Robert Dolamore

This brief provides a summary of

some of the key numbers from this year’s budget.

The headline economic forecasts

Table 1: Treasury forecasts of

major economic parameters (per cent)

|

|

2014–15 |

2015–16 |

2016–17 |

2017–18 |

2018–19 |

2019–20 |

|

Real GDP

|

2.2 |

2.5 |

2.5 |

3.0 |

3.0 |

3.0 |

|

Employment

|

1.6 |

2.0 |

1.75 |

1.75 |

1.25 |

1.5 |

|

Unemployment Rate

|

6.1 |

5.75 |

5.5 |

5.5 |

5.5 |

5.5 |

|

Consumer price index

|

1.5 |

1.25 |

2.0 |

2.25 |

2.5 |

2.5 |

|

Wage price index

|

2.3 |

2.25 |

2.5 |

2.75 |

3.25 |

3.5 |

|

Nominal GDP

|

1.6 |

2.5 |

4.25 |

5.0 |

5.0 |

5.0 |

|

Terms of trade

|

-10.3 |

-8.75 |

1.25 |

0.0 |

|

|

Source:

Australian Government, Budget strategy and outlook: budget paper no. 1:

2016–17, 2016, Statement 1,

Table 2, p. 1-8, Statement 2, Table 1, p. 2-6.

Table A1 provides a

snapshot of how these forecasts have changed since last year’s budget (see Attachment A).

The headline fiscal numbers

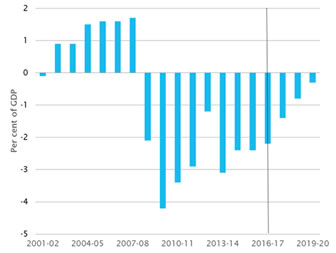

- The underlying cash deficit is estimated to be $39.9 billion

(2.4 per cent of gross domestic product (GDP)) in 2015–16, $37.1 billion

(2.2 per cent of GDP) in 2016–17 falling to a projected $6.0 billion (0.3 per cent

of GDP) in 2019–20.

- Over the four years to 2019 –20 accumulated deficits are

estimated to total $84.6 billion.

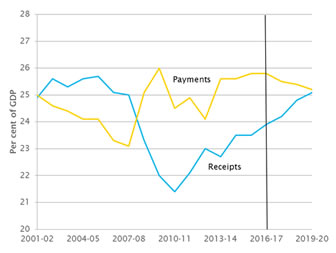

- General government sector receipts are estimated to be $388.0 billion

(23.5 per cent of GDP) in 2015–16, $411.3 billion (23.9 per cent

of GDP) in 2016–17 rising to a projected $500.7 billion (25.1 per cent

of GDP) by 2019–20.

- Tax receipts are estimated to be $364.5 billion (22.1 per cent

of GDP) in 2015–16, $382.8 billion (22.2 per cent of GDP) in 2016–17

increasing to a projected $468.3 billion (23.5 per cent of GDP)

by 2019–20.

- General government sector payments are estimated to be $425.0 billion

(25.8 per cent) in 2015–16, $445.0 billion (25.8 per cent

of GDP) in 2016–17 and increasing to a projected $502.6 billion (25.2 per cent

of GDP) by 2019–20.

- In terms of total general government receipts and payments, the

revenue side is forecast to make the biggest contribution as a share of GDP to

reducing the size of the Budget deficit over the forward estimates period.

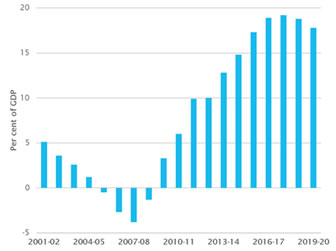

- General government sector net debt is estimated to be

$285.7 billion (17.3 per cent of GDP) in 2015–16, $326.0 billion

(18.9 per cent of GDP) in 2016–17 increasing to a projected $355.1 billion

(17.8 per cent of GDP) by 2019–20.

- General government sector net interest payments are

estimated to be $12.0 billion (0.7 per cent of GDP) in 2015–16,

$12.6 billion (0.7 per cent of GDP) in 2016–17 increasing to a

projected $14.2 billion (0.7 per cent of GDP) in 2019–20.

- The face value of Commonwealth Government Securities (CGS)

on issue is estimated to be $425 billion in 2015–16, $497 billion in 2016–17

and $565 billion in 2018–19. Looking further out the total value of CGS on

issue is projected to rise to $640 billion by 2026–27.

The

Budget deficit is forecast to gradually fall from $39.9 billion in

2015–16 to $5.9 billion in 2019–20.

Underlying

Cash Balance

| Year |

$m |

% GDP |

| 2014–15 |

-37,867 |

-2.4 |

| 2015–16 |

-39,946 |

-2.4 |

| 2016–17 |

-37,081 |

-2.2 |

| 2017–18 |

-26,123 |

-1.4 |

| 2018–19 |

-15,406 |

-0.8 |

| 2019–20 |

-5,955 |

-0.3 |

|

Underlying Cash Balance % GDP

Source: Australian Government, Budget strategy and outlook: budget paper no. 1: 2016–17, 2016, Statement 10, Table 1, p. 10–6. |

Achieving a surplus depends

on closing the gap between payments and receipts…

- In the last decade payments peaked at 26.0 per cent of GDP in

2009–10 and are estimated to be 25.8 per cent of GDP in 2016–17 and

decline to 25.2 per cent in 2019–20.

- In the last decade receipts bottomed at 21.4 per cent of GDP in

2010–11 and are forecast to be 23.9 per cent of GDP in 2016–17 and increase

to 25.1 per cent of GDP in 2019–20.

|

Receipts and Payments % GDP

Source: Australian

Government, Budget strategy and outlook: budget paper no. 1:

2016–17, 2016, Statement 10,

Table 1, p. 10–6. |

Net debt is forecast to peak

as a percentage of GDP in 2017–18.

Net

Debt

| Year |

$m |

%

GDP |

| 2014–15 |

238,721 |

14.8 |

| 2015–16 |

285,684 |

17.3 |

| 2016–17 |

325,962 |

18.9 |

| 2017–18 |

346,842 |

19.2 |

| 2018–19 |

356,373 |

18.8 |

| 2019–20 |

355,066 |

17.8 |

|

Net Debt % GDP

Source: Australian

Government, Budget strategy and outlook: budget paper no. 1:

2016–17, 2016, Statement 10,

Table 4, p. 10–12. |

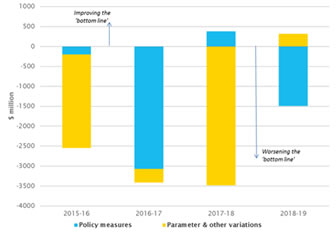

Since MYEFO,

policy measures and parameter variations have on balance worsened the

near-term budget outlook.

Effect on the

Underlying Cash Balance of changes since MYEFO

| Year |

Policy

measures

$m |

Parameter

variations

$m |

| 2015–16 |

-195 |

-2,352 |

| 2016–17 |

-3,070 |

-343 |

| 2017–18 |

384 |

-3,484 |

| 2018–19 |

-1,494 |

319 |

|

Effect of policy and parameter changes

on the Underlying Cash Balance since MYEFO

Source: Australian

Government, Budget strategy and outlook: budget paper no. 1:

2016–17, 2016, Statement 3,

Table 5, p. 3–24. |

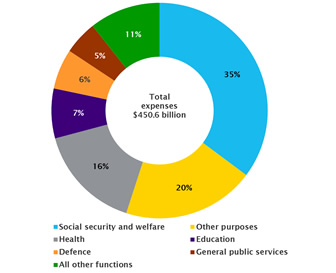

Where does government spending go

in 2016–17?

Estimates

of Expenses by function

|

$b |

% |

Social

security & welfare |

158.6 |

35.2 |

Health |

71.4 |

15.9 |

Education |

33.7 |

7.5 |

Defence |

27.2 |

6.0 |

General

public services |

22.7 |

5.0 |

All

other functions |

47.9 |

10.6 |

Other

purposes |

89.1 |

19.8 |

Total |

450.6 |

100.0 |

|

Expenses by function in 2016–17

Source: Australian

Government, Budget 2016–17 overview,

2016, Appendix B, p. 25. |

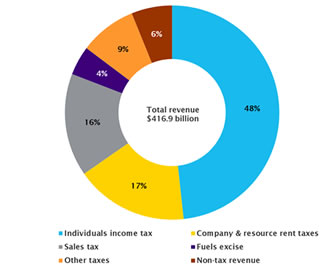

Where does the revenue come

from

in 2016–17?

|

$b |

% |

Individuals

income tax |

201.3 |

48.3 |

Company

& resource rent taxes |

71.0 |

17.0 |

Sales

tax (incl. the GST) |

64.8 |

15.5 |

Fuels

excise |

18.4 |

4.4 |

Other

taxes |

35.8 |

8.6 |

Non-tax

revenue |

25.6 |

6.1 |

Total |

416.9 |

100.0 |

|

Revenue in 2016–17

Source: Australian Government, Budget 2016–17 overview,

2016, Appendix B, p. 25. |

Attachment A

Table A1: Treasury forecasts of

major economic parameters (per cent)

|

|

2014–15 |

2015–16 |

2016–17 |

2017–18 |

2018–19 |

2019–20 |

|

Real GDP

|

|

|

|

|

|

|

|

Budget

2015–16

|

2.5 |

2.75 |

3.25 |

3.5 |

3.5 |

|

|

MYEFO

2015–16

|

2.2 |

2.5 |

2.75 |

3.0 |

3.0 |

|

|

Budget 2016–17

|

2.2 |

2.5 |

2.5 |

3.0 |

3.0 |

3.0 |

|

Employment

|

|

|

|

|

|

|

|

Budget

2015–16

|

1.5 |

1.5 |

2.0 |

2.0 |

2.0 |

|

|

MYEFO 2015–16

|

1.5 |

2.0 |

1.75 |

1.5 |

1.5 |

|

|

Budget 2016–17

|

1.6 |

2.0 |

1.75 |

1.75 |

1.25 |

1.5 |

|

Unemployment Rate

|

|

|

|

|

|

|

|

Budget 2015–16

|

6.25 |

6.5 |

6.25 |

6.0 |

5.75 |

|

|

MYEFO 2015–16

|

6.0 |

6.0 |

6.0 |

5.75 |

5.5 |

|

|

Budget 2016–17

|

6.1 |

5.75 |

5.5 |

5.5 |

5.5 |

5.5 |

|

Consumer price index

|

|

|

|

|

|

|

|

Budget 2015–16

|

1.75 |

2.5 |

2.5 |

2.5 |

2.5 |

|

|

MYEFO 2015–16

|

1.5 |

2.0 |

2.25 |

2.5 |

2.5 |

|

|

Budget 2016–17

|

1.5 |

1.25 |

2.0 |

2.25 |

2.5 |

2.5 |

|

Wage price index

|

|

|

|

|

|

|

|

Budget 2015–16

|

2.5 |

2.5 |

2.75 |

2.75 |

3.25 |

|

|

MYEFO 2015–16

|

2.3 |

2.5 |

2.75 |

2.75 |

3.0 |

|

|

Budget 2016–17

|

2.3 |

2.25 |

2.5 |

2.75 |

3.25 |

3.5 |

|

Nominal GDP

|

|

|

|

|

|

|

|

Budget 2015–16

|

1.5 |

3.25 |

5.5 |

5.25 |

5.5 |

|

|

MYEFO 2015–16

|

1.6 |

2.75 |

4.5 |

5.0 |

5.25 |

|

|

Budget 2016–17

|

1.6 |

2.5 |

4.25 |

5.0 |

5.0 |

5.0 |

|

Terms of trade

|

|

|

|

|

|

|

|

Budget 2015–16

|

-12.25 |

-8.5 |

0.75 |

|

|

|

|

MYEFO 2015–16

|

-10.2 |

-10.5 |

-2.25 |

|

|

|

|

Budget 2016–17

|

-10.3 |

-8.75 |

1.25 |

0.0 |

|

|

Source:

Australian Government, Budget strategy and outlook: budget paper no. 1:

2015–16, 2015, Statement 1,

Table 2, p. 1-7, Statement 2, Table 1, p. 2-5; S Morrison

(Treasurer) and M Cormann (Minister for Finance), Mid-year economic and fiscal outlook 2015–16, 2015, Table 1.2, p. 3, Table 2.2,

p. 9; Australian Government, Budget strategy and outlook: budget paper no. 1:

2016–17, 2016, Statement 1,

Table 2, p. 1-8, Statement 2, Table 1, p. 2-6.

All online articles accessed May 2016.

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Entry Point for referral.