CHAPTER 2

The inequity of fee deregulation

2.1

Fee deregulation is unfair and unpopular. The underlying contentions of

this reform package are that students who wish to attend a high prestige

university should expect to pay high fees and that graduates should pay more

for tertiary education because of the private benefit they receive. The

committee rejects this notion, and insists that equity must remain at the heart

of higher education policy.

We are in a global economy and a global market... Every other

developed country is increasing its investment in public education with public

funds for capital upgrades, new research programs and new research institutes.

It is somewhat astonishing to many people and to many students that we are the

only country that is seeking to reduce its investment in public education and

research at a postsecondary level.[1]

Fees will sky-rocket

2.2

It is clear that even under the revised higher education package, for

the vast majority of students and prospective students, the cost of higher

education will rise significantly. The scale of price increases facing students

was first signalled by the University of Western Australia's release of a

proposal, under a flat deregulated fee structure, to charge $16 000 per year

for base undergraduate degrees.[2]

2.3

The Queensland University of Technology (QUT) has subsequently published

scenarios for its fees, should the bill pass.[3]

Assuming a 20 per cent reduction in the Commonwealth Grant, QUT forecasts that

course fees will rise by an average of $11 186 across 22 undergraduate

degrees. The cost of a Bachelor of Creative Industries degree would increase

by 55 per cent, from $21 100 to $32 800, while students undertaking a combined

Bachelor of Fine Arts and Bachelor of Laws degree would pay $19 800 more than

the current price.[4]

2.4

In discussing the information available at this stage regarding price

increases, policy expert and economic modeller Mr Ben Phillips provided

evidence before the committee that increases are expected to vary from

university to university:

a university like the University of WA, one of the Go8

universities, is looking at prices of $16,000 and that would indicate a price

increase on their current fees of around 90 per cent. That is quite

substantial. QUT has gone for a lower increase of around 42 per cent, so they

are well and truly covering their losses from the 20 per cent reduction. It

will probably fall somewhere in there. You would say Uni of WA would be at the

higher end; QUT is more towards the lower end. In 2016, somewhere between 40

per cent and 90 per cent, perhaps a bit more for some unis and a bit less for

some others—broadly speaking, 50 or 60 per cent on average would not be

surprising.[5]

2.5

The committee is concerned that beyond 2016, it is unknown where price

increases could end. In evaluating the revised package, Professor Bruce

Chapman, an academic economist with extensive policy and research experience in

the area of contingent loans, noted:

.. there is a remaining and in my view a very important

further change needed [to this reform package], and this involves the notion

that institutions be able to set their own prices without government

involvement. To me this is highly contentious and requires further thought and

input...There are several important reasons for believing that full fee

deregulation in the Australian institutional and policy context would

potential[ly] lead, eventually, to very high course prices (and thus debts) for

students in some - perhaps many- areas of higher education.[6]

2.6

The committee heard evidence from the National Union of Students (NUS)

about discussions that occurred with many students across the country

concerning fee deregulation. NUS explained that:

Students have the highest awareness that I have seen around

fee deregulation and the quality of their education as well. When we were

talking to new students, mature-aged students, single mums and other parents,

students could articulately tell me what deregulation was and why they were

concerned... Students are saying that they are really concerned, because they

have no idea how much they could be paying by the end of their degree. They are

not sure if they will need to drop out, because they are not sure how much

their degree could be costing them.[7]

2.7

In its submission, La Trobe Student Union (LTSU) cautioned that with fee

deregulation, 'even Universities with a lower standard of teaching and

resources will price their fees as highly as possible'.[8]

The University of South Australia Student Association also noted that

'[universities] will be setting fees in an environment where the effect of

price on the consumer may not react as other markets.'[9]

2.8

Including the possibility of unrestrained student fees, considerable

concerns about the funding sustainability of the Government’s higher education

package. Professor Louise Watson, an education policy analyst and member of the

Base Funding Review 2011, made the point that the proposed reforms would

result in the government relinquishing control of the cost of higher education

while at the same time retaining full responsibility for it through

Commonwealth Supported Places (CSP) and funding HECS:

University Vice-Chancellors would henceforth decide how much

public money they wanted to receive. Whatever graduates cannot repay due to

price increases and declining graduate earnings, will be sheeted home to the

federal budget. As the ballooning HECS debt in the VET sector has demonstrated,

fee deregulation would simply make Australian higher education less

predictable, less affordable and less sustainable in the future.[10]

"Unsustainable" HELP DEBT will increase

2.9

Australia has a higher education system in which the contributions of

students to the cost of their university education are capped. The Higher

Education Contribution Scheme (HECS) was envisaged as a national insurance

system where the student paid a proportion of the cost of the course if - and

only if - they gained private benefits in the form of an above-average salary.

The proportion of the course that students would repay was initially set at

around 20 per cent. It was broadly supported by the public, in large part

because repayments commenced only when income rose to above-average levels and

thus, it could be argued, graduates were benefitting financially from their

higher education qualification. Later research showed that, within its modest

parameters, HECS did not deter students from enrolling in higher education.

2.10

The current government says its policy will increase students' share of

the costs of higher education to 50 per cent, but this goal does not require

removing the cap on fees. Indeed, it is likely that degree inflation will see

that proportion increase significantly.

2.11

It is unclear how the current government arrived at the proposition that

setting the student contribution to the cost of their higher education at 50

per cent is fair, reasonable or appropriate. Evidence received by the committee

from the National Tertiary Education Union (NTEU) demonstrates that the

Department of Education and Training:

will not release departmental modelling on fee deregulation

due to it having '...serious adverse consequences for the operation of the higher

education marker and the success of the Government's proposed reforms in this

area'.[11]

2.12

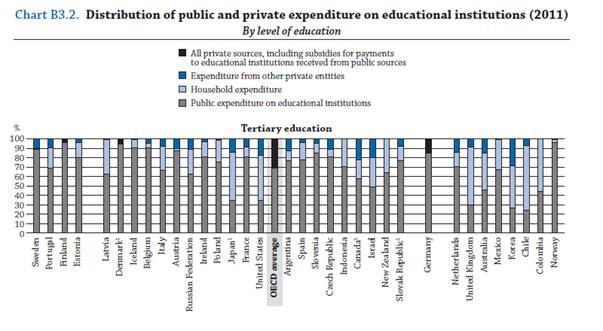

Australian students are already contributing a considerably higher

amount to their tertiary education than the majority of OECD countries. Figure

1 illustrates the private expenditure in tertiary education in OECD countries

in 2011.

Figure 1: Distribution of public and private expenditure on

tertiary education[12]

Even participants in this debate who support fee deregulation

argue that higher education and research require increased public funding.[13]

2.13

It is uncontested that any increase in the private contribution to

higher education in Australia will result in an increase in outstanding HELP

debt, something the Australian government already views as a problem. In

discussing unsustainable and rising costs in the 2014–15 Budget Higher

Education Reforms, the Department of Education noted that:

The value of student HELP debt is also estimated to rise to

around $29.9 billion at 30 June 2015, which is $5.4 billion higher than

projected for the same year at the 2011-12 Budget.[14]

2.14

Under these proposals it is inevitable that the amount of HELP debt that

will not be repaid will increase and that the system will become increasingly

unsustainable. As the Australia Institute has said:

Already, there are concerns about increasing HELP debt under

our current system. Facing increasingly large volumes of accumulated doubtful

HELP debt, future governments may be tempted to drop the repayment thresholds,

increase repayment amounts or introduce upfront. That would increase inequity

for the graduates and undermine HELP’s policy purpose. One could argue that

makes the changes unsustainable for the HELP system.[15]

2.15

Mr Ben Phillips also raised concerns about the likely increase in the

share of bad debt to beyond 23 per cent and where that could lead:

The current HELP debt in the long term is around $2 billion

per year, as the cost to government. If there was a doubling of fees and an

increase in the share of bad debt, you would expect that to at least double, if

not go beyond doubling. So I do not think $2 billion to $5 billion would be out

of the question.[16]

Unfair debt will result in social inequity

2.16

In addition to public policy consequences, the increased level of HELP

debt that will not be repaid will have a grave impact on individuals. Graduates

who are under-employed or unemployed or who take time out of the workforce will

be hardest hit by these reforms. Those with disabilities and those with

qualifications in particular low-earning disciplines such as the arts will be

especially disadvantaged. For the one in four university students who drop out

of their courses and leave university without a qualification, the prospect of

an income that hovers around $50 000 to $60 000 could mean a lifetime of debt,

as mandatory payments barely keep up with the interest on their loans.

2.17

There is no clear economic justification for public sector universities

to be allowed to use HECS, a government instrument, to raise substantial

revenue by unjustifiably increasing fees. Professor Chapman submitted that

under the proposed package:

An informed guess is that if Australian universities were to

charge the sort of prices that I believe many of them could under the planned

fee deregulation, the revenues received would in many cases far exceed the

costs of teaching. While there is little doubt that in many cases these sorts

of cross-subsidies already occur (particularly from the revenues received from

international students), the issue for me concerns the extent to which this can

be considered a "proper" use of the HECS instrument... That is, if it

is the case that fee revenues from price deregulation exceed considerably the

costs of teaching, it is arguable that this is an improper use of a government

instrument; basically put, it can be considered to be unfair.[17]

2.18

This may result in serious implications for graduates' life choices and

for the economy more generally. These include, for example, the capacity of

graduates to purchase a home or raise a family. A significant HELP debt would

be a factor taken into account by lending agencies and also, naturally, by

graduates themselves in deciding whether they are in a financial position to

take out a housing mortgage.

2.19

The impacts of the reform package are not limited to undergraduate

students. The Council of Australian Postgraduate Associations (CAPA) observed

that while discussion of the impacts of university fee deregulation has focused

on undergraduate students, it will also adversely affect higher degree students.

As CAPA explained:

where a fee of up to $3,900 per year is also charged for a

research degree as proposed by the [bill], the total debt will be compounded

over the 6 years as a postgraduate student. A science graduate starting with a

$33,300 Fee-HELP debt under the fee would end up with a final debt over $63,000

- almost double the amount they started with. [18]

2.20

NUS predicts that fee deregulation will impose 'unreasonable levels of

debt burden on millions of future students and graduates'.[19]

2.21

Many submissions were particularly concerned by the disproportionate

effect that higher debt is likely to have on female students, mature age

students, regional and rural students and students from lower socioeconomic

backgrounds.[20]

Tertiary student campaign group Australia Needs a Brighter Future argued that

the deregulation of fees will lay the foundation for the end of equity in

Australia's higher education sector[21]

resulting in 'unreasonable barriers for students whose parents cannot

financially support them into their mid-twenties and beyond.'[22]

LTSU also found it 'difficult to see how students from disadvantaged

backgrounds will be able to access a tertiary education in such a market'.[23]

The US system is not the way to go

2.22

Some participants in this debate have identified the United States system

as one that Australia should learn from and even replicate. Proponents say that

deregulating student fees will lead to US-like diversity, downplaying the

negative impacts of US-style higher education, particularly those relating to

inequality. While the US is home to some of the best universities in the world,

it also houses many of the worst. The US experience should be regarded as a

cautionary tale. In comparing the Australian and US systems, University of

Technology Sydney noted:

Australia graduates a similar percentage of young people as

the US college system, yet we have on average much higher quality. The US has

more than 10,000 colleges and universities, whose quality varies dramatically

from quite low standard schools to the small number of world leading

institutions such as Harvard and Yale. And further, in the fully deregulated US

market, fee levels have been rising at twice the rate of inflation for the past

decade and student debt is spiralling out of control.[24]

2.23

Student loan debt and fee inflation are significant social, economic and

political problems in the US. Student debt has quadrupled in the last ten years

and 38.8 million Americans have debts totalling more than

$960 billion.[25]

Student debt is now greater than credit card and automotive loan debt. The

National Centre for Education Statistics has found that:

Between 2001–02 and 2011–12, prices for undergraduate

tuition, room, and board at public institutions rose 40 per cent, and

prices at private non-profit institutions rose 28 per cent, after

adjustment for inflation.[26]

2.24

In its submission, the Australia Institute warns:

[t]he Minister wants to take our system... in the direction of

the US system. The evidence shows this would risk increasing social inequality.

It would also risk very large and wasteful fee inflation.[27]

The revised package does not come

close to undoing the inequity

2.25

The revised package includes some welcome amendments, specifically the

retention of the current measure for HELP debt indexation, the Consumer Price

Indexation (CPI), however, the revisions do not come close to undoing the

inequity of fee deregulation.

2.26

The introduction of a HELP indexation pause for primary carers of

children under the age of five who are under the minimum repayment threshold is

relatively minor in the context of the overall increase in costs that would be

incurred under the proposed reforms.

2.27

The government's introduction of the Structural Adjustment Fund is an

admission of failure and highlights the fundamental inequity that is at the

heart of this bill. The NTEU argued that:

The Structural Adjustment Fund has been introduced in

recognition that deregulation is likely to have a severely adverse impact on

regional and rural universities and those serving students that are highly

sensitive to the cost of attending university. The change is intended to

provide funding to assist providers in a transition to a post-deregulation

environment... However, the $100 million allocated falls well short of the $500

million which Universities Australia has calculated as the actual transitional

costs associated with such a radical change to the funding and regulation of

higher education.[28]

2.28

NUS submitted that the inclusion of $100 million over 3 years from 2015–16

for the Structural Adjustment Fund is simply an off-set of the government's

decision to not extend eligibility for Youth Allowance and Austudy.[29]

2.29

Regardless of where the allocated funds may be found to support the

government's decision to introduce the Structural Adjustment Fund, concerns

remain about the impact of the reform package on students from disadvantaged

backgrounds or those who are first-in-family university students who may be

deterred from higher education as a result of this package. In this context, Professor

Andrew Parfiit of the University of Newcastle discussed the impact on

communities to contribute to economies.

it is not necessarily the education we are providing for

people just to go into particular professions that is important; it is the

capacity that we have within our communities to innovate, have entrepreneurs,

have people with the skill levels that can provide the opportunities for growth

for the future where perhaps traditional industries are in decline and new

industries are emerging. I think we will do ourselves a disservice if we deter

people from taking up those opportunities that broadly higher education

provides rather than just specifically a discipline-based or a profession-based

approach.[30]

2.30

The Higher Education Participation (Access and Participation) Programme

(HEPAPP) that will replace the existing Higher Education Participation Programme

(HEPP) alters the assessment for a scholarship, such that grants will no longer

be based solely on low SES enrolments but the wider category of, students from

disadvantaged backgrounds. However, as NTEU aptly pointed out:

These new Scholarships are aimed at postgraduate and

undergraduate students from 'disadvantaged' backgrounds. While funding for

well-targeted equity programs and initiatives is always welcome, it should be

noted that this is not new funding as inferred by the Minister, but a

redirection of existing funding that inevitably will be spread more thinly.[31]

Who stands to benefit

2.31

Professor Louise Watson provided evidence to the committee that the

package would essentially result in offering universities a blank cheque:

It is unprecedented in public policy to invite a recipient of

public money to dictate how much they want to receive. I do not give pocket

money to my children on the basis of how much they want to receive; I give it

to them on the basis of how much I think they need and how much I can afford. I

think that those principles generally govern government financing and they

should be applied in the case of higher education.[32]

2.32

Mr Ben Phillips concurred with Professor Watson and highlighted to the

committee that one of his biggest concerns about the package was around the 'blank-cheque'

nature of deregulating fees.

With the uncapped fees, even though there is a supposed cap

at international fees, there is no reason is why they cannot be increased. I

see that there is a moral hazard here in that the universities effectively can

charge largely whatever they want. They will still get paid regardless,

guaranteed by the government. Who gets left holding the baby? Effectively, it

will be the government down the track. Many students of course will not pay it

back and some students will be aware of that. So really the fiscal consequence

that I am concerned about is the impact now on the government.[33]

2.33

Professor Bruce Chapman argued that under the package a student's debt

would far exceed the cost of teaching them.

So if it is true that in the presence of HECS institutions

could charge prices that are well beyond the costs of the teaching, and I think

that is possible. Even though we are not sure exactly what the costs of teaching

are, I would think it is very possible that in some parts of this so-called

market—it is kind of a combination market/public sector arrangement—you would

end up with students having HECS debts that cover much more than the actual

cost of teaching them. So the notion of unfairness comes into it.[34]

2.34

Graduate employment numbers three months after graduation are dismal at

the moment and graduate salaries are declining in real terms.[35]

As such, it is critical that any higher education reforms be focussed toward student

benefit and not higher education provider profit.

Committee view

2.35

The committee notes that fee deregulation as proposed in the HERR bill

is deeply unpopular among the Australian people. The committee heard extensive

evidence about the negative effects of the reform package: how high student

fees will go, how outstanding HELP debt will be increased, and how unfair debt

will lead to high and unfair levels on inequality.

2.36

The previous government had a clear commitment to increasing the

participation of a range of equity groups, including low-SES, regional and

remote students and Indigenous Australians. The committee is not convinced that

the Structural Adjustment Package and HEPP will go anywhere near maintaining

current levels of participation of equity groups, let alone increasing them.

2.37

The committee believes the HERR bill will continue to propel Australian

society down the low road of increasing inequality of access, opportunity and

outcomes that the Australian people neither need nor want. The committee is

particularly concerned that there is little doubt that the reforms will

accelerate wealth inequality in Australia – which would not only be socially criminal

but economically retrograde.

2.38

The committee is deeply concerned that the HERR bill does not stand to

benefit students in any way and is persuaded by evidence that the package is

unfair, unethical and unnecessary.

2.39

The committee notes that HERR bill is currently before the Senate.

Recommendation 1

2.40

The committee recommends that the HERR bill be rejected by the Senate.

Navigation: Previous Page | Contents | Next Page