Issue

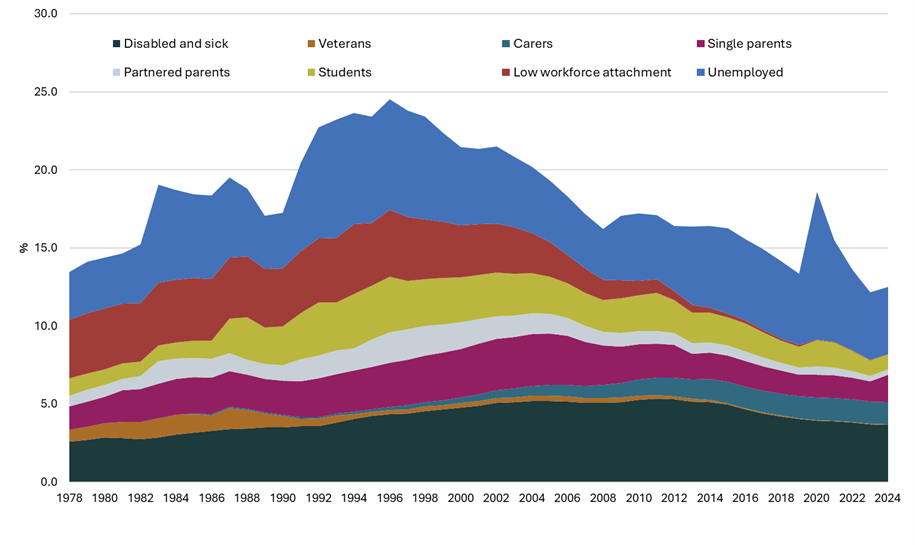

The proportion of Australia’s population aged 15–64 receiving

income support payments reached record lows in 2023 and 2024. This was driven

by a strong labour market and pre-COVID-19 policy changes.

Key points

- In

June 2023, close to 12% of the population aged 15–64 received income support

payments—the lowest level in more than 45 years. June 2024 was only slightly

higher at around 13%.

- The

long-term decline in working-age welfare receipt is partly due to previous

governments’ policy changes restricting eligibility for some payments,

phasing-out other payments, and tight targeting through means testing.

- There

has been a marked decline in student payment recipients. Possible causes

include more students working and undertaking part-time study, parental

income tests limiting eligibility, and low payment rates discouraging

participation in higher education and course completion.

- There

has also been a significant decrease in Disability Support Pension

recipients, with some people with disability being directed onto the

lower-rate JobSeeker Payment.

Context

Australia’s social security system comprises means tested

payments aimed at different recipient categories. While the Age Pension is the

primary payment for retired older people, there are various income support

payments for working-age people requiring assistance due to disability,

unemployment, caring responsibilities or while studying. The proportion of this

working age population—those aged 15–64—receiving income support payments has

gradually declined since its peak following the early-1990s recession, with

short interruptions following the Global Financial Crisis in 2008 and COVID-19

containment policies in 2020 (Figure 1).

Figure 1 Income support recipients as a % of people

aged 15–64

Notes: See ‘Technical notes’ section. ‘Low workforce

attachment’ includes female Age Pension recipients aged under 65 years,

payments for widows, Bereavement Allowance (merged into JobSeeker Payment from

March 2020), Mature Age Allowance, Partner Allowance from 1996 and a percentage

of estimated dependent partners of allowance payment recipients 1978–94.

‘Veterans’ includes Service Pension and Income Support Supplement. Data

excludes JobKeeper and disaster payment recipients.

Sources: Parliamentary Library calculations based on Department

of Social Services (DSS), ‘DSS

Demographics’, and predecessor departments’ statistical papers; Department

of Veterans’ Affairs (DVA), ‘Pensioner

summary statistics’, from 2000 onwards; and Department of Education annual

reports. 2023 and 2024 data for some payments provided by DSS in response to

data request. Latest source available used where published data varies.

Population data from Australian Bureau of Statistics (ABS), National,

State and Territory Population, (ABS: Canberra, September 2024),

‘Population by age and sex – national’.

Prior to July 2017, the Age Pension qualifying age was 65

years—making 64 years a natural upper boundary for ‘working-age’. The Age

Pension qualifying age gradually

increased from 65 to 67 between 2017 and 2023. The qualifying age for women

was increased from 60 to 65 between 1995 and 2013. The change commencing in

2017 has resulted in more people 65 and over receiving payments previously

reserved for ‘working-age’ people. For example, in June 2024, there were 52,390

JobSeeker Payment recipients aged 65 and over.

Pre-COVID-19 decrease

In 1996, almost a quarter of Australia’s resident working-age

population received government income support. The subsequent decline was

driven by labour market improvements, changes in young people’s education

patterns and government

policy decisions (pp. 56–57). These policy changes included:

-

the increase in the Age Pension qualifying age for women

-

the phasing-out of payments primarily aimed at dependent partners

such as widow and wife pensions

-

restricting Parenting Payment eligibility to those with younger

children and introducing activity requirements

-

new Disability Support Pension qualification requirements and a

changed method for assessing impairments.

COVID-19 impact and

labour market recovery

The number of welfare recipients increased sharply following

implementation of COVID-19 containment policies but reliance on income support

did not reach previous peaks. Notably, the pandemic response policy measures (particularly

the JobKeeper

wage subsidy) prevented the 2020 numbers from escalating. In June 2020 around

3.6 million individuals were subsidised

through JobKeeper (p. 49). This represented around 20% of the working-age

population, excluding the approximate 230,000 aged

65 and over (p. 52) and approximately 130,000 people receiving

another income support payment. In total, an estimated 38% of the

population aged 15–64 received government income support in mid-2020.

A year later the Australian Government introduced a

new COVID-19

Disaster Payment to support those affected by state and territory

government COVID-19 lockdowns. By December 2021, around 2.4 million individuals

had received

this payment. Adding these people together with social security recipients

indicates close to 29% of the working-age population received income support in

the second half of 2021.

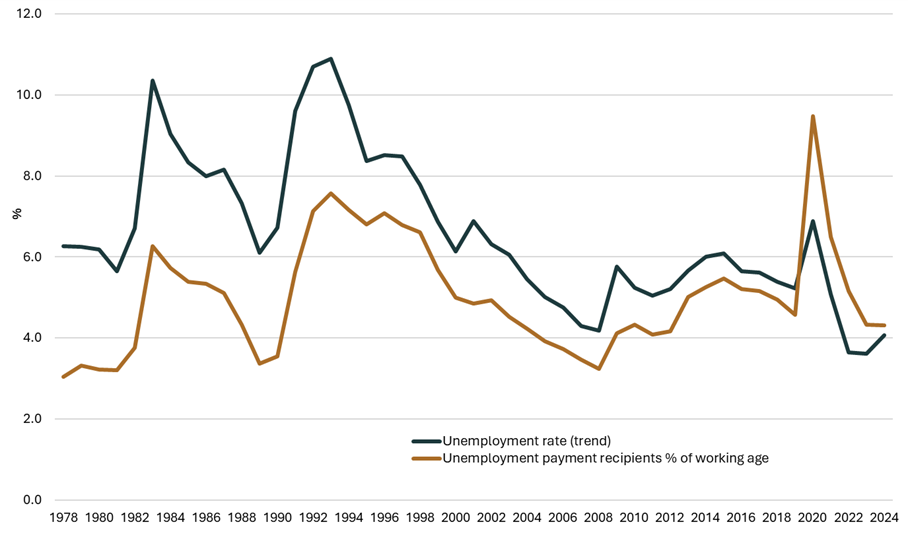

While pre-COVID-19 policy decisions contributed to the recent

record low rates of income support, the improved labour market has been the key

driver. The seasonally

adjusted unemployment rate plunged to 3.4% in October 2022, the lowest

level since the mid-1970s. It remained below 4% until December 2023, and as of

May 2025 is 4.1%.

Working-age income support receipt rates broadly follow

unemployment rate trends (Figure 2). While there is only

a partial overlap between unemployment payment recipients and those defined

as ‘unemployed’ in the ABS labour market surveys, unemployment rate trends

strongly correlate with trends in recipient numbers.

Figure 2 Trend unemployment rate and

unemployment payment recipients as % of working-age population

Notes: See ‘Technical notes’ section. Unemployment payments are

JobSeeker Payment and Youth Allowance (Other) and predecessor payments.

Sources: Parliamentary Library calculations based on DSS, ‘DSS

Demographics’, and predecessor departments’ statistical papers. 2023 and

2024 data payment data provided by DSS in response to data request. Latest

source available used where published data varies. Population data from

ABS, National,

State and Territory Population, (ABS: Canberra, September 2024),

‘Population by age and sex – national’. Unemployment rate from ABS, Labour

Force, Australia, (ABS: Canberra, April 2025).

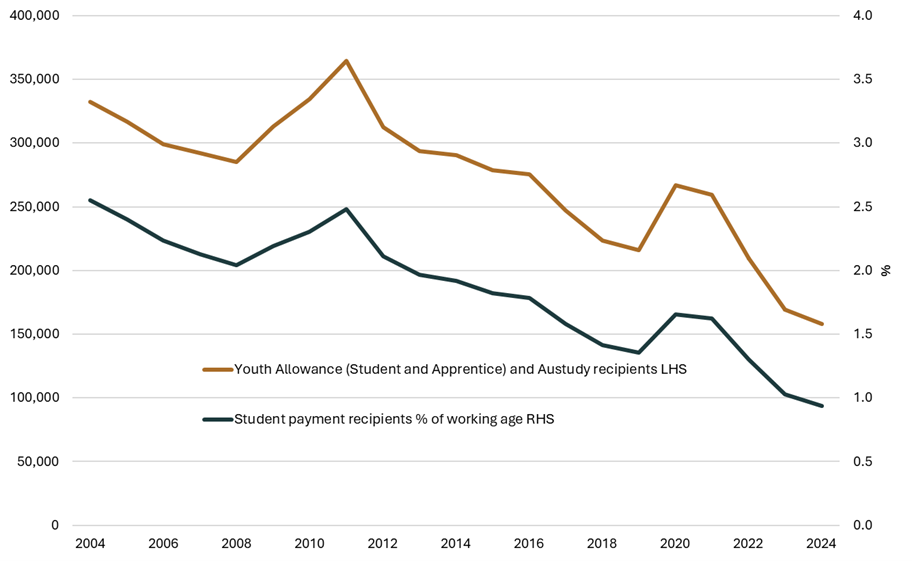

Decrease in students

receiving income support

Recipients of student payments such as Youth Allowance

(Students and Apprentices) and Austudy have more than halved in the 20 years to

June 2024, from 341,900 to 166,100. As a proportion of the working-age

population, this dropped from around 3% in 2004 to under 1% (Figure 3). A policy

change in 2012 shifted students aged 16–17 from Youth Allowance to Family

Tax Benefit but student payment recipient numbers continued to decline in the

years following (p. 5).

Figure 3 Student income support recipients

aged 15–64

Notes: See ‘Technical notes’ section. Student payment totals

include Youth Allowance (Student and Apprentice) and ABSTUDY Living Allowance

recipients.

Sources: Parliamentary Library calculations based on DSS, ‘DSS

Demographics’, and predecessor departments’ statistical papers. 2023 and

2024 payment data provided by DSS in response to data request. Latest source

used where published data varies. Population data from ABS, National,

State and Territory Population, (ABS: Canberra, September 2024),

‘Population by age and sex – national’.

In 2023, higher education researcher Andrew Norton observed

that student income support numbers are in a ‘structural decline that COVID-19

interrupted’ and that ‘no in-depth research explains the decrease’ (p. 66). The

subsequent Australian

Universities Accord Final Report (released in February 2024) suggested some

possible causes, including (pp. 144–5):

-

a strong labour market increasing the number of students combining

work and study

-

people deferring study to enter the labour market

-

increased part-time study, which generally prevents income

support eligibility

-

a narrowed parental income test, reducing the number of students

eligible for payments

-

independence criteria limiting eligibility and encouraging rural

and regional students to defer study

-

inadequate payment rates, discouraging participation and lowering

completion rates.

In response, the report

recommended increasing the parental income test free area and changing

indexation arrangements. It also advocated expanding eligibility to part-time

students (50%–74% study load) with a pro-rata payment and further government technical

analysis of the identified issues (p. 150).

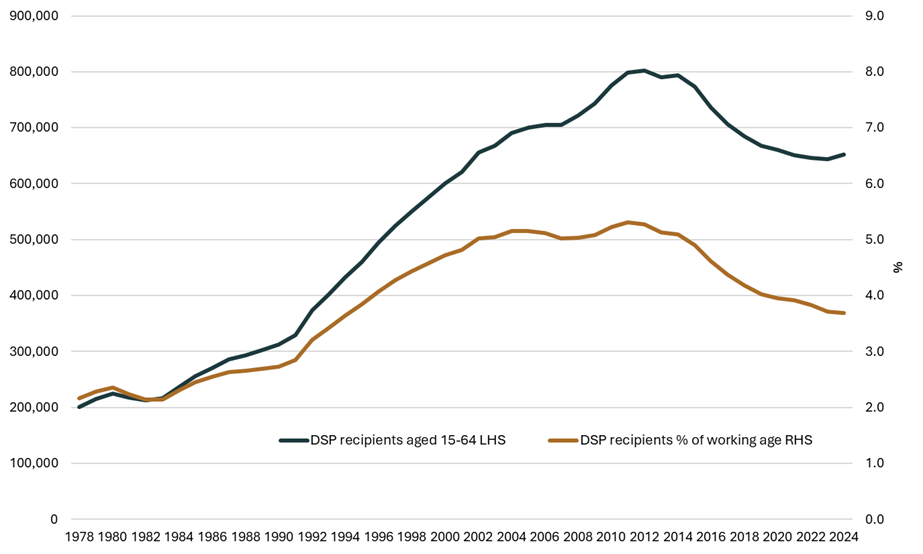

People with disability

receiving income support

There has also been a marked decline in the number of

working-age Disability Support Pension (DSP) recipients since 2011 and 2012

(Figure 4). In a 2018 report, the

Parliamentary Budget Office stated that the main driver of the slowdown in

DSP expenditure growth after 2012 was policy measures reducing the flow of

people onto the payment, particularly new assessment measures (p. vi).

Figure 4 Disability Support Pension recipients

aged 15–64

Notes: See ‘Technical notes’. DSP was known as the Invalid

Pension prior to 1991.

Sources: Parliamentary Library calculations based on DSS, ‘DSS

Demographics’, and predecessor departments’ statistical papers. Population

data from ABS, National,

State and Territory Population, (ABS: Canberra, September 2024),

‘Population by age and sex – national’.

While some found paid employment, many people with

disability who would have previously received DSP have moved onto other

payments, particularly the lower-rate JobSeeker Payment. The proportion of

JobSeeker (and predecessor payment) recipients assessed as having a ‘partial

capacity to work’ has grown from

less than 10% in 2007 (p. 20) to around

41% in 2025. These individuals are subject to different mutual obligation

requirements than other JobSeeker Payment recipients.

DSP policy changes have contributed to a significant demographic

change in JobSeeker Payment—it is no longer the payment for those seeking

full-time work. Approximately 40% of recipients have a disability and can only

work part-time. As JobSeeker absorbed

the former Sickness Allowance in 2020, there are also now recipients who

have a job or are studying but are temporarily unable to work or study due to a

medical condition.

Conclusion

The record numbers of working-age people in paid employment

is a significant achievement. However, the low numbers of working-age people

receiving welfare payments tells us little about how the income support system performs.

The system is intended to support those with full or limited capacity to engage

in or find work—recipient numbers are primarily driven by the overarching

economy.

Despite the potential to connect welfare receipt trends with

claims of program effectiveness, the data is only one measure. A much

broader analysis is required to sufficiently assess the appropriateness of

payment settings for different recipient categories or for achieving particular

objectives.

Beyond the headline figures, there are significant

demographic shifts happening within payment categories and missing from the

picture are the stories of those unable to find work but ineligible for income

support.

Technical notes

Data for all figures is at June of each year unless

point-in-time data unavailable.

Department of Social Services data

Prior to 2023, data sources report recipients of JobSeeker

Payment (and predecessor payments) and Special Benefit who are determined to be

current (i.e. entitled to be paid/not suspended) on the Centrelink payment

system, and not in receipt of zero rate of payment; and recipients of ABSTUDY

(Living Allowance), Austudy, Parenting Payment and Youth Allowance who are similarly

determined to be current (entitled to be paid/not suspended). In January 2023

the Department of Social Services revised reporting populations for income

support recipients. Published reporting populations now include all current

(including those on zero rate of payment) and suspended recipients. The data

used in this policy brief will not be wholly comparable to other published data

as it does not include zero rate JobSeeker Payment and Special Benefit

recipients or recipients suspended from payment.

Trend unemployment rate (Figure 2)

The unemployment rate measures unemployed persons as a

percentage of the labour market (population aged 15 years or over who are

employed or unemployed and actively looking for work). Due to large

month-to-month labour market changes during April 2020 to March 2022, the ABS

recommends using caution regarding the trend estimates for this period.