Posted 20/05/2016 by Richard Webb

Future Fund (FF) net earnings (gross earnings less associated costs) are currently excluded from the underlying cash balance measure of the budget outcome. This will change on 1 July 2020 when payments from the FF begin. Then, all FF expenses and earnings will be included in the underlying cash balance. The magnitude of the effect on the underlying cash balance will depend on the amounts paid from the FF and its earnings.

The FF was established in 2006 to fund the government’s unfunded superannuation liability. The objective was to accumulate:

… financial assets sufficient to offset the government’s unfunded superannuation liabilities by 2020.

FF net earnings are excluded from the underlying cash balance even though they are receipts. Receipts are normally included in the underlying cash balance. The rationale for the exclusion is that the FF’s resources:

… are not available for recurrent spending, instead being pre-committed to fund existing liabilities.

From 1 July 2020 when payments from the Future Fund will begin, all FF expenses and revenues will be included in the underlying cash balance. The reason payments will begin on 1 July 2020 derives from the Future Fund Act 2006. It provides that money can be paid from the FF at the earlier of (a) the time when the balance of the FF exceeds or equals the target asset level or (b) 1 July 2020. The target asset level is broadly equivalent to the superannuation liability. This means that if the amount in the FF is less than the superannuation liability on 1 July 2020, payments can be made from the FF to meet recurrent superannuation costs. Recurrent costs are included in the underlying cash balance.

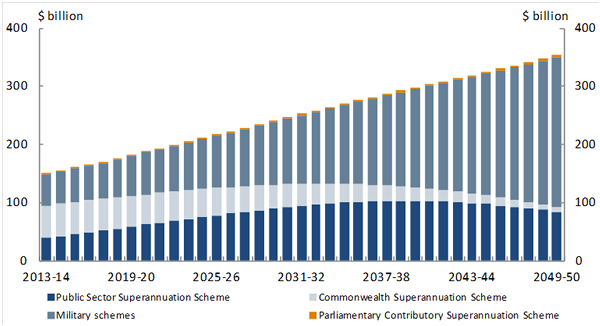

On 1 July 2020, the amount in the FF is likely to be less than the Australian Government’s general government sector superannuation liability. This liability is for the public sector; that is, civilian employees and military personnel. The following chart shows projections of this unfunded liability to 2049–50.

Chart: Unfunded Commonwealth Government superannuation liability projections

Source: Department of Finance.

Source: Australian Government, Towards Responsible Government. The report of the National Commission of Audit, Phase 1, 2014, p. 37.

At 30 June 2015, the public sector liability was estimated to be $248.2 billion. The amount in the FF was $117.2 billion at 30 June 2015, giving rise to a shortfall of $131 billion. The liability is projected to fall by $53 billion to $195 billion at 30 June 2020. Still, the balance in the FF seems likely to be less than the liability at 30 June 2020. For example, if the balance in the FF were to increase over four years to, say, $125 billion on 30 June 2020, the shortfall would be $70 billion ($195 billion less $125 billion). While this would be a considerable reduction in the shortfall of $131 billion at 30 June 2015, the unfunded liability would still be considerable at 30 June 2020.

The magnitude of the effect on the underlying cash balance from 1 July 2020 will depend on the amounts paid from the FF and its earnings. But not all superannuation payments need to be made from the FF. That’s because the government has the flexibility of deciding whether to:

discharge the unfunded liabilities from the Fund; rely on the special appropriations which exist in the legislation governing the various superannuation schemes (in which case payments will be made out of the budget; or some combination of both.