Qualifications and competence

3.1

This chapter discusses current qualification requirements, proposals to

lift the education standards and qualifications of financial advisers,

assessment of knowledge and competence, and continuing professional development.

In considering various proposals, the committee has focussed on personal advice

for Tier 1 financial products.[1]

Current regulatory requirements

3.2

The committee received significant evidence during the inquiry calling

for the qualifications of financial advisers to be increased as a way of

improving the standard of advice provided to consumers. Evidence was also

received to indicate that strong consideration should be given to creating a

framework to mandate ongoing professional development.

3.3

The committee has considered relevant recommendations from the

final report of the FSI. The final report noted that:

Consumers should have the freedom to take financial risks and

bear the consequences of these risks. However, the Inquiry is concerned that

consumers are taking risks they might not have taken if they were well informed

or better advised.[2]

3.4

As discussed

in Chapter 1, the final report of the FSI recommended that standards of

financial advice should be improved by lifting adviser competency

(Recommendation 25) and better aligning the interests of firms and consumers

and enhancing banning powers (Recommendation 24).

3.5

Through its submission, ASIC informed the committee about current

regulatory requirements, which include:

-

the overriding obligation in the law on Australian Financial

Service (AFS) licensees to ensure they and their representatives are adequately

trained and competent to provide financial advice; and

-

that all advisers must, as a matter of law, comply with these

training standards unless they fall within certain limited exceptions.

3.6

The Corporations Act 2001 requires AFS licensees to:

-

comply with the conditions on their AFS licence (s912A(1)(b));

-

maintain competence to provide the financial services covered by

their licence (s912A(1)(e)); and

-

ensure that their representatives are adequately trained and

competent to provide those financial services (s912A(1)(f)).[3]

3.7

Regulatory Guide 146 Licensing: Training of financial product

advisers (RG 146) sets out ASIC’s guidance on the minimum training

standards for financial advisers and how advisers can meet these training

standards.[4]

3.8

The requirements in RG 146 include the following:

- Educational level requirements: to give advice in relation

to Tier 1 products an individual must have the equivalent of a diploma under

the Australian Qualifications Framework (AQF). The level of education currently

required to provide advice on Tier 2 products is broadly equivalent to a

Certificate III under the AQF. These requirements apply for both general and personal

advice.[5]

- Knowledge requirements: All financial advisers providing

financial product advice to clients must have specialist knowledge about the

specific products they provide advice on and the markets in which they operate.

Any financial adviser who advises on Tier 1 products must also satisfy a

generic knowledge requirement, which includes training on the economic

environment, operation of financial markets and financial products.[6]

- Skill requirements: If the financial adviser provides

personal advice they must also meet the skill requirements. As the level and

type of skill varies so much for general advice, RG 146 has not mandated the

skill requirements for financial advisers who only provide general advice.[7]

- Monitoring, supervision and Continuing Professional Development

(CPD): RG 146 does not prescribe any period during which new entrants

to the industry must be supervised and there is no prescribed quantum of

continuing professional development. Instead, AFS licensees are required to

nominate an appropriate quantum for CPD, based on a financial adviser’s

activities and experience.[8]

3.9

The Department of the Treasury explained the relationship between the

requirements in the Corporations Act 2001, the regulatory guides and the

responsibilities of the AFS licensees:

The regulatory regime in Australia...requires licensees to

fulfil certain obligations, including taking reasonable steps to ensure that

its representatives comply with laws; that licensees provide efficient, honest

and fair financial services; and that they also ensure that their representatives

are adequately trained and competent to provide financial services...ASIC in

enforcing laws provides regulatory guidance to the industry to set out how it

might view what is adequate training...They provide additional information for

licensees for them to be able to comply with the law.[9]

Concerns about RG 146

3.10

Evidence put to the committee during the inquiry indicates that there is

a high degree of concern that RG 146 does not deliver appropriate standards. The committee

received submissions and oral evidence during hearings that was critical of the

RG 146 requirements[10]

and the varying standards of compliance.[11]

The potential for RG 146 requirements to be met through completion of a

short training course, possibly only requiring a few hours of study, was a

common concern.[12]

The committee was informed that while the training requirements for financial

advisers can be met in three days, the training requirements for professions

such as engineers, lawyers, accountants, doctors and dentists range upwards

from three years.[13]

3.11

ASIC submitted that in its view, there are numerous and fragmented

approaches to interpreting and implementing the requirements in RG 146, and that

training courses vary significantly in terms of content and quality. ASIC also advised

that there is no consistent measure of financial adviser competence.[14]

3.12

The FPA submitted that the training obligations in RG 146 are based on

the definition of financial product advice in the Corporations Act 2001 and

therefore are focused on training on financial products, rather than building

competencies in providing financial advice. In addition, the FPA informed the

committee that there are problems with how the training is delivered, and that

the requirements of RG 146 may not be keeping up with changing markets.[15]

3.13

FINSIA submitted that in its view, RG 146 lists topics that any training

program should cover, yet it does not specify the volume or complexity

of the coverage required.[16]

The Finance Sector Union of Australia (FSU) conducted a survey of 29 financial

planners, which found that 22 out of the 29 financial planners surveyed did not

consider RG 146 to be a satisfactory qualification.[17]

3.14

The FSU also submitted that:

Currently RG 146 places the onus on licensees to implement

policies and procedures to ensure they and their advisers undertake continuing

training. These policies and procedures can vary from organisation to

organisation and inherently create standards that are inconsistent across the

nation.

While there may be localised value in creating these at an

organisational level, creating national requirements and expectations removes

any localised interpretation and facilitates national enforceable standards

consumers can refer to.[18]

3.15

Dr Deen Sanders, Chief Executive Officer of the Professional Standards

Councils informed the committee that:

...before the Corporations Act was introduced there were at the

time six providers of qualifications in financial services. Six months after

the Corporations Act and RG 146...was introduced there were 432 providers,

including ex-hairdressing colleges, who saw the opportunity. This is the

challenge that emerges in education: introducing wholesale, industrywide change

just tends to lead to a massive flight to the bottom and increased competition

in providers.[19]

Proposals to lift standards of training

3.16

This section outlines proposals for improved training standards for

financial advisers. The discussion notes proposals developed in response to the

committee's 2009 inquiry into financial products and services, and proposals by

ASIC and others to the current inquiry.

Proposals prior to this inquiry

3.17

In 2009 the committee conducted an inquiry into financial products and

services in Australia. During that inquiry, ASIC raised concerns about the

training and competency of financial advisers.[20]

The inquiry noted a considerable amount of evidence to suggest that improved training

standards for financial advisers were required,[21]

and recommended that:

...ASIC immediately begin consultation with the financial

services industry on the establishment of an independent, industry-based

professional standards board to oversee nomenclature, and competence and

conduct standards for financial advisers.[22]

3.18

The government response to the 2009 inquiry included a proposal to

establish an expert advisory panel to review training standards and professional

standards in the financial advice industry. In November 2010 an Advisory Panel

on Standards and Ethics for Financial Advisers was established and in 2011 the

advisory panel made recommendations for the introduction of a new governance

framework for improving training, professional and ethical standards in the

financial advice industry.[23]

3.19

In 2011, ASIC published the findings of a consultation process in

Consultation Paper 153 Licensing: Assessment and professional development

framework for financial advisers (CP 153). CP 153 proposed introducing a

mandatory examination for financial advisers, as well as a requirement for

advisers to complete regular knowledge updates. The committee understands that work

on the CP 153 proposals was put on hold to enable industry to implement

the FOFA reforms.[24]

3.20

In 2013, ASIC published findings of a separate consultation process in

Consultation Paper 212 Licensing: Training of financial product

advisers—Update to RG 146 (CP 212). CP 212 proposed raising the level of

the training standards for financial advisers, to the knowledge and skill requirements

in RG 146 and increasing the educational levels for those providing financial

advice on both Tier 1 and Tier 2 financial products.[25]

3.21

The proposals in CP 153 and CP 212 were supported by broad-based advice

AFS licensees, consumer bodies and training organisations, while industry

bodies, insurance groups and stockbrokers raised concerns including:

-

that an examination was not a sufficiently sophisticated mechanism

for assessing competence;

-

the level of educational requirements;

-

the staged implementation process and grandfathering provisions;

and

-

costs to implement the proposed changes.[26]

ASIC's proposal

3.22

In its submission to this inquiry ASIC indicated that it had revised its

proposals for mandatory higher training standards for financial advisers in

response to comments made in relation to CP 212 and market developments. ASIC's

revised proposal for training standards is set out in Box 1 below and includes

training standards, assessment of competence and continuing professional

development. [27]

Box 1: ASIC's proposals for training standards

The educational level requirements for all financial advisers who provide personal advice

on Tier 1 products to retail clients should be increased. This includes financial planners

working in planning businesses and superannuation funds. It also includes stockbrokers.

From 1 July 2016, when accountants are required to hold a limited AFS licence, it would

also apply to accountants.

The mandatory minimum training standard should increase to a minimum degree

qualification in a relevant field. Relevant fields include financial planning, finance,

business, accounting or commerce, and that any relevant degree should cover the

knowledge and skills identified in CP 212.

This is a greater increase than the proposals ASIC consulted on in CP 212, which

supported an increase to degree-level qualifications (but not a full degree in a particular

field) for personal advice on Tier 1 products to retail clients. This level of education better

reflects the knowledge and skill requirements that financial advisers need to provide

competent personal advice on Tier 1 products to retail clients.

While a degree qualification would impose increased initial costs on financial advisers,

this would be consistent with the expectations of the community that advisers are

professionals. It should also, in combination with other efforts to increase ethics and

professional standards for financial advisers, result in better quality advice.

There would need to be an appropriate transition period for the introduction of increased

educational level requirements to allow time for courses to be developed, although we

note that there are a number of higher education courses already in the market.

Consideration also needs to be given to whether existing financial advisers should be

required to meet any increased minimum training standards.

ASIC, Submission 25, p.

22.

Other proposals and views

3.23

This section outlines other proposals and views on training standards

for financial advisers. Many submitters supported proposals to require a degree

qualification (AQF level seven) for financial advisers providing Tier 1

financial advice.[28]

3.24

In 2010 the FPA announced a requirement that all new members hold an

approved degree. The FPA also recommended that from January 2018 new financial

planners and financial advisers hold an approved degree to be eligible to

provide Tier 1 financial advice and have experience equivalent to one full

year within the last three years.[29]

The FPA set out proposals for curriculum requirements, including:

-

a minimum degree program (AQF level seven);

-

covering eight core knowledge areas each as discrete units of

study;

-

the equivalent of approximately 39 hours of contact time and

120 hours of non-contact time for each of at least the 8 core FPEC

subjects; and

-

assessment undertaken at a minimum AQF level seven.[30]

3.25

CPA Australia and Chartered Accountants Australia and New Zealand agree that

there are important benefits to increasing the requirements to degree level,

including that advisers would:

-

have broad, theoretical, technical and coherent knowledge as well

as the skills for professional work, rather than paraprofessional;

-

learn the skills to not only analyse but evaluate information;

-

have the skills to analyse, generate and transmit solutions to

unpredictable and sometimes complex problems; and

-

be able to communicate their knowledge, skills and ideas to

others.[31]

3.26

CPA Australia and Chartered Accountants Australia and New Zealand

suggested that in their view financial advice has a broader scope than

financial product advice and recommended that 'a comprehensive review is

undertaken to identify the knowledge and skills required to become a holistic

financial adviser.'[32]

They also called for findings from such a review to be a basis for a new

curriculum.[33]

3.27

Mr Robert Brown supported the introduction of a degree level

qualification for financial advisers and noted that this had been implemented

successfully in other professions such as the Chartered Accountants program,

which requires an appropriate undergraduate degree (not necessarily in

accounting), followed by an intensive diploma-style course in accounting

related disciplines.[34]

3.28

SPAA emphasised the difference between undertaking a complete degree and

completing separate units taken from an AQF level seven course, and called for

the introduction of a requirement that financial advisers have degree-level

qualifications:

SPAA believes it should be recognised that undertaking units

of study at AQF Level [seven] Bachelor Degree level is different to undertaking

an entire Bachelor degree. Undertaking a Bachelor degree is a cumulative,

knowledge building process in a particular area that allows a student to build

an in-depth understanding of a subject area as well as cumulatively improve

their ability to analyse and explain a subject. This is quite different to the

skills based training that the current RG 146 has embodied.[35]

3.29

The FPA informed the committee that 17 universities already offer

financial planning degrees, however the uptake of this degree is limited

because some employers only require completion of RG 146 which is a diploma

level qualification.[36]

3.30

ASIC and the FPA noted announcements by large AFS licensees regarding changes

to the training standards, including degree requirements and Certified

Financial Planner designations for their financial advisers.[37]

However, ASIC noted that the announcements, if implemented, will not completely

address the inadequacy of financial adviser training standards because:

-

the announced changes are voluntary;

-

the proposed higher training standards differ from licensee to

licensee;

-

the higher training standards do not cover the whole financial

advice industry;

-

the new arrangements involve extensive grandfathering provisions;

and

-

it is not clear how compliance with the announced higher

standards will be monitored and enforced.[38]

3.31

The Association of Financial Advisers (AFA) supported the introduction

of a degree level qualification for new financial advisers entering the

profession from December 2019. However, the AFA suggested that such a goal

may be difficult to achieve in the short term.[39]

3.32

The committee also notes evidence from submitters and witnesses that did

not support the introduction of a degree level qualification. Axiom argued that

a degree level qualification is theoretical and limited in relevance. Axiom did

not support the introduction of a degree level qualification.[40] Mr Peter Corrie argued that existing

educational requirements were adequate as, in his view, the percentage of

advisers involved with complaints or malpractice was low.[41]

3.33

FINSIA argued against a specific financial planning degree or vocational

diploma as they consider these specific qualifications would exclude those

wishing to move into the sector from other disciplines.[42]

There are not many entry-level adviser positions existing...it

is largely a career change and postgraduate degree. Financial services

providers, particularly the larger ones, will draw upon people who have

pre-existing financial services knowledge. They may have worked in a contact

centre at a bank or in a different sort of role. They may be progressed through

a para-planner type strategy before they move into a client-facing role.[43]

3.34

Mr Paul Moran informed the committee that he had similar concerns:

It should not be raised to a degree level...People who come

into financial planning tend to come in slightly older and one of the issues

with the undergraduate program that has been started is that no-one is

enrolling and a lot of the courses have been stopped. People are realising that

if they do an undergraduate degree in financial planning at 21 years, what

then? Where do I get a job as a financial planner?[44]

3.35

Instead of a degree level qualification, FINSIA proposed the following options,

both of which could be tested by a national exam:

-

A specific undergraduate degree (e.g. in finance, economics or

financial planning) and adherence to an accreditation framework, the latter

combined with two to five years of relevant experience; or

-

A non-specific undergraduate degree and adherence to an

accreditation framework, the latter combined with two to five years of supervised

mentoring by an employer.[45]

Committee view

3.36

The committee considers that little progress has been made to improve

the training standards of financial advisers since the committee's previous inquiry

and report in 2009. The committee accepts the view expressed by a number of

submitters and witnesses that increasing minimum training requirements are

insufficient on their own to comprehensively improve consumer outcomes.

However, the committee maintains that a suitable standard of education is an

important element in the system of defences.

3.37

The majority of evidence received by the committee in the current

inquiry supports raising the minimum training standard to a relevant AQF level

seven degree for financial advisers providing personal advice on Tier 1

financial products. The committee supports the findings of previous

reviews that there should be an independent body established to set and monitor

the educational framework that applies to financial advisers (discussed in more

detail in the section on the Finance Professionals' Education Council later in

this chapter).

3.38

The committee view is that this body should oversee not just the initial

education requirement to an AQF level seven standard, but also the competence

and theory requirements of a professional year. The professional year would be

administered by a relevant professional association.

3.39

An exam, to be set by Finance Professionals' Education Council, or FPEC,

would be the final threshold test prior to registration as a financial adviser.

This view is discussed in more detail in the next section of this chapter.

3.40

The committee notes the work undertaken by ASIC identified in CP 212 and

recognises that there will be relevant fields of study (such as financial

planning, finance, business, accounting or commerce) that may be common across the

various professional sectors involved in the financial services industry.

3.41

The committee's view is that the Finance Professionals' Education

Council should set core subjects to be undertaken by all students, and on

advice from the constituent professional associations, set sector specific

subjects that a student can choose to complete if they wish to become a member

of that particular professional group. As a minimum, the FPEC is likely to have

sub-panels working on the educational requirements for professional streams

including: financial planning, SMSF, insurance/risk and markets. The core and

sector specific subjects set by FPEC should cover both AQF level seven

education standards and the professional year to be administered by the

professional associations.

Recommendation 7

3.42

The committee recommends that:

- the mandatory minimum educational standard for financial

advisers should be increased to a degree qualification at Australian Qualification

Framework level seven; and

- a Finance Professionals' Education Council should set the core

and sector specific requirements for Australian Qualifications Framework level

seven courses.

Assessment of competence

3.43

This section outlines proposals for assessing the competence of

financial advisers. ASIC's proposal for a national exam, as well as other

proposals and views put to the committee during the inquiry are considered.

ASIC's proposal

3.44

A national exam to assess competence and deliver compliance with minimum

standards was proposed by ASIC. In its submission to the inquiry, ASIC argued that

in the past there have been significant issues with the consistency of training

and assessment and that a national exam is the most objective and efficient way

of assessing whether financial advisers can demonstrate competence and meet the

standards required of them. ASIC advised that implementation of this proposal

would require law reform and funding.[46]

Other proposals and views

3.45

Many submitters and witnesses supported the implementation of a national

exam.[47]

FINSIA noted that a national exam would ensure all participants would have to

meet the same technical knowledge benchmark.[48]

It was also noted that the national exam could be implemented more quickly than

other education requirements.[49]

3.46

The Superannuation Consumers' Centre advocated minimum entry level

standards in the form of a university degree combined with specialised learning

which would be assessed through specialist accreditation standards.[50]

3.47

CHOICE informed the committee of the advantages of requiring both the

degree and national exam:

We see an exam as a first step within a process. It is

something that can be set up relatively quickly compared to a long phasing in

of bachelor degree requirements and continuing professional development—all of

that infrastructure that needs to be developed to lift education and

qualification standards.[51]

3.48

Industry Super Australia and the Australian Institute of Superannuation

Trustees informed the committee that a national exam for financial advisers is

in place in the United States, the United Kingdom, Canada, Singapore and Hong

Kong.[52]

This was confirmed by ASIC's submission which noted that:

-

in the United States, to be a general securities representative,

a person must pass the Financial Regulatory Authority’s Series 7 examination;

-

in Canada, registered representatives dealing with retail

customers must complete an examination that is administered by the Canadian

Securities Institute;

-

in Hong Kong, a representative must pass an examination that is

administered by the Hong Kong Securities Institute.[53]

3.49

Some submitters and witnesses did not support a national exam on the

basis that it is not a suitable way of assessing practical competency in the

workplace.[54]

CPA Australia expressed concern that while exams might be an objective

method to ensure that advisers can demonstrate a minimum level of knowledge, an

exam will not ensure that a financial adviser has the combination of knowledge

and skills required to provide quality financial advice.[55]

3.50

Several submitters and witness raised concerns about the rigor of some

exam formats and argued for independently assessed, well-structured exams with

a mixture of multiple choice, long form answer and case study questions.[56]

3.51

The FPA did not support a national exam and submitted that in its view,

a national exam would not be required if a degree level qualification and an

education framework were implemented.[57]

Committee view

3.52

The committee recognises the value of a national standard being set

through the requirement that all financial advisers undertake a common exam.

While a valid and useful defence in the system, the committee does not believe

that an exam by itself is sufficient to drive ethical application of the

knowledge obtained through study. The committee view supports the contention

that competent and ethical application of knowledge and professional behaviours

is best developed via a structured mentoring program. The need for FPEC to allow for current participants in the industry to

have their knowledge and experience recognised through a process of Recognition

of Prior Learning is discussed further in this report at paragraphs 3.94 and

3.95.

3.53

The committee supports the concept of a professional year administered

by a recognised professional association in accordance with the requirements

established by the FPEC and in cooperation with the AFS licence holder. The

formal assessment of professional year outcomes undertaken by the professional

association would be complemented by an exam set by the FPEC and then conducted

at the end of the professional year.

3.54

The committee view is that the FPEC would be best placed to:

-

set parameters for a structured professional year that enables

professional associations to conduct both mentoring and assessment of

competence in a range of specified areas;

-

set an exam to assess theoretical and applied knowledge which

must be passed prior to a professional association recommending to ASIC that an

adviser be registered; and

-

select and monitor the work of external invigilators to

administer the exam.

3.55

The committee considers that FPEC would be best placed to establish a

policy on the setting and conduct of the exam, including a policy on

re-examination options available to an individual who fails to pass at their

first attempt. The committee also notes that the proposal to assess financial

adviser competence through a national exam was supported by many submissions

and witnesses to the committee's inquiry. The committee also notes that the

final report of the FSI did not recommend a national exam for advisers, however

the FSI suggested an exam could be considered if issues of adviser competency

persist.[58]

The committee considers that issues with financial adviser competence and

standards have been allowed to remain unresolved for too long and that a

comprehensive system of defences, including an exam, are warranted. The committee

has noted that an exam is part of the regulatory regime in a number of

comparable jurisdictions and therefore offers a precedent in the Australian

context.

3.56

Concerns were raised during the inquiry about the rigor of exams and the

integrity of the process and conditions under which they are conducted.

The committee observes that in other regulated sectors such as aviation and

maritime licencing, as well as some universities, exam invigilators are used to

ensure that exams are conducted in a rigorous way.

3.57

The Civil Aviation Safety Authority (CASA) has approved invigilators to

oversee aviation exams. The exams are presented on the approved invigilator's

computer that is stored in a secure examination room. The invigilator is

restricted to the functions of examination administration and supervision of

the examination sitting. The invigilator must not provide technical advice on

the examination.[59]

3.58

The Australian Maritime College also uses invigilators to supervise

examinations. Their role does not include marking papers or providing advice to

candidates about their performance. In addition, the invigilators do not have

access to the examination answers and do not retain copies of the questions.

This approach is designed to minimise the possibility of misconduct by

invigilators and is intended to be consistent with current practices of most

educational institutions in regard to invigilators.[60]

3.59

The committee view is that successful completion of the exam should be a

prerequisite for the professional association to make the recommendation to

ASIC that a financial adviser be listed on the ASIC register of financial

advisers. The committee therefore recommends that ASIC should only list a

financial adviser on the register when the nominated professional association

advises that a candidate has successfully completed the assessed components of

the professional year and passed the registration exam administered by an

independent invigilator.

Recommendation 8

3.60

The committee recommends that ASIC should only list a financial adviser

on the register when they have:

- satisfactorily completed a structured professional year and

passed the assessed components; and

- passed a registration exam set by the Finance Professionals'

Education Council administered by an independent invigilator.

Continuing professional development (CPD)

3.61

This section discusses proposals for CPD for financial advisers. The FPA

informed the committee about the importance of CPD:

It is not possible for a university program to train students

in all the attributes required for high quality financial planning practice.

Rather, initial education needs to be supplemented by further vocational

training and meaningful Continuing Professional Development (CPD) experiences

enabling individuals to critically evaluate progressive changes in financial

planning professional practice requirements, and to apply their knowledge

appropriately throughout their professional career.[61]

ASIC's proposal

3.62

In its submission, ASIC argued that initial and ongoing on-the-job

training, monitoring and supervision, as well as CPD are important parts of

competence. ASIC supported the introduction of:

-

mandatory ongoing professional education requirements for

financial advisers who give personal advice on Tier 1 products to retail

clients;

-

a minimum of 30 hours of relevant CPD each year, including at

least 15 hours of structured training; and

-

the introduction of mandatory supervision for one to two years of

new entrants to the financial advice industry who provide personal advice on

Tier 1 products to retail clients.[62]

3.63

ASIC noted that these proposals are consistent with the ongoing

requirements imposed on lawyers, accountants and tax agents.[63]

Other proposals and views

3.64

A number of submitters and witnesses supported requirements for periods

of work experience, mentoring for new advisers and CPD.[64]

Dean Evans & Associates supported mentoring of new advisers:

The real benefit for the adviser (and ultimately the client)

comes from this practical experience, gleaned from the “coal-face” of financial

planning and investment advice. That is why it is crucial to have new advisers

under the wing of more experienced advisers, for a considerable time, so that

(1) they may be trained emotionally to deal with clients throughout various

market cycles, and (2) learn to devise practical strategies for clients and so

nurture them through the worst of market cycles.[65]

3.65

SPAA highlighted the need for experience in specialist areas such as

SMSF advice and explained that it sets a minimum of two years’ relevant work

experience for its SMSF Specialist Advisor program.[66]

3.66

The FPA, Industry Super Australia (ISA) and the Australian Institute of

Superannuation Trustees (AIST) submitted that there is currently no minimum

experience requirement to be authorised to provide personal advice and that it

is up to each licensee to determine the supervision and experience

requirements.[67]

The FPA advised that it requires one year of supervised experience before an

adviser will be eligible to be a ‘Financial Planner AFP’ member, and three

years experience to be eligible for ‘CFP Professional’ membership.[68]

3.67

ISA and AIST recommended compulsory monitoring and supervision of new

entrants into the industry by the licensee. Thye also suggested that there

should be some limitation on specialised areas of practice during the period of

supervision to ensure consistency of experience for new entrants into the

industry.

3.68

FINSIA advocated for the supervision and mentoring framework first

suggested in CP 153 and noted that a period of supervision and experience is already

required by many employers as a way of managing risk.[69]

3.69

The FPA noted the requirements of the Tax Practitioners Board for CPD,

which include a minimum of 60 hours over three years with a minimum of seven

hours in one year. The FPA recommended that all financial planners and

financial advisers be required to meet minimum CPD requirements of 90 points or

hours over a three year period.[70]

3.70

Mr Paul Moran argued for a flexible approach suggesting an advanced

formal examination every three years or a total of 120 hours of approved CPD

each three years.[71]

3.71

ISA and AIST supported independently set annual CPD requirements

overseen by licensees covering professional and technical skills, regulatory

updates, ethics and professional conduct, and practice management and business

skills. ISA and AIST also submitted that:

In ensuring that advisers meet these requirements, there may

be merit in adopting a similar approach to that in the UK, which requires each

individual financial adviser who sells investment products, securities or

derivatives to have a current ‘Statement of Professional Standing’. The

Statement (which must be reviewed annually) indicates that they have completed

at least 35 hours of professional training each year, signed up to a code of

ethics and that they are up to date with changes in both industry and

regulation.[72]

3.72

The Australian Bankers Association offered the following suggestions:

Continuing professional development (CPD) should provide a

pathway for ongoing training and competency development and improvement. CPD

attainment could be received through a variety of modes, including face-to-face

and online channels, however, should focus on relevant knowledge and skill

learnings and mandatory ethics components. CPD should be completed to maintain

accreditation achieved by the financial adviser.[73]

3.73

SPAA advocated moving the CPD requirements out of RG 146 and tasking

professional associations with setting specific CPD requirements for their own

members. SPAA submitted that in its view, CPD would then be more targeted to

improving and challenging advisers’ skills, rather than being viewed as a

minimum compliance requirement by advisers and licensees.[74]

Committee view

3.74

The committee found that there is wide support to enhance the work

experience, supervision and CPD requirements for financial advisers as it

provides yet another systemic defence of consumer outcomes. The committee heard

a range of views about the level, number of hours and content of work

experience, supervision and CPD requirements. While ASIC's proposal appears to

provide a workable balance, the committee recognises that the professional associations

will have a primary obligation to comply with the PSC requirements. The

committee view is that while professional associations must administer an

appropriate level of continuing professional development to meet the PSC

requirements, each association should also work with the FPEC to achieve a

level of cross-industry standardisation.

3.75

The committee recommends that the government require professionals in

the industry to complete a mandatory program of professional development each

year administered by their respective approved professional association. Beyond

the professional year, if an AFS licence holder or the professional association

assesses an adviser as requiring additional supervision in some areas of

practice, this could be a recommendation made to ASIC for inclusion on the

register. Such actions would represent best practice for both the AFS licence

holder and professional association fulfilling their responsibilities under the

Corporations Act and Professional Standards legislation.

Recommendation 9

3.76

The committee recommends that the government require mandatory ongoing

professional development for financial advisers that:

- is set by their professional association in accordance with Professional

Standards Councils requirements; and

- achieves a level of cross industry standardisation recommended

by the Finance Professionals' Education Council.

Finance Professionals' Education Council

3.77

This section discusses the committee's consideration of setting,

maintaining and accrediting the qualifications and continuing professional

development standards that should be applied to financial advisers.

3.78

FINSIA submitted that the regulation of qualifications and continuing

education standards, as well as an exam, (if implemented) should be carried out

by an independent industry-led body. Membership of the body would include ASIC,

peak industry bodies with accreditation frameworks and educators, but no adviser

training businesses or training arms, to avoid possible or perceived conflicts

of interest.[75]

3.79

The FPA submitted to the committee that in its view:

The lack of an overarching framework to financial adviser and

financial planner education has led to a piece-meal approach developed and

added to over more than two decades, which contains unworkable, incompatible

and inappropriate requirements, as well as gaps in the holistic system needed

to ensure an increase in advice provider competency is achieved.[76]

3.80

The FPA informed the committee that the training obligations in RG 146 are

based on the definition of financial product advice in the Corporations Act 2001

and are therefore focused on training on financial products rather than

building the competencies required to provide financial advice.[77]

The FPA further submitted that in its view:

RG146 was developed in 1997 prior to the introduction of both

the Financial Services Reform (FSR) Act and the Future of Financial Advice

(FOFA) reforms. The changes introduced under these two regimes were so

substantial they have significantly changed the shape of the financial planning

profession and financial services industry more generally. The FPA argues that

basing any changes to financial adviser and financial planner education on the

existing structure of the RG146 will significantly undermine the objectives of

the change.[78]

3.81

The FPA argued for an approach that provides a clear set of minimum

education requirements, includes course requirements, course approval, CPD, experience

and on the job training and an adviser register.[79]

The FPA advised the committee that it has operated its own education council

since 2011 as a way increasing the standards of advice provided by its members:

In 2011, we established the Financial Planning Education

Council...an independent body chartered with the responsibility of raising the

standard of financial planning education and setting the standards for

accreditation of financial planning education programs.[80]

3.82

The FPA proposed that the current RG 146 be replaced with a broader,

more holistic industry wide framework for financial adviser and financial

planner education.[81]

3.83

The Superannuation Consumers' Centre proposed an option that included the

establishment of an industry

based, professional and competency standards body or board which would have:

-

governance by an independent chair and equal numbers of consumer

and industry representatives;

-

three yearly independent reviews;

-

adequate funding; and

-

responsibility for both competency standards and professional and

ethical standards.[82]

3.84

The Financial Services Council suggested the development of an Advice

Competency Standards Board (ACSB) that would oversee an adviser competency

framework with the following components:

-

education requirements (including ethics training);

-

continuing education;

-

and/or a national exam;

-

professional standards or a code of conduct;

-

experience requirements;

-

an enhanced register of advisers including employee

representatives;

-

a training/course register to enable advisers, licensees and

regulators to keep track of which courses meet ACSB requirements; and

-

powers to recognise professional associations.[83]

3.85

In contrast, the FPA argued for the administration of education

standards to be separated from the administration of professional and ethical

standards:

The expertise and structures required to develop, implement

and enforce professional and ethical standards, are fundamentally different to

those required for identifying, developing and implementing appropriate

education standards for financial advice providers.

A co-regulatory model should be implemented via a dual

holistic education and professional standards framework which includes:

- An

education framework - based on the existing Financial Planning Education

Council’s...National Accreditation and Curriculum framework, and

- A

professional and ethical standards framework - which leverages the existing

additional oversight of advice providers through membership of recognised

professional bodies.[84]

3.86

ASIC informed the committee that in its view the preferred approach

would be a single, independent body to set educational standards:

It should have the expertise to set the educational

standards. It should have the resources it requires to set those standards. It

should consult with all the relevant stakeholders and it should be independent

of the key interested parties, which are the industry and the education

providers.[85]

Committee view

3.87

The committee considers that to have multiple bodies administering the educational

requirements for financial advisers is not in the best interests of consumers.

The committee notes that some submitters suggested that a single body should

cover educational standards along with professional and ethical standards.

However, such a body does not currently exist and would have to be established.

In Chapter 4 the committee discusses options for bodies to oversee

professional and ethical standards. In Chapter 4 the committee concludes that

the PSC provides a suitable vehicle to regulate professional and ethical

standards without the need to create a new body.

3.88

The committee notes that the PSC is not currently fulfilling the

function of setting and maintaining educational standards, nor is it resourced

to do so. The committee therefore considers that a separate body is needed to

set and maintain educational standards for financial advisers.

3.89

The committee notes the existence of the Financial Planning Education

Council established by the FPA and considers that it provides a useful model as

it is controlled by a professional body and is industry funded. It operates

efficiently and at no cost to government. The FPA submission to the inquiry

indicated that the FPA would be willing to cede control of this council to a

governance model that included equal representation of members from other

professional associations.[86]

The council currently has four academic members, drawn by mutual agreement from

the 17 universities who provide courses for the financial services sector.

Given the failure to assure good outcomes for consumers highlighted in recent

inquiries, the committee considers that the council should also include a

consumer association representative and an ethicist.

3.90

The committee recommends that an independent Finance Professionals'

Education Council be established, and that it be controlled and funded by the industry

professional associations. The committee does not support membership of the

council being available to corporate AFS licence holders. The committee

considers that the Council's membership should include:

-

a member from each professional association that is operating

under a professional standards scheme approved by the PSC;

-

an agreed number of academics with relevant expertise;

-

at least one consumer advocate,

preferably two who represent different sectors; and

-

an ethicist.

3.91

The committee notes that transitional arrangements would be required

until the professional associations have established Professional Standards Schemes

under the PSC. The committee view is that during the transition period,

representation on the FPEC should be open to professional associations that

have individual members (as opposed to corporate members) working in the

financial services sector who intend to establish a Professional Standards Scheme

under the PSC.

3.92

In framing its recommendations, the committee has been mindful of the

need for transitional arrangements for individuals who are currently practicing

in the industry. The committee has received some evidence in submissions and

hearings about transitional arrangements for the recommendations in this report.

3.93

In respect to both educational standards and the assessment of

competence through the professional year, the committee notes that a variety of

transitional arrangements may be needed for financial advisers who are at

different stages of their careers. The committee also accepts the arguments put

forward by FINSIA that there is a case for allowing a transitional path for

people changing careers. The integrity of the profession will only be

maintained, however, if the extent of recognition of prior learning for both

cases is assessed in a structured and consistent manner.

3.94

The committee is aware that even if they do not hold formal tertiary

qualifications, years of practice has equipped many existing advisers with

the knowledge and experience to provide effective and ethical advice to

consumers. The committee view is that such advisers require a pathway to

transition to full registration. There may also be professionals seeking to

transfer from related fields into financial advice who already possess

satisfactory knowledge in relevant areas. A supplementary role for the FPEC

should therefore be to determine the Recognition of Prior Learning (RPL)

criteria for such pathways.

3.95

The committee view is that the FPEC should establish standard frameworks

for RPL of both AQF level seven and professional year assessment

requirements, as well as adjudicating on individual cases that fall

outside of standard parameters. The committee view is that when

considering RPL, the FPEC should take into account the length of time the

adviser has been in the industry, the scope and nature of the advice that the

adviser has been providing, the nature of the ASF licensee that the financial

adviser is working under and any sanctions or complaints (or lack thereof)

regarding the financial adviser’s demonstrated knowledge or past

conduct. To ensure the integrity of the profession, all advisers would

still be required to complete the agreed RPL professional year requirements and

pass the registration exam in order to be registered by ASIC. The committee

suggests that the FPEC should be able to implement a modified professional year

for existing financial advisers, that takes account of the experience of the

financial adviser where competence in the assessed areas can be demonstrated.

3.96

The committee recommends that the Finance Professionals' Education

Council establish and maintain the professional pathway for financial advisers

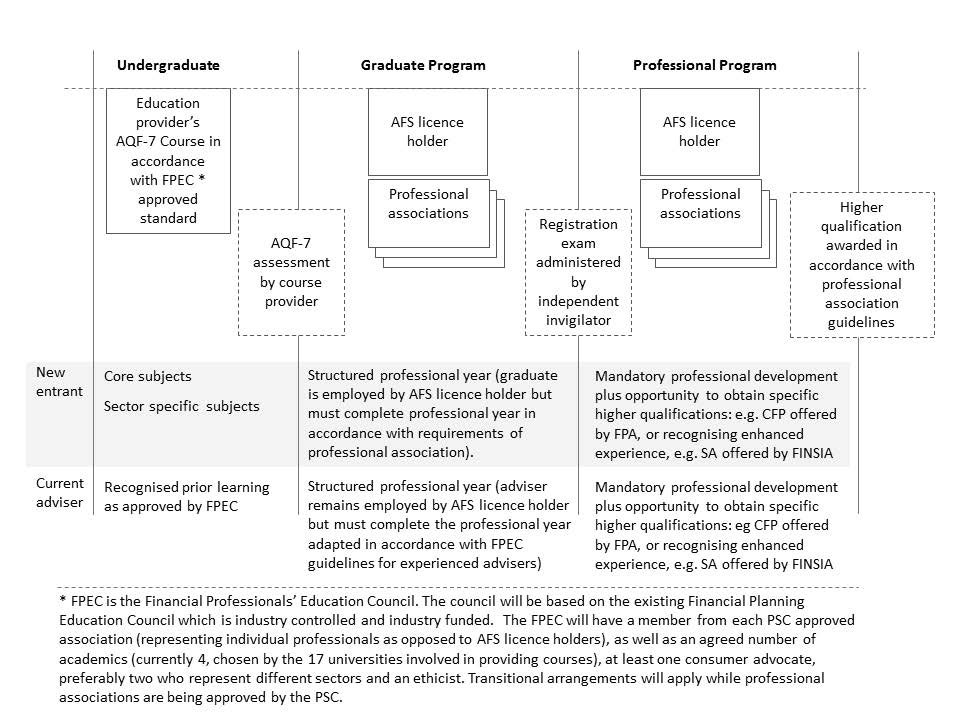

as outlined in the report overview and in Figure 3.1.

Recommendation 10

3.97

The committee recommends that the professional associations establish an

independent Finance Professionals' Education Council that:

- is controlled and funded by professional associations which

have been approved by the Professional Standards Councils;

- comprises a representative from each professional association

(which has been approved by the Professional Standards Councils), an agreed

number of academics, at least one consumer advocate, preferably two who

represent different sectors and an ethicist;

- receives advice from ASIC about local and international trends

and best practices to inform ongoing curriculum review;

- sets curriculum requirements at the Australian

Qualifications Framework level seven standard for core subjects and sector

specific subjects (e.g. Self-Managed Superannuation Fund services, financial

advice, insurance/risk or markets);

- develops a standardised framework and standard for the

graduate professional year to be administered by professional associations;

- develops and administers through an external, independent

invigilator a registration exam at the end of the professional year; and

- establishes and maintains the professional pathway for

financial advisers including recognised prior learning provisions and

continuing professional development.

Figure 3.1: Professional pathway for a financial adviser

Navigation: Previous Page | Contents | Next Page