Papers on Parliament No. 58

August 2012

Kenneth Mayer 'Forecasting Presidential Elections: Obama, Romney, or What?*'

Prev |

Contents |

Next

Thank you for taking the time to be here. I am delighted to be here, this is my third trip to Australia. My family and I spent six months here in 2006 and I returned in November 2007 to observe the parliamentary elections. I have been trying to convince my wife to move here. She is not having any of it because it is a little far away. But when my kids, who were in high school and primary school when they were here, now they are in college and high school, when they found out I was returning, my son who studies engineering at the University of Wisconsin indicated that he wants to do an exchange, spend a year studying here. My 15-year-old daughter says that she is adamant that she will marry an Australian. So if they follow through on that, we will have to move here. I have always enjoyed coming here, I learn something every time. I have spent a lot of time studying the Australian political system and on this trip I learned something very significant, that I have discovered a scientific cure for jet lag that occurs when you fly from the United States to Australia, which was debilitating on my first two trips. This is guaranteed to work. It is actually quite simple. All you have to do is fly business class on somebody else’s dime. It works like a charm.

What I will be talking about today is our presidential election but talking about it in a more general sense. Not just specifically about the presidential election but the more general problem of making forecasts of what is likely to happen when the general election is held in November 2012. I will pose the question, say some comments about the forecasting problem itself, talk specifically about the different models of forecasting presidential elections that have been developed through social science and other kinds of efforts and then talk about the implications of these models to come up with a forecast of what is going to happen in November. So the question can be put very simply—who will win the presidential election in November 2012? And like my discovery of the cure for jet lag, I have an absolute scientific answer to this question which is—nobody knows. The reason nobody knows is that it has not happened yet and that our ability to predict events that occur in the future is actually limited for reasons that make quite a bit of sense if you think about them.

Despite the fact that it is not possible to make predictions with certainty about what is going to happen in November, it is possible to express boundaries about what is the most likely or the most unlikely. One conditional probability that we can make is about the possibility that Sarah Palin will win approaches zero because she is not a candidate. That tells you a lot. Another conditional probability that we can express, that ‘if Sarah Palin is elected that something really bad has happened’, approaches one because that would require a kind of significant disruption that would be enormously traumatic if anybody but Romney or Obama is elected. I guess I will not get into trouble for giving investment advice, which I am not qualified to do, but if it looks like someone other than Barack Obama or Mitt Romney is going to be elected President in November, my advice is to buy as much gold as possible.

But this is what we really want to know: given the fact that we know that Barack Obama and Mitt Romney will be the Democratic and Republican candidates, who will win? And of the results of the deeper questions—by how much will they win, what will the percentage of the popular vote likely be, what will the electoral college vote count be?—what the implications would be for arguments about the legitimacy or mandate that the winning candidate will receive.

What is a forecast?

Given that the election has not happened yet, we are a little more than five months away, we have to make a forecast and I am going to get social sciencey here for a minute but these definitions will actually make some sense. A forecast or a prediction about something that happens in the future is really a conditional statement, meaning that based on what happens between now and then, much of which we do not know, we can make some predictions about likely or unlikely events in the future. But the key feature of a forecast—of an accurate forecast as opposed to a claim of psychic powers and really being able to divine the future—is we can only make forecasts based on the information that we have at any point in time. We do not know what is going to happen in August. We do have information that we can observe today and the problem then becomes one of using this information to make the best and most accurate prediction which we can express with the most confidence of what will happen in the future.

Let us parse this a little bit about what that means. ‘Conditional’ means that these predictions are uncertain; they might happen and they might not. Certain events are more likely than others but any time that you see a forecast expressed in terms of certainty is by itself a good sign that something fishy is going on. Anybody who makes a claim about what they know will happen in the future this far in advance is really lucky because given enough people making predictions it is possible that someone is going to hit the bullseye. The information that we have is our knowledge about particular events or things that we can measure. How the economy is doing, what the public opinion is about the candidates, what presidential approval is. We can use that information to relate it to previous outcomes and put the independent and the dependant variables together, which we use our models to do.

For example, one of the models I will describe that is very commonly used in the United States is to make forecasts about presidential elections based on economic growth and presidential popularity six months before the election and we can observe what has happened in the past. Previous presidents, their popularity, economic growth: we have good reasons to think of why those two things ought to be related to how an incumbent president performs and as our models get better and more sophisticated our predictions will become more accurate. It is also an invariable feature of forecasts that the farther into the future we are attempting to make our forecasts the more uncertain they become because as a function of time there are more things that can happen between the point at which we make the forecast and the election. I will show you that if you try to make a prediction of what is going to happen in the presidential election two days before the election, those predictions actually are very accurate because there is not a lot that can happen. Things have been set. But that is not really interesting. What we would like to know is what is going to happen six months from now?

Let me give you some examples. It turns out that we do forecasts all the time in our daily life even if we do not think about them as actual forecasts. Most of the time it is just an intuitive kind of prediction about what will happen and this can range from very simple forecasts to assessments that are far more complicated and uncertain.

Investments

One of the big things that virtually everybody wants to know is how investments are going to do. Whether you are buying real estate or stocks or bonds you want to make a prediction about what is going to happen to those investments a year, five years or ten years. This turns out to be very difficult to do because there is a strong random component. But to the extent that someone is able to make these kinds of forecasts accurately the payoffs can be enormous. If someone is able to construct a model that can predict with some accuracy how the stock market or real estate prices will do, the benefit is that you become fabulously wealthy if you are correct. The reason more people do not do this is because it is actually quite difficult.

Traffic routes

When you are getting ready to go to work in the morning you think what are the probabilities of an accident or heavy traffic or some type of traffic jam and you adjust your routes accordingly. How long is it going to take to get to work? This is something that we do every day.

Where to buy a house

In the United States it actually turned out to be a very risky forecast. Millions of people bought houses in 2005 and 2006 when real estate prices had reached their peak, which we now know was a bubble, only to see the prices drop dramatically over the next three or four years. For a long time buying a house was viewed as virtually a risk-free investment that would always go up in value. That is no longer true.

Whether to plan an outdoor wedding

Is it going to rain? Now if you are trying to plan an outdoor wedding three days in advance you actually have very good information about what the weather is going to be. If you are planning a wedding a year in advance—I do not know when the rainy season is here, but I guess if you were in Darwin it would be foolish to plan an outdoor wedding in January—you try to make forecasts and that can be very difficult to do.

Which checkout line will be fastest?

The forecast we do all the time is when we are at the grocery store, we try to predict which checkout line will move the fastest and the interesting feature about this forecast is that it is always wrong.

Some things are hard to predict

Random numbers

We can also make statements about conditions or things that are inherently difficult to predict. For example, the next number produced by a true random process such as lottery numbers. In the United States they use a variety of physical processes to produce random numbers and in an ideal random process there is zero relationship between the number that is picked now and the number that will be picked next. I do not know if they do this in casinos in Australia but in the United States roulette is an example of something that is very close to a true random process, where you cannot predict what the next number will be based on the numbers that have come up recently. But in the United States you will always see a display that lists the previous 10 or 15 numbers and so people instinctively think that if five black numbers or five red numbers have come up in a row that means that the next number is likely to be the opposite. It is very intuitive but of course it is wrong because these are independent events. There are lots of biases that creep in as we think about our own ability to predict.

Chaotic systems

In non-linear systems, infinitesimally small differences in the initial conditions can over time lead to gigantic differences in the outcomes. For example, long-range weather: our ability to predict weather a few days or a week into the future is actually pretty good; our ability to predict weather six months, a year, or climate change models which attempt to forecast what is going to happen in 10 or 20 years turns out to be very difficult. Tornado paths, in which you are trying to figure out when a tornado will form, where it will touchdown and the path that it will take, turns out to be impossible. Well not impossible, because we know certain areas have weather patterns that are more likely to produce tornados than others, but knowing precisely where a tornado will touch down and the path it will take is much less possible.

Low probability events

These are events that occur so infrequently that it is simply not easy or not possible to predict with any kind of confidence when or where they might occur. For example, commercial airline crashes. I should be careful here because I am getting on three planes in the next two days but I convince myself that I am more likely get hit by a bus in the middle of Parliament House than to die in a plane crash. Very difficult to predict. When the Concord had its only fatal accident—I think it was about ten years ago when it took off and a piece of metal that had dropped off a previous plane was kicked up and damaged the engine—it was the only fatal crash that Concord had every had in 20 years of service but it was considered such a vulnerability when it was discovered that it grounded the entire fleet permanently. Terrorist attacks are another example of things that occur with such low probability, particularly in the western world, that it is very difficult to predict when or where they will occur.

Poorly understood phenomena

There are also phenomena that we simply do not have sufficient understanding of to make any kind of confident predictions about what will happened next. Earthquakes for example. Scientists have been devoting enormous time over the last 30 to 40 years trying to come up with models that can tell us where the next earthquake will occur. Again, we can identify the places that are most likely along fault lines and so forth but when they will occur is much more difficult. It is simply because we lack an understanding of these phenomena that is sufficient to give us the ability to figure out why they happen, when they happen. Another example would be the Kardashians and in Australia I am also told that I have to make reference to Shane Warne as a poorly understood phenomenon that is impossible to predict.

Why forecasting is hard

The first reason why forecasting is difficult is our models may simply not be good enough to give us sufficient understanding of what is going to happen. There may be things that we do not know that we understand if they occur will have an effect on our predictions. With presidential elections it is very plausible to think, in fact it is true, that what happens with economic growth over the next few months will have a significant effect on the outcome. But we do not know what the figures for growth in real gross domestic product will be. The figures for the second quarter end in a little over a month and we know this will have an effect but we do not know what it will actually be. So there are future random shocks, things that could happen. They may not happen but if they do they will have an effect. If they do not, they will not have an effect. But we do not know what those might be. The conditions on the ground can change in unpredictable ways.

It is also the case that there may be things that we don’t know that we don’t know and engineers use this kind of terminology all the time. There are certain things that you understand will have an effect on your ability to construct a particular piece of equipment, or using technology, but in many other cases things arise that you cannot predict because you don’t know what you don’t know.

Back to November 2012

Let us take this back to November 2012. In trying to make forecasts about what is likely to happen we can group the forecasting models into a number of different categories. We can look at trial heats (public opinion polls). If the election were held today who would you vote for? For a variety of reasons which I will talk about, these tend to be extremely unreliable, particularly this far out, although they also have the characteristic that as you get closer to the election they become much more accurate. We can look at quantitative models, statistical models that relate economic performance six months or a year in advance, to know how an incumbent might do. We can also look at how popular an incumbent is at a particular point in time and make predictions based on what has happened in the past to presidents at that level of popularly, those that might have been more or less popular. We can use ‘expert’ methods. Being academics we like to attach scientific terms to these models, one of which is the Delphi method, which was very popular in the 1960s, and basically it means that you surveyed experts about what they think would happen. Before I came to the University of Wisconsin I worked for the Rand Corporation, which is a consulting firm in the US, and everybody at Rand talked about the ‘BOGSART’ model and I did not have any idea what this meant. Finally I asked my boss what does the BOGSART model mean? He said ‘Oh, that is an acronym that stands for a bunch of guys sitting around a table’. And we have the kind of model that I prefer which I will call market-based models and I think these have a lot of advantages over some of these other models but I want to walk through them and talk about their pluses and minuses.

Chart 1

(Copyright © 2012 Gallup, Inc. All rights reserved. The content is used with permission; however, Gallup retains all rights of republication.

So one of the reasons that trial heats are unreliable is they are hugely volatile and they can change in ways that are extremely unpredictable. What chart 1 shows is the results of the Gallup polling company trial heat of ‘if the election were held today who would you vote for, Obama or Romney?’ And you can see that a month ago, in April, Obama had a huge lead. I guess it is not 100 points, it ranges from 38 to 52 but Obama was up by as much as six to eight percentage points which would be a fairly safe advantage for any candidate. But you can see in the last week or so of April that it closed up considerably. Why did it close up considerably? Well there were more voters paying attention. Romney locked up the Republican nomination. There are a lot of things that can change, or did change, and the numbers have bounced around with both Romney and Obama. Sometimes one has the lead; sometimes the other has the lead. A difference of one or two percentage points is within the margin of error of any of these polls so basically Obama went from a huge lead to basically a statistical tie in the space of about ten days. That does not mean that these numbers are incorrect, what it means is that they can change so quickly that knowing what the numbers show today does not really tell you much about what is going to happen or what they might show in a week or two weeks or five or six months.

You could also look at these numbers and say, well, the fact that Obama is an incumbent and that only once in the last month or so did he get close to 50 per cent, that is a bad sign for an incumbent. Because one of the rules of thumb that we use is if an incumbent cannot break the 50 per cent threshold, that is a dangerous sign because Obama has been in office for three and a half years, voters have been exposed to a lot of what he has done, there is a record there, people are familiar with him. Presumably there are not that many people who were undecided about Obama. With Romney it makes more sense that his numbers do not break above 50 per cent because most people have not paid attention to politics yet and there is quite a bit of rational ignorance when it comes to thinking about politics and the general public. One sign that most of the public is relatively inattentive to politics and political information is that public opinion polls for the last 30 years have shown repeatedly that if you ask a random sample of Americans which party has a majority in the House of Representatives usually you will get between 50 and 55 per cent of people giving you the right answer. There are only two possibilities. So even if people flipped a coin or randomly responded you would actually expect to get numbers in that range.

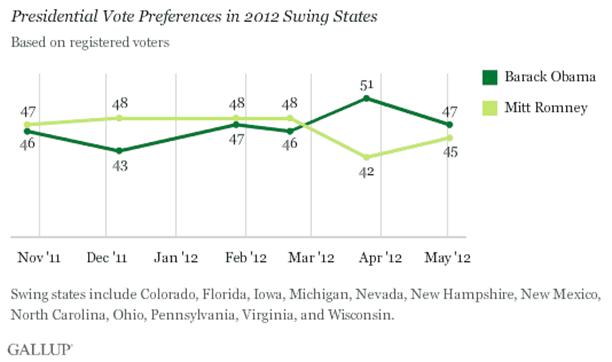

Chart 2

(Copyright © 2012 Gallup, Inc. All rights reserved. The content is used with permission; however, Gallup retains all rights of republication.

We can break this down a little bit. Chart 2 is also from Gallup looking at presidential vote preferences in swing states—Florida, Virginia, Ohio, Pennsylvania, Wisconsin and so forth. These are states that are considered competitive as opposed to California which is almost always reliably Democratic and Texas which is almost always reliably Republican. There is not much doubt as to what is going to happen there. So we can also look at how the candidates do in trial heats in the swing states and you see basically the same thing, that Obama a month ago was up by nine percentage points now again he is up by two. That is again very likely to be a statistical tie. But the problem with these models is that they can change in ways that are unpredictable and that knowing what is happening now simply does not tell us much of anything about what is going to happen a month, two months or four months from now.

Chart 3

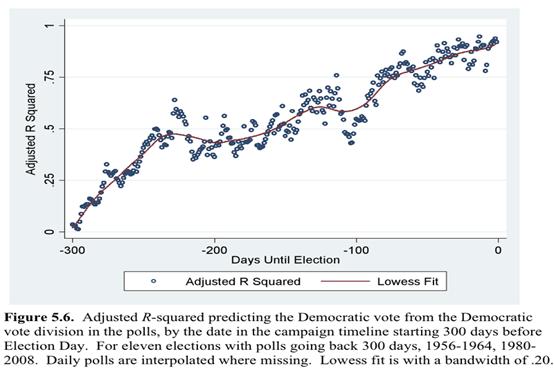

(Source: Robert S. Erikson and Christopher Wlezien, The Timeline of Presidential Elections: How Campaigns Do (and Do Not) Matter, University of Chicago Press, Chicago, 2012, p. 95).

Chart 3 is taken from an academic article that looks at the accuracy of the trial heat percentages, the candidate who the public says they are going to vote for and the correlation, the strength of the relationship, between the percentages at any point in time with the final percentages expressed. Here the x-axis is the number of days before the election going up to about a year and then going to just before the election. You can see very clearly that these numbers get better as you get closer to the election and it makes a lot of sense but it also means that six months out the relationship actually works out to be less than random. Well, not quite because we are not making a prediction of who wins, we are making a prediction about what the vote percentage will be. But the numbers this far in advance are simply not very accurate in trying to assess what is going to happen. So trial heats are interesting. It is a parlour game, but we need to have better ways of doing this.

Table 1

We can also look at models of presidential popularity. Table 1 is looking at the incumbent’s approval rating. Do you approve or disapprove of the job Barack Obama is doing as President in the popularity one year before the election and what happens at the election? For Obama, his popularity rating a year before the election was actually quite low, it was in the low-40s, and you can see that the lowest approval rating for a candidate who won one year before the election was Richard Nixon at 49 per cent in 1972. Going back all the way to the 1944 election, which was really the first time that these techniques had been worked out with sufficient accuracy to allow us to make good predictions, Barack Obama’s approval rating was about six percentage points lower than this. This would say it has never happened, he is going to lose. But again this suffers from the same problem as the trial heats. This is like something that never happens until it happens and then you have to revise your models. This is again interesting. You can also look at candidates. George Bush’s popularity rating was 59 per cent in November 1991. He wound up losing so even being more popular is no guarantee.

Quantitative models

Well what about quantitative models? Let us apply the techniques of statistical inference. We can look at a wide range of data, economic data, public approval data and look at how the data give us a sense of what is going to happen six months into the future. There is an economist at Yale named Ray Fair who is really one of the most well-known proponents of these models. He looks at the percentage of the two-party vote for the incumbent based on economic performance. There is another model that is used by the polling firm started by Helmut Norpoth which looks at economic performance and primary results, and there are other models that academics use that factor in incumbent popularity six months in advance. These turn out to be reasonably accurate in telling us what is likely to happen. These also suggest a rough road for Obama in large part because the economy in the US is technically not in recession but economic growth is anaemic, it is running in the one and a half per cent to two per cent range, not nearly enough to recover from the significant job losses that occurred between 2008 and roughly 2010 or early 2011. When you combine that with popularity, these would suggest that Obama is going to have a significant problem.

The advantage of these models is that because they have the desirable character that we can make predictions that have confidence intervals (how likely you are to be correct), we can say that this is our best guess, that the two-party vote will be 51 per cent and that the property of these inferences suggests that they are extremely unlikely to be more than a percentage or a percentage and a half away. That is actually a very useful phenomenon for these. We can make the predictions well in advance, six months or a year in advance, and they tend to be accurate.

But they also have some significant problems. They completely ignore candidates and campaigns. They simply assume that everything is determined by these variables six months to a year in advance. Even though they tend to be reasonably accurate, we also know that campaigns do matter and that it is probably a mistake to assume a level of determinism that suggests that the campaigns simply do not matter. They cannot deal with third parties. Third parties are generally not a major factor in American presidential elections but they can be. In 1992 Ross Perot got almost 20 per cent of the vote. In 2000 Ralph Nader got less than one per cent of the vote but he also got 90 000 votes in Florida where George Bush, as the result of a controversial series of decisions, was declared the winner with a margin of 547 votes. All of the statistical models suggested that the Democrats would win easily. Al Gore, in fact, won the popular vote but lost Florida and hence the presidency because that gave George Bush 271 votes in the electoral college. Even though Nader received a trivial number of votes, one and a half per cent in Florida, if Nader was not on the ballot most of those 90 000 people would have voted for Al Gore. Not all of them, but if Nader is not on the ballot our best models suggest that Gore wins Florida by tens of thousands of votes. So that makes these models less useful when that is a possibility. And by ignoring the campaigns and the candidates we know that those make a difference and it seems to be a problem if you use a model which by assumption waives those things away.

Market-based/expert methods

Now we can talk about market-based/expert methods. Economists have long known that crowds know things that individuals cannot or do not know and depending on the size of the crowd, crowds can know things in the aggregate that encompass far more information than any individual or small group of individuals could possibly know. This is one of the arguments for why market economies are always more efficient than centrally planned economies, because the essence of a market is lots and lots of individuals. In the classic economic perfect market you have an infinite number of buyers, an infinite number of sellers, and an infinite number of possible combinations and that allows for the efficient utilisation of resources that makes everybody best off. There is no way that even the most well-informed central planner can incorporate that much information.

We do not even have to know how this works. There is a wonderful book by an economist named James Surowiecki called The Wisdom of Crowds where he got interested in this by noting a phenomenon that economists have known about for years that had been a very common game in state fairs in the United States, to display a steer or a cow and have people guess the weight of that animal. As an individual looks at that, the animal could weigh 1200 pounds, 2600 pounds, maybe more. An individual is actually unlikely to be exactly right but if the number of people who make guesses is large enough it turns out that the average of all those guesses is almost always extremely close to the actual weight of the animal. How is that? How could you have no one person be right or close, or not many people be close, but the average of a large number of guesses turns out to be frequently very accurate. The reason is that individuals making estimates will often produced better forecasts than even the most well-informed individual and that is in part because there are a couple of things that have to happen for this to occur. You have to have a large number of individuals and the guesses have to be unrelated so the biases and the errors will even out. The reason this works is that you have a lot of people making guesses, maybe not even using the same method but if you have enough people using enough different methods it turns out that they will average out to be roughly correct because they are independent.

One of the reasons that people in markets tend to be very efficient is that people continually update their beliefs. If anybody is familiar with the efficient market hypothesis for stock market investing, the idea is that whatever information is known is instantly incorporated into people’s assessments of the price of a commodity, a stock, or something. Once you hear a hot tip at a cocktail party, by the time you hear that it is too late. There is a wonderful story about Joseph Kennedy who actually sold all of his holdings shortly before the stock market crash in 1929. When asked how he did it, he said, ‘Well, when I heard my shoeshine boy making stock market predictions, I knew it was time to get out’. The idea is that people will instantly incorporate all of the available information into their opinions and this is what a market is. It is a concentrated specialised narrow form of a market but it relies on the same mechanism which is Adam Smith’s ‘invisible hand’. We do not even need to know how people make these estimates, we just know that people who use different methods, in the aggregate they will tend to be accurate. The possibility in the sense of a market that people have their own skin in the game, they have their own money invested in this, gives them an even greater incentive to be efficient and informed and careful.

The University of Iowa Business School actually run something called the Iowa Electronic Markets (IEM). If you Google it you will be able to get there in one or two steps. They started this about 20 years ago and it is actually a futures market in which people can buy and sell shares in presidential candidates. As a futures market it would normally be regulated by the federal government through the agency that regulates these things called the Commodity Futures Trading Commission but they are exempt from the regulations because you can only invest up to 500 dollars, you cannot invest unlimited amounts of money. Because it is a research-oriented enterprise they do not have to abide by all the disclosure and control mechanisms that a true futures market has to abide by. But the idea behind the IEM is that you can buy and sell shares in candidates. If the candidate wins the election, each share pays off at a price of one dollar. If your candidate loses, it pays off zero, you lose everything. So whatever the price of a share is for a candidate at any point in time is exactly equivalent to the estimated probability in the market that that candidate will win. So if shares are selling for 50 cents you know that the candidate has a 50 per cent chance of winning. As it goes up or down the prices will go up or down.

Chart 4 is a graph that shows the price at which people are willing to buy and sell shares. This is the market clearing price of shares in Barack Obama and Mitt Romney and I updated this chart the day before I left for Australia. The share prices are roughly the same now and you can see that Barack Obama, his shares have been trading for about 60 cents and Mitt Romney shares are trading at about 40 cents. But you can also see that these numbers have moved around. There was a time back in September, when Obama’s popularity was in the high 30s, in which his shares were trading at less than 50 per cent. And then there was a time about two months ago when his shares were trading at close to 70 cents. So this gives us an ability to give a conditional probabilistic estimate of what people, with their own money, with their own skin in the game, who are informed, think is likely to happen.

Chart 4

(Source: Daily Price Graph, Iowa Electronic Markets, Tippie College of Business, the University of Iowa)

Now I actually think that the Obama shares are slightly overpriced. If I were buying and selling them I would probably not be willing to buy a share in Barack Obama at much above 55 per cent. The obvious question would be for you to ask, ‘Well, if you are so smart, why don’t you get into this market?’, because if I think I know something in money ball fashion and other people don’t, why don’t I put my own money in this? The answer is despite the fact that the Iowa Electronic Markets does not have to answer to the Commodity Futures Trading Commission, I have my own regulatory institution to which I have to answer to, which is my wife, and I do not think she would be very thrilled if I said ‘Hey, I just bet $500 in a political market place’. So I am content to observe and snipe from the sidelines. If I am right it is on record that I am right; if I am wrong, who is going to remember?

The advantages of this market-based model is that these actually tend to be much more accurate than most of the other models. We can quibble about the fact that the quantitative models actually are better able to make more precise estimates six months into the future but there are lots of things that can change and there has been a lot of research on these models that shows that these are actually among the most accurate methods of thinking about what is going to happen. They are less volatile than the trial heats where you can see wild swings in the short term, within a week or two, but they are still continually updating because the share prices are updated every day and so as soon as something happens that can affect people’s assessment of the probabilities, that will be reflected in the marketplace. We know that the preferences are most likely to be sincere because people are betting with their own money. There is some evidence that people in the campaigns will try to get in and buy and sell shares to each other at inflated or depressed prices but there are enough people involved with this, several thousand typically, that having a few people trying to play games with this is unlikely to succeed because you offer to sell shares at a particular price, you offer to buy them at a particular price, you have no control over who is going to buy your shares or not so you cannot really engage in what I guess we could call ‘stacked trading’. We do not need to specify the model. People might be using a variety of different models, they might be using intuition or they might be using statistical models.

So what do we do?

I think the most interesting from both an academic and from a personal perspective are the market-based models. I do this in my classes. I taught a class on the presidency and you can also buy and sell shares in presidential primary candidates, preselection candidates, and if I wanted to talk to my students about what had happened in the previous week, I would bring up the chart of prices in the IEM and I would be able to very clearly show, well, Romney won this primary, you can see his share prices spike, Santorum’s share prices went up and then dropped. It is an easy way to explain what can happen. I like to use the market-based models recognising that they cannot incorporate specific events that happen because those are unpredictable. But people have taken into account those future expectations about the probabilities of something happening that could affect the share price. This discounted information is already factored in. The polls themselves are much more volatile and these continually updated crowd-sourcing kinds of expectations are generally more intuitively plausible than even the most precise statistical method because there are some theoretical problems with that.

So we know that there are lot of things that could easily change the results. What happens in Iraq and Afghanistan in the next few months. Supreme Court decisions with respect to the Affordable Care Act (the court is likely to rule in the next month or so). In the US it is universally illegal to bet on election outcomes, but I do have a bet with a colleague about what is likely to happen with the Supreme Court. Ten bucks. In this country, ten bucks is a cup of coffee so I figured it is no problem. The economy could go up, the economy could go down, things in Greece, in Europe, the Euro, that could have a significant effect. There could be a scandal, although I know that never happens in Australia. Normally it is safe to bet on the incumbent. ‘Other things being equal’ is the way we express that; this time other things are not equal. We have a very different set of circumstances that make 2012 a lot different than 2008. So in conclusion, this is what I tell my American audiences, which is that things change, that they should pay attention and that there will be a quiz in November.

Question — Could you give us some idea of the practical consequences or financial consequences of making inaccurate predictions?

Kenneth Mayer — That is a very good question because there are all sorts of conventional wisdoms about what a Democratic or Republican victory might mean for not just the economy in the long term but shorter term consequences for what is likely to happen in the stock market. So if you are making bets on the economy long term it is difficult to make money off that right away but if you know with some confidence that the stock market is likely to go up or down then you can make quite a bit of money in a week. The difficulty is that I am not aware of any models that can accurately predict what is going to happen based on a Democratic or Republican victory. If you were a business person you might think that a Republican will be much better for the economy and a Democrat would be much worse but it is actually much more complicated than that. There are lots and lots of intervening variables.

So I think the implications particularly for Australia are less economic in the short term but more in terms of what an Obama re-election or a Romney election would mean for US–Australian relations or diplomacy and there I suppose there might be a bit of a surprise but I do not think there will be major changes in that regard. I am actually involved in some efforts now trying to figure out why forecasting models have such a difficult time incorporating unexpected events. Almost by definition that is going to be difficult but there are ways to think about the volatility of forecasts based on unexpected events. If anybody has discovered a way of making money in the stock market based on a Republican or Democratic victory I am not aware of that and I would assume that the smart thing would be to keep it under your hat and make your money and be quiet about it.

Question — Two things you did not mention that we read about are things like Mitt Romney’s religion and of course the race question with Obama. Will that become an issue this time?

Kenneth Mayer — The advantage of the market-based models is that it is not necessary to make any assumptions about how those things will affect the outcome because presumably the people who invest in these have already incorporated that. My sense as an observer is that things like Romney’s religion are not likely to be a significant factor in the election for a couple of reasons. There are two groups in the US who would think that issue important. One is conservative evangelical Christians who are overwhelmingly Republican and are suspicious of Mormonism for theological reasons. The other group would be your classic left-of-centre liberals who would be concerned about the conservatism of the Mormon religion and other characteristics of it from a social perspective. Those are almost entirely likely to be Democratic.

The major issue for Romney, which was also an issue in 2008, was that for conservative Republicans evangelical Christians are going to be most important in the primaries because there they have other options for what they consider to be more conservative candidates. If you are a conservative evangelical Republican now, you are faced with a decision between Mitt Romney, who you may not trust for a variety of reasons, or Barack Obama who you know you do not like. It seems to me that some of those people might choose to abstain but I think it would only become significant if the election was so close in specific states that a swing of a few thousand or a few tens of thousands of votes would make a difference. The other factor is that for people for whom Romney’s religion would make the biggest difference, not all of them but most of them live in states like Alabama or Tennessee, conservative states that are very likely to go Republican, or California which is very likely to be Democratic. So my sense is that it will be a factor only if the election is close.

Again, on the issue of Obama’s race, it is not novel anymore and there are some people who will say to pollsters that they will not vote for a candidate because of his or her race. The actual numbers are probably a little higher than that because it is not a socially acceptable answer but these are people who would be unlikely to vote for Obama in any event, I suspect. Or they are in states where their votes are not going to be determinate. So it could make a difference but I think it is unlikely to be near the top of the issues that people are most concerned about.

Question — Do you think Obama’s support of gay marriage will have any significant role in the election, and if so, do you think it will help or hinder his chances?

Kenneth Mayer — When Obama made his statement in support it got a lot of attention in the United States and it also had an effect here where the Prime Minister was asked what her opinion was. Again, that is similar to Romney’s religion and Obama’s race. There are people for whom that is an important issue but I would make the argument that if I know your stance on gay marriage, I would be able to predict with very high accuracy whether you are going to vote for Obama or not. I think that there are some people where that is the most important issue, a social version of gun control which is absolutely determinative. But I do not think that is going to cause a lot cross pressure—with one possible exception. The one group that might be cross pressured would be conservative evangelical African-Americans who would generally be extremely supportive of Barack Obama but also be concerned about gay marriage. But it is hard for me to think of why someone who was otherwise a supporter of Barack Obama, or an opponent, would change their vote based on his position on gay marriage. Again, the caveat is that if the election is razor close then any one of 500 things could make a difference. It might make a difference whether it rains in a state, which in the conventional wisdom can marginally depress turnout. If we are at a point in Florida where six million people vote and the margin is essentially a few hundred votes then all kinds of things can make a difference. But I suspect that with the benefit of hindsight it might be possible to look at the exit polls to tell us whether people used same-sex marriage as one of the most important factors. I would be very surprised if that happens.

Question — In your explanation of the market-based systems you were talking about a share trading market-based system. I was just wondering if you had any thoughts on betting markets and how useful they are in predicting elections?

Kenneth Mayer — The difference between betting markets and these market-based models is first of all that in the United States betting is illegal. But if you are here or in Great Britain or outside the US it is fair game. Not being much of a gambler—I do lose ten bucks a month at my neighbourhood poker game but that is really the extent of it—one of the differences is that betting usually involves odds making by the person who is laying the odds. I know that typically the odds maker will adjust those odds based on how the bets are coming in. If one side is receiving a lot of money, they will change the odds a little bit to get money coming in on the other side. And so there is a degree of centralisation there which makes them slightly different than market-based models. The market-based system is more of a pure market in which there is no centralised record keeping, there is nobody taking a percentage and so generally those two things will move together. They are similar except for that one difference and typically changes in the odds would correlate with changes in the share prices in the Iowa model.

Question — Who do you think is going to be Mitt Romney’s running mate?

Kenneth Mayer — I imagine you can bet on that and I would be curious to see what those show. I think the importance of the Vice President to the ticket is often overemphasised. Much of what we consider to be evidence of the importance comes from John F. Kennedy’s selection of Lyndon Johnson. Kennedy was a young northerner. He picked Johnson, a southerner in a key state of Texas. Johnson had been around in the Senate a long time and brought that geographic balance, ideological balance, age balance. Balance, balance, balance. But there is lots of evidence that that is no longer the case. When Bill Clinton was elected he picked Al Gore, another southerner, as running mate and when George Herbert Walker Bush ran in 1988 he picked Dan Quayle who was really an unknown from Indiana, which is a reliable Republican state. I think the lack of importance of the Vice President comes from 2008 when John McCain picked Sarah Palin, and Sarah Palin was considered interesting for a while but had a series of disastrous public appearances and interviews and it soon became clear that that she was having difficulty with the pressure of national politics. Even counting all of that, McCain was actually leading most polls until the financial meltdown occurred in October of 2008. If that does not occur, Romney has a very good probability of winning.

Given all the traditional balancing factors, what I think will drive Romney’s selection, which I suspect he will not make until August, close to the convention, will be someone conservative to address concerns that a lot of Republicans have that he is not conservative enough. But not scary conservative. Marco Rubio’s name comes up, a senator from Florida who is young, very conservative, Hispanic and comes from a swing state. That is a possibility. People play the equivalent of watching the line-up of the old Soviet politburo members in Red Square on the May Day parade. Rubio made some comment at an otherwise unremarkable press briefing when he said ‘when I’m the nominee …’ Was he playing games? Who knows? Another possibility would be maybe Rob Portman, senator from Ohio. People have mentioned Paul Ryan, who is a congressman from our Wisconsin, very smart, very ambitious, economically conservative. The problem with any of these names is that I can give you two reasons why they are likely but I can also give you ten reasons why they are unlikely. So things may shake out but I suspect the one thing I am very confident of is that Romney will not pick a northeast moderate Republican. I do not think there are any northeast moderate Republicans the way there were two decades ago. He is going to try to shore up his connection with the base but does not want to do it in a way that will scare off moderate voters in the general election.

* This paper was presented as a lecture in the Senate Occasional Lecture Series at Parliament House, Canberra, on 25 May 2012.

Prev |

Contents |

Next

Back to top