CHAPTER ONE

Terms of Reference

1.1

On 12 December 2013, the Senate referred the following matter to the

Senate Education and Employment References Committee for inquiry and report by

17 June 2014:[1]

-

cost and availability for parents over the short term, including the

effectiveness of the current government rebates;

-

administrative burden, including the impact of the introduction of the

National Quality Framework;

-

the current regulatory environment and the impact on children, educators

and service operators;

-

how the childcare sector can be strengthened in the short term to boost

Australia’s productivity and workplace participation for parents; and

-

any related matters.

1.2

The order of the Senate was amended on 17 June 2014 to extend the

reporting date until 15 July 2014.[2]

Background

1.3

Access to affordable, quality early childhood education and care (ECEC)

is important to individual children, their families and the broader community.

It not only helps children develop—influencing later outcomes at school and in

life—but also dictates the level of families' engagement with employment and

study and ultimately has a considerable impact on national productivity.[3]

1.4

Australian families have access to a range of public and private, for

and not-for-profit, home-based and centre-based ECEC services. The ECEC system

is based on market oriented arrangements which allow parents to choose the type

of service they use based on personal considerations and preferences, including

affordability.[4]

1.5

Most Australian families are involved with the sector in one way or

another, as the majority of Australian children participate 'in some form of

child care or early learning before entering school, or afterwards through

outside school hours care.'[5]

1.6

The ECEC sector is also an industry in its own right, generating

estimated revenues of over $10 billion annually and employing some 140 000

individuals.[6]

Child care payments

1.7

Under current legislative arrangements, the Child Care Benefit (CCB) is

paid to persons using 'approved' or 'registered' services, who are required to

meet the standards set out in family assistance law, specifically the A New

Tax System (Family Assistance) (Administration) Act 1999 (Cth).[7]

1.8

Parents and carers can claim CCB for between 24 and 50 hours per child

per week, either as a fee reduction paid directly to the provider or at the end

of the financial year through the tax system. The CCB is means tested, and is

payable as follows:

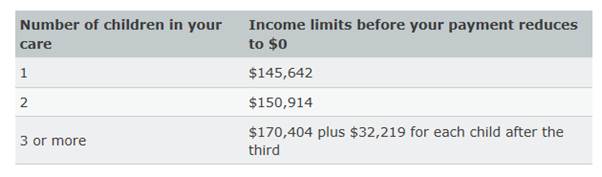

Figure 1- Child Care Benefit - Amounts payable [8]

1.9

Further, families can also access the Child Care Rebate (CCR), currently

$7500, to assist with additional child care costs. The CCR is not means tested.

1.10

The Department of Education (the department) advised the committee that

limited CCB subsidies are also available for registered (as opposed to

approved) care providers. Registered care providers are individuals who are

registered with the Department of Human Services (DHS). Families opting to use

registered care receive a lower rate of CCB than families using approved care,

'as approved care providers are required to comply with Family Assistance Law

quality standards and other legislative requirements.'[9] To receive the CCB,

families must use approved services that meet the requirements of one of the

following categories:

Long Day Care (LDC) – a centre-based form of care. LDC

services provide all-day or part-time education and care for children.

Family Day Care (FDC) – administers and supports

networks of FDC educators who provide flexible care and developmental

activities in their own homes, or in approved venues, for other people's

children.

Outside School Hours Care (OSHC) – provides education

and care before and/or after school and/or care during school vacation time.

Services may also open on pupil-free days during the school term.

Occasional Care (OCC) – a centre-based form of care.

Families can access OCC regularly or irregularly on a sessional basis.

In Home Care (IHC) – a flexible form of care where an

approved educator provides care in the child's home. The Australian Government

limits the number of approved IHC places available in the market and new IHC

services can only become CCB approved if places are available for allocation.[10]

Productivity Commission inquiry

1.11

On 22 November 2013, the Treasurer, the Honourable Joe Hockey MP,

directed the Productivity Commission to undertake an inquiry into future

options for child care and early childhood learning, with a specific focus on

developing a system which would address children's learning and development

needs whilst supporting workforce participation. The terms of reference for

the inquiry are:

- The

contribution that access to affordable, high quality child care can make to:

-

increased participation in the workforce, particularly for women

-

optimising children’s learning and development.

- The

current and future need for child care in Australia, including consideration of

the following:

-

hours parents work or study, or wish to work or study

-

the particular needs of rural, regional and remote parents, as well as

shift workers

- accessibility

of affordable care

- types

of child care available including but not limited to: long day care, family day

care, in home care including nannies and au pairs, mobile care, occasional

care, and outside school hours care

- the role and potential for employer provided child

care

- usual hours of operation of each type of care

- the out of pocket cost of child care to families

- rebates and subsidies available for each type of care

- the

capacity of the existing child care system to ensure children are transitioning

from child care to school with a satisfactory level of school preparedness

- opportunities

to improve connections and transitions across early childhood services

(including between child care and preschool/kindergarten services)

- the needs of vulnerable or at risk children

- interactions

with relevant Australian Government policies and programmes.

- Whether

there are any specific models of care that should be considered for trial or

implementation in Australia, with consideration given to international models,

such as the home based care model in New Zealand and models that specifically

target vulnerable or at risk children and their families.

- Options

for enhancing the choices available to Australian families as to how they

receive child care support, so that this can occur in the manner most suitable

to their individual family circumstances. Mechanisms to be considered include

subsidies, rebates and tax deductions, to improve the accessibility,

flexibility and affordability of child care for families facing diverse

individual circumstances.

- The

benefits and other impacts of regulatory changes in child care over the past

decade, including the implementation of the National Quality Framework (NQF) in

States and Territories, with specific consideration given to compliance costs,

taking into account the Government’s planned work with States and Territories

to streamline the NQF.[11]

Simultaneous inquiries

1.12

Many submitters relied in whole or in part on their submissions to the

Productivity Commission when contributing to the committee's inquiry. Some organisations

were unable to specifically tailor their submissions to the committee's terms

of reference, and instead provided the committee with copies of their

submissions to the Productivity Commission.

1.13

It should also be noted that the committee is conducting two inquiries

into aspects of Australia's child care system simultaneously.[12] Given the potential for

overlap and the relevance of each inquiry to the other, the committee decided

against holding separate hearings for both, opting instead for a more streamlined

approach.

1.1

The committee has divided the evidence received into two reports, one

focusing primarily on the National Quality Framework (NQF), and another on

economic issues. Ideally the reports should be read together, and this report

focuses on the economic issues facing families and communities accessing ECEC

services.

Acknowledgement

1.14

The committee thanks those individuals and organisations who contributed

to the inquiry by preparing written submissions and giving evidence at the

hearings.

Notes on references

1.15

References in this report to the Hansard for the public hearings are to

the Proof Hansard. Please note that page numbers may vary between the proof and

the official transcripts.

Navigation: Previous Page | Contents | Next Page