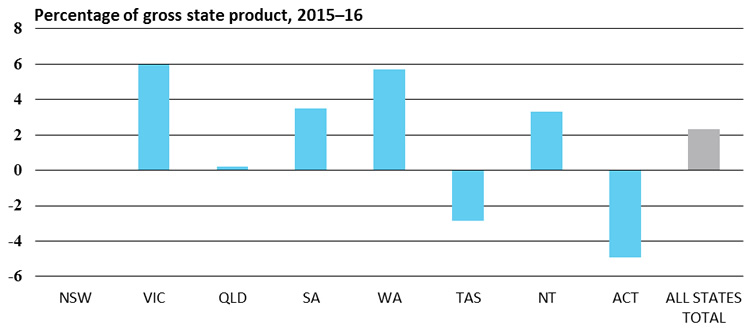

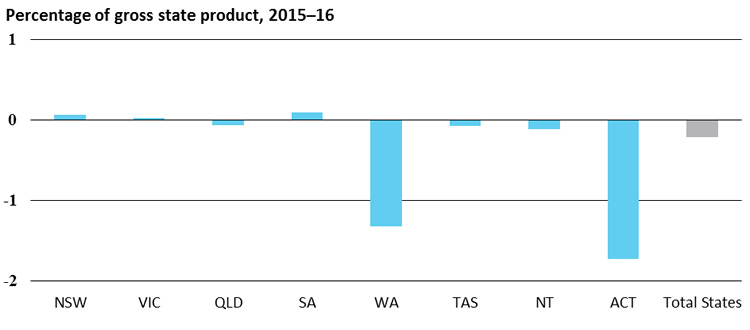

6.2 State government fiscal balance

| |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

| General

government sector fiscal balance (a) – $ million |

|

|

|

| New

South Wales |

-2 099 |

-3 571 |

-1 346 |

612 |

339 |

| Victoria |

-2 091 |

-2 704 |

1 105 |

- 398 |

84 |

| Queensland |

-5 557 |

-7 736 |

-2 587 |

- 530 |

- 201 |

| South

Australia |

-1 102 |

-1 001 |

-1 707 |

- 124 |

97 |

| Western

Australia |

-1 581 |

-1 853 |

-1 127 |

-1 809 |

-3 152 |

| Tasmania |

- 263 |

- 150 |

- 159 |

- 55 |

- 18 |

| Northern

Territory |

- 458 |

- 367 |

- 101 |

- 122 |

- 25 |

| Australian

Capital Territory |

- 336 |

- 755 |

- 575 |

- 912 |

- 628 |

| Total

(b) |

-13 490 |

-18 133 |

-6 494 |

-3 335 |

-3 516 |

| General

government sector fiscal balance – percentage of gross state product |

|

|

| New

South Wales |

-0.5 |

-0.7 |

-0.3 |

0.1 |

0.1 |

| Victoria |

-0.6 |

-0.8 |

0.3 |

-0.1 |

0.0 |

| Queensland |

-1.9 |

-2.7 |

-0.9 |

-0.2 |

-0.1 |

| South

Australia |

-1.2 |

-1.1 |

-1.8 |

-0.1 |

0.1 |

| Western

Australia |

-0.7 |

-0.8 |

-0.4 |

-0.7 |

-1.3 |

| Tasmania |

-1.1 |

-0.6 |

-0.6 |

-0.2 |

-0.1 |

| Northern

Territory |

-2.5 |

-1.8 |

-0.5 |

-0.5 |

-0.1 |

| Australian

Capital Territory |

-1.0 |

-2.2 |

-1.7 |

-2.6 |

-1.7 |

| Total

(c) |

-0.9 |

-1.2 |

-0.4 |

-0.2 |

-0.2 |

| (a)

The financing requirement of government. A positive sign, or fiscal surplus,

indicates a net lending position; a negative sign, or fiscal deficit,

indicates a net borrowing position. |

| (b)

The sum of all state and territory jurisdictions may not agree with the

total, due to transfers between jurisdictions. |

| (c)

Total or aggregate fiscal balance for all jurisdictions is expressed as a

percentage of gross state product. |

| Sources:

ABS, Government Finance Statistics, Cat. no. 5512.0 |

6.3 State

government taxation revenue

| |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

| General

government sector taxation revenue – $ million |

|

|

|

| New

South Wales |

20 757 |

22 166 |

24 105 |

26 461 |

29 811 |

| Victoria |

15 136 |

15 629 |

16 995 |

18 436 |

20 027 |

| Queensland |

10 616 |

10 960 |

11 846 |

12 575 |

12 547 |

| South

Australia |

3 869 |

4 112 |

4 107 |

4 393 |

4 426 |

| Western

Australia |

7 125 |

8 170 |

8 594 |

8 772 |

8 997 |

| Tasmania |

888 |

925 |

957 |

1 012 |

1 068 |

| Northern

Territory |

403 |

491 |

566 |

715 |

608 |

| Australian

Capital Territory |

1 183 |

1 237 |

1 296 |

1 377 |

1 568 |

| Total

(a) |

59 976 |

63 689 |

68 465 |

73 739 |

79 053 |

| General

government sector taxation revenue per capita - $ |

|

|

|

| New

South Wales |

3 037 |

3 192 |

3 417 |

3 704 |

4 130 |

| Victoria |

2 937 |

2 973 |

3 164 |

3 376 |

3 616 |

| Queensland |

2 582 |

2 597 |

2 737 |

2 855 |

2 803 |

| South

Australia |

2 463 |

2 588 |

2 553 |

2 700 |

2 699 |

| Western

Australia |

3 383 |

3 762 |

3 836 |

3 829 |

3 823 |

| Tasmania |

1 800 |

1 855 |

1 897 |

1 989 |

2 088 |

| Northern

Territory |

1 885 |

2 233 |

2 504 |

3 112 |

2 629 |

| Australian

Capital Territory |

3 453 |

3 551 |

3 653 |

3 806 |

4 261 |

| Total

(b) |

2 880 |

2 997 |

3 156 |

3 347 |

3 539 |

| (a)

Total is the sum of taxation revenue of all states, not taxation revenue for

Australia. |

|

|

| (b)

Total is the quotient of total taxation revenue (a) and the population of

Australia. This is not equivalent to the taxation revenue per capita for

Australia. |

| Source:

ABS, Taxation Revenue, Cat. no. 5506.0 |

Chapter 7: Exports

7.1 International merchandise exports

| |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

| Merchandise

exports (a) – $ million |

|

|

|

|

| New

South Wales |

40 540 |

37 044 |

36 599 |

37 032 |

36 193 |

| Victoria |

21 597 |

21 710 |

23 964 |

23 609 |

23 323 |

| Queensland |

52 868 |

44 433 |

44 813 |

46 488 |

47 867 |

| South

Australia |

11 410 |

10 711 |

12 354 |

11 322 |

11 567 |

| Western

Australia |

120 534 |

115 588 |

130 426 |

110 775 |

99 635 |

| Tasmania |

3 170 |

3 026 |

2 753 |

2 542 |

2 848 |

| Northern

Territory |

5 277 |

5 958 |

6 804 |

6 177 |

4 701 |

| Australian

Capital Territory |

12 |

7 |

1 |

6 |

14 |

| Australia

(b) |

264 018 |

246 978 |

272 922 |

254 552 |

243 423 |

| Merchandise

exports – percentage of gross state product |

|

|

|

| New

South Wales |

8.7 |

7.7 |

7.4 |

7.2 |

6.7 |

| Victoria |

6.6 |

6.4 |

6.9 |

6.5 |

6.2 |

| Queensland |

18.2 |

15.2 |

14.9 |

15.1 |

15.1 |

| South

Australia |

12.5 |

11.4 |

12.7 |

11.4 |

11.5 |

| Western

Australia |

49.8 |

47.1 |

48.6 |

44.2 |

41.6 |

| Tasmania |

13.0 |

12.3 |

10.9 |

9.9 |

10.9 |

| Northern

Territory |

29.1 |

28.8 |

30.9 |

26.8 |

20.4 |

| Australian

Capital Territory |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

| Australia

(b) |

17.7 |

16.2 |

17.2 |

15.7 |

14.7 |

| (a)

State in which the final stage of manufacture or production occurs. FOB value |

| (b)

Includes re-exports and state figures not available for publication.

Australian total, therefore, may not equal sum of states and territories. |

| Sources:

ABS, International Trade in Goods and Services, Cat. no. 5368.0; ABS, Australian

National Accounts: State Accounts, Cat. no. 5220.0 Note:

This table is based on national accounts data and is only updated for the

financial year publication |

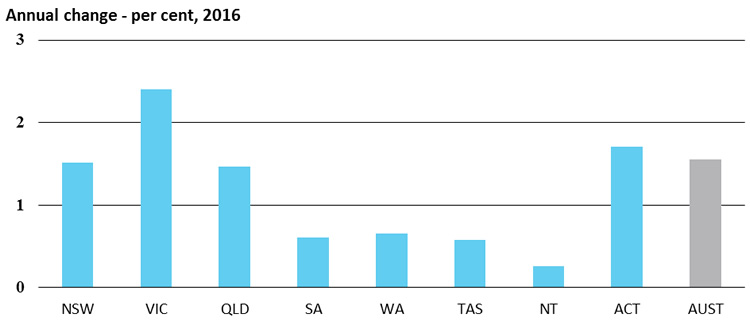

Chapter 8: Social Statistics

8.1 Population

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Population

(a) – '000 |

|

|

|

|

|

| New

South Wales |

7 358.3 |

7 462.4 |

7 573.1 |

7 681.4 |

7 797.8 |

| Victoria |

5 712.1 |

5 837.8 |

5 966.2 |

6 097.6 |

6 244.2 |

| Queensland |

4 611.3 |

4 688.9 |

4 753.2 |

4 813.3 |

4 883.7 |

| South

Australia |

1 663.2 |

1 678.4 |

1 694.0 |

1 706.6 |

1 717.0 |

| Western

Australia |

2 462.7 |

2 508.2 |

2 533.0 |

2 551.0 |

2 567.8 |

| Tasmania |

512.1 |

513.2 |

514.3 |

516.1 |

519.1 |

| Northern

Territory |

239.4 |

243.1 |

243.2 |

244.4 |

245.0 |

| Australian

Capital Territory |

380.0 |

386.7 |

392.6 |

399.6 |

406.4 |

| Australia |

22 942.2 |

23 321.7 |

23 672.6 |

24 012.8 |

24 385.6 |

| Annual

change – per cent |

|

|

|

|

|

| New

South Wales |

1.3 |

1.4 |

1.5 |

1.4 |

1.5 |

| Victoria |

2.1 |

2.2 |

2.2 |

2.2 |

2.4 |

| Queensland |

2.0 |

1.7 |

1.4 |

1.3 |

1.5 |

| South

Australia |

1.0 |

0.9 |

0.9 |

0.7 |

0.6 |

| Western

Australia |

3.2 |

1.8 |

1.0 |

0.7 |

0.7 |

| Tasmania |

0.0 |

0.2 |

0.2 |

0.3 |

0.6 |

| Northern

Territory |

2.9 |

1.5 |

0.1 |

0.5 |

0.3 |

| Australian

Capital Territory |

2.2 |

1.8 |

1.5 |

1.8 |

1.7 |

| Australia |

1.8 |

1.7 |

1.5 |

1.4 |

1.6 |

| (a)

Estimated resident population numbers are as at December of each year. |

| Source:

ABS, Australian Demographic Statistics, Cat. no. 3101.0 |

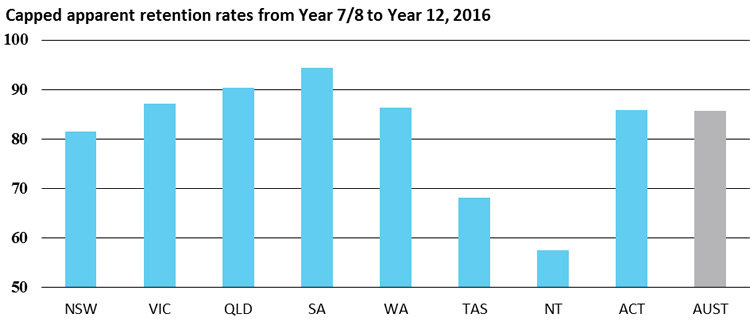

8.2 Apparent

school retention rates

| |

2012 |

2013 |

2014 |

2015 |

2016 |

| Apparent

retention rates from Year 10 to Year 12 (a) |

|

|

|

| New

South Wales |

77.6 |

79.8 |

79.5 |

79.8 |

81.5 |

| Victoria |

85.8 |

85.5 |

85.0 |

86.0 |

87.1 |

| Queensland |

86.2 |

87.9 |

87.0 |

88.5 |

90.1 |

| South

Australia |

85.1 |

87.4 |

89.3 |

90.7 |

92.2 |

| Western

Australia |

79.6 |

79.2 |

79.6 |

82.0 |

85.4 |

| Tasmania |

68.6 |

69.7 |

67.4 |

67.5 |

69.0 |

| Northern

Territory |

54.7 |

58.4 |

55.8 |

60.0 |

68.0 |

| Australian

Capital Territory |

82.6 |

84.3 |

83.8 |

84.4 |

84.8 |

| Australia |

81.9 |

83.1 |

82.8 |

83.7 |

85.5 |

| Apparent

retention rates from Year 7/8 to Year 12 (b) |

|

|

|

| New

South Wales |

76.3 |

78.4 |

78.9 |

80.1 |

81.4 |

| Victoria |

85.4 |

85.8 |

85.8 |

86.2 |

87.1 |

| Queensland |

88.3 |

88.7 |

88.1 |

89.3 |

90.4 |

| South

Australia |

86.3 |

89.8 |

91.7 |

92.9 |

94.4 |

| Western

Australia |

81.7 |

80.7 |

81.1 |

82.3 |

86.4 |

| Tasmania |

69.4 |

70.6 |

68.0 |

67.9 |

68.1 |

| Northern

Territory |

46.3 |

47.8 |

49.1 |

54.9 |

57.5 |

| Australian

Capital Territory |

82.5 |

84.8 |

82.6 |

85.5 |

85.9 |

| Australia |

82.3 |

83.2 |

83.2 |

84.2 |

85.6 |

| (a)

The number of full-time school students in Year 12 expressed as a percentage

of the corresponding group at the commencement of their Year 10 schooling. |

| (b)

The number of full-time school students in Year 12 expressed as a percentage

of the corresponding group at the commencement of their secondary schooling. |

| Source:

ABS, Schools, Cat. no. 4221.0 |

8.3 General practice bulk billing

| |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

| General

practice bulk billing rate (a) – per cent |

|

|

|

| New

South Wales |

85.9 |

86.8 |

87.6 |

88.2 |

88.6 |

| Victoria |

80.5 |

82.0 |

83.1 |

84.0 |

84.8 |

| Queensland |

80.6 |

81.6 |

82.8 |

83.7 |

84.5 |

| South

Australia |

80.5 |

81.3 |

82.3 |

83.3 |

84.0 |

| Western

Australia |

72.4 |

72.9 |

75.3 |

77.8 |

80.1 |

| Tasmania |

74.8 |

76.1 |

77.0 |

77.3 |

76.7 |

| Northern

Territory |

72.0 |

77.4 |

80.7 |

84.5 |

87.4 |

| Australian

Capital Territory |

49.5 |

54.9 |

57.0 |

57.9 |

60.0 |

| Australia |

81.2 |

82.2 |

83.4 |

84.3 |

85.1 |

| (a)

Proportion of general practitioner attendances (excluding practice nurse),

enhanced primary care and other non-referred attendances that are bulk

billed. |

| Source:

Department of Health and Ageing, Annual Medicare Statistics |

Glossary

Apparent school retention rate. The

number of full-time school students in a designated level/year of education

expressed as a percentage of their respective cohort group (which is either at

the commencement of their secondary schooling or Year 10). For a discussion of

‘apparent’ retention rates compared to actual retention rates, see the ABS

source publication, Schools, Australia, 2014 (cat. no. 4221.0)

explanatory notes.

Average weekly earnings. Average gross (before tax)

earnings of employees.

Average weekly ordinary time earnings. Weekly earnings

attributed to award, standard or agreed hours of work.

Business investment. Private gross fixed capital

formation for machinery and equipment; non-dwelling construction; livestock;

and intangible fixed assets.

Consumer price index. A measure of change in the price

of a basket of goods and services from a base period. Changes in the consumer

price index are the most commonly used measures of inflation.

Employed persons. Persons aged 15 and over who, during

a period of one week, worked for one hour or more for pay or worked for one

hour or more without pay in a family business or on a family farm.

General government sector. Government departments and

other entities that provide largely non-market public services and are funded

mainly through taxes and other compulsory levies.

General government sector net debt. Selected

liabilities (deposits held plus proceeds from advances plus borrowing) minus

selected assets (cash and deposits plus investments plus advances outstanding)

of the general government sector.

General government sector fiscal balance. The financing

requirement of the general government sector. A positive sign, or fiscal

surplus, indicates a net lending position; a negative sign, or fiscal deficit,

indicates a net borrowing position.

General practice bulk billing rate. The percentage of

general practitioner attendances (excluding practice nurse) that are bulk

billed.

Gross domestic product. The total market value of goods

and services produced within Australia, after deducting the cost of goods and

services used up in the process of production but before deducting for

depreciation.

Gross state product. Equivalent to gross domestic

product except it refers to production within a state or territory rather than

to the nation as a whole.

Gross state product—chain volume measures. Also known

as real gross state product, this is a measure used to indicate change in the

actual quantity of goods and services produced within a state or territory.

Gross state product per capita. The ratio of the chain

volume measure of gross state product to an estimate of the resident population

in the state or territory.

Job vacancy. A job available for immediate filling and

for which recruitment action has been taken.

Job vacancy rate. The number of job vacancies expressed

as a percentage of the number of employee jobs plus the number of job

vacancies.

Labour force. The employed plus the unemployed.

Labour force participation rate. The number of persons

in the labour force expressed as a percentage of the civilian population aged

15 years and over.

Labour productivity. Gross state product (chain volume

measures) per hour worked, all sectors (that is, market and non-market

sectors).

Male total average weekly earnings. Weekly ordinary

time earnings plus weekly overtime earnings of all male employees. This measure

of earnings is used in the process of benchmarking pensions.

Real average weekly earnings. Average weekly earnings

adjusted for inflation as measured by the Consumer Price Index.

Turnover. Includes retail sales; wholesale sales;

takings from repairs, meals and hiring of goods; commissions from agency

activity; and net takings from gaming machines. Turnover includes the Goods and

Services Tax.

Unemployed persons. Persons aged 15 and over who,

during a period of one week, were not employed but had actively looked for work

in the previous four weeks and were available to start work.

Unemployment rate. The number of unemployed persons

expressed as a percentage of the labour force.

Wage price index. A measure of change in the price of

labour (that is, wages, salaries and overtime) unaffected by changes in the

quality or quantity of work performed.

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Enquiry Point for referral.