Budget Resources

Gregory O’Brien

Australian Government debt levels have been increasing in

both absolute and relative terms since the Global Financial Crisis in 2008–09

and increased further to fund government health and economic support packages

in response to the COVID-19 pandemic. At the start of 2007, prior to the Global

Financial Crisis, Australian Government gross debt was under $52 billion.

Between 2007 and March 2020 total Australian Government Securities (AGS) on

issue increased to $580 billion, and is $897

billion as of 5 May 2023.

The 2023–24 Budget forecasts further increases in gross debt

to $1.067 trillion (36.5% of GDP) by the end of the 2026–27 financial year,

albeit at a slower pace than had been forecast in the October 2022–23 Budget (Budget strategy and

outlook: budget paper no. 1: 2023–24, p. 421). While these are the

highest levels of debt (relative to GDP) on issue by the Australian Government

since the 1950s, they remain well below Australian

historical peaks reached following the Second World War (p. 8) and

current government debt levels in many other developed countries.

Key terms used in the Budget when presenting Australian

Government debt figures are outlined below, followed by an overview of

Australian Government debt figures in the Budget based around 3 frequently

asked questions: how current levels of Australian Government debt compare to

the past; how they compare internationally; and who owns Australian Government

debt. A final section highlights where to find more detailed discussions of

debt in the Budget.

Australian Government debt issuance

and key terms

Australian Government debt is a key component of the Budget.

Government spending is funded either through receipts – primarily taxes – or

through borrowing. In the Budget, the difference between receipts and payments

is referred to as the cash balance, which had been in deficit (payments have

exceeded receipts) since 2007–08 prior to the estimated $4.2 billion underlying

cash balance surplus for 2022–23 reported in the 2023–24 Budget.

This financial year’s estimated underlying cash balance

surplus is not forecast to continue, with Treasury forecasting underlying cash

balance deficits through the medium-term to 2033–34, although the primary cash

balance (which adjusts the underlying cash balance for net interest payments)

is forecast to be in surplus from 2029–30 (Budget paper no. 1, p. 96). However, both the underlying cash

balance and the primary cash balance forecasts have improved over the

medium-term compared to the October 2022–23 Budget. The improved outlook means

that gross debt is now forecast to peak at 36.5% of GDP in 2025–26, five years

earlier than the 46.9% peak forecast in the October 2022–23 Budget for 2030–31.

The Australian Office of

Financial Management (AOFM) manages Australian Government debt issuance.

The AOFM issues 3 types of debt securities, collectively known as Australian

Government Securities (AGS):

Treasury Bonds: medium to long-term debt securities

that pay interest at a fixed annual rate every 6 months. These are the largest

type of AGS, representing 91.3% of AGS on issue by face value as of 5 May 2023.

Treasury Indexed Bonds: medium to long-term debt

securities that include adjustments for inflation. These represented 4.3% of

AGS on issue as of 5 May 2023.

Treasury Notes: short-term debt securities with

maturations up to one year. These represented 4.3% of AGS on issue as of 5 May

2023.

The total face value of AGS on issue at a given point in

time, which represents the total amount that will need to be repaid when all

extant AGS mature, is used as a measure of gross debt in the Budget. The AOFM publishes a weekly figure for total

AGS on issue, broken down into the 3 types described above, as well as more

detailed information in its data hub.

While gross debt is a good representation of the total

magnitude of outstanding debt, it may not be the best measure for analysing

debt sustainability depending on the financial assets available to service or

pay off this debt. For this reason, the Budget also provides figures for

Australian Government net debt, defined as ‘the sum of interest-bearing

liabilities less the sum of selected financial assets (cash and deposits,

advances paid, and investments, loans and placements)’ (Budget paper no. 1,

p. 249). While some of the investments, loans and placements are held by

government investment funds, including the Future Fund, holdings of equity,

including those held by these investment funds and the Government’s equity

investment in the NBN, are not included in the calculation of net debt.

Whether gross debt or net debt is a better measure of

government indebtedness will depend on the context of the analysis. The

difference between these measures is described in more detail when looking at

international comparisons of government debt, below.

Trends in Australian Government debt

The Budget provides historical data for a

range of budget aggregates back to 1970–71 in the Historical Australian

Government Data statement of Budget paper no. 1 (Statement 11). When comparing levels of debt across long periods of time, it is

useful to convert the dollar values of debt into a relative measure, usually

the ratio to GDP, to control for the impacts of price changes across the

economy. Figure 1 shows gross debt, represented by the total face-value of AGS

outstanding, and net debt, as a ratio to GDP over the last 50 years and

including Budget 2023–24 estimates through to 2026–27. It also shows total (gross)

interest payments on this debt for the same period, also as a ratio to GDP. The

estimates for gross and net debt for 2022–23 to 2025–26 contained in the

October 2022–23 Budget are provided for comparison.

Figure 1 Australian Government total

AGS on issue (gross debt), net debt, and interest paid

Source: Australian Government, Budget 2023–24: Budget Paper No. 1, 418–421, and October Budget 2022–23:

Budget Paper No. 1, 380–383.

Figure 1 shows that Australian Government debt fluctuated

around 20% of GDP from the early 1970s to the mid-1990s with one period of

sustained decreases in the late 1980s. Government debt then trended down between

the mid-1990s until the GFC in 2007–08, as the Howard Government prioritised

debt repayment and budget surpluses. From 2008–09, following the GFC and

associated government economic support packages, government debt has steadily

increased as a ratio to GDP.

The 2023–24 Budget forecasts the government debt to GDP ratio

will fall 3.9 percentage points from 38.8% in 2021–22 to 34.9% of GDP in 2022–23

as nominal GDP growth increased at a higher rate than gross debt. From 2023–24

to 2026–27 this ratio is forecast to increase slightly but both the level and

the growth is forecast to be much lower than had been forecast in the October

2022–23 Budget. In dollar terms, gross debt is forecast to increase to reach a

trillion dollars in 2025–26, reaching a peak over the forward estimates of $1.106

trillion in April 2027 (Budget

paper no. 1, p. 244). While current and forecast debt to GDP ratios are

high relative to recent history, they are still well

below the peak of over 120% of GDP reached following the Second World War (p.

8).

The increase in the level of Australian Government debt

following the GFC did not see a commensurate rise in the amount of interest

paid because interest rates on Australian Government debt fell over the period,

largely offsetting the increase in the level of debt. However, interest rates on

Australian Government debt have risen steeply since 2022. This increase has

been common to many countries globally in response to inflationary pressures

and the tightening of monetary policy by central banks. This increase in

interest rates has led to an increase in the estimates for Australian

Government interest payments as a proportion of GDP, which are estimated to

increase from 0.7% of GDP in 2022–23 to 1.0% of GDP in 2025–26. As Australian

Government debt is composed of a portfolio of fixed rate securities with

maturities extending up to 2051, the interest rate on this debt responds slowly

to changes in market interest rates. So, the full effect of an increase in

market interest rates takes many years to be fully reflected in the interest

paid on AGS.

International comparison of General

Government debt

Despite increases in Australian Government gross and net

debt since the GFC, levels of both remain relatively low when compared to other

similar countries. The International Monetary Fund (IMF) publishes data on

General Government sector gross and net debt across countries. The IMF approach

includes all levels of government (for Australia, the Australian Government,

state and local governments), which allows for more meaningful comparison

across countries with different structures of government. Figure 2 shows IMF

estimates of gross debt and net debt for 2022 across several advanced countries

from the IMF’s Fiscal

monitor April 2023 publication.

Figure 2 IMF General

Government gross and net debt (% of GDP) estimates, 2022

Source: International Monetary Fund (IMF), Fiscal

Monitor April 2023: On the Path to Policy Normalization (Washington,

DC: IMF, April 2023), Tables A7 and A8.

Figure 2 shows the important difference between gross debt

and net debt when comparing across countries. Countries with significant relevant

financial assets, such as Canada (held by public pension plans) and Norway

(held in a sovereign wealth fund) have much lower levels of net debt than gross

debt once these financial assets are incorporated. This is also relevant to a

lesser extent for Australia, where some of the $250.5 billion managed by the Future Fund and other smaller

government investment funds has contributed to a

widening gap between gross debt and net debt over time (p. 1).

There is variation across countries in the degree to which

these financial assets are held to meet future specified expenditure purposes,

and some debate as to whether it is appropriate to consider these assets as

offsetting government debt. Gross debt is a more consistent measure across

countries, as there is less variation due to different social security regimes.

As Figure 2 shows, despite the increase in both Australian

Government net debt and gross debt since 2007–08, the level of government debt

compared to international peers remains relatively low. The Australian General

Government gross debt to GDP ratio is less than half that of the United States,

and less than a quarter of that of Japan. Australia’s gross debt to GDP ratio is

lower than any of the larger economies in the G7 and only Canada has a lower net

debt to GDP ratio. Australia has a government debt ratio closer to that of other

smaller economies such as South Korea and New Zealand.

Holdings of Australian Government

Securities

Australian Government debt is owned by a range of Australian

and international investors. The AOFM provides information on the share of AGS

on issue owned by non-residents on a market-value basis. Under the Guarantee of State

and Territory Borrowing Appropriation Act 2009, the AOFM was

tasked with establishing a Public

Register of Government Borrowings. As the AOFM has no powers to compel

financial intermediaries to disclose the beneficial owners of AGS they

administer, the register has limited information on the countries of residence

of foreign owners of AGS.

The Reserve Bank of Australia (RBA) started purchasing

significant amounts of AGS on the secondary market as

part of its monetary policy response to the COVID-19 pandemic to support

financial markets and maintain loose monetary conditions when interest rates

approached zero. This led to the RBA holding a growing share of the total AGS

on issue. The RBA ceased purchasing AGS on 10 February 2022, and in its May

2022 Statement

on Monetary Policy decided:

[…] the Board will not reinvest

the proceeds of maturing government bonds and expects the Bank’s balance sheet

to decline significantly over the next couple of years as the Term Funding

Facility comes to an end. The Board is not currently planning on selling the

government bonds that the Bank has purchased during the pandemic. (p. 3)

This decision means that RBA ownership of AGS should slowly

recede as the existing AGS owned by the RBA mature. As total outstanding AGS is

forecast to increase over the period, these maturing bonds will need to be

absorbed by the resident and non-resident markets for AGS. Given the duration

of these bonds, this process is likely to slowly occur over the next decade,

with the longest duration AGS bond held by the RBA due to mature

on 21 April 2033.

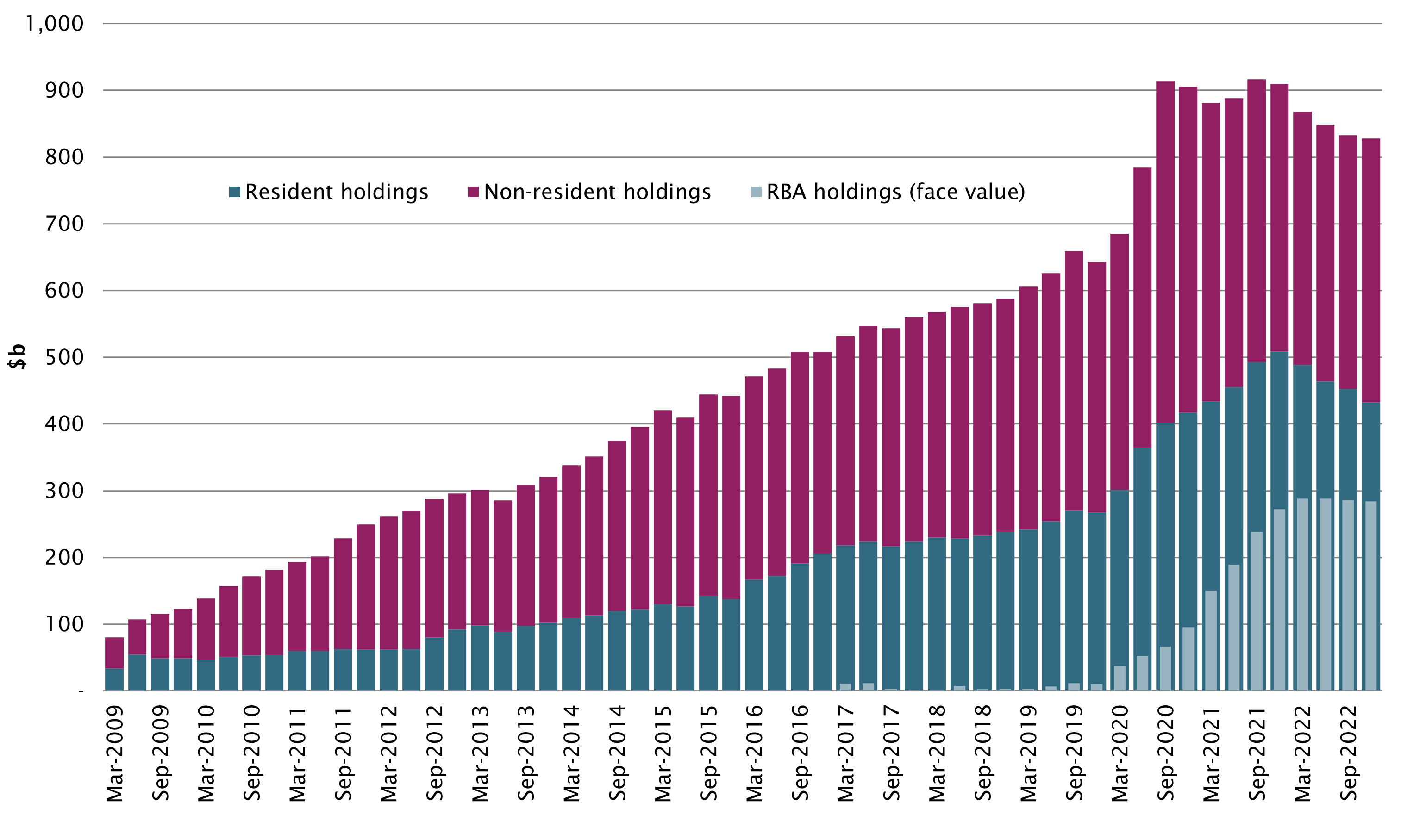

Figure 3 below shows estimates for the ownership of AGS by non-residents,

the RBA and other domestic owners. The figures for resident and non-resident

holdings are based on the market-value of AGS holdings (that is, the

value of the securities on the secondary market) while the RBA figures are

published in face value (that is, the amount the Government pays back at

maturity) (Budget paper no. 1, p. 243). RBA holdings of AGS are

considered resident holdings.

The chart shows resident holdings of AGS have steadily

increased over the last decade and non-resident holdings have fallen as a

proportion of the total while RBA holdings increased between March 2020 and

February 2022 when the RBA’s bond purchase program finished. This trend has

reversed somewhat over the past 12 months as non-resident holdings have

remained steady while resident holdings have fallen. The reduction in the

proportion of AGS held by non-residents reduces the risk of interest rate

volatility associated with capital flight, when non-resident investors sell

overseas assets and repatriate the money, often in response to market

volatility. The decrease in the overall level of AGS held by both resident and

non-resident investors at market value over the past 12 months shows the impact

that rising interest rates have had on the value of bond portfolios. The RBA

figures, published at face value, are not marked to market, so do not show the

same decline.

Figure

3 Estimated resident and non-resident holdings of AGS (market value) and

Reserve Bank Australia holdings of AGS (face value)

Source: Parliamentary Library calculations based on Australian Office of

Financial Management, Non-Resident Holdings of AGS, and Reserve Bank of Australia, Holdings of Australian Government Securities and Semis.

Where to find additional discussion

of debt in the 2023–24 Budget

While this article provides a broad overview of the debt

figures contained in the Budget, more detailed discussion is provided on

several debt-related topics in Budget paper no. 1:

- Budget

paper no. 1 – statement 3: fiscal strategy and outlook provides

the medium-term (through to 2033–34) projections for the underlying cash

balance (p. 96), gross debt (pp. 110–111) and net debt (p. 113), and how these

projections have changed since the October 2022–23 Budget.

- Budget paper no. 1 – statement 3 also includes an outline

of the Government’s new green bonds issuance slated to start in mid-2024, which

will see the AOFM issue green bonds to fund government projects with climate

change or environmental objectives (Box 3.4, p. 112).

- Budget paper no. 1 – statement 7: debt statement provides

detailed figures on Australian Government debt parameters over the forward

estimates (to 2026–27).

- a complete breakdown of Treasury Bonds on issue is provided in

Table 7.4 (p. 246).

- non-resident holdings of Australian Government Securities is

discussed on page 248.

- a breakdown of liabilities and assets included in net debt is

provided on page 249.

- yield curve assumptions (interest rate assumptions for Treasury

Bonds of different maturities) used in the Budget and how they have changed

since the October 2022–23 Budget are provided on page 251.

- Statement 8: forecasting performance and sensitivity analysis

discusses how changes in underlying assumptions impact key budget forecasts.

The sensitivity analysis for movements in yields (pp. 272–273) shows how

alternative assumptions of 10-year bond yields would lead to different

assumptions for the path of gross debt levels.

All online articles accessed May 2023

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Entry Point for referral.