Dr Peter Brain

Core message

This lecture represents an update of my 2001 Alfred Deakin Lecture, namely 'The Australian Federation 2001: Political structures and economic policy'.[1] The basic message here is that unless Australia adopts a middle course between the highly successful corporatist state model of development and the extreme neoliberal model that Australia has selected as its development framework then Australia's internal stability and national security could well be severely degraded over the next two decades. In short Australia will have to relearn and reapply some strategies and instruments to govern the market.

This will involve some restoration of the practices and institutions that were swept away in the name of micro-economic reform over the last two decades. Australian will never be able to match the efficiency of the informal governance structures of corporatist states. For Australia the leadership will have to be provided by its governance institutions in general and Parliament in particular.

To paraphrase Harvard's Stephen A. Marglin's recent book The Dismal Science: How Thinking like an Economist Undermines Community [2] the message of this lecture is 'The Australian Neoliberal Model: How thinking like an economist will degrade economic performance, social stability and national sovereignty.'

Australia has a limited understanding of history. The defeat of Communism was not a defeat for models aimed at governing the market. It was the defeat of one particular model by far more efficient models for governing the market.

The 2001 Alfred Deakin Lecture

In my 2001 Alfred Deakin Lecture I set out to explain:

- why Australia in the 1980s had adopted the extreme neoliberal (or the economic rationalists) model as its development framework; and

- some likely consequences of that choice.

Put simply, under the neoliberal model the State plays a largely passive role with many of the key decisions that will determine the direction and quality of Australia's economic development and its social consequences being left to the market. The explanation for why Australia adopted the model was, in part, attributed to the relatively weak state of Australia's parliamentary institutions as a representative democracy, strong executive and strong party discipline.

This is not to say that the Australian system does not produce good outcomes for many decisions. The problem is that for some key strategic decisions the tendency is to select simple, easy to market solutions for economic and social problems that reflect the capacity, interests, and vision of the leadership group which will include those established interests that have an affinity with the political leadership.

More complex solutions that require the input of the broader political community and the design of new governance structures that may lie beyond the control of strong established, including bureaucratic interests, tend to be eliminated at an early stage.

The likely consequences for the future noted in the 2001 lecture included:

- increasing wealth/income inequalities;

- increasing foreign ownership and narrow based economy;

- no solution to Australia's high current account deficit and foreign debt;

- financial instability from the capacity of the financial sector to expand debt to whatever level that was in its interest; and

- a vulnerability to negative economic shocks and a poor capacity to respond which is now an important issue in the context of a likely carbon price shock.

The focus of this lecture is to elaborate on the likely consequences of the adoption of the neoliberal model for Australia.

The Corporatist state model

The neoliberal approach focuses on market conduct and structures on the assumption that if market conduct and structure is appropriate then optimal outcomes will be achieved. Whatever outcomes are achieved by market forces will in the main, by definition, be optimal.

Corporatist states tend to approach development from the reverse direction. Objectives are specified in terms of social, political, security, export and industry output/cost targets. The means are then designed to mobilise whatever is necessary to achieve the defined objectives in the minimum time subject to global resource constraints and global if not local market forces.

The strategies, that is means, of corporatist states to achieve objectives involve reducing the risks to the institutions (governance and commercial) charged with the responsibility of ensuring the objectives are achieved by:

- building large scale enterprises to dominant markets and supply chains, reaping maximum economies of scale and scope, and reducing market risk to a minimum

- ensuring that all necessary resources in terms of finance, skills and technology are available for the task;

- ensuring that any other domestic or foreign organisation cannot impede the performance of the chosen organisation(s) for the task; and

- tending to rely on regulation rather than the price mechanism.

An early corporatist state, Germany, in the 1930s grew by 12 per cent per annum between 1933 and 1937, with the unemployment rate cut from a third back to full employment while most developed economies had an inferior performance though not necessarily by much. The superiority of Germany by 1937 over the United States compared to 1929 levels of GDP was 17 per cent, although it was the German ability to reduce unemployment that caught attention.[3] What is important is not whether a more neoliberal approach would have been more effective but that the approach was different and it seemed to work. It changed history.

The North Asian countries took note of the German strategies and applied them post war with astonishing results. To take one example, the case of South Korea is miraculous. In 1961 South Korea had an annual income of US$82 per person, or less than half that of Ghana at the time. Today it is one of the wealthiest countries in the world. It took the United Kingdom two centuries and the United States one and a half centuries to achieve the same result.[4] More importantly Korea, Taiwan, and Singapore continue to maintain per capita GDP growth rates well beyond the level achieved by other countries with a similar high level of per capita income.

In this context there are three categories of corporatist states:

- the social market model of Western Europe with democratic institutions where policy institutions rely on codified statute and regulations with some reliance on non-parliamentary governance bodies representing stakeholder interests;

- the corporatist state model of Singapore, Korea, Japan and Taiwan which may or may not have effective democratic institutions but where the governance is non-transparent, relying on networks between governments, bureaucracy and businesses with decisions made in the interests of the collective irrespective of codified statutes and regulations. The penalties for non-compliance are exclusion from social networks and business supply chains with severe consequences for social standing and material advancement;

- the extreme authoritarian models of Germany/Italy in the 1930s and Russia and China today, where along with social and commercial exclusion, violence (i.e. loss of property, liberty and in the extreme cases life) is a penalty for non-compliance. The extreme authoritarian model has an impenetrable informal governance structure.

The Germans showed in the 1930s that the arrest of an individual for economic treason when it is clearly understood that the real crime was the import of product instead of using the favoured domestic supplier was a very effective form of industry policy which did away with the need for costly tariffs, subsidies or other financial inducements. In this context it is interesting to note that the criteria applied in determining what foreign enterprises can and cannot currently do in China is expressed in terms of largely undefined parameters based on the concept of national economic security.

Many countries aspire to the status of corporatist states. Few however have the capacity to reach the desired status. On this criteria the classification of Russia as a corporatist state is problematic.

China where to?

Of high importance to Australia's national interest is how China will evolve. Neoliberals tend to assume it will evolve into a market based economy.

China is not going to be transformed into a neoliberal market economy. Instead, it may well transform itself into perhaps the most efficient corporatist state model of all time with, over the next 2 to 3 decades:

- a large number of its state-owned (or indirectly controlled) enterprises (70 per cent of business assets are still under direct government control) becoming the largest companies in the world dominating the control of capacity in many industries; and

- a Communist Party that will grow rapidly and in influence on the basis of generating individual material advancement that will also provide an informal governance framework that will be simply impenetrable. No matter what the codified statutes, China will have a machinery of governance capable of doing the opposite on non transparent command. In this context who owns the enterprises will be irrelevant.

The Chinese see large scale foreign investment in China mainly as a short term strategy to:

- introduce new technologies, management expertise and new skills generation; and

- construct distribution systems to the world economy

in the shortest possible time. It is likely as their own enterprises are built up to world competitiveness, the assets of foreign enterprises that directly compete with and are of no strategic value if left independent to a mandated Chinese enterprise will be taken over by a combination of intimidation (as per the Russian approach to BP and Shell assets in oil and gas sites), financial incentives and frustration of which the recent creation of Communist Party control of Trade Union cells in foreign enterprises will be a useful tool. At worst foreign enterprises exiting China may find that they will lose a significant proportion of non-Chinese assets and intellectual property and, in the extreme, the entire enterprise.

The only major uncertainty about China is the extent to which extreme nationalism will become a hallmark of its external relations similar to what occurred in Germany in late 1930s.

The recent signs in this regard are not encouraging. There are signs that strong nationalism is taking root amongst the young with the state having the capacity, like Germany, to manufacture out-pourings of mass nationalism triggered by suitable incidents. The optimists assume that massive environmental problems and widening inequalities will trigger a move, at worst, towards the social market model. The pessimists contend that threats to the legitimacy of the elite in the context of severe resource and environmental constraints will result in the sustained administration of the drug of extreme nationalism and the rectification of past injustices at the hands of the West.

To quote Robert Kagan in his recent assessment of China:

If East Asia today resembles late-nineteenth- and early-twentieth-century Europe … a comparatively minor incident could infuriate the Chinese and lead them to choose war, despite their reluctance. It would be comforting to imagine that this will all dissipate as China grows richer and more confident, but history suggests that as China grows more confident it will grow less, not more, tolerant of the obstacles in its path. The Chinese themselves have few illusions on this score. They believe this great strategic rivalry will only 'increase with the ascension of Chinese power'.[5]

All that has to be done is to assume, as is the case here, that China behaves no worse that the United States as a global power or no worse than the Western European powers behaved towards China in the Nineteenth Century to arrive at the conclusion that a difficult period for Australia lies ahead. This is returned to below.

The governance riddle

The riddle is that the leadership of corporatist states is even more politically exclusive and dominated by existing bureaucratic and commercial interests than what is the case I have described for Australia. Yet these states, because of a combination of history, culture, ethnic homogeneity, strength of nationalism, genes, a common view of economic competition as warfare by other means, requiring the nation to be on a permanent war footing, or whatever, are capable of delivering high performance sustainable outcomes on a long term basis.

My only answer to this riddle for Australia, based on observed Western European outcomes, is that the appropriate response to the corporatist states is not to emulate them in political structures and conduct, but to achieve similar outcomes by strengthening the institutions of representative democracy. That is, governance and the institutions of governance are important in contrast to the neoliberal view that governance is relatively unimportant.

The focus here, in regard to some of Australia's current and future economic problems, is how a corporatist state solution would differ from the actual or likely neoliberal solution.

Monetary policy

In the 2001 lecture I pointed to the Australian neoliberal 'privatised' monetary policy regime where no intermediate target for credit growth was set as is the case for the monetary policy of the European Union. Provided CPI inflation is within the desired bounds then debt accumulation could be at whatever level the market was willing to absorb. For the European Central Bank (ECB), inflation in the long run is a monetary phenomena and any credit growth on a sustained basis in excess of desired nominal GDP growth will result in undesirable inflation. In Australia credit growth in excess of desired nominal GDP growth is taken as a sign of a healthy economy. For the ECB monetary growth should be little more than desired nominal GDP growth.

As Table 1 indicates, the ECB has achieved its objective since 1996, while in Australia the growth in M3 (liquid liabilities) relative to nominal GDP has been 28 per cent. This does not seem much but, as will be outlined below, the consequences for long run economic and social stability will be very large.

Over the years I have criticised the Australian approach to money policy as irresponsible. That is, I have agreed with the ECB view provided inflation is defined as including established asset prices (shares, dwellings) as well as newly produced goods and services.

Therefore, sustained credit growth in excess of desired nominal GDP growth will:

- increase the vulnerability of the economy to negative shocks by encouraging borrowing for consumption and driving down household savings ratios;

- create an increasing proportion of households in 'serf' status by forcing households to pay high debt service/rent payments as a proportion of income over an extensive period of their life cycle;

- lead to house prices (and rents) putting home ownership beyond the reach of an increasing proportion of the population; and

- easy short term growth diverting energy and attention from the constant resource mobilisation effort required for long run sustainable growth.

Table 1

Ratio of M3 to GDP

| |

Australia |

Euro |

| 1997 |

0.20 |

0.25 |

| 2007 |

0.25 |

0.25 |

| Per cent change |

28 |

0 |

Source: IMP Financial Statistics

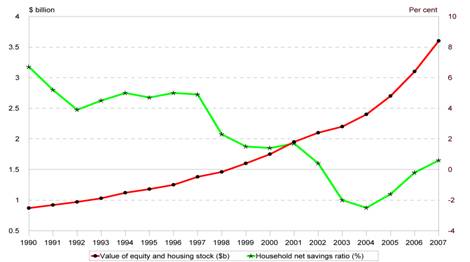

The excess monetary growth for Australia drove the build-up in asset values (Figure 1) which encouraged households to borrow and spend (Figure 2).

Figure 2 shows the precipice the Australian economy is now sitting on. Non-dwelling investment borrowings by households over the last half decade have increased from 5 per cent of income to currently around 15 per cent. If only a third of this is used to support consumption, then a repeat of the 1991 experience of household borrowings for non-dwelling investment turning negative, would cause the household savings ratio increasing by 5 to 7 percentage points, plunging the economy into the severest recession since the depression.

In the context of Figure 2, the current (August 2008) dilemma facing the Reserve Bank of Australia (RBA) is self evident. Although inflation is 1.5 per cent per annum above the 3 per cent upper bound of acceptable outcomes, the RBA can either maintain tight monetary control and risk of a severe recession, or abandon tight monetary policy and risk the return of longer term unsatisfactory inflation thereby simply postponing the day of reckoning to greater pain down the track.

The RBA has only itself to blame for this as it is simply the result of a decade of irresponsible monetary policy. It knew of the ECB approach, but showed no intellectual leadership and simply went along with the short term political objective of maintaining the financing of the new aspirational society. Indeed a good case can be made that Australia's low inflation rate over the decade to 2006 was in spite, not because, of the RBA. That is from the 'China price' effect, the productivity potential of the economy created by the 1991 recession, the reduction in protection etc. Its only effective task in this period was to ensure that financial structural disequilibrium did not occur. It failed.

Ultimately, Parliament will be held responsible for delegating without appropriate guidelines a core governance responsibility to unelected officials.

Towards debt serfdom

But what if Australia escapes the current policy difficulty and interest rates start to come down within a year or so? The current undersupply of housing (a shortage of around 150,000 units by 2010), is increasing rents and when interest rates come down will trigger a rapid rise in dwelling prices as many try to escape rental status. In other words, the 2003 to 2007 cycle will be repeated with a further increase in the proportion of households that could be classified as 'serfs' risking longer run social stability.

Figure 1

Asset value growth has allowed expenditure levels to be maintained well in excess of income

Source: ABS, 'Australian National Accounts', Catalogue Number 5204.0

Figure 2

Household debt has allowed savings ratios to fall

Source: ABS, Australian National Accounts. Catalogue Number 5204.0. NIEIR has adjusted the data for estimates of borrowings for new dwelling construction and renovation.

To elaborate on the concept of serf status. The origins of serfdom in Russia were based on the need to keep labour fixed in place because of the excess supply of land relative to labour with high marginal physical product of labour resulting from the large territorial gains from conquest with small populations. Market forces would have driven wages to very high levels. Various tactics were tried to constrain labour mobility, such as finding replacement labour before a peasant could move. Another tactic was for the landlord (the farmer of the day) to willingly lend to peasants all that was needed and more (for implements, livestock, fencing etc.). Another unfortunate linking of readily available finance with an emerging aspirational society.

Droughts, wars, plagues, would force more lending until peasants were hopelessly in debt. This debt serfdom facilitated legislated serfdom with the peasant tied to the land with the requirement of up to three days a week work for the landlord. As other family members could work on the serf's allocated land or in the cash economy modern serfdom 'status' will be taken here to arise when households pay over 35 per cent of income in debt service and rent.

The recent Australia history of more than doubling of the household debt to income ratio since the mid 1990s is well known. However, there is little recognition of what this may mean at the micro level. Both Tables 3 and 4 clearly spell that out. It means less homes in fully owned status and more households paying more than 35 per cent of income in rent and debt service costs. In terms of mortgage households the 2008 estimate of the share of households paying more than 35 per cent of income in debt service costs is 23 per cent due to interest rate rises since June 2006. It should be kept in mind that from the 2006 Census those households paying more than 35 per cent of income in debt service costs were paying an average debt service cost of just under 50 per cent of income. That is the living standard of a household with no debt would on average be twice that of the average household of serf status despite both households having the same income.

By 2018 on current conservative trends (an increase in the household debt to income of 30 per cent from current levels and interest rates declining from current levels), it is estimated that at least 22 per cent of households will be paying more than 35 per cent of income in debt service and rent costs, or a doubling since 1996 levels. This excludes the high debt of fully owned households.

It might be claimed that the use of the concept of 'serf' status in the modern context is over the top as households can eventually escape debt status and Russian serfdom was inter-generational. I would counter argue that in fact the intergenerational aspect of serfdom is de facto also emerging in modern times.

Table 2

Share of Households by Ownership Status

| |

1996 |

2001 |

2006 |

2018 |

| Mortgage |

26.2 |

27.6 |

34.1 |

39.0 |

| Rent |

28.9 |

28.1 |

28.1 |

29 |

| Fully owned and other |

44.9 |

44.3 |

37.8 |

32.0 |

| Total households |

100.0 |

100.0 |

100.0 |

100.0 |

Source: ABS Census and NIEIR

Table 3

Per Cent of Households with Debt Service and Rent over 35 Per Cent of Household Income

| |

1996 |

2006 |

2018 |

| Mortgage |

14.0 |

20.0 |

28.0 |

| Rent |

26.0 |

26.0 |

39 |

| Total (Mortgage plus rent households—per cent of total |

11.2 |

14.1 |

22.2 |

Source: ABS Census to 2006, adjusted for non-mortgage debt service costs from 2004 ABS HIS survey. Rent has been similarly adjusted.

The 2018 rent estimates assume a 30 per cent rise in the household rent income ratio between 2006 and 2018, a process that is now well underway.

The movement towards neoliberal solutions in education and health means that access to quality services is determined by household circumstances. The greater the number of households in serf status, the more likely the serf status will be passed on to their children from underinvestment in social capital complemented by increasing resort to reverse mortgages allowing a life time of high debt service costs with little or no inheritance for children.

This is consistent with findings from the United States vis-a-vis Sweden. For the United States the correlation coefficient between status of parents and children is around 0.5 while for high taxing equal opportunity education/health service across Sweden it is 0.2.[6] The irony is that the United States is a society that is approaching as rigid an intergenerational class structure as what prevailed in Europe in the Eighteenth and Nineteenth centuries which in part forced the migration to the United States.

The likelihood is that if something radical is not done there will be a high degree of intergenerational correlation in serf status. This will leave Australia with an unenviable choice around 2030 of, either a severe one-off tax on wealth to 'emancipate' the serfs, or suppression of the serf class to maintain social stability.

In any case a society in 2018, characterised by the results given in Table 2, will be a very grumpy place. Economists have discovered that after national per capita income is greater than US$20,000 happiness is a function of relative incomes not absolute incomes. The greater the serf class the greater the inequality of discretionary income and the greater the unhappiness.

Housing affordability

One of the core solutions to arrest the march towards a serf society is to significantly increase housing affordability for first home buyers. In this regard the case of Germany is important since German house prices in nominal terms are only a little more than what was the case a decade earlier and have fallen in real terms. In other parts of Europe house prices have doubled, such as Italy, so that although ECB tight monetary policy has helped it is a necessary not a sufficient condition for maintaining high levels of housing affordability. For Australia over the same period the increase in house prices has been a little under 180 per cent. You would think that current German housing market policies would be at the top of the agenda for all Australian governments.

Corporatist state type housing solutions have been followed in Austria and Germany for decades. These are called social partnerships. These policies aim at coordinating and accommodating conflicting interests between landlords, tenants, financial institutions and government. One core feature is risk shifting from the private sector to the state.

In terms of the rental market, the features of the German housing market are:

- long term contracts for tenants 3 to 10 years;

- can only be terminated from the landlord's perspective on a narrow range of criteria and 3 to 9 months mainly conversion to owner occupier status;

- defined rules for rent increases (e.g. CPI indexing);

- housing benefit support based on monthly income for both renters and owner-occupiers; and

- strong public sector housing construction with municipal housing construction providing around 10 to 15 per cent of housing stock.

In terms of dwelling construction and the supply of housing, there is direct subsidisation of housing construction at the state level taking into account the regional housing market situation. Construction support via preferential interest loans, grants, guarantees/ securities, provision of land etc. is allocated to housing companies, housing associations and individual builders on application.

Direct financial support comes from federal government/state financial institutions. The focus of loans is for:

- housing stock renovation;

- CO2 reduction retrofitting;

- Rental new housing construction; and

- low interest loans for the construction or purchase of owner-occupier housing.

A CO2 Building Renovation Program of 25 billion Euro was introduced in 2008 for the modernising of heating systems and energy efficiency optimisation of the building shell for both renters and owner-occupier stocks.

Accelerated depreciation allowances (9 per cent over 8 years and 7 per cent over remaining 4 years) was provided for renovation expenditures in listed buildings or precincts, for commercial property owners, with a similar depreciation scheme for owner-occupiers.

Regulation makes it difficult to borrow more than 60 per cent of house value, with German lenders reluctant to allow top up of mortgage if the home increases in value.

The overarching German objective is to ensure that the supply of houses runs well ahead of demand.

In an unequal society increasing housing affordability and equal opportunity for housing affordability can only come from one strategy, namely the rationing of opportunities by rationing of finance and a very targeted list of incentives. This is how the market was governed to allow Australia to solve its last major housing crisis after World War II. Each state had different strategies. Victoria rationed credit via the State Savings Bank while New South Wales (which lost its Saving Bank in the Depression) focussed on public sector housing construction. There were many other niche instruments which were swept away over the last 20 years under the mantra that the market will solve everything.

The Federal Government has introduced new supply side measures. However, what is clear about housing policies is that they have to be comprehensive to stop 'leakage' into house prices if they are to achieve the delivery of affordable housing to those who need it.

Telecommunications

If the corporatist states are as good as I am inferring in economic development then it would be expected that they would be well ahead in the provision of quality telecommunications infrastructure. This is the case. As at mid 2008 the average download speed in the United States is 1.9 Mbps, 61 Mbps in Japan, 45 Mbps in South Korea, 18 Mbps in Sweden and 17 Mbps in France. Eighty per cent of households in Japan can connect to a fibre network at a speed of 100 mlps, 30 times the average speed of the United States, while modem or DSL connections are at roughly the same cost.[7]

Australia is 30 per cent to 50 per cent below United States levels. Australia has announced a supply side initiative to improve things but the past delay in trying to incorporate market forces into the process will mean that like electricity to Timbucktoo Australia will get there but only when quality telecommunications is a competitive necessity and no longer a competitive advantage. Also the image of Australia being a technological laggard is not a good one to attract investment. The same approach in many other economic aspects has and will cost Australia dearly.

Greenhouse gas abatement policies

There is no better example of this than the approach to greenhouse gas abatement policies (GGAP). The design of GGAP regimes currently being undertaken in Australia is proceeding along strict neoliberal lines. The central touchstone is that the market is the most efficient platform to engineer the appropriate changes. All the government has to do is set an emissions cap and the resulting price changes will miraculously allow the emissions objective to be achieved. To quote:

The miracle of the market: 'There are two distinct elements of a cap and trade scheme— the cap itself and the ability to trade. The cap achieves the environmental outcome of reducing greenhouse gas pollution. The act of capping emissions creates a carbon price. The ability to trade ensures that emissions are reduced at the lowest possible cost.' [8]

The reality is it won't. Let's consider by illustration a segment of the adjustment effort, mainly the electricity sector. Assume that a target is set to reduce total emissions by 20 per cent below 2005 levels, which would represent a (EU 2020 target) 223 million tonnes reduction from a 2020 Business-as-usual (BAU) level in 2020.

Of the 223 million tonnes, a large part of the reduction would need to come from the electricity sector. Around 91 million tonnes would need to come from replacing about of 11 000 megawatts of coal fired plant. To do this the price of carbon would need to (on NIEIR and ACIL-Tasman estimates) quickly ramp up to around $55 a tonne by 2020, based on long run marginal cost of alternative supply in order to achieve the long run marginal costs of CCGT (combined cycle gas turbine) plant in combination with the mandated Federal renewables target.

A corporatist state would immediately conclude that the Australian market of independent generators independently bidding for supply would not be successful even if the $55 CO2 price were achieved. The market won't react because to achieve the target around 50 billion dollars in generators, gas development, pipeline and plant/pipelines, transmission investment would have to be spent. In an unfettered market environment the risks would simply be too great.

The risks would include:

- Existing supplier risk. Yes, the asset value of existing brown and black coal plant would be reduced by over 90 per cent. However, bankruptcy would merely mean that the new owners would be willing to supply some of the market at short run marginal cost which might require an additional $20 to $25 a tonne in CO2 price ( that is $80 a tonne) to reduce the risk. If they continued their pre-ETS output the cap would not be attained;

- Technology risk. Electricity generation technologies are rapidly changing. At any point in time technological change may well reduce the real LRMC by 20 per cent to 50 per cent in 10 year's time. Few are going to be building a 2 billion dollar plant today that could become obsolete shortly after it becomes operational;

- Regulatory risk. If $60 to $80 a tonne CO2 price results in excessive economic damage the CO2 price will be lowered and cap attainment strictly regulated, for example by applying mandatory gas targets as now applied in Queensland. Without compensation guarantee of future prices few will risk large investment funds; and

- Gas supply risk. Yes, long term contracts for gas supply will be negotiated with existing suppliers. However, at any time now gas discoveries could result in suppliers willing to supply long term gas at a fraction of current prices, especially if the location were remote from existing gas distribution infrastructure or the global LNG market were over-supplied.

One option a corporatist state would readily implement would be to combine all the generators into a single body. The arithmetic is simple. Under the present structure of independent suppliers a $55 a tonne carbon price would result in costs per megawatt hour increasing from $45–$50 to around $90, or around 80 per cent in the wholesale price. If these costs could be spread over the entire capacity, as it would be the case under a single entity, then the wholesale price increase could be limited to 20 per cent, or about 7 per cent for the price increase at the retail level which would represent a minor irritant.

However there would be further short term savings. The price increases would be phased in as plants are completed. In terms of cost savings, the strict neoliberal approach to the current Australia situation would result in cumulative CO2 price costs imposed on the economy between now and 2020 of anywhere between a minimum of 110 and 150 billion dollars to allow for market instability and required risk margins without any guarantee that much of the required capacity would be completed by 2020.

The corporatist state would allow a guaranteed outcome for total cumulative electricity costs increases of between 15 and 20 billion dollars. All other risks are reduced to zero by allowing a monopoly.

It is this logic that explains why the electricity sector was nationalised in Australia in the first half of the Twentieth Century as state after state gave up trying to induce the required supply response at the right price from an albeit regulated private electricity sector.

A good corporatist state that didn't want to renationalise the generating industry in Australia would sit down with the generators and hammer out an agreement for ownership change, exit arrangements on reasonable terms, and a regulatory environment that delivered an outcome in line with the old nationalised model where the private sector could still play a part. The current Queensland model for encouraging the use of gas in electricity generation would be a good place to start. The ultimate model would probably resemble this model and the model used by Victoria to run its train system.

The Garnaut recommendation to ignore private sector losses is not the right way to go. Governments are going to have to rely on the private sector (albeit with substantial risk shifting to the public sector) to undertake a substantial portion of the hundreds of billions of expenditures needed for greenhouse gas reduction.

Any rational corporatist state approach to CO2 reduction would place the emission trading system at the end point not at the beginning in policy design. It would work out all the possible regulatory, technology and mandatory market incentives (by directly paying tradesmen to retrofit dwellings with insulation, solar panels, gas, etc.) with the carbon price then set in terms of financing requirements and long term strategic direction.

A corporatist state would laugh off the suggestions of the neoliberals that Australia needs a high CO2 price for energy efficiency. Yes there is some low lying fruit but this isn't the main game. Australia makes little equipment so energy efficiency gains will depend on how overseas suppliers respond to the world carbon price. Accelerated depreciation allowances, tied investment allowances and energy efficiency performance regulation would be far more efficient in encouraging speedy adjustment. High carbon prices by themselves would simply result, in many cases, in plant shutdowns when they reached the end of their commercial life.

If the Treasury modelling into carbon prices simply assumes that the market operates optimally with 'near perfect' substitution between factors of production then it should be immediately thrown into the bin for the rubbish it will be.

In this context one of the best things the Federal Parliament could do for climate change is to give back to the states their income tax base set in line with their responsibilities so they can build the necessary transport infrastructure and urban design to minimise the CO2 content of connectiveness. The situation is now reaching the extreme position where an increasing number of households in major metropolitan areas will not have the time and/or financial incomes to reach their place of work on a regular basis.

To do this requires the Federal Parliament to stop the practice of spending what should be state resources on income tax cuts to enhance its short term election prospects.

Figure 3

Global temperature and sea level

David Spratt and Philip Sutton, Climate Code Red: the Case for Emergency Action.

Melbourne, Scribe, 2008, p. 41.

Finally in relation to climate change if the implication of figure 3 is correct then by 2012 the IPCC may well revise up the sea level rise by 2100 to 10 to 20 metres in the same way that predictions of an ice free summer Arctic have been quickly brought forward from a hundred years time to the near term. That is the 2 to 4 degrees Centigrade predicted rise in global temperatures even with substantial emission reduction success would still result in tens of metres rise in the sea level. This would require a response to reduce CO2 in the atmosphere back to the 1990 level of 350 parts per million which would in turn require a near zero emissions target by 2050. This would necessitate drastic action but the tools of the corporatist state could enable it to be done albeit with no increase in living standards (consumption per capita) for decades.

National security

In the 2001 lecture I gently suggested that to protect the national interest and economic sovereignty it was desirable to bring foreign investment decisions more under parliamentary control and not leave it to an effectively unaccountable body. This has become more urgent.

There is no national interest in allowing major customers (that is, Chinese enterprises) to control Australian resources. The objective here is simply to transfer value from Australia to China to enhance international competitiveness and real incomes.

The concept of sending tax inspectors to Beijing to politely ask to see the books of what will be the biggest companies in the world owned by a potentially hostile country to try and recoup billions of lost tax revenue is laughable.

The only possible reason to allow China (or any other major customer) to buy Australian resource assets would be if the supply resources at prices that would prevail if Australia was an occupied colony was in fact a part of our defence policy. If indeed it is part of our defence policy it is unlikely to work. The thing about global powers is that the stronger they get the more they want realised projections of that power to feel secure. In the not too distant future China will establish bases in Timor or nearby to 'secure' their trade routes. China will have the economic resources to 'buy' many countries. If they secure these bases and if Chinese enterprises owned substantial Australian resource assets, then it would be a simple matter to organise the blowing up of an offshore oil rig (which they would own) and then deploy navel units to the North West Coast on the grounds that this was necessary to protect their assets which Australia could no longer do. Once there the region would be effectively annexed using the same tactics that Western European powers used to effectively annex Chinese and Japanese key trading ports along with control over their national commercial policies in the Nineteenth Century.

A good case can be made that Australia is heading towards a classic "banana republic" status. The phrase 'banana republic' was invented to describe a country like Honduras where foreign interests (United States) controlled the region producing the principle Honduras exports (bananas) and all supporting infrastructure. The region was run like a private chiefdom in which companies kept order, and crushed labour dissent by the use of their own security forces or when necessary by calling in United States troops, who then established military bases in the country.

The irony is that it was the aim of preventing Australia from becoming a banana republic (Paul Keating 1986) that was one reason for adopting the extreme neoliberal model. It wouldn't be the first time that a policy shift achieved the reverse of what was intended.

In this context for Parliament not to take back control of foreign investment decisions could well be seen from the hindsight of 2030 as pure treason. The immediate task is to reduce Chinese foreign investment in Australian mineral resources to zero.

When doing this Parliament could usefully abolish the Productivity Commission and replace it with a body directly under parliamentary control, focussed on protecting Australia's economic and political sovereignty. The Productivity Commission can do good work but, unfortunately, its ideological blinkers can result in it unintentionally operating as a fifth column within government, reinforcing those private and foreign messages and demands that have and will undermine the national interest. This is an intolerable situation.

The United States and Australian security

Whether the above can occur depends in part on the speed of the decline of the United States relative to China.

Over the next decades Australian security very much depends on the relative decline in political economy strength of the United States being as slow as possible so as to allow the region to develop balanced multi-polar counterweight power centres in which Australia can enhance its security. Unfortunately, trends in this regard are not optimistic.

The United States has seemed to have gotten itself into an unstable political cycle where the Republicans are hell bent on exhausting the Federal treasury (largely for the benefit of their own constituency) so that when the other side obtains office there are few resources available to correct some of the United States' fundamental problems (not all that dissimilar to Australia's), except absorb the odium of raising taxes, ensuring the political cycle will continue.

This, when coupled with established interests being able to influence both parties for changed regulation, removal of regulation and less regulatory oversight for the enormous benefit of a few and the eventual misery of many does not bode well for a political response that will arrest America's relative decline.

In this context not surprising is the outcome that during the Bush administration three quarters of the economic gains went to the top 1 per cent of taxpayers.[9] To sustain its economic strength and combat climate change, the United States, like Australia, requires a redistribution of resources from consumption to investment. The magnitude of such a change probably can only be done with very strong political leadership that, in relatively normal times, would only effectively come from a leader from the right, that is, a Republican such as Teddy Roosevelt. This avoids the charge of class warfare. For a Democrat leader to engineer this outcome it would require a massive economic or security crisis as per Franklin Roosevelt. This might of course occur but the probability is that the United States will continue to experience destabilising political cycles that will sap its economic and political strength.

The point may well be reached sooner than any of us think when the United States will have to decide, as Britain had to in 1902 with the Anglo-Japanese treaty, what were its strategic interests and what had to be let go. That is, the United States will have to decide what will remain in its sphere of interest and what will have to be conceded to China, India etc. The more Australia becomes vital to the Chinese economy and the greater Chinese investment in Australia the more likely, irrespective of history, culture and tradition, that the United States may have to decide that Australia can no longer be justified as being a member of its sphere of influence.

From this perspective the faster Australia can diversify its trade and the stake of countries in Australia the greater the ability Australia will have to protect its effective sovereignty. This gives industry policy a strategic security status which is common to most corporatist states.

Industry policy

The record of Australian industry policy has been appalling. As Table 5 indicates, the relative fall in Australia's non-mining merchandise exports has accelerated over the last decade, which would be expected given the Coalition Government's downgrading of industry policy. Australian service exports in real terms have been virtually stagnant since 2000.

The resort to trade agreements will not be successful. NIEIR investigated the impact of the trade agreements to the end of 2007, including the United States Free Trade Agreement, and found the effect to be small, in terms of manufacturing.[10] They might have been successful 20 years ago but now Australia's trading relationships are being massively overshadowed by the growth of Asia and Latin America. The neoliberal policy focus is largely irrelevant. The concept of an Australian-China free trade agreement is an oxymoron.

To succeed in the future Australia will have to integrate itself into the informal networks of Asia, using whatever levers it has to lift the glass ceiling applying to Australia as set by informal governance structures. These levers would include defence relationships, foreign investment in Australia, ethnic networks operating from Australia, cultural affinity, the strategic foreign investment in selected countries, etc. For success this requires a coordinated effort from many.

Table 4

Change in share of Australia's nominal non-mining merchandise exports of selected regions export totals—per cent per annum

| |

1980-1996 |

1996-2006 |

| Asia |

-4.4 |

-5.6 |

| North America |

-1.8 |

-2.7 |

Source: World Trade Organisation

Conclusion

The outlook over the next 20 years realistically has to be approached with a sense of pessimism. Left unabated current trends suggest that Australia will be facing increasing external pressure coupled with internal economic malaise and a growing feeling that political institutions are not working. The most recent period that is likely to be similar to the future was in the mid 1970s from a combination of intense Cold War pressure and economic meltdown from an energy crisis.

The mid 1970s was a strange time with coups, quasi coups and attempted coups in a number of places including the UK where the early stages of an attempted coup centred on Lord Mountbatten and was terminated by the resignation of the British Prime Minister of the day, Harold Wilson.[11]

To avoid similar circumstances prevailing, Parliament's role is clear. It must be seen and be effective in putting in place institutions and policies which will govern the market in such a way that the current and future challenges are controlled, stemmed and defeated. The consequences of failure to do this are unthinkable in that it will resemble, and perhaps in some ways be more intense than, the political and economic pressure applied to Australia between 1931 and 1942. More intensive is that a large percentage of the population could have a very poor long term expectation of the future and this time around Australia could be without powerful friends. To effectively combat the three challenges of climate change, external security, and internal stability the requirement is for the adoption and maintenance of a semi wartime footing in policy focus and implementation.

Question — Dr Brain, I wonder if you might care to comment on Australia's seemingly ever-burgeoning foreign debt levels over the past decade or so. I understand that foreign debt isn't really a problem, so long as you can service the debt. What sort of likelihood do you think there might be of Australia getting into problems with servicing that debt?

Peter Brain — A large part of my speech was about the fact that who owns the debt could be quite important to Australia's future security. In terms of the foreign debt, what you might be alluding to is the fact that although we had a large mining boom and returns of trade escalation the current account deficit hasn't improved and that is because the mining sector is now about 75 per cent foreign owned, and it has very little operating costs relative to other industries. For every dollar that we get from a price increase, probably over 50 per cent flows back into the current account deficit and foreign debt because it accrues as profits to foreign enterprises.

To some extent, that has been disguised by the fact that some of those profits that have been credited to foreign enterprises are re-spent in Australia to expand the mining sector. So the current account deficit has gone up and has offset the terms of trade rise and we have the benefit of the investment. I suppose the real problem comes when that all stops, and terms of trade track back down again and we no longer get the capacity expansion. Then the full extent of this will only be seen in future difficulties. It has been largely neutral but will not be in the future. The fact of the matter is that the impact on the current account deficit hasn't improved because as terms of trade have gone up, the income has flowed out and secondly invested here, which has required the importation of more capital which has entailed more foreign borrowing with more interest credited to the overseas lenders. So we have been in a neutral situation; despite the all time high terms of trade boom nothing has happened. The consequences are when it stops, the music stops. Does that answer your question, or not really?

Question — I don't know if I fully absorbed your answer, to be quite frank.

Peter Brain — The other thing I suppose you are talking about, yes we have one of the highest current account debts in the world. We have seen a number of countries recently such as Iceland, which had high current account deficits and debts, where their exchange rates plunged. So Australia is obviously vulnerable to the current world slow down. If oil and coal prices turn back down again sharply, then the Australian currency will plunge, inflation will go up, we still have four and a half, it will go up to six or seven, and then interest rates have to go through the roof and then we will be in almost a depression-type situation. That's the risk. Does that answer your question?

Question — Pretty well, just a final comment. When Prime Minister Howard came to office, our foreign debt was about 29 per cent. I think of GDP, and the sky was about to fall in. It is 55 or 60 per cent now currently.

Peter Brain — Well the other figure I was mean to put in my talk but I didn't was the fact that foreign ownership of Australian corporate income in 2008 & 2009 will be over 50 per cent. I think that really put us in banana republic status.

Question — We are told that the market is the best regulator of the economy but yet we have the situation where we have Enron, we had our home-grown HIH, now we have Freddie Mac and Fannie Mae in the United States. We read that there was legislation in place to actually prevent disaster such as these occurring, disasters which are now affecting us all. We are told that the market, this supreme being, obviously has no morals, no ethics, no scruples, and no memory which is a bit of a worry. Action in terms of failure is always retrospective and it is so geared that it is never going to lose because it always has its hands in the taxpayers' pocket. Its ability to convert us back into serfs you mentioned already. Would you like to comment please?

Peter Brain — It all comes back to excessive monetary growth. As soon as you have excessive monetary growth in relation to basic requirements for real sector stability, you get the things I have talked about: over bias of households for consumption, house prices going up, drift into serf status, but also financial shenanigans that drive up the value of financial assets. Illusionary. People think that they are wealthy but they are not, financial engineering, so it all comes to an end just like any ponzi scheme. So really, what you are talking about is when you get too much excessive monetary growth you get all the things mentioned plus financial engineering, which undermines financial institutions and that was behind my quote: 'for the benefit of few and the misery of many'. It's just another reason for keeping very tight monetary control.

Question — Does that mean that we should never have floated the dollar?

Peter Brain — No, it just means that we should have put in a monetary regime that was more appropriate, more defined and more in terms of European standards. The monetary policy regime that we put in really was a benefit to short term political interests because it was non-capped so to speak; there was no cap on the credit that was floating around, and it created periods of intense aspirational euphoria. Which politicians always like because it means that they get re-elected

Question —You raised the question of returning to history. Until we look at history we should not even start to look at the alternatives.

Peter Brain — I agree 100 per cent. What strikes me especially about Australia is that we all start at year zero. Year zero is now. We are starting from year zero as if we didn't learn anything over the past 100 years. The capacity of Australia to do that is just simply amazing. The capacity of other countries such as the Europeans and obviously the north Asians is that history is so vital to the understanding of where they are going forward. Unless we start doing what you're saying, then we won't deserve to survive as a nation. A nation that starts everything at year zero in terms of its intellectual capital, it's not a very good way to go about things.

* This paper was presented as a lecture in the Senate Occasional Lecture Series at Parliament House, Canberra, on 8 August 2008.

[1] Published by ABC Books, 2001.

[2] Harvard University Press, 2008.

[3] R.J. Overy, The Nazi Economic Recovery 1932–1938. The Economic History Society, 2nd ed., New York, Cambridge University Press, 1996.

[4] HA-Joon Chang Bad Samaritans: the Myth of Free Trade and the Recent History of Capitalism. New York, Bloomsberg Press, 2008, pp. 3–4.

[5] Robert Kagan, The Return of History and the End of Dreams. New York, Alfred A. Knopp, 2008, p. 36.

[6] A. Bjorklund and M. Jantti. 'Intergenerational Mobility in Sweden Compared to the United States', American Economic Review, Vol. 87, 1997. See Also The Economist, 'Even higher society even harder to ascend', 29 December 2004.

[7] L. Cohen in testifying before the United States House Sub-committee on Telecommunication and the Internet.

[8] Carbon Pollution Reduction Scheme Green Paper—Summary. Canberra, Department of Climate Change, July 2008, p. 12.

[9] The Economist, 1 August 2008, p. 43.

[10] NIEIR, An evaluation of the impact of Australian Free Trade Agreements to the end of 2007, for the AMWU, 9 April 2008.

[11] Jonathan Freedland, 'The Wilson Plot was our Watergate', The Guardian, 15 March 2006.