Bills Digest no. 81 2012–13

PDF version [614KB]

WARNING: This Digest was prepared for debate. It reflects the legislation as introduced and does not canvass subsequent amendments. This Digest does not have any official legal status. Other sources should be consulted to determine the subsequent official status of the Bill.

Kai Swoboda

Economics Section

28 February 2013

Contents

Purpose of the Bill

Background

Committee consideration

Policy position of non-government parties/independents

Position of major interest groups

Financial implications

Statement of Compatibility with Human Rights

Key issue—cost recovery and transparency of levy arrangements

Main provisions

Date introduced: 13 February 2013

House: House of Representatives

Portfolio: Treasury

Commencement: 1 July 2013

Links: The links to the Bill, its Explanatory Memorandum and second reading speech can be found on the Bill's home page, or through http://www.aph.gov.au/Parliamentary_Business/Bills_Legislation. When Bills have been passed and have received Royal Assent, they become Acts, which can be found at the ComLaw website at http://www.comlaw.gov.au/.

The purpose of the Superannuation Legislation Amendment (Reform of Self Managed Superannuation Funds Supervisory Levy Arrangements) Bill 2013 (the Bill) is:

- to amend the Superannuation (Self Managed Superannuation Funds) Supervisory Levy Imposition Act 1991 (SMSF Levy Imposition Act)[1] to change the maximum annual levy payable by a self managed superannuation fund (SMSF) and

- to amend the Superannuation (Self Managed Superannuation Funds) Taxation Act 1987 (SMSF Taxation Act)[2] to allow for the levy to be paid in the income year to which it applies.

A SMSF is a small superannuation fund with one to four members where the members actively participate in the fund’s management. In contrast to large superannuation funds, which are regulated by the Australian Prudential Regulation Authority (APRA), SMSFs are subject to regulation by the Australian Taxation Office (ATO).

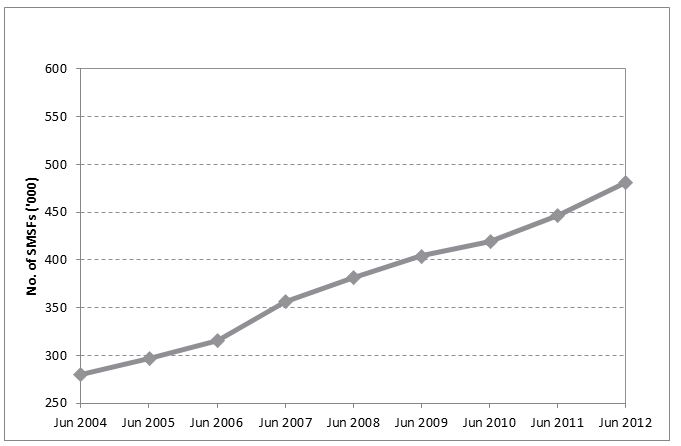

As at 30 June 2012, there were 478 263 SMSFs with 914 000 members.[3] There has been significant and sustained growth in the number of SMSFs in recent years, with almost 35 000 new SMSFs registered in 2011–12 (figure 1).

Figure 1 Growth in total number of SMSFs, June 2004 to June 2012

Source: Australian Prudential Regulation Authority (APRA), Statistics: annual superannuation bulletin, APRA, June 2012 (issued 9 January 2013), p. 32, viewed 18 February 2013, http://www.apra.gov.au/Super/Publications/Documents/June%202012%20Annual%20Superannuation%20Bulletin.pdf

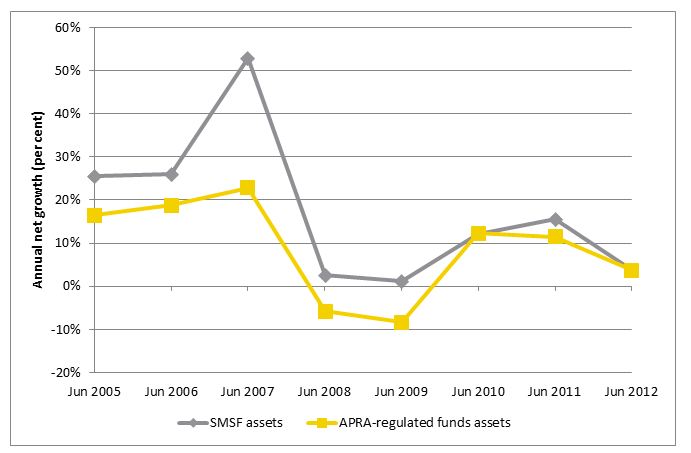

The SMSF sector accounts for around 30 per cent of superannuation assets.[4] In general, the value of assets under management by SMSFs has grown at a higher rate than those held by APRA-regulated superannuation funds (figure 2).

Figure 2 Net growth in estimated total assets of SMSFs and APRA-regulated superannuation funds, June 2005 to June 2012 (per cent)

Source: Australian Prudential Regulation Authority (APRA), Statistics: annual superannuation bulletin, APRA, June 2012 (issued 9 January 2013), p. 32 viewed 18 February 2013, http://www.apra.gov.au/Super/Publications/Documents/June%202012%20Annual%20Superannuation%20Bulletin.pdf

Under current arrangements, for the 2012–13 financial year, an annual levy of $191 will be paid by the trustee/s of an SMSF to the ATO with the lodgement of the fund’s combined income tax and regulatory return to the ATO.[5] The date of lodgement is typically in October or February following the end of a financial year.[6]

The levy payable by SMSFs has increased over time, with the most significant increase in 2007–08 (table 1). The increase in the levy to $150 in 2007–08 was largely implemented to enable greater cost recovery for the supervision of SMSFs. The $45 levy had not increased since 1999 and ‘no longer cover[ed] the Commissioner of Taxation’s costs’ in regulating SMSFs.[7]

Table 1: Self managed superannuation fund supervisory levy, (2002–03 to 2012–13) ($)

|

Year

|

SMSF levy (current dollars)

|

SMSF (2011–12 dollars)

|

|

2012–13

|

$191

|

$191

|

|

2011–12

|

$200

|

$205

|

|

2010–11

|

$180

|

$190

|

|

2009–10

|

$150

|

$162

|

|

2008–09

|

$150

|

$167

|

|

2007–08

|

$150

|

$173

|

|

2006–07

|

$45

|

$53

|

|

2005–06

|

$45

|

$55

|

|

2004–05

|

$45

|

$56

|

|

2003–04

|

$45

|

$58

|

|

2002–03

|

$45

|

$59

|

Source: Superannuation Supervisory Levy Amendment Regulations 1999 (No. 1), viewed 22 February 2013, http://www.comlaw.gov.au/Details/F1999B00133; Superannuation (Self Managed Superannuation Funds) Supervisory Levy Imposition Amendment Regulations 2007 (No. 1), viewed 22 February 2013, http://www.comlaw.gov.au/Details/F2007L00824; Superannuation (Self Managed Superannuation Funds) Supervisory Levy Imposition Amendment Regulations 2011 (No. 1), viewed 22 February 2013, http://www.comlaw.gov.au/Details/F2011L00759; Superannuation (Self Managed Superannuation Funds) Supervisory Levy Imposition Amendment Regulation 2012 (No. 1), viewed 22 February 2013, http://www.comlaw.gov.au/Details/F2012L01429

The justification for the increase in the SMSF levy in 2010–11 was for ATO and ASIC costs of implementing the SMSF aspects of the Government’s response to the Cooper Review.[8] The 2011–12 increase was associated with the costs of implementing the SMSF auditor registration requirements, which was another recommendation of the Cooper Review.[9]

The total value of funds collected by the SMSF levy was around $70 million in 2011–12.[10]

The measures proposed by the Bill seek to increase the maximum levy payable by an SMSF and change the timing of the payment of the levy to the financial year in which it applies. Both the actual amount paid and the timing of the payment will be specified in accompanying regulations.

The Government has proposed to make the levy $259 for the 2013–14 income year and to transition to the levy to be paid in the 2015–16 income year by providing that half of the payment for 2013–14 and 2014–15 be paid under the existing time frames. As a result, payments made in the financial years 2013–14 and 2014–15 will be higher than the nominal levy that applies to each of these years (table 2).

Table 2: Proposed SMSF levy arrangements

|

Financial year

|

Actual levy paid

|

Applicable levy for relevant financial year

|

Payment date within the relevant financial year

|

|

2012–13 (current arrangements)

|

$200

|

$191

|

On lodgement of 2011–12 return.

|

|

2013–14

|

$321

($191 for 2012–13 plus half of $259 for 2013–14)

|

$259

|

On lodgement of 2012–13 return.

|

|

2014–15

|

$388

(half of $259 for 2013–14 plus $259 for 2014–15)

|

$259

|

On lodgement of 2013–14 return.

|

|

2015–16 and future years

|

$259

|

$259

|

Within the financial year that applies by a date specified in regulations

|

Source: B Ripoll, ‘Second reading speech: Superannuation Legislation Amendment (Reform of Self Managed Superannuation Funds Supervisory Levy Arrangements) Bill 2013’, House of Representatives, Debates, 13 February 2013, p. 5, viewed 18 February 2013, http://parlinfo.aph.gov.au/parlInfo/search/display/display.w3p;query=Id%3A%22chamber%2Fhansardr%2Fe1b9741b-6117-42e6-bb54-219d93714fe7%2F0021%22

On 22 October 2012, as part of the 2012–13 Mid-Year Economic and Fiscal Outlook, the Government announced changes to levy arrangements for SMSFs that would bring forward the payment of the levy to the same financial year to which it applies and to raise the level of the levy ‘to ensure the Australian Taxation Office’s costs of regulating the sector are fully recovered’.[11] The proposed levy that would apply was $259 per year from 2013–14 onwards.[12]

Both this proposed increase in levy and the increase in levy that was made in 2010–11 and 2011–12 have their origins in the additional regulatory arrangements that the Government indicated it would implement in its response to the Cooper Review of Superannuation in December 2010.[13]

The Bill has been referred to the Joint Committee on Corporations and Financial Services (the Committee) for inquiry and report.[14] The Committee is scheduled to report by Monday 18 March 2013.[15]

At the time of writing this Bills Digest, the Senate Standing Committee for the Scrutiny of Bills had not published any comments about the Bill.

To date, members of the Coalition have not expressed a particular position on the Bill.

The Coalition has supported some of the recent regulatory changes relating to SMSFs, such as the establishment of a broader penalty regime for SMSFs and a strengthening of measures to reduce the incidence of illegal early release of superannuation.[16] However, another aspect of recent SMSF regulatory changes—the establishment of an SMSF auditor registration system—has been opposed.[17]

The peak body representing the SMSF sector, the SMSF Professionals’ Association of Australia (SPAA) did not support the proposed increase in the SMSF levy, on the grounds that ‘it has been sold on the basis of cost recovery, but further details of the increased cost to SMSFs are required from the Government to support such a substantial increase’.[18]

The Explanatory Memorandum to the Bill notes that the expected net financial impact of the proposed measures is $318.8 million over the forward estimates period (table 2).

Financial impact of proposed measures ($ million)

|

|

2012–13

|

2013–14

|

2014–15

|

2015–16

|

Total

|

|

Revenue

|

|

70

|

164

|

88

|

322

|

|

Expense

|

0.6

|

1.3

|

0.8

|

0.5

|

3.2

|

|

Total

|

-0.6

|

68.7

|

163.2

|

87.5

|

318.8

|

Source: Explanatory Memorandum, Superannuation Legislation Amendment (Reform of Self Managed Superannuation Funds Supervisory Levy Arrangements) Bill 2013, p. 3, viewed 26 February 2013, http://parlinfo.aph.gov.au/parlInfo/search/display/display.w3p;query=Id%3A%22legislation%2Fems%2Fr4963_ems_f3c34350-d22e-4f0a-9741-e84ad95a1b8c%22

The net financial impact is the combined effect of three factors–the additional expenses incurred by the ATO, the increase in the levy and the two-year transitional implementation period for changing to the levy being paid in the income year to which it applies.

As required under Part 3 of the Human Rights (Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed the Bill’s compatibility with the human rights and freedoms recognised or declared in the international instruments listed in section 3 of that Act.[19] The Government considers that the Bill is compatible.

The Explanatory Memorandum notes that ‘the current SMSF levy does not fully recover the ATO’s costs of regulating the sector. The reforms will ensure that the ATO’s costs of regulating the SMSF sector are fully recovered’.[20]

Greater attention to cost recovery arrangements for Commonwealth agencies was influenced by two significant Productivity Commission inquiries relating to cost recovery.

First, in mid-2001, the Productivity Commission’s inquiry into cost recovery by government agencies examined the economic and equity aspects of cost recovery. One of the key recommendations of this inquiry was that the Commonwealth Government should adopt a formal cost recovery policy for agencies undertaking regulatory and information activities.[21]

Second, in late 2001, the Productivity Commission in its inquiry into various statutes regulating the superannuation industry found that it is appropriate that the supervision of SMSFs be funded separately from that of other superannuation entities and be based on full recovery of costs incurred by the ATO in providing that supervision.[22] The Productivity Commission recommended that the ATO should publish the cost components involved in its regulatory supervision of SMSFs to ensure public accountability.[23]

Following these inquiries, the then Government adopted a formal cost recovery policy in December 2002. The guidelines, which were revised in 2005, required agencies providing government goods and services (including regulation) to the private and other non-government sectors of the economy to set charges to recover all the costs of such products or services, where it is efficient to do so, in consultation with stakeholders. The guidelines also set out a better practice management framework to assist agencies to design and implement cost recovery arrangements.[24]

As noted earlier, the significant increase in the SMSF levy in 2007 was attributed to covering the ATO’s costs of regulating SMSFs. The then Government noted in the explanatory statement for the regulation to increase the SMSF levy to $150 that:

All superannuation funds are subject to a supervisory levy designed to fund the regulatory costs of ensuring funds comply with superannuation legislation. Separate levy arrangements apply to SMSFs and to registrable superannuation entities to recover the costs of their regulation by the Australian Taxation Office and by the Australian Prudential Regulation Authority respectively.

The new Regulations are consistent with the Government’s approach that the regulation of SMSFs should be broadly on a cost-recovery basis. That is, that the money collected from the supervisory levy should broadly cover the reasonable costs of the Commissioner of Taxation (as regulator) in regulating SMSFs. The current $45 levy has not increased since 1999, and no longer covers the Commissioner of Taxation’s costs.

The levy arrangements are in accordance with the Australian Government Cost Recovery Guidelines.[25]

Recent changes to SMSF penalty provisions, including providing the Commissioner of Taxation with additional punitive and educational compliance tools to regulate SMSFs and with additional powers to deter promoters of illegal early release schemes, have added to the ATO’s regulatory powers over SMSFs. These recent changes, which were estimated to cost $17.1 million over five years, were to be offset by an increase in the SMSF levy.[26]

The ATO’s Compliance program 2012–13 highlights a number of activities that it plans to conduct during 2012–13 in relation to regulating SMSFs, including:

- analysing the top 200 SMSFs based on total assets and selecting 25 of these for a comprehensive audit[27]

- auditing 30 SMSFs which lodged their annual return following lodgement enforcement action that exhibit attributes across a range of income tax and regulatory risks. The ATO will target over 1500 SMSFs that have failed to lodge, to either obtain lodgement of annual returns or to remove them from the SMSF population[28] and

- auditing and reviewing 100 SMSFs to ensure they are complying with the requirement to invest on a commercial, arm's-length basis.[29]

However, this information does not link the total expenditure collected by the levy (or the increase in the levy) to the cost of different regulatory activities. In addition, published information about the costs of SMSF regulation in the ATO’s annual report and portfolio budget statements is limited to the resources dedicated to the ATO’s budget outcome 1, which also includes resources directed to compliance across a range of other activities.

More detailed information about the costs of ATO compliance activities is sometimes available in irregular performance audits undertaken by the Australian National Audit Office (ANAO).[30] Of the three performance audits undertaken by the ANAO into aspects of the ATO’s SMSF regulatory arrangements, only one contains information about the cost of the ATO’s regulatory activities for the SMSF sector.[31] This report, tabled in June 2007, included an examination of the costs of ATO regulation of SMSFs and the revenue received through the SMSF levy over the period 1999–2000 to 2006–07.[32] The ANAO concluded that at that time:

the Tax Office is not able to provide accurate data on levy revenue collections, and is only able to provide estimates. Importantly, the Tax Office is not able to readily determine the value of levy payments that have not been remitted, and which SMSFs have not remitted these payments.[33]

In agreeing to the ANAO recommendation to publicly report on the amount of annual levy revenue collected and the Tax Office’s cost of administering SMSFs, the ATO noted that:

Levy revenue and the Tax Office’s cost of administering SMSFs will be reported in the Tax Office’s annual report, in accordance with the Australian Government Cost Recovery Guidelines and financial reporting requirements.[34]

During discussions in 2012 about the imposition of a levy to recoup ATO and other agency costs from APRA-regulated superannuation funds for the ‘Superstream’ initiatives[35], the Treasury provided additional information about the use of additional funds raised.[36]

There is limited information available to assess the Government’s assertion that the proposed increase in the SMSF levy will ensure that the ATO’s costs of regulating the SMSF sector are fully recovered. The publication of additional information on the costs of activities to support SMSF regulatory arrangements would improve transparency about the use to which the SMSF levy is put and to assess the ATO’s effectiveness in undertaking its regulatory responsibilities.

Items 1 and 2 of the Bill amend the SMSF Levy Imposition Act to remove references in that Act to the payment of the SMSF levy on lodgement of a return.

Item 3 of the Bill amends section 6 of the SMSF Levy Imposition Act to increase the maximum levy amount from $200 to $300. The actual levy to be paid continues to be specified in regulations.

Item 6 of the Bill repeals and replaces section 15DA of the SMSF Taxation Act to provide that a trustee of a SMSF at any time during an income year is liable (or, if there is more than one trustee, the trustees are jointly and severally liable[37]) to pay a levy for that year of income.

Item 7 amends subsection 15DB(1) of the SMSF Taxation Act to remove the reference to the levy being payable on the lodgement of a particular return and replace it with a reference to the levy being applicable to an income year. According to the Explanatory Memorandum ‘this will ensure consistency within the superannuation industry as other superannuation funds regulated by APRA pay the superannuation supervisory levy in the same financial year that it is levied’.[38]

The date a levy is due and payable will continue to be specified in regulations.

Item 9 of the Bill is an application provision which operates, for the avoidance of doubt, so that the amendments proposed by this Bill apply in relation to the 2013–14 year of income and later years of income.

Item 10 provides transitional arrangements for the regulations to specify that an amount of the levy for 2013–14 (which is proposed to be $259) is due and payable on a different specified day to the rest of the levy for that year. These provisions facilitate the two-year transition period to bring the levy from being paid in arrears, to being paid in the financial year to which it applies according to the schedule proposed by the Government that is outlined in table 2 above.

Members, Senators and Parliamentary staff can obtain further information from the Parliamentary Library on (02) 6277 2500.

[5]. Section 6 of the Superannuation (Self Managed Superannuation Funds) Supervisory Levy Imposition Act 1991 prescribes a maximum levy of $200, with the actual amount set by regulation 4 of the Superannuation (Self Managed Superannuation Funds) Supervisory Levy Imposition Regulations 1991. The text of the regulation can be viewed at: http://www.comlaw.gov.au/Details/F2012C00407. The timing of payment is established by section 15DB of the Superannuation (Self Managed Superannuation Funds) Taxation Act 1987, with the date specified by regulation 4 of the Superannuation (Self Managed Superannuation Funds) Taxation Regulations 1999. The text of the regulation can be viewed at: http://www.comlaw.gov.au/Details/F2007C00393

[9]. Explanatory Statement, Superannuation (Self Managed Superannuation Funds) Supervisory Levy Imposition Amendment Regulation 2012 (No. 1), viewed 18 February 2013, http://www.comlaw.gov.au/Details/F2012L01429/Explanatory%20Statement/Text; The Cooper Review (also known as the ‘Super System Review’) was chaired by former deputy commissioner of ASIC Jeremy Cooper and was conducted over the period 2009–2010. The Cooper Review covered a broad range of issues including the performance and governance of the superannuation industry and has formed the basis for a number of recent legislative changes under the Government’s ‘Stronger Super’ package of measures.

[13]. Australian Government, Stronger Super: government response to the Super System Review (Cooper Review), op. cit.

[19]. The Statement of Compatibility with Human Rights can be found at pages 8–10 of the Explanatory Memorandum to the Bill.

[20]. Explanatory Memorandum, p. 5.

[23]. Ibid., recommendation 9.2.

[25]. Explanatory Statement, Select Legislative Instrument 2007 No. 75, op. cit.

[30]. For example, the ANAO’s performance audit on the administration of the superannuation lost members register was able to calculate the costs of administering various aspects of the program. Australian National Audit Office (ANAO), Administration of the superannuation lost members register, Audit report no. 31, 2010–11, February 2011, p. 62, viewed 20 February 2013, http://www.anao.gov.au/~/media/Uploads/Documents/2010%2011__audit__report__no31.pdf

[31]. The ANAO’s performance audits that are relevant to the ATO’s regulatory approach are detailed in The Australian Taxation Office's approach to regulating and registering self managed superannuation funds, Audit report no. 52, 2006–07, 2007, viewed 18 February 2013, http://www.anao.gov.au/~/media/Uploads/Documents/2006%2007_audit_report_52.pdf

The Australian Taxation Office’s approach to managing self managed superannuation fund compliance risks, Audit report no. 13, 2007–08, November 2007, viewed 18 February 2013, http://www.anao.gov.au/~/media/Uploads/Documents/2007%2008_audit_report_13.pdf

and Interpretative assistance for self managed superannuation funds, Audit report no. 40, 2011–12, June 2012, viewed 18 February 2013, http://www.anao.gov.au/~/media/Uploads/Audit%20Reports/2011%2012/201112%20Audit%20Report%2040/201112%20Audit%20Report%20No40.pdf).

[37]. When used in connection with the liability of two or more persons joint and several means that each person is liable together and individually. The liability may be enforced against all or any or only one of the persons bound by joint and several liability. Source: Butterworths Concise Australian Legal Dictionary, third edition, LexisNexis Butterworths, Australia, 2004, p. 238.

[38]. Explanatory Memorandum, p. 7.

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

Disclaimer: Bills Digests are prepared to support the work of the Australian Parliament. They are produced under time and resource constraints and aim to be available in time for debate in the Chambers. The views expressed in Bills Digests do not reflect an official position of the Australian Parliamentary Library, nor do they constitute professional legal opinion. Bills Digests reflect the relevant legislation as introduced and do not canvass subsequent amendments or developments. Other sources should be consulted to determine the official status of the Bill.

Feedback is welcome and may be provided to: web.library@aph.gov.au. Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Entry Point for referral.