No. 15 Reading a bill (PDF 168KB)

This guide examines the structure of bills and amendments to bills, and how they are dealt with in committee of the whole. For more detail on the consideration of legislation, see Guide No. 16—Consideration of legislation.

Structurally, bills fall into two categories, based on their function:

- bills proposing new, stand-alone legislation; and

- bills amending existing legislation.

Occasionally, bills combine both functions. The type of bill determines its layout and the terminology used to describe its parts.

New, stand-alone legislation

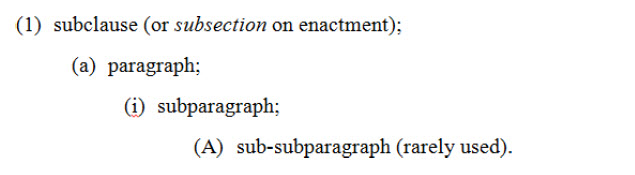

A bill proposing new, stand-alone legislation consists of a title ("A Bill for an Act to…"), enacting words ("The Parliament of Australia enacts:") and a series of clauses. When passed, a bill becomes an Act and clauses are referred to as sections. The parts of a clause are:

The clauses may be grouped according to subject matter. The normal hierarchy of groupings is as follows:

- Chapter

- Part

- Division

- Subdivision

If used, the most common groupings are Parts and Divisions. A bill of this type may also have one or more Schedules at the end, containing material which will form part of the Act but which is convenient to present separately from the main body. Examples include the texts of treaties or other international agreements being incorporated into Australian law, proformas such as the ballot papers and nomination forms in Schedule 1 to the Commonwealth Electoral Act 1918 or self-contained rules relating to particular matters referred to in the main body, such as the conditions applying to the various types of broadcasting licenses in Schedule 2 of the Broadcasting Services Act 1992. The parts of a Schedule are also usually called "clauses" and continue to be so called even after enactment.

Numbering

There is no universal system of numbering for Commonwealth legislation. Some bills or Acts have their own numbering systems. However, the most common system uses the following conventions:

- Chapters (if any) are numbered consecutively from 1;

- within each Chapter, Parts are numbered consecutively from 1, each new Chapter beginning with Part 1;

- within each Part, Divisions are numbered consecutively from 1, each new Part beginning with Division 1;

- within each Division, Subdivisions are lettered consecutively from A; and

- within the Act or bill as a whole, sections or clauses are numbered consecutively from 1; for example, Division 3 of Part 2 might begin with section (or clause) 46.

The system of numbering used in any bill or Act will be clear from the contents page. In citing a particular "bit" of a bill or Act, it is normal to include only so much information as is necessary to distinguish that "bit" from others. Clause or section numbers are always unique and are referred to in isolation; for example, it is not necessary to say "section (or clause) 46 of Division 3 of Part 2" because section (or clause) 46 occurs only once. But it may be necessary to say "Division 3 of Part 2", rather than "Division 3", if other Parts in the bill or Act also contain a Division 3.

Unless gaps have been left in the numerical sequence, new sections are inserted using a combination of numbers and letters. For example:

- 2 new sections inserted between sections 303 and 304 would be sections 303A and 303B; and

- 2 new sections inserted between sections 303A and 303B would be sections 303AA and 303AB, and so on.

Typeface

In Commonwealth legislation typography is used as a guide to the structure and, therefore, the meaning of the text, by providing signposts for the reader. Spacing and indentation are also used to indicate the relationship between units of text. For example:

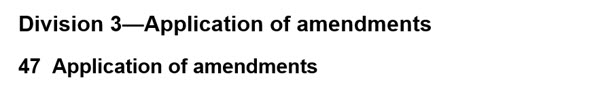

- normal text in a bill or Act is always in 11 point Times New Roman font:

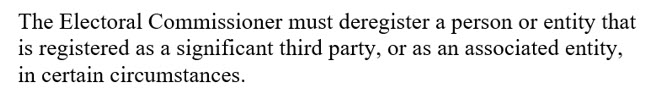

- notes or cross-references which do not form part of the bill or Act are distinguished by being in smaller 9 point font:

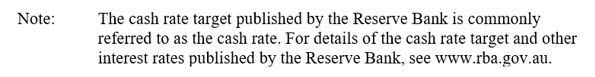

- section headings are always bold:

- other headings always have the same attributes:

- a defined term always appears in bold italics:

It is important to understand how an Act is numbered and the typographical conventions that are used because these are the keys to understanding any bill to amend that Act.

Amending bills

Most bills are bills amending existing legislation.

An amending bill usually consists of a title, enacting words, three clauses and a schedule or number of schedules. These schedules are sometimes called amending schedules to distinguish them from the schedules referred to above which contain substantive parts of the bill or Act. The three clauses provide for:

- what the Act is to be called (Short title);

- when it (or its various parts) will come into effect (Commencement); and

- an "activating" clause which gives the schedules their authority as law (Schedule(s)).

The Schedules comprise a series of items, each one containing an amendment to an Act or providing for related matters such as how the amendments are to apply, what transitional arrangements between the old law and the new law are necessary or whether the old law will continue to apply in any particular circumstances. These latter items are sometimes called application, transitional and saving provisions, respectively.

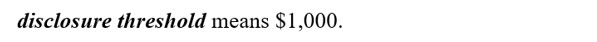

An item containing an amendment to an Act consists of 3 parts:

- the item heading which specifies where in the Act the amendment is to be made;

- the instruction which specifies what action is to occur (for example: "Insert", "Add", "Repeal", "Repeal…, substitute"); and

- the text of the amendment (if required).

Using the item heading as a locator, the reader can follow the instruction to read the proposed amendment into the parent Act in order to see what the Act will look like if the amendment proposed to the bill is made.

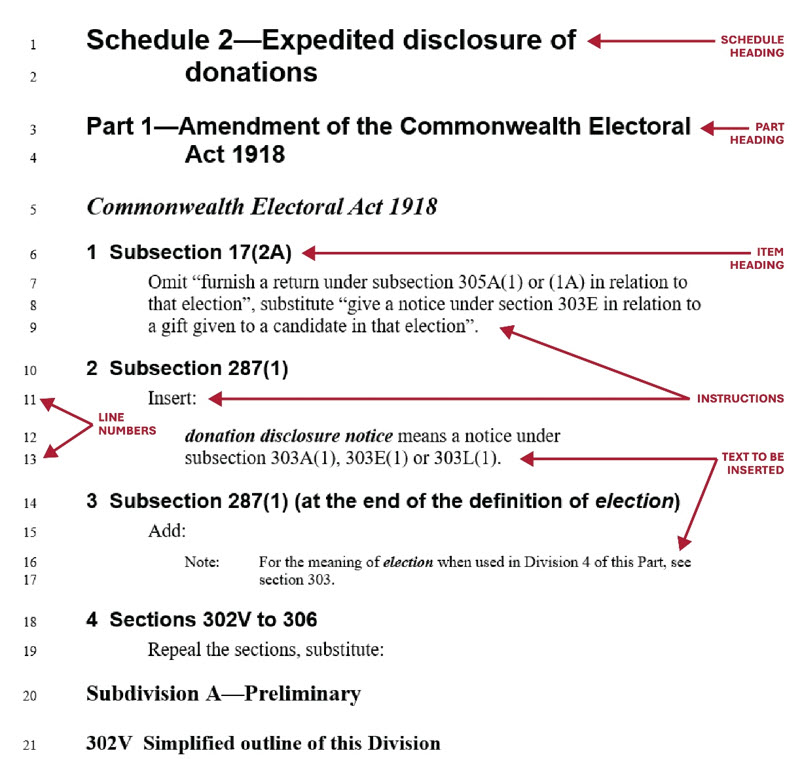

Typography is just as important in an amending bill as it is in a stand-alone bill because it is used to distinguish information about the location of amendments from the proposed new text (which follows the typographical conventions described above for stand-alone bills). The headings of amending schedules, parts of amending schedules and items are always in Arial font, with the font size corresponding to the level of heading. For example:

The name of the Act being amended is also shown distinctively if it is not included in the Schedule heading. For example:

In amending items, proposed new text uses the same terminology as the Act being amended. In Schedule 1, item 4, above, for example, section 302V is referred to as a proposed section, not a clause.

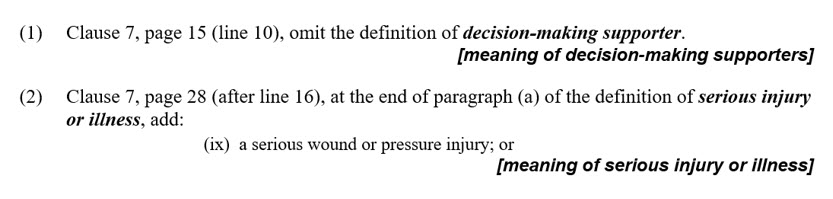

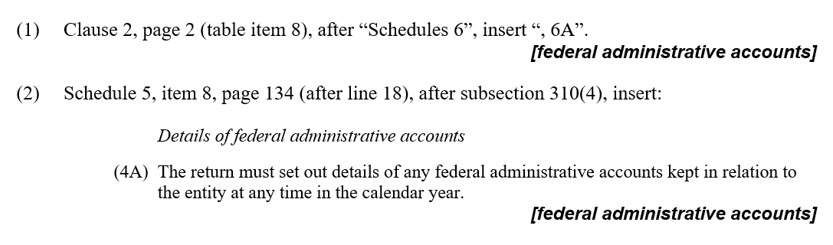

Amendments to bills

Just as bills follow strict structural, typographical and stylistic conventions, so too do parliamentary amendments. These conventions make it easy to read the amendments into the bill, in the same way that items in an amending bill are read into the parent Act. Using page and line numbers of the bill, amendments identify the point in the bill where the proposed action is to occur before describing the action and any proposed new text. The format differs slightly according to whether the bill is a standalone bill or an amending bill. For example:

For a stand-alone bill

For an amending bill

Note that the descriptor in bold, italicised text and square brackets at the end ("export permits") is not part of the amendment. It is a guide to the subject matter of the amendment to assist the Senate and facilitate the preparation of running sheets (see Guide No. 16—Consideration of Legislation).

Need assistance?

For assistance with any of the matters covered by this guide, government senators or their staff should contact the Clerk Assistant (Table), on extension 3020 or ca.table.sen@aph.gov.au; and non-government senators or their staff should contact the Clerk Assistant (Procedure) on extension 3380 or ca.procedure.sen@aph.gov.au.

Last reviewed: June 2025