6.1 State government net debt

| |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

| General government sector net debt

(a) – $ million |

|

|

|

| New South Wales |

9 225 |

7 766 |

13 238 |

10 898 |

5 899 |

| Victoria |

7 932 |

11 885 |

15 287 |

19 927 |

21 262 |

| Queensland |

-13 347 |

-9 055 |

-5 865 |

2 513 |

5 184 |

| South Australia |

735 |

2 251 |

3 401 |

4 459 |

6 296 |

| Western Australia |

-1 076 |

236 |

2 050 |

4 742 |

6 973 |

| Tasmania |

- 748 |

- 415 |

- 409 |

- 220 |

- 208 |

| Northern Territory |

719 |

1 172 |

1 633 |

1 829 |

1 811 |

| Australian Capital Territory |

-2 962 |

-2 987 |

-2 733 |

-2 504 |

-2 714 |

| Total |

479 |

10 854 |

26 603 |

41 643 |

44 503 |

| |

|

|

|

|

|

| General government sector net debt

– percentage of gross state product |

|

|

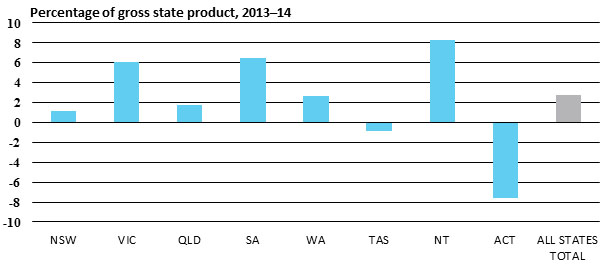

| New South Wales |

2.2 |

1.8 |

2.9 |

2.3 |

1.2 |

| Victoria |

2.7 |

3.8 |

4.7 |

5.9 |

6.1 |

| Queensland |

-5.3 |

-3.4 |

-2.1 |

0.9 |

1.7 |

| South Australia |

0.9 |

2.5 |

3.7 |

4.7 |

6.5 |

| Western Australia |

-0.6 |

0.1 |

0.8 |

2.0 |

2.6 |

| Tasmania |

-3.2 |

-1.7 |

-1.7 |

-0.9 |

-0.8 |

| Northern Territory |

4.4 |

6.7 |

8.6 |

9.2 |

8.3 |

| Australian Capital Territory |

-10.0 |

-9.4 |

-8.1 |

-7.1 |

-7.6 |

| Total (b) |

0.0 |

0.8 |

1.8 |

2.7 |

2.8 |

| |

|

|

|

|

|

(a) Selected liabilities minus selected

assets of the general government sector. A positive sign therefore indicates

that selected liabilities exceed selected assets; a negative sign indicates

that selected assets exceed selected liabilities.

(b) Total or aggregate net debt for all jurisdictions is expressed as a

percentage of gross state product at current prices.

Note: The 2014-15 Government Finance Statistics will be published in May

2016.

Sources: ABS, Government Finance Statistics, 2013–14, cat. no. 5512.0;

ABS, Australian National Accounts: State Accounts, 2013–14, cat, no.

5220.0

6.2 State government fiscal balance

| |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

| General government sector fiscal

balance (a) – $ million |

|

|

|

| New South Wales |

-2 604 |

-2 911 |

-2 010 |

-3 588 |

-1 227 |

| Victoria |

-2 437 |

-2 248 |

-2 091 |

-2 704 |

1 104 |

| Queensland |

-6 571 |

-7 115 |

-5 557 |

-7 736 |

-2 592 |

| South Australia |

-1 089 |

-1 403 |

-1 102 |

-1 001 |

-1 719 |

| Western Australia |

-1 062 |

- 276 |

-1 581 |

-1 853 |

-1 127 |

| Tasmania |

- 296 |

- 444 |

- 263 |

- 150 |

- 159 |

| Northern Territory |

- 41 |

- 549 |

- 508 |

- 313 |

- 98 |

| Australian Capital Territory |

- 202 |

- 311 |

- 336 |

- 755 |

- 574 |

| Total (b) |

-14 304 |

-15 257 |

-13 448 |

-18 098 |

-6 392 |

| |

|

|

|

|

|

| General government sector fiscal

balance – percentage of gross state product |

|

|

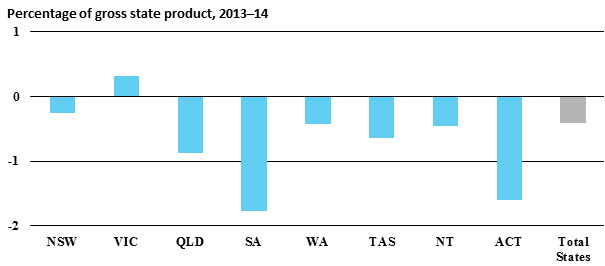

| New South Wales |

-0.6 |

-0.7 |

-0.4 |

-0.8 |

-0.2 |

| Victoria |

-0.8 |

-0.7 |

-0.6 |

-0.8 |

0.3 |

| Queensland |

-2.6 |

-2.7 |

-1.9 |

-2.7 |

-0.9 |

| South Australia |

-1.3 |

-1.6 |

-1.2 |

-1.1 |

-1.8 |

| Western Australia |

-0.6 |

-0.1 |

-0.7 |

-0.8 |

-0.4 |

| Tasmania |

-1.3 |

-1.8 |

-1.1 |

-0.6 |

-0.6 |

| Northern Territory |

-0.3 |

-3.1 |

-2.7 |

-1.6 |

-0.4 |

| Australian Capital Territory |

-0.7 |

-1.0 |

-1.0 |

-2.1 |

-1.6 |

| Total (c) |

-1.1 |

-1.1 |

-0.9 |

-1.2 |

-0.4 |

(a) The financing requirement of

government. A positive sign, or fiscal surplus, indicates a net lending

position; a negative sign, or fiscal deficit, indicates a net borrowing

position.

(b) The sum of all state and territory jurisdictions may not agree with the

total, due to transfers between jurisdictions.

(c) Total or aggregate fiscal balance for all jurisdictions is expressed as a

percentage of gross state product.

Note: The 2014-15 Government Finance Statistics will be published in May

2016.

Sources: ABS, Government Finance Statistics, 2013–14, cat. no. 5512.0

6.3 State government taxation revenue

| |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

| General government sector taxation

revenue – $ million |

|

|

|

| New South Wales |

19 280 |

20 549 |

20 731 |

22 054 |

24 362 |

| Victoria |

13 771 |

14 903 |

15 136 |

15 629 |

16 992 |

| Queensland |

9 385 |

9 987 |

10 616 |

10 960 |

11 846 |

| South Australia |

3 660 |

3 843 |

3 869 |

4 112 |

4 107 |

| Western Australia |

6 254 |

6 610 |

7 125 |

8 170 |

8 594 |

| Tasmania |

873 |

860 |

888 |

925 |

957 |

| Northern Territory |

415 |

397 |

403 |

491 |

566 |

| Australian Capital Territory |

1 128 |

1 244 |

1 183 |

1 237 |

1 296 |

| Total (a) |

54 764 |

58 395 |

59 950 |

63 577 |

68 720 |

| |

|

|

|

|

|

| General government sector taxation

revenue per capita - $ |

|

|

|

| New South Wales |

2 699 |

2 847 |

2 837 |

2 977 |

3 241 |

| Victoria |

2 522 |

2 691 |

2 687 |

2 726 |

2 910 |

| Queensland |

2 131 |

2 231 |

2 324 |

2 356 |

2 509 |

| South Australia |

2 249 |

2 344 |

2 336 |

2 462 |

2 437 |

| Western Australia |

2 730 |

2 809 |

2 922 |

3 248 |

3 350 |

| Tasmania |

1 716 |

1 681 |

1 734 |

1 803 |

1 859 |

| Northern Territory |

1 806 |

1 716 |

1 708 |

2 024 |

2 314 |

| Australian Capital Territory |

3 118 |

3 381 |

3 153 |

3 247 |

3 362 |

| Total (b) |

2 486 |

2 614 |

2 638 |

2 750 |

2 927 |

(a) Total is the sum of taxation revenue

of all states, not taxation revenue for Australia.

(b) Total is the quotient of total taxation revenue (a) and the population of

Australia. This is not equivalent to the taxation revenue per capita for

Australia.

Note: The 2014-15 Taxation Revenue publication will be released in May 2016

Source: ABS, Taxation Revenue, 2013–14, cat. no. 5506.0

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Entry Point for referral.