Posted 13/03/2019 by Dr Hazel Ferguson

The Department of Education and Training (DET) has released Higher Education Loan Program (HELP, formerly HECS) data, updating last year’s release from the Australian Taxation Office (ATO).

The DET HELP data is based on the ATO's annual HELP data report for 2017–18 (available from Data.gov.au), and previous ATO annual HELP data reports. Further historical data is available in the ATO release. All figures are at 30 June for the relevant financial year. Figures have not been adjusted for inflation.

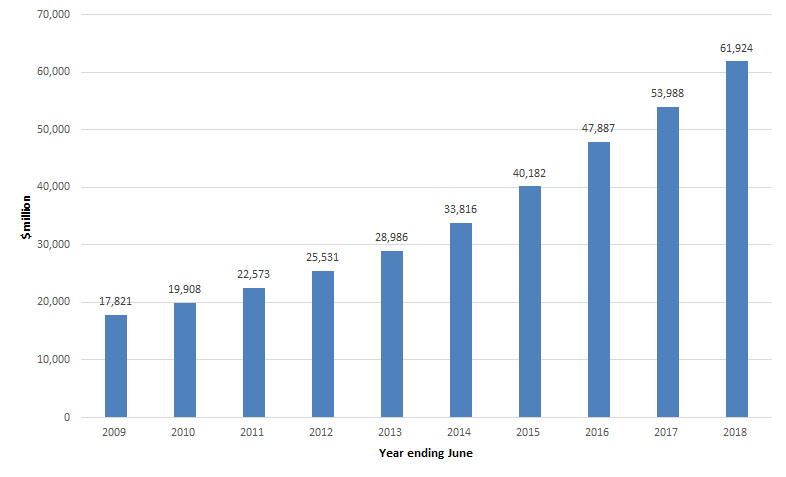

Total amount of outstanding HELP debt

This release updates the total amount of outstanding HELP debt to $62.0 billion, up from $54.0 billion in 2016–17.

Figure 1: Total amount of outstanding HELP debt 2008–09 to 2017–19 financial years ($m)

(Source: DET, HELP data - January 2019, published 2 January 2019.)

However, since HELP is an asset on the Government's balance sheet, the proportion of outstanding debt not expected to be repaid (DNER) is arguably more important than the overall size of the loan portfolio. The latest DNER estimate from the Australian Government Actuary is 18 per cent (according to the Department of Education and Training Annual Report 2017–18 (p. 44)). Taking into account DNER and the concessional nature of HELP loans, the ‘fair value’ of HELP debts was estimated at $42.4 billion at 30 June 2018 in the 2018–19 Budget papers (p. 9-39).

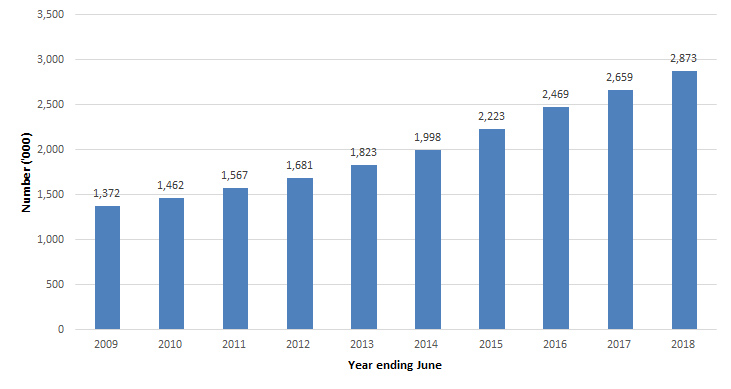

Number of people with outstanding HELP debt

The number of people with outstanding HELP debts reached 2.9 million in 2017–18, up from 2.7 million in 2016–17. This includes people who borrowed for Commonwealth supported (HECS-HELP) or full-fee (FEE-HELP) higher education qualifications, and vocational education qualifications (VET Student Loans, previously VET FEE-HELP). It also includes SA-HELP, for higher education students to defer the cost of their student services and amenities fees, and OS-HELP, for higher education students to defer the cost of eligible overseas study.

After rapid growth in the number of borrowers in 2013–14 (10 per cent), 2014–15 (11 per cent) and 2015–16 (11 per cent), growth during 2016–17 was down slightly to 8 per cent, and has remained at 8 per cent for 2017–18.

Figure 2: Total number of people with outstanding HELP debt 2008–09 to 2017–18 financial years

(Source: DET, HELP data - January 2019, published 2 January 2019.)

Size of outstanding HELP debts and time to repay

The number of debts above $50,000 also continued to grow in 2017–18, reaching 208,146, up from 159,475 in 2016–17. Among people with debts above $50,000, 18,729 have debts above $100,001, up from 14,046 in 2016–17.

The average amount of outstanding debt is much lower at $21,557, up from $20,303 in 2016–17.

However, the time taken to repay HELP debts has also been steadily rising, reaching 9.1 years in 2017–18, up from 8.9 years in 2016–17.

Table 1: Number of people with outstanding HELP debt, by size of outstanding balance 2008–09 to 2017–18 financial years

| Outstanding HELP debt |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

| Up to $10,000 |

629,541 |

657,876 |

696,577 |

723,714 |

768,048 |

799,772 |

827,484 |

851,313 |

893,574 |

910,732 |

| $10,000.01 to $20,000 |

462,428 |

471,039 |

471,194 |

495,681 |

524,986 |

566,386 |

619,799 |

665,697 |

679,259 |

706,962 |

| $20,000.01 to $30,000 |

200,610 |

224,071 |

252,253 |

269,787 |

296,244 |

338,949 |

403,064 |

473,584 |

509,360 |

548,229 |

| $30,000.01 to $40,000 |

54,470 |

71,669 |

91,733 |

114,051 |

131,384 |

157,758 |

195,492 |

242,240 |

281,594 |

328,753 |

| $40,000.01 to $50,000 |

15,131 |

21,976 |

31,679 |

42,338 |

53,877 |

67,468 |

84,863 |

110,455 |

135,795 |

169,781 |

| Over $50,000 |

9,734 |

15,141 |

n.a. |

n.a. |

n.a. |

n.a. |

n.a. |

n.a. |

n.a. |

n.a. |

| $50,000.01 to $60,000 |

n.a. |

n.a. |

11,978 |

17,444 |

23,705 |

32,258 |

43,096 |

56,919 |

70,265 |

87,380 |

| $60,000.01 to $70,000 |

n.a. |

n.a. |

4,601 |

7,322 |

10,589 |

15,002 |

21,035 |

29,235 |

37,363 |

50,425 |

| $70,000.01 to $80,000 |

n.a. |

n.a. |

2,429 |

3,507 |

5,009 |

7,433 |

10,629 |

15,164 |

19,996 |

27,393 |

| $80,000.01 to $90,000 |

n.a. |

n.a. |

1,515 |

2,126 |

2,943 |

4,147 |

5,827 |

8,120 |

10,809 |

14,850 |

| $90,000.01 to $100,000 |

n.a. |

n.a. |

1,034 |

1,391 |

1,851 |

2,527 |

3,563 |

5,216 |

6,996 |

9,369 |

| $100,000.01 and above |

n.a. |

n.a. |

2,107 |

3,339 |

4,652 |

6,273 |

8,189 |

10,996 |

14,046 |

18,729 |

(Source: DET and Parliamentary Library calculations, HELP data - January 2019, published 2 January 2019.)

Note amounts of debt up to $20,000 have been aggregated for Table 1—more detail is available in the source tables from the ATO or DET.