Introduction

On 26 February 2022, the United States and its allies announced they would remove selected Russian banks from the SWIFT global financial messaging network. Exclusion from SWIFT has been described as ‘the nuclear option’ of financial sanctions, and will have far-reaching consequences for the global economy and trade.

What is SWIFT?

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a Belgian based messaging network used by banks to send and receive information, such as money transfer instructions. Over 11,000 financial institutions around the world are members of SWIFT and use the network to transfer cross-border payments. SWIFT must comply with European Union (EU) regulations.

Each member institution of SWIFT has a unique ID code. For example, ANZ Australia’s SWIFT code is ANZBAU3M. This code allows ANZ and its account holders to receive payments from an overseas customer or vendor even if they use a different bank (see Figure 1).

Figure 1: how SWIFT works

Source: M Thakur and D Vaidya, ‘Full Form of SWIFT’, Wall Street Mojo website, n. d.

If a bank is excluded from SWIFT, it means the bank and its account holders cannot easily send or receive payments from overseas. If all the banks in a country are excluded from SWIFT, it would severely restrict the country’s ability to trade because importers could not easily pay for imports and exporters would not be able to conveniently receive payments for exports.

As an analogy, a country’s exclusion from SWIFT is like a person being banned from using credit and debit cards. While the person can still purchase groceries with cash, it restricts where the person can shop and makes everyday business transactions much more cumbersome.

In 2021, an average of 42 million messages (cross-border transactions) per day were sent through the SWIFT network.

What is the nature of the SWIFT ban?

Some Russian banks will be removed from SWIFT. At the time of writing, the EU has confirmed seven Russian banks, including the Russian central bank, will be disconnected from 12 March 2022.

An EU official told Reuters:

All these banks that we have listed under SWIFT... they are all based on their connection to the state and the implicit connection to the war effort. We have not gone for a blanket ban across the whole banking system.

Radio Free Europe, a US government funded news organisation, commented:

Notably, the list does not include Russia's biggest bank, Sberbank, or Gazprombank, in order to allow EU countries to pay for Russian gas and oil deliveries.

Precedents of SWIFT ban

Russia’s exclusion from SWIFT can be compared to the sanctions imposed on Iran or North Korea.

From 2012 to 2016, almost all Iranian banks were delisted from SWIFT as part of Western sanctions over Iran’s nuclear program. It is estimated Iran lost half of its oil export revenues and 30% of foreign trade due to the ban. Iran was reconnected to SWIFT in 2016, but some Iranian banks were suspended again from accessing the network in 2018.

In 2017, North Korean banks were banned from using SWIFT. The ban further restricts North Korea’s access to the global financial markets.

Russian response to the SWIFT ban

In 2019, then-Russian Prime Minister Dmitry Medvedev said in a media interview that Moscow would consider Russia’s exclusion from SWIFT as an act of war.

Nikolai Zhuravlev, a member of the Russian parliament, said:

if Russia is disconnected from SWIFT, then we will not receive [foreign] currency, but buyers, European countries in the first place, will not receive our goods - oil, gas, metals and other important components of their imports.

Al Jazeera reports:

… the impact [of the SWIFT ban] could be blunted if the listed banks were limited to those already sanctioned and Russia’s central bank was given time to transfer assets elsewhere, said one former senior Russian banker, who spoke on condition of anonymity.

“If it is the banks that are already sanctioned, it doesn’t really make a difference. But if it is the top 30 Russian banks then that is an entirely different matter,” he said.

At the time of writing, Russia has enacted several early measures to prevent capital leaving the country.

Short term consequences of the SWIFT ban

The seven Russian banks to be disconnected from SWIFT are already targeted under the 2014 sanctions imposed following the Russian annexation of Crimea but do include some of Russia’s largest banks. Some analysts believe the SWIFT ban is largely a symbolic measure.

CNN reports the sanctions will put the Russian ‘fortress economy’ to the test. Russia’s exclusion from SWIFT will curb its ability to conduct international transactions, which will likely destabilise its currency, reduce market confidence, lower trade volume, and possibly even lead to a mass-scale bank run and hyperinflation in the country.

As a sign of the troubles ahead, some oil companies and sovereign wealth funds (including BP, Shell, and Australian Future Fund) have announced plans to sell their holdings of Russian assets.

Potential long-term consequences of Russia’s SWIFT ban

It is likely Moscow anticipated it would be subject to Western sanctions and took measures to neutralise them. However, it is unclear if Moscow anticipated the severity of sanctions.

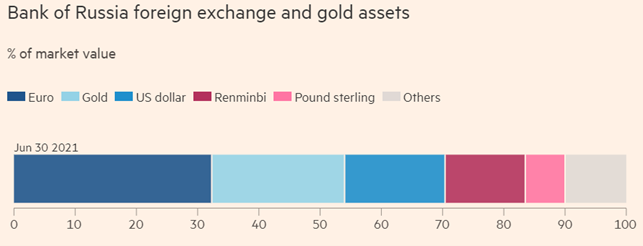

Since the 2014 Russian annexation of Crimea, the Russian central bank has amassed approximately US$630 billion worth of foreign currency reserves, with a significant portion of the reserves not denominated in USD (see Figure 2).

Moscow has planned to use these reserves to stabilise its economy. However, Russia’s exclusion from SWIFT will hamper its ability to use its reserves to buy Russian ruble from abroad and ‘prop up’ its value. A US official said in an interview:

This [SWIFT ban] will show that Russia’s supposed sanctions proofing of its economy is a myth. The $600 billion-plus war chest of Russia’s foreign reserves is only powerful if Putin can use it.

Figure 2: composition of Russian foreign currency reserves

Source: Financial Times, ‘A global financial pariah: how central bank sanctions could hobble Russia’, 27 February 2022.

In February 2022, Russia and China proclaimed there are ‘no limits’ to their strategic cooperation and subsequently signed new gas and oil deals estimated to worth US$117.5 billion.

In 2021, Russian Foreign Minister Sergey Lavrov spoke to the Chinese media about their ‘need to deviate from West-controlled international payment systems’:

We must lower risks of sanctions by means of enhancing our own technical self-dependence, transition to payments in national currencies and international currencies, which are alternative to the [US] dollar..

The Russian central bank developed its own international payment system (known as SPFS) in 2014. Reportedly, over 400 Russian banks are part of this alternative network.

Over the longer-term, it is likely that Moscow will increase usage of its own payment system SPFS or China’s Cross-Border Interbank Payment System (CIPS) as alternatives to SWIFT. This may accelerate both countries’ attempt to reduce reliance on the US dollar for international trade. For example, Gazprom Neft, a Russian oil company, said it will settle its transactions in Chinese Yuan.