4

August 2017

PDF version [397KB]

Amanda

Biggs

Social Policy Section

Introduction

The financing arrangements for health care in Australia are

complex, reflecting both historical developments unique to Australia and its federal

system of government.

Australia's health system is a mix of public and private

health care. Broadly, publicly-financed health care primarily refers to

services funded through government programs such as Medicare and the

Pharmaceutical Benefits Scheme, as well as public hospital services that are

jointly funded by the Commonwealth and the states and territories. In addition,

some health services are funded through private health insurance, individual

out-of-pocket payments, and third party insurers such as motor vehicle insurers.

It is not mandatory to have private health insurance cover.

Under Medicare,

all Australians are eligible for subsidised medical treatment and free treatment

as a public patient in a public hospital. However, private health insurance

provides a choice of doctor, can help with the cost of treatment in a private

hospital, and the cost of ancillary

treatments not covered by Medicare such as dental, optical and physiotherapy.

This quick guide outlines the broad arrangements around

private health insurance that exist today. It provides brief information on the

industry and regulatory arrangements, private health insurance membership and

types of cover, government surcharges and incentives, and key features of

private health insurance in Australia.

Current private health insurance

arrangements

Private health insurance sector

The origins of private health insurance lie in the friendly

and mutual societies that developed in the 19th century, which, for a

contributory fee, provided members with a range of medical services. These

entities were typically linked to a specific industrial sector, such as railway

workers, police or teachers.

Today’s private health insurance sector comprises some 37 registered

private health insurers, a mix of not-for-profit insurers (mutual

organisations) and for-profit insurers. This number also includes restricted

membership funds which only provide cover to members of a specified

industry or group. Private health insurers must comply with regulatory and

prudential standards, including those listed below. Private health insurers can

operate nationally, or be based in a particular jurisdiction or region.

According to industry regulator APRA, in 2015–16

private health insurers paid nearly $19 billion in benefits to members (see tab

‘Fin Perf’). Of this $14 billion in benefits was paid for hospital treatment which

includes treatment in private hospitals, public hospitals, day hospitals and

hospital substitute treatment (see tab ‘Bens by Cat’). Revenue (primarily from

premiums, but also from investments) totalled around $22.5 billion. Management

expenses totalled around $1.9 billion, or 8.5 per cent of total revenue (see

tab ‘Fin Perf’).

Legislation and governance

Private health insurance is regulated primarily under the

Private

Health Insurance Act 2007 , the Private Health

Insurance (Prudential Supervision) Act 2015, and related rules and regulations.

Private health insurance is administered by the Department of Health with

prudential oversight provided by the Australian Prudential

Regulation Authority (APRA), a role previously performed by the Private

Health Insurance Administration Council. Consumer complaints are handled by the

Private

Health Insurance Ombudsman, which sits within the Office of the Commonwealth

Ombudsman and produces a State

of the Health Funds report annually. Broader consumer and competition

issues are dealt with by the Australian

Consumer and Competition Commission (ACCC), which also provides annual

reports on the sector to the Senate.

Types of private health insurance

There are two types of private health insurance: hospital,

and general treatment (sometimes called ancillary or extras)—or these can be

combined. Private health insurance does not cover services that are provided

out of hospital and which are covered by Medicare, such as general practitioner

services. Private health insurance coverage for the cost of ambulance

services varies across jurisdictions. Private health insurance is available

for singles,

couples, and families.

Private hospital cover

Private hospital insurance only covers services for which a

Medicare benefit is payable, as listed in the Medical Benefits Schedule

(MBS). Services not listed in the MBS, such as plastic surgery for cosmetic

reasons, are not covered by private health insurance. Hospital cover includes hospital

substitute treatment, such as hospital-in-the-home care (subject to medical

approval).

Medicare covers 75 per cent of the listed Medicare fee for hospital

services; private hospital insurance covers the remaining 25 per cent (known as

‘the gap’). Private hospital insurance may cover part or all of any amount charged

above the gap, and some or

all of the costs of accommodation and operating theatre fees, drugs,

prostheses, and diagnostic tests, depending on the policy and whether the

insurer has agreements

with hospitals.

Broadly, four levels

of private hospital cover are offered, with varying levels of exclusions

or restrictions:

- public cover—covers the lowest benefit permitted in a public

hospital, but the patient retains a choice of doctor

- basic cover—low level benefit covering a minimal number of

services with a range of exclusions and out-of-pocket costs

- medium cover—includes some restrictions and exclusions, but

covers a broader range than basic cover and offers lower benefits than top

cover and

- top cover—comprehensive; must cover all services listed in the

MBS.

The National

Health Reform Agreement allows patients with private hospital insurance who

are admitted to a public hospital to choose whether to be admitted as a public

or private patient. A recent report

from the Independent Hospital Pricing Authority shows that the proportion

of public hospital activity funded through private health insurance has grown

in recent years and suggests this is driven by public hospitals encouraging patients

to use their private cover. This has prompted the Australian

Private Hospitals Association to express concern that this may drive up the

cost of private health insurance premiums, while the Health

Minister Greg Hunt said he would be concerned if this lengthened public hospital

waiting lists.

General or ancillary cover

General treatment (or ancillary or extras cover) provides benefits

for out-of-hospital services such as dental, optical, physiotherapy, natural

therapies and non-Pharmaceutical Benefits Scheme medicines.

Membership levels

According to APRA

statistics, as at March 2017 some 11.4 million Australians had private

hospital cover (around 46.5 per cent of the population) and 13.5 million had

ancillary or general cover (around 55.5 per cent of the population).

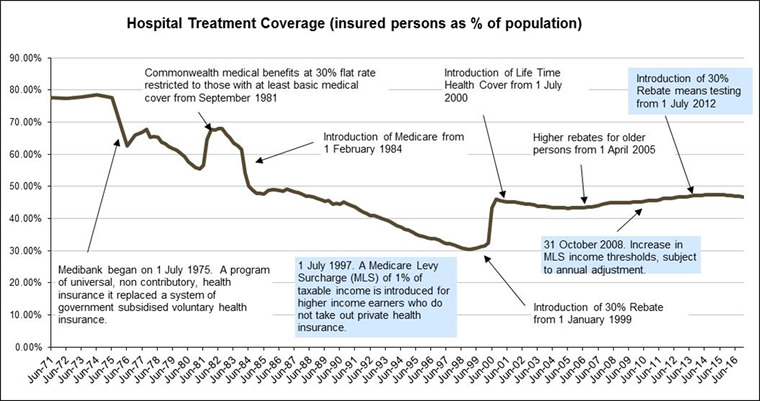

Private health insurance membership as a proportion of

population initially fell after Medicare was introduced in 1984 (see chart below

from APRA). However, following the introduction of measures to encourage

membership, the proportion covered increased. Since September 2015, private

hospital coverage as a proportion of the population has declined from

47.4 per cent to 46.5 per cent.

Hospital treatment coverage

(insured persons as a proportion of population)

Source: APRA

Complexity of products

Private health insurance is becoming more complex. A range

of different co-payments, exclusions and restrictions can apply, making it

increasingly difficult for consumers to choose a suitable policy. The number of

insurance products on offer is not clear either. In the ACCC’s 2014–15

report to the Senate, it estimated there were around 46,500 private health

insurance products as at June 2015 (p. 35). More recently, the Private

Health Insurance Ombudsman clarified that this estimate (based on the

number of Standard

Information Statements (SIS) which

summarise the key product features) included products that are no longer

available. Removing these brings the total number of SISs to 27,281 as at January

2017, but this also includes products offered by restricted membership funds.

The government

advises consumers to shop around for the best value. Consumers can use a government website to

compare policies, or they can use a number of commercial comparator websites. However,

according to a recent

Choice survey, consumers still report difficulties in comparing

policies.

Consumer incentives and penalties

As already noted, a number of government incentives and

penalties apply to encourage greater participation in private health insurance.

These are explained briefly below.

Lifetime Health Cover

Introduced by the Howard Government in July 2000, Lifetime

Health Cover (LHC) is a two per cent annual loading on the cost of premiums

for people over 31 who delay taking out private health insurance. The maximum

loading is 70 per cent. It means that a person who takes out hospital cover at

age 40 for the first time will pay 20 per cent more on their premium than

someone who buys the same hospital cover at age 30. After ten years of

continuous cover any LHC will cease to apply. Those with LHC are allowed

specified ‘permitted days’ without cover. For example, if they travel overseas

they can choose to be without hospital cover for periods totalling 1,094 days

(or three years).

According to the latest industry

statistics, in March 2017 some 13 per cent of adult policyholders had

incurred a LHC loading.

Private health insurance rebate

The private

health insurance rebate is an income-tested government rebate on the cost

of private health insurance premiums for hospital, general treatment and

ambulance policies. Introduced in 1999, the rebate originally provided a 30 per

cent discount on premiums for those under 65, with higher rebates for older

Australians. Income testing was introduced in 2012, resulting in those on incomes

above an indexed threshold receiving a lower rebate or no rebate at all. From

2014, the calculation

of the rebate changed from a flat 30 per cent (higher for older

policyholders) to the difference between the Consumer Price Index (CPI) and the

industry weighted average increase in premiums. Over time, this has resulted in

a lower

rebate being available. Income

tiers and their applicable rebate levels are published by the Government each

year from 1 April. The income tiers used for income testing are normally

indexed annually, but were frozen at 2014–15 levels until 2018 as part of a Budget

Savings Measure. The Government announced in the 2016–17

Budget that it would maintain the freeze until 2021. Legislation

to enact this extension was passed in September 2016.

Medicare Levy Surcharge

The Medicare

Levy Surcharge (MLS) is an additional levy (on top of the 2.0 per cent

Medicare levy) imposed on high-income earners who decline to purchase private

health insurance. The surcharge is calculated at a rate of between 1.0 to 1.5

per cent of income.

The same budget savings measure which froze the income tiers

for the private health insurance rebate has also frozen the income tiers for

the purpose of determining liability for the MLS.

Features of private health

insurance in Australia

Private health insurance in Australia has some notable legislated

features.

Community rating

Private

health insurance in Australia is community rated, not risk rated like other

insurance products such as life insurance. Community rating requires that private

health insurance policies be offered at the same price irrespective of an individual’s

risk factors such as age (apart from the LHC age loading), health status,

previous claiming history or how frequently they need health care. Private

health insurers participate in a risk

equalisation scheme which partially compensates insurers with a riskier

membership profile.

Portability and waiting times

The portability

rule allows consumers to switch to another policy with a different insurer without

incurring additional waiting times, provided the new policy offers the same

level of benefits as their old policy. Certain limits and restrictions apply. Private

health insurers can impose a 12-month waiting period before hospital benefits can

be claimed by a newly joined member or someone upgrading to more expensive

cover if the person has signs or symptoms of a pre-existing

condition. A 12-month waiting period for obstetrics, and a two month

waiting period for psychiatric care, rehabilitation, palliative care and other

services on new or upgrading members can also be applied.

If a person has already served out part of a waiting period

on their previous policy, the remainder of the waiting period will apply on the

new policy, provided there are no added benefits or better conditions under the

new policy.

Broader Health Cover

Private health insurers can also offer coverage for hospital

substitute treatment (such as hospital-in-the-home)

and programs to help manage chronic diseases, under Broader

Health Cover arrangements.

Private health insurance reforms

The Private

Health Ministerial Advisory Committee was established in September 2016 to

advise the Minister for Health on a range of reform options. Its Terms

of Reference include developing simpler categories of insurance (such as

gold, silver, bronze), empowering consumer choice, transparency and

affordability improvements, improving value for rural and regional consumers,

alternative funding models for general treatment and other issues as directed

by the minister. The Committee was established following a consultation

process in 2015–16 and a consumer survey which revealed a number of

consumer concerns with private health insurance.

Separately, the Senate Community Affairs Legislation Committee is

undertaking an inquiry into the value

and affordability of private health insurance and out-of-pocket medical costs.

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Enquiry Point for referral.