Chapter 2 - Social aspects of home ownership

2.1

Access to adequate housing has long been viewed as a basic human right[1]

and is considered to be an integral factor in the enjoyment of other economic,

social and cultural rights.[2]

The UN Committee on Economic, Social and Cultural Rights has defined adequate

housing as encompassing: legal security of tenure; availability of services,

materials, facilities and infrastructure; habitability; accessibility; location

(allowing access to employment, health services, schools etc); cultural

adequacy; and affordability. Affordable housing is commonly viewed as 'essential

to the maintenance of a cohesive and just society' and 'an issue that

transcends political ideologies and goes to the heart of people's dreams and

ambitions'.[3]

2.2

The vast majority of Australian households either own their home (34 per cent)

or are paying it off (35 per cent). Renters comprise around 29 per cent of

Australian households, with 22 per cent renting privately, 5 per cent in public

housing and the remainder in other rental accommodation, such as caravan parks

or employer-owned housing.[4]

It is estimated that around 100 000 Australians are homeless.[5]

The preference for home ownership

2.3

Despite recent declines in the proportion of Australians who own or are buying

their home, home ownership continues to hold a special place in the Australian

psyche. Home ownership rates have long been higher in Australia than in other

affluent countries (Table 2.1). In surveys conducted in 1997 and 2000, 54 per

cent of respondents indicated that buying their own home was an important goal

for them to achieve within the next three years. Those with dual incomes or

high incomes 'do not express any stronger preference for home ownership than

low income households', suggesting that home ownership is a universal dream in Australia,

regardless of economic circumstances.[6]

2.4

The purchase of a home is the largest investment that most people will

make. Australians frequently view a mortgage as 'good debt', as purchasing a

home allows people to avoid paying 'dead rent', provides for a form of enforced

saving and is seen as a prudent investment, which will appreciate over time.[7]

2.5

Given these strong public aspirations, it is unsurprising that home

ownership has long enjoyed bipartisan political support. This is illustrated by

the following extracts from two classic political speeches.

The material home represents the concrete expression of the

habits of frugality and saving ... one of the best instincts in us is that which

induces us to have one little piece of earth with a house and a garden which is

ours; to which we can withdraw, in which we can be among friends, into which no

stranger may come against our will.

Sir Robert Menzies, 'Forgotten

People' speech, 1942

The land is the basic property of the Australian people. It is

the people's land, and we will fight for the right of all Australian people to

have access to it at fair prices.

Gough Whitlam, 'It's Time' speech,

1972

Benefits of home ownership

2.6

The appeal of home ownership is about more than just financial security.

Home ownership provides people with a sense of physical and emotional security

and safety. It is a personal space in which they can be themselves.[8]

The social commentator Hugh Mackay describes home ownership in Australia as 'the

most culturally obvious and accessible symbol of personal power, achievement

and control over the environment'. He adds that as 'people

feel that they are losing control over so many aspects of their lives, so the

need grows for the sense of control and authority which home-ownership brings'.[9]

Table 2.1: Housing

tenure: international comparison

|

|

Tenure type (% of total; recent) |

Average dwelling size m2 |

|

|

Owner-occupiers (1980)

|

Private renters

|

Social rental

|

Other

|

existing

|

new

|

|

Australia

|

69 (71)

|

22

|

5

|

2

|

132

|

186

|

|

Austria

|

57 (na)

|

17

|

23

|

3

|

|

|

|

Belgium

|

74 (59)

|

16

|

7

|

3

|

|

|

|

Canada

|

66 (62)

|

6

|

28

|

0

|

114

|

|

|

Denmark

|

53 (na)

|

18

|

19

|

10

|

|

|

|

France

|

56 (47)

|

21

|

17

|

6

|

88

|

103

|

|

Germany

|

43 (41)

|

51

|

6

|

0

|

87

|

102

|

|

Ireland

|

77 (na)

|

11

|

7

|

5

|

|

|

|

Japan

|

60 (60)

|

|

|

|

90

|

94

|

|

Netherlands

|

53 (42)

|

12

|

35

|

0

|

|

|

|

New Zealand

|

67 (73)

|

26

|

7

|

0

|

132

|

|

|

Sweden

|

61 (58)

|

|

|

|

90

|

86

|

|

Switzerland

|

35 (33)

|

59

|

6

|

0

|

|

|

|

United Kingdom

|

70 (58)

|

10

|

20

|

0

|

84

|

76

|

|

United States

|

69 (65)

|

29

|

3

|

0

|

157

|

200

|

Sources:

BIS

(2006, p. 40); Ellis and Andrews (2001, p. 9); Ellis (2006, p. 18); Lawson and Milligan (2007, p. 20).

2.7

Home ownership also provides a sense of social belonging and acceptance.

As one witness from the Urban Development Institute of Australia stated:

Home ownership offers many distinct advantages for individuals

and the wider community by enhancing our sense of place, our sense of self and

our connections with the broader community. We believe homeownership provides

tangible benefits, as well as many intangible benefits, beyond the simple

provision of shelter. It can provide social stability, economic reliability and

community assurance and can impact dramatically on an individual's aspirations

for independence and security.[10]

2.8

The Productivity Commission concluded that:

Access to affordable and quality housing is central to community

wellbeing. Apart from meeting the basic need for shelter, it provides a

foundation for family and social stability, and contributes to improved health

and educational outcomes and a productive workforce. Thus it enhances both

economic performance and 'social capital'.[11]

2.9

While recognising that many of these social benefits are also provided

by affordable, high quality rental housing, the Commission cited research that

indicated that they tend to be larger for home owners. In particular, the report

found that:

- owner occupiers are likely to have stronger incentives than

renters for civic involvement;

- less frequent relocation, due to the security of tenure provided

by ownership, minimises disruption of social networks and children's education;

and

- home ownership enhances self esteem, in turn reducing the

incidence of socially disruptive behaviour and promoting physical wellbeing.[12]

2.10

It should be noted that many of the social benefits of home ownership

appear to be related to security of tenure as opposed to the actual act of

owning a home. It might therefore be argued that rental leases with longer and

more secure tenure, as are common in Europe (Table 2.1), may be an alternative

way of generating some of the social benefits attributed to home ownership for

those for whom this may not be an achievable or realistic option. Rental may be

a more suitable option for very mobile workers, and labour market flexibility

requires some mobile workers who can move to parts of the country where demand

is strongest.[13]

The increase in casual and part-time work together with the move in a number of

sectors to shorter term contracts also means that there is a growing section of

the working community who lack the long-term financial security required for a

mortgage. It could be argued that home ownership is sometimes overstressed

in Australia, to the extent that renters may feel like they have 'failed' to

achieve ownership.[14]

2.11

To the extent to which we seek to bestow the social benefits of

security, well-being and connection to community that are associated

with home ownership, we need to be mindful in developing and pursuing policies

that aim to increase housing affordability that we do not forget the equity

issues for those who cannot aspire to own their own home. We therefore need to

ensure that housing affordability does not come at the expense of rental

affordability, and that we take an integrated policy approach to meeting our

communities' housing needs. This issue is addressed in more detail in Chapter 10.

2.12

We also need to be mindful that to be truly affordable the cost of

housing needs to take into account not only the cost of purchase, rental or

mortgage repayments but also the cost of living in that particular

housing—including the cost of transport to work and to access social services

and community life, as well as the cost of utilities such as heating and

cooling. These factors are discussed in more detail in chapters 5 and 11.

Changing aspirations

2.13

While the social benefits of home ownership were almost universally

acknowledged by those providing evidence to the inquiry, a number lamented the

fact that housing had in recent years become a 'speculative industry':

...our generation...see housing differently from our parents, not as

something that you consume, pay off and is the right size for your

household—the right number of bedrooms—but increasingly as an investment good. There

is a whole industry out there selling books, magazines and television shows all

about this wonderful thing called your investment.[15]

2.14

Some witnesses considered this to have contributed to rising house

prices in Australia and the resultant housing stress. For example, Professor Troy

argued that:

Those processes which are now embedded in the situation helped

feed and create the philosophy that if you could only get into housing it would

be a sure way to make a quid. That was fed on by the coincidental changes in

the financing industry. It was fed on by the real estate industry. It was fed

on by the newspapers that flogged houses—the money-making supplements to the Sydney

Morning Herald are a classic illustration...So we ended up with a hoopla

situation... you were led to the view that you bought this house, you stayed in

it for a couple of years, you got a big capital gain and you moved on. And you

could spiral that up. You were also led to the view that you could take funds

out of the investment in your house and speculate in housing. This is a large

part of the psychology of why the market went the way it did in the past five

to six years and more.[16]

2.15

A number of witnesses and submissions also noted that housing standards

and expectations in Australia have changed significantly over the past 10–15

years. This was considered by many to have contributed to the increasing price

of 'starter homes' and affected the overall cost of housing.

The leading end of the housing market has

created very high standards and expectations. This inevitably also affects the

expectations and ultimately the price down to the lower or less affluent end of

the market. Houses overall have got much bigger (floor area per person) than 20

years ago. We have rumpus and family rooms, multiple bathrooms (the most

expensive room in the house on a cost per area basis), elaborate kitchens,

studies, numerous bedrooms, various quite expensive finishes. Many of these

aspirations have filtered down into the more modest end of the market.[17]

2.16

The size of houses has been growing while the size of households has

been declining. From 1994–95 to 2005–06 the average household size declined

from 2.69 to 2.51 persons, while the average dwelling size increased from 2.88

to 3.06 bedrooms. More than three-quarters of Australian households

occupied dwellings that had more bedrooms than needed to accommodate the

occupants.[18]

2.17

How much this situation was a consequence of home buyers demanding

bigger and better products, and how much it is was due to suppliers only

providing a 'McMansion' style product, was unclear to the committee. The issue

of supply of housing is discussed in Chapter 5 and the specific question of an

inadequate diversity of housing types in new developments is the subject of

Chapter 6.

Housing costs and poverty

2.18

A study by the National Centre for Social and Economic Modelling and The

Smith Family looked at the impact of housing costs on poverty in Australia. Measures of poverty are frequently based on

income alone, with the poverty line set at half the average family income of

all Australians. On this basis the study found that in 2000 approximately 13

per cent of Australians lived in income poverty.[19]

2.19

Once housing costs were taken into account however, the picture of

poverty changed. This is largely because home owners on low incomes (such as

elderly people on a pension) or low income earners in public housing, had

relatively low housing costs and, as such, were often better off than home

purchasers or private renters who may have been earning a higher income but

experienced much higher housing costs.

2.20

More Australian households (18 per cent) were considered to be in

poverty after housing costs were taken into account than if income alone was

considered (13 per cent). The types of families experiencing poverty also

varied when housing costs were taken into consideration. After-housing poverty

rates dropped for owner-occupiers, from 12 per cent to 8 per cent,

while the poverty rate faced by home purchasers increased from 8 per cent to 18

per cent once housing costs were taken into account. Taking housing costs into

consideration also had an impact on the risk of poverty across the life cycle,

increasing the risk of being in poverty for those aged 25–44 years (who are

generally starting a family and buying a home) from about 12 per cent

to 18 per cent.[20]

Impact of housing costs

2.21

Low income families devoting a large share of their income to housing often

make sacrifices to meet their housing costs, such as going without food, or

children missing out on school activities.[21]

Around a third of low income renters and about six per cent of low income home

owners also reported having to approach a welfare, community or counselling

agency for assistance. Similar proportions reported having to sell or pawn

personal possessions. (This is discussed further in Chapter 3.)

2.22

These survey results are consistent with

evidence provided by charitable organisations about the impact of housing costs

on families. For example, commenting on the results of a survey of 1250 people

presenting to the Salvation Army for emergency relief, Major Eldridge reported that:

...on top of the increasing utility costs across the country,

people do not have enough money left for school expenses—that was one that is

continually mentioned—food, clothing and other staples of life. [22]

2.23

Social welfare agencies consistently reported an

increase in the number of people accessing their services and a change in the

type of people needing assistance. For example the Northern Rivers

Social Development Council reported that:

The organisations such as neighbourhood centres across the

region have reported that there has been a change in clientele or in the character

of person that comes in to receive material assistance—that is, support to buy

food and other items essential for living. They are reporting to us that they

are finding firstly that they are getting pensioners starting to come in and

ask for support...Also there are increasing numbers of families, particularly

sole parents having to look after children, and people who are working. In the

past, it tended to be people who were not in the workforce, people who were, I guess,

your more traditional client of the welfare sector.[23]

2.24

Similarly, the Manager of the Casey North Community Information and

Support Service in Victoria, reported that:

...our agencies this year have assisted more than 220 families

with school expenses, 75 per cent of which had never accessed our agencies

before. Most of these families were experiencing housing stress.[24]

2.25

She also noted the impact of financial stress on other aspects of

peoples' lives, including family relationships and health:

A high number of clients have or are experiencing family

relationship breakdown as a result of their financial stress. Further to this,

at both agencies it is evident that an increasing number of clients dealing

with issues of financial stress are also suffering mental health problems. In

the last six months, statistics show that almost 20 per cent of clients

presenting to that program had relationship issues, and more than 25 per cent

had mental health issues, in particular depression and anxiety. It is also

noted by both of our organisations that people experiencing financial pressure

are often not able to address health issues due to lack of affordability. Poor

diet due to lack of funds also leads to poor health...[25]

2.26

In addition to these personal costs, the impact is also felt by the

broader community in social and economic terms. There are a myriad of studies

demonstrating links between socio-economic disadvantage and health outcomes. In

addition, children living in poor families have been found to have higher

injury rates, are likely to be hospitalised more frequently, are more likely to

become obese and have worse dental health than other children.[26]

Housing and specific populations

Older Australians

2.27

In 2005–06, 85 per cent of older Australians living in private dwellings

either owned (just over 79 per cent) or were purchasing (just over 5 per cent)

their home (Table 2.2). This pattern of home ownership is an important

component of the Australian welfare system, as it allows many older Australians

to live on relatively low incomes. In 1999, approximately 81 per cent of older

Australian households had an income that fell within the bottom two quintiles of

the income distribution (compared to 30 per cent of households with a reference

person aged under 65 years). However, the high rates of home ownership mean

that, on average, older households spend less of their income on housing costs.

For example, in 2005–06, older households spent around 7 per cent of their

gross income on housing costs compared to 14 per cent of gross income for all

households. [27]

Table 2.2 Tenure

type by household (%) 2005–06

|

|

Owner without a mortgage |

Owner with a mortgage |

Private rental |

Public rental |

Other tenure type |

|

All Australian

Households

|

34 |

35 |

22 |

5 |

4 |

|

Households with reference person

aged

65-74 years

|

75 |

8 |

7 |

6 |

4 |

|

Households with reference person

aged 75 years & over

|

85 |

3 |

5 |

4 |

4 |

Source: Australian Institute of

Health and Welfare (2008a).

2.28

The importance of home ownership in retirement is further demonstrated

by examining housing expenditure for older households who are renting. In 2005–06,

older households renting privately spent 36 per cent of their gross income on

housing, which represented the highest proportion of income spent on housing

costs for any age group or tenure type.[28]

According to the Treasury:

It is also the case that renters appear to have lower incomes

and lower retirement savings, which makes sense, and the consequence is that

renters have a lot less to spend on other things.[29]

2.29

Given the extent to which private rental costs impact disproportionately

on retirees who do not own their own home, there are grounds for the

Commonwealth to consider revising the support it provides to this group to

reflect better their circumstances (see recommendation 10.2).

2.30

Changes in the Australian housing system indicate that there may be very

different housing profiles among future generations of older Australians, with

larger proportions likely to enter retirement with a mortgage or renting

privately. This is shown by the data from the Australian Bureau of Statistics (ABS)

income and housing surveys conducted in 1995–96 and 2005–06 summarised in Chart

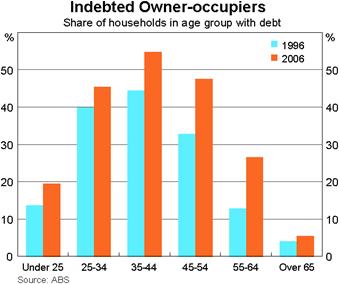

2.1.

Chart 2.1

Source: Battellino (2007).

2.31

Analysing these data further, Treasury reported that not only were more

older Australians still owing debt, but this debt was larger:

the proportion amongst older Australians with a mortgage which

was over $50 000 in real terms went from 30 per cent to 61 per cent and the

proportion with a mortgage over $100 000 went from 12 per cent to 38 per cent.

That is amongst the group with a mortgage. So that is a sizeable increase in

the level of housing debt of older Australians and that is of interest to us in

terms of retirement income policy...[30]

2.32

Despite more Australians entering retirement with a mortgage, Treasury

officials emphasised that in 2005–06, 75 per cent of 65–74 year olds still

owned their own home.[31]

Mr Tanton from the National Centre for Social and Economic Modelling proffered

one possible explanation for this, in that:

...once you get to the age of 65 and you hit retirement, if you still

have a mortgage then you can use a lot of the superannuation that you get to

pay off your mortgage. That does mean that you have a lot less in your

superannuation egg to be able to live off into the future.[32]

2.33

While to date there has only been a relatively small reduction in the

number of retired Australians who own their own home, research by the

Australian Housing and Urban Research Institute (AHURI) has projected that the

number of people aged 65 years and over living in low-income rental households

will more than double from 195 000 in 2001 to 419 000 in 2026.[33]

This has significant implications for both individuals and the broader

community. As noted by Treasury officials:

...there are...significant public policy issues around those who

have not done that [achieved home ownership] because of the importance of

homeownership as something which underlies the adequacy of retirement income...[34]

Housing and wellbeing

2.34

In addition to home ownership in retirement helping to maintain living

standards, suitable housing is also an important contributor to the health and

well-being of older Australians. As David Deans of the National Seniors

Association puts it:

The home has special significance for older people. Home is a

familiar place, in a familiar location where they know others and feel in

control of their lives. Studies examining older peoples' preferences for

housing have found that the majority wish to stay in their current home, or if

they had to move, at least remain within their current suburb, in a familiar social

environment. The health and well being of seniors is intrinsically linked to

housing.[35]

2.35

Home ownership enhances the ability of older Australians to remain living

in the community with assistance, which has been shown 'to be important to

people's capacity to maintain health and wellbeing'.[36]

Community care is the centrepiece of aged care policy, with the Australian

Government having invested significantly in community care approaches in recent

years. The Australian Association of Social Workers has emphasised that

approaches to ageing in the community are predicated, to some extent, upon home

ownership:

The nexus between health and housing

provision is well demonstrated in the area of aged care. Policies designed to

reduce the costs of premature admission to residential aged care by providing

services and case management for the frail aged or disabled person in

their own home, are predicated upon the individual's

having stable accommodation - preferably privately owned and capable of being

modified as necessary.[37]

2.36

Thus, as well as having implications for retirement and welfare policy,

the growth in the number of older Australians who are reliant on the private

rental market for housing also has implications for aged care policy. The

Director of the AHURI Southern Research Centre, Dr Faulkner, emphasised that 'for

many older people, the private rental market is not the appropriate place

because the housing is not suitable to their changing needs as they age'.[38]

Supporting people to remain in their own home and community often requires

modifications to the home environment, which in turn requires security of

tenure.[39]

This security is not generally available to those in the private rental market.

2.37

Community housing associations provided evidence about their capacity to

support 'ageing in place' by adapting existing housing, or by developing units

of appropriate housing nearby to give older tenants the option of maintaining

their neighbourhood connections as their mobility and support needs change. For

older Australians who own their own houses there are a number of barriers to

their ability to downsize or to access capital to modify existing housing to

meet their mobility needs. These issues are discussed in chapters 6 and 10

(recommendation 10.14).

Aboriginal and Torres Strait

Islander peoples

2.38

Home ownership among Indigenous households is around 36 per cent,[40]

almost half that of non-Indigenous households.[41]

Around 19 per cent of Indigenous households rent privately; 20 per cent rent

from a state or territory housing authority; and 9 per cent rent from an

Indigenous or mainstream community housing organisation.[42]

Significant regional variations exist, however. For example the Committee heard

evidence that only 0.4 per cent of Indigenous households are in the private rental

market in the Northern Territory and:

Indigenous people are significantly locked out of the private

rental market on income levels and the rent history criteria as well as because

of discrimination. Landlords and agents are able to auction rentals and they will

take the people who can pay the most and who physically look like the best

tenants. Indigenous people obviously must have education, life skills and jobs

to access that part of the housing rental market.[43]

2.39

According to AHURI, there is a high level of housing stress amongst

Indigenous Australians.[44]

The Australian Council of Social Service also emphasised the level of housing

disadvantage faced by Indigenous Australians:

...while low-income and disadvantaged Australians are at the most

severe part of the housing affordability crisis, you then need to go to another

level again in terms of severity to understand what is happening in Indigenous

communities around the country.[45]

2.40

Indigenous Australians also suffer from above-average levels of

substandard housing, overcrowding and homelessness.[46]

In 2001 nearly one-third of Indigenous dwellings were in need of major repairs.[47]

On census night 2001, 8.5 per cent of homeless persons were Indigenous[48],

despite Indigenous people constituting less than 1 per cent of the total

population. The average size of Indigenous households (3.6 persons) is also

greater than non-Indigenous households (2.7 persons)[49]

and up to 15 per cent of rural Indigenous homes are considered to be

overcrowded.[50]

2.41

Overcrowding was raised as a particular problem by NT Shelter who noted

that:

There are really high overcrowding rates

in Indigenous communities, in particular, and mobility between urban and remote

communities and vice versa is an issue.[51]

2.42

International studies have found that overcrowding increases the risk of

infectious diseases, such as meningococcal disease and respiratory infections,

and may impact on mental health.[52]

Recommendation 2.1

2.43

The committee recommends that, given the very high levels of housing

stress, overcrowding and homelessness experienced by Indigenous Australians, all

levels of government should give priority to addressing their high level of

unmet need for public and community housing under all exiting programmes and

the National Rental Affordability Scheme.

People with disabilities

2.44

Around four million Australians had some form of disability in 2003[53]

and, according to the 2006 census, just over four per cent of the Australian

population, or around 822 000 people, needed daily assistance with basic

activities such as self-care, mobility or communication.[54]

Seventeen per cent of people with disabilities (under age 65) reside in public

housing; 13 per cent own their own home or have a mortgage; 16 per cent are

private renters; 16 per cent are boarders; and 13 per cent live rent free.[55]

2.45

According to research by the Australian Housing and Urban Research

Institute Southern Research Centre:

...people living in households where one or more persons has a

disability are poorer, have much lower incomes, are much more likely to be in the

rental market and are much less likely to be homeowners. They have

significantly greater levels of housing stress than the population overall...

We are talking about people on the disability support pension

and the carers pension—very, very low incomes—who are struggling with high

housing costs, often in excess of 60 per cent of their gross household income.

That has a significant impact on their quality of life and their ability to

gain access to a whole raft of services that should be supporting them with

their disability.[56]

2.46

As with older Australians, many people with disabilities will require

housing adaptations to assist them to continue to live in the community. This

is difficult without secure housing tenure. There was evidence presented to the

committee by the community housing sector of the preparedness and capacity to

both adapt housing and provide greater security of tenure (see recommendation 10.13).

People with mental health problems

2.47

It is estimated that one in five Australians will experience a

significant disruption to their mental health and wellbeing at some time during

their lives, with 3-5 per cent of the population experiencing serious,

ongoing illness requiring treatment.[57]

2.48

People with a psychiatric disability are at particularly high risk of

experiencing housing problems and form a significant proportion of the homeless

population.[58]

Research conducted in Perth in 2000 found that around 49 per cent of the

residents in Supported Accommodation Assistance Program services on the day of

the survey were diagnosed with a mental illness. The same survey found that 46

per cent of inpatients in public mental health acute units could have been

discharged if there had been suitable community alternatives.[59]

A study conducted by the AHURI into stable housing for

people living with a mental illness found that 'stable housing improved health

and well being, increased independence, enhanced social relationships and led

to better mental health'.[60]

Shelter WA argue that, in order to achieve and maintain housing tenure, people

with a mental illness need to: feel secure and safe in their physical and

social environment; have access and proximity to a range of services, including

family, social and cultural networks; treatment and support services; and

transport; and have secure tenure that is sufficiently flexible to allow them

to move between independent housing and support options without loss of

continuity of care or tenancy.[61]

The issue of the best way to provide stable and secure housing for people

suffering from some form of mental illness requires further investigation.

2.49

The policy of de-institutionalisation has led to people with mental

health issues taking up an increasing proportion of the public housing stock.

This is discussed in chapter 10.

Conclusion

2.50

Access to appropriate, affordable, housing is a fundamental human right,

which 'is essential for individual, family and community wellbeing'.[62]

While many Australians have done well out of the housing market there is a

growing pool of people who cannot access affordable housing, appropriate or

otherwise. Those most at risk are often also the most vulnerable in our

society, such as Indigenous Australians and people living with a disability.

2.51

In developing policy options to promote access to affordable housing it

is crucial that we give due consideration to those groups for whom owning a

house may not be a viable option, and ensure that we take an integrated

approach to delivering both affordable home ownership and affordable rental.

2.52

Given its importance in promoting and maintaining a functional, stable

and just society, housing should not be considered just another commodity. Many

of the social benefits we see flowing from home ownership – such as security,

connection to community and control over one's lived environment – can also be

conferred through more secure tenancy models. This issue is discussed in more

detail in Chapter 10.

2.53

Governments at all levels have an important role to play in ensuring

that all members of the community, regardless of means, can access appropriate

and affordable housing. Community housing providers, who have made this aspect

of social housing their central product, have also demonstrated that they can

play a key role in providing a secure home to those otherwise socially

excluded.

Navigation: Previous Page | Contents | Next Page